How many funded accounts can I have with Topstep? That’s the question every serious trader asks after passing the Trading Combine. The short answer is that you can hold more than one, but there are clear rules on how many and how they operate. Each account works independently, which means if one breaks a rule and gets closed, your other funded accounts stay safe.

Understanding this policy is key to scaling your trading career. It helps you plan your strategy, manage risk, and use your capital more effectively. In this guide from H2T Funding, you’ll learn exactly how multiple funded accounts work, what limits Topstep sets, and how to use them to grow smarter as a prop firm trader.

Key takeaways:

- You can have up to five Express Funded Accounts or one Live Funded Account with Topstep, each earned through a separate Trading Combine.

- When promoted to a live funded account, all express accounts are closed until the live one becomes inactive.

- The Express Funded Account is a simulated live environment, while the Live Funded Account Topstep is a real brokerage account with true payouts.

- Topstep’s multi-account policy focuses on consistency and risk control, not just profit potential.

- Traders cannot merge or hedge between accounts under Topstep’s multiple funded accounts rules.

- Following official Topstep Express Funded Account rules ensures eligibility for payouts and account upgrades.

- Managing multiple funded accounts requires discipline, tracking, and clear risk management strategies.

1. What is a Funded Account on Topstep?

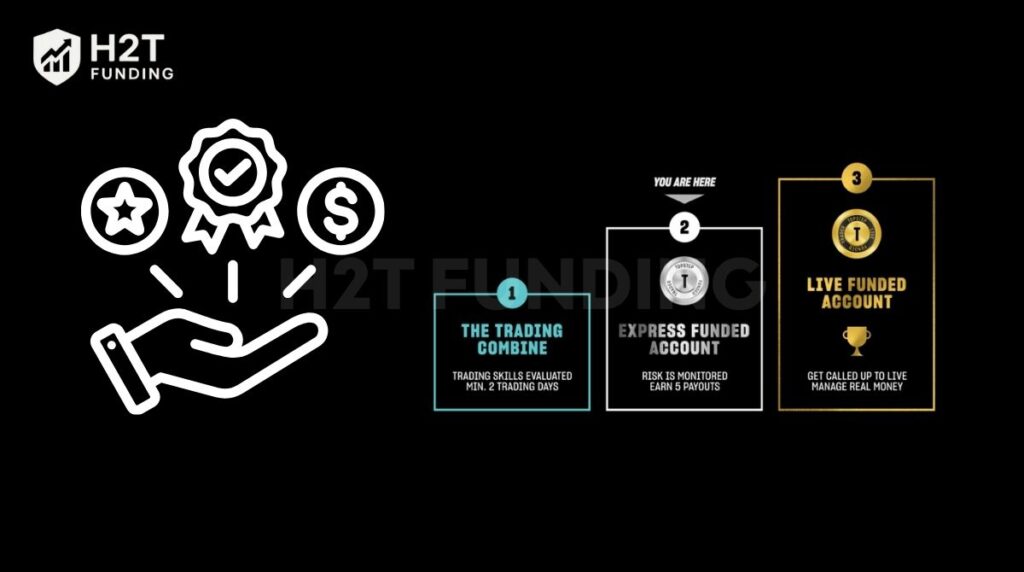

A funded account at Topstep isn’t just another trading account; it’s your real opportunity to trade using the firm’s capital instead of your own. In simple terms, once you’ve passed the Trading Combine (the evaluation process Topstep uses to test your skills), you gain access to a funded account where your trades can earn real payouts.

