Trading with your own capital can be limiting, but what if you could trade with a firm’s money instead? That is the powerful opportunity offered by prop firms, and FTMO and Topstep are two of the biggest names in the game. Both give skilled traders the chance to manage significant funding.

But they cater to very different traders. The FTMO vs Topstep choice is a split between Forex/CFDs with FTMO and the Futures market with Topstep. This guide, H2T Funding, breaks down exactly how they differ in cost, rules, and payout structures, so you can confidently decide which firm’s edge is the right one for you.

Key takeaways:

- FTMO is a Forex/CFD prop trading built for disciplined, methodical traders who prefer structured evaluations and static drawdown rules.

- Topstep is a Futures-only trading firm designed for active day traders who want fast funding, trailing drawdown, and quick payout cycles.

- FTMO = Forex/CFDs, Topstep = Futures, making your preferred trading market the most important factor in choosing between them.

- Both FTMO and Topstep are fully legitimate trading firms, trusted in the industry and known for consistent, reliable payouts.

1. FTMO vs Topstep: Quick overview & comparison table

At a glance, both FTMO and Topstep are industry-leading firms, but they serve entirely different arenas. FTMO has built its reputation on providing a structured, reliable path for traders in the diverse Forex and CFD markets.

In contrast, Topstep is a specialist, offering a faster, performance-driven route for dedicated Futures traders. The table below highlights their core operational differences, giving you a clear snapshot of each firm’s model.

| Aspect | FTMO | Topstep |

|---|---|---|

| CEO | Otakar Suffner | Michael Patak |

| Funding Models | 2-step | 2-step (Trading Combine) |

| Account Size | $10K – $200K | $50K – $150K |

| Profit Split | 80% – 90% | 100% first $10K profit, then 90% |

| Profit Target | 10% (Step 1) 5% (Step 2) | 6% |

| Payout Frequency | On-demand after 14 days | 5 Winning days (Net PnL each day +$150 or more) |

| Time Limits | No time limit | No time limit |

| Minimum Trading Days | 4 days | 2 days for Combine |

| Daily Loss Limit | 5% | TopstepX uses trader-set PDLL; legacy platforms still use fixed DLL |

| Maximum Loss Limit | 10% | Trailing Drawdown (varies by account) |

| Instruments | Forex, Commodities, Indices, Stocks, Crypto | Futures contracts |

| Platforms | MT4, MT5, cTrader, DXtrade | TopstepX |

| News/Weekend Trading | Weekend holding restricted (standard); News restricted on funded accounts | News allowed with caution; overnight/weekend holding strictly prohibited. |

| Starting Fees | €155 (~$178) | $49/month |

Note: Data is subject to change based on current promotions and updates from the firms.

Now, let’s dive deeper into what these numbers and rules mean for your trading career.

FTMO

#1

Account Types

2-step

Trading Platforms

MT4, MT5, cTrader, DXTrade

Profit Target

5% – 10%

Our take on FTMO

FTMO represents a clear and structured path to professional trading. Their entire system, especially the two-step evaluation, feels designed to filter for genuine consistency. It rewards the disciplined trader who can perform methodically over time, not just someone who gets one big trade right.

The refundable fee is what truly sets them apart in my mind. It shows confidence in their process and makes the challenge a true merit-based opportunity. Combined with transparent scaling plans, it feels less like a simple test and more like the start of a long-term trading career.

| 💳 Challenge Fee | €89 – €1,080 |

| 👥 Account Types | 2-step |

| 💰 Profit Split | 80% – 90% |

| 💵 Account Size | $10K – $200K |

| ⏱️ Time Limit | No time limit |

| 🎯 Profit Target | 5% – 10% |

| 📊 Trading Platforms | MT4, MT5, cTrader, DXTrade |

| 🛍️ Asset Types | Forex, Commodities, Indices, Stocks, Crypto |

Topstep

#2

Account Types

2-step

Trading Platforms

TopstepX

Profit Target

6%

Our take on Topstep

Topstep is built for performance and momentum. It’s a model built for active traders who want to capitalize on their skills immediately. The clear path from the Trading Combine to an Express Funded Account is designed to be swift, rewarding performance without a long audition.

