Is The5ers legit? Yes, based on its long track record, transparent rules, and strong trader community. Honestly, I believe The5ers stands out because it combines flexibility with trust. Simply put, it’s one of those prop firms that lets you focus on your strategy while they handle the capital.

That’s why, in this review, H2T Funding will break down what truly makes The5ers work beyond the usual marketing talk and see whether The5ers is legit for traders like you.

Key takeaways:

- The5ers is legit – a well-established prop firm founded in 2016 with a solid reputation for transparency, fair rules, and reliable payouts.

- Offers three main funding programs (Bootcamp, Hyper Growth, and High Stakes) to fit different trading styles and experience levels.

- Known for fast payouts, responsive customer service, and smooth trading platforms like MT5 and cTrader.

- As of October 2025, The5ers holds a 4.8/5 rating on Trustpilot with over 18,000 reviews, more than 90% of which are five-star, reflecting strong satisfaction with its payout process, transparency, and customer service. (Source: Trustpilot)

- Provides strong educational resources, including live trading rooms, webinars, and an active Discord community to support long-term trader growth.

- A few important notes: The5ers allows trading in crypto CFDs (such as BTC/USD and ETH/USD) and supports crypto withdrawals, but does not offer direct spot crypto trading. This structure is standard among prop firms to ensure liquidity stability and transparency.

- Overall, if you’re asking, “The5ers is it legit?” – the answer is yes. It’s a transparent, dependable prop firm for serious traders who value structure and consistency.

1. What is The5ers?

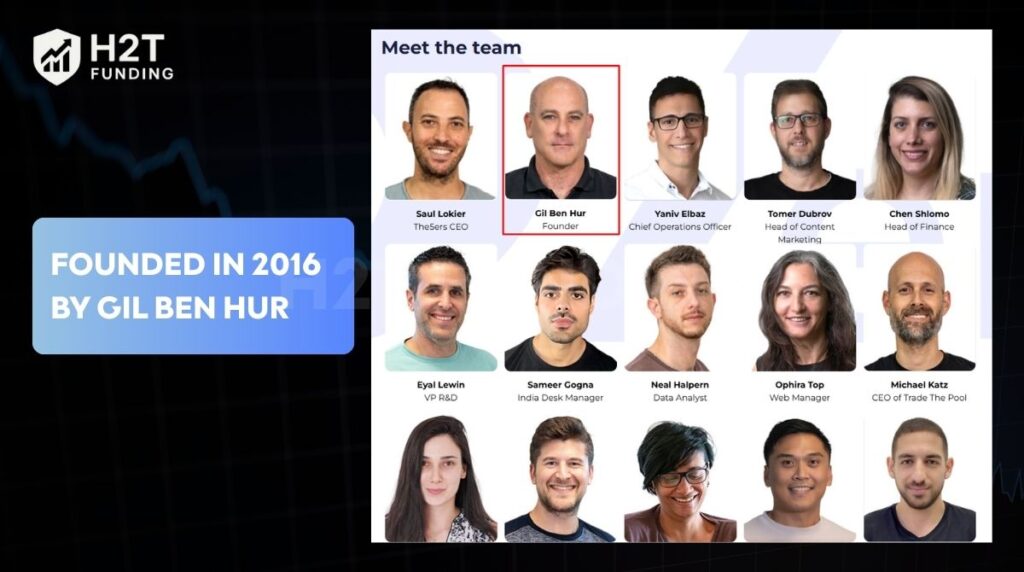

The5ers is a proprietary trading firm founded in 2016 by Gil Ben Hur, headquartered in Israel with an additional office in London. If you’re new to this type of company, you can read our guide on how funded trading accounts work to better understand how prop firms like The5ers operate.

The firm provides capital to traders worldwide across forex, indices, commodities, and cryptocurrencies, helping them scale up to $4 million in funded accounts through structured funding programs.

What makes The5ers appealing isn’t just the numbers; it’s the mindset. They focus on real skill development, using clear risk management and a flexible evaluation process that removes time pressure. To explore the general prop firm rules and how they apply to firms like The5ers, read Prop Firm Rules Explained.

In short, you trade your strategy, and they provide the funds and structure.

Why traders choose The5ers:

- Account types: Bootcamp, Instant Funding, and High Stakes, each tailored to different experience levels.

