Topstep funded account rules are designed to control risk and evaluate trading discipline across both Express and Live accounts. However, many traders misunderstand or overlook key details in these rules, which can lead to account closures even when their trading strategy is otherwise sound.

This guide from H2T Funding is an unofficial explanatory resource compiled from Topstep’s publicly available documentation. Its goal is to help traders understand how each rule works, the differences between Express Funded Accounts and Live Funded Accounts, and the key areas that require close attention.

This article focuses on providing neutral and practical explanations of the rules, helping traders stay compliant and manage risk more effectively when trading with Topstep’s capital.

Key takeaways

- A funded account is a trading account provided by a prop firm where traders use the company’s capital under strict rules instead of risking personal money.

- Daily Loss Limit sets the maximum you can lose in one trading day on platforms where it is enforced, triggering auto-liquidation if reached.

- Trailing Max Drawdown acts as a moving floor on your balance, locking in profits and closing the account if breached.

- The scaling plan restricts the number of contracts you can trade based on your account balance to prevent over-leverage.

- Payout rules allow withdrawals after five winning days in Express, and daily payouts of up to 100% of the trader’s share of the account balance in Live after 30 winning days.

- News trading is permitted, but all risks from slippage or volatility fall entirely on the trader.

- Copy trading is available between Combines and Express accounts, but not in Live accounts.

- Automated strategies are allowed, but traders take full responsibility for errors or malfunctions.

- Promotion from an Express Funded Account to a Live Funded Account is not automatic and depends on review and discretion by Topstep’s Risk Team.

1. What is a funded account?

A funded account is a trading account provided by a prop firm after a trader proves their skill in a Trading Combine. With a funded account Topstep, traders use the firm’s capital under strict risk management rules instead of risking personal funds. This model allows traders to focus on performance and consistency without the pressure of putting their own savings at risk.

With Topstep, the process begins in a simulated account. Here, you practice under live market conditions, build consistency, and show risk control. After meeting the required objectives, a trader may be called up to a Live Funded Account, subject to review and approval at the discretion of Topstep’s Risk Team.

Topstep offers multiple account size options: $50,000, $100,000, or $150,000. Each size comes with different profit targets, position limits, and a defined Max Loss Limit. For instance, the $50K account requires a $3,000 profit target with a $2,000 loss cap, while the $150K account allows bigger position sizes but demands a $9,000 profit target.

Your account balance must always stay above the drawdown limits. If it drops below, the account is closed immediately.

Depending on the chosen path (Standard or No Activation Fee), traders may be required to pay a one-time Activation Fee when activating an Express Funded Account. These costs are part of the broader Topstep funded account fees that traders should understand before participating in the program.

See also:

2. Topstep Funded account rules

Trading with firm capital is about proving you can manage risk under strict conditions. Topstep lays out a clear framework of rules to guide traders and protect accounts. Understanding these rules up front is essential because even one small mistake can mean losing your funded account.

In this section, we’ll break down every major rule that applies to a Topstep Funded account, including:

- Daily Loss Limit

- Trailing Max Drawdown (TMD)

- Scaling Plan

- Payout Rules

- News Trading, Weekend Holding, Copy Trading, and Automated Strategy Rules

- Trading Hours & Products

Keep reading to learn how each rule works in practice and what it means for your funded journey.

For a broader overview, explore our full guide on the Topstep trading rules, or see what platform Topstep uses to prepare your setup before trading live.

