In the Take Profit Trader vs My Funded Futures showdown, every trader is looking for the same answers: Who is easier to pass? Who pays out faster? And whose drawdown rules are less punishing?

H2T Funding delivers those answers. This analysis cuts straight to the point, comparing costs, difficulty, and critical rules to help you find the prop firm that’s truly right for you. Read now to get your answer.

Key takeaways:

- Take Profit Trader (TPT) champions a simple, one-step evaluation, designed to fund traders faster. My Funded Futures (MFF) offers several models, including a one-step challenge, but with more nuanced rules.

- TPT offers Day 1 Payouts on its self-funded PRO accounts, providing immediate profit access. MFF features weekly payouts on sim accounts but also offers daily payouts on its live accounts, making both firms highly competitive for cash flow.

- While TPT allows unrestricted news trading, MFF’s newer Core and Scale accounts also permit trading during major news events. MFF’s restrictions primarily target exploitative strategies like HFT bots and latency arbitrage, while normal scalping is allowed.

- Both firms are competitively priced. TPT uses a one-time activation fee for PRO accounts, which is often waived during promotions. MFF’s newer plans feature zero activation fees, lowering the initial barrier to entry.

- TPT is built for traders demanding speed, simplicity, and instant cash flow. MFF appeals to traders who value different account options and can adapt to a more structured trading environment.

1. Overview of each firm: Take Profit Trader vs My Funded Futures

Before we start splitting hairs over specific rules, let’s get a bird’s-eye view of Take Profit Trader and My Funded Futures. Think of this as the initial handshake. You’re about to see how each prop firm positions itself, its core offerings, and who it generally appeals to. You can tell a lot about a company just from this high-level snapshot.

Here’s a quick comparison to set the stage.

| Criteria | Take Profit Trader (TPT) | My Funded Futures (MFF) |

|---|---|---|

| Trustpilot Score | 4.5/5 (Excellent) | 4.9/5 (Excellent – Highly positive reviews) |

| Founded / Reputation | 2021 / Solid payout reputation | 2023 / Newer firm with rapid growth & trust |

| Evaluation Process | 1-Step (Simplified) | 1-Step (Multiple Models) |

| Key Models | TPT Evaluation | Core, Scale, Pro |

| Account Sizes | Up to $150k (simulated) | Up to $150k (simulated) |

| Asset Classes | Futures Only (CME, CBOT, etc.) | Futures Only (CME, CBOT, etc.) |

| Trading Platforms | NinjaTrader, TradingView, Tradovate, 15+ connections | NinjaTrader, TradingView, Quantower, Tradovate |

| Profit Split | 80% (PRO), scales to 90% (PRO+) | 80% default |

| Payouts | Day-one Payouts (PRO Sim Account) | Weekly (Sim), Daily (Live) |

| Trading Style | Very Flexible (News Trading Allowed) | Flexible (News allowed on newer accounts) |

Disclaimer: Rules, pricing, and trading conditions may change over time. Traders should always verify the latest terms directly on the official Take Profit Trader and My Funded Futures websites before purchasing any challenge.

Now, let’s zoom in on each firm individually.

Take Profit Trader

#1

Account Types

1-step

Trading Platforms

NinjaTrader 8, Tradovate, TradingView

Profit Target

6%

Our take on Take Profit Trader

To put it simply, Take Profit Trader is built for speed and simplicity. The founder, a former pro athlete, created it to cut out the “carnival rules” he saw elsewhere in the industry. The entire vibe is about getting you funded fast and paid even faster.

If you’re a trader who hates complex rules and just wants to trade, this is likely where you’ll feel at home. Their day-one payout feature isn’t a gimmick; it’s the core of their philosophy.

| 💳 Challenge Fee | $150 – $360 |

| 👥 Account Types | 1-step |

| 💰 Profit Split | 80% – 90% |

| 💵 Account Size | $25K – $150K |

| ⏱️ Time Limit | No time limit |

| 🎯 Profit Target | 6% |

| 📊 Trading Platforms | NinjaTrader 8, Tradovate, TradingView |

| 🛍️ Asset Types | Futures, Agricultural, Metals, Energy |

My Funded Futures

#2

Account Types

1-step

Trading Platforms

Tradovate, NinjaTrader 8, TradingView, Quantower, Volsys, Volumetricatrading

Profit Target

6%

Our take on My Funded Futures

My Funded Futures feels a bit more structured and appeals to traders who like having options. They’ve clearly put effort into creating different account types (Core, Scale, Pro) to suit various trading styles, from aggressive scalping to more conservative approaches.

