Finding the best prop firms with highest profit split is about more than just chasing a percentage; it is about maximizing your take-home income safely. In 2026, industry leaders like The5ers (Forex) and Apex Trader Funding (Futures) are setting the standard, offering payouts that scale up to 100%.

However, a 100% profit split is rarely 100% in practice. In most prop firms, traders only access “full” payouts after clearing consistency rules, payout buffers, profit caps, or higher trading fees. A legitimate high-split firm is not defined by the percentage it advertises, but by how much profit you can actually withdraw under real trading conditions.

In this guide, the H2T Funding team ranks the top 9 legitimate firms for both Forex and Futures. We analyze their true net profit, payout reliability, and sustainability to help you choose the right partner for your financial growth.

Key takeaways

- The highest advertised profit split does not equal the most money withdrawn. Firms with strict consistency rules, payout buffers, or trailing drawdowns often reduce real take-home income despite offering 100%.

- The most reliable high-profit split prop firms in 2026 are The5ers, FundedNext, FundingPips, FTMO, and E8 Markets.

- Leading high-profit split firms include Apex Trader Funding, My Funded Futures, TradeDay, and Topstep.

- 100% profit split is real, but rarely from Day 1. It usually applies only after scaling milestones (The5ers, E8), first profit caps (Apex), or under restrictive payout conditions.

- The biggest hidden traps are not the split, but the rules. Consistency limits, buffer zones, high commissions, and trailing drawdowns are the main reasons traders fail to withdraw profits.

- Traders who keep the most money focus on sustainability. A stable 90% split with fast, reliable payouts often delivers higher long-term earnings than a restricted 100% model.

1. What does profit split mean in proprietary trading?

In simple terms, a profit split is the percentage of trading gains that a funded trader keeps, while the trading firm retains the remainder. For instance, in a standard 80/20 arrangement, if you generate $5,000 in profit, you receive $4,000, and the firm keeps $1,000.

This ratio forms the core profit-sharing model for most funding platforms. While the industry standard used to be 70%, competitive firms now offer between 80% and 90% from day one. Some even provide scaling opportunities that reach 100%, effectively waiving their cut entirely.

However, the percentage on the banner is not the only factor. You must calculate your true earnings retention. A firm offering a 90% split but charging high commissions or non-refundable challenge fees may actually pay you less than a firm with an 80% split and lower costs.

To understand why profit splits are structured this way, it helps to look at how prop firms actually make money, beyond just taking a percentage of trader profits.

2. Top 5 forex prop firms with highest profit split

In the highly competitive Forex market of 2026, prop firms are battling for talent by offering increasingly generous rewards. The industry standard has shifted, with top-tier firms now offering profit splits that start at 80% and scale all the way up to 100% for consistent performers.

Whether you are a scalper seeking raw spreads or a swing trader who needs weekend holding, these five firms offer flexible solutions. Together, they represent the highest standards in payout reliability and trading conditions. We have selected them based on their proven track record, community trust, and ability to sustain high payouts without hidden caveats.

Scroll down for our in-depth analysis of each firm’s pros, cons, and unique funding features.

The5ers

#1

Account Types

1-step, 2-step, 3-step

Trading Platforms

MT5, cTrader

Profit Target

5% – 10%

Our take on The5ers

The5ers stands out as a pillar of stability in the prop industry, operating successfully since 2016 with a high 4.8/5 Trustpilot rating. They offer a versatile ecosystem: the Hyper Growth (1-Step) for speed, High Stakes (2-Step) for balance, and the cost-effective Bootcamp (3-Step) for disciplined growth. This variety allows traders to select a path that strictly matches their budget and risk tolerance.

The firm’s biggest draw is the potential to earn a 100% profit split upon reaching specific performance milestones and advanced funding levels, rewarding long-term consistency over short-term luck. Payouts are processed reliably on a bi-weekly basis via Crypto or Bank Transfer. However, traders must pay close attention to the specific rule sets of each program, as risk limits vary significantly between models.

| 💳 Challenge Fee | $22 – $850 |

| 👥 Account Types | 1-step, 2-step, 3-step |

| 💰 Profit Split | 50% – 100% |

| 💵 Account Size | $2.5K – $250K |

| ⏱️ Time Limit | No time limit |

| 🎯 Profit Target | 5% – 10% |

| 📊 Trading Platforms | MT5, cTrader |

| 🛍️ Asset Types | Forex, Indices, Commodities, Crypto |

FundedNext

#2

Account Types

1-step, 2-step, and Instant Funding

Trading Platforms

MT4, MT5, cTrader, Match Trader

Profit Target

4% – 10%

Our take on FundedNext

FundedNext defines itself by speed and incentives, boasting a 24-hour payout guarantee (avg. 5 hours) and offering a unique 15% Performance Reward from the challenge phase. Their ecosystem includes models such as Stellar 1-Step, 2-Step, and the distinct Stellar Instant, which replaces a fixed Daily Loss Limit with a trailing drawdown model designed for aggressive traders.

