Topstep trading rules are not suggestions; they are strict limits that can end your account instantly. Most traders don’t fail because they can’t trade profitably. They fail because they break one rule without realizing it.

In fact, the majority of failed Topstep accounts are caused by just a few critical mistakes:

- Hitting the Daily Loss Limit in a single bad session

- Getting caught by the Trailing Max Drawdown, often without noticing

- Overtrading near loss limits and trying to save the account

- Abusing position size to reach profit targets faster

- Showing inconsistent behavior, even while staying profitable

These rules are designed to expose emotional trading, poor risk control, and a lack of discipline quickly. Guide of H2T Funding will break down every Topstep trading rule, showing exactly how traders fail, why it happens, and how to avoid getting eliminated before you ever reach a funded account.

Key takeaways:

- Topstep trading rules are your framework for success, teaching the core principles of risk management, discipline, and consistency essential for a long-term trading career.

- The Trading Combine is a test designed to see if you can trade profitably while adhering to specific risk management guidelines.

- There are several key Topstep trading rules you must master: the Daily Loss Limit, Trailing Max Drawdown, Consistency Target, the Scaling Plan,…

- Funded accounts operate under a different set of rules, which often become more flexible after you pass the evaluation to support sustainable profit generation.

- Discipline is more important than strategy; a great strategy is worthless if one impulsive trade breaks a core rule like the Daily Loss Limit or Maximum Drawdown.

1. Why should you understand Topstep trading rules?

Topstep is a trader evaluation firm that provides capital to traders who can prove their ability to be profitable and manage risk through simulated trading in a realistic environment. This process is called the Trading Combine. Think of it as a job interview for a professional trader. The Topstep trader rules are your job description.

Why are they so important?

- To avoid instant failure: Violating a core rule, like the Maximum Loss Limit, will immediately disqualify your account. Many traders have failed just minutes after a big win because they weren’t paying attention.

- To build professional habits: These rules force you to adopt a disciplined approach. You learn to cut losses, manage position sizing, and think about long-term consistency rather than just one lucky trade.

- To secure your funded account: Passing the Trading Combine is just the first step. To keep your Express Funded Account and benefit from the generous profit split, you must continue to adhere to a set of rules.

For anyone serious about using Topstep, mastering the rules is the first and most critical step.

2. Topstep trading rules: How to overcome challenges?

The Trading Combine is where you prove your skills. Its rules are designed to identify disciplined traders. While there can be slight variations, the core principles apply to both Topstep step 1 rules and Topstep step 2 rules. Adhering to these risk parameters is what gets you to the finish line, so let’s break down the core Topstep trading combine rules.

2.1. Daily loss limit

This is a straightforward but critical rule. It defines the maximum net loss your account can sustain in a single trading day before being disqualified. The Daily Loss Limit is calculated from your Start of Day balance, which is typically the prior day’s ending balance but can change after payouts, resets, or account adjustments. Understanding what a drawdown is in trading is essential here, as this rule directly relates to the drawdown of your account during active trades.

Specific Limits: Topstep sets clear, hard limits based on account size:

- $1,000 on a $50K account

- $2,000 on a $100K account

- $3,000 on a $150K account

Example Scenario: You are trading a $100K account. Your Daily Loss Limit is $2,000. If you start the day with a balance of $101,500, your account cannot drop below $99,500 at any point during that trading session. Even a momentary dip below this level due to an open position’s drawdown will violate the rule.

2.2. Maximum Loss Limit (End of Day)

This is arguably the most important rule to understand, and Topstep has a uniquely trader-friendly approach. They use an End-of-Day Trailing Drawdown. If you are asking, does Topstep have trailing drawdown? The answer is yes, and it works differently from most other trading firms.

Unlike other firms that trail your drawdown based on intra-day equity peaks, Topstep’s drawdown only moves up when your account closes the trading day with a new high balance. This is a huge advantage. It means you can have a large unrealized profit during the day, which then pulls back, without your risk buffer being penalized. The drawdown only “trails” based on your end-of-day closing balance.

