The Apex Trader Funding evaluation phase is the first challenge that every trader needs to complete to access a funded account. It’s designed to measure a trader’s skill, discipline, and risk control in real market conditions but without using real capital.

Understanding the Apex Trader Funding evaluation rules is key to passing successfully and avoiding disqualification. The core structure is the same across platforms, but Rithmic and Tradovate have slight differences. Notably, the trailing drawdown behaves differently depending on your balance. Knowing these nuances early helps one plan trades safely and maintain compliance.

In this guide, H2T Funding explains every rule in detail, with trading platforms comparisons and real examples. It’s also pro tips to help you pass the evaluation smoothly and start trading a funded account with confidence.

Key takeaways

- Evaluation Phase: Simulated account to test trading skill, risk management, and discipline before earning a funded account.

- Profit Target Rule: Must reach the set profit target for your account size without breaching the trailing drawdown.

- Minimum Trading Days (7-Day Rule): Complete at least seven separate trading days to demonstrate consistent performance.

- Trailing Drawdown Rule: Maximum loss allowed while trading; dynamically moves with your highest unrealized balance on full accounts. Failing this threshold causes instant evaluation failure.

- Static vs Full Accounts: Full accounts allow the trailing drawdown to move with profits until locked, while static accounts have a fixed drawdown for conservative risk management.

- Position Size Limit: Maximum contracts per plan must be respected to avoid automatic order rejection and account violations.

- Overnight and Weekend Trading Rule (4:59 PM Rule): All trades must be closed by 4:59 PM ET; no positions carried overnight or through weekends.

- Holiday Trading Rule: Only trade on open market days; half-day holidays do not count as trading days; close all positions manually before early market closes.

- Professional Conduct & Account Monitoring: Sharing login credentials or allowing others to trade is prohibited; actively monitor account balance, profit target, and drawdown using RTrader or Tradovate.

- Platform Differences: On Rithmic, the trailing drawdown stops once the profit target is reached. On Tradovate, it continues throughout the evaluation phase.

- Evaluation Resets & Renewals: Accounts can be reset after a failed attempt; 30-day billing cycle with optional renewals; refunds only within 48 hours per account activation fee policy.

1. What is the Apex evaluation phase?

The evaluation phase in Apex consists of a SIM trading account, whereby the traders prove their skills before earning a funded account. It is not live trading but a mirrored execution of real-time market conditions to check on your risk management, trading discipline, and consistency of your strategy.

Every trader must satisfy a profit target, not exceed the maximum drawdown, and complete at least seven days of trading. These are in place to ensure that Apex picks traders who can consistently perform well, instead of simply getting lucky or winning big once.

There is no maximum time limit for the evaluation. You can take the time needed to meet your objectives and perfect your trading plan. The process also requires that traders be at least 18 years old. Since all of the trades are simulated, there are no real deposits or margin calls, which makes it a safe way to gain experience prior to managing real capital.

2. Key Apex Trader Funding evaluation rules (complete list)

Before starting your evaluation, it’s essential to understand all the key Apex Trader Funding rules that govern account qualification. Study these rules carefully and plan your trades wisely to maximize your chances of passing. Start mastering them today.

If you’re new to this prop firm model, you should first understand how Apex Trader Funding works before applying these rules to your evaluation plan.

2.1. Profit target rule

The profit target defines how much you must earn before qualifying for a funded account. Each plan has a fixed target based on the account size. Your gains must be achieved without breaching the trailing drawdown, ensuring consistent risk management rather than short-term luck.

Profits are net of commissions and fees, so always check your real-time PnL inside RTrader or Tradovate. Meeting the goal shows you can balance trading discipline and reward, which is vital for long-term performance.

Profit Target by Account Size

| Account Size | Profit Target |

|---|---|

| $25K | $1,500 |

| $50K | $3,000 |

| $100K | $6,000 |

| $150K | $9,000 |

| $250K | $13,000 |

| $300K | $15,000 |

Track your progress daily and avoid aggressive trades after reaching 80% of your goal. You should maintain your balance above the profit target after completing the required seven trading days to officially pass.

Check how many consecutive days are required for an Apex-funded account payout before planning your evaluation.

