Traders searching Tradeify vs Apex want direct answers: Which firm is easier to pass? Are the drawdown rules a trap? And who pays out faster? This comparison cuts through the marketing to give you the real data on rules, fees, and community trust.

Below, H2T Funding breaks down the key differences to help you choose the right prop firm for your strategy. Explore our detailed breakdown below!

Proprietary firm rules and promotions are subject to change. This article’s information is accurate as of December 2025. However, we strongly advise checking the official Tradeify and Apex websites for the most current rules before making a decision.

Key takeaways:

- Both Tradeify and Apex are proprietary trading firms that provide capital to futures traders. First, traders must prove their skills by passing an evaluation or purchasing an instant account with Tradeify. Successful traders can then use the firm’s capital and keep a large percentage of their profits.

- The most critical distinction lies in the drawdown rule. Apex exclusively uses an End-of-Day (EOD) trailing drawdown, which is far more forgiving as it only updates based on your closing balance. Tradeify uses a mixed model, with some accounts having a stricter Intraday trailing drawdown that can fail you based on unrealized profits, making it a higher-risk environment.

- Your journey to a funded account differs significantly. Tradeify offers multiple paths, including a one-day evaluation and an Instant Funding option that lets you skip the challenge entirely. Apex standardizes its process with a one-step evaluation that requires a minimum of seven trading days, focusing on consistency over speed.

- There is no single winner, only a better fit for your style. Apex is generally the superior choice for beginners and risk-averse day traders due to its simpler, more forgiving rules. Tradeify appeals more to confident, experienced scalpers who value speed, modern platforms, and the option for instant funding.

- Both firms have strong reputations for paying traders, but their models benefit different goals. Apex offers an incredible incentive, allowing you to keep 100% of your first $25,000 in profits. Tradeify’s strength is speed, with community reports confirming payouts processed in a matter of hours, making it ideal for traders prioritizing quick cash flow.

1. Overview of each firm: Tradeify vs Apex comparison

In the fierce competition of the prop firm world, let’s get a bird’s-eye view of these two firms. Honestly, they’re aiming for very different types of traders. Tradeify feels like the newer, more versatile player on the block. They’re branching out beyond just futures, offering things like forex and instant funding, which is a big deal if you’re confident enough to skip the traditional evaluations.

On the other hand, you have Apex, a powerhouse that has laser-focused its entire model on the futures market. They’ve built a massive following by keeping things simple and predictable.

Think of it this way: are you looking for a multi-tool that can do a bit of everything, or a specialized instrument crafted for one specific job? Let’s break down the core details side-by-side.

Criteria table overview

| Criteria | Tradeify | Apex Trader Funding (Apex) |

|---|---|---|

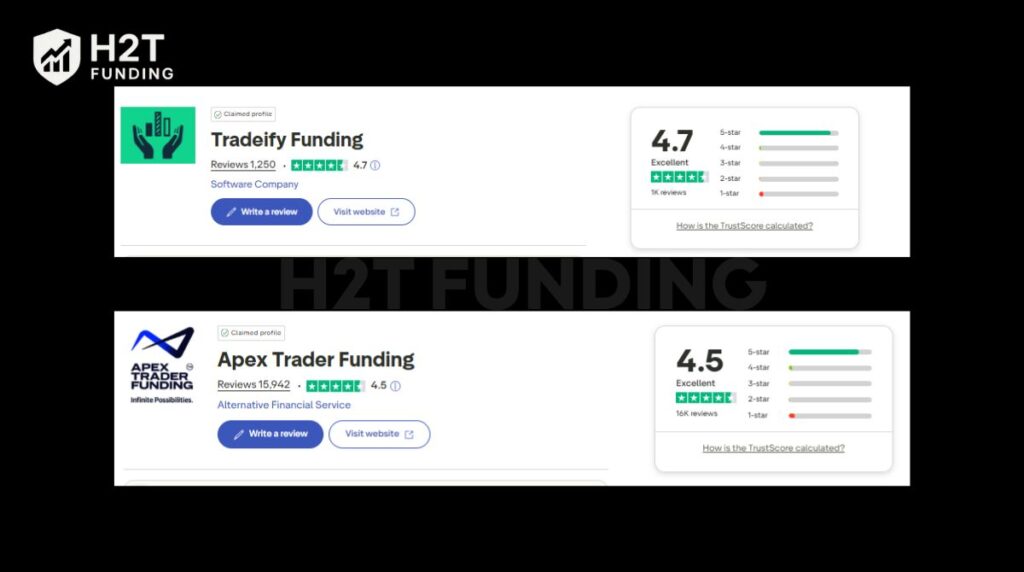

| Trustpilot Score | 4.7 / 5.0 (from 1,250+ reviews) | 4.5 / 5.0 (from 15,900+ reviews) |