The 100% payout on the first $10,000 is a brilliant incentive that changes the dynamic of the evaluation. However, this speed comes with the firm’s signature challenge: mastering the trailing drawdown. Success with Topstep means you are not just profitable, but you are also exceptionally good at protecting your open profits.

| 💳 Challenge Fee | $49 – $149 |

| 👥 Account Types | 2-step |

| 💰 Profit Split | 90% – 100% |

| 💵 Account Size | $50K – $150K |

| ⏱️ Time Limit | No time limit |

| 🎯 Profit Target | 6% |

| 📊 Trading Platforms | TopstepX |

| 🛍️ Asset Types | Futures Contracts |

Read more:

2. A side-by-side breakdown: FTMO vs Topstep comparison

Understanding the fine print is what separates successful traders from the rest. The day-to-day rules and processes are what truly define a firm’s character and your potential for success with them.

Let’s break down the core components of each firm, from the initial challenge to your long-term growth. This is where you find which model truly fits your style.

2.1. The evaluation process: How to get funded

Your path to a funded account is a defining difference between these firms. FTMO requires passing a complete two-part examination (Challenge and Verification) before you manage a funded account and are eligible for profit splits.

Topstep uses a single test, The Trading Combine, to grant you access to your first funded level. Passing this one stage moves you directly to an Express Funded Account, where you can start earning payouts.

| Parameter | FTMO | Topstep |

|---|---|---|

| Structure | 2-step evaluation: Prove profitability (Simulated) | Trading Combine: Prove profitability (Simulated) |

| Profit Target | 10% (Step 1) 5% (Step 2) | 6% |

| Min. Trading Days | 4 Days | 2 Days (Minimum for Combine) |

| Time Limit | Unlimited | Unlimited |

| Core Hurdle | Meeting targets within fixed loss limits | Managing a trailing drawdown |

FTMO’s evaluation process is a comprehensive, two-stage examination of your skills in a simulated setting. It is designed to find methodical traders who can prove their consistency before they manage a funded account.

Topstep’s path prioritises getting you to a payout-eligible account quickly after a single test. The subsequent Express Funded stage then serves as a live, paid probationary period to prove your long-term stability.

2.2. Risk management & trading rules

How a firm manages risk reflects its philosophy. FTMO enforces a static framework with clear daily and maximum loss limits, demanding consistent discipline. Prohibited practices focus on preventing gambling-like behavior.

Topstep’s primary rule is its trailing drawdown, offering more intraday flexibility but requiring careful management. Their prohibited conduct rules are extensive, focusing on preventing market manipulation and unrealistic trading strategies.

| Parameter | FTMO | Topstep |

|---|---|---|

| Primary Risk Rule | Static Maximum Loss Limit (10%) | Trailing Maximum Loss Limit |

| Daily Loss Limit | 5% of initial balance | Not on TopstepX; applies to others |

| Consistency Rule | No specific rule, but discourages gambling | Best Day must be < 50% of total profit |

| News Trading | Restricted 2 mins before/after news (Funded) | Permitted without restrictions |

| Weekend Holding | Not allowed (standard funded accounts) | Not allowed (positions close daily) |

| EA / Algos | Permitted with unique strategy conditions | Permitted |

| Forbidden tech | Third-party EAs, multiple profiles | VPNs, manipulative AI/automation |

I see FTMO’s risk management as a framework for professional discipline. The rules on position sizing and the prohibition of third-party EAs force you to develop and own your unique trading strategies, which is invaluable for long-term growth.

Topstep’s rules are acutely focused on integrity and preventing gaming the system. The Best Day consistency rule, for example, directly impacts high-frequency trading styles like scalping or aggressive momentum trading. These rules ensure they fund traders with skills that transfer to live markets, not just those who exploit demo conditions.

