It’s the question every new trader eventually asks: What is margin in trading? You see it mentioned everywhere. One person says it’s the key to making huge returns fast. Another warns you it’s the fastest way to lose all your money. Who do you believe?

Let’s get real. Margin is just a loan from your broker. You’re using the cash in your account as a security deposit to control a much larger amount of money. It’s a tool, and like any powerful tool, it can build things up or tear them down depending on how you use it.

This article isn’t going to give you a textbook answer. H2T Funding is here to show you how margin works in real trading. We break down what each term means for your wallet and how to avoid the pitfalls that catch so many traders. By the time you’re done, you’ll get the real picture, so you can decide if it’s a tool you’re ready to handle.

Key takeaways

- Margin is a good-faith deposit, a portion of your own money used as collateral in a margin account to open larger securities or derivatives positions.

- Margin formula: Required Margin = Position Size × Margin Requirement (%).

- Margin level (%) is the most important risk indicator in your account. A high margin level = safe; a low margin level = danger.

- A margin call occurs when your equity falls below the maintenance margin, requiring you to add funds or close positions to protect your investment.

- Margin amplifies both profits and losses, meaning small price moves, especially in volatile financial activities, can significantly impact your account.

- Safe margin trading requires discipline, including proper risk management, sizing, and conservative leverage tailored to your investment goals.

1. What is margin in trading in simple terms?

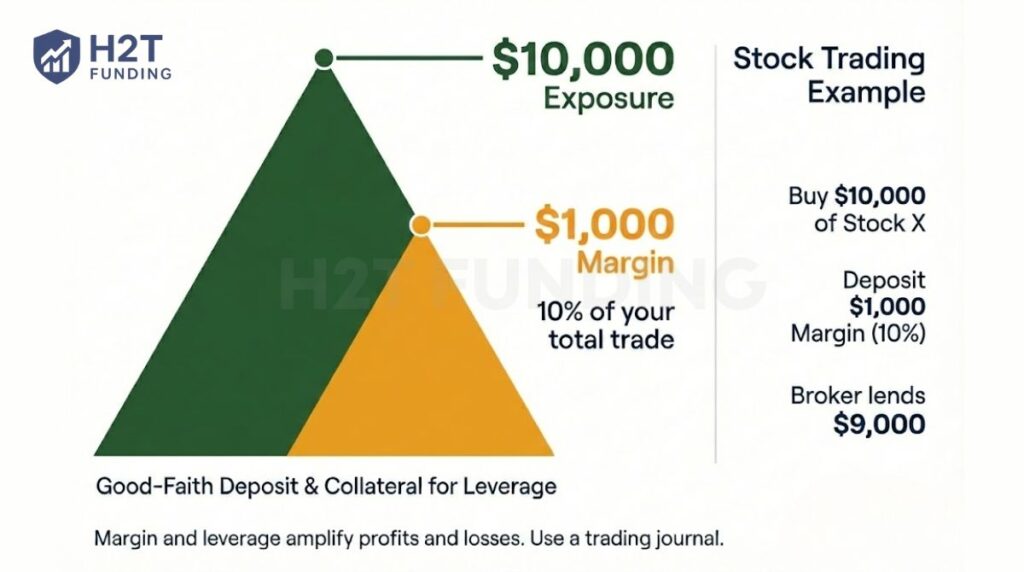

At its heart, margin in trading is a good-faith deposit. It is the amount of your own money you must put forward to open a larger trade. Your broker holds this deposit as security while your trade is active.

Crucially, it is not a transaction fee or a cost of the trade itself. Think of it as collateral, the security that you post, which then allows your broker to lend you the rest of the funds needed for the position. This process gives you access to leverage.

A great way to understand this is to compare it to buying a house. You might only put down a 20% deposit (your margin) to get a mortgage. With that 20%, you get to control 100% of the house. Margin in trading works on the same principle.

For example, imagine you want to open a $10,000 position in a stock. Normally, you would need the full amount. But with a margin, your broker may require only 10%. That means you put down $1,000, and the broker covers the remaining $9,000. With just $1,000, you control a $10,000 trade, showing how leverage lets you expand your market exposure with a small deposit.