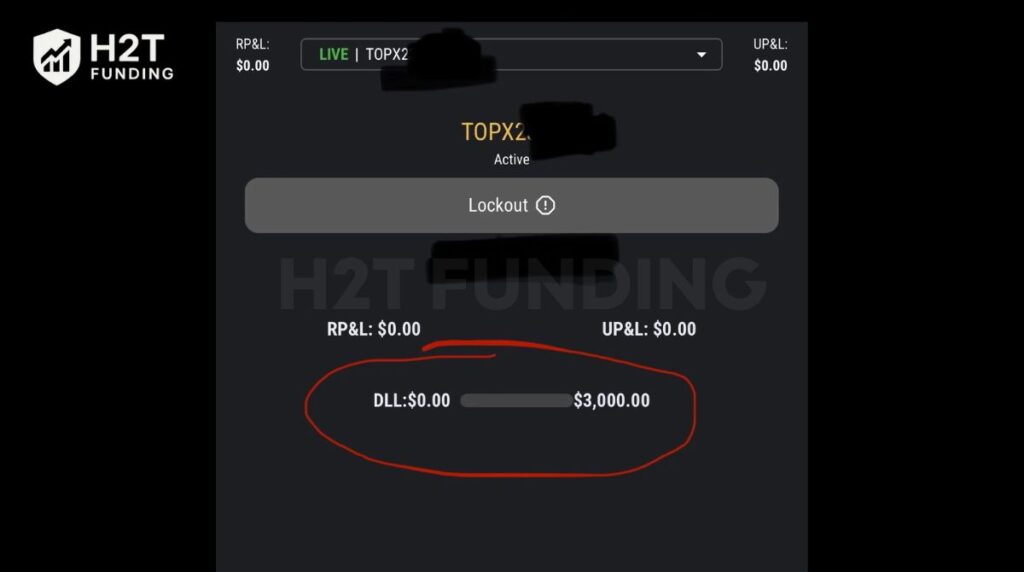

2.1. Daily loss limit

The Daily Loss Limit is an objective that sets a maximum amount you can lose in a single trading session. It’s designed to encourage discipline, limit emotional decision-making, and protect traders from blowing up their progress in just one day. Once the limit is hit, the system auto-liquidates all open positions and blocks new trades until the next session begins.

At Topstep, the limit depends on the account size:

- $50K account = –$1,000

- $100K account = –$2,000

- $150K account = –$3,000

If your Net P&L drops to or below the threshold at any point, all trades are closed automatically. Pending orders are canceled, and you cannot trade until the next reset at 5:00 PM CT.

It’s important to note that the Daily Loss Limit is platform-dependent. Some new or reset accounts on the TopstepX platform may not have a Daily Loss Limit applied, while other platforms such as NinjaTrader or Quantower may still enforce this limit.

2.2. Trailing max drawdown (TMD)

The Trailing Max Drawdown, sometimes called the Maximum Loss Limit, is a moving floor on your account balance. It follows your highest equity during the trading period and locks in gains, ensuring that profits are protected while preventing traders from giving too much back to the market.

Topstep applies the TMD across all account types, including the simulated account stage, Express Funded Accounts, and Live Funded Accounts. The values are set by account size:

- $50K account = $2,000

- $100K account = $3,000

- $150K account = $4,500

For example, if you start with a $50K account and earn $500, your balance becomes $50,500. The TMD shifts up to $48,500. Even if your balance later falls back to $50K, the drawdown does not reset downward.

Once the TMD reaches the original starting balance, it stops moving for the rest of the program. Dropping below this minimum results in immediate account closure, with no option to continue trading until a reset.

2.3. Scaling plan

The Scaling Plan controls how many contracts you can trade based on your account balance. It was created to protect traders from over-leverage and to promote steady growth. By scaling up gradually, traders build consistency and avoid blowing accounts with oversized positions.

At Topstep, this rule currently applies only to the Express Funded Account stage. Since July 22, 2025, the Scaling Plan in the Live Funded Account has been replaced by Dynamic Live Risk Expansion.

This system automatically adjusts your contract size and risk limits based on your real-time performance. Instead of fixed thresholds like in the classic Scaling Plan, the DLRE expands or contracts your allowed position size dynamically.

When you trade consistently and grow your balance, the system gradually unlocks larger position limits. If your equity drops or volatility increases, it reduces your exposure to protect the account. In simple terms, Dynamic Live Risk Expansion gives skilled traders more flexibility while still enforcing strict risk control.

Below is the Scaling Plan for each account size:

| Account Size | Balance Range | Max Lots Allowed |

|---|---|---|

| $50K | Below $1,500 | 2 Lots |

| $1,500 – $2,000 | 3 Lots | |

| Above $2,000 | 5 Lots | |

| $100K | Below $1,500 | 3 Lots |

| $1,500 – $2,000 | 4 Lots | |

| $2,000 – $3,000 | 5 Lots | |

| Above $3,000 | 10 Lots | |

| $150K | Below $1,500 | 3 Lots |

| $1,500 – $2,000 | 4 Lots | |

| $2,000 – $3,000 | 5 Lots | |

| $3,000 – $4,500 | 10 Lots | |

| Above $4,500 | 15 Lots |

Key notes and reminders:

- The maximum lot size is evaluated daily at 5 PM CT, after your Trade Report updates. Even if you qualify for a higher-tier mid-day, scaling up only applies from the next session.

