The choice between My Funded Futures vs Topstep often leaves traders feeling stuck. You want the fastest path to a funded account, but fear that complex rules or a punishing drawdown model could lead to a quick and expensive evaluation failure. Choosing the wrong firm is a costly mistake that can set your trading career back months.

This guide delivers the clarity you need to make the right choice. H2T Funding will dissect the critical differences, from the evaluation process and drawdown types to the true costs and payout speed.

By the end, you’ll know exactly which firm offers the structure that best supports your specific trading style and provides a more achievable path to getting funded.

Key takeaways

- My Funded Futures offers a fast 1-step evaluation to get you funded quicker. Topstep uses a slower, more structured 2-step process designed to build discipline.

- You get more flexibility with My Funded Futures, including no daily loss limit and your choice of popular platforms. Topstep has stricter daily rules and requires all new traders to use its exclusive TopstepX platform.

- If you want fast and frequent payouts, My Funded Futures is the clear winner. Topstep offers a better initial deal (you keep 100% of your first $10k), but their process for getting paid is slower and has more restrictions.

- The My Funded Futures vs Topstep decision comes down to this: choose MFFU for operational speed and reliability, or choose Topstep for its excellent education, but be aware of the current platform risks.

1. Overview & quick comparison: My Funded Futures vs Topstep

My Funded Futures and Topstep represent two distinct paths to securing a funded futures account. My Funded Futures prioritizes speed and flexibility through its modern 1-step evaluation. In contrast, industry veteran Topstep focuses on building discipline with a more structured 2-step process.

The table below offers a direct look at their core differences.

| Aspect | My Funded Futures | Topstep |

|---|---|---|

| CEO | Matthew Leech | Michael Patak |

| Funding Models | 1-step | 2-step (Trading Combine) |

| Profit Split | 80% | 100% first $10K profit, then 90% |

| Account Size | $50K – $150K | $50K – $150K |

| Profit Target | 6% | 6% |

| Payout Frequency | 5 Winning days on the Core and Scale accounts14 calendar days on Pro accounts | 5 Winning days (Net PnL each day +$150 or more) |

| Time Limits | No time limit | No time limit |

| Minimum Trading Days | None | 2 days for Combine |

| Daily Loss Limit | None | TopstepX uses trader-set PDLL; legacy platforms still use fixed DLL. |

| Maximum Loss Limit | EOD Drawdown: 3% – 4% | Trailing Drawdown (varies by account) |

| Instruments | Futures contracts | Futures contracts |

| Platforms | Tradovate, NinjaTrader, TradingView, Quantower, Volsys, Volumetricatrading | TopstepX |

| News/Weekend Trading | Prohibited | News allowed with caution; overnight/weekend holding strictly prohibited. |

| Starting Fees | $77/month | $49/month |

Disclaimer: Rules, pricing, and trading conditions may change over time. Traders should always verify the latest terms directly on the official My Funded Futures and Topstep websites before purchasing any challenge.

In summary, My Funded Futures offers a faster, more straightforward route for traders confident in their strategy. Topstep, on the other hand, provides a more methodical path with a generous initial profit split, designed to foster long-term discipline. The choice hinges on whether you prioritize evaluation speed and simplicity or a structured trading environment.

My Funded Futures

#1

Account Types

1-step

Trading Platforms

Tradovate, NinjaTrader 8, TradingView, Quantower, Volsys, Volumetricatrading

Profit Target

6%

Our take on My Funded Futures

My Funded Futures represents the new wave of prop trading firms. Their entire model is engineered for speed and simplicity, stripping away many of the complex rules that frustrate traders at older firms. They offer more forgiving risk limits and trader-friendly EOD drawdown limits.

