Managing multiple Topstep accounts can feel overwhelming when every trade needs to be placed by hand. Many traders ask the same question: how to copy trade on Topstep safely without breaking the rules. The truth is, copy trading can save time and reduce errors, but it must be done correctly to avoid account violations.

In this guide, H2T Funding explains why traders copy trades, what Topstep’s policies say, and the step-by-step methods to set up a trade copier. You’ll also see recommended tools, real risks, and practical notes so you can trade smarter and protect your funded accounts.

Key takeaways

- Copy trading helps traders save time and manage multiple Topstep accounts more efficiently.

- Topstep allows copy trading but only with official tools and strict risk controls.

- Tradovate and R|Trader Pro offer copier features, but new accounts must use TopstepX.

- The TopstepX copier requires setting a leader account, linking followers, and applying PDLL or PDPT.

- Risks when using copy trading include execution delays, slippage, and account violations if limits are ignored.

1. Why do Traders want to copy trades on Topstep?

Juggling more than one Topstep account can be a headache, making order execution stressful. That’s where trade copying comes in; it lets you manage all your accounts in sync without placing every order by hand. It’s also perfect for testing a single strategy across multiple accounts consistently.

Copy trading also helps avoid mistakes. When entering trades manually, it’s easy to slip on contract size or miss an exit. A trade copier reduces human error and keeps your follower account aligned with your lead account.

Another reason is discipline. Copying trades ensures consistent execution across accounts, helping you respect limits like the Personal Daily Loss Limit or Maximum Position Size. For traders who want stability and to understand all the Topstep trading rules before scaling up, this is a major benefit.

2. Does Topstep allow copy trading?

Yes, Topstep allows copy trading through its Trade Copier feature, but only under strict conditions. This means you can mirror trades across multiple accounts, yet you must respect the firm’s risk controls. Copy trading is not the same as using unapproved bots or EA automation, which are prohibited.

Follower accounts now support Personal Daily Loss Limit (PDLL) and Personal Daily Profit Target (PDPT). When a Follower account hits its PDLL or PDPT, the response depends on the selected action:

- Liquidate: All open positions and orders will close, and the account will be automatically removed from the copier.

- Liquidate & Block: The account will close all positions, be blocked from trading for the rest of the day, and then automatically resume following the Leader on the next trade day unless you remove it manually.

However, Trade Limits, Symbol Blocks, and Contract Limits remain disabled for follower accounts. This restriction ensures consistent trade replication, and allowing custom limits could lead to mismatched executions or potential rule violations.

Important restrictions apply. You cannot use the copier on Live Funded Accounts, only between Trading Combines and Express Funded Accounts. Also, the Lead account must have the lowest Maximum Position Size to ensure trades copy correctly.

For example, if you run a 50K, 100K, and 150K account, the 50K must be the lead. This rule exists because the copier scales trade quantities based on the leader’s capacity; if a follower has a smaller limit, it could exceed its allowed position size.

Traders must remember that copy trading on Topstep is legal but tightly monitored. Any misuse, such as bypassing the Maximum Loss Limit or ignoring liquidation rules, may result in account termination. This is why setting proper risk management and understanding copier limits is essential before scaling multiple accounts.

Continue reading: Does Topstep Allow Automated Trading? The Official Rules

3. How to copy trade on Topstep: How the Trade Copier works

Copy trading on Topstep works by linking a lead account with one or more follower accounts. When you place a trade on the lead, the same order is executed across the linked accounts. Each Topstep platform has its own method of setting up the copier, and traders must configure contract ratios and risk limits carefully.

3.1. How to copy trade Topstep accounts on Tradovate

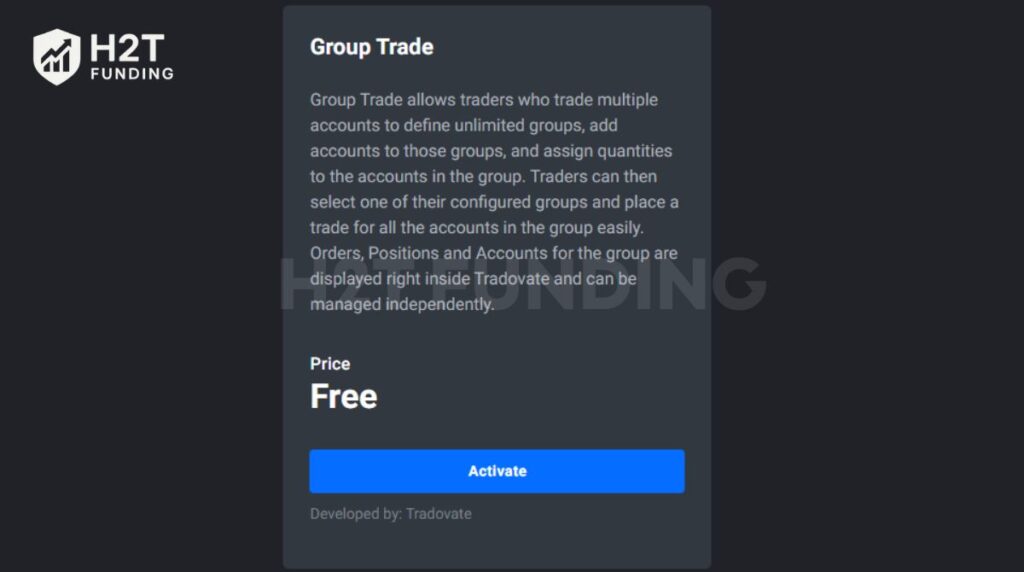

Tradovate offers a built-in Group Trade Add-On that functions as a trade copier. Once activated, you can group multiple accounts and assign contract sizes for each. Any trade placed in the lead account will mirror to follower accounts in real time.

- Pros: Easy setup inside Tradovate, integrated with Topstep, supports multiple accounts.

- Cons: Does not allow advanced order types like Bracket (ATMs), and latency may occur when markets are volatile.