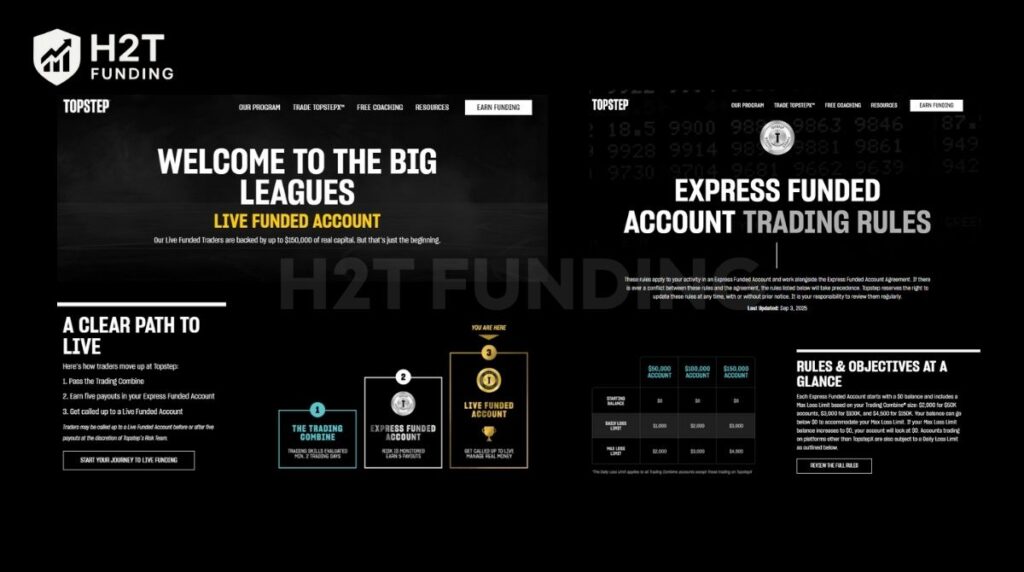

There are two main types of funded accounts: the Express Funded Account and the Live Funded Account. The Express Funded Account is what you get first; it’s a simulated environment that mirrors real market conditions, where profits can still be withdrawn. Think of it as a “live sim” stage that proves whether your risk management and discipline truly hold up once money is on the line.

Once you consistently meet your profit targets and follow every rule without violation, Topstep will begin your account activation and “call you up” to the Live Funded Account – a real brokerage account where you trade in live markets using company capital. That’s when payouts are real and performance matters even more.

Honestly, I think this step-by-step structure is what makes Topstep stand out among prop trading firms. It gives traders like us a clear, measurable path from simulation to live capital, without the huge financial risk. For example, if you pass a $50K Combine and stay consistent in your Express Funded Account, you could soon manage a Live Funded Account of the same size – all without putting your own savings on the line.

In the end, a Topstep-funded account is not just about trading permission. It’s proof of your trading discipline, your mastery of the evaluation process, and your ability to handle capital responsibly. And that’s exactly what every serious trader aims for.

Key points:

- Under the Topstep multiple Express Funded Accounts limit, traders can hold up to five Express Funded Accounts or one Live Funded Account at a time, each earned through a separate Trading Combine.

- The Express Funded Account is a simulated “live” environment, while the Live Funded Account Topstep is a real brokerage account with actual capital and payouts.

- Success in one account doesn’t transfer automatically; Topstep requires consistent performance and discipline for every funded account.

2. Understanding Topstep’s multi-account policy

The Topstep multiple accounts policy is built around one clear principle: traders must prove consistency, not luck. Simply put, every funded account must be earned through a separate Trading Combine evaluation.

Each Combine test your skill, discipline, ability to manage risk, and how well you align with Topstep’s trading objectives under real market conditions. This structure ensures that every account you hold is individually verified and independently managed.

In truth, this approach reflects what proprietary trading is really about. You’re not just aiming for profit, you’re mastering discipline and scalability. For example, a trader who can pass more than one Combine while maintaining steady results proves reliability and control.

Because of that, the Topstep multiple funded accounts policy allows traders to hold several funded accounts, but only within specific limits and under strict compliance with performance rules.

3. How many Funded Accounts can I have with Topstep?

If you’ve ever wondered how many Topstep accounts I can have, the answer is that you can hold multiple funded accounts, but there are clear boundaries. According to the official Topstep multiple funded accounts limit, traders may hold up to five active Express Funded Accounts at a time and only one Live Funded Account.

