This The5ers vs Funding Pips comparison is all about deciding between two distinct trading philosophies. The5ers offers a structured path focused on long-term, consistent growth, making it a great choice for disciplined traders.

In the Funding Pips vs The5ers debate, Funding Pips provides a flexible, performance-driven model with faster scaling and higher profit splits, appealing to those with a more aggressive style. This in-depth review by H2T Funding’s experts will break down their core differences to help you find the prop firm that best aligns with your trading strategy.

Key takeaways:

- The5ers represents a structured, long-term career path emphasising discipline and stability, whereas Funding Pips offers a flexible, performance-driven environment designed for speed and aggressive returns.

- The5ers is ideal for patient traders focused on building a portfolio; it offers massive scaling potential up to $4M and access to real capital, though it often requires strict adherence to conservative risk management rules.

- Funding Pips is better suited for experienced traders who prioritise high efficiency and fast cash flow; it features competitive entry fees, weekly payouts, and a lucrative profit split structure that starts at 80% and can reach 100% at the Master stage.

1. Overview of each firm The5ers vs Funding Pips

To understand the The5ers vs Funding Pips review, it’s crucial to know the philosophy behind each prop firm. The5ers is a veteran firm built on a foundation of long-term growth and disciplined risk management. Funding Pips is a newer, more agile firm that attracts traders with its flexibility, aggressive profit splits, and fast-track scaling opportunities.

| Criteria | The5ers | Funding Pips |

|---|---|---|

| Founded / Trust | 2016 (Industry Veteran, Highly Trusted) | 2022 (Rapidly Growing, High Volume) |

| Evaluation Models | 1-Step (Hyper Growth), 2-Step (High Stakes), 3-Step (Bootcamp) | Zero (Instant), 1-Step, 2-Step |

| Account Sizes | $5,000 – $250,000 | $5,000 – $100,000 |

| Asset Classes | Forex, Metals, Indices, Crypto | Forex, Crypto, Indices, Metals, Energies |

| Trading Platforms | MT5, cTrader | MT5, cTrader, Match Trader |

| Profit Split | 50% – 100% (Scales with performance) | 80% – 100% (Starts high) |

| Minimum Trading Days | 0 Days (Unlimited time on most accounts) | 0 Days (Unlimited time) |

| Scaling Potential | Up to $4,000,000 (Double capital milestones) | Up to $2,000,000 (Rapid scaling plan) |

| Execution Speed | Stable Market Execution | Fast Execution (Optimised for performance) |

| Commissions | Competitive Institutional Rates | Low Commissions |

| Payouts | Fast Payouts (Avg 16h processing) | Weekly, Bi-weekly, Monthly, On-Demand |

| Risk Restrictions | Conservative (Stop-loss often required) | Flexible (Strict news trading rules ±5 mins on Standard accounts) |

Disclaimer: Rules, pricing, and trading conditions may change over time. Traders should always verify the latest terms directly on the official The5ers vs Funding Pips websites before purchasing any challenge.

While the technical specifications provide a quick snapshot, the true difference lies in how these firms support your daily trading journey. Let’s dive deeper into the background and unique ecosystem of each provider, starting with the industry veteran.

The5ers

#1

Account Types

1-step, 2-step, 3-step

Trading Platforms

MT5, cTrader

Profit Target

5% – 10%

Our take on The5ers

Founded in 2016, The5ers is one of the industry’s most reputable proprietary trading firms, known for its focus on trader development. As noted in our The 5%ers review, their model fosters consistency using structured growth paths.

With over 256,000 traders and 1.3 million trading accounts, The5ers is a proven industry veteran. They offer diverse programs like the 1-Step Hyper Growth for speed, the 2-Step High Stakes for rewards, and the 3-Step Bootcamp for cost-effective entry.

The5ers operates less like a typical challenge provider and more like a true trading incubator. While their lower leverage and stricter risk parameters might feel restrictive to aggressive “gun-and-run” scalpers, these rules are intentional.

