For futures traders comparing OneUp Trader vs TopstepTrader, the most critical distinction is their approach to risk: OneUp’s unforgiving real-time drawdown versus Topstep’s more lenient end-of-day limit. This fundamental difference shapes the entire evaluation experience and determines which firm best suits your trading psychology.

This in-depth comparison from H2T Funding breaks down their models, rules, and costs, ensuring you partner with the firm that truly aligns with your strategy and career ambitions. Let’s explore which path is the right one for you.

Key Takeaways

- OneUp Trader offers a simple 1-Step Evaluation to get funded. TopstepTrader uses its “Trading Combine®,” a single-phase evaluation that requires passing specific objectives to earn an Express Funded Account™.

- OneUp Trader features a single monthly subscription fee. TopstepTrader provides two paths: a lower monthly fee with a one-time activation fee upon passing, or a higher monthly fee with no activation fee.

- OneUp Trader utilizes a real-time trailing drawdown. TopstepTrader’s main rule is a Maximum Loss Limit calculated on your end-of-day balance, which many traders find more forgiving.

- Both firms are highly competitive. OneUp Trader offers a 90/10 split, with traders keeping 100% of the first $10,000. TopstepTrader also provides a 90/10 split and lets traders keep 100% of their first $10,000 in profits.

- OneUp Trader is well-suited for experienced traders who want a quick, cost-effective path to funding. TopstepTrader is excellent for both new and veteran traders who value a reputable, structured environment that promotes consistent, disciplined trading habits.

1. Overview of OneUp Trader and TopstepTrader

OneUp Trader and TopstepTrader are both premier firms in the futures trading space, offering talented traders a path to a funded account. However, they approach this opportunity from two distinct philosophical standpoints. One firm prioritizes speed and simplicity, while the other champions structure and long-term habit formation.

OneUp Trader has positioned itself as the go-to choice for confident traders who want a fast and straightforward evaluation. Their entire model is built around a single-step challenge, designed to quickly identify profitable traders and get them funded without unnecessary complexity. The central question traders ask, “Is OneUp Trader legit?”, is often answered by its transparent rules and simple process.

TopstepTrader, founded in 2012, is an industry veteran with a strong reputation for building disciplined traders. Their renowned Trading Combine® is more than just an evaluation; it’s a structured program designed to test and instill consistent, risk-managed trading habits. This established framework is a key reason many traders trust the brand.

Criteria Table – A Quick Comparison

| Criteria | OneUp Trader | TopstepTrader |

|---|---|---|

| Founded / Trust | Strong reputation with high Trustpilot scores. | Established in 2012, an industry pioneer with numerous awards. |

| Evaluation Models | 1-Step Evaluation program. | 1-Step Trading Combine®. |

| Account Sizes | $25,000 to $250,000. | $50,000 to $150,000. |

| Asset Classes | Futures contracts exclusively. | Futures contracts exclusively. |

| Trading Platforms | Over 20 platforms, including a free NinjaTrader license. | TopstepX™ (proprietary), plus other popular platforms. |

| Profit Split | 100% of the first $10K, then 90% for the trader. | 100% of the first $10K, then 90% for the trader. |

| Minimum Days | 10 days (5 for Express Funding). | Minimum of 2 trading days. |

| Scaling Programs | Dynamic Scaling Targets for funded accounts. | Dynamic Live Risk Expansion program. |

| Payouts | Daily requests (Mon-Fri) with a $1,000 minimum. | Daily payout processing after meeting requirements. |

| Risk Restrictions | The key rule is a real-time Trailing Drawdown. | The key rule is an end-of-day Maximum Loss Limit. |

This table highlights the core differences in the Topstep vs OneUp debate. OneUp Trader offers more account sizes and a simple evaluation, while TopstepTrader provides a more forgiving drawdown rule and a faster path to funding eligibility. Your choice will depend on which of these factors you value most.

