Struggling to choose between FTMO’s renowned, structured path in the forex markets and Apex’s straightforward approach to futures trading? This is a common dilemma, as each firm represents a very different philosophy in prop trading.

This head-to-head showdown demystifies the choice. H2T Funding will break down the critical differences in their evaluation process, trading rules, costs, and profit splits, giving you a transparent look at what each firm truly offers.

By the end, you won’t just see a comparison; you’ll have a clear verdict. You will know precisely which firm provides the better platform and funding options to accelerate your trading career.

Key takeaways

- FTMO and Apex represent two fundamentally different strict evaluation criteria, with FTMO using a structured 2-step model and Apex offering a fast, simplified 1-step evaluation.

- Apex provides greater trading flexibility by allowing news trading, weekend holding, and removing the daily loss limit, making it ideal for traders who value freedom in execution.

- FTMO delivers a multi-market environment with broad trading strategies thanks to support for Forex, indices, crypto, metals, and MT4/MT5/cTrader platforms.

- FTMO is best suited for traders who prefer stability, fixed drawdown rules, diversified CFD markets, and a strong support ecosystem.

- Apex is ideal for futures traders who prioritize speed, fewer restrictions, a 1-step evaluation model, and the ability to manage a trailing drawdown effectively.

1. FTMO vs Apex: An overview and quick comparison table

Choosing between FTMO and Apex Trader Funding is more than just comparing profit targets; it is a choice between two entirely different trading philosophies. FTMO offers a structured, prestigious path within the Forex and CFD markets, while Apex provides a high-speed, flexible gateway to the professional Futures exchanges.

To understand which environment suits your edge, let’s look at the core identity of each firm.

1.1. FTMO

Founded in 2015, FTMO is widely recognized as the most established and trusted prop firm in the global Forex and CFD industry. Having pioneered the modern prop trading model for over a decade, FTMO is best known for its institutional-grade structure, professional user interface, and a strong emphasis on disciplined risk management.

The firm focuses exclusively on CFDs, allowing traders to access currencies, crypto, metals, and indices on familiar retail platforms like MT4, MT5, or cTrader. Its two-step evaluation model is designed to filter for long-term consistency.

By mastering their rules, successful traders can manage large account sizes and benefit from a clear scaling plan designed for steady capital growth in a secure, time-tested environment.

1.2. Apex Trader Funding

Apex Trader Funding is the premier destination for dedicated futures traders who prioritize speed and execution freedom. It stands out by offering a streamlined one-step evaluation, allowing profitable traders to reach funded status much faster than traditional models.

Unlike FTMO, Apex removes the daily loss limit and offers significantly more freedom regarding news trading and weekend holding. This makes it highly appealing to aggressive day traders who thrive on intraday volatility. With a focus on Direct Market Access (DMA) to the futures exchanges (CME, CBOT, etc.), Apex is built for those who want a high-reward, low-restriction environment.

Before diving into the technical details, we’ve compiled a quick comparison table below to help you see which firm’s infrastructure aligns with your current trading goals.

| Aspect | FTMO | Apex Trader Funding |

|---|---|---|

| CEO | Otakar Suffner | Darrell Martin |

| Funding Models | 2-step | 1-step |

| Account Size | $10K – $200K | $25K – $300K |

| Profit Split | 80% – 90% | 100% first $25K profit, then 90% |

| Profit Target | 10% (Step 1) 5% (Step 2) | 6% |

| Payout Frequency | Bi-weekly (every 14 days) | Twice per month, once payout conditions are met |

| Time Limits | No time limit | No time limit |

| Minimum Trading Days | 4 days | 7 days |

| Daily Loss Limit | 5% | None |

| Maximum Loss Limit | 10% | Trailing threshold: ~3% – 4% depending on account size |

| Instruments | Forex, Metals, Commodities, Indices, Stocks, Crypto, and Energies | Futures contracts |

| Platforms | MT4, MT5, cTrader, DXtrade | Rithmic, NinjaTrader, Tradovate, and WealthCharts |

| News/Weekend Trading | Weekend holding restricted (standard); News restricted on funded accounts | Allowed holding over the weekend; News trading allowed, but no opposing positions. |

| Starting Fees | €155 (~$178) | $177/month |

Disclaimer: Rules, pricing, and trading conditions may change over time. Traders should always verify the latest terms directly on the official FTMO vs Apex websites before purchasing any challenge.

FTMO

#1

Account Types

2-step

Trading Platforms

MT4, MT5, cTrader, DXTrade

Profit Target

5% – 10%

Our take on FTMO

FTMO operates like a well-established financial institution. Their entire process, from the structured two-step evaluation to the polished user dashboard and multi-channel support, is designed to instill confidence and foster discipline. They are not looking for traders who can get lucky; they are looking for professionals.