The standout feature is their exceptional payout timing, allowing traders to access profits quickly from their simulated account. This, combined with a straightforward profit-sharing model, makes them highly attractive for traders who prioritize consistent cash flow and operational efficiency.

| 💳 Challenge Fee | $77 – $477 |

| 👥 Account Types | 1-step |

| 💰 Profit Split | 80% |

| 💵 Account Size | $50K – $150K |

| ⏱️ Time Limit | No time limit |

| 🎯 Profit Target | 6% |

| 📊 Trading Platforms | Tradovate, NinjaTrader 8, TradingView, Quantower, Volsys, Volumetricatrading |

| 🛍️ Asset Types | Futures Contracts |

Topstep

#2

Account Types

2-step

Trading Platforms

TopstepX

Profit Target

6%

Our take on Topstep

Topstep is the original educator in the futures prop trading space. Their entire program, from the 2-step Trading Combine to the free coaching, is designed to forge disciplined traders. They enforce a structured trading environment with firm consistency rules to instill good habits for long-term success.

However, their excellent profit-sharing model and coaching are currently undermined by significant platform risks. The slower payouts and widespread reports of technical issues on the proprietary TopstepX platform are a major concern for any trader who depends on reliable execution to succeed.

| 💳 Challenge Fee | $49 – $149 |

| 👥 Account Types | 2-step |

| 💰 Profit Split | 90% – 100% |

| 💵 Account Size | $50K – $150K |

| ⏱️ Time Limit | No time limit |

| 🎯 Profit Target | 6% |

| 📊 Trading Platforms | TopstepX |

| 🛍️ Asset Types | Futures Contracts |

View more:

Before diving into the detailed breakdown below, check out the video for a quick, visual overview of how Topstep works and what real traders experience on the platform.

2. Detailed My Funded Futures vs Topstep comparison

The overview table gives a quick summary, but a trader’s success often depends on the finer details. We will now dissect the core components that truly define the trading experience at each firm. This deep dive covers the critical factors, from their evaluation rules and drawdown models to the real costs and profit potential you can expect.

2.1. Evaluation process & requirements

The evaluation is your gateway to a funded account, and this is where the two firms differ most. My Funded Futures uses a fast, one-step model that lets you prove profitability quickly, while Topstep trading rules are designed to measure discipline and consistency over time.

The table below breaks down the requirements for their standard $50K accounts.

| Feature | My Funded Futures ($50K Core Plan) | Topstep ($50K Standard Plan) |

|---|---|---|

| Model | 1-Step Evaluation | 2-Step Trading Combine |

| Profit Target | $3,000 | $3,000 |

| Time Limit | None | None |

| Minimum Trading Days | 2 Days | 2 Days |

| Consistency Rule | 50% Rule (during evaluation) | Yes (Best Day < 50% of total profit) |

The difference is clear. My Funded Futures provides the fastest possible path to funding. If you are confident in your strategy, you can secure a funded account in as little as two days. This is a massive advantage for experienced traders who want to get started immediately.

Topstep’s two-step process is deliberately longer and more demanding. It is designed to filter for consistent performance, not just a single lucky streak. This structured approach is often better for traders who are still developing their discipline and want to prove their long-term viability.

2.2. EOD drawdown rules explained

A firm’s drawdown rule is the single most important factor for survival. In a major industry shift, both My Funded Futures and Topstep now primarily use the End-of-Day (EOD) drawdown model. This is a significant advantage, as it removes the intense pressure of a live trailing drawdown that follows your intraday highs.

The EOD model means your maximum loss limit is only recalculated based on your account’s balance at the close of the trading day. This gives you crucial breathing room to manage positions and absorb normal market volatility. You can have an intraday profit pullback without the fear of instantly violating your account’s primary rule.

Since both firms offer this superior, trader-friendly model, the drawdown rule itself is no longer a major point of differentiation. This levels the playing field considerably. Your decision should now weigh more heavily on other factors, such as the evaluation process, how often you can get paid, and the overall costs.