| Founded / Trust | A newer firm founded by Brett Simberkoff, building its reputation. | Founded in 2021 by Darrell Martin. Industry leader with a huge user base. |

| Evaluation Models | Offers 1-step challenges and Instant Funding. | Strictly a 1-step evaluation model. |

| Evaluation Fee | Monthly subscription or one-time fee, depending on the account type. | One-time fee per evaluation, often with significant discounts. |

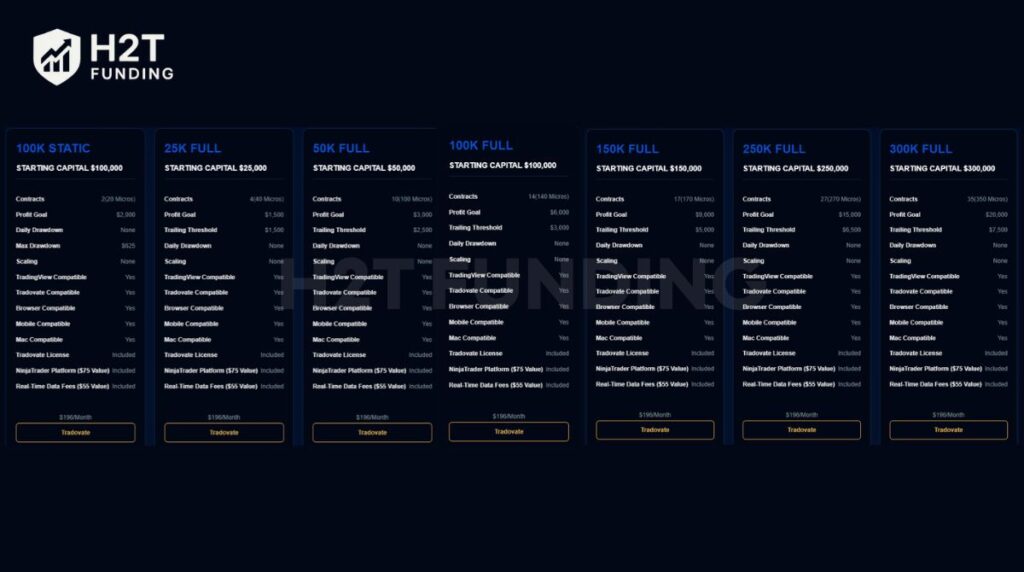

| Account Sizes | $25k, $50k, $100k, $150k. | $25k up to $300k, with various plan types (Full, Static). |

| Asset Classes | Futures Only (from CME, COMEX, NYMEX, CBOT exchanges). | Futures only. |

| Trading Platforms | Tradovate, ProjectX (with TradingView). | NinjaTrader, Rithmic, Tradovate, and others. |

| Profit Split | Up to 90%. | 100% of the first $25,000, then 90%. |

| Minimum Days | 1-day pass possible on some challenges. | Requires a minimum of 7 trading days. |

| Max Daily Loss | Varies by account type. Some accounts have it, while others do not. | None. This is a signature feature of their evaluations. |

| Payout Speed | Very Fast. Payouts are often processed within hours, according to community reviews. | Reliable. Payouts are processed on a bi-monthly schedule, typically within 5-10 business days. |

| Scaling Plan | Rule-based & Progressive. Starts with reduced contracts (e.g., 2 minis on a 50K account) and scales up based on profit milestones (e.g., full 4 minis at $2,000 profit). | Rule-based & Automatic. Once your EOD balance exceeds the initial balance + drawdown + $100 (e.g., $52,600 on a $50k account), you can trade the full contract limit. |

| Risk Restrictions | Utilizes both Intraday and EOD trailing drawdown depending on the account. | Famous for its forgiving EOD trailing drawdown on all evaluations. |

Quick verdict: Which firm should you choose?

- Which firm is better for you? Apex is generally better for beginners and risk-averse traders due to its simple rules and forgiving drawdown. Tradeify is the superior choice for experienced traders who prioritize speed, instant funding, and fast payouts.