This limit is clearly defined under the Topstep multiple accounts limit, ensuring traders maintain fair usage and manageable risk exposure. Each account must come from a separate, successfully passed Trading Combine.

When you’re promoted to a Live Funded Account, all Express Funded Accounts will be closed, and you can’t open new ones until that live account is inactive. This rule helps maintain fairness and effective risk management. For example, if you have three Express accounts of $150K each and get called up, your Live Funded Account will start with $150K the size of your largest Express account.

I personally think this rule makes sense. It encourages traders to focus on mastering one level before scaling up. It’s like moving from training to the real field; once you’re trading live capital, the practice accounts naturally end.

4. Distinguishing account types

Understanding the difference between these account types, the Express Funded Account vs Live Account Topstep, is crucial before managing multiple accounts. The Express Funded Account is your first real step – a live simulation that mirrors market conditions but operates in a controlled environment. Traders follow the official Topstep Express Funded Account rules, which outline specific profit targets, trailing drawdowns, and consistency criteria.

Once you show consistent performance, you may be invited to the Live Funded Account Topstep. This is a true brokerage account using Topstep’s real capital, where your trades directly impact real funds and payouts. The Live account usually offers larger capital allocation and more favorable profit splits, reflecting trust earned through proven discipline.

Every account you hold requires separate validation, meaning success in one account doesn’t automatically carry over to another. Honestly, that’s what makes Topstep’s structure so fair. It gives every trader the same opportunity to grow, one Combine, one account, one step at a time.

5. The mechanics of acquiring multiple funded accounts with Topstep

So, you understand that having multiple funded accounts with Topstep is possible, provided you pass separate Trading Combines for each. Now, let’s get into the practical steps and underlying principles of how this actually works. This isn’t just theory; it’s about the tangible process you’ll follow.

5.1. The path to your next funded account

Acquiring an additional funded account isn’t magic; it’s a testament to your consistent skill.

Step 1: Pass another Trading Combine: This is non-negotiable. To secure a second, third, or even fourth funded account, you must enroll in and complete a new Trading Combine for each one. Think of it as proving your consistency, time and again, to Topstep. Each successful Combine demonstrates your ability to meet their performance objectives and risk parameters.

Step 2: Account segregation: Once funded, each of your Topstep accounts operates as an entirely independent entity. They are not linked in terms of performance or risk limits. This means each account has its own profit targets, daily loss limits, and a specific trailing maximum drawdown rule to follow. Your performance in one account doesn’t directly impact the status of another.

This leads to a crucial point often misunderstood by traders: you cannot combine the balances from multiple funded accounts into a single, larger trading account. This is a common misconception. Topstep’s model focuses on individual trading performance and risk management discipline rather than combining capital from different evaluations.

5.2. Why segregation matters (for the trader)

The independent nature of each funded account with Topstep isn’t a limitation; it’s a strategic advantage for astute traders.

- Enhanced risk management: One of the biggest benefits is the inherent risk compartmentalization. If, for instance, one of your accounts experiences a difficult trading day and hits its daily loss limit or trailing maximum drawdown, your other funded accounts remain unaffected. This prevents a single setback from derailing your entire trading operation with Topstep.

- Strategy diversification: Having separate accounts offers an excellent opportunity to diversify your trading strategies or even focus on different asset classes. You might use one account for your preferred intra-day scalping strategy on a highly liquid market, while another could be dedicated to swing trades on a different instrument. This allows for focused experimentation and specialization without co-mingling risk.

- Psychological benefits: From a psychological standpoint, separate accounts can help compartmentalize your trading decisions. It can reduce the emotional impact of a loss in one account, as you know your other accounts are still active and capable of generating profits. This clear separation can foster stronger psychological discipline, helping you stay less emotional and more consistent in your trading approach.

6. Strategic advantages & considerations of managing multiple Topstep accounts

Now that we’ve covered the how, let’s explore the why. Managing multiple funded accounts with Topstep isn’t just about proving yourself repeatedly. It’s a strategic move that can significantly amplify your trading potential. However, like any powerful tool, it comes with its own set of considerations.