Because margin and leverage can amplify both profits and losses, many traders rely on a trading journal to track their trades, manage risk, and improve performance over time.

2. How does margin work in trading?

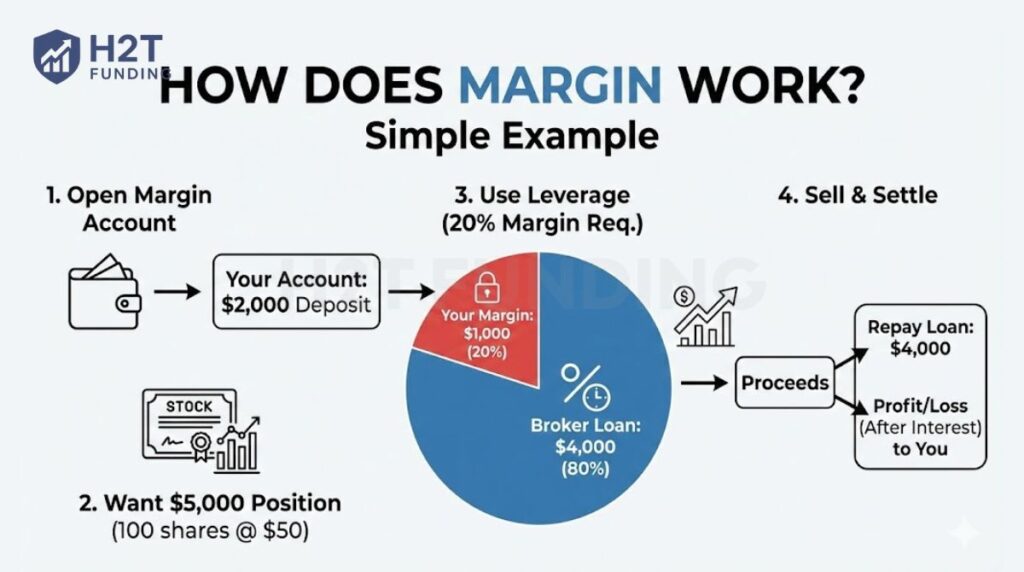

The process of trading on margin becomes much easier to understand with a simple example. It begins when you open a margin account, which is a special type of brokerage account designed for leveraged trading. Suppose you deposit $2,000 of your own money into this account; this amount now serves as your collateral.

Now imagine you want to buy 100 shares of a company trading at $50 per share. The total value of this position is $5,000. Under normal circumstances, you wouldn’t have enough capital to take this trade. But with a margin account, your broker may require only a 20% margin.

Here’s how it works:

- Required Margin: 20% of the $5,000 position equals $1,000.

- The Loan: Your broker lends you the remaining $4,000.

This loan from the broker instantly increases your buying power. From your initial $2,000 deposit, the broker sets aside $1,000 as the required margin, giving you full control of a $5,000 position. That is a clear illustration of leverage in action. Since the $4,000 is effectively a loan, you’ll pay interest on that borrowed amount for as long as the position remains open.

When you eventually sell the shares, the broker automatically deducts the $4,000 loan from the proceeds. Any remaining profit or loss (after subtracting interest) is then added to or deducted from your account balance.

To use margin effectively, traders should combine leverage with solid technical skills. Knowing how to trade using indicators and how to understand trading charts to make more informed entry and exit decisions.

