In the Tradeify vs My Funded Futures matchup, Tradeify is best for maximizing profit with its 90% split, while MyFundedFutures is easier to pass for beginners.

Choosing the wrong prop firm is a costly mistake. A hidden drawdown rule can cost you your account and wasted effort. Read H2T Funding’s in-depth comparison to see which firm truly fits your style.

Key takeaways:

- Tradeify is best for traders seeking high profit splits (90%) and flexibility. MyFundedFutures is easier to pass for beginners due to simpler rules and no daily loss limit during evaluation.

- Tradeify is ideal for traders who value choice and flexibility, including those confident enough for instant funding. MyFundedFutures appeals to traders seeking a simple, direct path to a funded account with minimal rule constraints.

- Tradeify offers superior flexibility with three distinct paths (Growth, Select, and Lightning instant funding). MyFundedFutures focuses on a single, efficient 1-step evaluation model for all its account options.

- Tradeify primarily uses End-of-Day trailing drawdowns. Some previous plan versions reportedly used intraday drawdown. MyFundedFutures applies a consistency rule during evaluation but completely removes it on funded accounts, offering greater freedom.

- Tradeify offers daily withdrawal options. Some traders report flexible timing, though the website lists daily payouts as the primary option. MyFundedFutures offers daily payouts, with the first withdrawal available after 5 winning days and a minimum of $100.

- Both firms support popular trading platforms. However, Tradeify offers its exclusive ProjectX platform with analytics and integrated tools; some traders report advanced journaling features.

1. Overview of each firm: Tradeify vs My Funded Futures

While both Tradeify and MyFundedFutures are leading platforms that fund talented futures traders, their core philosophies diverge significantly. This initial overview will highlight the fundamental differences in their approach, giving you a clear snapshot of where each firm stands in the proprietary trading landscape.

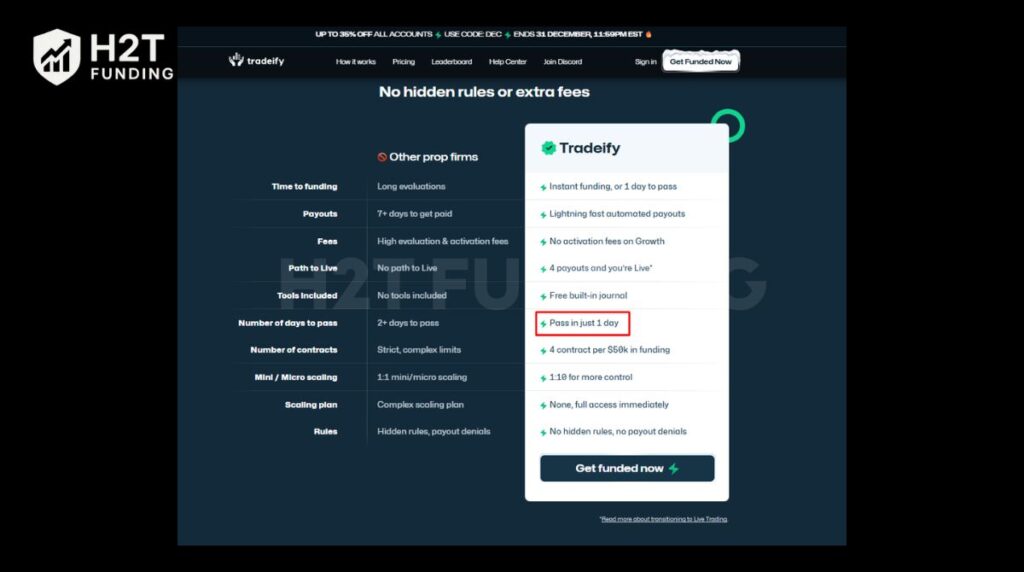

Tradeify positions itself as a versatile ecosystem with multiple funding avenues, including instant funding options. It caters to traders who value speed, choice, and technological integration.