Disclaimer: Rules, pricing, and trading conditions may change over time. Traders should always verify the latest terms directly on the official OneUp Trader vs TopstepTrader websites before purchasing any challenge.

OneUp Trader

#1

Account Types

1-step

Trading Platforms

NinjaTrader 8, R | Trader Pro, AgenaTrader, Bookmap, MotiveWave, Trade Navigator, Volfix, Sierra Chart, Jigsaw Trading, MultiCharts, Photon, InsideEdge

Profit Target

6%

Our take on OneUp Trader

OneUp Trader is designed for the decisive trader who has a proven strategy and wants to get funded quickly. The firm’s model eliminates complexity by focusing on a single-phase evaluation with clear, concise rules. Personally, I view OneUp Trader as a proving ground for traders who have already sharpened their edge and are ready to execute. It feels less like a training program and more like a direct gateway to capital.

| 💳 Challenge Fee | $125 – $325 |

| 👥 Account Types | 1-step |

| 💰 Profit Split | 90% – 100% |

| 💵 Account Size | $25K – $250K |

| ⏱️ Time Limit | No time limit |

| 🎯 Profit Target | 6% |

| 📊 Trading Platforms | NinjaTrader 8, R | Trader Pro, AgenaTrader, Bookmap, MotiveWave, Trade Navigator, Volfix, Sierra Chart, Jigsaw Trading, MultiCharts, Photon, InsideEdge |

| 🛍️ Asset Types | Futures Contracts |

Topstep

#2

Account Types

2-step

Trading Platforms

TopstepX

Profit Target

6%

Our take on Topstep

TopstepTrader has built its brand on being a structured and supportive environment for trader development. The firm’s “1 Rule, 1 Goal” philosophy simplifies the objective: manage your risk while hitting the profit target. From my perspective, TopstepTrader feels more like a long-term partner in your trading journey. Their focus on education and the more forgiving drawdown rule suggest they are invested in your development, not just your immediate performance.

| 💳 Challenge Fee | $49 – $149 |

| 👥 Account Types | 2-step |

| 💰 Profit Split | 90% – 100% |

| 💵 Account Size | $50K – $150K |

| ⏱️ Time Limit | No time limit |

| 🎯 Profit Target | 6% |

| 📊 Trading Platforms | TopstepX |

| 🛍️ Asset Types | Futures Contracts |

See more:

2. OneUp Trader vs TopstepTrader comparison: Core models and key rules

The fundamental difference between these two firms is found in their risk models and rule philosophies. OneUp Trader offers a simple set of rules centered on a strict, real-time drawdown. In contrast, TopstepTrader provides a more structured environment with a forgiving end-of-day drawdown, balanced by additional objectives.

2.1. Funding model & evaluation difficulty

Both firms utilize a single-step evaluation, but the practical experience and difficulty level are shaped by their distinct approaches to risk and consistency. This directly impacts the psychological stress a trader endures during the challenge.

| Criteria | OneUp Trader | TopstepTrader |

|---|---|---|

| Evaluation Required | Yes, a 1-Step Evaluation. | Yes, the 1-Step Trading Combine®. |

| Profit Target | Consistently 6% across all available account sizes. | Consistently 6% across all available account sizes. |

| Time Pressure | Low. No maximum days, but a monthly subscription applies. | Low. No maximum days and a very short 2-day minimum. |

| Psychological Stress | High, primarily due to the real-time trailing drawdown. | Moderate, as the EOD drawdown allows for intraday recovery. |

| Overall Difficulty | Higher for many, as the trailing drawdown is unforgiving. | More manageable, as the main rule is less punitive intraday. |

In short, TopstepTrader offers a more forgiving entry point due to its drawdown rule. OneUp Trader’s model, while simple on paper, demands greater discipline and precise risk management from the very first trade.