The firm’s clear, fixed drawdown rules are its greatest strength, providing a stable and predictable environment that removes the guesswork from risk management. While the initial fee is higher than some competitors and the rules are less flexible, the refund policy and strong reputation make it a top-tier choice for serious traders.

| 💳 Challenge Fee | €89 – €1,080 |

| 👥 Account Types | 2-step |

| 💰 Profit Split | 80% – 90% |

| 💵 Account Size | $10K – $200K |

| ⏱️ Time Limit | No time limit |

| 🎯 Profit Target | 5% – 10% |

| 📊 Trading Platforms | MT4, MT5, cTrader, DXTrade |

| 🛍️ Asset Types | Forex, Commodities, Indices, Stocks, Crypto |

Apex Trader Funding

#2

Account Types

1-step

Trading Platforms

Tradovate, Rithmic, WealthCharts

Profit Target

6%

Our take on Apex Trader Funding

In our view, Apex Trader Funding is built for the decisive and confident futures trader. Their entire model is optimized for speed and flexibility, from the streamlined one-step evaluation to the freedom from daily loss limits. The firm clearly trusts its traders to manage their own intraday risk in exchange for fewer restrictions.

The 100% payout on the first $25,000 is a powerful and almost unmatched incentive in the industry, making it highly attractive for skilled traders. While Apex’s consistency rules and trailing drawdown demand close attention, it still offers one of the fastest and most rewarding paths to a funded futures account.

| 💳 Challenge Fee | From $196 |

| 👥 Account Types | 1-step |

| 💰 Profit Split | 90% – 100% |

| 💵 Account Size | $25K – $300K |

| ⏱️ Time Limit | No time limit |

| 🎯 Profit Target | 6% |

| 📊 Trading Platforms | Tradovate, Rithmic, WealthCharts |

| 🛍️ Asset Types | Equity Indices, Currencies, Commodities, Interest Rates, Crypto |

This high-level overview clearly shows two distinct philosophies. FTMO presents a structured path with fixed risk parameters, appealing to traders across various CFD markets. Apex offers a streamlined model tailored for the high-stakes world of futures trading.

But raw data only tells part of the story. To see which firm truly aligns with your goals, we will now provide a detailed review of each company’s core components. Let’s begin by dissecting their distinct evaluation programs.

Read more:

2. A deep dive comparison: FTMO vs Apex on key factors

While the comparison table gives a snapshot, your success as a trader depends on the details hidden within the rules. A firm’s approach to its evaluation, trading restrictions, and profit structure directly impacts your daily strategy and long-term profitability.

Let’s begin with the very first hurdle every trader must clear: the evaluation process and funding models.

2.1. Evaluation process and funding models

The path to securing funded accounts begins with a rigorous performance evaluation, and this is where FTMO and Apex diverge most significantly.

FTMO champions a methodical, two-step challenge designed to verify consistency under pressure. In contrast, Apex offers a streamlined, single-phase evaluation aimed at getting profitable traders funded faster.

| Feature | FTMO | Apex Trader Funding |

|---|---|---|

| Evaluation Model | 2-Step (Challenge + Verification) | 1-Step Evaluation |

| Profit Target (Step 1) | 10% | 6% (single target) |

| Profit Target (Step 2) | 5% | N/A |

| Time Limit | Unlimited | Unlimited |

| Minimum Trading Days | 4 days (per phase) | 7 days |

| Transition to Funded | After passing Step 2 (Verification) | Immediately after passing the single evaluation |

FTMO’s two-step model acts as a rigorous filter. It’s not just about hitting a profit target once; it’s about proving you can perform consistently under strict rules. This structure suits disciplined and patient traders, especially those who already know how to pass the FTMO challenge.

To succeed, traders must also strictly comply with the FTMO challenge rules, as even minor violations during either phase can result in immediate disqualification despite strong performance.

Apex’s one-step evaluation is built for speed and simplicity. Removing the second verification stage provides the most direct path to a funded account. This model strongly appeals to confident traders who believe their strategy can meet the objective without needing a second proving ground.

2.2. Key trading rules and restrictions

Beyond the evaluation targets, the daily trading rules define your freedom and limitations. These rules are not suggestions; they are hard limits that protect the firm’s capital and can determine whether your account remains active.

FTMO and Apex enforce different philosophies. FTMO focuses on restricting trading around high-impact events, while Apex implements more rules on how you manage your trades intraday.