In contrast, MyFundedFutures adopts a more streamlined approach, built around single, structured evaluations. It has earned a reputation for its rapid payouts, simplicity, and clear-cut rules.

| Criteria | Tradeify | MyFundedFutures |

|---|---|---|

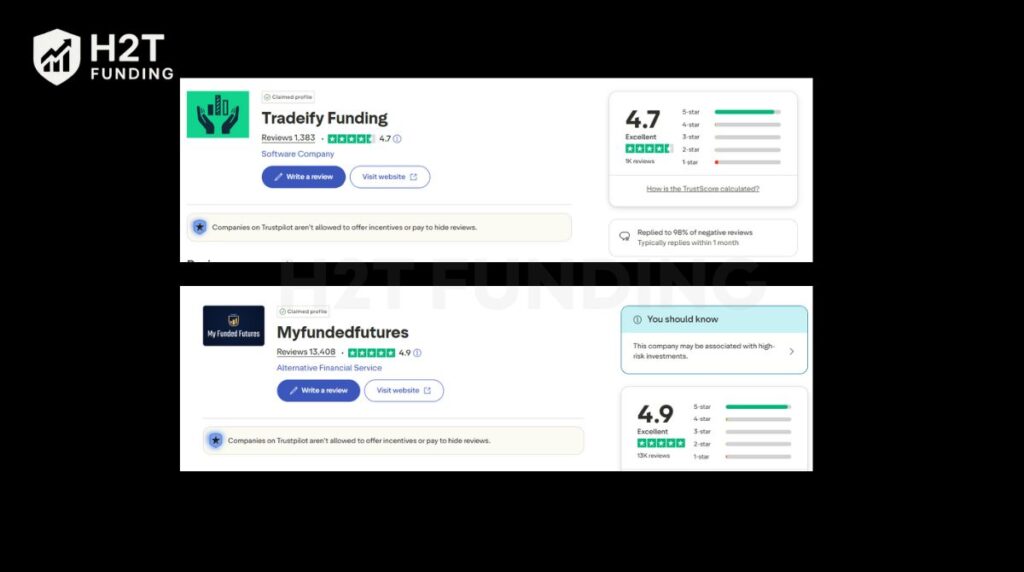

| Trustpilot Score | 4.7 / 5.0 (from 1,380+ reviews) | 4.9 / 5.0 (from 13,400+ reviews) |

| Founded / Trust | Established firm known for flexibility and technology. | Highly trusted with a massive review base; known for transparency. |

| Evaluation Models | Growth (1-Day Eval), Select (1-Day Eval), Lightning (Instant) | 1-Step Evaluation (Rapid, Core, Scale, Pro plans) |

| Account Sizes | $25K, $50K, $100K, $150K | $50K, $100K, $150K |

| Asset Classes | Futures (CME, CBOT, NYMEX, COMEX) | Futures (CME, CBOT, NYMEX, COMEX) |

| Trading Platforms | Tradovate, ProjectX, NinjaTrader, TradingView | Tradovate, NinjaTrader, TradingView |

| Profit Split | 90% | 80% |

| Minimum Days | 0 (Lightning) or 1 (Evaluation) | 1 Trading Day |

| Scaling Programs | Yes, based on account equity growth | Yes, based on account equity growth |

| Execution Speed | Fast, via professional platforms and data feeds | Fast, via professional platforms and data feeds |

| Commissions | Standard platform commissions apply | Standard platform commissions apply |

| Payouts | Highly Flexible: Daily or 5-Day options available | Very Fast: Daily Rapid Payouts |

| Risk Restrictions | EOD Trailing Drawdown: Some plans have consistency rules | EOD Trailing Drawdown; no consistency on core plans; stricter news trading rules |

The choice between Tradeify and MyFundedFutures comes down to your priorities. Instead of a single answer, this summary table highlights the winner in each key area so you can decide based on your trading style.

