Many traders compare Take Profit Trader vs Tradeify because both firms promise strong funding opportunities, but follow very different philosophies. Tradeify focuses on fast funding, flexible payout structures, and multiple account types across forex, CFD, and futures.

Take Profit Trader keeps a futures-only model with simple rules, fast activation, and a clear trailing-drawdown framework.

This guide from H2T Funding provides a direct, unbiased review of the two firms and highlights the factors that matter most: drawdown rules, payout schedules, evaluations, pricing, and long-term consistency. If you want a straightforward breakdown with zero confusion, read this guide before selecting your next prop firm.

Key takeaways:

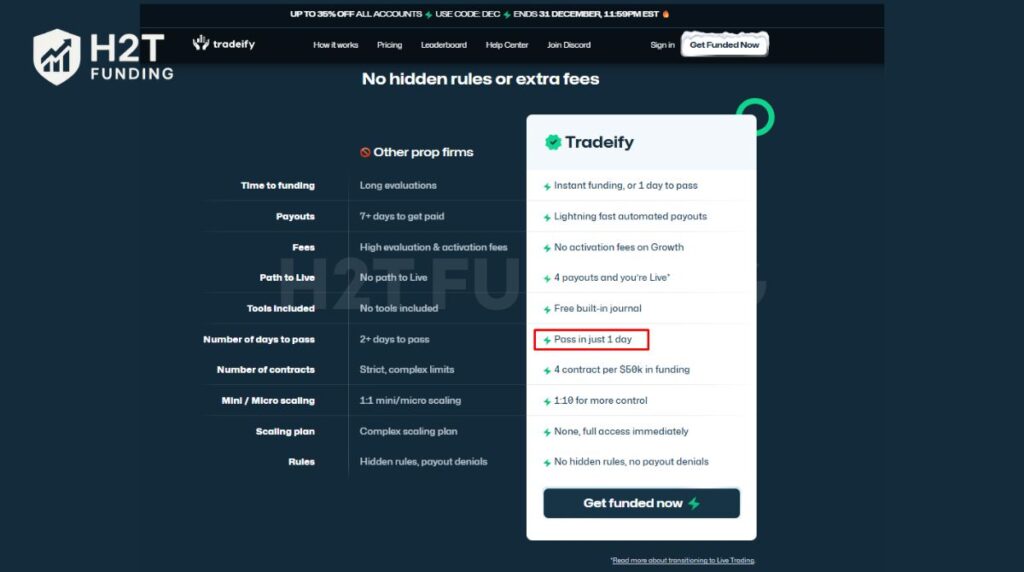

- Tradeify offers flexible funding models, including instant funding, diverse accounts, and payout frequency options suitable for traders who want fast cash flow.

- Take Profit Trader delivers a simpler structure, using clear trailing drawdown rules and futures-focused evaluations ideal for disciplined day traders.

- Drawdown management differs sharply, with Tradeify splitting EOD and intraday trailing drawdown across account types, while Take Profit Trader maintains a traditional trailing approach.

- Tradeify supports very frequent payouts, including daily withdrawals depending on account type.

- Pricing and resets affect long-term value, with Tradeify offering broader funding paths and Take Profit Trader offering more predictable costs.

- Tradeify suits traders who want flexibility and fast payouts, while Take Profit Trader fits futures traders who prefer stable rules and consistent evaluations.

1. Overview of each firm: Take Profit Trader vs Tradeify

Both firms attract traders seeking funded opportunities, yet they operate with very different models. Tradeify stands out with diverse markets, multiple account paths, automation-friendly platforms, and instant funding options.

Take Profit Trader remains a strong, futures-focused prop firm with simple rules, transparent trailing drawdown, and accessible evaluations.

These distinctions shape how each firm supports trading strategies, risk profiles, and payout expectations. The following comparison highlights the core structural differences to help traders choose the model that fits their objectives.