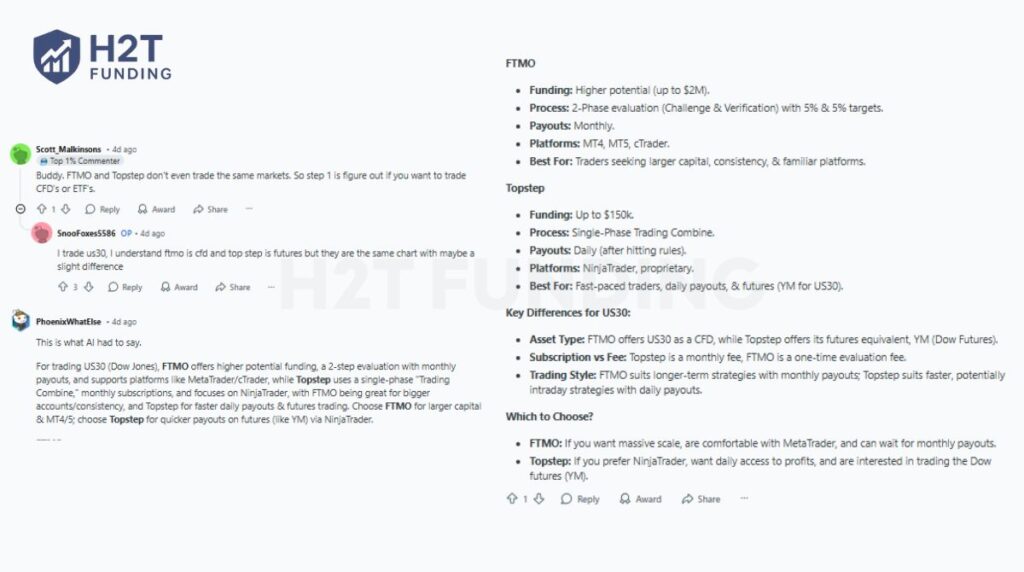

2.3. Tradable markets & leverage: Forex/CFDs vs. Futures

The markets you can access from the core differ in the FTMO vs Topstep comparison. Unlike brokers that offer stocks or options trading, these firms specialize in specific derivatives. If your strategy thrives on variety within CFDs, FTMO’s broad offering is built for you.

However, if you are a specialist who lives and breathes the centralized, regulated futures market, then Topstep is your arena. This choice fundamentally dictates the tools and leverage at your disposal.

| Parameter | FTMO | Topstep |

|---|---|---|

| Asset Classes | Forex, Indices, Crypto, Stocks, Commodities (as CFDs) | Exchange-Traded Futures |

| Core Market | Forex (e.g., EUR/USD, GBP/JPY) | Index Futures (e.g., ES, NQ) |

| Leverage | Up to 1:100 on Forex pairs Up to 1:50 on Indices Up to 1:3 on crypto | Based on contract specs: $50K Account → Up to 5 Minis/ 50 Micros $100K Account → Up to 10 Minis/ 100 Micros $150K Account → Up to 15 Minis/ 150 Micros |

| Market Focus | Broad, multi-market versatility | Deep specialization in one asset class |

For me, FTMO is about flexibility. The high leverage on forex means I can control a large position with less of my allocated capital, which is great for many retail strategies. It’s the perfect environment for a trader who follows opportunities across different markets.

Topstep, on the other hand, is about specialization. The leverage is defined by position limits, forcing a deep mastery of the unique market structure of core products like the ES/ NQ, a path many professional day traders prefer.

2.4. Profit split & payout structure

A firm’s payout policy directly impacts your earning potential. FTMO offers a straightforward system with an 80% profit split from the start, which can increase to 90% later. Payouts are available after 14 days.

Topstep’s structure is performance-based and highly attractive upfront. You keep 100% of your first $10,000 in profits across all accounts, then move to a generous 90% split. This model powerfully incentivizes early success.

| Parameter | FTMO | Topstep |

|---|---|---|

| Initial Profit Split | 80% to the trader | 100% of the first $10,000, then 90% |

| Payout Frequency | On-demand, every 14 days | After accumulating 5 winning days |

| Minimum Payout | $20 (Bank) / $50 (Crypto) | $125 |

| Key Requirement | Account must be in profit | 5 winning days ($150+ net PNL) per request |

| Withdrawal Methods | Bank, Crypto, Skrill, Visa/Mastercard | Wise, ACH, Wire/SWIFT |

FTMO’s payout system is simple and reliable. The 80% starting split is a strong industry standard, and the process is clear. It’s a dependable model for traders who value predictability in their income.