To use the Tradovate Trade Copier (Group Trade Add-On):

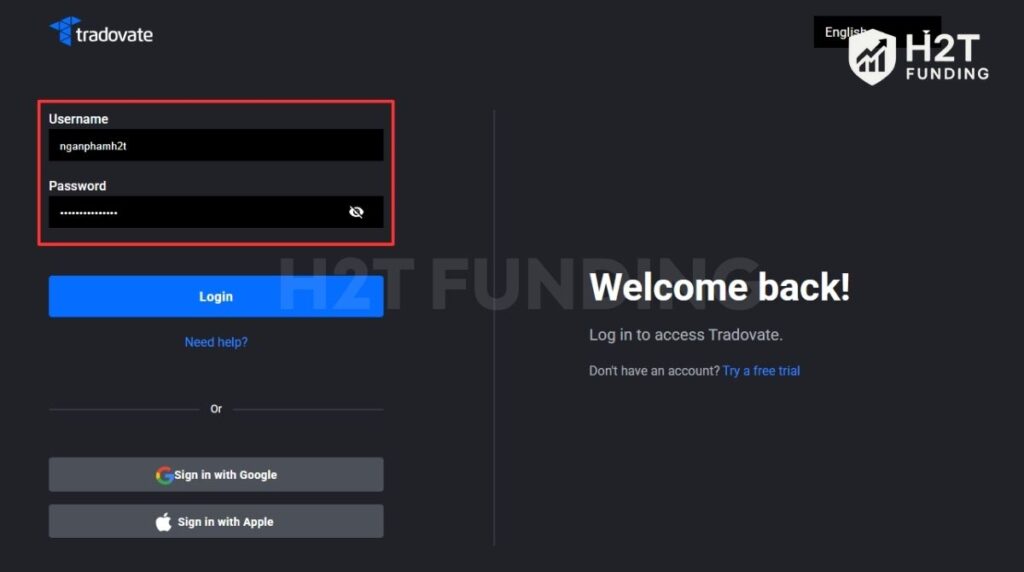

1. Log in to your Tradovate account with Topstep credentials.

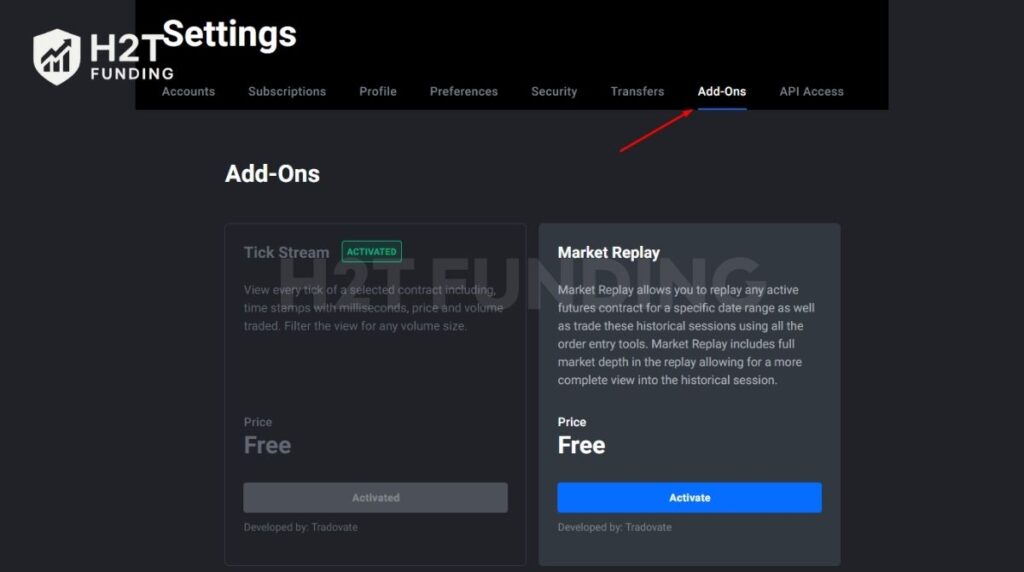

2. Go to Application Settings → Add-Ons.

3. Scroll down and click Activate under Group Trade.

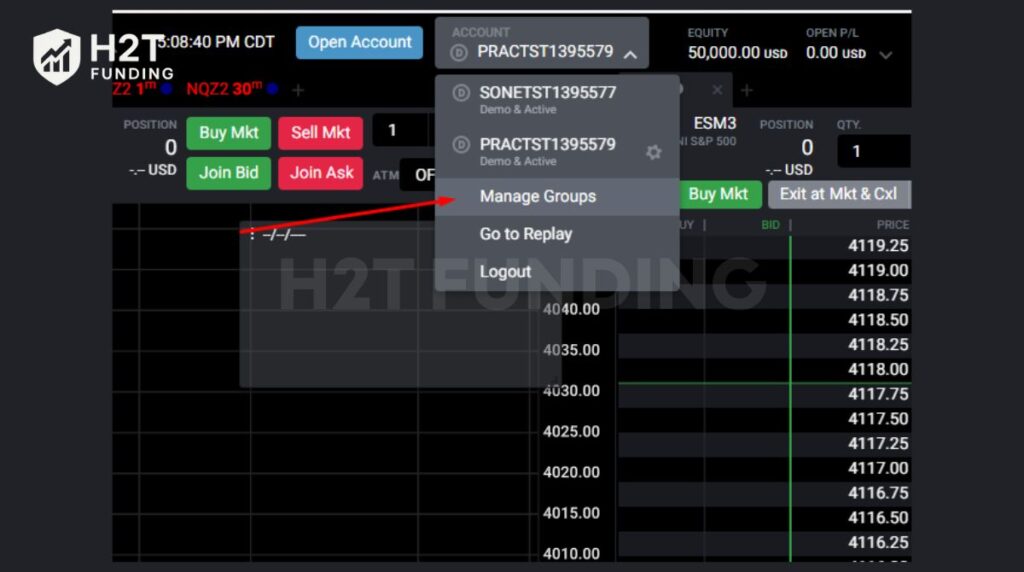

4. Log out and back in to enable the copier.

5. In the accounts drop-down, select Manage Groups.

6. Create a group and drag the accounts you want to copy trades to.

7. Set the number of contracts for each follower account.

8. Save your group.

Now, any trade placed on the lead account will mirror across the follower accounts in real time.