Their major selling point is the absence of activation fees on their newer plans, which lowers the barrier to entry significantly. Founded in 2023, My Funded Futures is a newer player that has quickly gained significant traction by offering competitive, trader-friendly rules and a clear path to a live account.

| 💳 Challenge Fee | $77 – $477 |

| 👥 Account Types | 1-step |

| 💰 Profit Split | 80% |

| 💵 Account Size | $50K – $150K |

| ⏱️ Time Limit | No time limit |

| 🎯 Profit Target | 6% |

| 📊 Trading Platforms | Tradovate, NinjaTrader 8, TradingView, Quantower, Volsys, Volumetricatrading |

| 🛍️ Asset Types | Futures Contracts |

Read more:

2. Core models & key rules: Take Profit Trader vs My Funded Futures review

Alright, this is where you’ll find the make-or-break details. A prop firm’s core rules on profit, risk, and trading styles directly impact your chances of success.

I think this is the most important section in any Take Profit Trader vs My Funded Futures comparison. Let’s cut through the marketing and look at the actual rules you’ll be trading under.

2.1. Profit targets & minimum trading days

To put it simply, how high is the mountain, and how fast can you climb it? The profit target is your goal, while the minimum trading days can sometimes feel like a speed limit. Some traders hate being forced to wait, while others appreciate the time to avoid rushing.

| Criteria | Take Profit Trader (TPT) | My Funded Futures (MFF) |

|---|---|---|

| Profit Target | $3,000 on a $50K account. A standard 6% target. | $3,000 on a $50K account. Also, a 6% target. |

| Minimum Trading Days | 5 days. You must trade for at least five separate days to qualify. | As little as 2 days on the Scale plan. This allows for a quicker path to funding for profitable traders. |

| Evaluation Difficulty | Straightforward. The 5-day rule encourages consistency. | Potentially faster. If you hit the target in 2 days, you’re done. |

For a trader who is dialed in and hits their target quickly, My Funded Futures offers a much faster path to a funded account. However, Take Profit Trader’s 5-day minimum isn’t a bad thing; it actually encourages a steadier pace, which can prevent impulsive mistakes.

2.2. Drawdown & daily loss limits

Now for the rules that can get you disqualified. These are your real risk parameters. How a firm defines its drawdown can make a world of difference in the pressure you feel each day.

| Criteria | TPT | My Funded Futures |

|---|---|---|

| Max Loss | None during the evaluation. A Daily Loss Limit is applied to live accounts according to their scaling plan. | End-of-Day (EOD) Trailing during evaluation. This drawdown becomes static (fixed at the initial balance) after the first payout on most plans. |

| Daily Loss Limit | None. They completely removed this rule. A massive advantage. | None during the evaluation. A Daily Loss Limit is applied on live accounts according to their scaling plan. |

| Drawdown Type | Switches from EOD to Intraday on the PRO account. | Trailing Drawdown during evaluation, but becomes static after the first payout on some plans. |

| Rule Strictness | Very relaxed. The absence of a DLL simplifies risk management immensely. | More complex. You have freedom during the eval, but the rules change as you progress. |

The absence of a Daily Loss Limit at both firms during the evaluation is a significant advantage. However, traders must pay close attention to the drawdown type at Take Profit Trader, as it switches from a forgiving EOD trailing drawdown in the evaluation to a much stricter Intraday trailing drawdown on the PRO account. This change is a critical factor and a common point of failure for traders who are not prepared for it.