2.2. Minimum trading days rule (7-day rule)

The 7-day rule ensures traders demonstrate steady performance rather than luck from a few winning trades. You must complete at least seven separate trading days before qualifying, even if your profit target is reached early. This helps Apex verify consistency and trading discipline across different market conditions.

Trading days don’t have to be consecutive, so you can pause and resume as needed. Sundays count as part of Monday’s trading session, following the 6:00 PM ET to 4:59 PM ET cycle. There’s also no maximum time limit; you can take as long as necessary to finish your evaluation.

2.3. Trailing drawdown rule (Most important)

The trailing drawdown is the most critical part of the Apex evaluation. It defines the maximum loss allowed while trading. Unlike other firms, Apex doesn’t use a daily max loss; instead, it tracks your highest account balance in real time, moving the drawdown upward as your profits grow.

This means the drawdown follows your unrealized balance, not just closed trades. If your balance peaks at $50,875 and later closes lower, the drawdown still trails from that highest point. Falling below the liquidation threshold at any time fails the evaluation.

To stay safe under this rule, each trade should follow a strict risk management guideline with a clearly defined stop-loss. Ideally, your risk-to-reward ratio should not exceed 5:1, and you should never move stops further away from entry to increase risk.

Trailing Drawdown by Account Size

| Account Size | Max Drawdown (Trailing) |

|---|---|

| $25K | $1,500 |

| $50K | $2,500 |

| $100K | $3,000 |

| $150K | $5,000 |

| $250K | $6,500 |

| $300K | $7,500 |

| $100K Static | $625 (fixed) |

Platform differences:

- Rithmic accounts: The trailing drawdown stops once the threshold equals your profit target, locking your progress.

- Tradovate accounts: The drawdown continues trailing throughout the evaluation, demanding closer account monitoring.

Tip: Track your trailing threshold daily in RTrader or Tradovate. Knowing how it moves with your balance helps prevent unexpected liquidation and supports better risk management.

Apex has no daily drawdown limit that causes instant failure; only the trailing drawdown determines pass/fail status

2.4. Static vs. Full account rule

Apex offers two main account types: Full and Static, each with different drawdown mechanics and trading flexibility. Understanding which one you’re using helps you plan your risk-reward ratio and manage trades more effectively.

Full Accounts:

- The trailing drawdown moves with your unrealized profits.

- Once your balance exceeds the starting balance + drawdown + $100, the threshold stops moving.

- Ideal for traders who prefer flexible growth and larger position sizing.

Static Accounts:

- The drawdown is fixed and doesn’t trail with your profits.

- Example: A $100K static account has a set drawdown of $625.

- Suitable for those who prefer stable rules and smaller daily risk exposure.

| Account Type | Drawdown Movement | Risk Style | Best For |

|---|---|---|---|

| Full | Trailing until locked | Dynamic | Growth-focused traders |

| Static | Fixed | Conservative | Risk-controlled traders |

Always confirm your account type in RTrader or Tradovate before starting. Mixing strategies between static and full setups often leads to misjudged risk and premature liquidation.

2.5. Position size limit

Every Apex evaluation plan sets a maximum number of contracts you can trade at once. This rule ensures traders manage position sizing responsibly and maintain control during volatile markets. Orders that exceed the limit are automatically rejected by the trading platforms.

The limit applies to both standard and micro futures, allowing you to split positions across instruments. For example, if your cap is 10 contracts, you could trade 7 ES and 3 GC, staying within the same total.

Position size by account plan

| Account Size | Max Contracts | Example Setup |

|---|---|---|

| $25K | 4 minis | 4 ES or 8 micros |

| $50K | 10 minis | 7 ES + 3 GC |

| $100K | 14 minis | 10 ES + 4 NQ |

| $150K | 17 minis | 12 ES + 5 GC |

| $250K | 27 minis | Flexible mix |

| $300K | 35 minis | High-volume trading |

| $100K Static | 2 minis | Conservative setup |

You should track your contract usage carefully inside RTrader or Tradovate. Staying within your plan’s contract limits protects your account from instant rule violations and maintains good standing for funded approval.

2.6. Overnight and weekend trading rule (4:59 PM Rule)

Apex requires all trades to be closed by 4:59 PM ET, with no open positions carried overnight or through weekends. This rule protects traders from market volatility and gaps that can occur outside regular hours. Failing to close positions before the cutoff may lead to automatic liquidation or account failure.