- Micros are counted toward position limits based on their leveraged equivalent to mini contracts, according to Topstep’s contract ratio rules.

- Some trading platforms (e.g., NinjaTrader, Rithmic) will block oversized orders automatically, but not all do. On platforms like T4, you must monitor exposure yourself.

- Small mistakes under 10 seconds may be forgiven, but leaving an oversized position open longer can result in review or closure.

- Following the Scaling Plan is part of overall compliance and helps prove long-term trading discipline.

This structure ensures traders don’t rush into large positions before proving they can manage smaller ones, making the funded account journey more sustainable.

2.4. Payout rules

The payout structure at Topstep is designed to reward consistency. If you’re researching the Topstep funded account payout and Topstep funded account payout rules, here’s how eligibility and amounts work by stage.

Instead of waiting months, traders can access profits regularly while still proving their ability to manage risk. The system begins in the Express Funded Account and evolves once you are promoted to the Live Funded Account.

In the Express stage, traders are eligible for a payout after completing five winning trading days, defined as any day with $150 or more in net profit. Each request allows up to 50% of the balance, capped at $5,000. Once processed, the cycle resets, and another five winning days must be completed before the next withdrawal.

Promotion to the Live Funded Account unlocks even more flexibility. After each cycle of five winning days, traders can withdraw up to 50% of their trading profits.

When you reach 30 total winning days in Live, payouts become daily, and you can access up to 100% of your share of the account balance. However, withdrawing the full amount will trigger account closure, since the balance will be reduced to the Maximum Loss Limit.

The table below compares the two payout stages:

| Account Type | Eligibility | Payout Amount | Frequency |

|---|---|---|---|

| Express Funded | 5 winning days ($150+ per day) | Up to 50% of balance, max $5,000 | Every 5 winning days |

| Live Funded | 5 winning days ($150+ per day) | Up to 50% of the balance | Every 5 winning days |

| Live Funded (advanced) | 30 winning days in total | Up to 100% of the trader’s share of the balance | Daily |

Notes:

- From July 29, 2025, new dashboards require $150 profit per day to qualify as a winning day; legacy dashboards still use $200.

- From July 22, 2025, winning days from Express accounts no longer carry over to Live accounts. Only days earned in Live count toward daily payouts.

- The first $10,000 in payouts is kept entirely by the trader. After that, Topstep applies a 90/10 split (trader keeps 90%).

- Payouts are processed through ACH, Wise, or Wire. ACH and Wire withdrawals have a $20 processing fee.

- Minimum payout request is $125.

- Choosing a full 100% payout in a Live account will close the account permanently.

2.5. News trading rules

Topstep allows traders to trade during major economic news events. However, all risks related to increased volatility, slippage, or unfavorable execution are fully the trader’s responsibility.

Topstep does not review or compensate losses caused by news-related market conditions. Traders should assess their own risk tolerance and ensure their strategy is appropriate when trading during high-impact news events.

2.6. Weekend holding rules

Topstep is structured for active day trading. This means positions cannot be carried from one session into the next or into the weekend. The rule protects traders from uncontrolled risk when markets are closed.

Trading then resumes at 5:00 PM CT the same day. After the weekend break, accounts reopen on Sunday at 5:00 PM CT. Failing to follow these cut-off times may result in forced liquidation and can jeopardize account status.

2.7. Copy trading rules

Copy trading in TopstepX allows trades from a Leader account to be mirrored into one or more Follower accounts. This setup helps traders manage multiple accounts with the same strategy, but it also requires careful oversight to avoid unnecessary risk.

Since August 2025, Follower accounts can once again set their own Personal Daily Loss Limit (PDLL) and Personal Daily Profit Target (PDPT). If those limits are hit, the system will automatically liquidate positions on that account and may block further trading until the next session. This gives traders more flexibility in managing risk separately on each account.