6.1. Leveraging multiple accounts for growth

For the disciplined trader, acquiring more than one funded account can be a game-changer. If you’re looking for prop firms that offer faster evaluations, check out prop firms with the lowest minimum trading days to see how their programs compare.

Scaling capital:

While Topstep doesn’t combine your account balances, having multiple funded accounts effectively allows you to trade a larger aggregate capital pool. For instance, two $150,000 funded accounts give you access to the same total capital as a single $300,000 account, but with the added benefit of segregated risk.

Additionally, understanding the Topstep Express Funded Account payout rules helps traders plan how profits are distributed across multiple funded accounts. This is how many traders subtly scale their operations without violating individual account limits.

Diversifying strategies:

Imagine dedicating one account to your go-to trend-following strategy, while another is used for exploring mean-reversion tactics. Multiple accounts provide the perfect sandbox for implementing different trading styles across varied market conditions or asset classes. You could have one account solely for crude oil futures and another for E-mini S&P 500 futures, allowing for specialized focus.

Optimized risk allocation:

This approach allows for a more granular distribution of risk. By spreading your risk exposure across distinct accounts, you can potentially reduce your overall portfolio volatility. A drawdown in one account, while challenging, doesn’t necessitate halting trading across all your capital, as it might with a single, larger account.

6.2. Practical challenges & best practices

While the advantages are clear, managing multiple Topstep accounts isn’t without its demands.

- Increased management overhead: Let’s be honest, juggling multiple accounts requires a heightened level of discipline and meticulous organization. You’ll need to track performance, manage risk, and adhere to rules for each account individually. It’s a commitment that demands your full attention.

- Software & platform management: If you’re trading different instruments or using varied strategies, you might find yourself managing multiple logins or workspaces within your trading platform. While Topstep primarily uses futures platforms like NinjaTrader, setting up separate profiles or layouts can streamline the process of monitoring each account effectively.

- Maintaining consistency: The biggest hurdle I’ve seen traders face is replicating consistent performance across several distinct accounts. Each combination you pass demonstrates your skill, but applying that same discipline and edge day in and day out across multiple live accounts is where the true challenge lies. It’s about maintaining focus, not just during the evaluation, but continually.

Here’s a pro-tip I’ve seen successful traders use: they don’t treat all their accounts the same. They’ll have their main “bread and butter” account where they run their strongest strategy on familiar markets.

Then, they use another account as a lab – a place to test new strategies or trade more volatile products without risking their primary income stream. This calculated approach is the key to achieving both stability and growth. It’s also how many prop firms make money by funding traders who can balance risk and deliver consistent results.

View more:

7. Topstep’s philosophy on scaling and trader development

Topstep permits, and in many ways encourages, traders to operate more than one funded account. This isn’t random; it’s part of their commitment to long-term trader development within the prop trading model. They’ve built a model designed to identify and nurture genuinely skilled traders.

7.1. Why Topstep encourages scaling (within limits)

Topstep’s structure is fundamentally about rewarding consistent, disciplined performance.

- Their model is intrinsically designed to reward consistent performance. By allowing traders to manage multiple funded accounts, they create a clear pathway for those who consistently demonstrate profitability and sound risk management. It’s a merit-based system where repeated success unlocks greater opportunities.

- It offers a clear progression path for skilled traders. Instead of hitting a ceiling after securing one funded account, traders have the option to continue growing their trading capital by successfully navigating additional Combines. This fosters a long-term relationship based on mutual benefit.

- Crucially, it allows them to manage risk effectively across their entire pool of funded traders. By keeping each account separate and requiring individual qualification, Topstep can maintain granular control over its exposure. It ensures that even with multiple accounts, the firm’s overall risk remains diversified and manageable.

7.2. What Topstep looks for in multi-account holders

Becoming a multi-account trader with Topstep isn’t just about passing tests; it’s about embodying the qualities of a professional.