Quick Winner’s Summary

| Category | Winner | Reason |

|---|---|---|

| Profit Split | Tradeify | A higher 90% share vs. MFF’s 80%. |

| Ease of Passing | MyFundedFutures | No Daily Loss Limit during evaluation is a major advantage. |

| Beginner-Friendly | MyFundedFutures | Simpler rules and a more straightforward process. |

| Payout Flexibility | Tradeify | Offers more payout policy options. |

| Advanced Tools | Tradeify | The proprietary ProjectX platform is a significant plus. |

Disclaimer: Rules, pricing, and trading conditions may change over time. Traders should always verify the latest terms directly on the official Tradeify and My Funded Futures websites before purchasing any challenge.

Let’s now dive deeper into the specific offerings of each firm. This will help you understand the nuances that make each platform unique.

Tradeify

#1

Account Types

1-step and instant funding

Trading Platforms

Tradovate, NinjaTrader 8, Quantower, TradingView, Project X

Profit Target

6%

Our take on Tradeify

From my experience analyzing dozens of prop firms, Tradeify stands out for its sheer adaptability. It has built a platform that empowers traders to choose a path that perfectly matches their risk tolerance, timeline, and trading style. The emphasis is clearly on removing unnecessary friction.

This makes it an excellent choice for traders who prioritize getting funded quickly and want fewer initial hurdles. Whether you’re a seasoned professional ready for an instant account or a developing trader who wants a fast evaluation, Tradeify provides a tailored solution. Its proprietary ProjectX platform with integrated trading tools, like automated journaling, further reinforces its commitment to a seamless trader experience.

| 💳 Challenge Fee | $69 – $729 |

| 👥 Account Types | 1-step and instant funding |

| 💰 Profit Split | 80% |

| 💵 Account Size | $25K – $150K |

| ⏱️ Time Limit | No time limit |

| 🎯 Profit Target | 6% |

| 📊 Trading Platforms | Tradovate, NinjaTrader 8, Quantower, TradingView, Project X |

| 🛍️ Asset Types | Futures Contracts |

My Funded Futures

#2

Account Types

1-step

Trading Platforms

Tradovate, NinjaTrader 8, TradingView, Quantower, Volsys, Volumetricatrading

Profit Target

6%

Our take on My Funded Futures

My impression of MyFundedFutures is that it’s a firm built on clarity and efficiency. It has carved out a strong niche by focusing exclusively on futures and perfecting a simple, direct path to funding. The entire process feels transparent, which is why it has become so popular among day traders who thrive on clear rules and consistent execution.

MFF is best suited for traders who value a straightforward evaluation, transparent risk parameters, and freedom from complex rules like consistency on their main plans. The firm’s reputation for rapid, reliable payouts and a supportive community makes it a trusted name for those focused on disciplined, long-term growth in their simulated trading journey.

| 💳 Challenge Fee | $77 – $477 |

| 👥 Account Types | 1-step |

| 💰 Profit Split | 80% |

| 💵 Account Size | $50K – $150K |

| ⏱️ Time Limit | No time limit |

| 🎯 Profit Target | 6% |

| 📊 Trading Platforms | Tradovate, NinjaTrader 8, TradingView, Quantower, Volsys, Volumetricatrading |

| 🛍️ Asset Types | Futures Contracts |

Read more:

2. Core models & key rules: Tradeify vs MFF

The rules a trader must follow are the heart of any prop firm comparison. This is where the trader experience is truly defined, separating a platform that fuels growth from one that creates frustration. How each firm structures its evaluation, manages risk, and dictates trading freedom will ultimately determine its suitability for your strategy.

This section provides a direct Tradeify vs MyFundedFutures analysis of their core models, risk parameters, and operational policies, giving you the clarity needed to choose the right partner for your capital allocation goals.

2.1. Evaluation process, profit targets & minimum days

The path to a funded account is the first major hurdle for any trader. Here, we directly compare how difficult it is to pass the initial challenge at both firms by examining the structure, targets, and time required.

| Criteria | Tradeify | MyFundedFutures |

|---|---|---|

| Evaluation Structure | Multiple Paths: 1-Day Evaluations (Growth, Select) or Instant Funding (Lightning). | Single Path: A streamlined 1-Step Evaluation for all account types. |

| Profit Target | $3,000 on a $50K Growth account. | $3,000 on a $50K account. |

| Minimum Trading Days | 0 for Lightning (Instant) or 1 Day for evaluation accounts. | 1 Trading Day to meet the objective. |

| Evaluation Difficulty | More Flexible. The variety of options means a trader can pick their preferred path. | More Straightforward. One clear set of objectives to meet. |

Note: For standard 50K accounts, both firms set a $3,000 target; however, profit targets for other account types and sizes (like Pro or Select) will vary.