2.3. Trading rules & risk management

Beyond the drawdown model, the daily trading rules dictate your strategic freedom. This is where the core philosophies of both firms become clear. My Funded Futures imposes specific restrictions on certain events like news trading, while Topstep focuses more on preventing exploitative behaviors and providing protective guardrails.

| Feature | My Funded Futures | Topstep |

|---|---|---|

| Daily Loss Limit | None. Offers maximum trading flexibility. | Protective Threshold. A soft breach liquidates positions for the day to prevent major losses, but it is not a rule violation. |

| News Trading | Highly Restricted. No positions 2 minutes before/after news. Tier 1 news trading is prohibited on Pro accounts. | Allowed. Offers significant freedom for traders whose strategies incorporate news events. |

| Hedging | Prohibited. You cannot hold long and short positions on the same underlying asset (e.g., NQ and MNQ). | Not explicitly prohibited, but falls under the general rules against manipulative strategies. |

| Automated Trading (EAs) | Allowed, but strategies must not exploit the simulated environment. High-Frequency Trading is not allowed. | Allowed, but the trader assumes all responsibility for any malfunctions or errant trades. |

The approach to risk management is fundamentally different. Topstep’s rules, especially its protective Daily Loss Limit, create a structured and forgiving environment. This is a powerful risk management tool for traders, preventing one bad day from ending an evaluation.

My Funded Futures grants more autonomy but demands greater self-discipline. The absence of a Daily Loss Limit is a significant advantage for skilled traders, but the complex news trading restrictions require careful calendar management. Your choice depends on whether you value a protective safety net or fewer day-to-day restrictions.

2.4. Account fees, activation, and resets

The headline monthly price is just the starting point. To understand the true cost of getting funded, you must consider the entire fee structure, including one-time activation fees and the cost of resets if you fail. These expenses significantly impact your overall investment in the evaluation process.

| Fee Type | My Funded Futures ($50K Core Plan) | Topstep ($50K Account) |

|---|---|---|

| Monthly Fee | $77 / month | Standard: $49 / month No Activation Fee: $89 / month |

| One-Time Activation Fee | $0 | Standard: $129 No Activation Fee: $0 |

| Evaluation Reset Fee | $77 (same as monthly fee) | $49 or $89 (same as monthly fee) |

| Funded Account Recovery | Yes (Paid reset available for some legacy accounts) | No (Offers a Back2Funded reactivation option for a fee) |

My Funded Futures stands out for its simple, transparent pricing. The complete absence of an activation fee on their new plans is a major advantage, as there are no hidden costs after you pass. This what you see is what you get approach is ideal for traders who value predictability.

Topstep provides strategic flexibility with two distinct paths. The Standard plan offers a very low monthly fee, perfect for traders who want to minimize upfront costs and may take more than a month to pass.

The No Activation Fee path costs more per month but saves you money if you are confident you can pass quickly, directly competing with MFFU’s model.

2.5. Trading platforms & tradable assets

Your platform is your primary tool, while the available assets define your opportunities. My Funded Futures offers broad compatibility with popular third-party software.

In a major strategic shift, Topstep is now focusing exclusively on its proprietary platform, TopstepX, for all new traders, phasing out support for other platforms for new accounts.

| Feature | My Funded Futures | Topstep |

|---|---|---|

| Primary Offering | Wide selection of popular third-party platforms. | Exclusive focus on TopstepX for new accounts and resets. |

| Supported Platforms | NinjaTrader, Tradovate, TradingView, Quantower, ATAS, and more. | TopstepX (Proprietary) (Legacy support for other platforms is being phased out for new users.) |

| Best For | Traders who want to use their existing, preferred platform and custom setups. | Traders who want a fully integrated, all-in-one experience provided by the firm. |

| Data Fees | Included in the monthly subscription fee for evaluations. | Monthly data fees are a separate charge for Live Funded Accounts. |

| Tradable Assets | Wide range of CME Group futures, including Equity Indices (ES, NQ), Metals (GC), Energy (CL), Forex (6E), and more. | Wide range of CME Group futures, including Equity Indices (ES, NQ), Metals (GC), Energy (CL), Forex (6E), and more. |