Criteria Table Overview

| Criteria | Tradeify | Take Profit Trader |

|---|---|---|

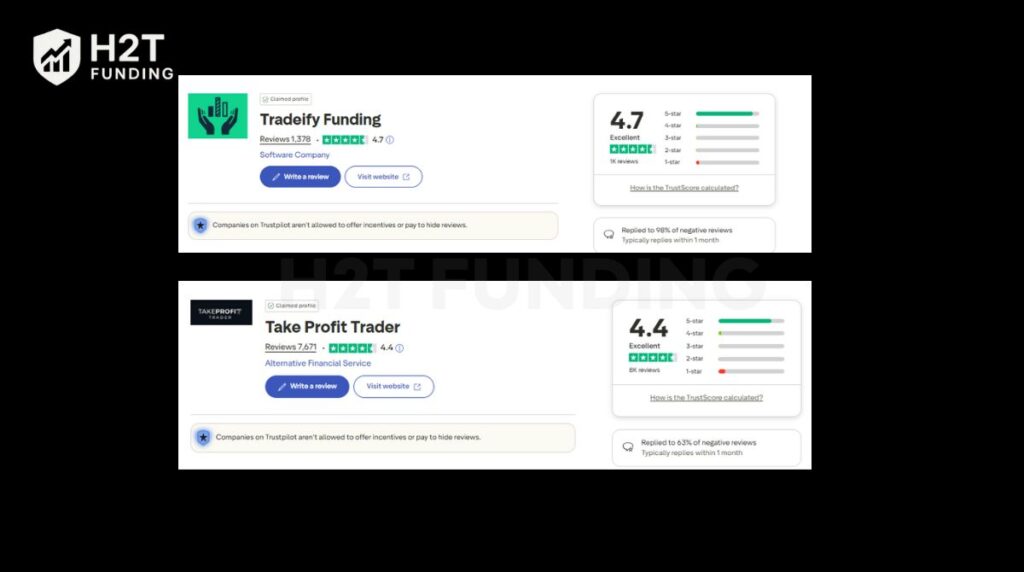

| Trustpilot Score | 4.7 (Excellent) | 4.4 (Excellent) |

| Founded / Trust | Newer, strong growth | Established; large review volume |

| Evaluation Models | Multi-path: Advanced, Growth, Select, Lightning | Single-phase PRO or evaluation test |

| Account Sizes | 25K–150K | 25K–150K |

| Asset Classes | Forex, CFD, futures | Futures only |

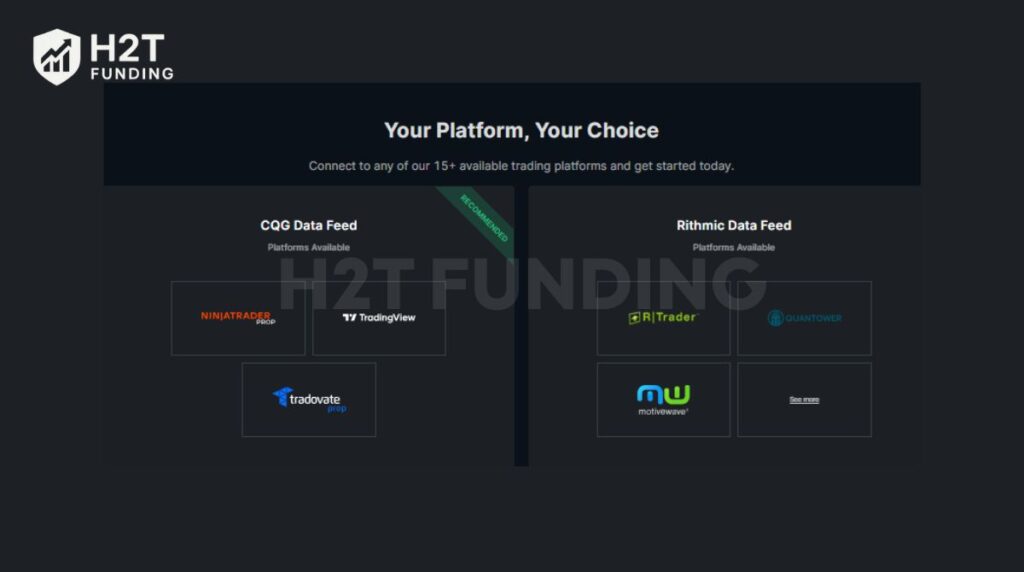

| Trading Platforms | Tradovate, ProjectX, NinjaTrader, TradingView | NinjaTrader, Rithmic, Tradovate |