3. The critical difference: Margin vs. Leverage

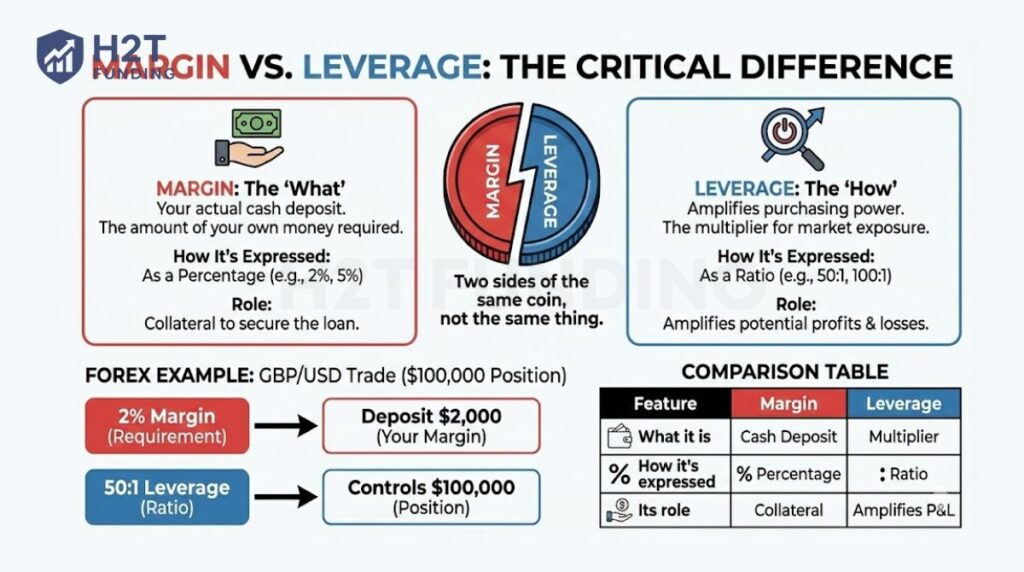

It’s the single most common point of confusion for new traders: are margin and leverage the same thing? The answer is no, but they are two sides of the same coin. Understanding the distinction is vital for managing your account.

Let’s break it down simply:

- Margin is what? It is the actual deposit you need to open a trade, expressed as a percentage. Think of it as the amount of your own money required for the position.

- Leverage is the how. It is the power that increases your purchasing power by amplifying your margin, expressed as a ratio.

In essence, understanding what the margin requirement in trading is key, as this rule set by your broker determines the maximum leverage you can use. If a broker requires a 2% margin, they are effectively offering you 50:1 leverage (100% / 2% = 50).

Let’s look at a clear leverage example in the forex market. Suppose you want to trade one standard lot of GBP/USD, which is worth $100,000. With 50:1 leverage, you don’t need to provide the full amount. Instead, you only need to deposit 1/50 of the total value as margin, which is $2,000.

Your $2,000 serves as the margin, while the 50:1 leverage is what allows you to control a $100,000 position with a much smaller amount of capital.

Here is a simple table to summarize the key differences:

| Feature | Margin | Leverage |

|---|---|---|

| What it is | The actual cash deposit required from your account. | The multiplier that increases your market exposure. |

| How it’s expressed | As a percentage (e.g., 2%, 5%, 10%). | As a ratio (e.g., 50:1, 100:1, 200:1). |

| Its role in a trade | It acts as collateral to secure the loan. | It amplifies the potential profits and losses on a trade. |

While they work together, never mistake one for the other. Margin is the money you commit, and leverage is the power that money wields.

4. Key margin trading terms you must know

To trade on margin effectively, you must speak the language. These are not just abstract terms; they represent the real-time status of your capital and risk. Understanding them is non-negotiable.

4.1. Margin account

A margin account is a special type of brokerage account that allows you to borrow money from the broker to trade. It’s different from a standard cash account, where you can only use the funds you have deposited. This is your gateway to using leverage.

4.2. Initial margin vs. maintenance margin

These two terms are often confused, but are critically different.

- Initial margin is the minimum amount of your own capital required to open a new position. Think of it as the entry ticket for a trade.

- Maintenance margin is the minimum amount of equity you must maintain in your account to keep your positions open. If your account’s value drops below this level due to losses, it will trigger a warning from your broker.

4.3. Required margin / used margin

This is the total amount of your money that is currently locked up as collateral for all your open positions. For example, if you have one trade requiring $500 in margin and another requiring $300, your used margin is $800.

Because the required margin is directly affected by position size, understanding how to calculate lot size in Forex is essential for controlling risk and avoiding over-leveraging.

4.4. Free margin

Free margin is the money left in your account that is available to open new trades. It’s a simple calculation: Equity – Used Margin = Free Margin. A healthy amount of free margin provides a cushion against losses and gives you the flexibility to seize new opportunities.

4.5. Equity vs. balance

This is another crucial distinction.

- Balance is the amount of money in your margin account before accounting for the profit or loss of your current open trades. It only changes when you close a position or deposit/withdraw funds.