While the End-of-Day calculation is forgiving, traders can still fail. For instance, if your $50K account has a $2,000 drawdown, your floor is $48,000. If you close the day at $51,000, your new floor becomes $49,000. The mistake is forgetting that this floor never moves down, even if you have a losing day afterward.

2.3. Consistency target

Topstep wants to fund traders who have a repeatable strategy, not just one lucky break. Topstep enforces a Consistency Target, where no single trading day may account for more than 50% of total profits. Additionally, traders must trade on at least two separate trading days to pass the Trading Combine.

However, you must trade on at least two separate days to demonstrate consistent trading before passing. This prevents a trader from hitting their profit target in a single massive trade on their first day. It ensures your performance statistics reflect a consistent approach.

2.4. Scaling plan

This rule enforces professional risk management by limiting the maximum number of contracts you can trade based on your account equity. As your profits increase, your buying power grows, allowing you to scale positions safely. This guideline is a fundamental part of the Prop Firm Rules that ensure traders manage risk while remaining eligible for funding.

2.5. Payout rules

While the Topstep payout rules are more relevant for the funded stage, understanding them provides motivation. Topstep allows traders to keep 100% of their first $5,000 in profits, after which profits are split 90/10 in the trader’s favor.

2.6. Step 1 rule

Topstep separates rules into Step 1 and Step 2 for the Trading Combine. The Step 1 rules focus on initial account discipline and basic risk adherence, while Step 2 rules build on this foundation, testing a trader’s ability to maintain consistent performance over multiple days. Both steps emphasize risk management, daily loss limits, and demonstrating a repeatable strategy.

2.7. Trading hours and products available

You can trade whenever the markets for your chosen products are open. Topstep is a specialist in futures trading, and you can trade a wide variety of products from the CME Group, including:

- Equity Futures (E-mini S&P 500, NASDAQ 100)

- Foreign Exchange Futures (EUR, GBP)

- Agricultural Futures (Corn, Soybeans)

- Energy Futures (Crude Oil, Natural Gas)

- Interest Rate Futures

- Metals Futures (Gold, Silver)

All positions must be closed by 3:10 PM CT on Friday. Holding trades over the weekend is not permitted in the Trading Combine.

2.8. Other critical rules and unique features

News Trading Allowed: Yes. The Topstep news trading rules are more flexible than at many firms, allowing you to hold positions during major news events. However, the responsibility is entirely on you to manage the extreme volatility and risk associated with these periods.

Allowed Instruments: Topstep is a specialist in futures trading. You can trade a wide variety of products from the CME Group, including:

- Equity Futures (E-mini S&P 500, NASDAQ 100)

- Foreign Exchange Futures (EUR, GBP)

- Agricultural Futures (Corn, Soybeans)

- Energy Futures (Crude Oil, Natural Gas)

- Interest Rate Futures

- Metals Futures (Gold, Silver)

Automated and Copy Trading:

- EAs/Bots: You are permitted to use trading bots and other automated strategies.

- Copy Trading: The Topstep copy trading rules are specific. Trade copiers may be used for execution convenience across your own accounts; however, mirrored trading, hedging behavior, or risk-stacking across accounts is strictly prohibited and subject to behavioral review. However, copying other traders is prohibited conduct. Note that trade copiers cannot be used on Live Funded Accounts.

In short:

Exceeding Topstep account limits doesn’t always mean your account is instantly failed but it does change how your account is treated. In many cases, traders are confused because they still have an active account but suddenly cannot withdraw profits or continue trading normally.

When this happens, Topstep may freeze the account for review, even if no single hard rule appears to be broken. This review focuses on trading behavior, not just numbers. High-risk patterns, aggressive sizing near drawdown limits, or erratic trading can trigger restrictions.