They are perfect for disciplined career traders who prioritise safety and massive scaling potential (up to $4M) over instant gratification. If you are looking for a stable, long-term partner rather than a quick flip, The5ers is the gold standard.

| 💳 Challenge Fee | $22 – $850 |

| 👥 Account Types | 1-step, 2-step, 3-step |

| 💰 Profit Split | 50% – 100% |

| 💵 Account Size | $2.5K – $250K |

| ⏱️ Time Limit | No time limit |

| 🎯 Profit Target | 5% – 10% |

| 📊 Trading Platforms | MT5, cTrader |

| 🛍️ Asset Types | Forex, Indices, Commodities, Crypto |

For a more interactive look at how The5ers operates, check out our exclusive video review below. I take you inside their platform, breaking down the dashboard, trading conditions, and the reality of their scaling plan so you can see exactly what to expect before signing up.

Funding Pips

#2

Account Types

1-step, 2-step, and Instant Funding

Trading Platforms

MT5, cTrader, Match Trader

Profit Target

5% – 10%

Our take on Funding Pips

Launched in 2022, FundingPips quickly made a name for itself with a performance-driven and highly flexible model. Its standout feature is the Zero Payout Denial policy, which builds significant trust with traders.

The firm provides multiple funding options, including a “Zero” evaluation model (Instant Funding) and a rapid scaling plan. Its standout feature is the “On-Demand” payout cycle, allowing traders to withdraw profits whenever they want. This model caters to confident traders who want fewer restrictions holding them back.

In my opinion, Funding Pips is the ideal “disruptor” for traders who value speed and efficiency over tradition. While standard accounts have news trading restrictions, traders who choose the On-Demand reward cycle are allowed to trade during major news events without restrictions. In exchange, they enjoy superior profit splits and a high-tech environment.

| 💳 Challenge Fee | $29 – $555 |

| 👥 Account Types | 1-step, 2-step, and Instant Funding |

| 💰 Profit Split | 80% – 100% |

| 💵 Account Size | $5K – $100K |

| ⏱️ Time Limit | No time limit |

| 🎯 Profit Target | 5% – 10% |

| 📊 Trading Platforms | MT5, cTrader, Match Trader |

| 🛍️ Asset Types | FX, Metals, Indices, Energy, Crypto, CFD |

In essence, the choice between The 5%ers vs Funding Pips begins with their core identities. The5ers is the established mentor, offering a structured, secure path designed for long-term consistency.

Funding Pips is the dynamic challenger, providing a flexible, high-reward environment for traders who are ready to perform from day one. This fundamental difference in philosophy sets the stage for how they handle rules, fees, and scaling.

Read more:

2. The5ers vs Funding Pips: Which one is more legit?

In the prop trading industry, legitimacy is not just about paying out today; it is about sustainability, transparency, and how a firm handles adversity. Both The5ers and Funding Pips are top-tier, verified legitimate firms, but they build trust in fundamentally different ways: one through longevity, the other through sheer volume and policy.