2.2. Drawdown, consistency & risk rules

A prop firm‘s risk parameters are the most critical factor for success, and this is where the two firms diverge significantly. Understanding these differences is essential to choosing the right environment for your strategy.

| Criteria | OneUp Trader | TopstepTrader |

|---|---|---|

| Max Drawdown | A real-time trailing drawdown that follows peak equity. | An end-of-day Maximum Loss Limit. It does not trail intraday. |

| Daily Loss Limit | None. Offers complete intraday freedom in this regard. | Yes, this is a soft rule (objective) for most platforms. |

| Trailing Drawdown | Yes, this is the primary and strictest rule of the evaluation. | No. The Maximum Loss Limit is calculated from the EOD balance. |

| Consistency Rules | Yes. The sum of the 3 other best days must be ≥ 80% of the best day. | Yes. Your best day must be below 50% of your total profits. |

| Rule Strictness | Very strict. The trailing drawdown punishes open profits severely. | More forgiving. Allows for intraday drawdowns without penalty. |

Ultimately, TopstepTrader’s rules provide more breathing room during the trading day and are less likely to penalize a trader for a single large winning trade. OneUp Trader’s rules require constant vigilance over your account’s high-water mark.

2.3. News, Overnight & strategy policies

To maintain a fair and stable trading environment, both firms enforce clear policies regarding trading hours, major economic events, and specific trading methods.

| Policy | OneUp Trader | TopstepTrader |

|---|---|---|

| News Trading | Permitted during evaluation; restricted in the funded account. | Permitted during evaluation; restricted in the funded account. |

| Overnight Trading | Strictly prohibited. All positions must be closed by 3:15 PM CT. | Strictly prohibited. All positions must be closed by 3:10 PM CT. |

| Weekend Trading | Strictly prohibited. | Strictly prohibited. |

| EA / Automation | Prohibits HFT, latency arbitrage, and certain copy trading. | Copy trading is explicitly supported on platforms like TopstepX™. |

| Allowed Strategies | Focuses on manual discretionary day trading. | Accommodates a range of day trading styles, including systematic ones. |

Both firms are aligned in their prohibition of holding positions overnight or through the weekend. However, TopstepTrader appears more accommodating of modern trading tools like trade copiers, particularly through its proprietary TopstepX™ platform.

3. OneUp Trader vs TopstepTrader review: Fees, refunds, and cost efficiency

The total cost of an evaluation is a major factor for any trader, and both firms offer distinct pricing models. OneUp Trader uses a straightforward monthly subscription, while TopstepTrader provides two flexible paths that cater to different trader confidence levels and budgets.

| Criteria | OneUp Trader | TopstepTrader |

|---|---|---|

| Fee Type | Simple monthly subscription fee. | Two paths: Standard (lower monthly fee + activation fee) or No Activation Fee (higher monthly fee). |

| Refund Policy | No refunds. Fees are for the monthly evaluation period. | No refunds. Subscription fees are for the evaluation attempt. |

| Challenge Cost | Ranges from $65/month for a $25K account to $325/month for a $250K account. | Monthly fees range from $49/month to $189/month, depending on the chosen path and account size. |

| Transparency | High. One clear monthly fee with no hidden costs upon passing. | High. Both pricing paths are clearly explained upfront. |

| Added Fees | Resets are available for a fee ($100 for most accounts). | Resets cost the same as the monthly subscription. Activation fees apply to the Standard path ($129). |

| Payout Cycle | No fees are charged for payouts. | No fees are charged for payouts. |

In conclusion, OneUp Trader is more cost-predictable, with one monthly fee regardless of outcome. TopstepTrader offers a lower initial monthly cost on its Standard path, but the total cost to get funded will be higher due to the activation fee. The No Activation Fee path is best for confident traders who expect to pass quickly, making the all-in cost lower.