- What are the key differences in risk and rules? The main difference is the drawdown. Apex uses a safe End-of-Day (EOD) trailing drawdown. Tradeify uses a mix, including a much stricter and higher-risk Intraday trailing drawdown on some accounts, which can fail you based on unrealized profits.

- Which firm has more reliable payouts? Both firms are highly reliable. Community feedback confirms consistent payouts from both. The difference is in the model: Apex offers a larger initial payout (100% of the first $25k), while Tradeify offers significantly faster payout speeds, often within hours.

That table gives you the high-level summary, but the devil is always in the details, right? The real difference between passing and failing and ultimately getting paid comes down to how each firm’s specific rules and philosophies impact your day-to-day trading. So, let’s peel back the layers and look at each company individually.

Tradeify

#1

Account Types

1-step and instant funding

Trading Platforms

Tradovate, NinjaTrader 8, Quantower, TradingView, Project X

Profit Target

6%

Our take on Tradeify

So, what’s the real story with Tradeify? My take is that they are targeting the modern, flexible trader. The ability to get funded instantly with their Lightning accounts is a game-changer for those who have a proven track record and don’t want to jump through evaluation hoops.

While they also focus exclusively on futures, their main distinction lies in their funding models, especially the instant funding offered via Lightning accounts. This is a game-changer for traders with a proven track record who want to bypass the evaluation process entirely.

However, this flexibility comes at a cost of complexity. You really have to pay attention to which account you’re choosing because the drawdown rules are different. An Intraday trailing drawdown on an Advanced Challenge account is a very different beast from the EOD drawdown on a Growth account. You need to know what you’re signing up for.

It’s an excellent option if you want instant funding or trade more than just futures. Just be prepared to study the specific rules of your chosen account type

| 💳 Challenge Fee | $69 – $729 |

| 👥 Account Types | 1-step and instant funding |

| 💰 Profit Split | 80% |

| 💵 Account Size | $25K – $150K |

| ⏱️ Time Limit | No time limit |

| 🎯 Profit Target | 6% |

| 📊 Trading Platforms | Tradovate, NinjaTrader 8, Quantower, TradingView, Project X |

| 🛍️ Asset Types | Futures Contracts |

Apex Trader Funding

#2

Account Types

1-step

Trading Platforms

Tradovate, Rithmic, WealthCharts

Profit Target

6%

Our take on Apex Trader Funding

Now, Apex. There’s a reason they’ve become so popular. They built their entire brand on being simple and trader-friendly, especially for futures day traders. When you talk to traders who use Apex, they almost always bring up two things: the EOD trailing drawdown and the no daily loss limit rule.

Honestly, this is a massive psychological advantage. You aren’t constantly worried that one bad trade will knock you out for the day.

Their focus is purely on futures, and they’ve perfected that model. Partnering with platforms like NinjaTrader and Rithmic makes them a go-to for the established futures trading community. The 100% payout on the first $25k is, frankly, an incredible incentive that gets people in the door and funded quickly.

If you are a dedicated futures trader who values simple, straightforward rules and a forgiving drawdown, Apex is, without a doubt, one of the best choices out there.

| 💳 Challenge Fee | From $196 |

| 👥 Account Types | 1-step |

| 💰 Profit Split | 90% – 100% |

| 💵 Account Size | $25K – $300K |

| ⏱️ Time Limit | No time limit |

| 🎯 Profit Target | 6% |

| 📊 Trading Platforms | Tradovate, Rithmic, WealthCharts |

| 🛍️ Asset Types | Equity Indices, Currencies, Commodities, Interest Rates, Crypto |

Read more:

2. Core models & key rules: Tradeify vs Apex review

This section is the heart of the matter. Forget the marketing for a second. The core rules around profit targets, drawdown, and trading styles are what will determine your actual experience. Let’s be real, a firm’s rulebook can either feel like a safety net or a straitjacket.

2.1. Profit targets & minimum trading days

First up, how hard is it to actually pass these challenges? The difficulty isn’t just about the profit target; it’s also about the time constraints. Simply put, Tradeify offers a potential shortcut, while Apex insists on seeing a bit more consistency.

| Criteria | Tradeify | Apex Trader Funding |

|---|---|---|

| Profit Target | Standard targets (e.g., $1,500 on a $25k account, which is 6%). | Standard targets (e.g., $1,500 on a $25k account, also 6%). |

| Minimum Days | 1 Day. You can pass in a single day if you hit the target. | 7 Days. You must trade for at least seven different days. |

| Evaluation Difficulty | Potentially easier for skilled traders who can hit targets quickly. | Requires more patience and consistent performance over a week. |

To me, this is a clear philosophical difference. Tradeify is saying, If you’ve got the skill to hit the profit target in one great session, we’ll fund you. Apex, on the other hand, wants to ensure you’re not just a one-hit wonder. Neither is right nor wrong; it just depends on your personal style.

