Ever wondered what is swing trading and if it could actually fit into your busy life? Trust me, you’re not alone.

It’s all about capturing those bigger market swings, the ones that play out over days or weeks, without the stress of day trading. At H2T Funding, we’re here to break down the exact concepts and strategies you can use. If you’re ready to learn, keep reading.

Key takeaways:

- Swing trading is a short- to medium-term strategy where traders hold positions for several days or weeks to capture market swings.

- Swing traders use technical analysis, including support–resistance, trend lines, and various indicators, to find high-probability setups.

- Swing trading works by entering near support, exiting near resistance, and letting momentum develop over time.

- Swing trading suits traders who want flexibility without monitoring charts all day.

- Effective swing trading requires strict risk management, emotional discipline, and a structured trade plan.

- Popular strategies include trend-following, breakout trading, reversal setups, Fibonacci pullbacks, and range trading.

- Swing traders can operate in stocks, forex, and crypto markets with the same core principles.

- Beginners can start swing trading by learning basic chart analysis, choosing a reliable broker, and practicing with a clear plan.

- Swing trading offers higher flexibility and lower stress than day trading but carries the risk of overnight market moves.

1. What is swing trading?

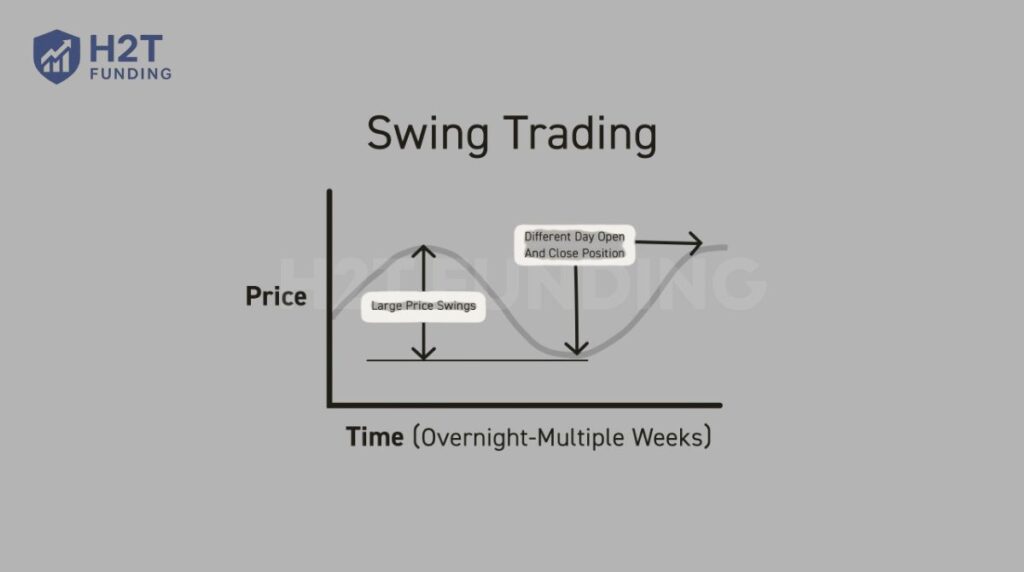

To put it simply, swing trading is all about holding trades for several days or weeks. You aren’t trying to predict the perfect top or bottom. Instead, your goal is to capture the big, meaty part in the middle of a price swing, that’s where the real profit is.

Unlike day traders, we don’t close everything out at the end of the day. We give our trades time to develop. To do this, we rely heavily on technical analysis, using tools like support and resistance to find good opportunities. Indicators like RSI or MACD are also great for confirming momentum.

And the best part? The core idea works whether you’re trading stocks, forex, or crypto. It always comes back to this: buy near support, sell near resistance, and protect your capital.