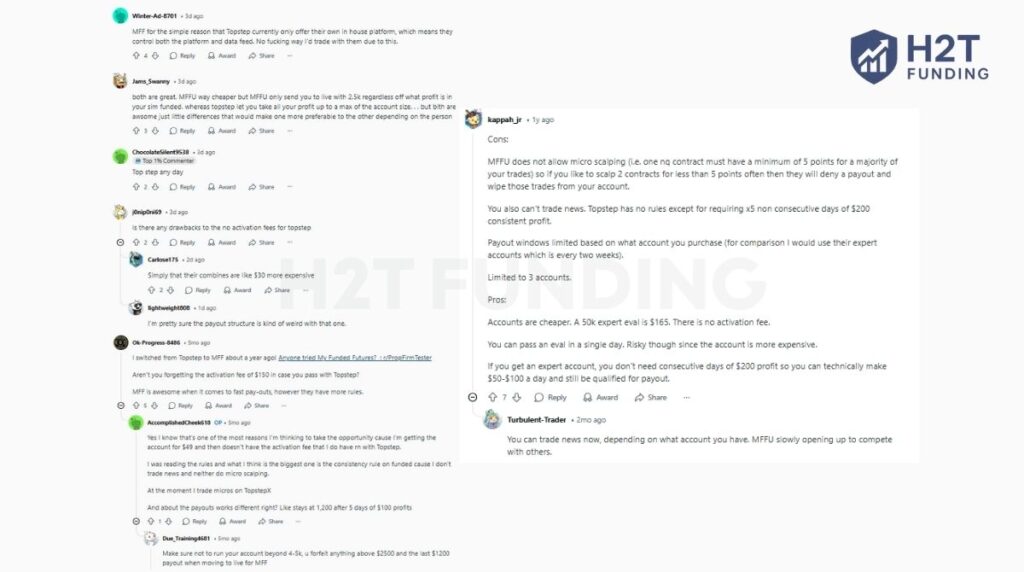

The platform choice has become the clearest dividing line between these two firms. My Funded Futures is the undeniable choice for traders who have an established workflow on platforms like NinjaTrader or TradingView. Their open ecosystem ensures you can use the tools you already know and trust.

Topstep is also transitioning all new activity toward TopstepX. Traders can request to switch to TopstepX as long as no trades have been placed on the new account. Starting July 7th, 2025, all new Trading Combines must be purchased on TopstepX, and after August 1st, all resets and new Combines will also be restricted to TopstepX.

Existing Express and Live Funded Accounts on other platforms may continue trading as usual. For traders who prefer chart-based execution, Topstep can also be integrated smoothly with TradingView. Understanding how to connect Topstep to TradingView is essential for anyone relying on that platform for analysis and order flow.

Regarding tradable assets, there is virtually no difference. Both firms provide access to the same deep pool of CME Group futures contracts. This means your decision will not be limited by market access; you can trade all major indices, commodities, and currencies with either company.

2.6. Profit split & scaling plans

The ultimate goal is to earn payouts and grow your account. Both firms offer attractive profit splits, but their philosophies on account growth (scaling) differ significantly. This is a crucial factor for your long-term earnings potential.

| Feature | My Funded Futures | Topstep |

|---|---|---|

| Profit Split | 80% to the trader on most plans. | 100% of the first $10,000, then 90% to the trader. |

| Scaling Plan | Plan-Dependent: Offers various models from traditional, gradual scaling (Core Plan) to immediate access to larger position sizes (Pro Plan). | Equity-Based Scaling: Your maximum position size is directly tied to your account’s end-of-day profit. As your account balance grows, your buying power automatically increases. |

Topstep’s initial offer is clearly more compelling. Keeping 100% of your first $10,000 is a powerful incentive that can significantly accelerate your early earnings. The Topstep scaling plan is also straightforward and rewards consistent profitability with increased buying power in a structured way.

My Funded Futures offers more diverse account options to suit different strategies. Their Pro Plan allows experienced traders to access larger sizes immediately, a key benefit for those who don’t want to be constrained by a gradual scaling plan.

This flexibility makes MFFU a strong choice for aggressive or well-capitalized traders who want fewer initial restrictions on their size.