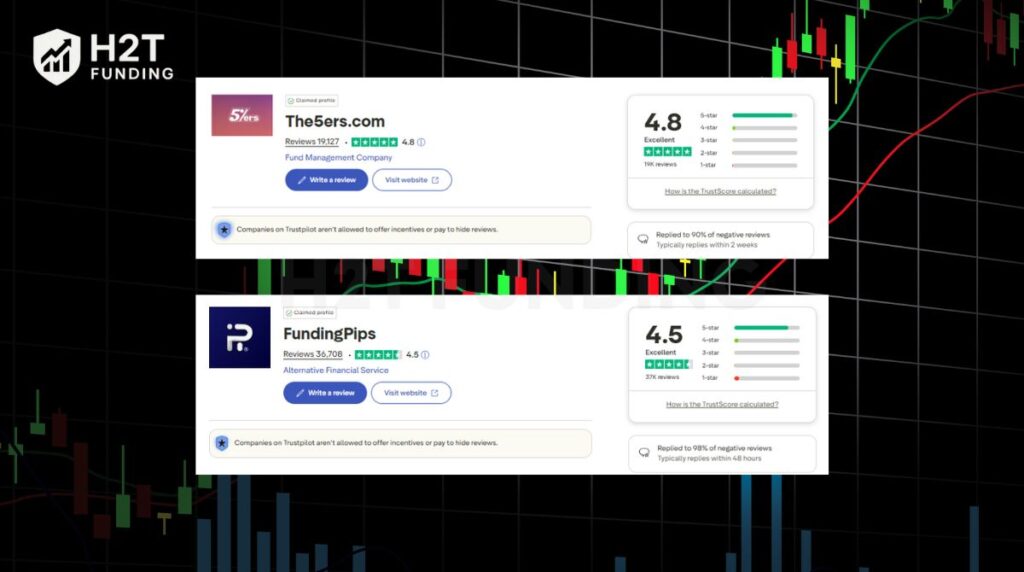

Is The5ers legit? The5ers holds a unique position as one of the few firms that has operated continuously since 2016. In an industry where firms often disappear overnight, surviving nearly a decade is the ultimate seal of approval.

- Trustpilot score: An exceptional 4.8/5 based on 19,100+ reviews.

- Why they are legit: They have weathered every industry regulatory crackdown without pausing payouts. Their high score reflects years of consistency, not just a recent hype cycle. When you trade with The5ers, you are trading with a firm that has already proven it can survive long-term market shifts.

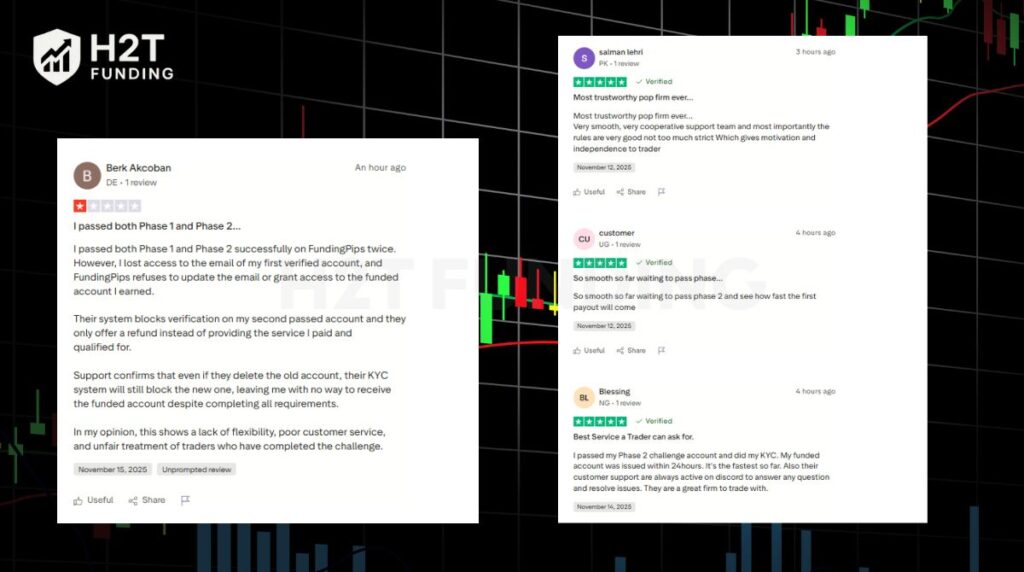

Funding Pips may be younger (founded in 2022), but their growth is unprecedented. They have amassed a massive community in a short time, signalling a highly active and paid user base.

- Trustpilot score: A strong 4.5/5 based on a staggering 36,700+ reviews.

- Why they are legit: The sheer volume of reviews nearly doubles that of many older competitors, proving they are paying out thousands of traders regularly. Furthermore, their Zero Payout Denial policy addresses the #1 fear of traders: having profits denied due to hidden rule violations. Their 98% reply rate to negative reviews further demonstrates a commitment to resolving issues publicly.