Topstep’s payout frequency is a significant advantage. The ability to withdraw after just five winning days and the initial 100% split are powerful motivators. This system rewards consistent, profitable trading with fast results.

2.5. Scaling plans

A good prop firm doesn’t just fund you; it provides a clear path for growth. FTMO’s scaling plans are based on long-term, consistent performance, rewarding traders with significant capital increases and a higher profit split over time.

Topstep’s approach is more dynamic. Your buying power adjusts based on your account equity, allowing you to trade more size as you become more profitable. This offers a more immediate path to leveraging your success.

| Parameter | FTMO | Topstep |

|---|---|---|

| Method | Scheduled capital increase (every 4 months) | Dynamic increase in position size based on equity |

| Requirement | 10% net profit over 4 months, 2+ payouts | Increase the account balance to the next tier |

| Benefit | +25% account balance, profit split rises to 90% | Ability to trade more contracts |

| Maximum Size | Up to $2M via scaling | Based on the account’s maximum position size |

For me, FTMO’s scaling plan is like a career progression. It’s a structured, long-term goal that rewards patience and consistency. The prize is not just more capital but also a larger share of the profits, which is a powerful motivator.

Topstep’s scaling feels more like an organic part of my day-to-day trading. As my account grows, my ability to take on bigger positions grows with it. This dynamic model is perfect for traders who want their buying power to reflect their current performance.

3. Cost analysis: Refundable fee vs. monthly subscription

Your upfront investment is a key differentiator when comparing funding options. FTMO operates on a one-time, refundable fee model (from €89 to €1,080). You pay for the Challenge, and if you succeed, you get the entire fee back with your first profit split.

Topstep uses a monthly subscription model (from $49 to $189/mo) for its Trading Combine. This lowers the initial barrier to entry but can become more expensive if you need several months to pass the evaluation, especially if you plan to scale by holding multiple funded accounts, as explained in this guide on how many funded accounts you can have with Topstep.

| Parameter | FTMO | Topstep |

|---|---|---|

| Primary Cost | One-time evaluation fee (€89 – €1,080) | Monthly subscription ($49 – $189/mo) |

| Fee Refund | Yes, with the first payout | No, subscription is non-refundable |

| Activation Fee | None | Yes ($129), or a higher monthly fee to waive |

| Data Fees | Included in the initial fee | Optional Level 2 data for $34.25/mo |

| Reset Fee | Free with a new Challenge | Equal to the monthly fee |

As a trader, I see FTMO’s model as a high-confidence play. You are essentially betting on your own success. Passing the challenge means your entry was free, which is a powerful incentive for skilled traders who are ready to perform.

Topstep’s monthly fee is great for accessibility. However, traders must factor in the recurring cost and potential for a Back2Funded purchase if they break a rule on a funded account. It’s a system that favors passing quickly.

4. Trading platforms of FTMO vs Topstep

The platform you trade on is more than just software; it’s your command center for every market decision. FTMO addresses this by offering widely used platforms such as MetaTrader 4, MetaTrader 5, DXtrade, and cTrader. Using familiar tools helps traders focus on execution and improve their chances when learning how to pass the FTMO Challenge.

Topstep, while supporting a roster of professional futures platforms like NinjaTrader, is now guiding new traders toward its proprietary TopstepX. This shift aims to build a more integrated ecosystem. After July 7th, 2025, traders can only switch to TopstepX and can no longer move between other platforms.

| Parameter | FTMO | Topstep |

|---|---|---|

| Core Platforms | MetaTrader 4, MetaTrader 5, cTrader, DXtrade | TopstepX (for new accounts), NinjaTrader, TradingView, Quantower, etc. |

| Availability | Windows, macOS, Web, iOS, Android | Varies by platform; TopstepX is web-based |

| Specialization | Built for Forex & CFD trading | Built for professional Futures trading |

| Future Focus | Supports multiple popular 3rd-party platforms | Directing new users to its proprietary TopstepX |

There’s a level of comfort and trust that comes with using platforms like MT4 and MT5, which FTMO provides. You know the tools, the indicators, and the execution flow inside and out, which lets you focus on following strict FTMO challenge rules during the evaluation phase.