3. The payout process: Who pays faster?

Getting paid is the ultimate goal, and the process for accessing your profits differs significantly between the two firms. My Funded Futures has built its reputation on an aggressive payout schedule with rapid processing. In contrast, Topstep employs a more structured, milestone-based system designed to encourage account growth and stability.

| Feature | My Funded Futures | Topstep |

|---|---|---|

| Eligibility for First Payout | 5 winning days (Core/Scale) or after meeting a profit buffer (Pro). | At least 5 winning days with a profit of $150+ each day. |

| Payout Frequency | It can be every 5 winning days, every 14 days, or even daily with special add-ons. | Cycle resets after each payout; requires 5 new $150+ winning days. |

| Subsequent Payout Rules | No balance restrictions. You can withdraw profits as they are earned per plan rules. | Your account balance must be higher than it was after your last payout to be eligible for a new one. |

| Processing Speed | Most payouts are approved instantly; manual reviews take 6-12 hours. | 1-3 business days for approval, plus 1-10 business days for the funds to arrive. |

When it comes to pure speed, My Funded Futures is the undeniable winner. Their system is built for traders who want to access their profits as quickly and frequently as possible. The instant approval feature and the ability to get paid often are massive advantages if regular cash flow is your priority.

Topstep’s payout process is deliberately more conservative. The rule requiring your balance to be above its previous post-payout level is a significant hurdle. It forces traders to build a substantial profit cushion before making withdrawals, promoting long-term account health at the expense of short-term liquidity.

4. Customer support and education of My Funded Futures vs Topstep

Beyond capital, the right support system can significantly impact a trader’s success. This is an area where the two firms have vastly different priorities. Topstep leverages its long history to offer a comprehensive, coaching-focused ecosystem. In contrast, My Funded Futures centers its experience around a massive and highly active community for real-time peer support.

| Feature | My Funded Futures | Topstep |

|---|---|---|

| Primary Support Channel | AI-assisted Live Chat, Discord, Knowledge Base | AI-assisted Live Chat, Email, Discord |

| Educational Resources | Self-service knowledge base with articles and FAQs. | Extensive: Free group coaching, digital coaching tools, TopstepTV (live analysis), structured courses, and detailed articles. |

| Community | Very Large & Active: 72,000+ members on Discord. | Active Discord community (48k+ members) with direct access to professional coaches. |

| Coaching | No formal coaching program. | Core Feature: Access to a team of named performance coaches with professional backgrounds. |

Topstep is the undeniable leader for traders seeking structured learning and professional guidance. Their free coaching programs, daily market analysis via TopstepTV, and team of experienced mentors provide invaluable educational materials. This ecosystem is designed to build better, more disciplined traders actively.

My Funded Futures excels in community support. Their massive Discord server is a bustling hub for traders to share ideas, ask questions, and get instant peer feedback. While their formal educational library is smaller, the value of having a 72,000+ member network is a powerful resource for real-time market insights.