Example of swing trading:

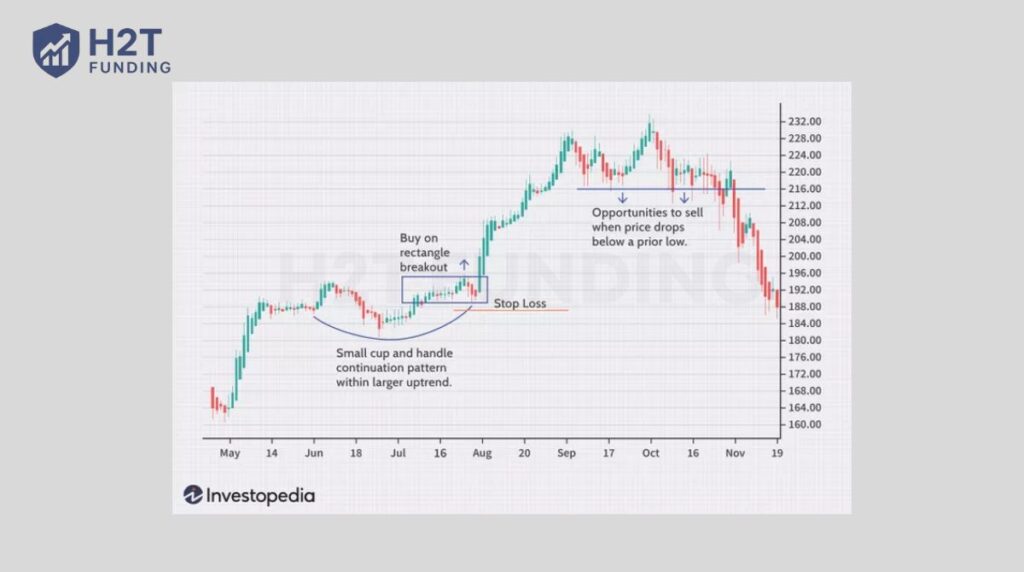

To truly answer the question, What is swing trading with an example, let us look at a practical setup using Apple Inc. (AAPL). The chart below shows how an experienced trader could have planned a trade based on technical analysis and natural market behavior.

In June and July, Apple’s stock moved sideways between $185 and $195 while forming a classic bullish cup-and-handle pattern. This pattern often suggests a continuation of the previous uptrend and an opportunity for a price breakout.

Since May, the stock had already shown strong upward price movements, climbing from below $165. This created a solid support base and confirmed a bullish trend in the larger market structure.

Before entering the trade, the trader checked several key indicators. The stock held above its major moving averages, and momentum remained positive. Volume stayed consistent, showing that buyers were still active and accumulating shares.

When AAPL broke above $195 on strong volume in mid-July, the trader entered a long position at $196. A stop-loss order was placed around $185, just below the handle’s lower edge. This setup provided a healthy risk/reward ratio, balancing safety and potential profit.

The stock then rallied by nearly 15%, moving past $210 and reaching about $230 by early September. The trader first targeted $205–$210 but chose to stay longer, using the 20-day moving average to trail the stop-loss and secure profits. In October, the price began to weaken.

The rally failed to make a new high, and the Relative Strength Index (RSI) showed bearish divergence. Volume also declined. When AAPL fell below the key support level near $216, the trader exited at $215, securing a gain of roughly 9.7%.

This example shows how individual traders apply structure and discipline to manage trades. In fact, many successful traders with these skills often partner with a prop firm to trade larger accounts without risking personal capital. It also demonstrates how price formations, technical analysis, and emotional control come together in real trading conditions. Swing trading is not about luck; it is about careful observation, logical planning, and respect for market psychology.

2. How does swing trading work?

Swing trading works by capturing short and medium-term price movements in the market. Traders enter the market and hold their trades for several days or weeks until the price hits a specific profit target. In some trading models, this is achieved through a clear system to match the target price, ensuring trades are closed systematically.

The basic idea is simple: buy when the market shows strength near support and sell when it slows close to resistance. Instead of predicting every peak or dip, swing traders focus on the middle part of each move where momentum is usually the strongest.