Topstep’s move to prioritize TopstepX shows a commitment to building a tailored experience. For a futures trader, having a platform designed by the firm you’re trading with can be a significant advantage, offering better integration and support.

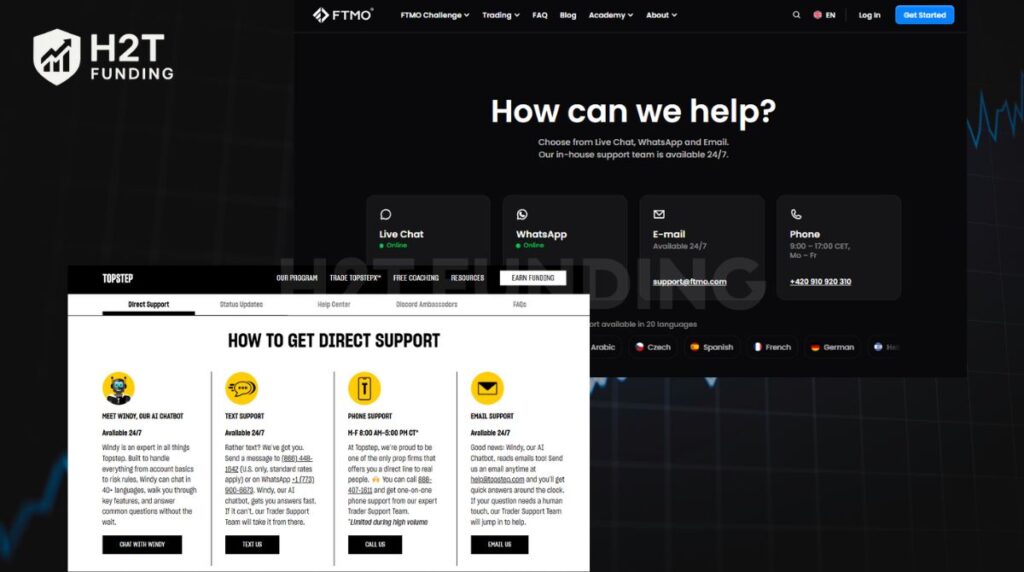

5. Customer support & educational resources

Beyond capital, the right prop firm invests in your growth. FTMO provides a structured learning environment through its FTMO Academy and offers reliable, multi-language client support through channels like live chat, email, and WhatsApp.

Topstep places a heavy emphasis on live interaction and community. They offer free group coaching, a popular podcast, and an active Discord community, alongside a robust AI-powered support system to handle trader inquiries efficiently.

| Parameter | FTMO | Topstep |

|---|---|---|

| Educational Core | FTMO Academy (structured courses) | Resource Library (Blog, Videos, Podcast) |

| Coaching | Performance Coach for funded traders | Free daily group coaching, Digital Coach |

| Support Channels | 24/7 Live Chat, Email, WhatsApp, Phone | AI Assistant, Live Chat, Phone, Email, SMS |

| Community | Social Media Profiles | Large, active Discord community |

The educational resources from FTMO are fantastic for building a solid foundation. The structured nature of the Academy is perfect for someone who wants to learn the fundamentals of trading and risk systematically before diving in.

Topstep’s approach feels more like being part of a live trading floor. The daily coaching sessions and active Discord create a sense of community and provide real-time feedback, which is incredibly valuable for continuous learning and staying sharp.