| Rule/Restriction | FTMO | Apex Trader Funding |

|---|---|---|

| News Trading | Restricted on funded accounts around major news releases (e.g., NFP, CPI). Allowed on Swing accounts. | Allowed. However, placing opposing orders or hedging around news is strictly prohibited. |

| Weekend/Overnight Holding | Not allowed on standard funded accounts. Permitted on Swing accounts. | Allowed. Positions can be held over the weekend. |

| End-of-Day Requirement | None (except for the weekend holding rule). | Strict. All trades and pending orders must be closed by 4:59 PM ET. |

| Consistency Rules | No strict rule, but consistency is monitored. They discourage huge, single-day lucky profits that make up the bulk of your total gain. | Several rules apply, including contract scaling until a profit buffer is met and a 30% max adverse excursion (MAE) rule. |

| Hedging | Allowed within a single account. Hedging across multiple FTMO accounts is a forbidden practice. | Strictly prohibited. Holding opposing positions on the same or correlated assets is a violation. |

| Use of EAs/Bots | Allowed, provided they do not use forbidden strategies (e.g., high-frequency trading, arbitrage). | Allowed. Traders are responsible for ensuring their EA complies with all other rules. |

| Trading Hours | Follows standard market hours (24/5), but weekend positions must be closed on funded accounts. Specific instrument times are based on server time (e.g., CET). | Offers nearly 24-hour access (23 hours daily, from 6 PM ET to 4:59 PM ET the next day), allowing for broad coverage of futures market sessions. |

FTMO’s rules are built around macro risk management and trader discipline. Their goal is to prevent account blow-ups from news volatility while encouraging sustainable, consistent performance over one-hit wonders. This approach suits traders whose trading strategies produce steady gains.

Apex, in contrast, focuses on micro risk management and intraday discipline. They grant you freedom during news events but demand strict adherence to rules like the end-of-day close and position management. This environment is ideal for day traders who thrive on intraday volatility but can operate within a rigid framework.

2.3. Trading platforms and market access

A trader’s edge is only as sharp as their tools. The trading platform you use and the markets you can access are fundamental to executing your strategy effectively. This is another area where the two firms cater to completely different audiences.

FTMO provides access to a suite of popular, versatile trading platforms known in the retail Forex and CFD space. Apex, conversely, offers a selection of specialized software built specifically for the professional futures trading environment.

| Aspect | FTMO | Apex Trader Funding |

|---|---|---|

| Primary Market Focus | Forex & CFDs | Futures Contracts |

| Available Platforms | MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, DXtrade | NinjaTrader, Tradovate, Rithmic, WealthCharts |

| Platform Type | Widely-used retail platforms with extensive charting tools and EA support. | Specialized futures platforms with direct market access (DMA) capabilities and professional-grade tools. |

| Tradable Asset Classes | Forex, Indices, Metals, Commodities, Stocks, and Cryptocurrencies (as CFDs). | Equity Futures (ES, NQ), Currency Futures (6E), Metals (GC), Energy (CL), Agricultural (ZC), and Micros. |

| Mobile Trading | Yes. Full-featured mobile apps available for MT4, MT5, and cTrader. | Yes. Primarily through the Tradovate platform and other compatible mobile solutions. |

| Data Feed | Standard broker data feeds for CFDs. | Professional data feeds like Rithmic provide direct exchange data. |

FTMO’s offering is built for versatility and familiarity. If you come from a retail trading background, you will feel right at home with platforms like MT4 and MT5. This ecosystem provides access to a very broad range of trading instruments, making it ideal for traders whose strategies span multiple CFD asset classes.

Apex provides a specialized, professional-grade environment. Its platforms are designed for serious futures traders who need speed and direct market access. However, trading futures also comes with stricter operational rules. This includes requirements such as how many consecutive days for an Apex-funded account payout, which traders must plan for when managing execution and risk.

2.4. Leverage and commissions

Understanding your true buying power and how much each trade costs is essential for profitability. FTMO and Apex handle this in completely different ways, designed for the markets they specialize in.

FTMO uses a classic leverage model, giving you a multiplier on your capital that changes based on what you trade. Apex doesn’t use multipliers; it sets a clear limit on how many contracts you can open at once.

| Factor | FTMO | Apex Trader Funding |

|---|---|---|

| Leverage Model | Multiplier Model (Ratio varies by asset). | Position Limit Model (Maximum contracts allowed). |

| Your Buying Power | Forex: 1:100 Metals & Energy: 1:30 Indices: 1:50 Stocks & Crypto: 1:3 | Based on account size. Example: A $50,000 account lets you trade up to 10 contracts (or 100 micros). |

| Cost Structure | Based on trading volume (per lot) and asset type. | Fixed fee per contract traded (per side). |

| Example Cost | A standard forex trade (1 lot) costs about $6 total ($3 in, $3 out). Indices can be commission-free. | A standard futures trade (1 ES contract) costs about $4 total ($2 in, ~$2 out). |

FTMO’s system offers high buying power, especially in the forex market, where you get 100 times your capital as leverage. This is great for traders who need that extra firepower, but it’s important to note the leverage drops significantly for other assets like crypto, where it’s only 1:3.

Apex operates on a principle of Total Capacity, which is the standard for professional futures trading. There is no 1:100 ratio here. Instead, you are given a maximum contract limit (e.g., 14 contracts for a $100K account). This straightforward approach makes calculating your precise risk and cost for every single trade incredibly simple and predictable.

For a full breakdown of this model, it helps to understand how Apex Trader Funding works.

2.5. Profit split and scaling plan

The ultimate goal of any prop firm trader is the payout. A firm’s profit splits and scaling plan reveal how they reward success and support long-term growth, turning a challenge pass into a career.