What traders often don’t realize:

- You may not be eligible for payouts, even though the account is still active

- The account can be frozen for behavioral review

- Topstep reviews how you traded, not just profit or loss

- Balances cannot be merged to offset risky behavior

- Many traders believe they are blocked or shadow-banned when, in reality, their risk profile raised red flags

This is why exceeding account limits feels confusing; there isn’t always a clear rule violation. Instead, Topstep is assessing whether your behavior aligns with professional risk management standards, not just whether you stayed within numeric limits.

3. Funded account rules: Maintaining sustainable profits

Earning an Express Funded Account marks the transition from evaluation to professional application. For traders asking how funded trading accounts work, the objective now evolves from proving capability to generating sustainable profit with the firm’s capital. While founded on the same principles of disciplined risk management, these rules feature critical modifications that are essential for maintaining and profiting from a funded account.

3.1. Maximum loss limit

This is the most critical rule for your funded account. Think of it as the ultimate safety net. If your account equity ever drops to or below the Maximum Loss Limit, the account will be permanently closed.

So, does Topstep have a trailing drawdown in the funded stage? The limit is based on your highest end-of-day balance and functions similarly to the trailing drawdown in the combine; it moves up when you close a day at a new equity high. Crucially, this limit does not go down if you have a losing day. It establishes a permanent floor below which your account cannot fall.

3.2. Daily loss limit

The Daily Loss Limit (DLL) remains a critical parameter for the Express Funded Account, but its function transitions to a risk-mitigation tool. It’s important to understand this is not commission-free trading. The DLL is calculated intraday from your net P&L, which includes all commissions and fees to accurately reflect market conditions.

Instead of disqualification, hitting the limit triggers an automatic suspension of trading for the remainder of the session, with privileges fully restored at the start of the next trading day. This mechanism acts as a crucial “circuit breaker,” designed to prevent a single adverse trading day from escalating into a catastrophic loss to the account.

Daily loss limits by account size:

- $50K Combine = -$1,000

- $100K Combine = -$2,000

- $150K Combine = -$3,000

Key operational rules

- Permitted trading hours: You can trade during normal electronic hours for your chosen products. However, a strict rule is that all positions must be closed by 3:10 PM CT or by the product’s specific market close, whichever comes first. Be sure to check abbreviated holiday hours.

- Trading Platforms: When considering what platform does Topstep use, traders have a wide range of choices. Topstep supports over 14 different platforms, including popular options like NinjaTrader, TradingView, Quantower, and their own proprietary TSTrader®, ensuring you can trade in an environment you are comfortable with.

- Scaling your success: Topstep allows successful traders to manage multiple streams of income. You can have up to five active Express Funded Accounts at one time, giving you a clear path to scale your trading business.

Most Topstep failures occur after traders are already in profit, when they increase size aggressively and violate the Daily Loss Limit within minutes.

4. Live-funded account trading rules

Progressing to a Live Funded Account marks the final transition from a simulated environment to trading with the firm’s direct capital. The operational framework, including the Daily Loss Limit, mirrors the Express Funded Account. However, the risk parameters and consequences for violations are significantly elevated.

Your primary directive in the live environment is capital preservation.

- In the Live Funded Account, the Maximum Loss Limit functions as a firm-defined risk floor based on starting balance and approved risk parameters. The account must remain within approved drawdown limits; breaching them results in termination, even if the balance remains positive. This means your account balance must remain positive at all times. Any trade that causes your account equity to dip into a negative balance will result in the permanent termination of the account.

- The Daily Loss Limit acts as a safety circuit breaker. It triggers a temporary suspension of your trading if you hit the intraday threshold, helping you avoid the hard $0 floor.

The consequences for any rule violation in the live stage are immediate and directly tied to your profitability:

- Violation Below Starting Balance: If you breach any rule while your account balance is below its initial starting capital, the Live Funded Account will be closed immediately, and any potential profits are forfeited.