If your definition of legit is history and stability, The5ers is the safer choice. They are the bank of prop firms, steady, reliable, and predictable.

If your definition of legit is current liquidity and transparent policies, Funding Pips is equally trustworthy. They represent the modern standard of prop trading, backed by a massive, active community verifying their payouts daily.

3. Core models & key rules: The5ers vs Funding Pips

Now, let’s get into the details that truly matter for your daily trading. The rules of a prop firm define your entire experience, from the pressure you feel to the strategies you can use. This is where the contrast between The5ers’ structured approach and Funding Pips’ performance-driven model becomes crystal clear.

3.1. Evaluation phase & profit targets

How you get funded is the first major difference. To put it simply, The5ers wants to guide you through a journey, while Funding Pips wants to see if you can perform right out of the gate.

| Feature | The 5%ers | Funding Pips |

|---|---|---|

| Evaluation Structure | Offers 1-step, 2-step, and 3-step programs (including Bootcamp). | Offers Zero (Instant), 1-step, and 2-step challenges. |

| Trading Style Focus | Designed for gradual growth and long-term consistency. | Built for speed and quick progression. |

| Profit Targets | Reasonable and consistency-focused. | Standard 5–10% profit targets. |

| Main Highlight | Helps traders build strong habits and solid psychology. | Instant funding option skips evaluations and starts funding immediately. |

| Risk/Reward Profile | Lower pressure, more structured development. | High-stakes, high-reward model. |

In short, The 5%ers is ideal if you want a structured, consistency-focused path, while Funding Pips is perfect if you prefer speed and the option to get funded instantly. Your choice really comes down to your trading style and how quickly you want to scale.

3.2. Drawdowns & daily loss limits

This is where a firm shows its true philosophy on risk management. How much room are you given to make mistakes?

| Feature | The 5%ers | Funding Pips |

|---|---|---|

| Risk Controls | Known for conservative, stricter drawdowns to enforce discipline. | Uses more standard drawdown rules with greater flexibility. |

| Impact on Traders | Ideal for new traders who need structure and tighter guardrails. | Better for experienced traders who already understand risk management. |

| Philosophy | Focuses on building long-term, sustainable trading habits. | Trusts traders to manage their own risk with more freedom. |

If you prefer stricter rules that shape discipline and consistency, The 5%ers is the safer fit. If you already have strong risk management skills and want more breathing room, Funding Pips gives you the flexibility to trade your own way.

3.3. Trading conditions & allowed strategies

Can you trade your system your way? This is a deal-breaker for many traders, especially those who rely on automation or trade the news.

| Feature | The 5%ers | Funding Pips |

|---|---|---|

| Trading News | Allowed | Allowed on On-Demand cycle (Restricted on others) |

| Automated Systems (EAs) | Allows most automated systems unless they use prohibited strategies. | Bans HFT and arbitrage bots. |

| Leverage | Leverage is typically capped at 1:30 to promote disciplined risk management and long-term survival. | Offers higher leverage up to 1:100 for Forex pairs, giving experienced traders more room to execute aggressive strategies. |

The rules truly separate these two firms. The5ers builds a protective framework with its structured path and strict risk management rules, making it ideal for those focused on long-term skill development.

In contrast, Funding Pips provides a more open arena that rewards proven talent with speed and flexibility but expects you to manage your own risk with less hand-holding. Your choice here really depends on your personal risk tolerance and trading maturity.

4. Fees, refunds & cost efficiency: The5ers and Funding Pips

Let’s talk about the money you have to put on the table. In reality, the initial fee isn’t just an entry ticket; it’s a crucial part of the deal that reveals a firm’s philosophy. How they handle your upfront cost, especially when it comes to refunds, separates a simple challenge provider from a genuine trading partner.

