When you first hear about prop trading firms, they seem like a big opportunity in online trading, offering access to large capital and clear profit-sharing. However, they also come with investment risks that many new traders don’t fully recognise enough to make many people search are prop firms legit before getting started. That’s why thousands of traders still wonder whether prop firms are truly legitimate or just sophisticated simulations.

In this guide, H2T Funding takes a clear, experience-based look at how proprietary trading operates in practice, from evaluation challenges to funding models, while also adding insights on financial education to help traders avoid hidden traps many firms never disclose.

Whether you’re trading Forex, futures, or stocks, this breakdown will help you tell the difference between real opportunities and risky promises before you invest time or money.

Key takeaways:

- Most prop trading firms are legit, but their funding models vary; some use simulated accounts, while others mirror real trades.

- Evaluation processes and risk management rules are what separate real firms from scams.

- Be cautious with firms that use unclear profit targets, drawdown limits, or payout terms; understanding trading limitations is an essential part of scam prevention for every trader.

- Forex and futures prop firms differ in regulation, trading environments, and how they manage trading accounts and capital allocation within each model.

- Top trusted names in 2026 include FTMO, The 5%ers, Ment Funding, Alpha Capital Group, and FundedNext.

- Always research user reviews, transparency, and a firm’s Prop firm payout history and withdrawal process before joining.

- Prop firms can be worth it if you value structure, discipline, and the chance to trade large capital without personal risk.

1. What are prop firms, and how do they work?

A proprietary trading firm (prop firm) is a company that lets traders use its capital to trade the markets and share profits based on performance. Instead of risking personal savings, traders pay for an evaluation to prove skill, discipline, and risk control before receiving funded capital.

Once you pass the evaluation, the firm gives you access to a live or simulated account and pays you a profit split (often 70–90%). If you lose, your downside is limited to your challenge fee; you never owe the firm money, which makes prop trading a safer alternative to trading your own funds.

Basic model (Simple breakdown):

- Evaluation: Hit the profit target and stay within daily loss and drawdown rules.

- Funding: Receive company capital with the same risk limits.

- Payout: Withdraw your profit share monthly or biweekly.

Market types:

- Forex Prop: FX pairs, gold, and indices – popular for retail traders.

- Futures Prop: CME futures – ideal for scalpers and day traders.

- Stock Prop: US equities – suited for experienced equity traders.

Why risk rules matter:

Prop firms use strict rules to ensure traders show real risk management, not luck. For example:

- Profit target: 10% on a $100,000 account = $10,000

- Max daily loss: 5% = $5,000

- Max drawdown: 10% = $10,000

If you follow your strategy with discipline and consistency, a prop firm can help you scale quickly without risking personal capital. If not, the rules will stop you before losses grow. If you want a data‑backed view of outcomes, read our breakdown of what percentage of day traders make money to understand success rates and realistic expectations.

Read more:

2. Are prop firms legit or just a simulation?

Are prop firms legit? Most prop firms are legitimate, but many use simulated accounts instead of real capital. You trade virtual money, and the firm mirrors or records your trades to evaluate consistency and risk management.

In many cases, even after passing the challenge, traders still trade in a simulated environment. The firm monitors performance, and if results are stable, they may later copy trades onto a real master account using company funds. This allows firms to limit risk and verify traders without exposing real money upfront.

These demo-style accounts replicate live market conditions with the same spreads, execution, and slippage, but no real funds move. Payouts come from the firm’s revenue, mainly evaluation fees and profit splits from successful traders. It’s a sustainable business model as long as transparency is clear.

Only a small group of consistent traders reach the stage where their trades are mirrored on live accounts. These traders typically hit clear performance milestones, maintain a positive track record for several months, follow drawdown rules, and show steady performance rather than one-time gains.

If you want a deeper way to evaluate your strategy’s stability, check our breakdown of what a good Sharpe Ratio is to see whether your performance meets prop-firm standards.

Trading on simulated accounts isn’t a scam by itself; it’s simply a risk-controlled setup. However, a prop firm must be transparent about whether the account is real or simulated. If a company hides this, delays payouts, or manipulates execution, that’s a red flag.