The firm offers a high ceiling for growth, with profit splits scaling up to 95%. In addition, the “Lifetime Payout” guarantee ensures you never need to requalify for the same account. They support a wide range of platforms, including MT4, MT5, cTrader, and Match-Trader, alongside flexible withdrawal options like USDT and RiseWorks to ensure smooth cash flow.

However, recent market developments and user feedback from January 2026 highlight concerns about instability. Verified reports cite platform desyncs where traders could not manually close trades during volatility, while support allegedly closed tickets without resolution. Additionally, swing traders have faced “policy volatility,” with sudden, temporary restrictions on weekend holding disrupting active strategies.

| 💳 Challenge Fee | $32 – $1,099 |

| 👥 Account Types | 1-step, 2-step, and Instant Funding |

| 💰 Profit Split | 80% – 95% |

| 💵 Account Size | $2K – $200K |

| ⏱️ Time Limit | No time limit |

| 🎯 Profit Target | 4% – 10% |

| 📊 Trading Platforms | MT4, MT5, cTrader, Match Trader |

| 🛍️ Asset Types | Forex, Indices, Commodities, Crypto, CFDs |

Funding Pips

#3

Account Types

1-step, 2-step, and Instant Funding

Trading Platforms

MT5, cTrader, Match Trader

Profit Target

5% – 10%

Our take on Funding Pips

FundingPips offers the industry’s most versatile “Pay-for-Patience” model, allowing traders to choose between speed and profit percentage. You can opt for rapid cash flow via the Tuesday Payday (60% split), or maximize your income by waiting for the Monthly Reward to unlock a 100% profit split. For high-performers, the On Demand (90% split) option is ideal, provided you meet the strict 35% consistency requirements (no single day accounting for >35% of profit).

Accessibility is a major strength here. FundingPips supports a vast array of payment methods, including Credit/Debit Cards, Crypto (USDT, USDC, BTC), and local options like Skrill and Neteller, making it easy for traders globally to join. Their pricing remains aggressively low (e.g., $219 for a $50k account), positioning them as a top value contender in 2026.

However, technical precision remains a point of contention. While onboarding is smooth, verified user reports from January 2026 highlight price feed discrepancies where charts on the dashboard occasionally desync from TradingView, leading to confusion over daily loss breaches. Traders using the “On Demand” payout must also be vigilant about the 35% consistency rule, as a single lucky trade can disqualify you from an immediate withdrawal.