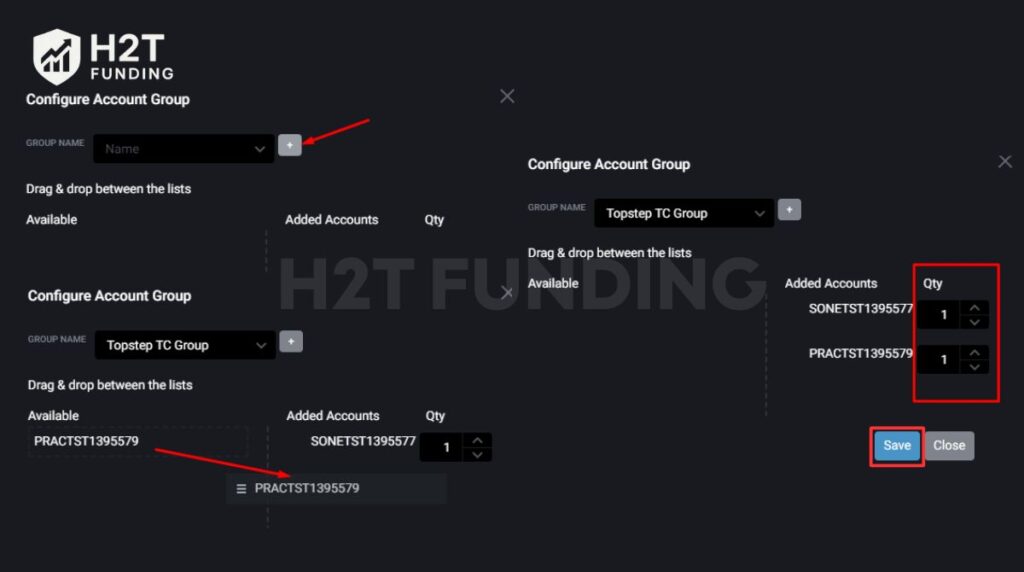

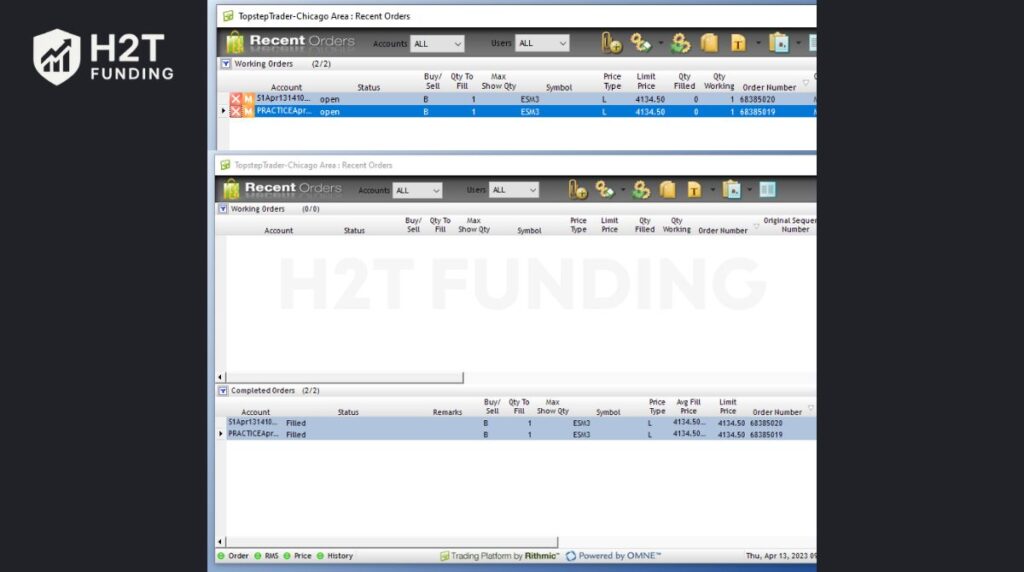

3.2. How to copy trade with Topstep R|Trader Pro (Rithmic)

R|Trader Pro allows traders to manage several accounts at once using its Account Template function. By creating a template, you can decide how many contracts each account will receive when the master account sends an order. This makes it easier to run one trading strategy across different funded accounts or combine accounts.

- Pros: Strong flexibility in contract sizing, clear visibility of orders across accounts.

- Cons: The interface can feel complex for beginners, and templates must be configured carefully to avoid mistakes.

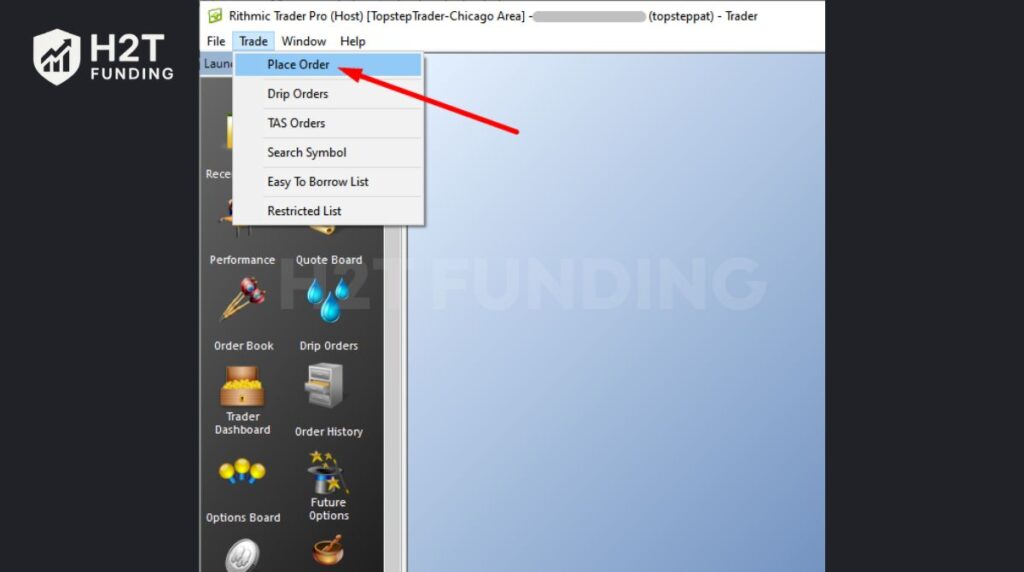

Steps to set up R|Trader Pro copier:

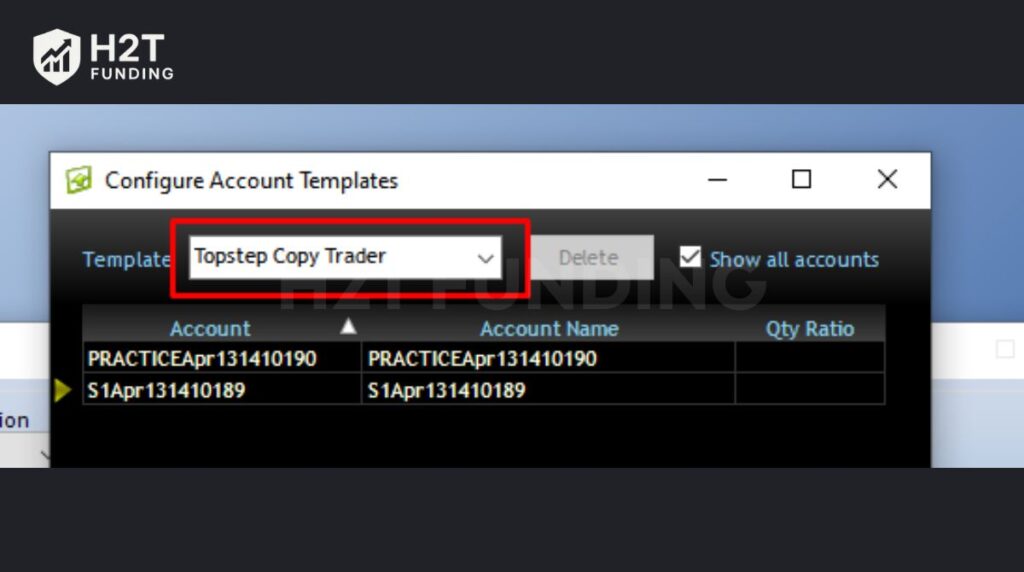

1. Sign in to the platform using your Topstep login details.

2. From the main menu, go to Trade → Place Order.

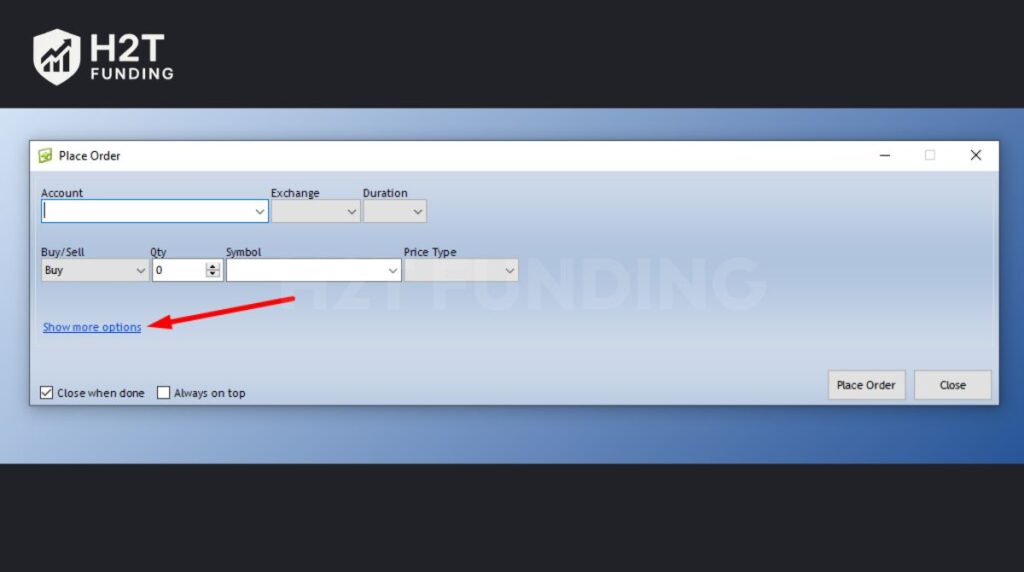

3. Expand the settings by clicking Show more options.

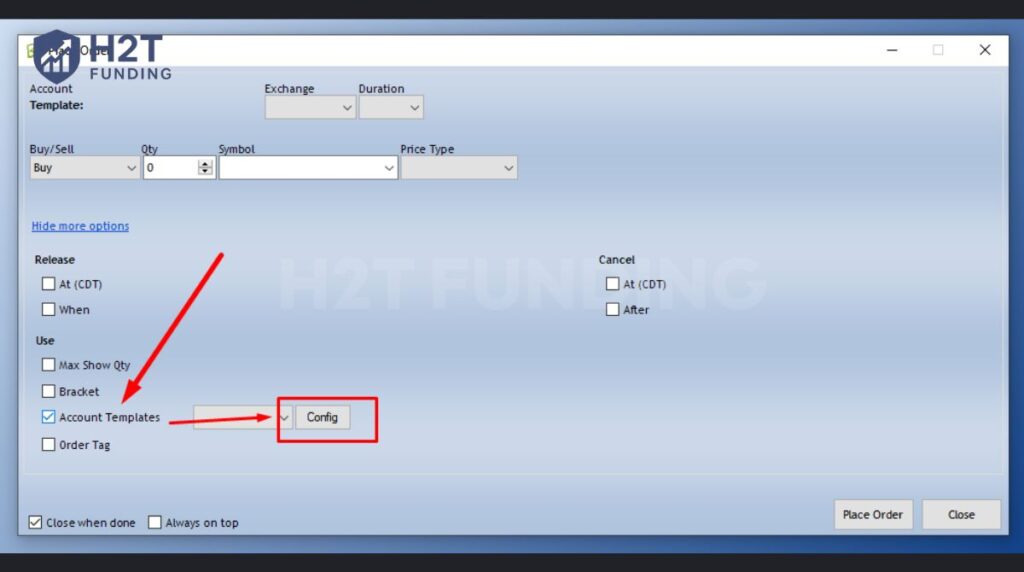

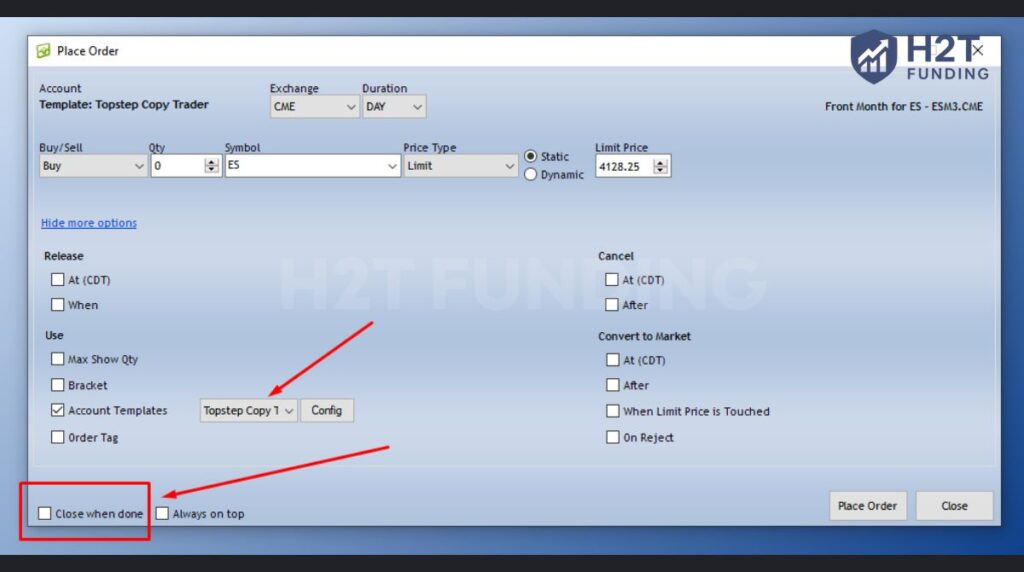

4. Check the box for Account Templates and select Config.

5. Type a unique name for your new template.

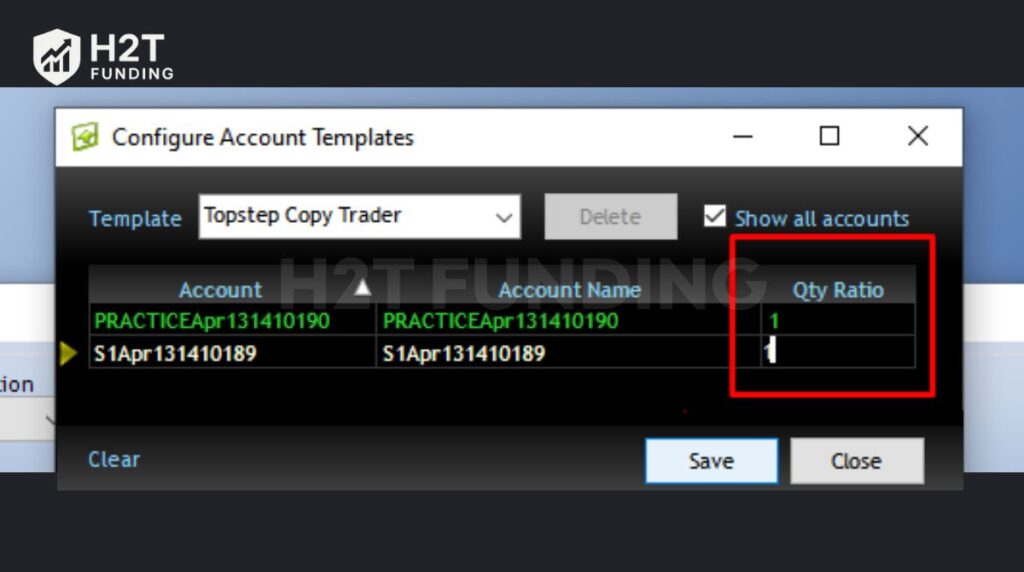

6. Choose the accounts you want included and assign a Qty Ratio for each.

7. Save the template once all ratios are correct.

8. Choose your saved template from the drop-down list and clear the option Close when done. This keeps the order window active, so it will reopen automatically after each trade.

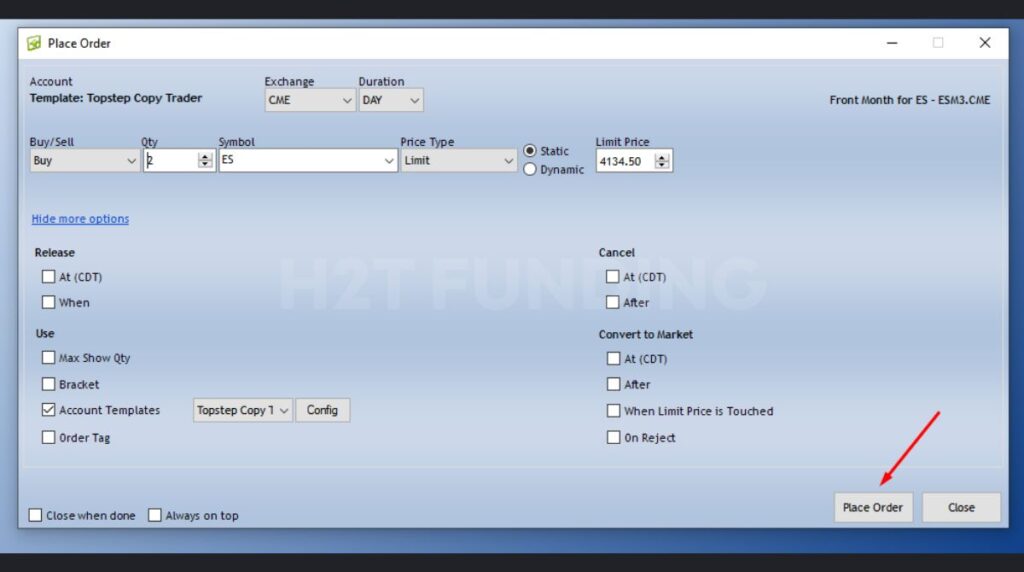

9. Place your order with symbol, direction, and contract type.

10. The trade will automatically duplicate across all linked accounts based on the ratios you set.

11. Track execution in the Recent Orders panel to ensure everything is copied as expected.

All linked accounts will execute trades simultaneously based on your template.