| Profit Split | Offers a flat 90/10 profit split to the trader starting from the very first payout on Sim Funded accounts. | Features a tiered structure: starts at an 80/20 split for PRO accounts and increases to 90/10 for PRO+ accounts. |

| Minimum Days | 1–3 depending on plan | 5 days minimum to reach PRO |

| Scaling Programs | Multi-level contract scaling | TPT provides contract-based scaling after traders reach PRO+, though the firm does not outline a formal multi-level scaling program like some competitors |

| Execution Speed | Fast execution on supported platforms. | Fast SIM execution; reliable fills |

| Spreads/Commission | Varies by platform | Standard CME futures costs |

| Payouts | Daily or 5-day | Eligible for withdrawal on day one of the PRO account. |

| Risk Restrictions | Offers an End-of-Day (EOD) trailing drawdown option, which only updates based on the closing balance, protecting unrealized intraday profits. | Enforces an Intraday trailing drawdown on PRO accounts, which trails in real-time and includes unrealized profits, increasing risk during pullbacks. |

Disclaimer: Rules, pricing, and trading conditions may change over time. Traders should always verify the latest terms directly on the official Take Profit Trader and Tradeify websites before purchasing any challenge.

Both firms deliver strong funding frameworks, but they prioritize different trader needs. The next sections explore each prop firm in more depth so you can assess how their structures influence real trading performance.

Tradeify

#1

Account Types

1-step and instant funding

Trading Platforms

Tradovate, NinjaTrader 8, Quantower, TradingView, Project X

Profit Target

6%

Our take on Tradeify

With over $100 million in verified payouts to its traders, Tradeify allows proprietary automated strategies under specific restrictions. Traders gain access to fast payouts, multiple valuation paths, and risk models that support a range of trading strategies.

The firm feels modern and technology-driven. It suits traders who want broad market access, automated strategies, and larger funding options such as the 150k account. Its fast execution and payout structure help active traders maintain steady momentum.

| 💳 Challenge Fee | $69 – $729 |

| 👥 Account Types | 1-step and instant funding |

| 💰 Profit Split | 80% |

| 💵 Account Size | $25K – $150K |

| ⏱️ Time Limit | No time limit |

| 🎯 Profit Target | 6% |

| 📊 Trading Platforms | Tradovate, NinjaTrader 8, Quantower, TradingView, Project X |

| 🛍️ Asset Types | Futures Contracts |

Take Profit Trader

#2

Account Types

1-step

Trading Platforms

NinjaTrader 8, Tradovate, TradingView

Profit Target

6%

Our take on Take Profit Trader

Take Profit Trader is recognized for its futures-only structure, low-cost evaluations, and clear trailing drawdown rules. It offers straightforward advancement from evaluation into PRO and PRO+ accounts, making it attractive for disciplined futures traders.

The firm fits traders who want a simple structure and predictable execution. It works well for day traders comfortable with trailing drawdown and those who prefer a clean, futures-only model without complex rule layers.

| 💳 Challenge Fee | $150 – $360 |

| 👥 Account Types | 1-step |

| 💰 Profit Split | 80% – 90% |

| 💵 Account Size | $25K – $150K |

| ⏱️ Time Limit | No time limit |

| 🎯 Profit Target | 6% |

| 📊 Trading Platforms | NinjaTrader 8, Tradovate, TradingView |

| 🛍️ Asset Types | Futures, Agricultural, Metals, Energy |

Read more:

2. Core models & key rules of Take Profit Trader and Tradeify

Tradeify and Take Profit Trader follow different structures for evaluations, risk rules, and daily trading limits. These differences shape how traders progress toward funding accounts and how each model affects long-term consistency.