- Equity is the real-time, live value of your account. It is your Balance + the floating Profit/Loss of all open positions. Equity is the most important number to watch as it reflects your account’s current financial health.

4.6. Margin level (%)

The margin level is the single most important metric for gauging the risk of your account. It’s a percentage that shows the ratio of your equity to your used margin.

The formula is: (Equity / Used Margin) x 100%. A high margin level (e.g., above 1000%) is healthy. A low margin level is a danger sign.

4.7. Margin call

A margin call is a warning from your broker that your margin level has fallen to a dangerously low, pre-defined threshold. It’s a demand for immediate action, either add more funds or close positions, to restore your equity and bring your margin level back to safety.

4.8. Margin closeout / forced liquidation

This is what happens if you fail to meet a margin call, leading to a forced liquidation of your positions. If your margin level drops to the margin closeout level (e.g., 50%), your broker will automatically start closing your trading positions, starting with the least profitable one.

This is not a choice; it is an automated safety mechanism to prevent your account from going into a negative balance and to protect the broker from losses.

5. Margin trading examples in different markets

Theory is one thing, but seeing how margin works with real numbers is what truly matters. The principles are the same across markets, but the levels of leverage and volatility change everything.

5.1. Example 1: Trading stocks on margin

Stock trading typically involves lower leverage. Suppose you want to buy 100 shares of Company XYZ at $100 per share, giving you a total position of $10,000. Your broker requires a 50% margin.

- Your Investment: You must provide 50% of the position value, which is $5,000. Your broker lends you the remaining $5,000.

- The Power of Margin: If the stock rises by 10% to $110, your position becomes $11,000. Your profit is $1,000. On your initial $5,000, that’s a 20% return. Without margin, the same 10% price increase would have only resulted in a 10% return.

5.2. Example 2: Trading forex on margin

The forex market is famous for offering high leverage. To trade a standard lot (100,000 units) of a currency pair, you do not need the full $100,000. Most brokers require around 1% margin.

- Your Investment: To control a $100,000 position, you only need $1,000 (1% of $100,000) deposited as margin.

- The Power of Margin: A small 1% move in your favor, something that can happen within a day, could generate a $1,000 profit. That’s effectively a 100% return on the margin you used to open the trade.

5.3. Example 3: Trading crypto on margin

Crypto margin trading is even more intense because of extreme volatility. Suppose you want to open a long position on Bitcoin (BTC) worth $10,000. A standard initial margin requirement for BTC might be 20%.

- Your investment: You don’t need the full $10,000. Instead, you only need $2,000 (20% of $10,000) in your account to open this position.

- The power of margin: If Bitcoin’s price rises by 10%, your position gains $1,000 in value. That’s a 50% return on your initial $2,000 margin.

As these examples show, the core principle is the same everywhere: you use a small deposit to control a large position. However, the impact of that leverage changes dramatically based on the market’s typical leverage, volatility, and prevailing market conditions. This trade-off between amplified gains and amplified risk is the central theme of margin trading.

6. Pros and cons of margin trading

Let’s be honest: margin is a tool that can either make you a lot of money or cost you dearly. The outcome depends entirely on how you use it. Anyone considering margin trading needs to look at both sides of the coin with open eyes before placing a single trade.

Here’s a straightforward look at the good and the bad:

| Pros | Cons |

|---|---|

| Increased profit potential: The primary benefit. A small positive move in the market can result in a disproportionately large return on the capital you invested. | Bigger loss potential: This is the brutal reality. A small losing trade can wipe out your deposit just as quickly. Losses are amplified the same way profits are. |

| More trading flexibility: You don’t have to lock up all your investment capital on one idea. This lets you spread your capital around and jump on different opportunities. | Incurring interest costs: Don’t forget, it’s a loan. You are charged interest every day your trade is open, and these costs can add up and reduce your overall profit. |

| Access to short selling: To bet on a market going down (shorting), you need a margin account. It gives you another way to trade. | The risk of margin calls: If a trade goes against you, your broker will force you to either add more money or close your position at a loss. It’s their way of protecting themselves. |

At the end of the day, margin itself isn’t good or bad. It’s an amplifier. If you have a winning strategy and strong discipline, it can amplify your success. But if you’re unprepared or reckless, it will amplify your mistakes with devastating speed. The risks are real and demand respect.