Although Apex includes an auto-close safeguard, it’s only a last resort, not a substitute for proper trade management. You’re responsible for canceling all pending orders not linked to open positions. Relying on the safeguard repeatedly can signal poor trading discipline and affect your evaluation standing.

Summary of the 4:59 PM Rule

- All trades must close before 4:59 PM ET.

- Cancel all pending orders manually.

- Early market closures (e.g., holidays) require earlier manual exits.

- The auto-close system is a backup only, not a trading strategy.

Tip: Set alerts 10 minutes before 4:59 PM to avoid rushed exits. Following this rule consistently reflects professional conduct and helps prevent unnecessary account resets.

2.7. Holiday trading rule

You can trade during holidays only if the markets remain open, but half-day holidays do not count as trading days in your evaluation. This rule ensures traders operate in normal market conditions where liquidity and volatility are stable.

If a market closes early (for example, on Christmas Eve or Independence Day), all open trades must be closed manually before the early close time. Failure to do so may trigger unwanted account liquidation or impact your trading consistency record.

Remember to check the CME and Apex holiday calendars weekly. Managing your trading schedule around low-volume sessions helps you maintain consistent results and avoid unpredictable moves during holiday volatility.

2.8. Professional conduct and account monitoring

Apex expects traders to follow strict professional standards throughout the evaluation. Sharing your login credentials or allowing others to trade your account is strictly prohibited. Maintaining ethical conduct reflects reliability, a key factor in progressing to funded accounts.

You must actively monitor your account through RTrader or Tradovate to track balance changes, the trailing threshold, and open positions. These platforms also serve as backups for managing orders in case of connectivity issues. Ignoring account monitoring can lead to missed liquidations or delayed reactions to drawdown thresholds.

Best practices for account monitoring

- Keep RTrader or Tradovate open while trading.

- Regularly check your account balance, profit target progress, and drawdown limit.

- Verify that all orders are executed or canceled properly before the session closes.

- Maintain consistent trading behavior that aligns with your plan.

Tip: Treat your evaluation as if it were a live funded account. Displaying professional discipline and careful monitoring during this stage shows Apex that you’re ready for real capital management.

Following all Apex funding trading rules is the foundation for passing and earning a funded account. Adhere to profit targets, maintain seven trading days, respect trailing drawdown, and monitor positions actively. Professional conduct and consistent strategy execution not only help you succeed but also build habits for long-term, risk-controlled trading performance.

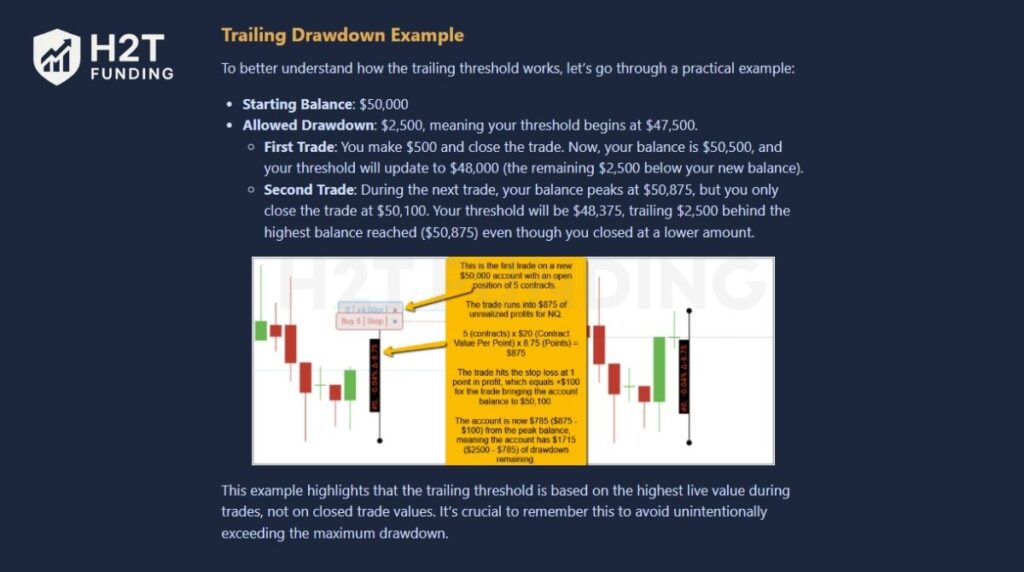

3. Understanding the trailing drawdown (Examples)

The trailing drawdown is designed to measure how well you manage losses and protect gains. It moves upward with your highest unrealized balance, not your closed trades, making it crucial to understand how your trading behavior affects the threshold in real time.