Important note:

- Since July 2025, Topstep has shifted all new Trading Combines to TopstepX. While you can still use R|Trader Pro or Tradovate if you already have an active account, resets and new purchases are no longer possible on this platform.

- Starting August 1st, resets are only supported on TopstepX. This means the copier on R|Trader Pro or Tradovate is mainly useful for traders managing older accounts, but moving forward, you’ll need to adapt to TopstepX for future evaluations.

4. Instructions for installing copy trade on Topstep (Step-by-Step)

The TopstepX Trade Copier lets you mirror trades from one lead account to one or more follower accounts. This tool is designed for traders running the same strategy across multiple Combines or Express Funded Accounts. Here’s how to copy trade on TopstepX in a structured way.

4.1. How to install Trade Copier in TopstepX

Before you can start copying trades, you need to activate the Trade Copier inside TopstepX. This setup links your leader account to followers so all trades execute in sync.

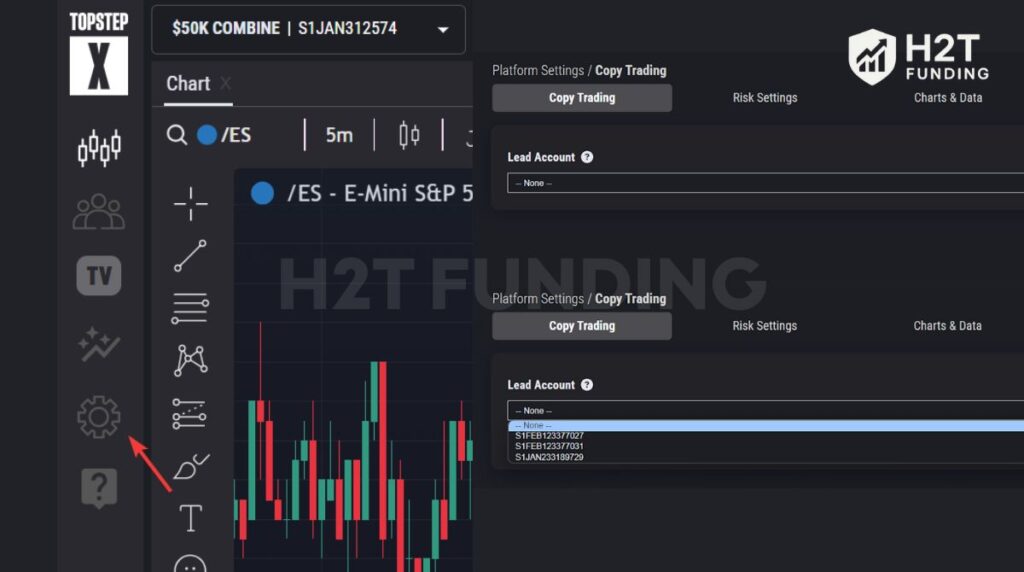

Step 1: Log in to your TopstepX dashboard using your account credentials.