To identify these opportunities, traders use technical analysis. They study price action, trend lines, and moving averages to understand how price momentum develops.

For example, if a stock consistently holds above a support zone after a pullback, it can be a signal that buyers are stepping in. Entering a trade near that level with a clear exit plan can improve the probability of success.

In my experience, understanding market psychology is just as important as reading charts. Every move in the market reflects emotion. When traders panic, prices drop. When they become greedy, prices rise. Recognizing these emotions helps you stay calm and make logical decisions.

Many swing traders also use tools based on Fibonacci ratios to measure possible turning points after a strong move. This tool helps define entry levels, stop-loss points, and where to realistically take profits. By combining these tools with a clear plan, traders can balance opportunity and risk.

So, what is swing trading and how does it work? It is a strategy built on patience, structure, and observation. This disciplined approach is the foundation of how funded trading accounts work, providing traders with the capital to apply their strategies. You wait for the right setup, plan your trade carefully, and let the market complete the move.

3. Who is swing trading for?

Honestly? Swing trading is a perfect fit for the patient individual who wants to actively trade but still has a life outside of the charts. It’s for the thinker, not the gambler. It occupies that sweet spot between the slow pace of long-term investing and the frantic energy of day trading.

So, who does it really suit?

- People with a day job: Got a 9-to-5? Perfect. Since you’re holding trades for days or weeks, you don’t need to be glued to your screen. You can analyze your charts in the evening, set your trades, and let them play out without constant supervision.

- The aspiring chart analyst: This is for you if you genuinely enjoy the puzzle of a price chart. You’re the type of person who likes to spot trends, identify support and resistance levels, and use indicators to confirm your ideas. It’s a game of strategy, not just speed.

- The balanced trader: I think of this as the middle ground. You want more action and potential profit than just buying and holding for years, but you don’t want the heart-pounding stress that comes with day trading. You’re okay with taking calculated risks for a solid reward.

But let’s be clear, it’s NOT for everyone:

- The impatient “get-rich-quick” type: If you’re looking for instant profits and constant adrenaline, this isn’t it. Swing trading is a game of patience. Sometimes the best move is to do nothing at all.

- Anyone who can’t stomach the overnight risk: Your positions will be open while you sleep. News can break, markets can gap up or down, and that’s just part of the deal. If that idea makes you anxious, you should probably pass.

- The “set-it-and-forget-it” investor: This is an active strategy. While it’s less demanding than day trading, it still requires you to regularly review your charts, manage your positions, and stay in tune with the market.

To put it simply, swing trading is for the disciplined planner who prefers a strategic approach over a reactive one. It’s for individual traders who want to build their accounts thoughtfully, one solid swing at a time.

4. Best markets for swing trading

To be honest, the best market for swing trading isn’t a specific name; it’s any market that has two key ingredients: plenty of liquidity and healthy volatility. When you find a market with both, you’ve found a great playground.

So, what do those really mean?

- High liquidity: Let me put it this way: you need to be able to get in and out of a trade easily. Liquidity just means there are tons of buyers and sellers ready to go. Think about popular large-cap stocks like Apple (AAPL) or major forex pairs like EUR/USD. You can trade significant sizes without drastically moving the price. A lack of liquidity, on the other hand, is a trader’s nightmare.

- Healthy volatility: This one is simple. The market needs to move. Volatility is the engine that actually creates the price swings you’re trying to capture. A flat, boring chart offers zero opportunities. That’s why swing traders love markets that have a natural rhythm of ups and downs. After all, how can you profit if the price never changes?

With that in mind, here are the markets where traders typically find this magic combination:

- Major stock markets: Think large, well-known companies (like the S&P 500 components). They have the volume and the daily price movement that are perfect for swing trading.

- Forex (Foreign exchange): If you’re wondering what swing trading in forex is, this is arguably the most popular market for it. Major and minor currency pairs are incredibly popular, and the market is open 24/5, offering constant opportunities and unmatched liquidity.