FTMO offers a traditional path to a higher share and larger capital. In contrast, Apex provides a highly attractive initial offer with a unique condition attached to its scaling.

| Factor | FTMO | Apex Trader Funding |

|---|---|---|

| Initial Profit Split | Starts at 80% for the trader. | 100% of the first $25,000 in profit, then 90% thereafter. |

| Maximum Profit Split | 90%. | 90% (after the initial $25k). |

| Scaling Mechanism | Increases account balance (up to $2M) and raises profit-sharing to 90% after meeting performance metrics. | Unlocks the full contract size allowed for your account. It does not increase the account’s capital balance. |

| Requirement for Scaling | Consistent profitability (10% gain) over 4 months and processing at least 2 payouts. | Reaching a pre-defined profit buffer. (e.g., on a $50k account, reaching $52,600). |

FTMO’s scaling plan is a true long-term incentive program. It is designed for disciplined traders who can demonstrate consistent profitability over several months. The reward is significant: a larger account and a permanent increase in your share of the profits.

Apex’s model offers powerful immediate gratification. Keeping 100% of your first $25,000 is a major draw. However, their scaling is a risk management feature, requiring you to prove profitability before you can use your account’s full trading power. This front-loads the reward but demands initial discipline.

3. Consistency rules and risk management

Staying above the drawdown limit is only half the battle. Prop firms also enforce rules to ensure you are trading with a consistent, professional strategy rather than gambling. These rules define the boundaries of acceptable risk management.

FTMO’s approach is more philosophical, encouraging good habits. Apex is much more granular and rule-based, with specific mathematical limits on your trading activity.

| Rule / Philosophy | FTMO | Apex Trader Funding |

|---|---|---|

| Daily Loss Limit | Yes. A fixed 5% of your initial balance. | None. No daily loss limit. |

| Maximum Drawdown | Static 10%. A fixed floor based on your starting capital. | Live Trailing Drawdown. A limit that follows your highest equity point. |

| Consistency Guideline | Encourages steady profit accumulation; discourages one massive, lucky trade making up all your gains. | Strict 30% Windfall Rule. Your highest profit day cannot account for more than 30% of your total profit for a payout. |

| Risk/Reward Limit | No specific rule, but recommends sound risk principles. | Strict 5:1 Ratio Rule. Your stop loss cannot be more than five times your profit target on any given trade. |

FTMO’s risk framework is built on providing clear, fixed boundaries. The 5% daily and 10% maximum loss limits are easy to track and never change. While they don’t have a strict mathematical consistency rule, they monitor trading behavior to ensure you are not taking wild, unsustainable risks.

Apex offers more flexibility but enforces stricter structural rules. There is no daily loss limit, which suits active intraday traders. However, traders must comply with the consistency rule for Apex payouts, including the 30% windfall cap and the 5:1 risk rule. Some also consider whether failed Apex accounts can be used as tax write-offs when running multiple evaluations.

4. Breaking down the costs: Evaluation fees and resets

Your initial investment in a prop firm is the evaluation fee. This cost, along with the price of a potential reset, can significantly impact your decision. Both firms approach their pricing from different angles.

FTMO uses a one-time, refundable fee structure that feels like an initial deposit on your skill. Apex operates on a recurring monthly subscription model, offering flexibility but requiring ongoing payments.

| Cost Type | FTMO | Apex Trader Funding |

|---|---|---|

| Fee Structure | One-time fee per challenge attempt. | Monthly subscription per evaluation account. |

| Starting Price | €155 (~$164) for a $10K account. | Starts at $137/month for a $25K account (often discounted). |

| Refund Policy | Yes. The initial fee is 100% refunded with your first profit split after passing. | No. The monthly fee is a recurring operational cost and is not refundable. |

| Account Reset Options | A new one-time fee is required to restart a failed challenge. | A flat fee of $80 – $100 is available to reset the account balance without changing the billing cycle. |

FTMO’s one-time, refundable evaluation fees present a very appealing offer. If you are confident in your ability to pass, the cost effectively becomes zero after your first payout. This model rewards success and makes the initial investment feel more like a security deposit than a sunk cost.

Apex’s subscription model is designed for flexibility. It allows traders to keep an evaluation account open for as long as needed without a hard deadline. This is beneficial for those who may need more than a month to pass, but the costs can add up over time. Their frequent and deep discounts on evaluation fees, often up to 90% off, can make this a highly affordable option, especially for the first month.

To avoid unexpected violations, traders should clearly understand the Apex consistency rule before managing evaluations or payouts. In some situations, it is also useful to know whether a funded Apex account can be reset instead of opening a new evaluation.

5. Payout structure: How and when do you get paid?

A prop firm’s payout process is the moment of truth. How frequently you can withdraw, the requirements you must meet, and any withdrawal limits are all critical factors in your decision.