Here’s an accurate breakdown of what you’re actually paying for.

| Feature | The 5%ers | Funding Pips |

|---|---|---|

| Fee Range | $39 – $850 | $29 – $529 |

| Refund Policy | Yes. Fees are fully refunded with the first payout once you are funded. | No. All fees are strictly non-refundable as per their Terms & Conditions. |

| Value Proposition | The fee acts as a refundable deposit for your success. A sign of partnership. | The fee is a pure sunk cost for the opportunity to take the challenge. |

| Low-Cost Entry | The Bootcamp Program ($95) allows you to prove your skill first and pay the rest after passing. | Extremely low entry fees (starting at $29) for smaller accounts. |

The difference here is night and day.

To be blunt, Funding Pips offers a low-cost gamble. Their entry fees are incredibly low, which is fantastic for getting your foot in the door without a big investment. However, and this is a huge however, that money is gone for good.

Whether you pass or fail, you will not get your fee back. It is the price of admission, period. This model works for traders who are extremely confident and view the fee as a disposable cost for a shot at a funded account.

The5ers, on the other hand, treat the fee as a professional commitment. Yes, the upfront cost might be higher for some account sizes, but they refund it entirely with your first profit split. This tells me they are invested in finding profitable traders to manage their funded accounts, not just collecting challenge fees.

It feels much more like a partnership. Their Bootcamp Program is the perfect example; it minimises your initial risk by letting you prove your talent before paying the full price.

5. Profit splits & scaling potential of The5ers and Funding Pips

This is where the real dream of prop trading comes to life: gaining meaningful capital access to earn significant profits and manage huge accounts. How much of the profit do you keep, and how big can your account actually get? To be honest, both firms offer incredible opportunities here, but they get you there in very different ways.

5.1. Profit splits

This is the percentage of the profit you get to keep. Simple as that.

| Feature | Funding Pips | The 5%ers |

|---|---|---|

| Base Profit Split | High baseline at 80%. | Varies by program; commonly starts around 50–80%. |

| Maximum Profit Split | Up to 100% at the Master Stage. | Up to 100% as you scale through higher stages. |

| How to Achieve Top Split | Reach the Master Stage for a full 100%. | Earned progressively through consistent performance. |

| Key Advantage | Extremely aggressive and attractive for top performers. | Progressive model that rewards long-term consistency. |

I think Funding Pips wins for immediate gratification with its high starting split. But The5ers’ model, where the split increases as you grow, feels like a real career progression.

5.2. Scaling capacity

This is all about growth. How quickly and how high can you climb?

| Feature | The 5%ers | Funding Pips |

|---|---|---|

| Maximum Scaling | Up to $4 million, one of the highest in the industry. | Up to $2 million total allocation. |

| Scaling Style | Methodical and consistency-based. | Fast, performance-driven scaling. |

| How Scaling Works | Hit 6–12% profit → account size doubles. | Meet criteria → account grows by 20% each step. |

| Key Strength | Feels secure, steady, and predictable for long-term traders. | Quick capital growth based on recent performance. |

So, what’s the verdict? Funding Pips gives you a better deal on profit splits right away and a faster, though smaller, scaling path. It’s built for traders who want maximum rewards right now. The 5ers, on the other hand, play the long game.

The journey to the top, profit split, and the massive $4M cap are more measured, rewarding discipline and consistency over time. It’s about building a trading empire, not just winning a battle.

6. Platforms & tradable assets: The5ers vs Funding Pips

Alright, let’s talk about the tools of the trade. A prop firm can have the best rules in the world. But that means nothing if you can’t access the platforms and markets you need to succeed. Honestly, this is one area where both firms are quite strong, but one definitely has a slight edge.

Your trading platform is your cockpit. You need to be comfortable and efficient. Fortunately, both firms offer the industry titans.

| Platform / Assets | The 5%ers | Funding Pips |

|---|---|---|

| Platforms | MT5, cTrader | MT5, cTrader, Match Trader |

| Tradable Assets | Forex, Metals, Indices, Crypto | Forex, Metals, Indices, Crypto, Energies |

To put it simply, Funding Pips gives you more choices.