- Cryptocurrencies: For those asking what swing trading in crypto is, this is a popular but challenging arena. Major cryptos like Bitcoin (BTC) and Ethereum (ETH) are a favorite for their dramatic swings, but their extreme volatility requires caution.

- Commodities: Things like Gold, Silver, and Oil have their own distinct patterns and are heavily influenced by global news, which creates consistent, tradable swings.

Ultimately, the best market is the one you understand. My advice? Pick one from this list, study its personality, and master it before you start jumping all over the place.

5. Key concepts in swing trading

When people ask what swing trading and scalping are, I like to explain it as a mix of technical structure and trader psychology. At its core, understanding what swing in trading is about recognizing the natural rhythm of the market, why prices pause, and what triggers the next wave of momentum.

Below are the main ideas every trader should master.

- Support and resistance: These are the backbone of swing trading. Support marks the level where buyers step in, and resistance shows where sellers take control. In my experience, when a stock bounces several times near support, it often hints at a possible bullish move. Watching how prices react to these levels helps you find better entry and exit points.

- Technical analysis: This is how traders make sense of market data. We read charts, analyze price movements, and spot repeating chart patterns that signal opportunity. I usually combine trend lines with volume and moving averages to see where strength is building up. It is not magic, it is observation.

- Indicators and momentum: Tools such as the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) help measure buying or selling pressure. RSI highlights when a market may be overbought or oversold, while MACD shows shifts in momentum. I often use both to confirm whether a trend is losing steam or preparing for another push.

- Fibonacci retracement: Traders use this tool to identify potential reversal levels after strong moves. For instance, if the S&P 500 rallies sharply and then pulls back to the 38.2% retracement level, that area can attract new buyers. It gives structure when planning trades and defining risk.

- Profit targets and trade management: Setting a clear exit plan, which includes a stop-loss, is essential. A balanced approach to risk and reward, such as 1:2, allows you to stay consistent even after a few losses. I learned this the hard way; without limits, even one bad trade can erase a week of profits. It’s a harsh lesson in what a drawdown is in trading, and why managing it is so critical.

- Market psychology: The market reflects emotion. Fear, greed, and hesitation appear as candles on your chart. Understanding this behavior helps you anticipate key market changes and manage your reactions. Emotional restraint separates average traders from consistent ones. Mastering this is the key to longevity, and it starts with understanding how to be more disciplined in your trading.

In short, swing trading works when technical discipline meets patience. Once you understand these concepts and apply them to your analysis, you begin to see patterns repeat. That is when trading shifts from guessing to reading the market with purpose.

6. Swing trading strategies

People often ask me about what swing trading is in stocks, or which swing trading strategies are best. My response is always the same: it’s not about guessing, but about recognizing patterns that show up time and time again. To be honest, these strategies are built on a solid foundation of patience, structure, and watching how the market reacts to simple supply and demand.

Let’s break down some of the most effective approaches you can start with.

6.1. Trend Trading

The old saying is true: the trend really is your friend. This strategy is all about identifying the market’s main direction and just riding the wave. You’re looking for those beautiful patterns of higher highs and higher lows in a bull market, or lower highs and lower lows in a bear market.

A classic way to do this is with moving averages. A classic example is when a faster-moving average crosses above a slower one. This is a strong signal that buyers are in control, giving you a great opportunity to buy on any small dip.

6.2. Breakout Trading

This is all about momentum. Imagine the price is stuck in a box, trading sideways for days while pressure builds up. The breakout strategy is all about catching the explosive move that happens when the price finally breaks free from that range.

You’ll often see a tight consolidation period on the chart, and then suddenly, a powerful candle pushes through a key support or resistance level. The real key here is volume. A true breakout usually comes with a big spike in trading volume, confirming the move has real strength behind it.

6.3. Reversal (or Countertrend) Trading

Let’s be honest, no trend goes up in a straight line forever. This strategy involves spotting when a trend is getting tired and is due for a pullback or a full reversal. It feels like trading against the crowd, but it can be incredibly profitable.