2.2. Drawdown & daily loss limits

Okay, this is the big one. This is the rule that blows up more accounts than any other. How a firm calculates your maximum allowable loss, or drawdown, is a critical piece of the puzzle. And on this point, the two firms couldn’t be more different.

| Criteria | Tradeify | Apex |

|---|---|---|

| Max Loss | A trailing drawdown that follows your account’s peak value. | A trailing drawdown that follows your end-of-day balance. |

| Daily Loss Limit | No official daily loss limit, but the intraday drawdown can act like one. | Absolutely none. This is their signature feature. |

| Drawdown Type | Mixed Model: Intraday trailing for Advanced accounts; EOD trailing for Growth and Lightning accounts. | EOD Trailing Only: The drawdown value is only updated at the end of the trading day. |

| Rule Strictness | Higher. The intraday trailing drawdown is extremely unforgiving and can stop you out mid-rally. | Lower. The EOD drawdown gives you room to breathe and recover from intraday dips. |

However, it’s important to note that the rules change after passing the evaluation. Once a trader moves to a Performance Account (PA), additional risk management rules are introduced, such as the 30% MAE rule per trade.

2.3. News, overnight & automation policies

Finally, let’s talk about freedom. Can you trade your strategy without constantly looking over your shoulder? Some firms have a laundry list of restrictions, especially around major news events. Here’s how Tradeify and Apex stack up.

| Policy | Tradeify | Apex |

|---|---|---|

| News Trading | Allowed. They state no rules against it, but warn of volatility. | Allowed. This is a core feature; they encourage trading your edge anytime. |

| Overnight Trading | Not Allowed. Positions must be closed before the end of the day. | Not Allowed. All positions must be closed by 4:59 PM ET. |

| Weekend Trading | Not Allowed. | Not Allowed. |

| EAs/Automation | Allowed. Seems to be generally accepted. | Allowed. They support automated trading, with some restrictions on HFT/arbitrage bots. |

The bottom line here is that both firms give you a surprising amount of freedom compared to some others in the industry. However, Apex has really built its brand around the trade anytime, any style mantra, which gives it a slight edge in perception for traders who feel restricted elsewhere.

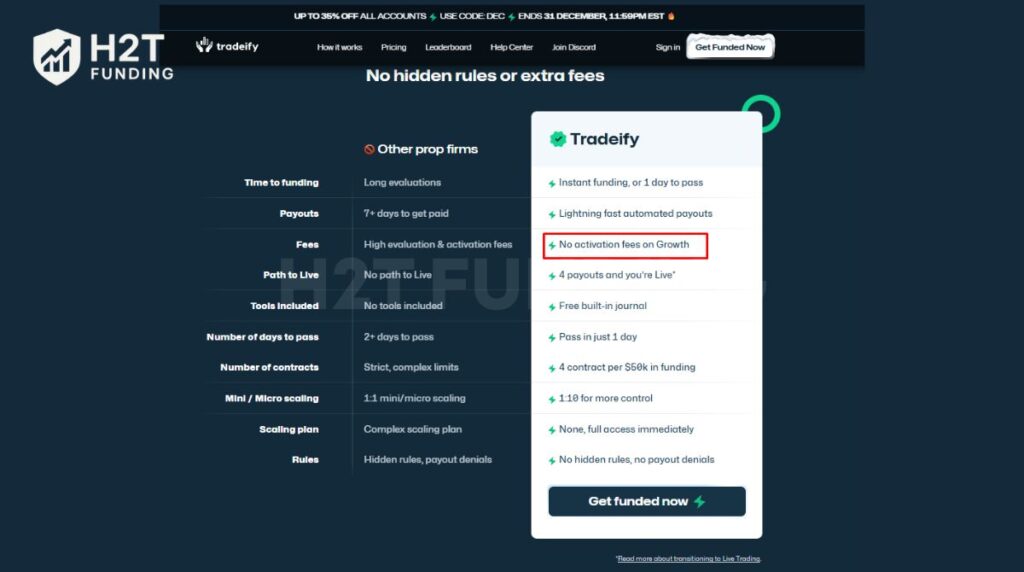

3. Fees, refunds & cost efficiency: Apex vs Tradeify

Let’s be honest, the cost to get in the door is a huge factor for most of us. It’s not just the initial fee; it’s about the entire financial picture, from the price of a reset to the commission you’ll pay on each trade. You want to know exactly what the commission structure looks like, so there are no surprises.