And if you’re wondering what realistic earning potential looks like, check our guide on how much a day trader can make to set accurate expectations before choosing a prop firm.

Legit prop firms are transparent about their trading structure. Simulated trading helps identify disciplined traders, while real-capital mirroring rewards those who prove long-term consistency.

3. Why do people doubt if prop firms are legit?

People doubt prop firms because many still wonder: Do prop firms actually payout, or is the whole thing just simulated trading dressed up as funding?

A big reason for the doubt is how many firms rely heavily on evaluation fees. In simple terms, when you fail a challenge, the firm earns. And once you notice that pattern, you start thinking, wait, who is really benefiting here?

I’ve also heard traders complain that their so-called funded accounts still run on demo servers. Using simulation isn’t necessarily wrong, but when a firm avoids explaining it clearly, you can’t help but question their intentions.

Another thing that fuels doubt is payout delays. Imagine having a great month, feeling proud, submitting your first withdrawal, and then hearing nothing for a week. That silence alone is enough to make anyone sceptical.

Some of the marketing out there also sounds too perfect: instant funding, huge profits, zero risk, and guaranteed consistency. If you have even a bit of trading experience, you know nothing in the markets works that smoothly, so these promises feel suspicious.

And then there are the horror stories shared on Reddit and Discord. I remember reading a post where a trader got his account terminated because of a data sync issue. At first, I laughed, but then I realised how worrying that must feel. When rules are vague, trust disappears fast.

4. How to know if a prop firm is legit (Step-by-Step)

If you want a simple way to check whether a prop firm is legit, this is the exact system I use. It’s quick, it works, and honestly, it saves you from a lot of headaches. I also checked what people say on are prop firms legit reddit because that’s where traders are brutally honest.

4.1. Step 1: Check legal info and reputation

Start by looking at the firm’s official website. Real firms list their address, business registration, and sometimes even their founders. If something feels off, trust that feeling. Then look for reviews on Trustpilot, Forex Peace Army, and even YouTube creators who show real experiences.

I usually check how long the firm has been around because, in my experience, anything running for more than two years tends to be more stable.

4.2. Step 2: Verify payouts and real payment history

Ask the community or search for actual payout proofs. Traders love to share screenshots and videos when they get paid. And you’ll notice legit firms aren’t shy about posting public proof of payment either.

I once watched a trader celebrate his first payout on a livestream, and the excitement on his face said everything. Real money does not lie.

4.3. Step 3: Read the rules carefully

Take a moment to check whether they explain their rules clearly. You want specifics: drawdown limits, refund conditions, scaling plans, and profit splits.

Real firms care about clarity because it reduces confusion. And if support replies quickly when you ask a simple question, that’s always a good sign.

4.4. Step 4: Watch for scam signals

Please stay away from any firm promising guaranteed profits or “instant funding with no test.” That’s not how trading works. Also, be careful with websites that list no real contact info or keep changing their terms quietly.

I once saw a firm promise 100 per cent win rates in their ad, and I remember thinking. Who falls for this? Sadly, a lot of beginners do.

If you follow these steps, you can spot a real prop firm long before you risk a dollar. It’s not complicated. You check the facts, look at how they treat traders, and trust your instincts. In the end, a legitimate firm always shows transparency, while a shady one always hides something.

5. Why aren’t prop firms regulated?

Prop firms avoid regulation because they trade their own capital, not client funds. That distinction places them outside the same financial laws that govern brokers or investment firms.

Unlike brokers, prop firms don’t take deposits from traders. They earn mainly from evaluation fees and profit splits, so legally they are not handling customer money. Many classify themselves as training or education providers, which keeps them outside financial supervision.

While this structure is legal, it also means traders receive very limited protection. If a firm holds your payout or terminates your account unfairly, there’s no regulator you can appeal to. That’s why transparency and reputation matter more than regulation in this space.

When assessing risks like this, you can apply a “safety buffer” mindset using the principles behind the margin of safety formula to protect your expectations and decision-making when dealing with prop firms.