2.3. News, overnight & automation policies

Can you actually trade your preferred strategy? These policies determine your level of freedom. For some trading styles, like news trading or automated scalping, these rules are everything.

| Policy | Take Profit Trader | My Funded Futures |

|---|---|---|

| News Trading | Allowed. They embrace a simple approach: if the market is open, you can trade. | Allowed on newer Core and Scale accounts. Restrictions apply only to older account models (Starter/Expert). |

| Overnight Trading | Not allowed. Positions must be closed by the end of the trading day. | Not allowed. Same standard rule; positions are auto-liquidated. |

| Weekend Trading | Not allowed. Positions cannot be held over the weekend. | Not allowed. |

| EAs/Automation | Allowed. Generally permissive as long as it’s not exploitative HFT. | Allowed, but with stricter rules. Prohibits HFT and strategies that exploit the sim environment. |

| Allowed Strategies | Very flexible. Great for scalpers and discretionary day traders. | Very flexible on Core/Scale plans. Restrictions mainly target exploitative HFT and microscalping, not standard scalping. |

Both firms enforce standard trading hours and do not permit holding positions overnight or through the weekend. Previously, news trading was a major differentiator. However, with My Funded Futures now allowing news trading on its popular Core and Scale accounts, both firms offer significant freedom.

TPT’s flexibility, combined with how they structure Take Profit Trader leverage, remains unrestricted across all accounts, while MFF’s policy change makes it highly competitive for news traders. MFF’s remaining restrictions focus on preventing system exploitation rather than limiting legitimate strategies.

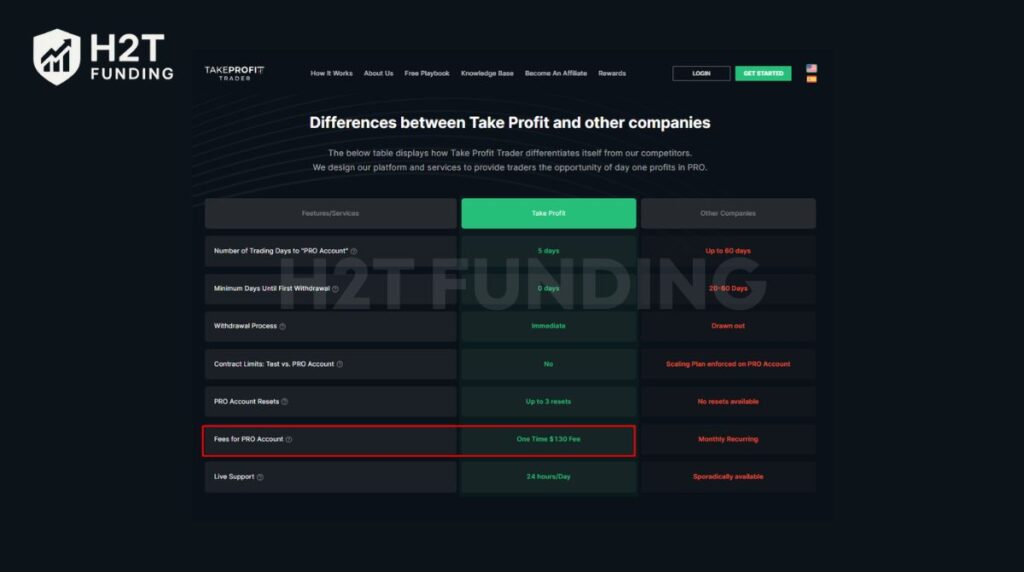

3. Fees, refunds & cost efficiency of My Funded Futures vs Take Profit Trader

Let’s be real, no one likes hidden fees. The cost of an evaluation is an investment in yourself, so you need to know exactly what you’re paying for and what you get in return. This is where we look at the upfront cost, any extra charges, and whether you can get your money back. A good prop firm should be transparent about its costs.

| Criteria | TPT | My Funded Futures |

|---|---|---|

| Fee Type | Monthly Subscription. You pay a recurring fee for the evaluation account. | Monthly Subscription. Same model, you pay monthly until you pass or cancel. |

| Refund Policy | 100% Refund on your first month’s fee with your first payout (often during promotions). | No Refunds. They focus on keeping initial costs low instead of offering refunds. |

| Challenge Cost | $170/mo for a $50K account. | Starts at $127/mo for a $50K Scale account. A bit cheaper upfront. |

| Transparency | Very clear. The monthly fee and a one-time PRO activation fee are the main costs. | Excellent. They are upfront about having zero activation fees on newer plans. |

| Added Fees | A one-time $130 Take Profit Trader activation fee for the PRO account, which is often waived during promotions. | None. This is a huge selling point for them. |

| Payout Cycle | Daily payouts are available, maximizing cash flow efficiency. | Weekly/bi-weekly payouts, which are still good but less frequent. |

So, what’s the verdict? My Funded Futures is undeniably cheaper to get started, especially with its zero activation fees. It’s a straightforward, what-you-see-is-what-you-get model. However, Take Profit Trader’s refund policy is incredibly valuable. If you pass, you essentially get a free shot at the evaluation.