2.1. Profit targets & minimum trading days

Profit targets and required trading days determine how quickly a trader can complete evaluations and request funding. Both firms use clear rules, but their difficulty levels differ.

Criteria Table

| Criteria | Tradeify | Take Profit Trader |

|---|---|---|

| Profit Target | Varies by plan; Growth and Advanced require moderate targets; Select allows structured progress | $1,500–$9,000 depending on account size |

| Minimum Trading Days | 1–3 days for most evaluations | 5 days required to reach PRO |

| Evaluation Difficulty | Flexible due to multiple paths and instant funding options | Straightforward but traditional; futures-only |

Overall, Tradeify makes it easier for traders to reach their profit goals because it offers multiple evaluation modes and faster progression.

2.2. Drawdown & daily loss limits

Drawdown rules influence how aggressively a trader can use their accounts. The two firms apply different mechanics, affecting both safety and pacing.

Criteria Table

| Criteria | Tradeify | Take Profit Trader |

|---|---|---|

| Max Loss | Depends on the account; EOD or intraday trailing | Fixed trailing drawdown |

| Daily Loss Limit | Present on most plans except some Select models | No DLL; traders manage losses within trailing parameters |

| Drawdown Type | EOD or intraday trailing | Traditional trailing drawdown only |

| Rule Strictness | Higher on Advanced plans; moderate on Growth | Consistent and predictable |

Tradeify offers more flexibility, while Take Profit Trader enforces a tighter structure that protects risk capital but leaves less room for volatility.

2.3. News, overnight & automation policies

Both firms handle news trading and automation differently. Their rules define how traders can manage volatility, sessions, and trading strategies.

Criteria Table

| Policy | Tradeify | Take Profit Trader |

|---|---|---|

| News Trading | Allowed; traders must manage volatility | Allowed without restrictions |

| Overnight | No overnight holding; all positions close daily | No overnight holding |

| Weekend | No weekend positions | No weekend positions |

| EAs / Automation | Allows proprietary automated strategies under specific restrictions. | Automation allowed, depending on the platform |

| Allowed Strategies | Some users report stricter review on extremely short-duration trades, though Tradeify does not list formal hold-time rules on its website | Allows most day trading strategies but requires adherence to a 50% consistency rule. |

Tradeify supports a wider range of automation choices, while Take Profit Trader prioritizes simplified rule structures for futures trading strategies.

3. Fees, refunds & cost efficiency

Both firms use clear fee structures, but their models create very different cost profiles for traders. Tradeify focuses on flexible plans, while Take Profit Trader keeps costs predictable with a simple funding structure.

Criteria Table

| Criteria | Tradeify | Take Profit Trader |

|---|---|---|

| Fee Type | Monthly subscriptions for evaluations; one-time fees for instant plans | Flat monthly evaluation fees |

| Refund Policy | Refunds are tied to the first withdrawal on Select plans | Refund after passing the evaluation and reaching PRO |

| Challenge Cost | Higher on Select and instant plans; moderate on Growth | Lower overall evaluation cost |

| Transparency | Clear pricing with plan differences | Very straightforward fee model |

| Added Fees | No hidden charges; activation waived on Select | Activation fees for PRO; no surprise charges |

| Payout Cycle | Supports very frequent payouts, including daily withdrawals depending on account type. | Eligible for first withdrawal on day one |

Tradeify offers broader options but can feel more expensive, especially for instant models. Take Profit Trader is generally more cost-efficient, and traders benefit from predictable pricing and affordable evaluations.

Both firms allow resets, though TPT keeps its reset structure simpler. The best choice depends on whether the trader prefers flexibility or steady progression from a 150k account or smaller models.

4. Profit split & scaling programs: Take Profit Trader vs Tradeify

Profit split structures and scaling rules define how traders progress after completing evaluations, and both firms apply distinct frameworks that influence long-term growth.