Some countries, especially in the EU and the US, are beginning to monitor these programs more closely. For example, after the My Forex Funds case in 2023, regulators like the CFTC and Ontario Securities Commission started investigating how prop firms operate and advertise. Future rules may require registration or reporting standards.

Update 2026: the court dismissed the CFTC’s complaint in the MFF case, sending a clear message that the legal framework around retail prop firms remains highly contested.

Before joining any prop firm:

- Read their terms and refund policies carefully.

- Verify the company’s location and business registration.

- Check for clear payout procedures and public audit proofs.

And if you rely on EAs or automated systems, make sure your approach aligns with prop-firm rules by reviewing the best MQL5 strategies for prop firms before starting any challenge.

Prop firms are mostly unregulated because they manage internal capital, not clients’ money. That’s legal, but it puts the responsibility on traders to research each firm’s credibility, transparency, and payout history before signing up.

6. Common red flags and scam warnings

Let’s be honest: while many prop trading firms are legit, some play tricks that can cost traders real money. I’ve seen cases where people passed an evaluation process only to lose access days later due to vague rule violations. That’s frustrating, right?

- Vague or unclear rules: When a firm hides details about its profit target, drawdown limit, or time limit, that’s a sign to be cautious. Legit companies explain these upfront. If rules are buried in fine print or change mid-challenge, it’s not a good look.

- Fake or manipulated trading environment: Some shady firms use platforms that simulate bad slippage or change execution speeds to make you fail the challenge. Others run everything on demo servers and claim you’re trading real capital. There’s nothing wrong with simulation unless they lie about it.

- Unjust commissions or hidden fees: I once tested a firm that charged a trading fee after each payout request. That’s unusual. Legit forex prop firms and futures prop firms are transparent about trading commissions and the withdrawal process. If fees appear after you’ve passed, walk away.

- Poor customer support: Real firms respond quickly and clearly. Scams ignore emails, vanish from social media, or give robotic answers. When a company’s customer support disappears after you pay, that’s your cue.

- Unrealistic promises: If a company claims you can earn $10,000 in your first week or guarantees funding “without any trading challenge,” pause. Are there any legit prop firms offering instant funding? Yes, a few, but they’re upfront about the conditions. Scammers usually aren’t.

- Fake reviews or influencer hype: Some firms flood Trustpilot or forums with paid reviews. Others hire influencers to promote them with fake payout screenshots. Always double-check reviews on Reddit or ForexPeaceArmy; traders there don’t sugarcoat their experiences.

A good prop firm won’t pressure you with hidden rules or fake promises. They’ll show clear risk management policies, consistent payouts, and real trader feedback. When something feels off, trust your gut. Legitimate firms don’t need to hide behind fine print.

7. How to tell a legit prop firm from a fake one

Honestly, I’ve seen both sides of proprietary trading. Some firms treat traders fairly, while others bend the rules the moment you get close to a payout. So, how do you know which ones are real? Let’s break it down.

Ratings and reviews: What other traders say:

The easiest way to start is by reading prop firm reviews from real users. Check platforms like Trustpilot, Reddit, and ForexPeaceArmy. Don’t just look at star ratings, read the comments. If several traders complain about delayed payouts or “account termination for minor breaches,” that’s not a coincidence. In my experience, the most legit prop trading firms are open to criticism and respond to reviews publicly.

Transparency and website quality:

A professional website tells you a lot. Legit firms clearly list their evaluation process, profit target, drawdown limit, and time limit. Fake ones use vague terms like “flexible funding” or “instant funding” without specifics. If a firm hides its refund policy, trading fees, or withdrawal process, that’s a red flag.

Requirements and limitations:

Every Forex prop firm and futures prop firm sets limits, but they should make sense. Reasonable firms offer profit targets between 8 and 10%, daily loss caps around 4–5%, and risk management rules that encourage consistency. If you see unrealistic goals like “20% profit in 10 days,” it’s either a marketing trick or a trap.