Here’s how the two firms compare when it comes to your wallet.

| Criteria | Tradeify | Apex Trader Funding |

|---|---|---|

| Fee Type | One-time fee for challenges and instant funding accounts. | One-time fee per evaluation account. |

| Refund Policy | No refunds. Once you buy a challenge, the fee is final. | No refunds. Standard practice for one-step evaluations. |

| Challenge Cost | Competitively priced, often with promotions. | Famous for deep discounts and frequent sales (80-90% off is common). |

| Transparency | Generally clear. No activation fees on Growth accounts. | Very transparent. What you see is what you pay. No hidden data fees. |

| Added Fees | No account activation fees mentioned. | None. No activation fees. A NinjaTrader license is included for free. |

| Payout Cycle | Monthly, with the first payout possible after just 5 days. | Requests can be made twice a month (e.g., 1st-5th and 15th-20th). |

So, what’s the verdict on cost-efficiency?

From my perspective, Apex often wins the battle on initial cost, but only if you catch one of their famous sales. Their 80% or 90% off deals are legendary and make their evaluation accounts incredibly cheap. It’s a low barrier to entry for a shot at a big account.

Tradeify, on the other hand, offers something different with its instant funding model. Yes, these accounts cost more upfront than a discounted evaluation, but you are paying a premium to skip the evaluation process entirely.

For a trader who is confident and well-capitalized, this can be more cost-effective in the long run than potentially paying for multiple resets on an evaluation.

Ultimately, the best value depends on your confidence and capital. If you want the cheapest possible entry ticket to prove your skills, a discounted Apex evaluation is tough to beat. If you value your time more and have the skills to back it up, paying the premium for Tradeify’s instant funding could be the smarter financial move.

4. Profit split & scaling programs: Tradeify vs Apex Trader funding

Alright, let’s talk about the ultimate goal: withdrawing your profits. A prop firm can have the best rules in the world, but if their payout policies are slow or unfair, what’s the point? This is where a trader’s trust is truly won or lost. Beyond the first payout, we also need to look at the opportunities they provide to scale your account.

| Criteria | Tradeify | Apex |

|---|---|---|

| Profit Split | Up to 90% for the trader. | 100% of the first $25,000, then a 90/10 split. |

| Scaling | Yes, offers a scaling plan to grow your account. | Yes, a simple and clear scaling plan is included with funded accounts. |

| First Payout | Eligible after 5 trading days on a funded account. | Eligible after 10 separate trading days. |

| Payout Frequency | Processed monthly. | Two payout periods per month. |

| Withdrawal Method | Not specified, likely standard methods like bank transfer/crypto. | Bank wire, ACH, wire, paper check, crypto. |

When you lay it all out, Apex comes out with a very aggressive and attractive offer, especially for new traders. That keeps 100% of your first $25k is a massive carrot.

Think about it: on a $50k account, you could hit a $9,000 profit and withdraw the entire amount. That’s a huge confidence booster and can fund your trading journey for months. It’s one of the best deals in the futures trading industry, period.

Tradeify is more in line with the industry standard with its 90% profit split. It’s still a fantastic deal, but it doesn’t have that initial wow factor that Apex does. However, the ability to request a payout after just 5 days is a nice touch for traders who prioritize quick cash flow.

In simple terms, Apex is designed to give you a massive initial payout to get you started, while Tradeify follows a more traditional, but still very fair, payout model. Both firms provide solid scaling plans, allowing you to increase your contract size as your account balance grows, which is a crucial element of long-term trader development.

5. Platforms & tradable assets of Tradeify vs Apex

At the end of the day, your trading experience is only as good as the tools you use. The trading platform is your cockpit, so its reliability and features are non-negotiable. It’s also vital to know what you can actually trade. Do you have access to the markets where your strategy works best?