Criteria Table

| Criteria | Tradeify | Take Profit Trader |

|---|---|---|

| Profit Split | Up to 90% depending on the plan | 80/20 in PRO, 90/10 in PRO+ |

| Scaling | Equity-based contract scaling with multiple tiers | TPT provides contract-based scaling after traders reach PRO+, though the firm does not outline a formal multi-level scaling program like some competitors. |

| Payout | Daily or 5-day payout options | First withdrawal available on day one |

| Minimum Payout | Low thresholds on Select plans | Starts at $50 depending on level |

| Withdrawal | Very fast processing with rapid turnaround | Same-day approval on most requests |

Tradeify offers broader payout options and faster scaling, which benefits traders who prefer flexible expansion, especially on larger models such as the 150k account. Take Profit Trader remains the more structured choice, helping traders maintain steady growth while protecting their progression under consistent rules.

5. Platforms & tradable assets of Tradeify and Take Profit Trader

This part compares how each firm supports traders through their platforms, asset access, and execution quality. The differences influence how well each model fits specific trading strategies and how traders experience live market conditions in a Take Profit Trader vs Tradeify comparison.

Criteria Table

| Criteria | Tradeify | Take Profit Trader |

|---|---|---|

| Trading Platforms | Tradovate, ProjectX, NinjaTrader, TradingView connectivity | NinjaTrader, Rithmic, Tradovate |

| Asset Classes | Forex, CFD, futures | Futures only |

| Execution Speed | Fast execution on supported platforms | Stable fills with consistent performance |

| Spreads/Fees | Depends on platform; competitive structure | Standard CME costs |

| Dashboard | Modern analytics, trade tagging, and detailed tracking | Simple interface focused on rule clarity |

Tradeify supports a broader platform ecosystem with access to forex, CFD, and futures, making it more versatile for traders who want multiple markets or automation tools.

Take Profit Trader keeps its environment streamlined for futures trading, offering stable execution and clear rules, which benefits traders seeking reliability. Although neither firm focuses on virtual currency markets, traders appreciate the clarity in how each platform defines supported products.

6. Payout & Trust: Real Trader Feedback from Reddit and Trustpilot

To get the real story, we have to look beyond the official websites and see what actual traders are saying. Forums like Reddit and Trustpilot are where the praise, the complaints, and any potential “scandals” come to light. This is where you find the most authentic feedback on each firm’s reliability and payout speed. The information is updated on December 29, 2025

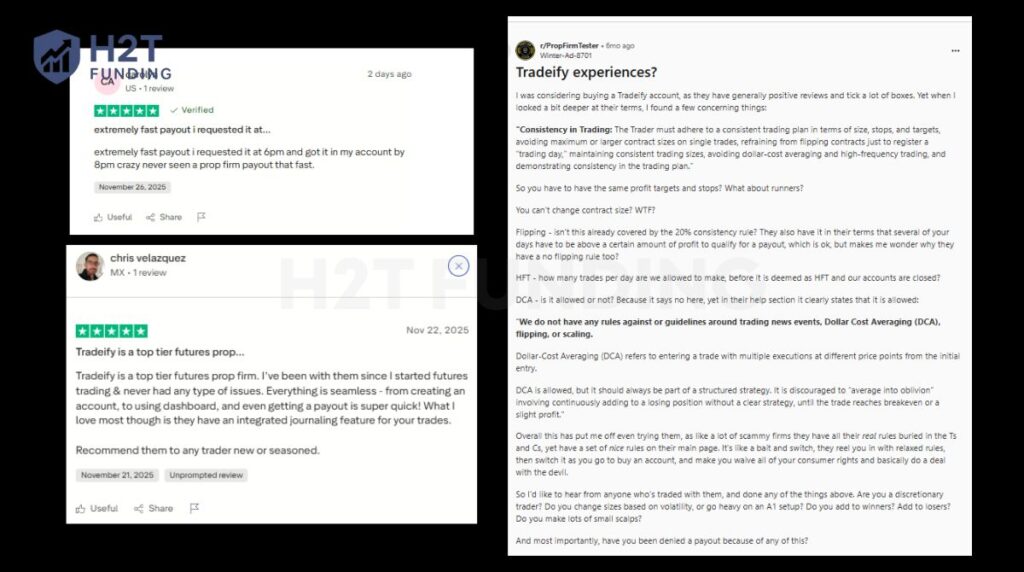

Community Feedback on Tradeify: Fast, But Read the Fine Print

On Trustpilot, Tradeify is flooded with praise for its payout speed. Comments like the one from user “carolyn,” who received her money in just two hours, are common. This builds strong confidence that Tradeify does pay and does it efficiently.