- Proven consistency: This is paramount. Topstep isn’t interested in one-hit wonders. Repeatedly passing the Trading Combine and then maintaining profitability across multiple funded accounts demonstrates an exceptional level of discipline, adaptability, and a deep understanding of market dynamics.

- Adaptability: The markets are constantly evolving. A trader managing multiple accounts needs to show they can adapt their strategies to different market conditions, asset classes, and even varying risk parameters across their accounts. It speaks to a robust trading mindset.

- Adherence to rules: With more capital comes greater responsibility. Topstep expects strict compliance with all trading rules and risk parameters for each account. It’s not enough to be profitable; you must also be disciplined and responsible in every single operation you undertake.

8. Rules & restrictions when managing multiple accounts

Let’s get straight to it. Managing several funded accounts under Topstep rules for multiple accounts, officially outlined in the Topstep rules multiple accounts section, isn’t just about trading skill; it’s about strict discipline. Every account has its own guidelines, and breaking one can cost you all the hard work you’ve put in.

- Each account must remain independent: You can’t merge, transfer balances, or treat your accounts as one large portfolio. Every Express Funded Account and Live Funded Account Topstep operates separately, with its own risk parameters and drawdown limits. I’ve seen traders forget this and blow multiple accounts at once because they ignored this rule. Keep them separate, always.

- No hedging between accounts: Topstep is very clear about this restriction. You can’t open opposite positions on different funded accounts to hedge your trades. It’s tempting, I know, especially when markets get volatile. But hedging between accounts violates Topstep’s policy and can lead to account termination. Focus on risk management instead of trying to outsmart the system.

- Consistency over aggression: The goal isn’t to make huge profits overnight. It’s to show steady performance. The evaluation process and profit targets are designed to reward traders who follow consistent trading strategies. For example, a trader who earns smaller daily profits across multiple accounts is valued more than one who hits big wins and massive losses.

- Respect profit splits and payout schedules: Each funded account, whether Express or Live, has its own payout cycle. Don’t assume you can withdraw from all of them at once. Plan your payouts carefully, and review your payout eligibility under Topstep’s latest policy before making requests.

- Maintain strong documentation: Topstep often reviews trading activity across accounts to verify compliance. Keeping a personal log of your trades, platform settings, and risk management choices can save you trouble. I personally keep a simple spreadsheet that tracks drawdowns, profit splits, and key dates. It’s boring, but it’s what separates a professional prop trader from an impulsive one.

- Platform and account restrictions: You can use different trading platforms for each funded account, but don’t switch too often without informing Topstep support. Sudden changes in account activity or platform usage can trigger compliance reviews.

- Violations and suspensions: If you break a rule on one account, only that specific account is usually affected. However, repeated violations across multiple accounts can lead to a full suspension. It’s better to pause, review, and correct your approach before jumping back in.

Owning multiple funded accounts is a privilege, not a loophole. Topstep rewards traders who manage each account responsibly, respect its restrictions, and show discipline in both prop trading and personal behavior. That’s the foundation of real trading success. Follow the rules, trade with focus, and your consistency will do the talking.

9. What about evaluation accounts and copy trading? (Addressing related queries)

Beyond the main question of how many funded accounts you can hold, traders often have other concerns. Many of these relate to the evaluation phase and the idea of copy trading. Let’s clarify these points, as they are crucial for a complete understanding of Topstep’s operational framework.

9.1. How many Topstep evaluation accounts can you have?

This is a very common and practical question. While our main focus is on funded accounts, it’s important to understand the preceding step. You can enroll in multiple Trading Combines (your evaluation accounts) simultaneously or sequentially. If you’re using the TopstepX platform, check out the guide on how to add a simulation account in TopstepX to set everything up correctly from the start.

Each Combine, however, will require a separate fee, reflecting the resources and opportunity Topstep provides for each evaluation attempt.

Think of each Trading Combine as a distinct trial. If you pass one, you get a funded account. If you want another funded account, you simply start a new Combine.

This flexible approach allows ambitious traders to pursue multiple funding opportunities in parallel, or to simply try again if an initial attempt doesn’t go as planned. It’s the direct precursor to having multiple funded accounts in the first place.