I think that makes the slightly higher monthly fee much more palatable, especially for confident traders. It really comes down to whether you prefer lower initial costs or the potential for a full refund.

4. Profit split & scaling programs of Take Profit Trader and My Funded Futures

Okay, you passed! Now for the best part: getting paid. The profit split is obviously huge, but the scaling program is just as important. A good scaling plan is how you turn a funded account into a real career, allowing you to increase your trading size as you prove your consistency.

| Criteria | Take Profit Trader | My Funded Futures |

|---|---|---|

| Profit Split | 80% initially, then 90% on the PRO+ (live) account. One of the best splits out there. | 80% across the board. It’s competitive but doesn’t increase. |

| Scaling | No official scaling plan on the PRO account. You upgrade to PRO+ for more size. | Clearly defined scaling. The Scale plan, for example, lets you add contracts as your account balance grows. |

| Payout | Day 1 Payouts. You can request a withdrawal on your very first profitable day. | Weekly/Bi-weekly on SIM-funded accounts, with daily payouts offered on live accounts. |

| Minimum Payout | No minimum amount on PRO accounts. | $250 minimum on SIM-funded accounts. |

| Withdrawal | Automated process via Plaid, PayPal, or Wise. Fast and efficient. | Processed through their partners, typically very reliable. |

Here, the choice depends entirely on your goals. Take Profit Trader offers a higher potential profit split (90%) and the incredible flexibility of daily payouts with almost no withdrawal restrictions. It’s perfect for traders who want maximum cash flow.

On the other hand, My Funded Futures has more structured withdrawal restrictions, like a minimum payout amount and a weekly/bi-weekly schedule.

However, it provides a predictable path to increasing your trading size with its transparent scaling plan, helping you effectively manage a larger maximum balance. It’s built for methodical traders who want a clear ladder of progression.

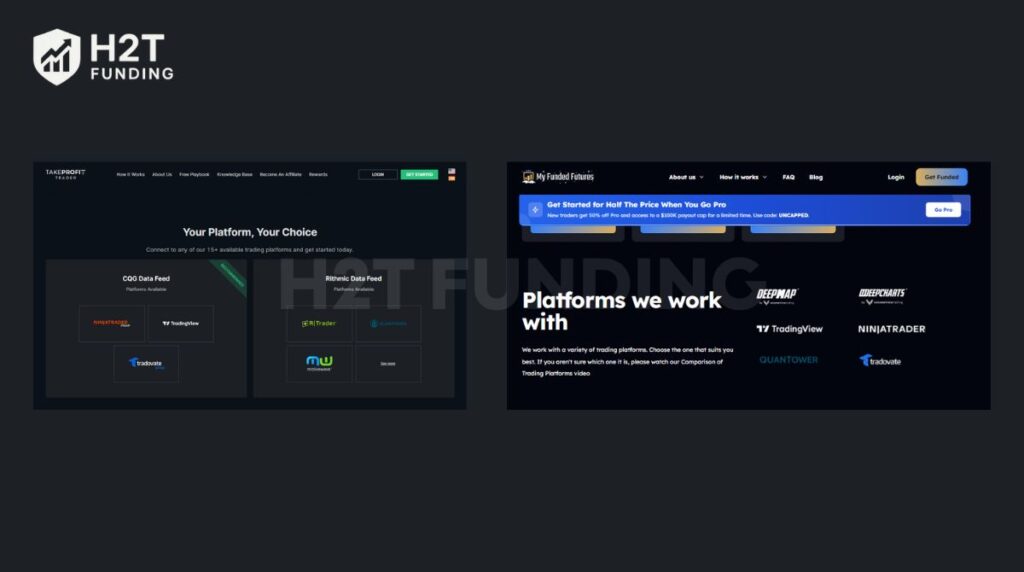

5. Platforms & tradable assets of Take Profit Trader and My Funded Futures

A prop firm can have the best rules in the world, but it doesn’t mean much if their platforms are clunky or you can’t trade your preferred markets. In reality, the technology behind the firm is your direct link to the market, so solid platforms and reliable data are non-negotiable. Both Take Profit Trader and My Funded Futures do a pretty good job here, but there are subtle differences.