4. OneUp Trader vs TopstepTrader debate: Profit split and scaling potential

A trader’s long-term success with a prop firm hinges on its profit-sharing and growth opportunities. In the OneUp Trader vs TopstepTrader debate, both firms offer an identical and highly competitive profit split. However, their approaches to scaling and the conditions for payouts reveal different philosophies about trader growth.

| Criteria | OneUp Trader | TopstepTrader |

|---|---|---|

| Profit Split | 100% of the first $10,000, then a 90/10 split in the trader’s favor. | 100% of the first $10,000, then a 90/10 split in the trader’s favor. |

| Scaling Plans | Yes, a Dynamic Scaling Target plan. A trader’s maximum position size increases as their account balance grows. | Yes, a Dynamic Live Risk Expansion plan. Both Daily Loss Limit and contract size increase as profits grow, with a clear path to trading up to 100 lots. |

| Payout Frequency | Payouts can be requested any day, Monday to Friday, and are processed the same day. | Payouts are processed daily but require 5 winning days per request until 30 total winning days are achieved. |

| Minimum Payout | The minimum withdrawal amount is $1,000. | The minimum payout request is $125. |

| Withdrawal Conditions | A profit threshold buffer must be maintained in the account after a withdrawal. | Once a payout is made, the Maximum Loss Limit is set to the starting balance ($0 profit). |

In summary, the profit split between TopstepTrader and OneUp Trader is a dead heat; both are excellent. TopstepTrader offers a more structured and potentially larger scaling plan, along with a significantly lower minimum payout amount.

However, its “5 winning days” requirement adds a condition that OneUp Trader does not have, making OneUp’s withdrawal process feel more direct for traders who can meet the higher minimum withdrawal threshold.

5. TopstepTrader vs OneUp Trader: Platforms and tradable markets

A trader’s performance is heavily influenced by the quality of their tools and market access. In the TopstepTrader vs OneUp Trader comparison, both firms provide access to the same core futures markets, but their platform offerings differ significantly, especially with TopstepTrader’s recent innovations.

| Criteria | OneUp Trader | TopstepTrader |

|---|---|---|

| Trading Platforms | Extensive selection of over 20 platforms, including NinjaTrader (with a free license), R | Trader Pro, Sierra Chart, and more. |

| Asset Classes | Futures only. Covers all major CME, CBOT, NYMEX, and COMEX products. | Futures only. Covers all major CME, CBOT, NYMEX, and COMEX products, including micros. |

| Execution Speed | Relies on Rithmic’s data feed, which is an industry standard for speed and reliability. | Uses a dedicated feed for TopstepX™ and other industry-standard data feeds, ensuring low latency. |

| Commissions & Fees | Standard simulated commissions apply during evaluation. Funded accounts have competitive, transparent rates. | Commission-free trading on TopstepX™ (exchange fees still apply). Standard commissions on other platforms. |

| Trader Dashboard | A functional dashboard for tracking progress and account metrics. | A modern, intuitive dashboard with instant performance updates and integrated digital coaching via “Coach T”. |

To conclude, while both firms offer the necessary tools, TopstepTrader holds a distinct advantage with its proprietary TopstepX™ platform. The integration of TradingView charts and commission-free trading is a powerful combination that provides a superior user experience.

OneUp Trader’s strength lies in its sheer number of supported third-party platforms, offering maximum flexibility for traders already proficient with a specific software. This part of the OneUp Trader and TopstepTrader review highlights a clear divergence in technological focus.

6. Payout & trust: OneUp Trader and TopstepTrader Reddit and Trustpilot reviews

A prop firm’s reputation is ultimately defined by the experiences of its traders. To gauge real-world sentiment, we’ve analyzed recent feedback from Trustpilot and Reddit, focusing on payout reliability, rule enforcement, and the quality of customer support. This provides a crucial, unfiltered look at both companies.