Traders often look for clues, like the price making a new high while an indicator like the RSI fails to do so (this is called divergence). It’s a subtle hint that momentum is fading, giving you a chance to enter right as the tide begins to turn.

6.4. Fibonacci Retracement Strategy

This one sounds technical, but it’s actually a beautiful way to find entry points in an established trend, and it’s a core component of what is forex swing trading. After a strong price move, the market will often pull back or “retrace” a portion of that move before continuing. Understanding what swing trading in forex is often means mastering tools like this.

Here’s a perfect example of a Forex swing trading strategy. Imagine EUR/USD makes a strong upward move and then pulls back to a key Fibonacci level like 50% or 61.8%. That exact zone is where traders will watch like a hawk for a buying opportunity to rejoin the trend.

6.5. Range Trading

Markets don’t trend all the time. In fact, they often just chop back and forth between two clear levels: a floor (support) and a ceiling (resistance). This is where range trading shines. The plan is brutally simple: you buy near the bottom of the range and sell near the top.

It sounds easy, but the hardest part is having the discipline to trust the range and not get faked out by a false breakout.

In the end, the best strategy is the one that clicks with your personality. My advice? Don’t jump between them. Pick one, learn it inside and out by keeping a trading journal, and master it. That’s how you build real, lasting consistency.

7. How much money do you need to start swing trading?

Let’s get straight to it: there’s no single magic number, and you should be wary of anyone who tells you there is. Honestly, you can technically start with as little as a few hundred dollars, as many brokers have very low minimum deposits.

But here’s the real talk: while you can start small, your goal should be to have enough capital to trade properly without breaking the rules of risk management. Why does this matter? Because with a tiny account, you’re often forced to risk a huge percentage on a single trade just to make a meaningful profit. That, my friend, is a quick path to zero.

Here’s a more realistic breakdown:

- The bare minimum ($500 – $1,000): I think this is a decent starting point, especially for markets like Forex. It’s enough to let you practice with real money, understand the psychology of having skin in the game, and apply the 1-2% risk rule without your positions being meaninglessly small.

- A more comfortable start ($2,000 – $5,000): This is where things get much better. This amount gives you breathing room. You can survive a few losing trades without panicking, take on multiple positions, and explore a wider variety of stocks or assets. You’re moving from just surviving to actually being able to execute a strategy.

- The ideal range ($5,000+): With this level of capital, you can properly diversify, handle volatility, and generate returns that feel significant. It gives you the most flexibility and the best chance to trade like a business.

So, what’s the bottom line? Forget the get-rich-quick numbers. Start with an amount you are genuinely okay with losing, maybe that’s $1,000 for you. The real goal isn’t to make a fortune overnight; it’s to learn the skill and stay in the game long enough to become profitable.

8. What is swing trading vs day trading vs positional trading

If you’re trying to understand the difference between day trading and swing trading, it mostly comes down to time, patience, and the trader’s mindset. Each method has its own approach, risk level, and degree of complexity. Understanding these differences helps you find which approach suits your lifestyle and personality best.

Day trading is all about speed. Traders open and close positions within a single day, trying to profit from small price changes. Because trades are short-lived, emotional control and quick reactions are crucial. This style requires constant monitoring and can feel intense, especially when markets move fast.

Swing trading, on the other hand, sits comfortably between day and long-term trading. Traders hold trades for several days or weeks, aiming to capture medium-term price moves that align with overall market trends. It allows more breathing room than day trading but still needs discipline and timing. I often tell new traders that swing trading fits those who enjoy analysis but do not want to be glued to the screen all day.

Positional trading goes further in the long-term direction. Positions may be held for months, even years, depending on macroeconomic trends. It is slower, less stressful, but it demands deep research and patience. Market noise matters less here, and traders rely on fundamental factors instead of short-term momentum.