- Violation Above Starting Balance: If a rule is broken while the account is in profit (above the initial starting balance), the account is still terminated. However, the profits you have accrued will be distributed according to the profit split outlined in your agreement.

This unforgiving structure underscores the heightened level of responsibility required when managing live capital, where flawless adherence to every rule is paramount to your success.

5. Withdrawal and profit-sharing policy

This is the goal for every trader. Topstep’s payout policy is known for being straightforward.

- Profit Split: You keep 100% of your first $5,000 – $10,000 in profits (depending on the account size). After that, the profit split is a very generous 90/10, meaning you keep 90% of all profits you generate.

- Process: You can request a payout after accumulating a certain profit cushion and meeting the requirement for the number of winning trading days. Payouts are typically processed daily.

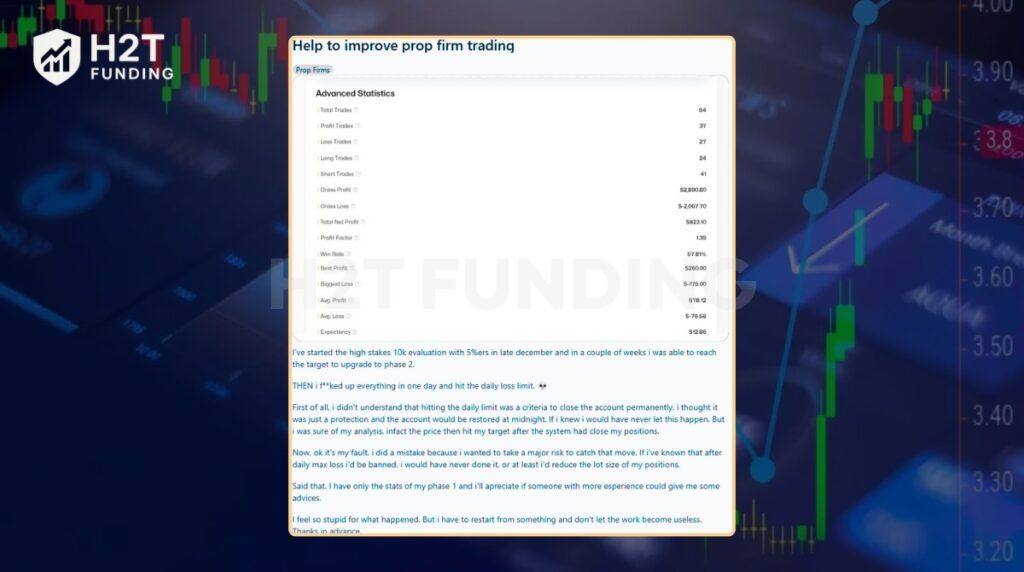

6. Real-life examples of Topstep rules violations

Theoretical knowledge of the rules is one thing; seeing how they play out in real-time trading is another. The following scenarios illustrate the most common ways that skilled traders, even those who are profitable, can fail an evaluation due to a momentary lapse in discipline.

Daily Loss Limit violation: The profit target trap

A trader entered a $50,000 Trading Combine evaluation and quickly built up some profits. Feeling confident, they increased their position size to chase bigger gains. Unfortunately, one bad session pushed their account down more than 5% in a single day, which automatically triggered a Daily Loss Limit violation.

Even though the trader still had capital left, the breach of this single rule ended their evaluation. This case shows how easy it is to lose a funded trading chance if you ignore risk controls. The Daily Loss Limit is not about total balance, but about how much you can afford to lose in one trading day, and exceeding it, whether through realized or unrealized losses, means instant disqualification.