FTMO follows a straightforward bi-weekly schedule. Apex offers a similar frequency but layers in additional performance requirements and initial withdrawal caps.

| Factor | FTMO | Apex Trader Funding |

|---|---|---|

| Payout Frequency | Bi-weekly. You are eligible for a payout every 14 calendar days. | Twice per month. After an initial 8 trading day period. |

| Payout Method | Bank transfer, Skrill, or crypto. | Deel (which supports Bank Transfer, PayPal, Revolut, Wise, Coinbase, and more). |

| Minimum Withdrawal | No official minimum. Payout is processed based on profits generated. | $500. |

| Initial Payout Rules | None. You receive your 80% split of all profits earned. | Capped. Max payout is limited for the first five withdrawals (e.g., $2,000 max on a $50K account). |

| Additional Rules | None. Profit is the only requirement. | Yes. Must meet the FTMO30% Consistency Rule FTMO and other criteria. |

FTMO’s payout system is built on simplicity and speed. Once you are funded, you can request your 80% share of the profits every two weeks without any complex calculations or additional rules. This direct approach is highly appealing for traders who want a clear and predictable income stream.

Apex offers a very attractive profit-sharing model, but with more initial complexity. While you get 100% of the first $25k, your first few withdrawals are capped, and you must adhere to consistency rules. This system is designed to reward long-term, disciplined traders, as all withdrawal caps are removed after the fifth successful payout, offering unlimited potential.

6. Support & education: Which firm offers better resources?

When you run into a technical issue or need guidance, the quality of a firm’s trader support becomes your lifeline. Similarly, high-quality educational resources can accelerate your learning curve and refine your strategy.

FTMO invests heavily in a polished, comprehensive suite of in-house tools and multi-channel support. Apex focuses on practical resources and a streamlined, ticket-based support system.

| Resource | FTMO | Apex Trader Funding |

|---|---|---|

| Customer Support | Multi-channel: Live Chat, WhatsApp, and Email, available 24/7 in multiple languages. | Ticket-based: 24/7 support primarily through a help desk ticketing system. |

| Educational Content | FTMO Academy, blog, webinars, and detailed performance analysis tools. | Extensive help center, webinars, and an FTMO Trading Tools section with partner resources and bootcamps. |

| Unique Tools | Account MetriX, Equity Simulator, Trading Journal, and Performance Coach apps. | Trade Copier software and a partnership with The Pit Discord community for live market insights. |

| Community | Official and active Discord server for traders to connect and learn. | Strong presence in various trading communities and an official partnership with a dedicated Discord group. |

FTMO provides a premium, all-in-one ecosystem. Their custom-built applications, like the Account MetriX and Equity Simulator, offer traders deep, data-driven insights into their performance. The multi-language, 24/7 live customer support ensures that help is always immediately accessible, creating a highly professional experience.

Apex offers a more practical, community-focused approach. While their support is primarily ticket-based, it is known for being effective. Their strength lies in providing functional tools like trade copiers and connecting traders with established educational partners and active communities, fostering a collaborative learning environment.

7. Which is easier to pass? FTMO vs Apex

Determining which evaluation is easier depends on whether you prioritize a lower profit hurdle or a more forgiving risk management structure. While Apex offers a faster route, FTMO provides a more stable environment for tracking losses.

To provide an objective answer, we must break down the ease of passing into three specific categories: the profit hurdle, the drawdown mechanics, and the time commitment.

7.1. Profit targets and evaluation steps

From a purely mathematical standpoint, Apex Trader Funding is easier to pass in terms of the total profit required.

- Apex: Requires a single 6% profit target in one step.

- FTMO: Requires a total of 15% profit across two steps (10% in Step 1 and 5% in Step 2).

If your strategy relies on hitting a target quickly without needing to prove consistency over two separate phases, Apex presents a lower barrier to entry.

7.2. Drawdown mechanics (The Difficulty Factor)

While Apex has a lower profit target, many traders find its Trailing Drawdown more difficult to manage than FTMO’s Fixed Drawdown.

- FTMO (Easier risk tracking): Uses a static maximum loss limit (10%). The floor stays at a fixed level based on your initial balance. This is predictable and easier for most traders to calculate.

- Apex (Higher technical difficulty): Uses a live trailing drawdown. As your unrealized profit increases, the drawdown floor moves up with it. If you have a trade that goes deep into profit and then reverses, you could hit your drawdown limit even if the trade is still in profit.

7.3. Speed vs. consistency

The ease of passing also relates to how much time you are required to trade.

| Factor | FTMO | Apex Trader Funding |

|---|---|---|

| Number of Steps | 2 Steps | 1 Step |

| Minimum Trading Days | 8 days total (4 per phase) | 7 days |

| Profit Target | 10% then 5% (Total 15%) | 6% (Total 6%) |

| Drawdown Type | Fixed (Easier to manage) | Trailing (Harder to manage) |

Easy is subjective to your experience level and market focus. Neither firm is designed to give away capital; they both test for specific types of trader competence.