(Note: Information collected and updated on January 23, 2026)

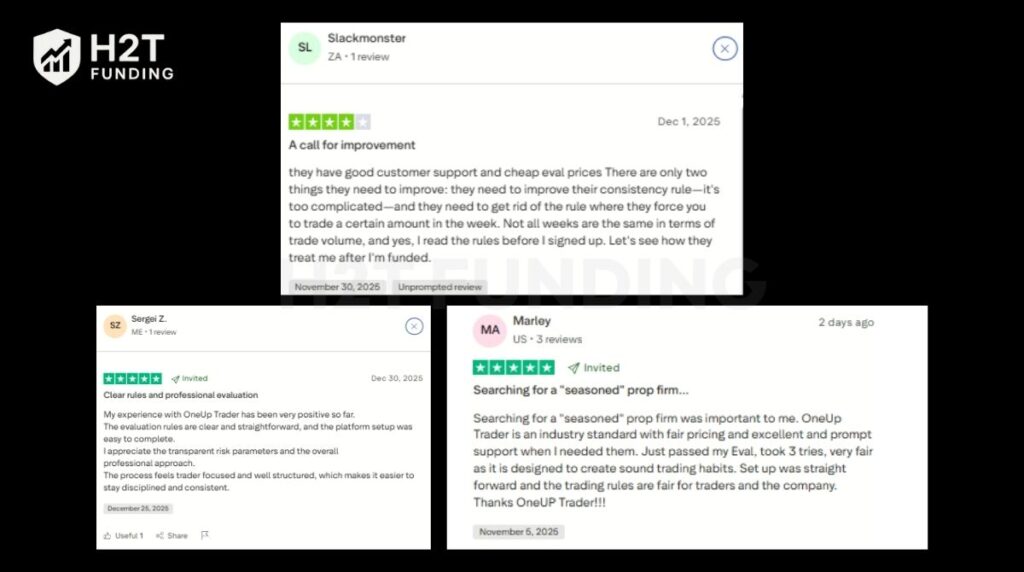

The community feedback paints two very different pictures. OneUp Trader generally receives a chorus of praise for its simplicity, responsive support, and transparent rules. The most common complaint is not about the firm’s integrity but about the inherent difficulty of its strict trailing drawdown and consistency rules. Traders seem to respect the model, even if they find it challenging.

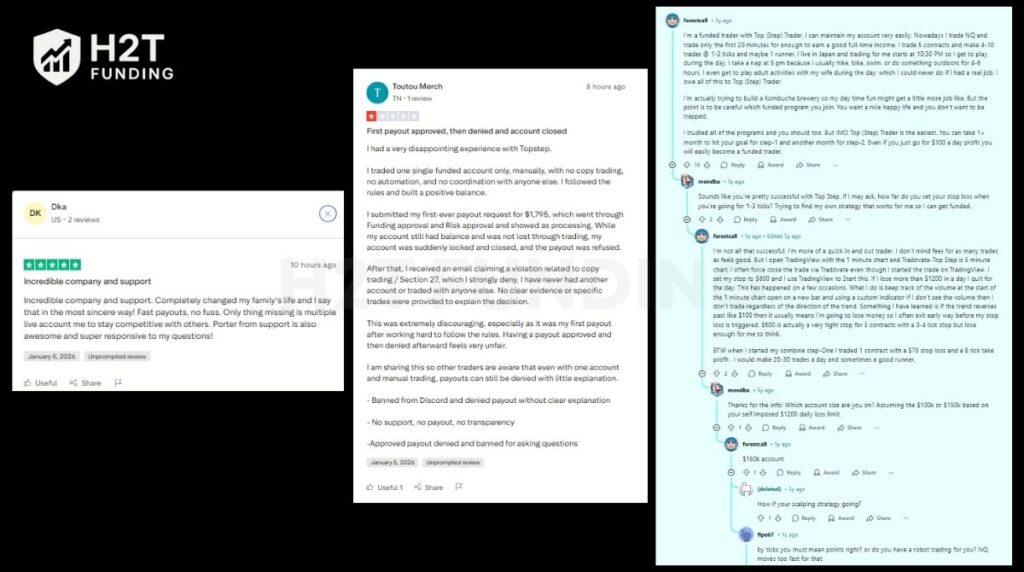

Conversely, sentiment around TopstepTrader is more polarized. It has a foundation of long-term, successful traders who vouch for its legitimacy and life-changing potential. However, there is a significant and recent volume of negative reviews citing platform glitches, unfair account closures, and denied payouts.