For platforms, both provide MetaTrader 5 and cTrader, which will satisfy the vast majority of traders. I’ve used both for years, and they are rock-solid. If you feel aligned and want to start, check our guide on how to buy The5ers account.

However, Funding Pips goes one step further by adding Match Trader. This is a big deal, especially for U.S.-based traders who often face platform restrictions. That extra adaptability is a clear win for them.

When it comes to what you can trade, the lists are nearly identical. Both firms give you access to the big leagues: major and minor forex pairs, popular metals like gold and silver, key global indices, and even a selection of cryptocurrencies. This covers the needs of most retail traders.

Where’s the difference? FundingPips also includes Energies, like Oil (WTI, Brent). If you’re a commodities trader who specialises in oil markets, this is a significant advantage. It’s a small detail, but for the right trader, it could be the deciding factor.

7. Payouts & trustworthiness

Okay, let’s cut to the chase. This is the most important section of all. Can you actually get your money out? And can you trust the firm to be around for the long haul? A prop firm’s reputation is built on its payout process. If that fails, nothing else matters.

Both firms score highly here, but they build that trust in different ways.

| Feature | Funding Pips | The 5%ers |

|---|---|---|

| Payout Cycle | Maximum flexibility: weekly, bi-weekly, monthly, or on-demand. | Bi-weekly (Avg 16h processing time). |

| Speed Advantage | Ideal for traders who need fast, frequent access to profits. | Faster than traditional monthly models; very competitive. |

| Trust & Transparency | Zero Payout Denial policy guarantees payouts if rules are followed. Trustpilot rating: 4.5/5. | Market leader since 2016 with a consistent track record. Trustpilot rating: 4.8/5, and offers fixed salaries for top traders. |

| Reputation Strength | Modern, bold policies that build trust quickly. | Industry longevity and proven reliability. |

So, who wins on trustworthiness? Honestly, you’re in safe hands with either. The5ers is the established veteran known for speed and reliability, boasting an average payout processing time of just 16 hours. Funding Pips competes with unmatched flexibility, offering an “On-Demand” payout option that allows traders to request withdrawals at their convenience, alongside weekly and bi-weekly schedules.