To make comparisons clearer:

| Trading Style | Holding Period | Effort Level | Key Focus | Common Challenge | Trading Frequency | Trading Complexity |

|---|---|---|---|---|---|---|

| Day Trading | Minutes to hours | Very high | Intraday volatility | Managing stress and overtrading | High | High |

| Swing Trading | Days to weeks | Moderate | Timing market cycles and technical signals | Balancing risk and patience | Low to Moderate | Moderate |

| Positional Trading | Weeks to months | Low to moderate | Long-term trend and fundamentals | Staying consistent through slow periods | Very Low | Low to Moderate |

In simple terms, swing trading offers flexibility without the exhaustion of daily execution. It teaches you to study patterns, use momentum oscillators wisely, and let the trade play out within its natural rhythm.

Each style can be profitable, but the best one depends on who you are as a trader. What matters most is aligning your approach with your goals and your tolerance for risk.

9. How to start swing trading

So, you’re ready to jump in? Great. If you’re asking what swing trading for beginners is, the answer is simple: it’s less about needing a huge account and more about having a smart, step-by-step plan. Forget trying to learn everything at once. Let’s break it down into a simple roadmap that actually works.

- Step 1: Choose your playground: Actually, your first big decision is deciding what to trade. My advice? Don’t try to master stocks, forex, and crypto all at once. Just pick one and get to know its personality. Stocks are often a great starting point because they tend to have clearer trends. Once you understand one market, the skills transfer surprisingly well.

- Step 2: Open a demo account (Seriously, do it): I think this is the most underrated step. Before you risk a single dollar, use a demo account to practice. It’s your personal sandbox to test strategies, learn the platform, and make mistakes without a price tag. This is how you build real confidence.

- Step 3: Learn the language of charts: Charts tell a story, and your job is to learn how to read it. To put it simply, focus on the fundamentals first:

- Support and resistance: Key levels where the price often stops or reverses.

- Trend lines: The simplest way to see which direction the market is heading.

- Basic indicators: Start with Moving Averages (like the 20 or 50 EMA) to help confirm the trend. That’s it. Master these before moving on.

- Step 4: Pick a timeframe that fits your life: This one’s a game-changer. For swing trading, the 4-hour (H4) and daily (D1) charts are your best friends. Why? They filter out the chaotic “noise” of shorter timeframes, giving you a clearer view of the market’s bigger moves. This means you don’t have to be glued to your screen all day.

- Step 5: Always define your exits before you enter: I can’t stress this enough: never enter a trade without a plan to get out. That means setting a stop-loss to protect your capital and a take-profit target to lock in gains. This single habit is what separates disciplined traders from gamblers. Trust me on this one.

- Step 6: Keep a trading journal: Your journal is your best teacher. For every trade, write down your entry reason, your exit reason, and what the outcome was. It might feel like a chore at first, but this is how you discover what you’re doing right and, more importantly, what you’re doing wrong. It turns guesswork into a real skill.

In the end, it’s not about mastering everything overnight. It’s about taking one deliberate step at a time. Each trade, win or lose, teaches you something new about discipline, patience, and the natural rhythm of the market.

Read more:

10. Pros and cons of swing trading

If you have been researching what swing trading is in stocks or what the swing trading strategy is, you probably already know it offers a balance between flexibility and opportunity. Still, like every trading style, it has both strengths and weaknesses. Knowing these can help you decide if swing trading fits your goals and personality.

| Pros | Cons |

|---|---|

| Flexibility: You do not have to sit in front of the screen all day. Swing traders can hold trades for several days or weeks, giving them more freedom to plan around work or study. I personally like this balance because it keeps trading from feeling like a full-time job. | Overnight market risk: Positions stay open longer, which means news or events can move the market unexpectedly while you sleep. Even with stop-loss protection, gaps can happen. |

| Lower stress level: Since trades develop over time, you are not reacting to every small market tick. It teaches patience and helps reduce emotional exhaustion. | Discipline is required: Because trades take days to play out, impatience can lead to early exits or overtrading. I learned early that waiting is harder than clicking the buy or sell button. |