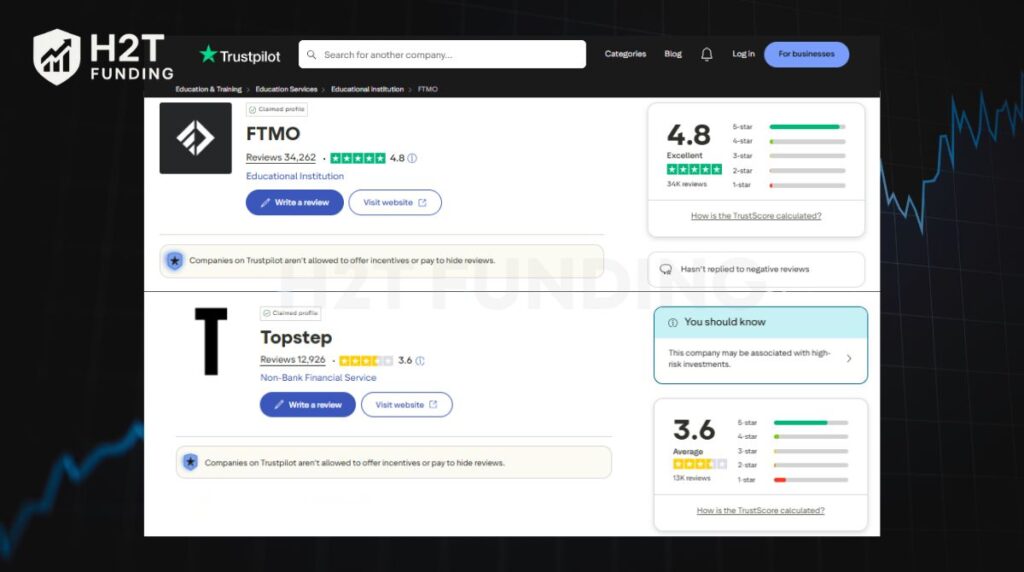

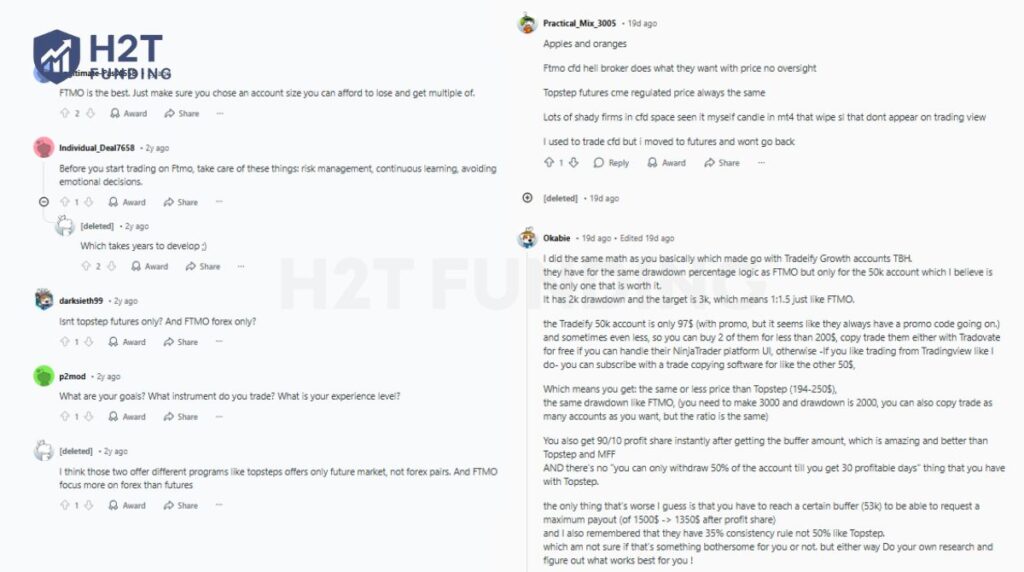

6. FTMO vs Topstep Reddit: What real traders say

Official websites tell one story, but trader forums like Reddit often reveal the ground truth. When searching for FTMO vs Topstep Reddit, discussions usually split along one key line: Forex/CFDs versus Futures. This distinction is also central to broader debates about whether prop firms are legit in the first place.

Experienced traders often say comparing them is like comparing apples and oranges. They note FTMO is in the CFD space while Topstep uses regulated CME futures, a vital distinction for professionals choosing a firm.