Here’s a look at the platform support and asset offerings from both firms.

| Criteria | Tradeify | Apex |

|---|---|---|

| Trading Platforms | Tradovate, ProjectX. ProjectX is modern and integrates with TradingView. | Huge selection: Rithmic, NinjaTrader, Tradovate, TradingView, and more. |

| Asset Classes | Futures, Forex, and CFDs. A much broader selection. | Futures only. Specialized and focused. |

| Execution Speed | Good, uses reputable brokers like Tradovate. | Excellent, leverages top-tier data providers like Rithmic. |

| Dashboard/Analytics | Offers a built-in trading journal for performance tracking. | Provides a simple dashboard for account management, without in-depth performance metrics. |

So, what’s the takeaway here?

Tradeify is clearly targeting the trader who appreciates a modern, streamlined experience. Their platform, ProjectX, with its built-in TradingView charts, is sleek and intuitive.

While they focus on the same asset class as Apex futures, their value proposition lies in a modern user experience and flexible funding paths. The choice between their Growth, Select, or Lightning accounts provides different routes to getting funded, which can appeal to traders who want more options than a single, standard evaluation.

Conversely, Apex is the undisputed king for dedicated futures traders. They support nearly every major platform, especially industry standards like NinjaTrader and Rithmic. If your strategy uses NinjaTrader or depends on Rithmic’s data feed, Apex is practically built for you. They don’t distract with other markets, providing the best possible environment for trading futures.

Ultimately, your choice here depends on your focus. Do you want a versatile, multi-asset firm with a modern feel? Go with Tradeify. Are you a futures purist who needs support for a wide range of platforms and rock-solid execution? Apex is your champion.