Let’s break down the tech and tools you’ll be using.

| Criteria | TPT | MFF |

|---|---|---|

| Trading Platforms | Excellent. Supports 15+ platforms via CQG and Rithmic data feeds, including NinjaTrader, TradingView, and Tradovate. | Very Good. Also supports major platforms like NinjaTrader, TradingView, and Quantower. |

| Asset Classes | Futures only. You get access to CME, CBOT, COMEX, and NYMEX products. | Futures only. The same standard offering of major futures exchanges. |

| Execution Speed | Industry standard. They use regulated brokers and data providers, so execution is reliable. | Industry standard. No complaints here; they use established tech partners. |

| Spreads/Fees | Competitive trading fees, with industry-standard commissions (e.g., ~$5 per round-turn contract). | Commissions are also competitive and in line with the industry. |

| Dashboard | Clean and functional. It’s easy to track your progress and request payouts. | Modern and user-friendly. Their dashboard is well-designed for monitoring your account. |

Honestly, there isn’t a massive difference between the two firms in this category. Both Take Profit Trader and My Funded Futures provide access to the essential tools every futures trader needs. They both partner with top-tier data providers like Rithmic and offer a wide range of compatible trading platforms. You can confidently use professional-grade software with either firm.

I think the choice here comes down to personal preference for the user dashboard or if you have a niche platform that one supports and the other doesn’t. But for 99% of traders, the technology at both firms is more than sufficient to get the job done right.

6. Payout policies compared: Take Profit Trader vs My Funded Futures

Alright, let’s talk about the most exciting part: getting paid. A prop firm’s payout policy is the ultimate test of its promises. To be honest, this is where you separate the contenders from the pretenders. Both Take Profit Trader and My Funded Futures have strong, competitive payout systems, but they are built on completely different philosophies. One values immediate, simple access, while the other creates a structured journey with incredible rewards for consistency.

6.1. Take Profit Trader: The Day-One Payout Philosophy

To put it simply, TPT’s payout model is all about speed and simplicity. Their headline feature, governed by clear Take Profit Trader payout rules, is the “Day-One Payout” on the sim-funded PRO account. Essentially, it’s exactly what it sounds like.

- How it works: The moment you make a profit on your PRO account, you can request a withdrawal. There’s no minimum number of trading days you have to wait, no profit buffer you need to build up first. If you make money on day one, you can take it out on day one.

- Key Features:

- Frequency: Daily requests are permitted.

- No Minimum Withdrawal: You can pull out any amount of profit.

- No Buffer Requirement: You don’t have to build up a cushion before you can access your earnings.

- Process: Payouts are processed quickly through methods like Plaid, PayPal, or Wise.

The TPT model is incredibly straightforward. It’s designed for traders who want maximum flexibility and immediate access to their cash flow. It’s a system built on the idea that if you earn the money, it’s yours, right away.

6.2. My Funded Futures: The Structured Journey to Daily Payouts

My Funded Futures takes a different approach. Their system is structured around the type of account you hold, rewarding you with more flexibility as you prove your skills. It’s a journey that starts with clear rules and ends with one of the best payout policies in the industry for live accounts.

- Sim-Funded Accounts (Core, Scale, Pro): During this stage, payouts are structured.

- Core & Scale Plans: You can request payouts after achieving 5 winning days (with certain profit minimums). Payouts are typically weekly, but there are limits on how much you can withdraw per request.

- Pro Plan: Payouts are available every 14 days, but you first need to reach a specified “profit buffer.” This is a more traditional model designed for steady growth.

- Live Accounts: This is where MFF truly shines. Once you transition to a live account, you unlock daily payouts.

- You can request a withdrawal every single day (requests must be in before 11 AM EST).

- The minimum withdrawal is $250.

- Most payout requests are approved instantly through an automated system.

MFF’s approach is a clear progression. They give you a structured environment to prove yourself in the sim stage, and once you do, they reward you with incredible payout flexibility on a live account.

Direct Comparison: Which Payout Policy is Better?