Let’s look at a simple example with a $50K account:

- Starting balance: $50,000

- Allowed drawdown: $2,500 → initial threshold at $47,500

- First trade: You earn $500 and close at $50,500 → threshold rises to $48,000

- Second trade: Balance peaks at $50,875 but closes at $50,100 → threshold moves to $48,375, trailing the highest balance reached.

This means even if you close a trade lower, the drawdown still locks to the highest point achieved. Dropping below this moving threshold instantly fails your evaluation.

| Action | Account Balance | Trailing Threshold |

|---|---|---|

| Start | $50,000 | $47,500 |

| After the first trade | $50,500 | $48,000 |

| Peak during the second trade | $50,875 | $48,375 |

| Close lower | $50,100 | (unchanged) $48,375 |

Track your drawdown threshold daily using your RTrader or Tradovate dashboard. Awareness of this moving limit helps you manage risk, adjust position sizing, and avoid unexpected liquidation.

If you fail an evaluation, it’s also worth checking whether failed Apex accounts can be used for tax write-offs. And once you pass, make sure you understand the Apex consistency rule for payouts to avoid payout delays later.

4. How to pass the Apex evaluation successfully

For anyone wondering how to get funded as a trader, the key is following a consistent plan and respecting risk limits. Traders who focus on steady growth and strict risk management tend to qualify faster and maintain stronger performance once funded.

Follow these practical steps to pass efficiently:

- Start small and scale gradually as your balance grows.

- Track your trailing drawdown daily to stay above the liquidation threshold.

- Avoid trading during major economic news unless your strategy is tested under volatility.

- Close all positions before 4:59 PM ET to comply with the daily cut-off rule.

- Maintain consistency in trade size and timing rather than chasing large one-day profits.

These habits help you build a disciplined trading plan, demonstrate reliability to Apex, and prepare for the funded account phase.

Once you reach the funded stage, make sure you understand the Apex Trader Funding consistency rule to avoid payout issues and keep your performance stable.

5. Common reasons traders fail evaluations

Most evaluation failures happen not because traders lack skill, but because they overlook key Apex trading funding rules. Apex’s system is transparent, and understanding where others fail can help you avoid costly resets.

The most frequent causes include:

- Dropping below the trailing drawdown threshold due to poor risk control.

- Forgetting to close positions before 4:59 PM ET, triggering auto-liquidation.

- Exceeding the maximum contract limit or ignoring position-size rules.

- Misunderstanding how the trailing vs. static drawdown functions on each platform.

- Reaching the profit goal but failing to maintain it for seven trading days.

- Relying on the auto-close safeguard instead of managing trades manually.

By avoiding these mistakes, traders can maintain cleaner records, reduce the need for resets, and progress toward their performance account faster.

6. Evaluation resets, renewals, and refunds

Apex allows traders to reset their evaluation account anytime after a rule violation or failed attempt. Resetting restores your starting balance and drawdown level, giving you a clean slate without needing to open a new plan.

Evaluations run on a 30-day billing cycle and renew automatically unless canceled. This is often called the Apex Trader Funding 30 rule, since your subscription follows a monthly renewal structure. After failing, you can either reset immediately or wait for renewal to continue.

Accounts not reset within eight days after failure are disabled unless there’s an active subscription. Refunds are only available under the 48-hour renewal policy, following the same conditions as Apex’s activation fee refund. This system gives traders the flexibility to learn, adjust their strategy, and re-enter the evaluation smoothly.

7. Account management & monitoring

Effective account monitoring is essential during the Apex evaluation. Your dashboard on RTrader or Tradovate provides real-time data on profit, drawdown, and overall progress, helping you manage trades with accuracy and confidence.