While its defenders are passionate, the number of detailed complaints raises valid concerns about technical reliability and rule enforcement in today’s environment.

7. OneUp Trader vs TopstepTrader: Which prop firm is easier to pass?

For the majority of traders, TopstepTrader is the easier prop firm to pass. This is almost entirely due to its more forgiving drawdown rule, which provides crucial breathing room for traders to manage positions and recover from intraday dips without penalty.

The OneUp Trader vs Topstep comparison on this point is stark. While both firms present challenges, the nature of their core risk rules creates a significant difference in the psychological and strategic burden placed on the trader.

| Criteria | Winner | Notes |

|---|---|---|

| Profit Target | Both | Both firms require a standard 6% profit target, making this a neutral factor in the difficulty comparison. |

| Drawdown Strictness | TopstepTrader | Its end-of-day drawdown is far more forgiving than OneUp Trader’s real-time trailing drawdown, which can instantly fail an account that is still in profit. |

| Rule Complexity | OneUp Trader | It has fewer overall rules to track. The absence of a Daily Loss Limit simplifies the trading day significantly. |

| Overall Difficulty | TopstepTrader | Despite having more secondary objectives, the leniency of its primary drawdown rule dramatically lowers the overall difficulty and psychological stress for most trading styles. |

In conclusion, while OneUp Trader offers a simpler rulebook, the punishing nature of its real-time trailing drawdown makes it a much harder challenge to pass for most traders. TopstepTrader’s end-of-day drawdown rule is the single biggest factor that makes its evaluation more achievable.

8. OneUp Trader and TopstepTrader: Which prop firm suits your trading style?

Choosing the right firm means aligning its rules and model with your specific trading methodology. Your strategy, risk tolerance, and experience level will determine whether OneUp Trader’s flexibility or TopstepTrader’s structure is the better fit. The OneUp Trader or TopstepTrader decision should be based on this personal alignment.

| Trader Type | Best Choice | Why |

|---|---|---|

| Beginners | TopstepTrader | The forgiving end-of-day drawdown and extensive educational resources (coaching, TopstepTV™) provide a much safer environment for learning and development. |

| Systematic Traders | TopstepTrader | Its support for trade copiers on TopstepX™ and a more structured rule set align well with automated and rule-based strategies. |

| Swing Traders | Neither | Both firms are designed exclusively for day trading and strictly prohibit holding positions overnight or through the weekend. |

| Scalpers | OneUp Trader | The absence of a Daily Loss Limit allows scalpers to trade with high frequency without the fear of hitting a restrictive intraday loss cap, a crucial element in many OneUp Trader reviews. |

| Risk-Averse Traders | TopstepTrader | The Maximum Loss Limit provides a stable floor, allowing traders to manage risk without the constant psychological pressure of a drawdown that trails their open profits. |

| Traders Aiming for Large Capital | OneUp Trader | It offers account sizes up to $250,000, providing a higher initial capital ceiling compared to TopstepTrader’s maximum of $150,000. |

Ultimately, the choice is clear. Traders who are new to futures or who value a supportive, structured environment with a forgiving primary rule will find TopstepTrader to be the superior option. On the other hand, experienced, confident traders, especially scalpers who want maximum intraday flexibility and a straightforward path to larger capital, will be better served by OneUp Trader.