7. How to trade on margin safely

Now that you understand the power and the risks, let’s talk about the most important part: survival. Trading on margin requires being smart and disciplined. Here are the non-negotiable rules we believe every margin trader should follow to protect their capital.

- Choosing the right leverage level: Just because a broker offers 500:1 leverage doesn’t mean you should use it. We recommend starting with a much lower level, like 5:1 or 10:1. This gives you a crucial buffer against market swings and reduces the risk of a single bad trade wiping you out.

- Use stop-loss orders religiously: A stop-loss order is your automated safety net. It closes your trade at a predetermined price to cap your potential loss. Trading on margin without a stop-loss is reckless; you must always define your exit point before you enter a trade.

- Proper position sizing: Never risk a large portion of your account on one idea. A professional standard is to risk only 1-2% of your total equity on any single trade. This ensures that even a losing trade doesn’t cause significant damage to your overall capital.

- Monitor your margin level constantly: Your margin level (%) is your account’s most critical health indicator. We can’t stress this enough: you need to watch it constantly. If you see it dropping towards the danger zone, it’s a clear signal to reduce your risk before your broker does it for you.

Read more:

8. How to start trading on margin: A 5-step guide for beginners

If you’re going to use margin, you need a smart approach from day one. Just diving in is the fastest way to get into trouble. Here’s a simple, five-step process that we recommend to anyone serious about starting the right way.

- Step 1: Build a solid foundation of knowledge

- Step 2: Choose a reputable broker and open your margin account

- Step 3: Develop a clear trading plan

- Step 4: Practice with a demo account

- Step 5: Start small and manage your trades actively

Keep reading to learn each step in detail.

8.1. Step 1: Build a solid foundation of knowledge

Don’t even think about placing a trade until you get this part right. You need to really understand how margin, leverage, and all the key terms work. Read guides like this one, watch videos, and learn until the concepts feel second nature. Knowledge is your first line of defense.

8.2. Step 2: Choose a reputable broker and open an account

Your broker matters. You need a partner you can trust, so look for one that is well-regulated and has a strong track record. Go through their application to open a margin account; you’ll have to confirm you understand the risks, which is a good final check for yourself.

8.3. Step 3: Develop a clear trading plan

Successful traders don’t guess; they plan. Your trading plan is your personal set of rules. It should cover what you trade, how you’ll find your opportunities, and, most importantly, your rules for cutting losses. Write it down and stick to it.

8.4. Step 4: Practice with a demo account

Every good broker offers a demo account, which is basically a trading simulator with virtual funds. Use it. Get a feel for the platform, test your strategy, and see how leverage affects your trades without risking a single dollar. This is where you make your mistakes for free.

If you need a reliable tool to start with, check out the best free trading simulator to practice safely and sharpen your skills before going live.

8.5. Step 5: Start small and manage your trades actively

When you do go live with real money, start small. Use the lowest leverage and the smallest trade size you can. The goal here isn’t to make a fortune, it’s to learn the ropes. Watch your positions and your margin level carefully and stay disciplined.

9. Common mistakes beginners make with margin trading

After years in the markets, you start to see the same story play out again and again. A new trader discovers margin, gets excited by the potential, and then makes one of a handful of predictable, costly mistakes. Frankly, many of us learned these lessons the hard way in our own trading journeys, and we’ve seen countless others repeat them.

The theory of margin is simple, but the psychology of trading with it is not. Recognizing these common mistakes is the first and most important step to protecting your capital.

9.1. Using excessive leverage

This is the number one mistake. Beginners are often drawn to the highest leverage a broker offers, thinking it’s a shortcut to big profits. They fail to realize that extreme leverage leaves no room for error. A tiny, normal market fluctuation can be enough to trigger a liquidation and wipe out their entire account.

9.2. Having no risk management plan

Entering a margin trade without a plan is pure gambling. Many beginners trade based on hype or fear of missing out (FOMO) instead of strategy. A proper plan defines exactly how much you’ll risk per trade, where you’ll place your stop-loss, and when you’ll take profit. Without these rules, emotions take over and lead to disastrous decisions.