| Potential for solid returns: Because swing trades last longer than day trades, they can capture bigger price moves. With proper risk control, the reward-to-risk balance can be very attractive. | Possible missed opportunities: Since you are not trading every minute, you might watch some strong moves pass by. That is fine if your plan is to focus on quality rather than quantity. |

| Good learning ground for beginners: This method helps new traders understand both short-term and mid-term market behavior without the intensity of day trading. You learn to analyze charts, time entries, and manage trades calmly. | Analysis workload: Although swing trading looks simple, it still requires consistent analysis, review, and adaptation. You must adjust strategies as market conditions shift. |

In simple terms, swing trading is a practical middle ground. It rewards discipline and planning but punishes carelessness. If you like structure, patience, and steady progress instead of constant adrenaline, this approach might suit you best.

11. FAQs – Frequently asked questions

Swing trading focuses on holding trades for several days or weeks to capture short- and medium-term price moves. Traders study market trends, use technical tools, and plan trades around patterns that repeat over time.

Yes, it can be a great starting point. It teaches patience, discipline, and the basics of market timing without the high pressure of day trading.

Day traders open and close all trades within the same day, while swing traders hold positions longer to catch larger moves. Day trading requires more screen time and faster decisions.

It depends on the market and your broker’s requirements. Many traders begin with a few hundred dollars, though a larger balance helps manage risk better.

Yes, but crypto markets move quickly, so volatility is higher. It is important to use stop-loss orders and stick to your plan to avoid emotional decisions.

Always use clear entry and exit rules, define your position size, and never risk more than you can afford to lose. Consistency in risk management is key to long-term success.

No, and that is one of the main advantages. Swing traders wait for the best opportunities and skip low-quality setups.

Some traders use algorithms, but most prefer manual control. Automation can help with execution, but it cannot replace the experience and judgment of a human trader.

Honestly, neither is “better” it just depends on your personality. Swing trading aims for larger, more stable profits over several days with less stress. Day trading is all about smaller, faster gains within a single day but requires constant attention. I think swing trading is a more balanced approach for most people.

It’s a super important risk management guideline. To put it simply, it means you should never risk more than 2% of your total account balance on a single trade. For example, on a $10,000 account, you wouldn’t let a single trade lose you more than $200.

Nope, that’s a common misconception. The $25,000 Pattern Day Trader (PDT) rule only applies to people who buy and sell the same stock within the same day, multiple times a week. Since swing traders hold positions overnight, this rule doesn’t apply to them.

It really comes down to a few key things: poor risk management, making emotional decisions (like panic selling), breaking their own rules, and overtrading. In short, they lack discipline.

Absolutely, it can be very profitable. But it’s not a get-rich-quick scheme. Success comes from having a solid strategy, being incredibly disciplined, and managing your risk on every single trade.

Typically, a swing trade lasts anywhere from a few days to several weeks. You’re holding on long enough to capture a significant “swing” in the price, but not so long that it becomes a long-term investment.

Most swing traders stick to the classics because they work. The most popular ones are Moving Averages (MAs), the Relative Strength Index (RSI), and the MACD. They are great for identifying trends and momentum.

This is just a more conservative version of the 2% rule. It means you never risk more than 1% of your trading capital on any single trade. It’s an excellent guideline for beginners because it protects your capital while you learn.

Again, this is the classic rule of thumb for risk. Never put more than 2% of your account at risk on a single trade. This simple rule ensures that a string of losses can’t wipe you out, so you can always stay in the game.

12. Conclusion

In short, what is swing trading comes down to timing, discipline, and understanding price behavior. It is a trading style that helps you capture meaningful market swings without the stress of day trading.

At H2T Funding, we view swing trading as a foundation for developing patience and consistency in the markets. If you want to keep learning and improving, explore our Prop Firm & Trading Strategies category for more guides, insights, and real examples to sharpen your trading edge.