Customer support and communication:

When you’re trading online, responsive customer support is everything. Send a quick test message before you pay for a challenge. Real companies reply in hours, not days. Some even have live chat or Discord communities with active traders. That’s a good sign of transparency and trader reputation.

Regulation and business registration:

Although most prop firms aren’t regulated like brokers, they should still be a legal entity. Check the footer for business registration or company number. You can also Google the founder’s name or LinkedIn profile. Firms that operate in silence or hide behind PO boxes often vanish overnight.

Realistic funding and payouts:

Ask yourself: Are any prop firms legit? Usually not at first; they’re simulated accounts used to test discipline. However, is Prop Firm Capital legit? For good firms, yes. Once you prove consistency, your trades may be mirrored on real accounts, and payouts come from verified profits. Firms like FTMO, Topstep, and The 5%ers are examples of this model done right.

Legit prop firms act as partners rather than gatekeepers. They provide transparent rules, real payouts, and honest communication to support safer market participation and reduce investment risks during the trading process.

Fake firms hide behind vague terms and blame you when things go wrong. So before you click “buy challenge,” slow down, read the fine print, and remember transparency is the real sign of trust.

8. Are prop firms worth it? Pros and cons

I’ve been around enough traders to say this: prop firms can be worth it, but only if you understand what you’re signing up for. They’re not a shortcut to easy money. Think of them more like a training ground where you rent capital to prove your edge.

| Pros | Cons |

|---|---|

| Access to large capital: You trade $50K, $100K, or even $200K accounts without risking personal savings. That’s powerful leverage for skilled traders. | Challenge pressure: The evaluation process can be mentally exhausting. One bad trade might fail the entire challenge. |

| Risk management structure: The strict drawdown limit, profit target, and time limit force discipline. Many traders say this helped them build consistency faster than trading alone. | Strict rules: Daily loss limits or rule breaches can void your account instantly. If your trading strategy requires wide stops or swing positions, this structure may not fit. |

| Fair profit share: Legit firms pay out 70–90% of profits. It’s a win-win model: your trading success is their success. | Simulated environment: Many accounts are still demo-based. You’re trading “virtual capital” until you prove you can manage risk consistently. |

| No regulation hassle: Since prop firms don’t handle client deposits, you skip broker paperwork, and trading fees often remain low. | Unclear payout systems: Some firms delay or deny payouts for vague reasons. That’s where transparency matters. |

| Learning opportunity: I’d call this underrated. You learn risk control, patience, and emotional discipline skills that translate into real-world Forex trading or futures trading. | Short-term mindset: Focusing only on passing challenges can hurt long-term growth. Trading isn’t a sprint. |

I remember a trader friend who passed two firms in a month, then failed both because he over-traded once funded. He told me, “Prop firms don’t test your skills; they test your patience.” That sums it up perfectly.

So, are prop firms worth it? Yes, if you see them as a tool for growth rather than a quick-money shortcut. The real value lies in structure and discipline, not speed. Choose firms that are transparent, have a clean payout history, and fit your trading style. And if you want to prepare properly before joining one, you can explore this guide on how to get into prop trading.