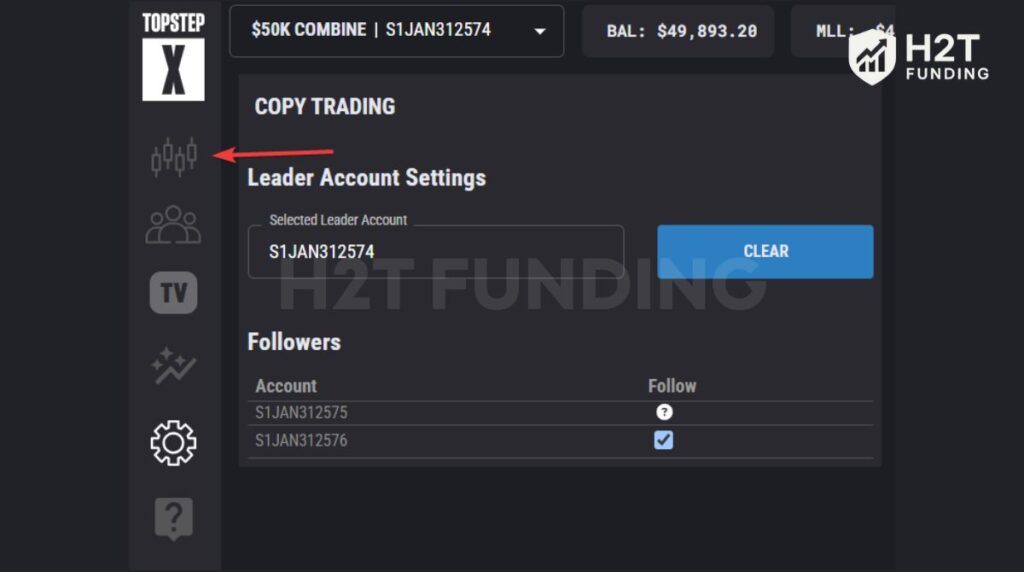

Step 2: On the left side panel, open the Settings menu.

Step 3: At the top of the page, select the tab called Copy Trading to enter copier settings.

Step 4: A list of all your active accounts will appear in a drop-down menu.

Step 5: Choose which account will act as the Leader (this is the one you’ll place trades on).

Step 6: Under the Followers section, tick the box beside each account you want to mirror trades to.

Step 7: After you’ve selected the follower accounts, press Save Changes to confirm.

Step 8: Return to your main trading workspace by clicking the Trading icon in the sidebar.

Once these steps are complete, any trade you place on the leader account will automatically be duplicated across the followers. This ensures you can run the same strategy seamlessly on multiple accounts without entering each trade manually.

To understand how this feature fits within general prop firm rules and compliance requirements, be sure to review your firm’s trading guidelines before enabling copy trading.