9.3. Ignoring the margin level

Many new traders are so focused on the price direction that they completely forget to monitor their account’s most critical vital sign: the margin level (%). They don’t realize how close they are to a margin call until it’s too late. Successful margin trading requires constant awareness of your account’s health.

9.4. Chasing losses (revenge trading)

After a losing trade, the emotional urge to “win it back” quickly is incredibly strong. Beginners often double down on their next trade, using even more leverage to try to erase the loss. This behavior, known as revenge trading, almost always leads to bigger and faster losses, compounding the initial mistake.

9.5. Over-positioning and overtrading

The excitement of margin can lead traders to open too many positions at once or to trade too frequently. This ties up too much of their margin, leaving no cushion for market swings. It also leads to mental fatigue and poor decision-making. Professional trading is patient and selective; it’s about waiting for high-quality setups, not chasing every small move.

Avoiding these mistakes isn’t about being a perfect trader; no one is. It’s about building disciplined habits. By focusing on control, planning, and patience instead of chasing fast profits, you shift the odds dramatically in your favor and set a foundation for long-term survival in the markets.

10. Frequently asked questions (FAQ)

In forex, margin is the small deposit you need to control a much larger currency position (a lot). Because leverage in forex is often high (e.g., 100:1), the required margin is typically a very small percentage of the total trade size, like 1% or 2%.

Yes. While possible, margin trading in crypto is extremely risky due to the market’s high volatility. Small price swings can cause rapid and significant losses, leading to frequent margin calls. It should only be attempted by very experienced traders with a high-risk tolerance.

Think of collateral as the general term for an asset you pledge to secure a loan. Margin is a specific type of collateral used in the trading world. The cash and securities in your account act as collateral for the margin loan from your broker.

Yes, absolutely. Because you are borrowing money, if your losses exceed the amount of your initial deposit (your equity), you will be in debt to your broker. This is the single biggest risk of margin trading.

Margin interest is calculated daily on the amount of money you have borrowed and is typically charged to your account monthly. The rate is variable and is set by your broker, similar to a credit card interest rate.

It works by you providing a small deposit (the margin) from your own funds. Your broker then lends you the rest of the money needed to control a much larger position. This process allows you to amplify your potential returns and losses.

A 5% margin requirement means you must put down 5% of the total trade value from your own capital. This is equivalent to using 20:1 leverage. For example, to open a $10,000 position, you would need $500 in margin.

It depends entirely on the trader. For an experienced, disciplined trader with a solid risk management plan, it can be a useful tool. For a beginner or an undisciplined trader, it is an exceptionally bad idea and can lead to rapid financial loss.

A good margin is actually about using less of it. The key is to use the lowest leverage possible for your strategy and to always maintain a very high margin level in your account to avoid risk.

Yes, in essence, it is. When you trade on margin, you are taking out a short-term loan from your brokerage to fund a portion of your trade. You are responsible for repaying this loan, plus any interest that accrues.

You calculate the required margin by multiplying the position size by the margin rate (e.g., $50,000 × 2% = $1,000). The fee applied is the interest on the borrowed amount, which is calculated separately.

The higher, the better. A safe margin level provides a large cushion against losses. Most conservative traders aim to keep their margin level well above 1,000% to ensure they are nowhere near a margin call.

Free margin is the money left in your account that is available to open new trades. It’s a simple calculation: Equity – Used Margin = Free Margin.

E-margin is a specific facility offered by some stockbrokers, particularly for intraday trading. It allows traders to take larger positions with a lower margin deposit than traditional methods, but these positions must be closed before the market ends on the same day.

11. Conclusion

Ultimately, margin is a powerful amplifier, not a magic ticket to wealth. It magnifies both your winning and losing trades with equal force. The difference between using it successfully and having it end in disaster comes down to one thing: your knowledge and discipline.

Understanding what is margin in trading is the foundational first step. But true mastery comes from applying this knowledge with a well-defined plan. To go further, explore our in-depth articles on Prop Firms and Trading Strategies to see how professionals manage risk in prop trading.