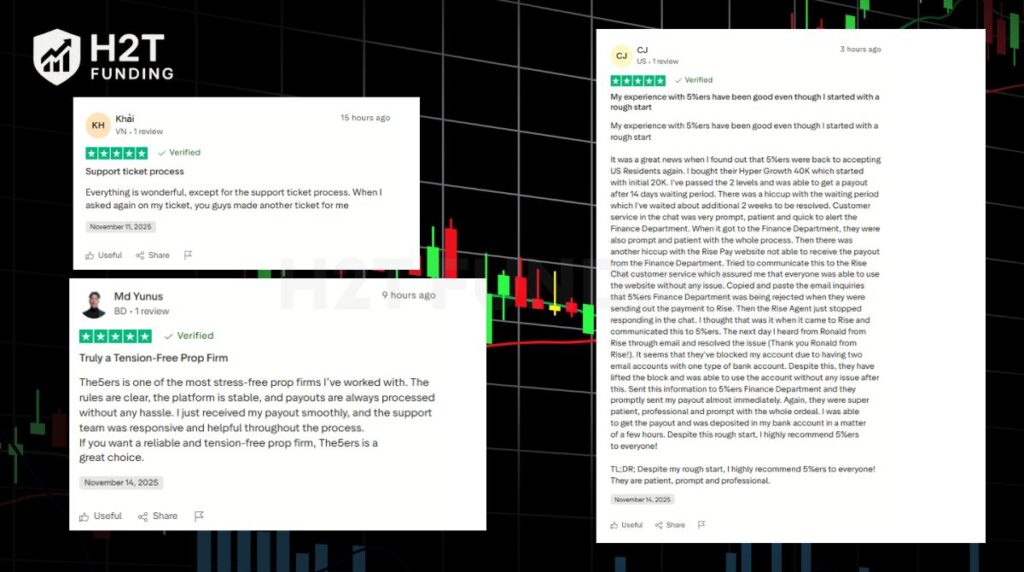

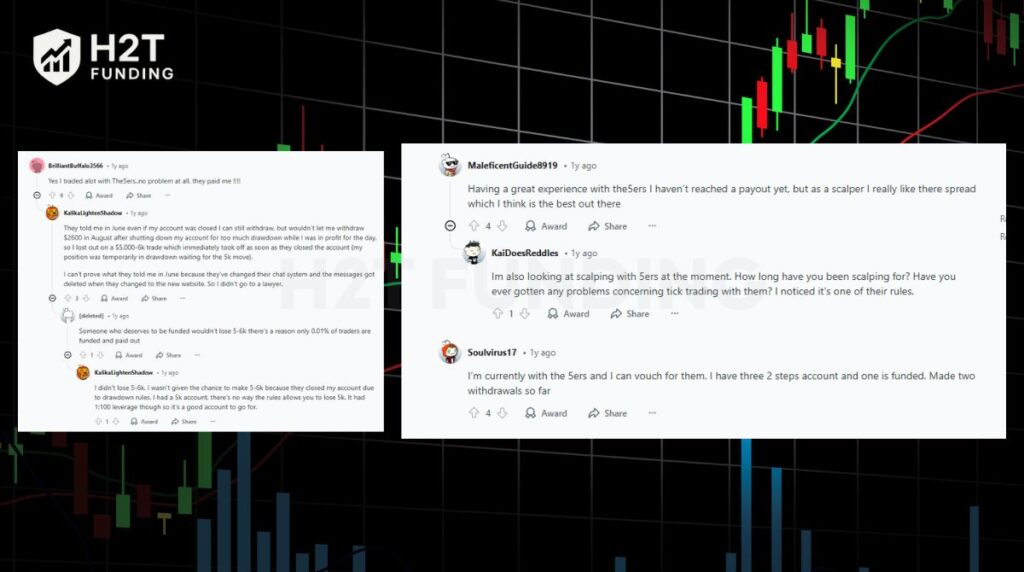

8. Trader Reviews: The5ers vs Funding Pips community opinions

When you dive into community feedback by searching terms like The5ers vs Funding Pips Reddit and reviewing The5ers vs Funding Pips Trustpilot ratings, a clear picture emerges: traders praise both firms but for very different reasons.

Across the board, traders praise The5ers for its stability, supportive community, and the feeling of being on a clear career path. The feedback is overwhelmingly positive regarding the reliability of their payouts.

Conversely, traders love Funding Pips for its lightning-fast, flexible withdrawals and straightforward rules.

However, common complaints on these platforms mention slower customer support and occasional platform slippage, which are important trade-offs to consider.

9. Who should choose which firm?

Alright, we’ve broken down all the details. So, what’s the bottom line for you? This isn’t about which firm is better overall, but which one is the right fit for your specific personality and trading style. Let’s make this really simple.

Choose The 5%ers if you are:

- A trader focused on long-term consistency: If your goal is to build a sustainable trading career over the years, not just have a profitable month, this is your firm. Their entire model is designed to reward discipline and steady growth.

- Someone who prefers a structured path: You appreciate clear rules and a predictable scaling plan. The idea of doubling your account after hitting a specific target appeals to you more than a chaotic, unstructured environment.

- A conservative or disciplined trader: You value strict risk management and see their tighter drawdown rules as a helpful guide, not a hindrance. You’re not trying to get rich overnight; you’re building wealth methodically. In short, if you see trading as a serious profession that requires patience and a solid foundation, The5ers is practically tailor-made for you.

Choose FundingPips if you are:

- An aggressive or flexible trader: You are confident in your strategy and want the freedom to execute it with fewer restrictions. You’re not looking for a firm to hold your hand; you’re looking for a firm to give you capital and get out of the way.

- Someone who wants the highest possible profit split and instant funding: The idea of keeping up to 100% of your profits is a massive motivator. You believe you have what it takes to pass a challenge quickly or even skip it entirely with their instant funding option.