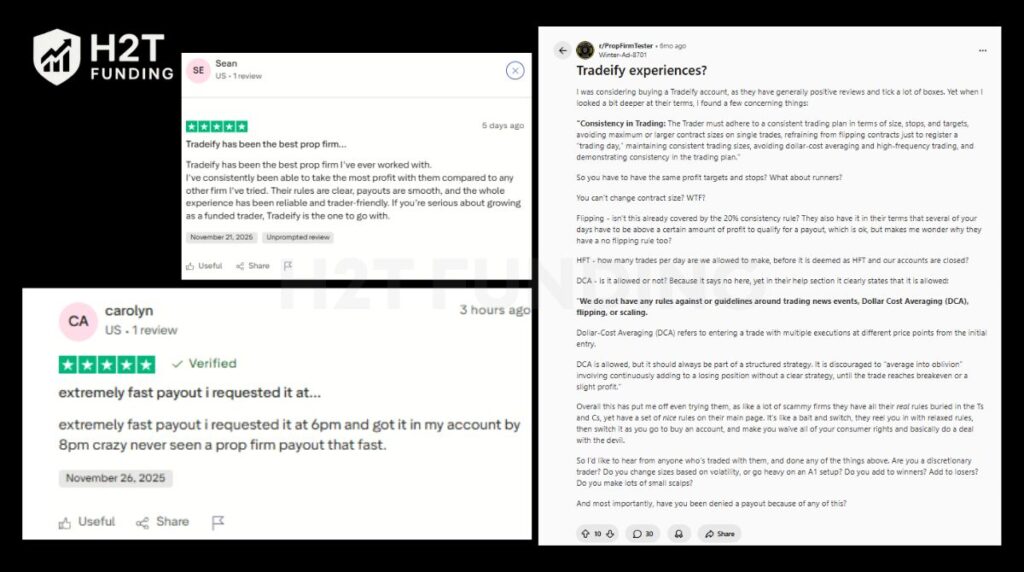

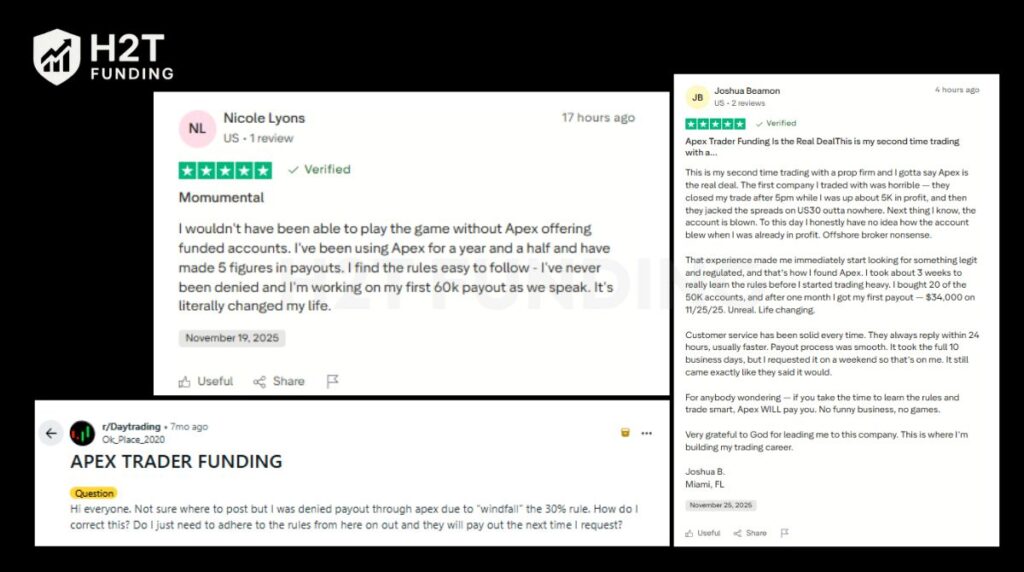

6. Tradeify vs Apex reviews on Reddit and Trustpilot

Okay, we’ve looked at the rules, the fees, and the platforms. But here’s where the rubber really meets the road. What are actual, funded traders saying? Marketing promises are one thing, but unfiltered thoughts from forums like Reddit and review sites like Trustpilot tell the real story about payout reliability and overall trust.

(Note: Information collected and updated on November 30, 2025)

Let’s dive into what the community is reporting. I’ve pulled some key themes and will suggest specific reviews you should look at to get a balanced picture.

Tradeify is overwhelmingly praised for its lightning-fast payouts. This is their standout feature, with countless traders reporting getting their money within hours, not days. The Lightning Funded accounts are also very popular.

However, the main point of friction is the consistency rule, which some traders feel is restrictive and can make it difficult to withdraw profits from a single huge winning day.

Apex is celebrated for its simplicity and life-changing opportunities. Traders love the clear rules (especially the EOD drawdown and no daily loss limit) and the potential to make significant income.

The vast majority of negative feedback revolves around one thing: strict rule enforcement. If you break a rule, especially the 30% windfall rule, you should expect your payout to be denied. They are known for paying reliably, but only if you operate perfectly within their stated framework.

7. Which prop firm is easier to pass?

This is the million-dollar question, isn’t it? When you’re putting your money and time on the line, you want the path of least resistance. But easy is subjective. To one trader, it means speed; to another, it means forgiveness. Let’s break it down logically.

| Criteria | Tradeify | Apex | Win |

|---|---|---|---|

| Profit Target | Standard 6-8% targets. Can be passed in 1 day. | Standard 6-7% targets. Requires a minimum of 7 days. | Tradeify |

| Drawdown Strictness | Varies. The intraday trailing drawdown on some accounts is brutal and unforgiving. The EOD is better. | Uniformly lenient. The EOD trailing drawdown across all accounts provides much better risk protection. | Apex |

| Rule Complexity | More complex. You have to navigate different trading rules like the consistency rule. | Far simpler. No daily loss limit, no consistency rule on evals. The rules are few and very clear. | Apex |

| Overall Difficulty | A quicker path, but with more potential traps. | A slower, more methodical path with a bigger safety net. | Depends on the Trader |

So, which one is truly easier?

Honestly, I think for the average trader, especially those who are still developing their discipline, Apex is easier to pass.

Why? It comes down to the drawdown and rule simplicity. The EOD trailing drawdown is a massive psychological advantage. It allows you to make mistakes during the day and recover without being instantly disqualified.

The lack of a daily loss limit or complex consistency rules during the evaluation challenges removes so much mental pressure. It’s a forgiving environment with strong risk protections, designed to test your profitability over a week, not your perfection in a single moment.

That said, for a highly skilled, confident scalper who can hit their profit target in a few killer trades, Tradeify is undeniably faster. The ability to pass in a single day is a huge plus. But that speed comes with a higher risk of being tripped up by a sudden market spike due to the unforgiving nature of an intraday trailing drawdown.