So, who wins the payout battle? It really depends on what you value most.

| Criteria | Take Profit Trader (PRO Sim) | My Funded Futures (Sim-Funded) | My Funded Futures (Live) |

|---|---|---|---|

| Payout Frequency | Daily (from Day 1) | Weekly / Bi-weekly | Daily |

| Buffer Required? | No | Yes (on Pro Plan only) | No |

| Minimum Withdrawal | None | $250 / $1,000 | $250 |

| Approval Speed | Fast (Manual) | Instant (Automated) | Fast (Same-day) |

Here’s the final verdict:

If your absolute top priority is immediate cash flow from the very first day on a funded (sim) account with zero restrictions, Take Profit Trader is the undisputed choice. Its model is unmatched for simplicity and speed right out of the gate.

However, if you appreciate a structured path and want the long-term reward of daily payouts on a real, live account, then My Funded Futures presents an incredibly compelling journey. Their automated approval system is a huge technological advantage, and unlocking daily payouts on a live account is the ultimate goal for many serious traders.

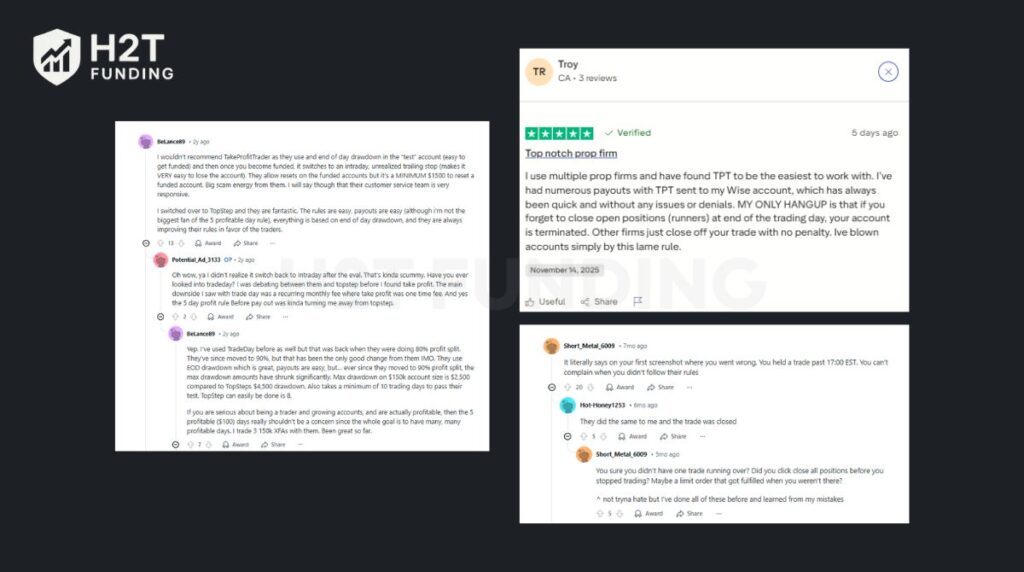

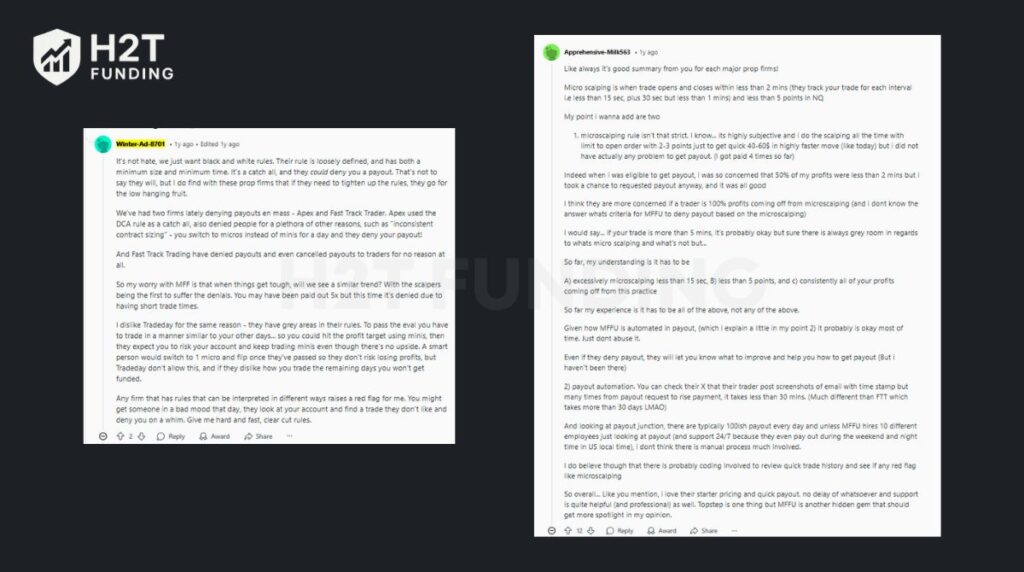

7. Community reviews about Take Profit Trader vs My Funded Futures

Okay, let’s get into the real talk. A prop firm can promise the world, but the ultimate test is its reputation within the trading community. Do they actually pay out? Is their support team helpful when things go wrong? This is where we sift through reviews on platforms like Trustpilot and Reddit to see if the marketing matches reality.

I’ve analyzed the community feedback for both Take Profit Trader and My Funded Futures. Below, I’ll guide you through the key takeaways and suggest which specific user comments you should screenshot to tell the full story, the good, the bad, and the misunderstood.

Here’s what the community is saying and which reviews paint the most accurate picture.

For Take Profit Trader:

The general sentiment is that TPT is legitimate and pays out, but traders absolutely must understand the rules, especially the intraday trailing drawdown on PRO accounts. Many negative reviews come from traders who were caught off guard by this.

For My Funded Futures:

MFF has built a strong reputation, reflected in its high Trustpilot score. Community discussions often mention their policy on prohibited trading practices. While this causes concern for some, reports indicate the rules primarily target exploitative microscalping and HFT bots, while standard scalping strategies are generally unaffected.

So, what’s the bottom line? Both firms pay their traders. Take Profit Trader’s reputation is solid among those who take the time to understand their drawdown rules. The negative feedback almost always revolves around that intraday trailing stop, which can be brutal if you aren’t prepared for it.