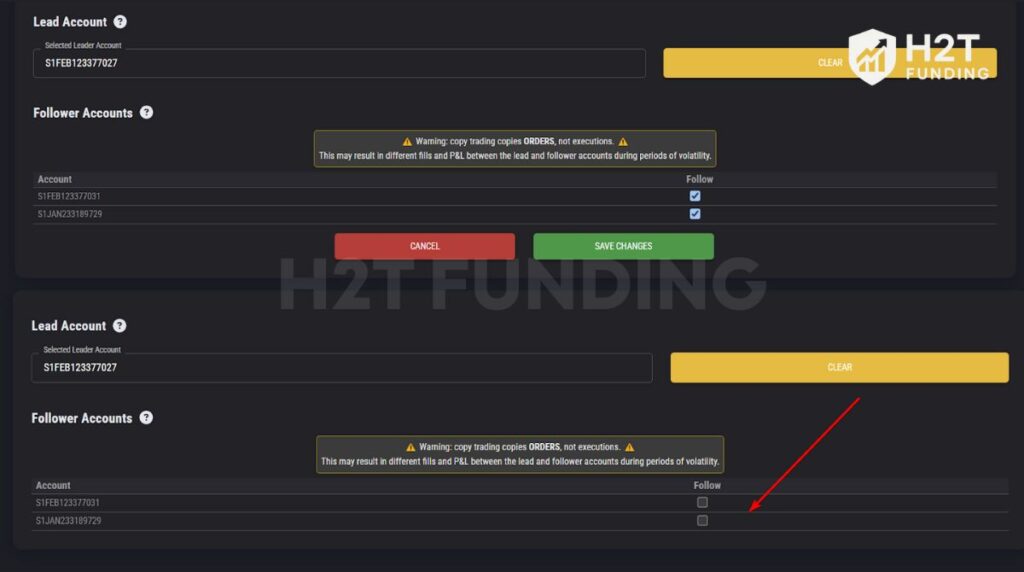

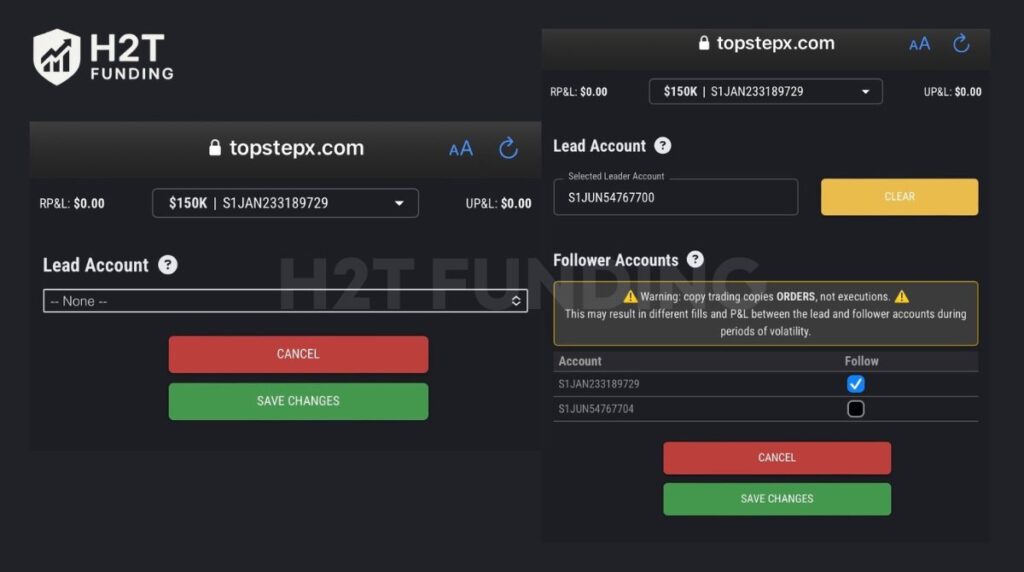

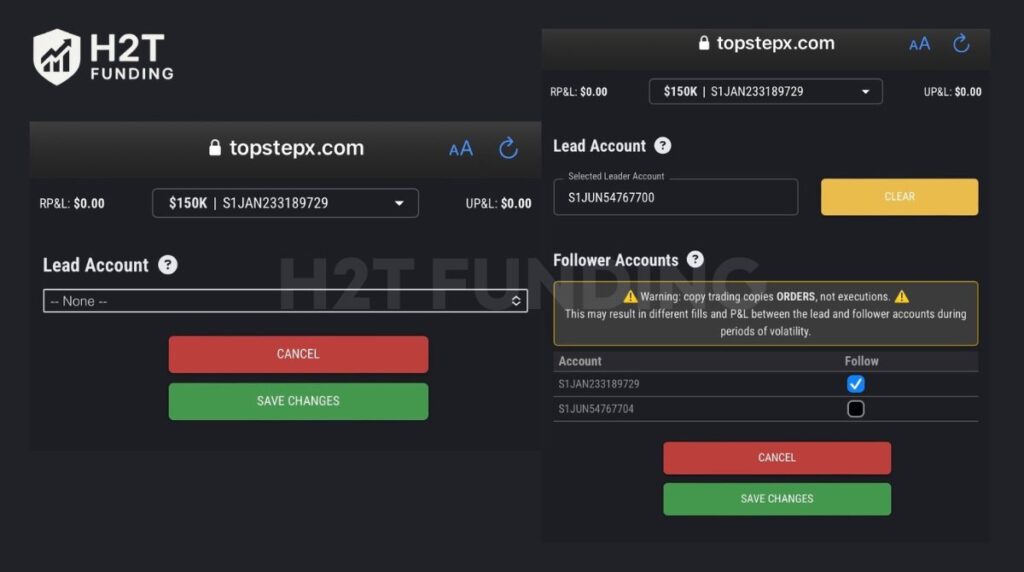

4.2. How to add or remove follower accounts

Sometimes you’ll want to expand your setup by including new follower accounts or removing one that you no longer wish to mirror trades. The process is simple and only takes a few clicks inside TopstepX.

- Step 1: Open TopstepX and click on the Settings icon in the sidebar.

- Step 2: Go to the Copy Trading tab, where all linked accounts are displayed.

- Step 3: To add a follower, check the box next to the account you want included. To remove one, uncheck the box instead.

- Step 4: After making your selections, press Save Changes to apply them.

- Step 5: Return to your main workspace by clicking the Trading icon on the sidebar.

Once saved, the copier will immediately update. New followers start mirroring the leader’s trades, while removed accounts stop copying and can be traded independently again.

If you’re managing multiple setups, check out our detailed guide on how many funded accounts you can have with Topstep. It helps stay within firm limits and avoid account violations.

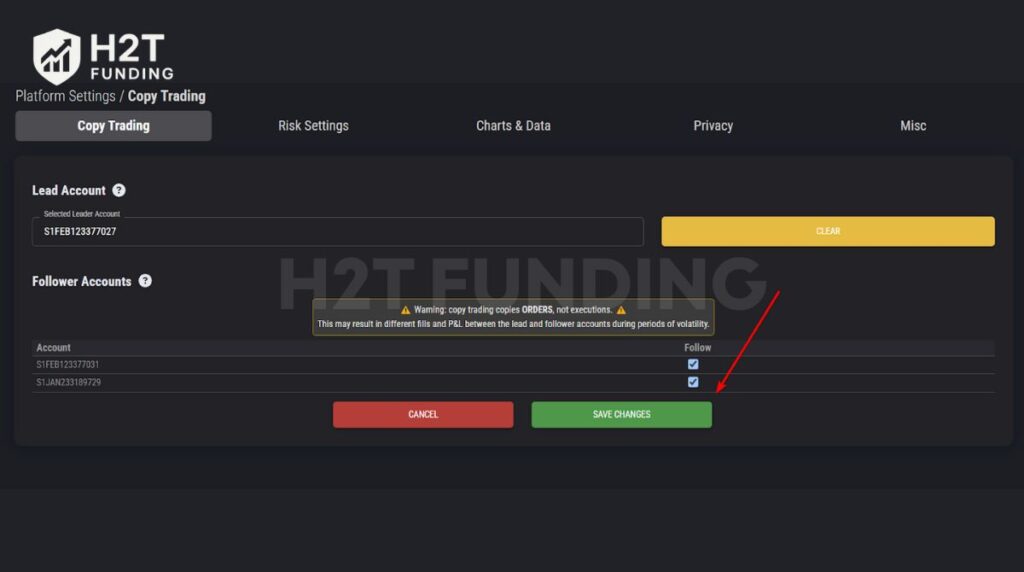

4.3. How to configure risk settings

Risk management is essential, and TopstepX now allows Personal Daily Loss Limit and Personal Daily Profit Target on follower accounts.

- Step 1: Go to each follower’s settings.

- Step 2: Set a Personal Daily Loss Limit.

- Step 3: Add a Personal Daily Profit Target.

- Step 4: Choose between:

- Liquidate → close trades and disconnect the follower.

- Liquidate & Block → close trades and block for the day, resume next session.

These tools give you extra protection, but Trade Limits, Symbol Blocks, and Contract Limits remain unavailable on followers.

For traders managing multiple prop accounts across different firms, it’s worth comparing with setups like FTMO’s multiple account rules. This helps you see how flexibility differs between platforms.

See more of Topstep’s rules on:

4.4. How to turn off the Trade Copier

There may be times when you don’t want trades to be copied across accounts, and TopstepX allows you to disable the copier quickly.