It’s important to note that copy trading is only available between Trading Combines and Express Funded Accounts. Live Funded Accounts are excluded, meaning you cannot mirror trades once you’re called up to live capital. Traders must also ensure that the Leader account has the smallest maximum position size to keep copied trades valid.

2.8. Automated strategy rules

Automated strategies can be used in both the Trading Combine and funded accounts. These tools let traders run systems without constant manual input, but any errors or malfunctions are entirely the trader’s responsibility. Slippage, platform glitches, or strategy bugs cannot be appealed.

Topstep permits automation but does not provide setup or technical support. Traders must ensure their bots, scripts, or Expert Advisors (EAs) are fully functional before use. The best practice is to test your automated strategy extensively during the Combine. Start in a simulated environment to confirm stability, check order logic, and ensure your risk controls work properly before going live.

If an automated trade violates any rule, it’s treated exactly like a manual mistake. Rule compliance, consistency, and discipline remain the trader’s full responsibility, regardless of how the trade is placed.

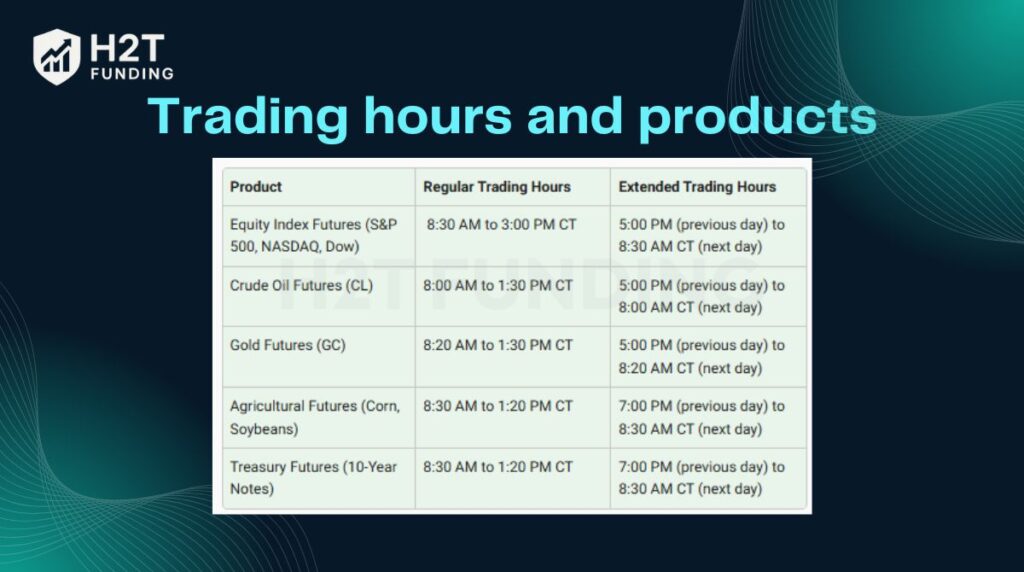

2.9. Trading hours and products

Topstep follows a strict day-trading structure. All positions must be closed by 3:10 PM CT, Monday through Friday. Trading resumes at 5:00 PM CT the same day, giving a short reset period. After the weekend, accounts reopen at 5:00 PM CT on Sunday. Risk managers may begin flattening trades a few minutes before the cut-off, but traders remain responsible for being flat on time.

Not all markets close exactly at 3:10 PM CT. Some futures contracts, such as grains or livestock, shut earlier in the day. In those cases, positions must be closed before the product’s own daily session ends. Holding past the official cut-off or a product-specific close is considered a rule violation.

Topstep permits trading in a wide range of CME futures products, covering equity indexes, currencies, commodities, metals, energy, and interest rates. This includes contracts like ES, NQ, YM, 6E, CL, GC, ZB, and many others. Micros are also allowed, but some platforms (like T4) may not fully support them.

Swing trading and Forex are not allowed. Positions cannot be carried overnight or over the weekend, and Topstep focuses entirely on futures markets rather than spot FX. This keeps risk controlled and ensures all trading follows the same structured parameters.

Understanding the rules is more than a checklist; it’s the foundation of keeping your account safe. By respecting these guardrails, you not only keep your account active but also build the habits needed to succeed in professional trading environments.