- Comfortable navigating specific rule restrictions: You’ve read their rules and know that your strategy doesn’t involve prohibited techniques like high-frequency trading or aggressive news scalping. You can adapt to their framework to get the benefits of their model. Simply put, if you’re a proven, profitable trader who wants maximum payout potential and speed, Funding Pips is calling your name.

Ultimately, the choice reflects your trading philosophy. The5ers is like a structured apprenticeship program for building a professional trading career. Funding Pips is like a high-performance contract for skilled traders ready to deliver results immediately. One is about the journey; the other is about the destination.

10. Frequently asked questions (FAQs)

I’d say The5ers is more beginner-friendly. Its structured programs, emphasis on risk management, and educational resources create a much better learning environment. Funding Pips is better suited for traders who already have a proven, consistent strategy.

Both firms generally have similar profit targets, typically ranging from 5% to 10% depending on the specific evaluation program. Neither one is significantly “easier” than the other in this regard; the main difference is in the drawdown rules and trading conditions.

Yes, but with important restrictions. The5ers is generally more open to various EAs (Expert Advisors). Funding Pips allows EAs but strictly prohibits high-frequency trading (HFT), latency arbitrage, and other strategies that could exploit the platform. Always check their specific rules before using any bot.

For long-term traders, The5ers has a clear advantage in safety. The firm’s long history, proven payout record, and sustainable growth model make it a trusted partner.

The 5%ers offers a higher maximum scaling potential, reaching up to $4 million. Funding Pips has a faster, more aggressive scaling plan, but caps out at a lower maximum of $2 million.

Yes, Funding Pips supports MT5, along with cTrader and Match Trader, offering a wider selection of platforms than many competitors.

The5ers is widely available globally but, like most prop firms, restricts services in countries under international sanctions. As of late 2026, you should always check their official website for the most current list, as regulations can change.

Funding Pips’ main competitors are other prop firms known for flexible rules and competitive pricing, such as FTMO, Funded Engineer, and My Forex Funds.

The5ers primarily uses MetaTrader 5 (MT5) and cTrader, two of the most popular and reliable platforms in the industry.

Many top-tier prop firms use MT5. The “best” depends on your needs. The5ers is an excellent choice for stability and growth, while Funding Pips is great for flexibility and high profit splits. Both are among the best MT5-compatible firms available.

The core difference lies in their philosophy: The5ers focuses on long-term career growth, offering a structured path to manage up to $4 million with conservative risk rules. In contrast, Funding Pips is built for speed and efficiency, offering lower entry fees, flexible payouts (including On-Demand & Tuesday Payday), and higher leverage for traders seeking faster returns.

In February 2024, Funding Pips experienced a temporary service disruption due to licensing changes involving MetaQuotes and their former brokerage partner. The firm successfully navigated this by migrating to a new tech infrastructure and diversifying its platforms to include Match Trader and cTrader. They are now fully operational, stable, and actively paying out traders.

Yes, absolutely. The5ers has maintained a flawless payout record since its inception in 2016. With a 4.8/5 Trustpilot rating and nearly a decade of verified withdrawals, they are widely considered one of the most reliable “paymasters” in the industry.

Funding Pips main competitors are firms that offer similar low-cost entry and flexible trading conditions. Key rivals include FundedNext, E8 Markets, and Alpha Capital. FTMO is also a major competitor, though it generally positions itself at a higher price point with stricter evaluation criteria.

11. Conclusion

When it comes to The5ers vs Funding Pips, the right choice depends entirely on your trading identity. The5ers is built for disciplined traders who value structured growth, long-term consistency, and a proven $4M scaling plan. Meanwhile, Funding Pips shines for performance-driven traders who want flexibility, fast scaling, and high profit splits from day one.

Both are legitimate, trusted prop firms, but they serve different trading personalities. Follow H2T Funding for more unbiased prop firm reviews, comparisons, and funding insights.