| 💳 Challenge Fee | $29 – $555 |

| 👥 Account Types | 1-step, 2-step, and Instant Funding |

| 💰 Profit Split | 80% – 100% |

| 💵 Account Size | $5K – $100K |

| ⏱️ Time Limit | No time limit |

| 🎯 Profit Target | 5% – 10% |

| 📊 Trading Platforms | MT5, cTrader, Match Trader |

| 🛍️ Asset Types | FX, Metals, Indices, Energy, Crypto, CFD |

FTMO

#4

Account Types

2-step

Trading Platforms

MT4, MT5, cTrader, DXTrade

Profit Target

5% – 10%

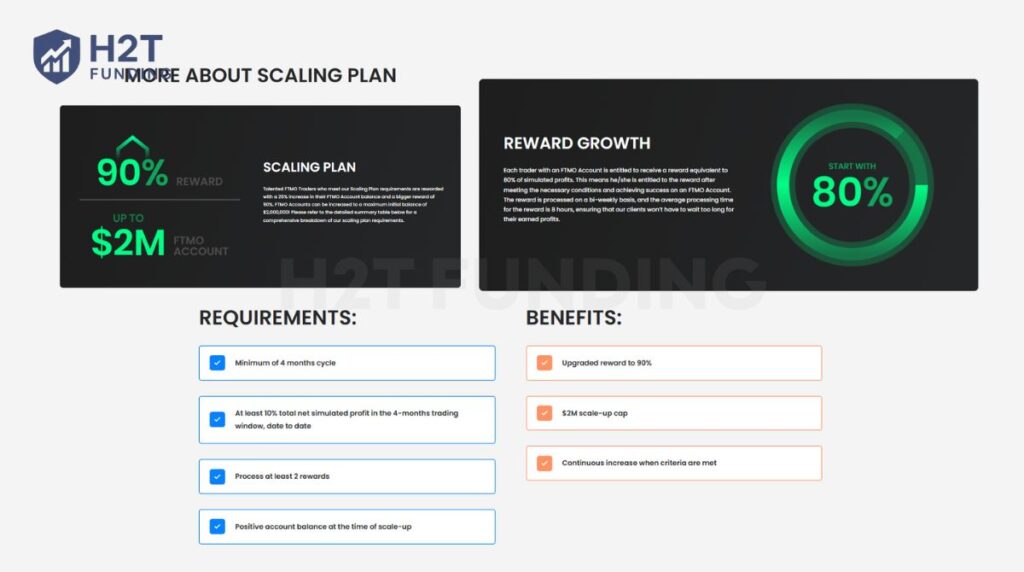

Our take on FTMO

FTMO is widely considered the “Gold Standard” of proprietary trading, operating highly regarded since 2015 with over 36,000 verified Trustpilot reviews. While many firms compete on high-risk, aggressive models, FTMO focuses on stability and professional growth.

Their standard profit-sharing structure starts at 80%, which is lower than some newer competitors, but their Scaling Plan allows consistent traders to upgrade this to 90%. To unlock this higher tier, you must achieve a 10% net profit over a 4-month cycle and process at least two payouts.

The infrastructure here is well-established. FTMO offers a massive $2,000,000 scaling cap and processes rewards on a bi-weekly basis with an average processing time of just 1-2 days. They support a wide range of payment methods, including Credit Cards, Crypto, and Skrill, ensuring global accessibility (though Bank Transfers are restricted in sanctioned regions like Venezuela and Russia).

FTMO provides 24/7 support in 20 languages and follows a robust two-step evaluation structure. With a 10% profit target in Phase 1 and 5% in Phase 2, it remains a safe choice for traders who prioritize fund security over “get rich quick” schemes.

| 💳 Challenge Fee | €89 – €1,080 |

| 👥 Account Types | 2-step |

| 💰 Profit Split | 80% – 90% |

| 💵 Account Size | $10K – $200K |

| ⏱️ Time Limit | No time limit |

| 🎯 Profit Target | 5% – 10% |

| 📊 Trading Platforms | MT4, MT5, cTrader, DXTrade |

| 🛍️ Asset Types | Forex, Commodities, Indices, Stocks, Crypto |

E8 Funding

#5

Account Types

1-step

Trading Platforms

MT5, cTrader, Match Trader, TradeLocker

Profit Target

6%

Our take on E8 Funding

E8 Markets positions itself as the “Tech Leader” of the industry, having paid out over $65 million since 2021. Their defining feature is the E8 One account, which offers unprecedented customization.

Unlike rigid competitors, E8 allows you to “build your own challenge” by selecting your starting capital (up to $500k) and increasing your Drawdown limit up to 14%. This flexibility is perfect for aggressive trading styles that need wider breathing room and are willing to pay a premium for it.

The firm incentivizes high performance with a profit split that scales from 80% up to 100%. Payouts are processed efficiently via Rise (Crypto/Cash) or Plane (Bank Transfer), ensuring global access with zero commission charges from the firm’s side.

However, getting that payout requires navigating complex logic. You must follow a “Best Day Rule”, meaning no single trading day can account for more than 35–40% of total profit. In addition, maintaining a “Payout Buffer” adds extra difficulty compared to simpler firms.

More alarmingly, some traders have accused the firm of “market manipulation,” claiming their winning positions were manually cut during volatility. While E8 Support is responsive, these reports suggest a need for caution regarding execution quality.

| 💳 Challenge Fee | $40 – $4,460 |

| 👥 Account Types | 1-step |

| 💰 Profit Split | 80% – 100% |

| 💵 Account Size | $5K – $500K |

| ⏱️ Time Limit | No time limit |

| 🎯 Profit Target | 6% |

| 📊 Trading Platforms | MT5, cTrader, Match Trader, TradeLocker |

| 🛍️ Asset Types | Forex, Commodities, Indices, Crypto, Energy, and Futures |

Selecting the right partner depends entirely on your specific goals, whether you prioritize rapid income, long-term scaling, or maximum fund security. Based on our analysis of the 2026 market data, here are our specific recommendations for each trader profile:

- If you are a career trader aiming for massive capital, choose The5ers. Their Hyper Growth plan includes a rare scaling mechanism that doubles your account size at each milestone, such as from $10k to $20k. This structure provides a direct path up to a 100% profit split.

- If you prioritize immediate cash flow and speed, choose FundedNext. They are a top choice for speed, with a 24-hour payout window, and are among the few firms offering a 15% profit share generated during the challenge phase itself.