- Choose Apex if you are an experienced Futures trader ONLY. Best for a fast 7-day sprint to funding using NinjaTrader or Tradovate. A live trailing drawdown applies, requiring precise risk control.

- Choose FTMO if you are a Forex, Crypto, or Index CFD trader. You prefer a structured environment where the rules are fixed, and the drawdown is static (does not trail). Includes strong educational support across a two-phase evaluation.

Ultimately, Apex is faster to pass, but FTMO is often considered safer because its risk rules are more transparent and don’t move against the trader during an open position.

8. Community feedback: FTMO vs Apex Reddit and Trustpilot reviews

A firm’s marketing promises one thing, but the unfiltered experiences of other traders often tell the real story. Looking at platforms like Trustpilot and Reddit gives us a valuable glimpse into the true strengths and weaknesses of each company.

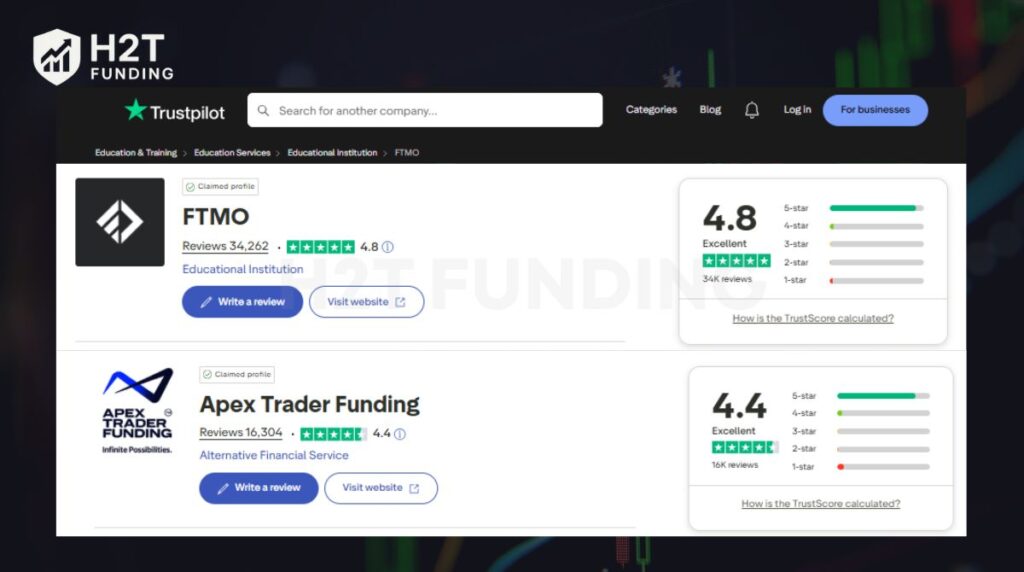

Both FTMO and Apex have thousands of reviews, showcasing their significant presence and global recognition in the industry. However, the tone and common themes in their feedback differ significantly. On Trustpilot, FTMO maintains an Excellent 4.8-star rating from over 34,000 reviews, a testament to its long-standing reputation. Traders consistently praise its professionalism, clear rules, and reliable payouts, solidifying its status as an industry benchmark.

Apex Trader Funding also holds a strong 4.4-star Excellent rating on Trustpilot. Their community often highlights the straightforward one-step evaluation and generous profit-sharing model as major advantages for experienced traders.

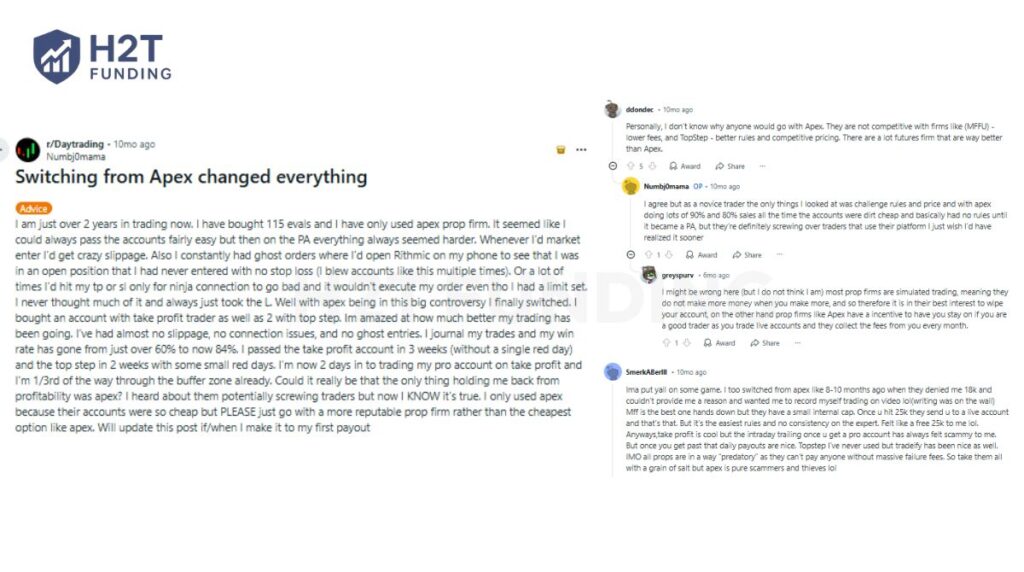

However, discussions on Reddit reveal a more nuanced picture. Some traders, like the one in the post below, report issues with trade execution and slippage on Apex’s platform, leading them to switch firms and find more consistent results elsewhere. This suggests that while many succeed, the trading environment may not be optimal for everyone.