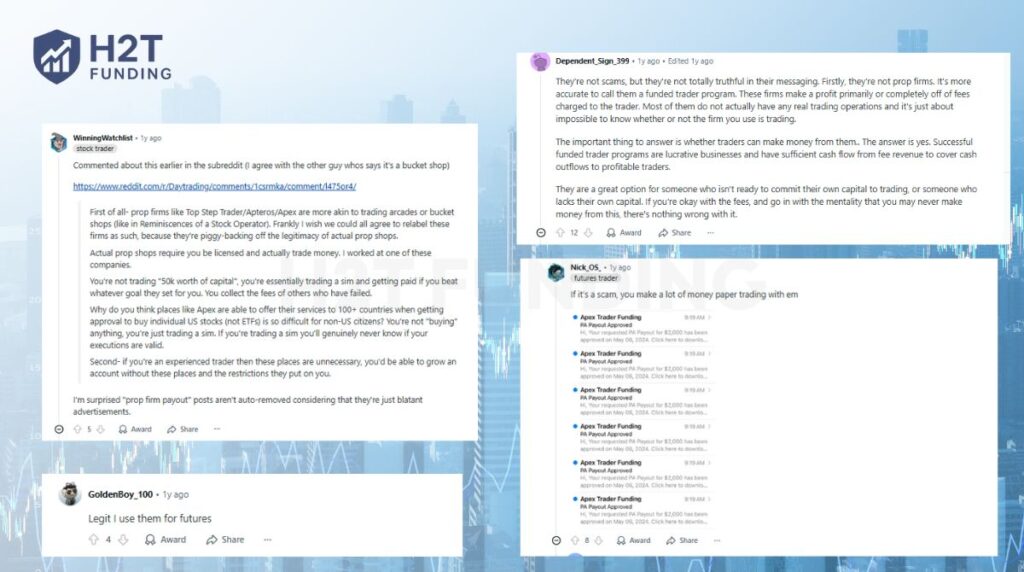

9. Are prop firms legit Reddit & Quora

If you’ve ever scrolled through Reddit or Quora, you know traders don’t hold back. These forums are where the truth about prop trading firms often comes out, both the wins and the horror stories.

One Reddit user wrote, Most of these firms are real, but not all are fair. They make money off failed challenges, not from your trading success.” That comment got hundreds of upvotes, and honestly, it reflects how many traders view the evaluation process.

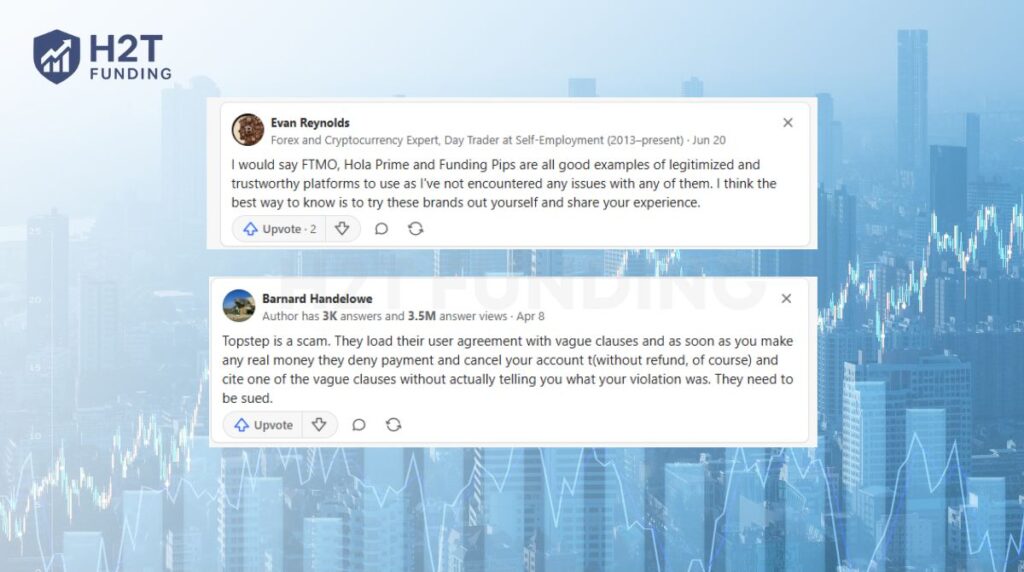

Another trader shared on Quora: FTMO and Topstep actually pay. I’ve received multiple payouts. But some smaller firms delay payments or change rules midway. It’s simple, really; transparency separates the real ones from the shady ones.

From what I’ve seen, the community agrees on a few points:

- Legit prop firms like FTMO, The 5%ers, and Topstep are consistent with payouts.

- Are forex prop firms legit? Mostly yes, but they rely heavily on simulated trading environments.

- Futures prop firms like Topstep tend to be more structured and regulated.

- Most funding programs make money through fees; that’s not a scam, but it does mean the odds favour the firm.