- If you are on a budget but want frequent withdrawals, choose FundingPips. They provide exceptional market value with entry costs around ~$164 for a $50k account and a “Tuesday Payday” option that facilitates weekly cash flow.

- If fund security is your primary concern, choose FTMO. They have a proven track record dating back to 2015, supported by thousands of verified reviews. As a result, they remain a top choice for traders who prioritize stability and reliable liquidity over high leverage.

- If your strategy requires extra breathing room, choose E8 Markets. Their “E8 One” account stands out by allowing you to customize risk parameters, giving you the option to increase Maximum Drawdown limits up to 14% to handle volatile market conditions.

3. Top 4 futures prop firms with the highest profit split

Futures’ proprietary trading offers a streamlined path to capital, often featuring simpler 1-step evaluations and the industry’s most aggressive payout structures. In 2026, the leading firms distinguish themselves by allowing traders to keep 100% of their initial profits (typically the first $10,000 to $25,000) before switching to a generous 90/10 split.

Unlike Forex firms that often require months of scaling to reach top-tier rewards, these Futures firms prioritize immediate cash flow. We have ranked the top 4 contenders that combine these massive payout percentages with reliable execution platforms (like Rithmic and Tradovate) and fair drawdown rules.

Explore our detailed breakdown of the top Futures funding programs below.

My Funded Futures

#1

Account Types

1-step

Trading Platforms

Tradovate, NinjaTrader 8, TradingView, Quantower, Volsys, Volumetricatrading

Profit Target

6%

Our take on My Funded Futures

My Funded Futures has revamped its lineup in 2026 with the Rapid Plan, which now features a 90% profit split and daily payout frequency. This model is built for speed, offering “Instant Payout Approvals” that can hit your wallet in as little as 1 minute. An advantage over competitors is the absence of daily drawdown limits on funded accounts, allowing you to trade volatile sessions without fear of arbitrary breaches.

Verified feedback from January 2026 is overwhelmingly positive regarding their technical support. Users report that connectivity issues between Tradovate and TradingView are resolved rapidly, often within minutes. Furthermore, the firm offers a transparent transition to “Live Accounts” for traders who demonstrate consistent high performance or hit specific profit milestones.

However, traders must understand the Buffer Rule. To unlock full withdrawals on Pro and Rapid plans, you must build a profit cushion (e.g., $2,100 on a 50k account). If you choose to withdraw funds while still within this buffer zone, your profit split is penalized and drops to 60%, incentivizing you to compound your account first.

| 💳 Challenge Fee | $77 – $477 |

| 👥 Account Types | 1-step |

| 💰 Profit Split | 80% |

| 💵 Account Size | $50K – $150K |

| ⏱️ Time Limit | No time limit |

| 🎯 Profit Target | 6% |

| 📊 Trading Platforms | Tradovate, NinjaTrader 8, TradingView, Quantower, Volsys, Volumetricatrading |

| 🛍️ Asset Types | Futures Contracts |

Apex Trader Funding

#2

Account Types

1-step

Trading Platforms

Tradovate, Rithmic, WealthCharts

Profit Target

6%

Our take on Apex Trader Funding

Apex Trader Funding dominates the Futures market with a volume-centric model designed for scaling. Traders can operate up to 20 accounts simultaneously, keeping 100% of the first $25,000 in profits per account and 90% thereafter. This structure allows for exponential income growth without the need to climb complex ladder systems found in Forex firms.

The evaluation is a straightforward 1-Step process requiring a minimum of 7 trading days. A major advantage is the absence of daily drawdown limits, providing significant flexibility for volatile intraday strategies. However, traders must be disciplined with the “Trailing Threshold,” a unique drawdown rule that follows unrealized profits until a specific buffer is established.

While the profit potential is immense, the administrative side requires patience. Payouts are processed on a specific schedule (requestable every 8 days), and large withdrawals often trigger manual reviews or a request for trading video verification. Furthermore, the firm enforces strict payment policies, accepting only credit/debit cards that match the account holder’s name, with no option for Crypto deposits.

| 💳 Challenge Fee | From $196 |

| 👥 Account Types | 1-step |

| 💰 Profit Split | 90% – 100% |

| 💵 Account Size | $25K – $300K |

| ⏱️ Time Limit | No time limit |

| 🎯 Profit Target | 6% |

| 📊 Trading Platforms | Tradovate, Rithmic, WealthCharts |

| 🛍️ Asset Types | Equity Indices, Currencies, Commodities, Interest Rates, Crypto |

TradeDay

#3

Account Types

Intraday, End of Day (EOD), and Static evaluation

Trading Platforms

NinjaTrader 8, Tradovate, Jigsaw Trading, TradeDayX

Profit Target

2.5% – 6%

Our take on TradeDay

TradeDay differentiates itself by focusing on professional development rather than just selling evaluations. Established in 2020, they offer a clear “Path to Live Funding,” meaning successful traders eventually trade real capital, not just simulations. Their Best Payout Policy is a standout feature, allowing for Day One Payouts once the buffer is cleared. The profit split structure is tiered to reward longevity: starting at 80% for the first $50k, rising to 90%, and capping at 95% once you’ve withdrawn over $100k in lifetime profits.