5. Community feedback: My Funded Futures vs Topstep Reddit & Trustpilot

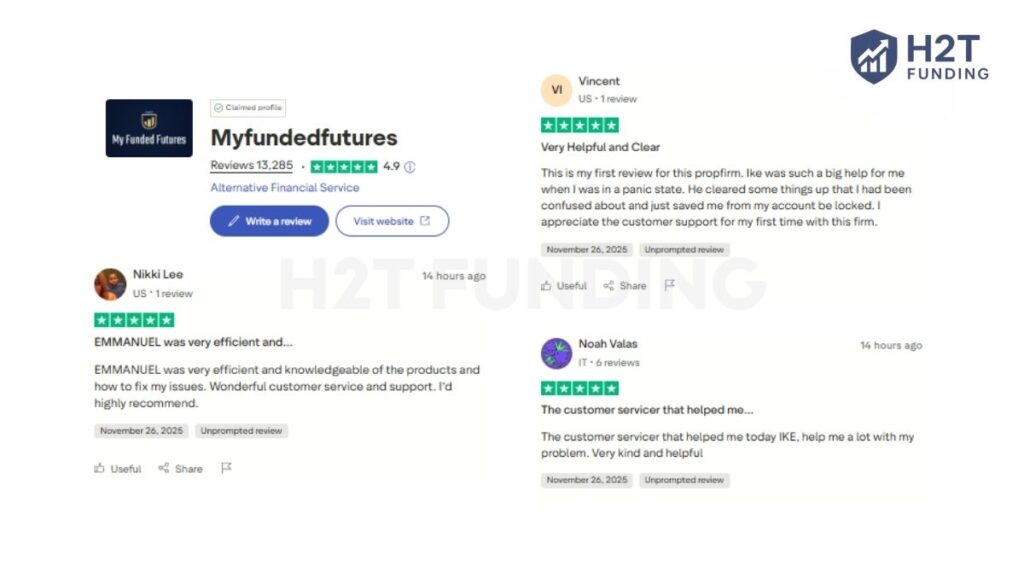

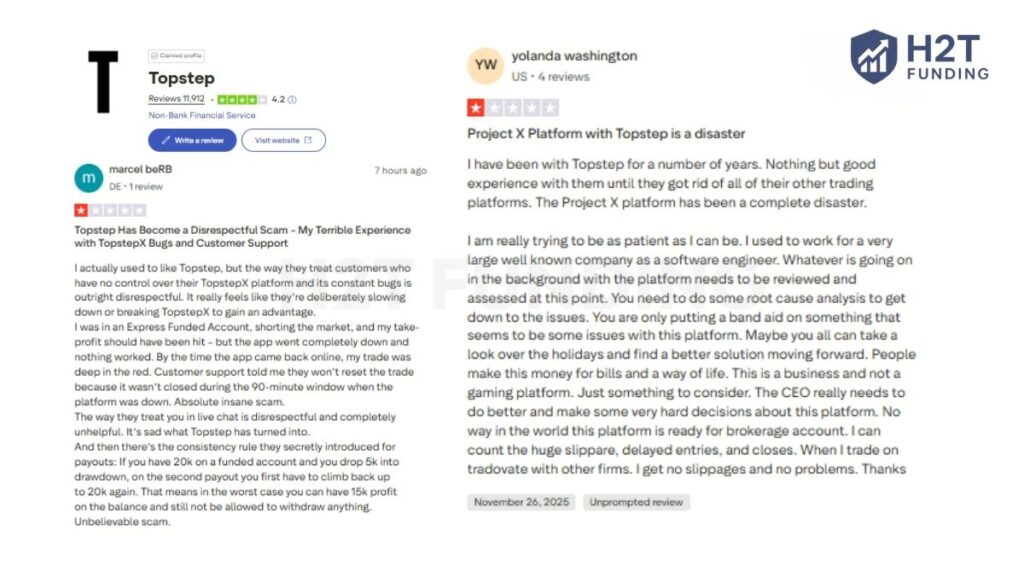

Marketing materials tell one story, but trader experiences on platforms like Trustpilot and Reddit tell another. While Topstep holds a solid overall rating, recent feedback raises questions that many traders now associate with concerns about whether Topstep is legit. Especially given the issues surrounding its newer trading infrastructure.

A recurring theme in negative reviews is the poor performance of their exclusive TopstepX platform, with traders citing server lag, huge slippage, and critical order execution failures. These technical issues are often compounded by what users describe as slow and unhelpful responses from their support team.

In stark contrast, My Funded Futures boasts a near-perfect Trustpilot score, with users consistently praising their fast, professional customer service and reliable payouts. This strong positive sentiment suggests a smoother, more dependable day-to-day trading experience.

Recent community feedback highlights a crucial divide. Widespread reports of platform instability are overshadowing Topstep’s legacy and educational offerings. Meanwhile, My Funded Futures is consistently praised for operational reliability and excellent support, making it the more dependable choice based on current user sentiment.

6. Which prop firm is right for you?

The decision between My Funded Futures vs Topstep comes down to your personal priorities. There is no single best choice, only the firm that aligns with your specific needs as a trader. Use this guide to make your final decision.

You should choose My Funded Futures if:

- You prioritize speed and simplicity. Their 1-step evaluation is the fastest path to a funded account, ideal for confident traders ready to prove their trading skills quickly.

- You value rule flexibility. With no Daily Loss Limit and support for various trading platforms, MFFU offers a less restrictive environment for diverse trading styles.