Traders frequently complain about:

- Sudden rule changes (like new profit targets or time limits).

- Delayed withdrawal process or unclear payout systems.

- Inconsistent trading platforms and execution speeds.

One Reddit post that stuck with me said: I passed two challenges, but my funded account was closed because of a ‘data sync issue. That was their excuse. You can almost feel the frustration through the screen.

To be fair, not every trader is negative. Some appreciate the risk management structure, saying it helped them avoid emotional trading. One comment summed it up nicely: Prop firms gave me discipline I never had on my personal account.

Online forums reveal both sides: the good, the bad, and the frustrating. The general consensus? Prop firms are legit, but not all are trustworthy. Look for real user feedback, payout proof, and a firm that values your consistency more than your entry fee.

10. Prop firms worth researching in 2026

What are some legit prop firms? In 2026, there isn’t a universal list of “guaranteed trusted prop firms,” because traders’ experiences vary widely. To put it simply, some firms appear frequently in community discussions on Reddit, Quora, and review platforms, but you should still verify everything before committing. Below are the firms worth researching, not endorsements.

| Prop firm | Model | Profit split | Account sizes | Community notes |

|---|---|---|---|---|

| FTMO | 2-step | 80–90 percent | 10K–200K USD | Fast payouts, trusted long-term |

| The 5%ers | Low-risk programs | 80–90 percent | 5K–250K USD | Great for consistent traders |

| Ment Funding | 1-step | 50–100 percent | 25K–2M USD | Clear rules, helpful support |

| Alpha Capital Group | 1–3 step | 80 percent | 5K–200K USD | Strict KYC, stable payouts |

| FundedNext | Eval or instant | 75–90 per cent | 2K–200K USD | Modern dashboard, smooth payouts |

10.1. FTMO

FTMO (Czech Republic) has been around since 2015 and remains one of the most legit prop firms out there. Its two-step evaluation process is tough but fair, with realistic profit targets (10%) and a generous profit split up to 90%. Traders praise its fast payouts and professional analytics tools. Platforms: MT4, MT5, DXTrade, and cTrader.

| Feature | Details |

|---|---|

| Profit Split | 80–90% |

| Account Size | $10K – $200K |

| Time Limit | No time limit |

| Rating | 4.8/5 Trustpilot |

I’ve been funded twice with FTMO. Never had a payout issue, one Reddit trader wrote.

10.2. The 5%ers

Founded in Israel (2016), The 5%ers focuses on low-risk trading strategies and long-term consistency. Traders can scale up to $4 million, and profit splits can reach 100%. I like how their Bootcamp and Hyper Growth programs suit both cautious and aggressive traders.

| Feature | Details |

|---|---|

| Profit Split | 50–100% |

| Account Size | $5K – $250K |

| Markets | Forex, indices, commodities, crypto |

| Rating | 4.9/5 Trustpilot |

Honestly, it’s one of the few firms that rewards patience over quick profits.

10.3. Ment Funding

Ment Funding (U.S., 2021) stands out with its 1-step evaluation process and transparent payout system. Accounts range from $25K to $2M, with scaling up to $5M. Many traders appreciate its realistic drawdown limits and risk management rules.

| Feature | Details |

|---|---|

| Profit Split | 75–90% |

| Profit Target | 10% |

| Account Size | $25K–$2M |

| Rating | 4.8/5 Trustpilot |

One user said, Ment feels like FTMO with faster funding. Their support actually listens.

10.4. Alpha Capital Group

Based in the UK, Alpha Capital Group offers multiple funding options (1-, 2-, and 3-step challenges). Profit split is fixed at 80%, and there’s no time limit. However, traders mention strict KYC and payout verification. It’s solid, but you’ll need patience.

| Feature | Details |

|---|---|

| Profit Split | 80% |

| Account Size | $5K – $200K |

| Markets | Forex, indices, commodities |

| Rating | 4.6/5 Trustpilot |

10.5. FundedNext

Founded in 2022 (UAE), FundedNext gives traders up to 95% profit split and flexible choices between evaluation and instant funding. It supports multiple platforms and markets, including Forex, indices, and crypto CFDs. Traders love its modern dashboard and real-time analytics.

| Feature | Details |

|---|---|

| Profit Split | 80–95% |

| Account Size | $2K – $200K |

| Time Limit | No time limit |

| Rating | 4.6/5 Trustpilot |

My first payout was smooth. Communication was fast, one Quora user shared.