8. Who should choose which firm?

At the end of the day, the best firm is the one that fits your personality and strategy like a glove. What works for a scalper might be a nightmare for a swing trader. So, let’s cut to the chase and match the trader type to the right prop firm.

| Trader Type | Best Choice | Why |

|---|---|---|

| Beginners | Apex | The simple rules, forgiving EOD drawdown, and lack of a daily loss limit provide a much better learning environment. It’s a great place to develop discipline without constant pressure. |

| Futures Day Traders | Apex | This is their bread and butter. The EOD trailing drawdown is perfectly suited for intraday strategies, and the focus on futures trading means their entire system is optimized for it. |

| Scalpers | Tradeify | Scalpers who can hit a profit target quickly will love the 1-day pass potential. The fast execution and modern platforms are also a big plus for high-frequency strategies. |

| Swing Traders | Neither | Honestly, both firms are designed for day trading. The requirement to close all positions by the end of the day makes true swing trading impossible. |

| Risk-Averse Traders | Apex | The clear and minimal set of rules, combined with the EOD drawdown, creates a superior environment for risk management. You have more room to manage trades without fear of instant failure. |

| Automated Traders | Both (Leans Apex) | Both firms permit automated strategies, but Apex’s broad platform support, especially with NinjaTrader and Rithmic, gives it an edge for traders running established systems. |

| Cash-Flow Traders | Tradeify | If your goal is to get paid as fast as possible, Tradeify is the winner. The possibility of a first payout in just 5 days and subsequent lightning-fast withdrawals is unmatched. |

9. Frequently asked questions (FAQs)

Neither firm is objectively better; they are built for different traders. Tradeify is ideal for those who want instant funding, multi-asset trading (futures, forex, CFDs), and extremely fast payouts. Apex is superior for dedicated futures traders who prioritize simple rules, a forgiving EOD drawdown, and no daily loss limits.

Yes. Based on extensive community feedback and Trustpilot reviews, Tradeify has a strong reputation for paying its traders consistently and quickly. Their key feature is the speed of their payouts, with many traders reporting they receive their funds within hours of a request.

Yes, Apex Trader Funding is widely considered one of the most trustworthy firms in the industry. They have a long track record of paying out hundreds of millions of dollars to traders and maintain a high rating on Trustpilot (4.5/5). Their trustworthiness is built on a foundation of clear rules: if you follow them, you get paid.

Trust is always subjective. However, firms like Apex Trader Funding and Topstep are often considered the most trusted in the futures space due to their longevity, massive user base, and transparent payout history. Trust is typically earned through consistent payouts and clear communication, which both firms demonstrate.

Apex is a proprietary (prop) trading firm, not a broker. They provide traders with funded trading accounts to trade the firm’s capital. Traders connect to the market through brokers and data providers that partner with Apex, like Tradovate or Rithmic.

Tradeify offers a diverse range of assets, which is one of its key advantages. You can trade futures, Forex currency pairs, and various CFDs (Contracts for Difference), making it a versatile choice for multi-market traders.

The main differences are: Funding Models: Tradeify offers both evaluations and instant funding; Apex only offers one-step evaluations. Drawdown: Apex uses a forgiving EOD trailing drawdown. Tradeify uses a mix of EOD and stricter intraday trailing drawdowns. Assets: Tradeify offers futures, forex, and CFDs. Apex is futures-only. Payouts: Apex offers 100% of the first $25k. Tradeify offers up to 90% from the start, but with faster processing.

For most traders, Apex is easier to pass. Its simpler rules and more forgiving EOD drawdown provide a larger margin for error. However, a highly skilled trader might find Tradeify faster to pass due to the 1-day minimum requirement.

Yes. This is one of Tradeify’s main attractions. Their Lightning Funded accounts allow traders to skip the evaluation phase. This appeals to experienced traders who want to start earning right away by trading a funded account immediately after purchase.

Yes, Apex is very friendly to automation. Their wide range of platform integrations, especially with NinjaTrader, makes them a popular choice for traders who use expert advisors (EAs) or other automated systems. They have clear guidelines on what type of automation is acceptable.

Yes, Tradeify is widely regarded as a good prop firm, especially for traders who prioritize speed. Its main strengths are the instant funding options, modern platforms, and exceptionally fast payouts. However, its more complex rules may be less suitable for beginners.

Yes, absolutely. Community reviews and the company’s reputation confirm that Tradeify pays its profitable traders. Their speed of payment is one of their most highly praised features.

10. Conclusion

Ultimately, the Tradeify vs Apex debate doesn’t have a single winner; it has a strategic choice based on which firm offers the best trader conditions for your personal style. Tradeify champions speed and flexibility, offering an express lane to funding for versatile traders who can handle a more complex rulebook.

In contrast, Apex provides a fortress of simplicity and focus, creating a forgiving environment for dedicated futures traders who value straightforward, predictable rules.

At H2T Funding, our goal is to empower you to choose with confidence, and we may use affiliate links to support our research. Whether you need guidance from a performance coach or just clear data, we hope this review helps. To see how these firms stack up, explore our comprehensive prop firm comparison page.