My Funded Futures, on the other hand, is a community favorite right now. Their stellar Trustpilot score is built on hyper-responsive support and lightning-fast automated payouts. While their rules on certain trading styles like news trading and scalping are stricter on paper, the vast majority of traders report having no issues at all. The trust they’ve built is undeniable.

8. Which prop firm is easier to pass?

Alright, let’s cut to the chase. You want to know which evaluation process gives you the best shot at getting funded. Is it the one with the simplest rules or the one that lets you pass the fastest? To be honest, “easier” is subjective, but we can objectively compare the hurdles you have to jump through.

I’ve broken it down into the core components that determine the difficulty of any trader evaluation.

| Criteria | Take Profit Trader | My Funded Futures | Winner |

|---|---|---|---|

| Profit Target | Standard 6% ($3,000 on $50K) | Standard 6% ($3,000 on $50K) | Equal Choice |

| Drawdown Strictness | Very Lenient. End-of-day drawdown and no daily loss limit. | Lenient. Also, EOD drawdown with no daily loss limit during the evaluation. | Equal Choice |

| Rule Complexity | Extremely Simple. No news rules, no complex consistency rules, just trade. | More Complex. Has news trading restrictions and stricter automation policies. | Take Profit Trader |

| Overall Difficulty | Lower. Fewer rules mean fewer ways to accidentally fail. | Slightly Higher. The added rules require more mental bandwidth to track. | Take Profit Trader |

So, what’s the final word?

While both firms have identical profit targets and friendly EOD drawdowns, Take Profit Trader is arguably easier to pass simply because its rulebook is shorter.

The absence of a daily loss limit is a huge psychological advantage, removing one of the most common ways traders fail. Furthermore, you don’t have to worry about accidentally trading during a news event, which is a significant tripwire at other firms.

My Funded Futures is faster to pass; you can get funded in as little as two days. However, that speed comes with more rules to follow.

Simply put, Take Profit Trader’s forgiving rules give disciplined traders a less stressful path to focus on solid trading performance and pass the evaluation. It’s a great funding program for both day trading and other short-term trading strategies.

9. Who should choose which firm?

At the end of the day, there’s no single “best” prop firm; there’s only the best firm for you. Your personality, risk tolerance, and trading style are the deciding factors. After everything we’ve covered, I think the choice becomes pretty clear once you know what you’re looking for.