3. Illustrative examples of how to apply the rules

Rules matter most when they’re tested in real trading; these scenarios double as a mini Topstep funded account review of how the framework behaves in practice. Below are three scenarios that show exactly how Topstep’s funded account rules apply in practice, what happens when they’re broken, and how they protect disciplined traders.

3.1. Example 1: Breaking the daily loss limit

A trader with a $100K Express Funded Account begins the session cautiously but quickly takes two losing trades, putting them at –$1,600. After the initial losing trades, the trader increases position size in an attempt to recover previous losses.

A sudden market drop pushes losses to –$2,050. Since the Daily Loss Limit for this account is –$2,000, the system auto-liquidates all open positions at 3:09 PM CT. The trader is locked out for the rest of the session. Even though the account can be reactivated later, the violation wipes out hard-earned progress.

This example also shows how Topstep’s risk controls, like the trailing drawdown that follows your account equity.

3.2. Example 2: Applying the scaling plan correctly

In a $50K Express Funded Account, the Scaling Plan allows only two contracts when the balance is under $1,500. The trader starts the week with steady wins, raising equity by $600. At the end of the day, their balance stands at $51,100. In the next session, the Trade Report updates and unlocks three contracts.

By waiting until the next day instead of forcing extra size early, the trader stays compliant and avoids penalties. Over two weeks, equity rises above $2,000, unlocking five contracts and showing how patient scaling leads to sustainable growth.

Traders who use automated systems often struggle with over-leverage, so understanding these limits is crucial. If you’re considering using bots or EAs, it’s worth reviewing whether Topstep allows automated trading to ensure your setup complies with firm policies.

3.3. Example 3: Trading during a news release

Let’s put the news trading rule into perspective. A trader is holding an ES position just before the 1:00 PM CT FOMC statement. The trader may attempt to hold the position through the news release, or may simply fail to close the position in time.

When the news hits, the market goes haywire. Their stop-loss gets blown past in a split second, and what should have been a small, manageable loss turns into a devastating one. This example shows that news events can introduce significant risk if they are not managed carefully.

These scenarios highlight that success in a funded account is less about chasing big wins and more about respecting limits. Applying the rules in real trading situations, you protect your capital and prove you are ready for larger opportunities.

4. Checklist to comply with rules in Topstep

Trading a funded account means balancing opportunity with strict compliance. To help you avoid unnecessary mistakes, here’s a concise summary of the core Topstep rules and what they mean in practice.

| Rule | Requirement / Limit | Explanation |

|---|---|---|

| Maximum Express Funded Accounts | Up to 5 active Express Funded Accounts at one time | The number may vary if you join other Topstep programs. |

| Maximum Loss Limit (TMD) | $50K: $2,000 $100K: $3,000 $150K: $4,500 | If the account drops below this, it is permanently closed. Based on the highest end-of-day balance. |

| Daily Loss Limit | $50K: –$1,000 $100K: –$2,000 $150K: –$3,000 | Intraday safeguard. Hitting the limit triggers auto-liquidation until the next session reset. |

| Scaling Plan | Lot size increases with account balance | Prevents over-leverage. Updated daily at 5 PM CT. Micros are counted toward position limits based on their leveraged equivalent to mini contracts, depending on the platform used. |

| Payout Policy | Express: 5 winning days → up to 50% balance (max $5K) Live: after 30 winning days → up to 100% | Rewards consistent performance. First $10K is 100% trader; then 90/10 split applies. |

| News Trading | Permitted, but all risk is the trader’s responsibility | No exceptions or credits for slippage during economic releases. |

| Weekend Holding / Trading Hours | Not permitted across all funded accounts. Trading is strictly day trading, with no overnight or weekend positions allowed. | Day-trading only. No swing trading, no overnight, no Forex. |

| Copy Trading | Only between Combine ↔ Express accounts Live excluded | Since Aug 2025, Follower accounts can set personal loss/profit limits (PDLL/PDPT). |

| Automated Strategies | Allowed, but the trader bears full responsibility for errors | Must test in a simulated account first. Rule breaks by bots = rule breaks by the trader. |

| Account Inactivity | Accounts may be closed after 30+ days of no activity | Seen in XFA cases; better to keep accounts active or clarify policy with support. |

Note: The Daily Loss Limit applies only on platforms where it is enforced. Some TopstepX accounts may not include a Daily Loss Limit objective.