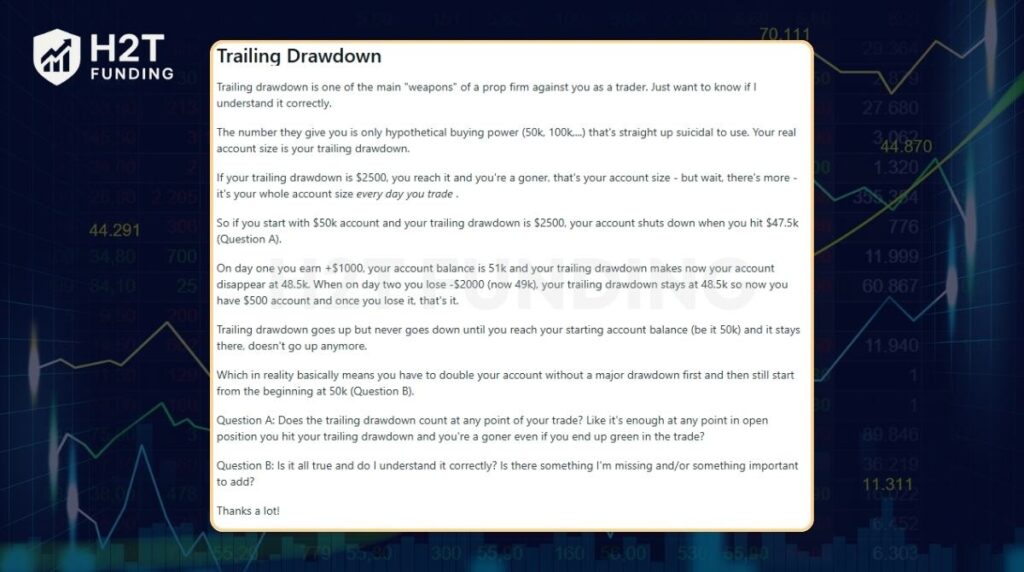

Trailing Max Drawdown violation: The invisible floor

A trader began a $50,000 evaluation account. On Day 1, they booked a profit of $1,000, raising their balance to $51,000. The prop firm’s rules include a trailing max drawdown, meaning the maximum drawdown floor moves up with closed profits. In this case, once the balance hit $51,000, the trailing max drawdown floor became $48,500 (i.e. $51,000 minus $2,500 allowance).

On Day 2, the trader lost $2,000, bringing the balance down to $49,000. Although still above the $48,500 floor, the buffer only permitted a further loss of $500 before triggering the violation. When that further loss occurred, dropping the balance to $48,500 or below, the account was immediately closed, acceptable for the firm, but catastrophic for the trader. No reset or remediation was offered.

This illustrates how Trailing Max Drawdown doesn’t allow margin for error after making a profit. If you go above a high-water mark, the drawdown resets (floor shifts up), and once you breach that floor, the account is busted.

7. Prohibited trading strategies at Topstep

To maintain a fair and professional trading environment and ensure funded traders succeed based on legitimate skill, Topstep prohibits any activity not representative of a professional approach. While this guide explains the rules, it is not investment advice. Adherence to these rules is mandatory, and any violation can result in immediate account termination.

The following strategies and conduct are expressly prohibited:

- Exploiting system vulnerabilities: Any strategy designed to take advantage of platform errors, including price display inaccuracies, data feed delays, or other system bugs, is forbidden.

- Manipulative or disruptive practices: Engaging in trading practices that would be considered improper in live markets, such as “spoofing,” or consistently executing trades far outside the best bid or offer.

- Collusion and coordinated trading: Working in concert with other traders to execute the same or opposing strategies across multiple accounts to pool or hedge risk. This also includes violating the Topstep copy trading rules by copying other traders.

- Abuse of risk parameters (account stacking): The practice of using multiple accounts to make repeated high-risk trades, abandoning accounts that fail the Maximum Loss Limit until one is successful, is strictly prohibited.

- Improper use of automation: Employing any software, AI, or high-frequency trading algorithm in a manner that manipulates, abuses, or gives the user an unfair advantage over the system is not allowed.