9. FAQs – People Also Ask (Optimized)

Yes, OneUp Trader is a legitimate proprietary trading firm. It has a strong reputation in the industry, backed by a 4.7-star rating on Trustpilot from over 2,000 reviews. The firm is known for its transparent 1-Step Evaluation, clear rules, and reliable payouts to funded traders.

Yes, TopstepTrader is one of the most established and legitimate prop firms in the futures trading industry. Founded in 2012, it has funded thousands of traders worldwide and paid out millions in profits. Its long track record and numerous industry awards confirm its legitimacy.

For most traders, TopstepTrader is easier to pass. Its key advantage is the Maximum Loss Limit, which is calculated based on your end-of-day balance. This is far more forgiving than OneUp Trader’s real-time trailing drawdown, which can fail an account even while it’s in profit.

OneUp Trader works by offering a 1-Step Evaluation program. Traders pay a monthly fee to trade in a simulated account. To pass, they must hit a 6% profit target and trade for a minimum of 10 days without violating the real-time trailing drawdown rule. Successful traders receive a funded account and keep 90% of their profits (after the first $10,000, which is 100%).

TopstepTrader’s model is the Trading Combine®, a 1-step evaluation. Traders pay a monthly fee and must achieve a 6% profit target without hitting the end-of-day Maximum Loss Limit. After passing, traders receive an Express Funded Account™ and keep 90% of their profits (after an initial 100% on the first $10,000).

“Better” depends on the trader’s needs. OneUp Trader can be considered better for traders who want a larger initial account size (up to $250K) and no Daily Loss Limit. However, many traders find TopstepTrader’s end-of-day drawdown rule and extensive educational support to be superior.

The cost of OneUp Trader is a recurring monthly subscription fee that varies by account size. Prices start at $65 per month for a $25,000 account and go up to $325 per month for a $250,000 account. There are no hidden activation fees upon passing.

The primary risks are failing the Trading Combine® and losing your monthly subscription fee. Recent community feedback also points to risks associated with platform glitches and potentially strict enforcement of rules related to payouts, which could lead to account closure.

Many traders consider TopstepX™ to be the best platform for Topstep. It is their proprietary platform featuring integrated TradingView charts, commission-free trading, and built-in risk management tools. It offers a seamless and optimized experience designed specifically for their evaluation.

Yes, OneUp Trader accepts traders from the United States and many other countries worldwide.

TopstepTrader supports trade copiers on its TopstepX™ and Quantower platforms. However, it prohibits certain automated strategies like high-frequency trading (HFT) bots. Traders should always review the firm’s Prohibited Conduct list for specific details.

Both firms have strict consistency rules. OneUp Trader’s rule (sum of 3 other best days ≥ 80% of the best day) can be complex to track. TopstepTrader’s rule (best day must be below 50% of total profits) is more straightforward, but both require disciplined trading to avoid violation.

Yes, both firms offer fast withdrawals. OneUp Trader processes withdrawal requests daily (Monday-Friday). TopstepTrader also processes payouts daily, but new funded traders must first accumulate 5 winning days per withdrawal request until they reach 30 total winning days, after which restrictions are lifted.

10. Conclusion

Ultimately, the OneUp Trader vs TopstepTrader debate is a question of philosophy. OneUp Trader operates as a high-stakes proving ground; it provides a direct, unhindered path for confident traders who believe their strategy is already perfected and simply need capital to execute. It asks the question: “Are you a professional right now?” If the answer is yes, its straightforward model is your launchpad.

In contrast, TopstepTrader functions more like a prestigious trading academy. Its structured Trading Combine® and more forgiving drawdown rule are designed not just to test skill but to forge it, building the long-term discipline required for a sustainable career. Your choice, therefore, depends on whether you’re looking for a simple funding transaction or a formative partnership to help you become the trader you aim to be.

Your journey is unique, and choosing the right partner is paramount. To see how these firms measure up against other industry challengers, explore the comprehensive breakdowns in the Compare section on the H2T Funding blog.