Flexibility is a core strength. TradeDay provides three evaluation types: Intraday (trailing drawdown), End of Day (EOD trailing), and Static (fixed drawdown), catering to different risk management styles. Entry costs are competitive (e.g., $125 for a $50k Intraday account), and crucially, there are no activation fees upon passing.

While the “Day One Payout” is attractive, traders must understand the Buffer Zone. You must build a profit cushion (e.g., $2,000 on a $50k account) before withdrawing full amounts. Withdrawing while inside this buffer reduces your split to 50%. However, the firm’s commitment to education is well-established, offering free 1-on-1 coaching, daily market research, and a comprehensive ebook library, making it ideal for traders looking to upskill.

| 💳 Challenge Fee | $125 – $375 |

| 👥 Account Types | Intraday, End of Day (EOD), and Static evaluation |

| 💰 Profit Split | 80% – 95% |

| 💵 Account Size | $50K – $150K |

| ⏱️ Time Limit | No time limit |

| 🎯 Profit Target | 2.5% – 6% |

| 📊 Trading Platforms | NinjaTrader 8, Tradovate, Jigsaw Trading, TradeDayX |

| 🛍️ Asset Types | Futures Contracts |

Topstep

#4

Account Types

2-step

Trading Platforms

TopstepX

Profit Target

6%

Our take on Topstep

Topstep is arguably the most famous name in Futures prop trading, with a history spanning over 12 years. They have simplified their process to a single rule: “1 Rule. 1 Goal.” Pass the Trading Combine (min. 2 days) and get funded. Their payout policy is incredibly trader-friendly: once you accumulate 30 winning days of $150+ across your accounts, you unlock 100% of your profits. Even before that, you get a 90/10 split and can request payouts of up to 50% of your balance after just 5 winning days.

Speed is a key theme here. Topstep offers Live Daily Payouts for consistent traders and processes withdrawals daily, often deducting funds instantly so you can keep trading without interruption. They also provide free coaching, a massive Discord community, and the ability to trade up to 5 “Express Funded Accounts” simultaneously.

However, recent technical feedback from January 2026 is concerning. While support agents receive high praise, some traders report significant data lag on Topstep’s new exchange feed, leading to profit discrepancies (e.g., charts showing $500 profit but closing at $40). Additionally, there are complaints about unresolved technical issues even after submitting video proof, suggesting their infrastructure might be straining under high volume.

| 💳 Challenge Fee | $49 – $149 |

| 👥 Account Types | 2-step |

| 💰 Profit Split | 90% – 100% |

| 💵 Account Size | $50K – $150K |

| ⏱️ Time Limit | No time limit |

| 🎯 Profit Target | 6% |

| 📊 Trading Platforms | TopstepX |

| 🛍️ Asset Types | Futures Contracts |

Choosing a Futures partner in 2026 comes down to whether you prioritize scaling volume, educational support, or rapid withdrawals. Based on our analysis of payout structures and recent user feedback, here are our specific recommendations:

- If you want to trade massive volume and scale aggressively, choose Apex Trader Funding. Their model allows you to copy-trade across 20 accounts simultaneously, meaning a single winning trade is multiplied twenty-fold. Plus, keeping 100% of the first $25k per account is an unbeatable cash incentive for starters.

- If you need daily cash flow and dislike daily drawdowns, choose My Funded Futures. Their Rapid Plan offers daily payouts and zero daily drawdown limits. This makes it ideal for intraday traders who want to withdraw profits quickly without the pressure of strict daily loss rules.

- If you are a developing trader who values education and career growth, choose TradeDay. Unlike “churn and burn” firms, they invest in you with 1-on-1 coaching and premium research. Their clear path to trading real capital (not just sims) makes them the best choice for building a long-term professional career.

- If you want a simplified process and community support, choose Topstep. Their “1 Rule, 1 Goal” philosophy removes complexity, and their Live Daily Payouts reward consistent winners instantly. The widely recognized community and educational resources provide a safety net that newer firms cannot match.