In summary, Tradeify offers unmatched speed and flexibility for getting funded, especially with its instant account option. MyFundedFutures provides a simple, singular focus that many traders find refreshingly clear and easy to follow.

2.2. Drawdown & daily loss limits

Risk management rules are non-negotiable and represent the most common reason traders fail challenges. Understanding the exact drawdown and loss limit parameters is critical before committing to either firm.

| Criteria | Tradeify | MyFundedFutures |

|---|---|---|

| Max Loss (Drawdown) | $2,000 Trailing Drawdown on a $50K Growth account. | $2,000 Trailing Drawdown on a $50K account. |

| Daily Loss Limit | Yes, varies by plan (e.g., $1,250 on a 50K Growth account). | None during the 1-Step Evaluation phase. |

| Drawdown Type | End-of-Day (EOD) Trailing Drawdown for most plans. | End-of-Day (EOD) Trailing Drawdown. |

| Rule Strictness | Moderate. The presence of a Daily Loss Limit adds a layer of risk control. | Lenient. The absence of a Daily Loss Limit during evaluation provides more intraday freedom. |

Ultimately, the risk parameters for Tradeify and MyFundedFutures cater to different mindsets. MyFundedFutures offers greater freedom during the evaluation day by removing the daily loss limit, which can benefit certain strategies. Tradeify implements a daily loss limit from the start, which encourages more disciplined risk management throughout the process.

2.3. News, overnight & automation policies

Beyond profit and loss, a firm’s operational rules dictate how and when you can trade. Policies around news events, holding positions, and using automated systems can significantly impact a trader’s performance and freedom.

| Policy | Tradeify | My Funded Futures |

|---|---|---|

| News Trading | Allowed. Traders can trade during news events at their own risk. | Highly Restricted. Prohibits holding positions 2 minutes before and after Tier-1 news releases. |

| Overnight Trading | Prohibited. All positions must be closed before the market closes. | Prohibited. All positions must be closed daily. |

| Weekend Trading | Prohibited. | Prohibited. |

| Automation / EAs | Allowed, with conditions (not HFT, strategy must be owned by the trader). | Allowed, with conditions (cannot exploit the system, must follow CME rules). |

| Prohibited Strategies | High-Frequency Trading (HFT), platform exploitation. | Hedging, exploiting platform errors, and collaborative trading. |

In conclusion, Tradeify offers significantly more freedom regarding news trading, making it a better fit for traders whose strategies rely on volatility around major economic events. In contrast, MyFundedFutures enforces stricter controls around news, which promotes a more disciplined, risk-averse trading environment but limits certain opportunities. Both firms have similar, reasonable policies regarding automation and prohibited trading practices.

3. Fees, refunds & cost efficiency of Tradeify and MyFundedFutures

The initial cost of an evaluation is a critical factor for any trader, as it represents the upfront financial risk. A firm’s fee structure, refund policy, and overall transparency can reveal much about its trader-centric approach. Understanding these financial aspects is key to determining the long-term value and cost-efficiency of a prop firm partnership.

This section breaks down the costs associated with Tradeify vs MyFundedFutures, helping you assess which firm offers a better return on your initial investment.

| Criteria | Tradeify | MyFundedFutures |

|---|---|---|

| Fee Type | One-time payment for Lightning accounts; monthly subscription for evaluation plans. | Monthly subscription for all evaluation plans. |

| Refund Policy | No refunds are mentioned in the provided materials. | No activation fees on Growth plans. A reset fee applies if you breach the rules. |

| Challenge Cost (50K) | $97/month for the Growth 50K plan. | $77/month for the Core 50K plan. |

| Transparency | Very high. All costs are clearly displayed with no hidden fees. | Very high. Clear pricing and a detailed, public refund policy. |

| Added Fees | No activation fees on Growth plans. A reset fee applies if you breach rules. | No activation fees mentioned. |

| Payout Cycle | No cost. Payouts are processed without fees. | No cost. Payouts are processed without fees. |