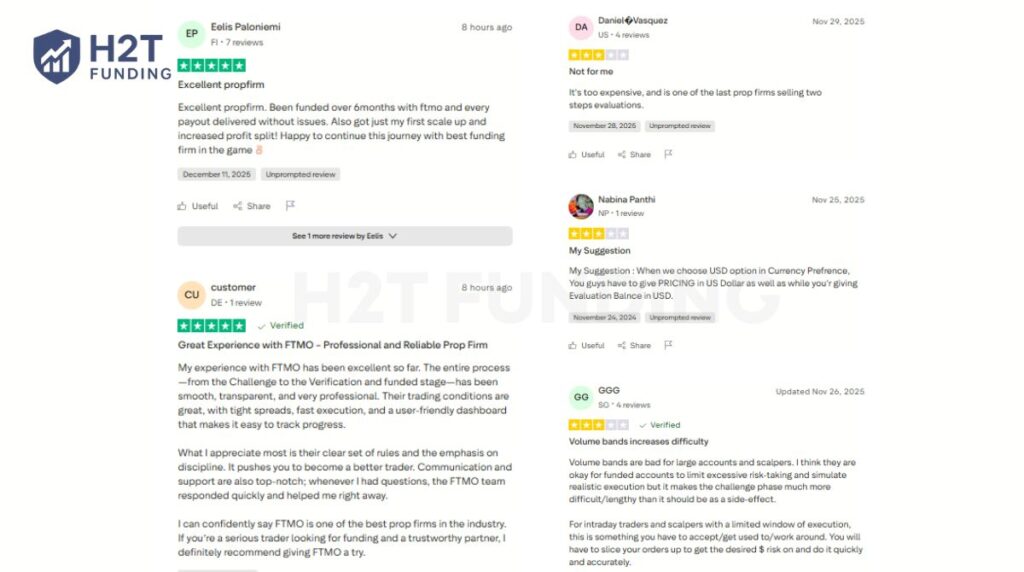

Conversely, positive feedback for FTMO often emphasizes the reliability of the entire process. Funded traders frequently report smooth, issue-free payouts and appreciate the supportive infrastructure, describing it as an FTMO professional and reliable experience.

Of course, no firm is perfect. Some traders find FTMO’s two-step evaluation and higher initial cost to be a significant barrier. This feedback highlights that FTMO’s structured, more expensive model isn’t a universal fit, especially for traders who prioritize speed and lower upfront costs.

To provide a transparent look at the operational reality of these firms, we have summarized the most frequent pain points reported by the community. While both firms are legitimate, they present different sets of challenges:

Apex Trader Funding hurdles:

- Trailing drawdown trap: The live trailing threshold follows your peak unrealized profit, which can prematurely fail an account during a volatile retracement.

- Technical execution: Traders often cite inconsistent fills and slippage during high-volume periods on the futures exchange.

- Support delay: The ticket-based system can lead to slower response times compared to live chat options.

FTMO Trading constraints:

- Rigid rules: Strict news trading restrictions on funded accounts and a hard 5% daily loss limit can feel overly punishing for aggressive strategies.

- Financial barrier: The higher upfront fee (non-subscription) is a larger initial investment compared to Apex’s frequent deep-discount model.

- Platform limits: As a CFD specialist, it lacks the direct exchange depth that professional futures traders may require.

Understanding these specific limitations is just as important as knowing the profit splits. By recognizing these friction points early, you can choose the firm whose rules best align with your tolerance for risk and technical requirements.

9. Which prop firm is right for your trading style?

The final decision isn’t about which firm is objectively best; it’s about which firm’s philosophy aligns with your personal trading styles, market preference, and risk tolerance.

FTMO offers a structured, secure path with a strong reputation, ideal for those who value predictability. Apex provides a faster, more flexible arena for confident traders who want fewer restrictions. Here’s who fits best where.

You should choose FTMO if you:

- Prioritize predictable risk. Their fixed 5% daily and 10% maximum loss limits are clear and never change, providing a stable trading environment.

- Mainly trade Forex and CFDs. Their platforms and instrument offerings are perfectly tailored for these markets.

- Value a structured evaluation. You see their two-step challenge as a fair test of consistency and discipline, not just a race to a profit target.