✅ Tip: Keep this table as your “daily pre-check” guide. Most funded accounts are lost not from bad trades, but from rule oversights like cutoff times, scaling errors, or inactivity.

5. FAQs

If you break a rule like the Maximum Loss Limit, your funded account will be closed permanently. For rules such as the Daily Loss Limit, you’ll be locked out until the next session, but not permanently removed. In either case, it’s your responsibility to monitor P&L and make sure positions are closed on time.

The Trailing Max Drawdown follows your highest end-of-day balance and moves upward as you make profits. For example, if your $100K account grows to $103K, the drawdown shifts to $100K. It never moves back down, so falling below this floor at any point means instant account closure.

Yes, Topstep allows trading during news events. However, all responsibility is on the trader. Volatility during announcements like FOMC or unemployment data can cause slippage, and Topstep will not review or credit these trades. Many traders choose to reduce size or stay flat during such events.

No. Topstep requires all positions to be closed by 3:10 PM CT on trading days. Trading can resume at 5:00 PM CT. Positions cannot be held over the weekend or into market breaks. This rule ensures traders don’t face uncontrolled risk when markets are closed.

In the Express Funded Account, traders become eligible to request a payout after completing five profitable trading days of $150 or more per day. Each request allows withdrawals of up to 50% of the reward balance, with a maximum of $5,000. After being called up to a Live Funded Account, the same payout structure continues to apply. Once a trader accumulates a total of 30 qualifying trading days, daily withdrawals become available, allowing access to up to 100% of the trader’s share of the account balance.

The key rules include respecting the Daily Loss Limit, Trailing Max Drawdown, following the Scaling Plan, closing trades by 3:10 PM CT, and avoiding violations like exceeding lot size. These rules are meant to protect both the trader and the firm’s capital while promoting discipline.

The “30 rule” refers to the requirement in the Live Funded Account. After reaching 30 total winning days, you unlock daily payout eligibility and can withdraw up to 100% of your balance. This is a milestone that shows consistent performance over time.

The consistency rule applies only during the Trading Combine evaluation and does not apply to Express Funded Accounts or Live Funded Accounts. For example, if you’ve earned $6,000 in profit, your biggest single day cannot exceed $3,000. This shows steady skill rather than one lucky trade.

Yes. Topstep allows traders to use their own strategies, including discretionary, automated, or system-based approaches. However, prohibited styles like martingale, grid trading, or exploiting platform delays are not allowed.

Topstep provides three account sizes: $50K, $100K, and $150K. Each has its own profit targets, scaling limits, and drawdown thresholds. Your choice should reflect both your risk tolerance and trading style. Limits and objectives differ slightly between Topstep Express funded account rules and Topstep Live funded account rules.

Back2Funded is available if you lose an Express Funded Account before your first payout. Within 7 days, you can log in to the Topstep dashboard, pay the reactivation fees, and resume trading with the same account size. Costs are $499 for $50K, $599 for $100K, and $729 for $150K accounts. Each account can be reactivated up to 2 times. Once you’ve taken a payout, Back2Funded is no longer an option.

A Benchmark Trading Day is a requirement before your first payout. It means completing at least one full trading day in your funded account that meets Topstep’s basic standards, showing controlled risk, positive P&L, and compliance with all rules. Without this step, you cannot request your first withdrawal, even if you already have enough winning days.

6. Conclusion

At the end of the day, understanding the Topstep Funded account rules is what separates traders who keep their accounts from those who lose them too quickly. These rules aren’t there to hold you back; they’re there to help you stay disciplined, protect your capital, and prove you can manage risk like a professional.

If you stick to the limits, respect the Scaling Plan, and know when to step aside during tough market conditions, you give yourself the best chance to succeed. Many traders fail not because of strategy, but because they overlook the basics.

Want to dive deeper? Check out more articles in the Prop Firm & Trading Strategies section of H2T Funding. There you’ll find detailed comparisons, trading tips, and real-world case studies to guide you through the funded trading journey.