This table is designed to be your final cheat sheet. Find your trader profile below and see which firm gets our recommendation.

| Trader Type | Best Choice | Why |

|---|---|---|

| Beginners | My Funded Futures | Lower initial cost and zero activation fees mean less financial pressure. The structured environment can also help build good habits. |

| Futures Day Traders | Equal Choice | Both firms are exceptional for futures trading. It really depends on whether you prefer TPT’s rule simplicity or MFF’s account variety. |

| Scalpers | Equal Choice | Both firms are excellent for scalpers. TPT offers simpler rules overall. MFF’s Core/Scale plans also allow news trading and do not restrict normal scalping, making them highly competitive. |

| Swing Traders | Neither | Both firms require positions to be closed daily, making them unsuitable for swing trading that holds overnight or over weekends. |

| Risk-Averse Traders | Take Profit Trader | The combination of a lenient EOD drawdown and no DLL during the evaluation creates a less stressful environment to pass. |

| Automated Traders | Take Profit Trader | Both firms offer strong options. TPT provides Day 1 Payouts on SIM accounts. MFF offers daily payouts on its live accounts, providing traders with fast access to profits once they reach the live stage. |

| Cash-Flow Traders | Equal Choice | Both firms offer strong options. TPT provides Day 1 Payouts on sim accounts. MFF offers daily payouts on its live accounts, providing traders with fast access to profits once they reach the live stage. |

So, there you have it.

If you are a trader who values speed, simplicity, and immediate access to your profits, Take Profit Trader is, without a doubt, the superior choice. It’s built for professionals who want to focus on trading, not on navigating a complex rulebook. The ability to get paid on day one is a powerful feature that puts them in a class of their own for traders needing consistent cash flow.

On the other hand, if you’re just starting out, appreciate having multiple account options, or want the absolute lowest cost of entry, My Funded Futures is an outstanding option. Their high trust rating and excellent community support make them a safe and reliable partner for building a trading career. They’ve earned their spot as a top-tier firm for a reason.

10. FAQs

Take Profit Trader is a futures proprietary trading firm that offers funded trading accounts to traders who pass their one-step evaluation. They are best known for their simple rules, lack of a daily loss limit, and their industry-leading Day 1 Payout policy, which allows traders to withdraw profits immediately.

My Funded Futures is another top-tier futures prop firm that provides funded accounts through a one-step evaluation. They stand out by offering multiple account models (Core, Scale, Pro), zero activation fees on their newer plans, and a strong reputation for excellent customer support and fast, automated payouts.

Yes, absolutely. Take Profit Trader has a strong and well-documented history of paying its traders. Their payout reliability is a cornerstone of their brand, with many users on Trustpilot and Reddit confirming fast and consistent withdrawals.

Yes, My Funded Futures is a legitimate and highly trusted firm. They boast an exceptional 4.9-star rating on Trustpilot with over 12,000 reviews. Their payouts are known to be extremely fast and reliable, often processed automatically within hours of a request.

You can trade a wide range of futures products from major exchanges, including CME, CBOT, COMEX, and NYMEX. This includes popular instruments like equity indices (E-mini S&P 500, Nasdaq), commodities (Oil, Gold), and more.

The main differences are: Payouts: TPT offers Day 1 Payouts, while MFF has weekly/bi-weekly payouts. Rules: TPT has simpler rules with no news trading restrictions. MFF has stricter policies on news trading and high-frequency trading. Fees: MFF has no activation fees, making it cheaper upfront. TPT has a one-time activation fee that is often waived during promotions, but it also offers a refund on the first month’s evaluation fee.

Take Profit Trader is generally considered easier to pass. While both firms have similar profit targets and drawdowns, Take Profit Trader’s rulebook is much simpler. The lack of news trading rules and a daily loss limit makes the evaluation less stressful and reduces the chance of accidental disqualification.

11. Conclusion

Ultimately, the Take Profit Trader vs My Funded Futures debate reveals two excellent but distinct paths for aspiring traders. Your choice boils down to a simple question of priority. If your goal is maximum flexibility, rule simplicity, and the unparalleled advantage of daily payouts, Take Profit Trader is the clear winner. It’s a platform built for confident traders who want to focus purely on performance and cash flow.

Ready to take the next step on your trading journey? Explore these in-depth comparisons at H2T Funding today and start your path to becoming a consistently profitable trader!