Step 1: From your TopstepX dashboard, open the Settings panel on the sidebar.

Step 2: In the Copy Trading section, click Clear to remove all follower connections.

Step 3: Hit Save Changes to confirm and reset the copier settings.

Step 4: Go back to your main trading screen by clicking the Trading icon on the sidebar.

After these steps, the copier will be fully deactivated, and follower accounts will no longer mirror the leader until you set them up again.

4.5. How to use the copier on a mobile device

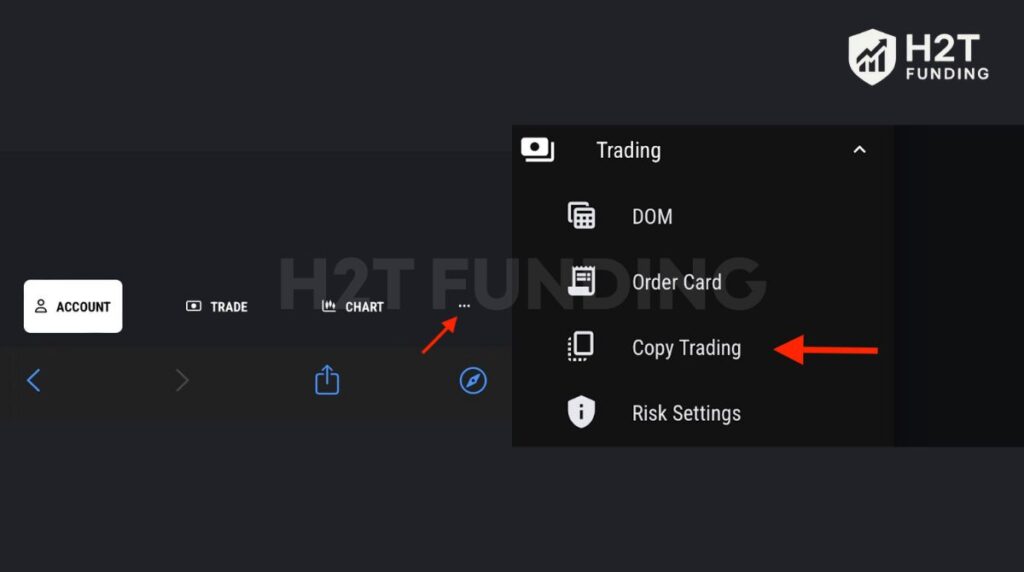

For traders who prefer managing accounts on the go, TopstepX also allows you to set up and control the Trade Copier directly from your smartphone browser.

Step 1: Open TopstepX in your preferred mobile web browser.

Step 2: Tap the menu icon (three dots) in the bottom-right corner of the screen.

Step 3: Select Trading, then tap Copy Trading.

Step 4: From the drop-down, choose the account you want to set as the Leader.

Step 5: Check the boxes for the accounts you want to include as Followers.

Step 6: Tap Save Changes to apply your settings.

Once saved, trades placed on your leader account will be mirrored on follower accounts even when managed entirely through a mobile device.

Following each step carefully, you can connect accounts, set risk limits, and manage copy trading both on desktop and mobile devices. Since August 2025, follower accounts support PDLL and PDPT, giving traders more flexibility while keeping them compliant with Topstep rules.

5. Risks & notes when copy trading on Topstep

While the trade copier is a powerful tool, it’s not a “set it and forget it” solution. To keep your accounts safe and compliant, here are some crucial rules and technical points you need to know.

- Risk limits apply differently to followers: You can now enable PDLL and PDPT for follower accounts. However, features like Trade Limits, Symbol Blocks, and Contract Limits remain disabled.

- Action settings matter: If a follower hits its risk limit with Liquidate, all trades close, and the account disconnects from the copier. If set to Liquidate & Block, the account is locked for the day and resumes copying the next session.

- Account hierarchy is important: The leader account must have the smallest maximum position size. For example, if you run 50K, 100K, and 150K accounts, the 50K must be the leader.

- Environment restrictions: Copying is only supported between Trading Combines and Express Funded Accounts. Live Funded Accounts cannot use the copier.

- Execution differences: Follower trades only appear after the leader’s order is filled. Small discrepancies may occur because of slippage, liquidity, or latency.

- Breaking loss limits: If a follower account breaches its Maximum Loss Limit or Daily Loss Limit, all positions close, and the account blocks for the day. It will reconnect the next day unless removed.

- Turning off during active trades: Turning off the Trade Copier while there are active positions will immediately flatten (close) all trades on follower accounts. This action happens instantly and cannot be undone. Always ensure trades are closed safely before disabling the copier.

These notes highlight that copy trading is powerful but unforgiving. Careful configuration and monitoring are essential to keep accounts safe and compliant with Topstep rules.

Read more:

6. FAQs

No, automated trading systems like Expert Advisors or bots are not allowed. Topstep only permits the use of its supported copier tools, and any unauthorized automation can lead to account termination.

The TopstepX Trade Copier is the safest and most reliable option because it’s officially supported. Other tools like R|Trader Pro or Tradovate can still work on legacy accounts, but they are being phased out.

You can link several Trading Combines and Express Funded Accounts together, but Live Funded Accounts are excluded. The copier works within the same environment only.

Yes, copy trading carries risks. Execution delays, slippage, or hitting risk limits on followers can quickly lead to violations. You must configure PDLL and PDPT carefully to avoid unexpected losses.

Yes, Topstep allows trade copying through its built-in tools. When set up correctly, trades on the leader account are mirrored to follower accounts automatically.

There is no fixed number, but your copier must follow Topstep’s scaling rules. The lead account must have the smallest maximum position size when linking multiple accounts.

Tradovate uses the Group Trade Add-On for account linking. Once activated, you can assign contract sizes and manage follower accounts. However, new Combines are now only available on TopstepX.

When you deactivate the copier, follower accounts immediately stop mirroring trades. If trades are open, those positions will be closed (flattened) right away.

Yes, you can. Trade copying is supported across these two environments, but Live Funded Accounts cannot use the copier.

Yes, but note that disabling the copier while trades are active will immediately close all follower positions. It’s safer to wait until all trades are flat before doing so.

7. Conclusion

Mastering how to copy trade on Topstep is about more than just saving time; it’s about executing your strategy flawlessly, minimizing errors, and managing multiple accounts with confidence. While the setup is straightforward, always remember to test your configuration before trading live to ensure everything runs smoothly.

To deepen your skills, explore more articles in our Prop Firm & Trading Strategies section on H2T Funding, where you’ll find practical guides on trading rules and risk settings management. These resources will help you build a stronger foundation and stay compliant while trading with prop firms.