- You want fast and frequent access to your profits. Their rapid, high-frequency payout system is built for traders who prioritize cash flow.

- You trust recent community feedback. Overwhelmingly positive reviews on support and platform reliability make them the safer choice based on current user sentiment.

You should choose Topstep if:

- You are focused on education and development. Their free coaching, live market analysis, and structured environment are invaluable for traders looking to build discipline.

- The initial profit split is your main driver. Keeping 100% of your first $10,000 in profit is the most generous starting offer in the industry.

- You value a long-standing brand reputation. Despite recent issues, Topstep is an industry pioneer with over a decade of history.

- You are willing to accept the platform risk. You must be comfortable with the widely-reported technical issues on TopstepX in exchange for their educational benefits.

Ultimately, your choice reflects a trade-off. Weigh these factors carefully against your own goals and risk tolerance.

7. Frequently Asked Questions (FAQs)

The main difference lies in their philosophy. My Funded Futures prioritizes speed and flexibility with a 1-step evaluation, no activation fees, and support for many trading platforms. Topstep focuses on structured development with a strong educational ecosystem and free coaching. Especially, a generous 100% initial profit split, but now centers exclusively on its proprietary TopstepX platform.

Topstep is often considered better for beginners due to its extensive educational resources. The free group coaching, live market analysis on TopstepTV, and structured environment are designed to help new traders build discipline and good habits. These resources provide a valuable support system that goes beyond capital alone.

Yes, My Funded Futures is widely considered reliable. They have built a strong reputation for operational excellence, reflected in their near-perfect Trustpilot score. The community consistently praises their transparent rules, a helpful support team, and, most importantly, their fast and dependable payout process.

Yes. Fast and reliable payouts are one of their biggest strengths. Most payout requests are approved instantly or within a few business hours, which is a major reason for their popularity. Community feedback consistently confirms that they honor payouts quickly and efficiently.

Yes, Topstep has a long and proven track record of paying traders for over a decade. Their payout process is reliable but more structured and generally slower than My Funded Futures.

Their End-of-Day (EOD) drawdown means your maximum loss limit is only updated based on your account’s closing balance from the previous day. This is a trader-friendly rule that gives you breathing room, as unrealized profits from the current trading day don’t count toward the drawdown limit.

The consistency rule is designed to ensure you pass the evaluation with a sustainable strategy, not just one lucky trade. It typically requires that your single best trading day cannot account for more than 50% of your total profit. This proves you can generate profits consistently over time.

No, neither firm allows you to hold positions overnight or over the weekend. Both My Funded Futures and Topstep are designed for intraday futures trading. All positions must be closed before the end of each trading session as per their rules.

Yes, and this is a key difference. My Funded Futures has strict rules, prohibiting open positions for two minutes before and after major news events on most accounts. Topstep is much more flexible and generally allows traders to trade during news releases, but traders must still avoid behaviors that exploit volatility spikes.

Both firms generally permit the use of automated strategies or EAs, but with important restrictions. The strategy must not be designed to exploit the simulated environment (like high-frequency trading). Copying the trades of another person is strictly prohibited at both firms.

My Funded Futures is significantly faster, with most payouts being approved instantly or within 6-12 business hours. Topstep’s process is longer, typically involving a 1-3 business day approval period, followed by several more days for the bank transfer to complete.

Yes, both firms allow traders to manage multiple funded accounts. Topstep permits up to 5 active Express Funded Accounts, and you can mix different account sizes (e.g., 50K and 150K). My Funded Futures allows up to five sim-funded accounts per household, but this is currently restricted to their 50K accounts only.

8. Conclusion

The choice between My Funded Futures vs Topstep depends entirely on what you value as a trader. My Funded Futures excels with a faster evaluation process, flexible rules, and a payout system that is widely praised for its speed and reliability.

Topstep provides world-class educational resources and an excellent starting profit split. However, these significant benefits currently come with well-documented risks related to the performance and stability of its proprietary trading platform.

Finding the right funding partner is a critical step. To continue your research, explore more detailed prop firm comparisons and guides on the H2T Funding blog to find the best fit for your trading strategies.