When evaluating cost-efficiency, MyFundedFutures presents a slightly more attractive initial proposition. Its lower monthly fee for the 50K account and a clear, trader-friendly refund policy reduce the initial financial barrier. This makes it a lower-risk entry point for traders who are confident in their ability but appreciate a safety net.

While Tradeify’s fees are competitive, its subscription model for evaluations and the lack of a stated refund policy mean the upfront commitment is firmer. However, the value proposition of its Lightning (instant funding) model could be seen as highly cost-efficient for experienced traders, as it bypasses recurring evaluation fees entirely.

For traders comparing Tradeify and MyFundedFutures, the choice comes down to prioritizing a lower initial cost and refund security versus paying for flexibility and speed.

4. Profit split & scaling programs of Tradeify and MyFundedFutures

A prop firm’s true partnership potential is revealed in its profit-sharing and growth opportunities. The profit split directly impacts a trader’s earning power, while well-structured scaling plans provide a clear path for career progression. These elements are crucial for long-term success, as they determine how a firm rewards and reinvests in its profitable traders.

This section examines how both firms handle payouts and account growth, highlighting which one offers a more lucrative and sustainable future.

| Criteria | Tradeify | MyFundedFutures |

|---|---|---|

| Profit Split | A generous 90% for the trader across all funded account types. | An 80% split for the trader on funded accounts. |

| Scaling Plans | Yes. Offers a progressive, equity-based scaling system on funded accounts. Contract limits increase as your account balance reaches specific profit milestones. | Yes. Provides a clear scaling plan where traders can increase their contract size as their account grows. |

| Payout Frequency | Highly Flexible. Traders can choose between a Daily or a 5-day payout policy. | Very Fast. Known for its Rapid Payout system, which allows for daily withdrawals. |

| Minimum Payout | No minimum specified for the 5-Day plan; $250 for the Daily plan. | $100 for the first payout, with conditions varying for subsequent withdrawals. |

| Withdrawal Conditions | Both feature conditional payouts; the 5-Day plan requires 5 winning days, while the Daily plan uses a profit buffer system. | Requires 5 winning trading days for the first withdrawal, with a consistency rule on some plans. |

If your end goal is to maximize your income, the choice is clear. I recommend choosing Tradeify. While both have good scaling plans, Tradeify’s 90% profit split means you keep more money in your pocket from every winning trade.

5. Platforms & tradable assets: MyFundedFutures and Tradeify

The quality of a firm’s technology infrastructure and the range of available assets are fundamental to a trader’s success. Reliable platforms, fast execution, and access to desired markets are non-negotiable. A firm that invests in superior technology demonstrates a commitment to providing a professional-grade trading environment.

This section compares the platforms and assets offered by both firms, revealing which provides a more robust and versatile trading experience.

| Criteria | Tradeify | MyFundedFutures |

|---|---|---|

| Trading Platforms | Excellent Selection. Supports Tradovate, NinjaTrader, TradingView, and its proprietary ProjectX platform. | Industry Standard. Supports Tradovate, NinjaTrader, and TradingView. |

| Asset Classes | Futures. Offers a wide range of futures products from CME, CBOT, NYMEX, and COMEX. (Does not offer virtual currency derivatives.) | Futures. Focuses exclusively on futures from CME, CBOT, NYMEX, and COMEX. |

| Execution Speed | Fast. Utilizes professional market data feeds and reliable platform connections compatible with VPS hosting. | Fast. Relies on established platforms known for stable and quick execution. |

| Commissions & Fees | Standard commissions are charged by the platform (e.g., Tradovate). | Standard platform commissions and fees apply. |

| Trader Dashboard | Advanced. Provides a comprehensive dashboard for performance tracking and rule monitoring. | Functional. Offers a clear and easy-to-use dashboard to track account progress. |

In this Tradeify vs MyFundedFutures comparison of technology, Tradeify has a distinct edge. The inclusion of its proprietary ProjectX platform, which features integrated tools like an automated trading journal, provides significant added value. Both firms support core platforms and markets. However, Tradeify’s investment in its technology gives it an edge for traders wanting advanced analytics.