- Trading on behalf of others: Your Topstep account is for your personal use only. Trading for any other individual or entity, or sharing profits as part of an external business arrangement, is a direct violation.

- Uncommercial or non-viable strategies: Topstep reserves the right, in its sole discretion, to determine if a trading activity is uncommercial, not a viable long-term strategy, or otherwise represents irresponsible trading.

View more:

8. Tips to follow the Topstep trading rules and pass the evaluation

Successfully navigating the Topstep Trading Combine is less about having a secret strategy and more about demonstrating unwavering discipline. The rules provide a framework, and your ability to operate within it is what is truly being tested. Integrating the following practical habits into your daily routine will significantly enhance your ability to remain compliant and achieve your funding goal.

- Know your numbers: Before each trading day, calculate your daily loss limit level and your trailing drawdown level. Write them down.

- Use a hard stop-loss: Always trade with a stop-loss to protect yourself from violating the daily loss limit.

- Respect the scaling plan: Don’t get greedy. Increase your size only when the rules permit. Your goal is to prove you can follow rules.

- Plan for consistency: If you have a massive winning day, switch your mindset. Your new goal is to add small, consistent gains to pass the consistency target.

- Keep a journal: Track your trades and your proximity to the rule limits. This will help you stay aware and compliant.

9. What happens if you break Topstep rules?

Breaking Topstep rules leads to immediate account termination, even if your account is currently profitable. Any fees paid are non-refundable, and all accumulated or unrealized profits will be forfeited. Traders who violate key rules must either reset the account or purchase a new one to continue. These strict policies reflect Topstep’s focus on discipline, consistency, and professional risk management over short-term gains.

What happens when you break Topstep rules:

- Your trading account is disabled instantly

- You lose the account fee with no refund

- Any unrealized or unpaid profits are forfeited

- You cannot continue trading on that account

- You must reset the account or start over with a new one

- Repeated violations increase financial and psychological pressure

This checklist makes it clear that following Topstep rules is essential if you want to pass the evaluation and trade funded capital long-term.

10. FAQs

Yes, Topstep is one of the oldest and most respected firms in the industry. They have a long track record of funding traders and processing payouts.

If you break a rule in the Trading Combine, your account is disqualified. However, Topstep frequently offers a reset option at a discounted price. If you have questions about your account status, the trader support team is available to provide clarification.

For many new traders, yes. It’s dynamic and unforgiving. The key is to protect your unrealized profits and understand that your risk buffer shrinks as your equity high-water mark increases.

It ensures that your profits are distributed over several days and not from a single lucky trade. Your best day’s profit cannot make up more than a set percentage (e.g., 50%) of your total profit.

In the standard Topstep futures rules for the Trading Combine, holding positions overnight or over the weekend is prohibited. All positions must be closed before the end of the trading day.

Your Topstep trader dashboard provides all the necessary performance statistics in real-time, showing your current profit/loss, daily loss limit, and trailing drawdown levels. Check it frequently.

The “2% rule” is a general risk management guideline in trading, suggesting you should not risk more than 2% of your account on a single trade. It is not an official Topstep rule, but applying this principle can help you stay well within the Daily Loss Limit and Maximum Loss Limit.

This likely refers to the “50% rule” for consistency, where your best day cannot exceed 50% of your total profits. Always check the specific rules for your chosen account size, as this percentage can vary.

The two most common violations are the Daily Loss Limit and the Trailing Maximum Drawdown. These often happen due to a single oversized loss or a failure to protect unrealized profits.

11. Conclusion

The Topstep trading rules are not obstacles; they are a blueprint for disciplined trading. They force you to manage risk, think about consistency, and behave like a professional. Past performance is no guarantee of future results. However, embracing these rules as part of your strategy transforms Topstep from a challenge into a genuine opportunity for your trading career.

If you are exploring different opportunities in the proprietary trading space, check out our Prop Firm & Trading Strategies category of H2T Funding for more reviews and comparisons.