4. The reality of 100% profit split: Marketing vs. truth

Seeing a 100% profit split offer is naturally attractive. While it doesn’t automatically mean a firm is illegitimate, it does indicate a fundamentally different business model compared to the standard 80/20 or 90/10 structures.

In the futures market, a 100% profit split is often used as a promotional incentive or as a reward for the first $10,000 in profits. That said, traders should always ask a critical question: how does the firm sustain this payout if it isn’t taking a share of your profits?

As highlighted in the discussion above, many modern firms operate under a simulated execution model. In this setup, when a firm pays out 100% of a trader’s profits, its revenue is generated almost entirely from challenge fees and account resets from failed evaluations.

This creates a delicate balancing act. To remain profitable while offering a full profit split, firms often impose stricter trading rules. These include trailing drawdowns based on unrealized profits, which can significantly increase the risk of account failure.

A 100% profit split can be an excellent opportunity, but it requires caution. Always read the fine print, especially regarding drawdown mechanics and payout conditions. In many cases, a sustainable 90% split with more flexible rules can deliver better long-term cash flow than a heavily restricted 100% account.

Always read the fine print, especially regarding drawdown mechanics, payout conditions, and take time to understand how to choose the right prop firm before committing capital.

5. What traders should look for beyond the profit split

A profit split looks great on a dashboard, but it is meaningless if the money never reaches your bank account. To truly judge a prop firm’s value, you must look beyond the 90% sticker and analyze the infrastructure supporting it.

5.1. Payout frequency and withdrawal conditions

Your goal is consistent cash flow, not just a one-time jackpot. The best firms now offer weekly or bi-weekly payout frequencies, allowing you to reinvest and compound your earnings more quickly.

Pay close attention to payout speed. In 2026, a 2-week waiting period will be obsolete. Leading firms process withdrawals in under 24 hours, giving you immediate access to your funds.

Also, check the withdrawal conditions. Avoid firms that enforce hidden “buffer zones” or minimum profit thresholds that make it technically difficult to request your hard-earned money.

Payout frequency and withdrawal speed vary widely depending on how funded trading accounts are structured at each firm.

5.2. Transparency and trader support

True transparency isn’t just about listing fees; it is about proving solvency. We recommend checking independent tracking platforms like PayoutJunction, where you can verify real payout records and trader reputation.

If a firm hides its payout history, view it as a red flag. Additionally, test their trader support before buying a challenge. When a payment issue arises, you need a responsive human team, not an automated bot spinning in circles.

5.3. Trading freedom and style restrictions

Trading freedom goes beyond just allowing EAs or news trading. The highest hidden cost in many firms is the “payout freeze”, where your account is locked while a withdrawal is processed.

A true trader-first firm ensures zero downtime. You should be able to continue executing your trading strategy immediately after requesting a payout. Breaking your momentum to wait for administrative processing is a silent profit killer.

6. How we rated these high-paying prop firms

To ensure a fair, objective, and trader-focused ranking, we evaluated each high-paying prop firm using a consistent set of criteria. Our assessment prioritizes long-term profitability, rule transparency, and real payout potential, rather than headline-grabbing profit splits alone.

6.1. Profit split & payout structure

We examined the advertised profit split (90%, 100%, etc.), but more importantly, how realistic and sustainable that split is. Firms with hidden payout caps, delayed withdrawals, or conditional profit sharing were scored lower.

6.2. Drawdown rules & risk constraints

Drawdown mechanics play a critical role in a trader’s survival. We closely analyzed:

- Trailing vs. static drawdowns

- Whether drawdowns are calculated from balance or equity

- How unrealized profits impact risk limits

Firms with trader-friendly, clearly defined risk rules ranked higher.

6.3. Evaluation & challenge difficulty

We assessed how achievable the evaluation process is by reviewing:

- Profit targets

- Time limits (or lack thereof)

- Consistency rules and minimum trading days

Overly restrictive or statistically unrealistic challenges negatively impacted scores.

6.4. Fees, resets & cost transparency

Since many firms rely on fee-based revenue models, we evaluated:

- Upfront challenge fees

- Reset costs after failure

- Refund policies

Firms with transparent pricing and fair reset structures ranked more favorably.

6.5. Payout reliability & withdrawal speed

A high profit split means little without reliable payouts. We reviewed:

- Minimum payout thresholds

- Payout frequency

- Historical reports from traders regarding withdrawal success and delays

Firms with consistent, timely payouts received higher ratings.

6.6. Trading conditions & platform quality

We examined the overall trading environment, including:

- Spreads, commissions, and slippage

- Available platforms (MT4, MT5, cTrader, NinjaTrader, etc.)