6. Payout & trust: Tradeify vs MyFundedFutures Trustpilot and Reddit review

A prop firm’s marketing promises are put to the ultimate test in public forums like Trustpilot and Reddit. Real-world trader experiences reveal the truth about payout reliability, support quality, and rule fairness. Analyzing this community sentiment is the best way to gauge true trustworthiness.

(Note: Information collected and updated on December 18, 2025)

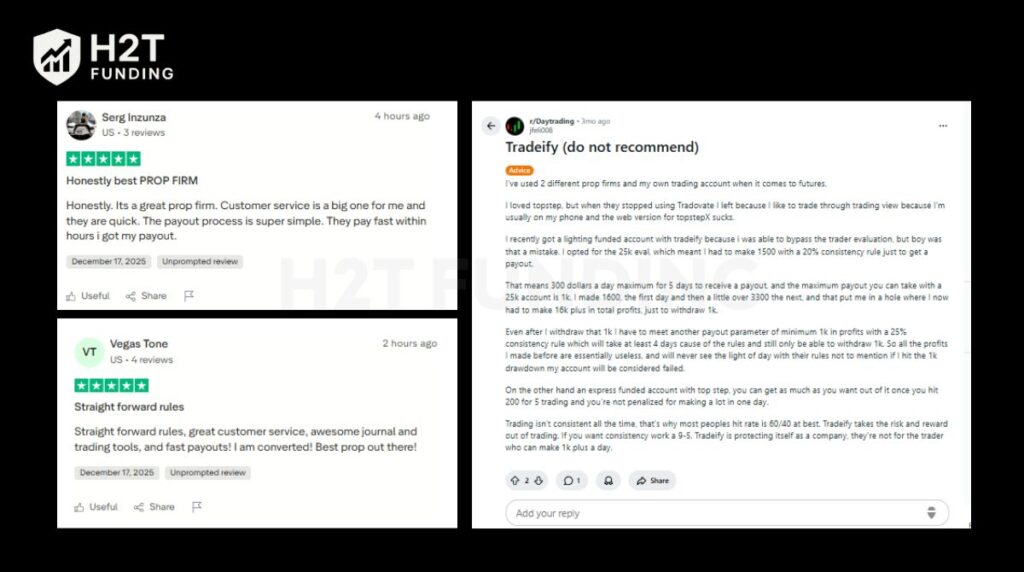

Community Evidence for Tradeify:

Positive reviews, like those from users Serg Inzunza and Vegas Tone, consistently praise Tradeify for “super simple” and “fast” payouts, along with “straightforward rules.” However, the negative feedback is just as revealing.

A detailed post from Reddit user jfeli008 warns that complex rules like the “consistency rule” can create a mathematical “hole,” making it nearly impossible to withdraw large profits.