Beyond the market debate, discussions often shift to the specific rules and value propositions. You’ll find traders doing deep mathematical breakdowns, comparing the drawdown rules, profit targets, and costs of each firm against others in the industry. Some argue that FTMO’s static drawdown is more straightforward, while others are drawn to Topstep’s faster payout potential despite its rules.

Ultimately, the consensus on forums is that there is no single best firm. The right choice depends entirely on your personal goals, the instruments you trade, and your experience level. The community strongly advises new traders to align the firm’s model with their own trading style before committing.

7. Which prop firm should you choose?

Making the final call between two top-tier firms can be tough. Before committing any capital, we strongly recommend extensive paper trading on each firm’s free trial to see which rule set feels more natural.

After comparing every critical aspect, the decision comes down to your personal trading identity. Neither firm is objectively better; they are built for different traders. Your choice should reflect your strategy, risk tolerance, and preferred market.

Choose FTMO if you are:

- A trader whose edge is in the Forex and CFD markets.

- Someone who prefers a structured, two-step evaluation to prove consistency.

- Motivated by a fully refunded fee upon passing and a clear path to a 90% profit split.

- Comfortable working within predictable, static drawdown limits.

Choose Topstep if you are:

- A dedicated Futures trader focused on markets like the ES, NQ, or CL.

- Seeking the fastest path to a funded account to start earning quickly.

- Attracted by the powerful incentive of keeping 100% of your first $10,000.

- Confident in managing a trailing drawdown and value payout flexibility.

Overall, the best choice aligns with your strengths. FTMO rewards methodical, long-term consistency in the CFD space, while Topstep rewards high-performance, specialized skill in the futures arena.

8. FAQs

Neither is “easier,” they are just different. Some traders find FTMO’s static 10% drawdown easier to manage than Topstep’s trailing drawdown. Others find Topstep’s single-phase test and lack of a daily loss limit (on TopstepX) an easier hurdle to clear for initial funding. It depends entirely on your trading style and how you manage risk.

Yes, both FTMO and Topstep are widely regarded as two of the most legitimate and reputable prop firms in the industry. They have a long track record of paying out successful traders consistently and are trusted by thousands of users worldwide.

Absolutely. There are no rules from either firm that prevent you from trading for the other simultaneously. Many traders manage accounts at different firms to diversify their opportunities across both the Forex/CFD and Futures markets.

Yes, through a specific partnership with OANDA (FTMO US). US traders must use a designated platform, not MT4/MT5. Note that residents of certain states, such as Arkansas, Delaware, Louisiana, Montana, or South Carolina, are excluded from participating.

The biggest risk is failing the evaluation and losing your initial fee. For funded traders, it’s violating a key rule like the maximum drawdown. Ultimately, the greatest danger is making emotional decisions under pressure, which is why strict adherence to your strategy is crucial.

Neither is better; they serve different traders. Choose FTMO for Forex/CFDs with a refundable fee. Choose Topstep for Futures with faster funding and a 100% initial profit split. The best choice depends entirely on your market.

This depends on your needs. A trader might prefer a competitor for a single-step challenge or a different drawdown rule. However, FTMO remains an industry leader in the Forex/CFD space due to its strong reputation and clear scaling path.

This rule prohibits trades on funded accounts within two minutes of major news events. It is a risk management measure to avoid extreme volatility. Crucially, this rule does not apply during the initial Challenge and Verification stages.

Alternatives to Topstep in the futures space might offer a static drawdown instead of a trailing one, which some traders prefer. While many competitors exist, Topstep is a top choice due to its fast funding and excellent payout structure.

9. Conclusion

Ultimately, the FTMO vs Topstep decision is a reflection of your own trading identity. Should your choice be guided by one primary question: are you a Forex/CFD trader or a Futures specialist? Aligning with the right market is the most critical step toward success with either firm.

FTMO offers a methodical path with its two-step evaluation and predictable, static risk limits. Topstep provides a faster route to funding, built on a performance-driven test and a dynamic trailing drawdown that rewards active management of your equity.

Your education doesn’t stop here. To see how these firms stack up against other industry leaders and find the absolute best fit for your capital, explore more in-depth prop firm comparisons on the H2T Funding.