On Reddit, however, the discussions are more nuanced. A major topic revolves around “rule complexity,” specifically the consistency and hold-time regulations. Traders worry these rules could be a “trap” if not read carefully. Despite this, the consensus among traders who have received payouts is that as long as you follow the stated rules, the withdrawal process is smooth.

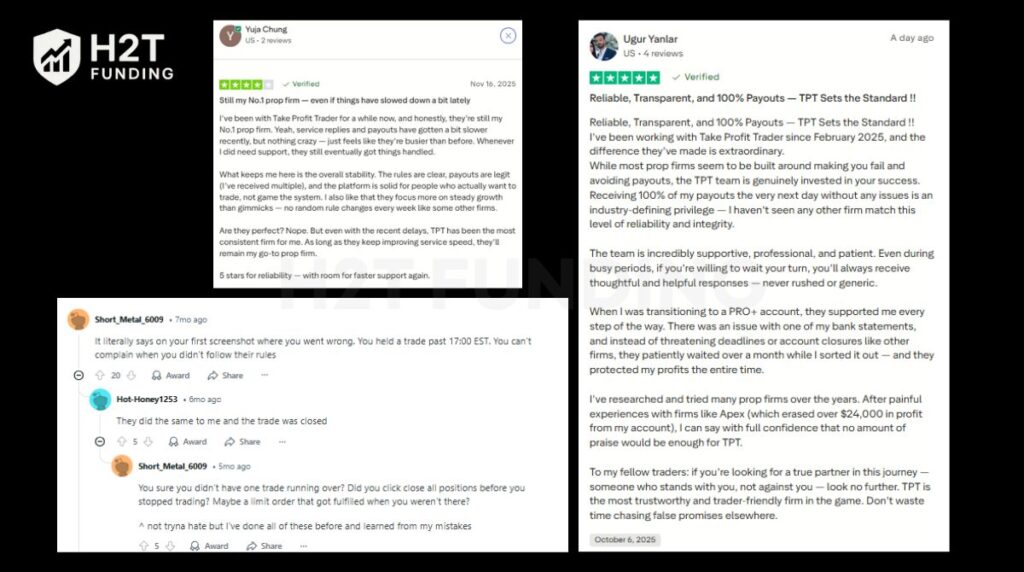

Community Feedback on Take Profit Trader: Reliable, But the Drawdown is a Killer

Take Profit Trader (TPT) has a solid reputation for reliable payouts. Detailed reviews like the one from “Ugur Yanlar” on Trustpilot, who contrasts his positive TPT experience with issues at other firms, strongly reinforce their standing. The praise often centers on transparency and the firm’s commitment to honoring its payout promises.

However, browse Reddit, and you’ll find one recurring theme: the trailing drawdown. This is the biggest “scandal” and the number one reason traders fail. Many users complain that the trailing drawdown on the PRO account, which includes unrealized profits, is unforgiving and makes it easy to liquidate an account. It’s worth noting, though, that most complaints are about failing the challenge, not about TPT refusing to pay those who succeed.

Both firms are considered legitimate, and they do pay out. The biggest “scandals” are not about non-payment but about their operational rules. For Tradeify, it’s the complexity of its secondary rules. For Take Profit Trader, it’s the unforgiving nature of its trailing drawdown.

7. Take Profit Trader vs Tradeify: Which prop firm is easier to pass?

Evaluating which firm is easier depends on how each model handles profit targets, risk rules, and overall structure. A clear comparison shows how these differences affect traders at various experience levels.