9.2. Topstep and copy trading

The concept of copy trading is increasingly popular, and it’s essential to understand Topstep’s position on it.

General stance: Some traders use third-party trade-copier tools to manage multiple Express Funded Accounts. However, if you ever notice two charts mirroring together in TopstepX, it might indicate a configuration issue with your copy trading setup.

However, Topstep does not officially endorse or provide a built-in copy-trading feature. Hedging between accounts is strictly prohibited, and traders should always verify current rules in Topstep’s Help Center before using any copying software.

What to keep in mind: The purpose of allowing copy trading is to consistently manage positions across your accounts. However, Topstep strictly prohibits using a trade copier to engage in forbidden strategies, such as executing opposing (hedged) trades across different accounts.

Recommendation: Always check Topstep’s official rules and FAQ for the most up-to-date and detailed information on how to properly use their trade copier. Adhering to the rules ensures you can leverage this feature without risking a violation.

10. Tips for successfully managing multiple Topstep-funded accounts

Achieving the status of a multi-account funded trader with Topstep is a significant accomplishment. However, the true test lies not just in acquiring these accounts but in effectively managing them for sustained profitability. Here are some insights and best practices to help you navigate this advanced stage of your trading journey.

10.1. Master one, then expand

It might sound counterintuitive in a discussion about multiple accounts, but the best strategy is often to first achieve consistent profitability with one funded account before attempting to manage more.

Rushing into multiple accounts without a proven track record on a single one can dilute your focus and spread your risk management too thin. Build a solid foundation, then scale.

10.2. Robust trading plan for each

Just as each funded account is independent, so too should be its operational blueprint. Stress the importance of having a distinct trading plan for each account. This doesn’t mean you need wildly different strategies.

It could be a variation of your core approach, tailored to specific instruments or market hours for that particular account. A clear plan for each helps maintain discipline and avoids mixing up risk parameters.

10.3. Advanced risk management

While Topstep sets individual limits for each account, a savvy trader implements portfolio-level risk management that goes beyond those individual account limits. Consider your total capital across all accounts.

How much exposure are you comfortable with across your entire Topstep portfolio? This overarching perspective helps you avoid situations where a series of small losses across multiple accounts could aggregate into a significant overall drawdown.

10.4. Leverage technology

Efficiently monitoring multiple accounts requires smart use of your trading tools. Learn how to use your trading platforms effectively to monitor multiple accounts.

This might involve creating separate workspaces or using different chart layouts for each account. You can also set up alerts to track performance and rule breaches without constant manual checks. Technology is your friend when juggling multiple responsibilities.

10.5. Continuous learning & adaptation

The financial markets are dynamic. What works today might need adjustment tomorrow. Therefore, continuous learning and adaptation are non-negotiable. This applies even more acutely when managing multiple accounts.

Stay abreast of market changes, refine your strategies, and be prepared to adjust your approach across your accounts as conditions evolve. Your ability to adapt will be key to long-term success.

Read more:

11. Common mistakes when owning multiple funded accounts

Managing several funded accounts might sound like the dream for many traders, but in reality, it can quickly turn into chaos if you are not disciplined. I’ve seen this happen to good traders who simply tried to do too much at once. Here are the most common mistakes to watch out for when trading under Topstep Express Funded Account rules.

- Ignoring risk management: Many traders forget that each account has its own limits. Treating all your Express Funded Accounts like one large pool of money is a recipe for failure. Every account has its own drawdown, stop-loss, and profit targets, so you should manage them separately and apply unique trading strategies to each.

- Copying trades without thought: Some traders copy the same entry across all accounts without checking market volatility or liquidity. I’ve made that mistake once, and a single wrong move wiped out gains in every account. It’s smarter to adjust your lot size or timing slightly to spread risk and give yourself flexibility.

- Letting emotions take control: The pressure of managing multiple accounts can be overwhelming. When one account takes a loss, the temptation to overtrade another is strong. Staying calm, patient, and focused on your plan is what keeps a prop trading professional instead of emotional.