- Execution model (simulated vs. live)

Better trading conditions and stable infrastructure improved rankings.

6.7. Scaling plans & capital growth

We evaluated whether firms offer:

- Account scaling programs

- Increased capital after consistent performance

- Clear rules for progression

Firms that reward long-term consistency ranked higher.

6.8. Reputation, transparency & trader feedback

Finally, we considered:

- Company transparency and rule clarity

- Community feedback from experienced traders

- Patterns of complaints related to rule enforcement or payouts

Firms with strong reputations and consistent trader satisfaction scored best.

Rather than rewarding firms with the highest advertised numbers, our rankings favor prop firms that offer a realistic path to sustained profitability. A well-balanced 90% split with flexible rules often outranks a restrictive 100% profit split with aggressive drawdowns.

7. How to maximize your earnings retention with prop firms

Securing a 90% split is a great start, but true wealth building comes from optimizing what you keep. Here is how professional traders at H2T Funding maximize their bottom line.

7.1. Prioritize capital growth over split percentage

A clear real-world example can be seen in FTMO’s standard $100,000 challenge and scaling plan. Under FTMO’s publicly documented scaling rules, traders who stay profitable and respect risk limits over consecutive payout cycles can scale their accounts by 25% every four months. The profit split structure remains unchanged.

In practice, this means:

- A trader starting with a $100,000 funded account at an 80–90% profit split

- After consistent performance, the account scales to $125,000, then $156,250, and continues compounding over time

- Without increasing strategy risk, buying power grows purely through capital allocation, not higher leverage

At that point, earning even 2–3% per month on a scaled account results in materially higher cash payouts than a short-lived 100% split on a small, non-scalable account. This is why experienced traders prioritize firms with clear, fast, and achievable scaling frameworks over marginal differences in profit split percentages.

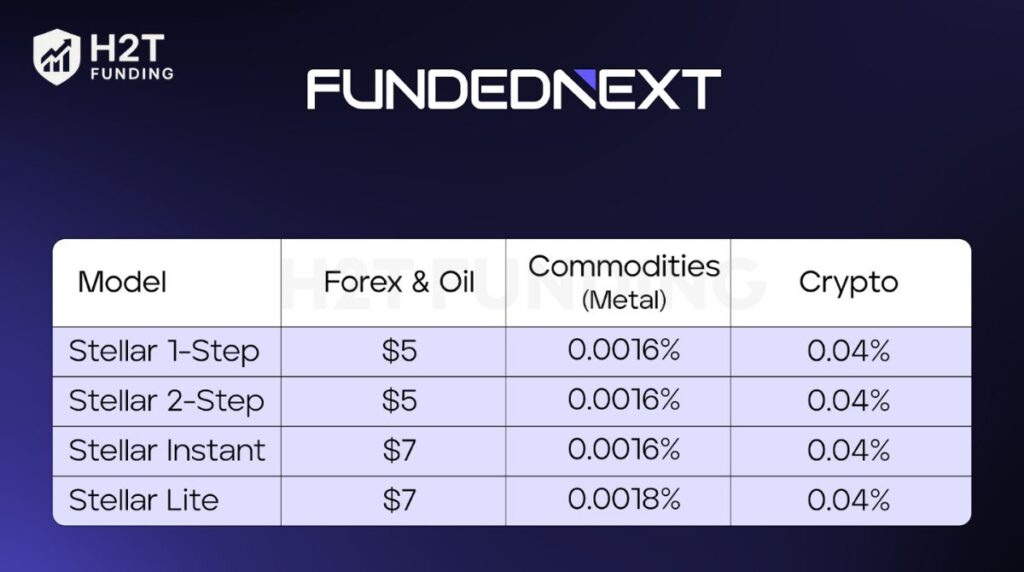

7.2. Minimize trading costs

Spreads and commissions directly impact your net profit. A firm offering a 100% split may charge $7 per lot, while a 90% split firm might charge $3–$5 per lot. This is why choosing Raw Spread accounts is critical; otherwise, transaction costs quietly eat into your margins.

A clear real-world example can be seen with FundedNext’s Stellar models, where commissions are publicly listed:

- Stellar 1-Step & 2-Step: $5 per lot on Forex

- Stellar Instant & Stellar Lite: $7 per lot on Forex

This means two traders earning the same gross profit can end up with very different net payouts purely due to transaction costs.