Within the Eval Charts tab, traders can review their PnL history, daily performance, and number of trading days completed. The system also displays key metrics such as account balance, profit target, trailing threshold, and account status, whether active, passed, or failed.

Knowing your account type (static or full) and platform (Rithmic or Tradovate) is critical, as each has different drawdown behavior. Before transitioning to a funded account, Apex may request identity verification to confirm eligibility and ensure regulatory compliance.

Monitoring these metrics consistently supports disciplined trading and keeps your account aligned with Apex’s evaluation standards.

If you run into issues after passing, it’s also helpful to know whether you can reset a funded Apex account and how the process works.

8. Compare Apex evaluation rules with other prop firms

Apex Trader Funding stands out for its flexible evaluation structure and no time limits, making it more accessible than many competitors. Unlike other prop firms that impose strict deadlines or daily loss caps, Apex focuses on overall discipline and drawdown control rather than speed.

| Prop Firm | Daily Loss Limit | Profit Target | Min. Trading Days | Trailing Drawdown |

|---|---|---|---|---|

| Apex Trader Funding | None | ~6% | 7 | Yes (Rithmic stops at target) |

| FTMO | 5% | 5% – 10% | 4 | No |

| Topstep | None | ~6% | 2-5 | No |

| FundedNext | 3% – 5% | 4% – 10% | 2-5 | No |

Apex’s evaluation is flexible, giving traders unlimited time, no daily max loss, and stopping the trailing drawdown on Rithmic accounts at the profit target. This design helps traders focus on risk management, trading consistency, and strategy development instead of rushing to meet deadlines.

Read more:

9. Community Insights: Apex Trader Funding Evaluation Rules Reddit Discussions

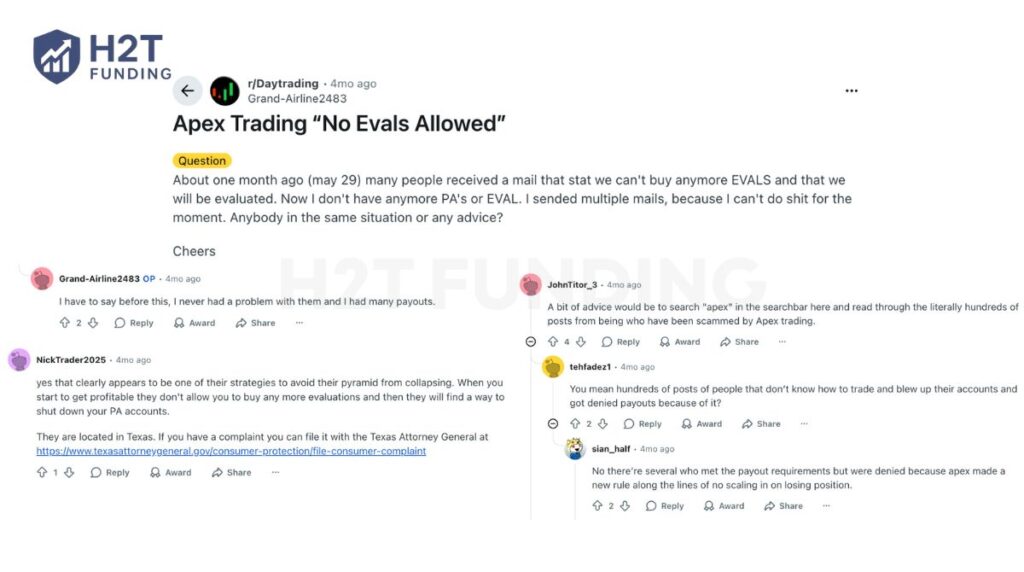

Traders on Reddit’s r/DayTrading have shared firsthand experiences with the Apex evaluation rules, giving new traders a clearer view of how these rules work in real conditions.

Many discussed the brief “No Evals Allowed” period, when Apex temporarily paused new evaluations for compliance and internal review. Some traders expressed frustration at not being able to access their PA or Eval accounts, while others confirmed that Apex had processed payouts smoothly before the pause.

In the same thread, users debated whether Apex’s strict enforcement of drawdown and scaling rules was fair or overly cautious. A few suggested it was meant to protect firm stability, while others suspected it limited high-performing traders. Still, several confirmed successful payouts have occurred after following the rules precisely.