Criteria Table

| Criteria | Tradeify | TPT | Win |

|---|---|---|---|

| Profit Target | Moderate targets across plans with flexible paths | Higher targets tied to account size | Tradeify |

| Drawdown Strictness | EOD or intraday variations, depending on the plan | One strict trailing model | Tradeify |

| Rule Complexity | Multiple plan types with layered rules | Very straightforward | TPT |

| Overall Difficulty | Easier for structured traders | Easier for disciplined futures traders | Both |

Tradeify offers a more forgiving path for traders using a structured approach, especially for those starting with a 100k account, where flexible profit targets reduce pressure. Its dynamic setup works well for traders who benefit from a clear plan.

Take Profit Trader is better for traders who prefer simple rules, especially those who dislike navigating a detailed consistency rule or complex frameworks. New traders often find Tradeify easier to complete. Experienced futures traders succeed more often with TPT because its rules are simple and work well with an analytical approach.

8. Who should choose which firm?

Each firm fits a different type of trader. Their rules, platforms, and payout structures shape who benefits most from each environment, especially for those comparing Tradeify vs Take Profit Trader based on strategy and experience level.

Comparison Table

| Trader Type | Best Choice | Why |

|---|---|---|

| Beginners | Tradeify | Flexible plans, simple progression, and tools that help beginners learn without pressure, making it suitable for traders exploring markets, including foreign currency. |

| Futures Day Traders | Take Profit Trader | Straightforward rules and a clear structure are ideal for intraday decision-making in a pure futures environment. |

| Scalpers | Tradeify | Faster execution on supported platforms and direct access to conditions that suit fast entries and exits. |

| Swing Traders | Tradeify | Broader asset choices allow more freedom for longer setups and diversified approaches. |

| Risk-Averse Traders | Take Profit Trader | Simple risk rules, fewer variables, and predictable requirements help reduce stress during active trading. |

| Automated Traders | Tradeify | Strong platform compatibility and flexible conditions support automated systems and testing before scaling. |

| Cash-Flow Traders | Tradeify | Faster payouts and flexible withdrawal structures benefit traders who rely on frequent income. |

Tradeify suits traders who want flexibility, tool-rich platforms, and broader market access, while Take Profit Trader is ideal for those who prefer a focused futures environment with stable, predictable rules. Both firms support trader growth, but Tradeify offers more variety for traders who want flexibility beyond basic learning stages.

9. FAQs

Yes. Tradeify is well-rated for fast payouts, flexible account structures, and strong platform support. Many traders appreciate its modern tools and responsive support team.

Yes. Take Profit Trader processes withdrawals quickly, including day-one eligibility on funded accounts. Traders consistently report reliable payout execution.

TPT is simpler and usually cheaper, while Topstep offers a more traditional model. Traders who prefer minimal rule layers often choose TPT, whereas Topstep appeals to those who want a legacy brand.

Yes. Tradeify is known for extremely fast payout turnaround, and several traders use it specifically for frequent withdrawals.

TPT is the stronger choice for pure futures trading because its structure is built entirely around CME products. Tradeify offers futures as well, but it also supports multi-market strategies.

Take Profit Trader enforces a consistent trailing model, which many traders find more restrictive. Tradeify adapts its drawdown rules by plan, making some models more forgiving.

Take Profit Trader is often cheaper due to simpler evaluations and lower recurring fees. New traders who want predictable costs tend to start there.

Tradeify allows automation as long as traders use proprietary systems. TPT permits automation within platform limitations but does not support high-frequency systems.

Yes. Both firms operate in simulated environments during early stages, and traders understand that results may differ from live conditions.

No. They are used for real funded progression, but their structure also helps traders learn discipline and improve execution. Some traders join through an affiliate introduction or community referral, but their core purpose remains skill-based funding.

10. Conclusion

Choosing between Take Profit Trader vs Tradeify depends on your trading style and long-term goals. If you want variety, speed, and dynamic tools, Tradeify fits well. If you prefer simplicity, transparency, and a futures-only model, TPT is the better match.

If you want to compare more firms and find the one that truly fits your strategy, explore more prop-firm comparisons and in-depth reviews at H2T Funding.