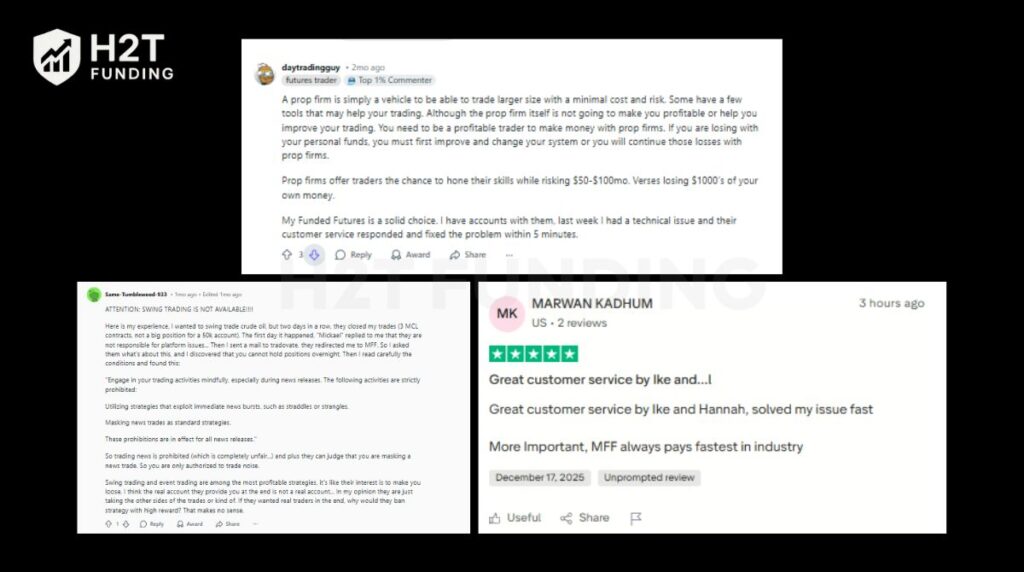

Community Evidence for MyFundedFutures:

MyFundedFutures receives glowing endorsements for its payout speed, with user MARWAN KADHUM claiming they “always pay fastest in the industry.” Support quality is also highly rated, as user daytradingguy shared that his issue was resolved “within 5 minutes.”

On the other hand, the main criticism comes from experienced traders like Same-Tumbleweed-933, who points out that strict rules banning “swing trading” and news trading restrict the most profitable strategies.

After analyzing dozens of reviews, a clear picture emerges. Both firms are trustworthy, with payouts being the most critical factor.

The core difference lies in the source of frustration. For Tradeify, the friction comes from rule complexity. Traders can get trapped by terms like “consistency” if they don’t read the fine print. For MyFundedFutures, the friction comes from rule strictness. Traders are restricted by operational bans like news trading.

Both are safe choices. Your decision depends on which risk you’re more comfortable managing: the risk of mastering complex rules for more freedom (Tradeify), or the risk of having your strategy limited for the sake of simplicity (MyFundedFutures).

7. Which prop firm is easier to pass?

For many traders, the single most important question is: which evaluation presents fewer obstacles to success? The ease of passing is determined by a combination of profit goals, the strictness of risk rules, and the overall complexity of the challenge.

This comparison analyzes the key factors affecting each firm’s evaluation difficulty. We will provide a clear verdict on which platform offers a smoother path to funding.

| Criteria | Tradeify | MyFundedFutures | Winner |

|---|---|---|---|

| Profit Target | Identical ($3,000 for a 50K account). | Identical ($3,000 for a 50K account). | Both |

| Drawdown Strictness | Includes a Daily Loss Limit during evaluation. | No Daily Loss Limit during the 1-Step evaluation. | MyFundedFutures |

| Rule Complexity | Multiple evaluation models with varying rules. | A single, streamlined 1-Step challenge with uniform rules. | MyFundedFutures |

| Overall Difficulty | Offers an instant funding option that bypasses evaluation entirely. | The evaluation itself has fewer intraday restrictions. | MyFundedFutures |

If you want the highest probability of passing an evaluation on your first attempt, choose MyFundedFutures. The absence of a Daily Loss Limit is a massive psychological advantage. Don’t let Tradeify’s “instant funding” option distract you from picking the path with a higher likelihood of success.

8. Tradeify vs MyFundedFutures: Who should choose which firm?

The best prop firm is not a one-size-fits-all solution; it’s the one that aligns perfectly with your specific trading style, risk tolerance, and financial goals. Use this guide to match your trader profile with the firm that will best support your journey.