- Poor organization and tracking: When you have multiple accounts, losing track of results is surprisingly easy. Keep a simple tracking sheet to log payouts, trades, and performance stats for each account. It helps you stay in control and makes your trading more intentional.

- Skipping the learning phase: Some traders rush into scaling up before they’ve mastered one profitable account. In my opinion, that’s like running before learning to walk. Focus on building consistency with one Live Funded Account Topstep or Express account first. Once you can repeat results naturally, managing more accounts becomes much easier.

Owning multiple funded accounts is not about showing off your capital. It’s about consistency, focus, and strong risk management. If you treat each account as its own business with its own plan and emotion-free discipline, Topstep’s system can truly work in your favor.

12. FAQs

No, Topstep does not allow you to combine the balances or capital from multiple funded accounts into a single, larger account. Each funded account remains separate and operates independently.

If you violate a rule on one funded account, that specific account may be closed. However, your other funded accounts (if you have them) typically remain unaffected, as each operates independently.

Yes, each Trading Combine you enroll in, regardless of whether it’s your first or a subsequent attempt to gain another funded account, requires a separate fee.

Managing multiple funded accounts can be more challenging. It requires increased discipline, meticulous organization, and a robust trading plan for each account, along with an overarching risk management strategy.

Yes, you can. Topstep allows traders to hold up to five active Express Funded Accounts at once, and only one Live Funded Account Topstep. Each account must come from a separate, successfully passed Trading Combine. When you’re promoted to a Live Funded Account, all Express accounts are closed until that live one becomes inactive.

The “50 rule” refers to the payout structure in a Live Funded Account. Traders can withdraw up to 50 percent of their profits once the account reaches the minimum withdrawal threshold. The remaining balance stays in the account to maintain a safe trading buffer. It’s Topstep’s way of rewarding performance while ensuring capital protection.

This usually refers to the 30 percent consistency rule, which requires that no single trading day’s profit exceeds 30 percent of your total profits during the evaluation phase. The rule is designed to promote consistent trading behavior and discourage over-leveraged, high-risk strategies.

Yes, you can request a platform change once you move into your Express Funded Account. Topstep supports several major trading platforms such as NinjaTrader, Tradovate, and Rithmic. It’s best to contact support before switching to ensure your data and trading permissions transfer correctly.

Some traders use third-party trade-copier tools to manage multiple accounts at the same time. However, Topstep does not officially provide or endorse any built-in copy-trading feature. If you use a copier, make sure you don’t hedge between accounts, since that violates Topstep Express Funded Account rules.

No, merging accounts is not allowed. Each funded account must remain independent, with its own profit target, drawdown, and rules. Topstep’s policy is designed to maintain separate performance tracking for each account and prevent risk overlap.

Topstep does not officially support copy trading between your own accounts. While traders may use third-party tools, the company emphasizes that any hedging or mirrored trades that violate risk parameters can lead to account closure. Always review the latest Topstep policy before using such tools.

Each funded account handles payouts separately. You’ll receive profits from each account individually based on its performance and payout cycle. If you manage multiple Express or Live accounts, keep track of payout dates and amounts to ensure proper accounting and tax reporting.

If an account is suspended for a rule violation, you can start a new Trading Combine and earn another funded account. However, Topstep reviews each case individually. Serious or repeated violations may require approval before you’re allowed to participate again.

8. Conclusion: Maximizing your Topstep max allocation journey

Navigating the world of proprietary trading with Topstep offers serious traders a clear path to growth and financial freedom. The question of how many funded accounts can I have with Topstep isn’t just about numbers; it’s about discipline, structure, and consistency.

In the end, having multiple funded accounts is possible, but only for traders who can manage risk wisely and perform consistently. If you’re ready to scale your trading career, explore more practical insights and expert guidance in the Prop Firm & Trading Strategies section on H2T Funding. It’s where every trader can find the tools, tips, and confidence to grow with purpose.