In practical trading terms:

- A trader executing 10 standard lots per day

- On a $5 commission model, it pays roughly $50/day in commissions

- On a $7 commission model, it pays roughly $70/day

- Over 20 trading days, that’s a $400 difference per month

- Over multiple payout cycles, commissions alone can exceed the difference between a 90% and 100% profit split

This is why raw-spread access matters more than headline percentages. As confirmed in FundingPips’ RAW spread documentation, Forex, Metals, and Crypto are traded with raw spreads, but commissions vary by model. Indices and Oil may appear cheaper due to commission-free pricing, yet Forex traders bear the true cost through per-lot fees.

Experienced traders, therefore, prioritize:

- Lower, fixed commissions on RAW spreads

- Models where commission does not increase in exchange for faster funding

- Net profitability over marketing-driven profit split numbers

When evaluated correctly, a 90% split with $5 commissions often produces higher retained earnings than a 100% split paired with $7 commissions, especially for intraday and high-frequency strategies.

7.3. Diversify your portfolio

Never keep all your eggs in one basket. Use your first payouts to purchase challenges at different high-paying firms (e.g., one with FTMO, another with FundedNext). This protects your income; if one firm faces technical issues, your other accounts continue to generate revenue.

7.4. Treat trading as a business

To truly align with your financial objectives, view challenge fees as business investments. Reinvest a portion of your profits into new evaluations. This constant cycle of funding ensures you always have fresh capital ready to deploy, smoothing out the variance of monthly trading results.

Based on my experience, the most common mistake I see isn’t choosing the wrong firm; it’s “lifestyle creep.” I remember a talented trader who hit his first $5,000 payout and immediately spent it on a vacation. Two weeks later, he hit a bad streak and lost the account, with zero funds left for a reset.

Real retention isn’t just about the split the firm gives you; it’s about the buffer you build for yourself. Always use your first few payouts to buy “backup lives” (new challenges) before you spend a dime on luxuries. That is the only secret to staying in this game forever.

8. FAQs

The5ers (Forex) and Apex Trader Funding (Futures) currently offer the highest potential payouts. The5ers allows you to scale up to a 100% profit split on their Hyper Growth accounts. In the Futures market, Apex lets you keep 100% of the first $25,000 in profits per account, offering the most generous upfront cash flow.

Yes, but usually only after specific milestones. Firms like The5ers unlock a 100% split only after you scale your account significantly. Apex Trader Funding offers 100% on the initial $25k profit as a promotion. Be cautious of any new firm offering a “lifetime 100% split” from Day 1 without conditions, as this model is often unsustainable.

Forex firms typically start lower (80%) and scale up to 100% based on long-term consistency. Conversely, Futures firms often start high (100%) for the first few thousand dollars to incentivize new traders, then revert to a standard 90/10 split for all subsequent withdrawals.

It ranges from 1 minute to 14 days. Modern firms like My Funded Futures and FundedNext offer automated payouts processed within hours (or even minutes). Traditional leaders like FTMO still adhere to a bi-weekly (14-day) payout cycle for the first withdrawal.

Yes. To protect their capital, high-paying firms often enforce stricter rules. For example, FundingPips requires a 35% consistency score (no single day > 35% profit) for on-demand payouts. Futures firms often use a “Buffer Zone,” penalizing your profit split if you withdraw before building a safety cushion.

A Payout Buffer is a mandatory profit cushion (e.g., $2,000) found mostly in Futures firms like TradeDay. If you withdraw funds before clearing this buffer, the firm penalizes you by drastically reducing your profit split (e.g., from 90% down to 50% or 60%) for that specific withdrawal.

This is specific to Futures prop firms. Unlike Forex firms that usually refund your entry fee, Futures firms charge a one-time “Activation Fee” (typically $85 – $150) to cover real-time data feeds and platform licenses before setting up your funded account.

Choose Apex Trader Funding if you are a short-term trader, as it gives you 100% of the first $25,000. However, for long-term career trading, FTMO or The5ers often yield more “take-home money” because they lack the predatory trailing drawdown rules that cause account failures in high-leverage futures firms.

9. Conclusion

Selecting the best prop firms with highest profit split in 2026 requires looking beyond the marketing numbers. While a 100% profit split is the ultimate goal, it often comes with stricter drawdown rules or “buffer zones” that can hinder your actual cash flow.

Whether you choose the rapid scaling of The5ers (Forex) or the high-volume model of Apex Trader Funding (Futures), your priority must always be solvency over percentages. A reliable 90% payout that arrives in your bank account is infinitely more valuable than a theoretical 100% split trapped in a firm with technical desyncs.

If you are still confused about your choice, dive deeper into our detailed comparisons and real-time rankings in the Best Prop Firms category at H2T Funding. We constantly update our reviews to help you find a funding partner that scales with your ambition.