| Trader Type | Best Choice | Why |

|---|---|---|

| Beginners | MyFundedFutures | Its simpler 1-step evaluation and lack of a daily loss limit are less intimidating. While both firms lack formal educational resources, MFF’s clear path is crucial for building confidence. |

| Futures Day Traders | Tradeify | The higher 90% profit split and flexible payout options (daily or 5-day) maximize earning potential for consistent, active traders. |

| Scalpers | MyFundedFutures | The absence of a Daily Loss Limit during the evaluation provides the necessary intraday flexibility that scalping strategies require to avoid nuisance breaches. |

| Swing Traders | Neither | Both firms prohibit holding positions overnight, a core requirement for swing trading. Traders using this strategy must look for other prop firms. |

| Risk-Averse Traders | MyFundedFutures | The clear refund policy reduces upfront financial commitment, and the straightforward rules are easier to follow without accidental breaches. |

| Automated Traders | Tradeify | Its proprietary ProjectX platform and a more advanced technology ecosystem offer a better environment for integrating automated trading strategies. |

| Cash-Flow Focused | Tradeify | The combination of a high withdrawal frequency (daily option) and a superior 90% profit split provides the fastest and largest access to profits. |

Ultimately, your choice should be deliberate. MyFundedFutures excels in providing a safe, simple, and forgiving entry point into the world of funded trading, making it ideal for beginners and those who prioritize rule clarity.

Tradeify is the superior platform for maximizing profitability and flexibility. It caters to experienced traders who can leverage its higher profit split and advanced technology.

9. FAQs

Yes, Tradeify is a highly-rated prop firm, particularly for traders who prioritize flexibility, multiple funding options, and advanced technology. Its reputation for fast, reliable payouts is very strong within the trading community.

Yes, absolutely. Community feedback on Trustpilot and Reddit consistently confirms that Tradeify processes payouts reliably and very quickly, often within a few hours of the request being approved.

Their profit targets are identical for comparable account sizes. The main difference is the structure: MyFundedFutures uses a single, uniform 1-step evaluation. In contrast, Tradeify offers multiple paths, including 1-day evaluations and an instant funding model that skips the evaluation entirely.

Tradeify offers a superior 90% profit split with flexible daily or 5-day payout policies. MyFundedFutures provides an 80% profit split with a rapid daily payout system. Withdrawal conditions vary, but both are designed for frequent access to profits.

Both firms support industry-standard platforms like Tradovate and NinjaTrader. However, Tradeify also offers its proprietary ProjectX platform with integrated tools, giving it a technological edge. Costs are standard platform commissions, and performance is reliable on both.

Yes, MyFundedFutures is generally considered more suitable for beginners. While both firms lack formal trader education programs, its simpler evaluation, which has no daily loss limit, reduces the chance of accidental breaches for new traders.

The MyFundedFutures evaluation is easier to pass because it does not have a daily loss limit, which provides more intraday freedom. However, Tradeify offers an “instant funding” account that bypasses the evaluation altogether, which is technically the easiest route to funding.

Yes, Tradeify’s Lightning account provides instant access to a funded account without an evaluation. This is fundamentally different from MyFundedFutures, where all traders must successfully pass their 1-step evaluation to get funded.

Both primarily use an End-of-Day (EOD) trailing drawdown. The critical difference is that MyFundedFutures removes the daily loss limit during its evaluation, while Tradeify includes one, making MFF’s rules less restrictive on an intraday basis.

Both firms allow for very frequent withdrawals. MyFundedFutures has a well-known rapid daily payout system. Tradeify matches this flexibility by offering traders a choice between a daily or a 5-day payout plan.

Yes, both permit the use of automated strategies or EAs, provided they are not classified as High-Frequency Trading (HFT). Traders must also be able to prove ownership of the strategy if requested.

Both firms have excellent, equity-based scaling plans. However, Tradeify offers slightly better long-term earning potential due to its higher 90% profit split, which allows successful traders to retain more of their profits as they scale.

10. Conclusion

Ultimately, the Tradeify vs My Funded Futures debate has no single winner, only the best fit for your specific needs. Your decision is simple. Choose Tradeify if you are an experienced trader who wants to make the most money possible. Their 90% profit split and superior technology are unmatched. Conversely, choose MyFundedFutures if you are a beginner or prioritize safety. It is the easiest and lowest-risk entry into the world of funded trading.

Ready to find your perfect match? Explore more prop firm comparisons and futures trading guides on the H2T Funding blog.