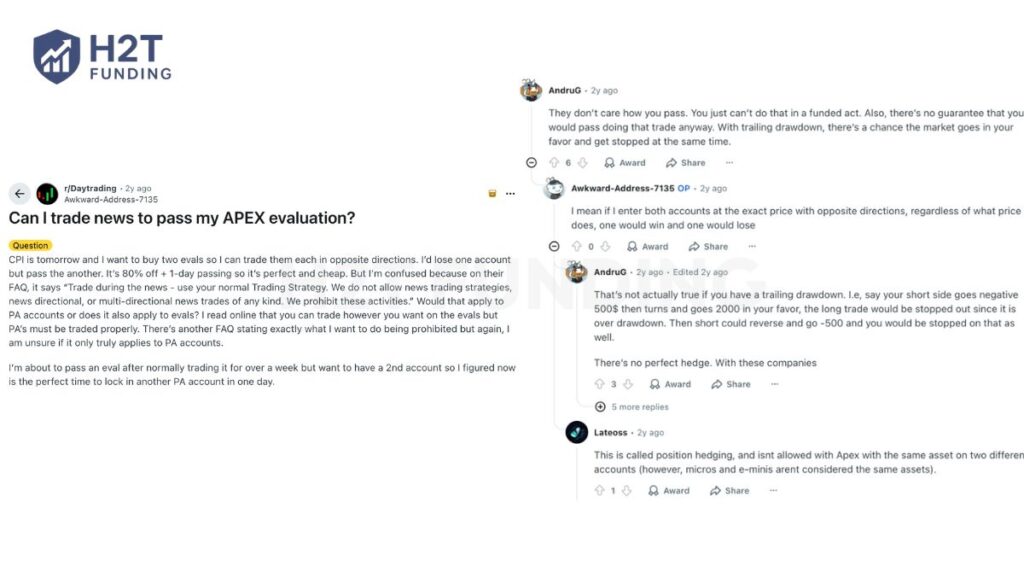

Other Reddit users questioned whether news trading or hedging between two evaluation accounts was allowed. Experienced traders clarified that trading opposite directions or using multi-account hedges can violate Apex’s rules, especially under trailing drawdown conditions, and often leads to instant disqualification.

These Reddit discussions highlight how crucial it is to understand each rule, especially the trailing threshold and risk restrictions, before attempting to pass or manage multiple evaluations. They also emphasize the need for discipline and full awareness of Apex’s platform-specific policies.

10. FAQs

They include key requirements like meeting a profit target, completing at least seven trading days, and staying above the trailing drawdown threshold. You must also follow platform-specific limits and trading hours to remain compliant.

You must trade on seven separate days before passing the evaluation, even if you reach the profit goal early. This helps prove trading consistency and discipline.

It’s a moving loss limit that rises with your highest unrealized balance. If your account falls below this level, your evaluation fails immediately.

Your account is liquidated, and you’ll need to reset the evaluation to start again. The reset restores your balance and drawdown to their original levels.

No. All positions must be closed before 4:59 PM ET each day. Orders left open may trigger automatic liquidation.

Yes. You can reset anytime to try again without creating a new plan. The reset fee depends on your account size.

For Rithmic accounts, the drawdown stops moving once it reaches your profit target. On Tradovate, it continues to trail throughout the evaluation phase.

A static account has a fixed drawdown that doesn’t move, while a full account has a trailing drawdown that adjusts with your profits. Each type suits different risk management styles.

11. Conclusion

Apex Trader Funding evaluation rules define how traders prove discipline, consistency, and risk control before funding. Master the trailing drawdown, meet the profit goal, and log seven trading days; these are the pillars that prevent avoidable failures and keep your account in good standing.

Passing isn’t about speed; it’s about rule awareness and steady execution. Close positions before 4:59 PM ET, respect contract limits, and track your threshold in RTrader or Tradovate. Choose the right account type (Full vs Static) and platform (Rithmic vs Tradovate) to align with your plan.

For practical next steps, review your metrics daily and refine your trading plan for consistent results. Want deeper comparisons, funded account guides, and strategy notes? Visit the Prop Firm & Trading Strategies section on H2T Funding for clear, actionable insights.