- Appreciate a strong, long-standing reputation. You want to partner with one of the most established and trusted names in the prop trading industry.

Apex is the better fit if you:

- You are a dedicated futures trader. Their platforms and rules are built from the ground up specifically for futures trading.

- Want the fastest path to funding. Their one-step evaluation gets you to a funded account more quickly.

- Need maximum flexibility. You want the freedom to trade during news events, hold positions over the weekend, and not worry about a daily loss limit.

- Are confident in managing a trailing drawdown. You can handle the dynamic nature of a live trailing drawdown in exchange for greater trading freedom.

If you’re still undecided, weigh these trade-offs:

- Fixed rules vs. trading freedom: Is the psychological safety of FTMO’s fixed drawdown worth more to you than the flexibility of Apex’s news trading rules?

- Upfront cost vs. subscription: Do you prefer a higher, one-time refundable fee (FTMO) or a lower, recurring monthly payment (Apex)?

- Evaluation style: Does a two-step consistency test (FTMO) feel more professional, or does a one-step profit sprint (Apex) better suit your confidence level?

To make this decision easier, the table below summarizes which prop firm best fits each trading style.

| Best Choice | Trader Type |

|---|---|

| FTMO | Forex & CFD trader |

| Prefers fixed risk limits and predictability | |

| Likes structured, step-by-step evaluations | |

| Avoids trading during major news | |

| Values long-term reputation and stability | |

| New or conservative prop trader | |

| Apex Trader Funding | Futures-only trader |

| Comfortable with live trailing drawdown | |

| Wants the fastest path to funding | |

| Trades news and weekends | |

| Needs maximum trading flexibility | |

| Experienced and aggressive trader |

Your answers will guide you to the right firm. We suggest considering trial accounts with FTMO or waiting for a deep discount from Apex to test their platform with minimal risk.

10. FAQs

The main difference lies in their target market and risk models. FTMO focuses on Forex/CFD traders with a 2-step evaluation and fixed drawdown rules. Apex caters to futures traders with a 1-step evaluation and a live trailing drawdown.

Apex’s 1-step challenge is faster, which some find easier. FTMO’s 2-step challenge has lower profit targets in the second phase, which others find less stressful. It depends entirely on your trading style and which rule set you find less restrictive.

Yes, Apex Trader Funding has a long track record of paying out successful traders. Like all legitimate prop firms, they process payouts as long as the trader has followed all the rules, including consistency and withdrawal requirements.

This rule, also known as the windfall rule, states that your single best trading day cannot account for more than 30% of your total profit when you request a payout. It ensures traders are consistently profitable, not just getting lucky with one big trade.

With Apex, yes. You are generally allowed to trade during news and hold positions over the weekend. With FTMO’s standard account, both are restricted to a funded account. You would need their Swing account type for that freedom.

Both firms are known for reliable and timely payouts. FTMO typically processes payouts within 8 hours of the request on their bi-weekly schedule. Apex processes requests on a similar twice-per-month schedule, usually within a few business days.

FTMO is often considered better for beginners due to its structured rules and extensive educational resources. The fixed daily loss limit can prevent catastrophic mistakes, and the FTMO Academy provides a solid learning foundation.

Yes, both firms generally permit the use of EAs and copy trading. However, your strategy must be unique and follow all firm rules. High-frequency bots or duplicated strategies used by large groups are not allowed.

Yes, but through a specific partnership. FTMO offers its services to US residents via the FTMO US program, which operates in collaboration with OANDA. This version uses different trading platforms (not MT4/cTrader) and has tailored processes to comply with US regulations.

Better depends on your needs. For futures trading, firms like Apex may be better due to their specialized rules. For forex, competitors exist, but FTMO remains a top-tier benchmark for its reputation, support, and reliable payouts.

Absolutely. FTMO is one of the most reputable firms in the industry with a very long history of consistent and reliable payouts to thousands of funded traders worldwide. Their high Trustpilot score reflects this reliability.

No. FTMO requires a minimum of 4 trading days to pass each phase of their evaluation (Challenge and Verification). This rule ensures that traders demonstrate some level of consistency over time, not just a single lucky day.

11. Conclusion

The FTMO vs Apex decision is a defining choice between two proven but fundamentally different philosophies. FTMO represents the path of structure, discipline, and security, making it a fortress for risk-conscious Forex and CFD traders. Apex champions speed and flexibility, offering a direct, high-reward route for confident futures traders who thrive with fewer restrictions.

Ultimately, your success hinges on self-awareness. Ask yourself: Does your strategy require the predictable safety of fixed drawdowns, or the intraday freedom of no daily loss limit? Does a two-step evaluation feel like a professional rite of passage, or an unnecessary delay? Your honest answers to these questions will reveal the firm that is truly built for you.

At H2T Funding, our mission is to provide you with the clarity needed to make these critical career decisions. To continue your research and see how other firms stack up, we invite you to explore our full library of in-depth prop firm comparisons on the H2T Funding Blog.