These are firms that traders consistently rank high for transparency, fairness, and funding opportunities. Whether you prefer Forex trading or futures, pick a prop firm that fits your style, not just the one with the highest split. A real partner firm helps you grow; a fake one drains your focus.

11. FAQs – Common questions about prop firms

Not always. Most prop trading firms use simulated accounts during the evaluation phase to test consistency and discipline. Once traders prove themselves, some firms mirror their trades on real capital accounts. So yes, the profits can be real, but the trading environment might still be simulated.

Yes, many forex prop firms are legitimate, especially those with transparent rules, fair profit targets, and a clean payout record. The best ones, like FTMO and The 5%ers, openly publish their terms and have real traders confirming payouts.

Most futures prop firms are considered legitimate since they often connect to regulated exchanges like the CME. Firms such as Topstep or Ment Funding are trusted for transparent risk management and consistent trading challenges.

In general, yes. Prop firms are legal because they trade their own funds, not client deposits. That’s why they don’t need a broker license. However, a lack of regulation means traders must research carefully before joining.

If you’re asking whether the funding is real, it depends. Many firms use demo accounts but pay traders from company profits. Legit ones explain this clearly; scams hide it. Always read the fine print.

It depends on your goals. If you’re learning and want structure, a prop firm can be great for developing discipline and risk management. But if you’re still guessing entries, passing an evaluation process might feel overwhelming. Start small and treat it like tuition.

You lose the challenge fee, but nothing else. Many firms allow discounted retries or reattempts. Think of it as paying for training; the lesson is in the mistakes you made.

Emotions. Overtrading, revenge trading, and ignoring drawdown limits are the biggest killers. The evaluation isn’t just about hitting profit goals; it’s about surviving long enough to show consistency.

Yes, many traders do make money, but usually the ones with discipline, a real edge, and strong risk management. It is not easy, but it is possible.

Most traders lose because of emotions, inconsistent strategies, and poor risk control. Many chase quick wins instead of building a repeatable process.

Yes, but only for learning and micro accounts. With $100, you can practice structure, not aim for big profits. Prop firms exist because most people don’t have large capital.

In most countries, no. Prop firms don’t handle client deposits, so they fall outside typical financial regulation. Legal, but less protected for traders.

Yes, if you can stay consistent. The structure helps disciplined traders scale, but it won’t fix a bad strategy.

Legit firms do. Most payout issues come from rule breaches or firms with unclear terms. Always check payout proof and community feedback first.

Red flags include vague rules, unrealistic promises, hidden fees, slow support, no payout proof and no real company information.

Yes. FTMO is widely considered legit, with years of operation and thousands of public payout proofs.

Some are, but the rules are usually strict, and the risk model is different. Always review terms carefully.

Most bans come from rule violations: overleveraging, news trading restrictions, copying signals or using banned EAs.

Your account access ends, and pending payouts may be lost. Since they are not regulated, there is usually no formal protection.

12. Final verdict – Are prop firms legit?

So, are prop trading firms legit? In most cases, yes, but not all are created equal. The reputable ones are transparent, pay on time, and focus on trader growth. Others hide behind vague rules and marketing hype.

The truth is simple: prop firms aren’t scams, but they’re not charities either. You’re paying for access to capital, structure, and a chance to prove your strategy. If you treat it like a business, it can be worth every dollar.

When choosing a firm, look for:

- Clear evaluation process and payout policy

- Real trader reviews and proof of funding

- Transparent risk management and scaling plans

At H2T Funding, we regularly review the best firms in the Prop Firm & Trading Strategies category to help traders make smarter, safer decisions. Do your homework, read the fine print, and remember legitimacy comes from transparency, not promises.