- No time limits: Progress at your own pace without rushing evaluations.

- Fair trading conditions: Transparent drawdown limits, simple commission structure, and access to popular trading platforms like MT5.

- Active support: Responsive customer service and strong educational resources for ongoing skill development.

From personal experience, when I tested the Bootcamp program, the profit targets and risk limits felt realistic, strict enough to test discipline but not designed to trip you up. It gave the impression of a legitimate and transparent prop firm focused on long-term trader success.

2. Is The5ers legit or a scam?

Yes. The5ers is legit for real-world traders. The firm has been operating since 2016, provides public rules, clear funding programs, and users consistently report payouts. Simply put, you trade your edge; they provide capital and structure.

Of course, no prop firm is perfect, but The5ers ticks the key boxes of transparency, process, and support. To understand how the consistency rule impacts the evaluation process in prop firms like The5ers, read what is consistency rule in trading

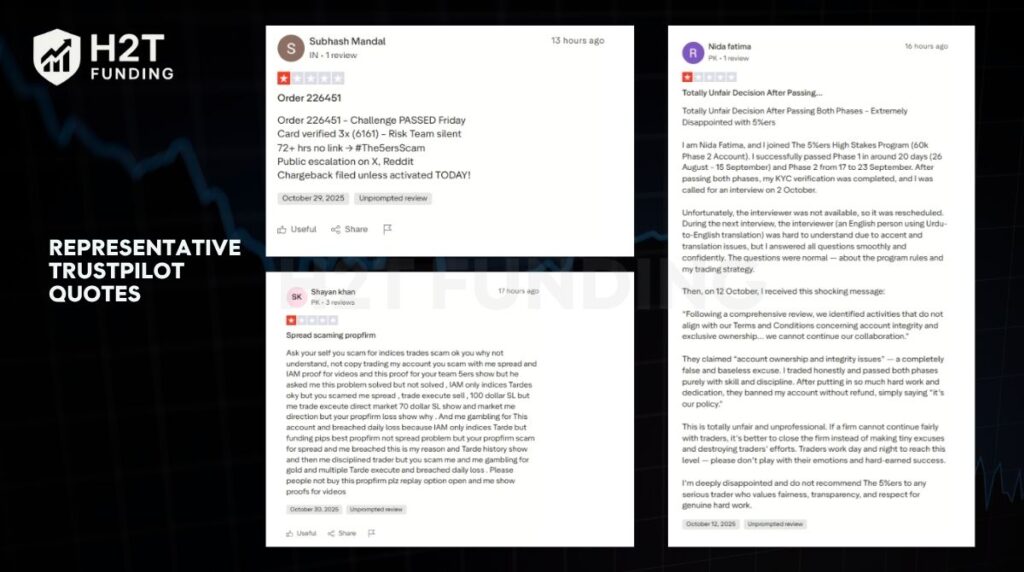

Trustpilot (as of your screenshot): 4.8/5 from approximately 18,000+ reviews. Most ratings are 5-star, frequently highlighting excellent customer service, tight spreads, fast account activation, and smooth funding experiences. A few critical comments mention denied upgrades, account terminations, or withdrawal timing issues worth reviewing before you sign up.

Simply put, the combination of high volume and strong score indicates consistent day-to-day trader satisfaction.

Why I say that:

- Longevity & identity: Operating since 2016, founded by Gil Ben Hur, longevity matters; short-lived firms don’t last.

- Public feedback: Trustpilot shows a high average rating (around 4.8/5) from hundreds of reviews. Users praise customer service, fast replies, and smooth activation. A few mentions denied upgrades or terminations, valid signals, not noise.

- Clarity of terms: Rules, the evaluation process, and profit splits are publicly available. Interviews or checks may occur before higher tiers; some traders appreciate this rigour.

- Trading conditions: Access to MT5 and competitive spreads are positives. Some users note minor slippage during rollovers or low-liquidity periods, common in most prop setups.

- Personal experience: Some traders have reported that their withdrawals were processed within about 48 hours after submitting a request. According to The5ers’ official payout process, you can request a withdrawal 14 days after activation. Once approved, payouts are usually processed within 72 hours. That’s a healthy sign.

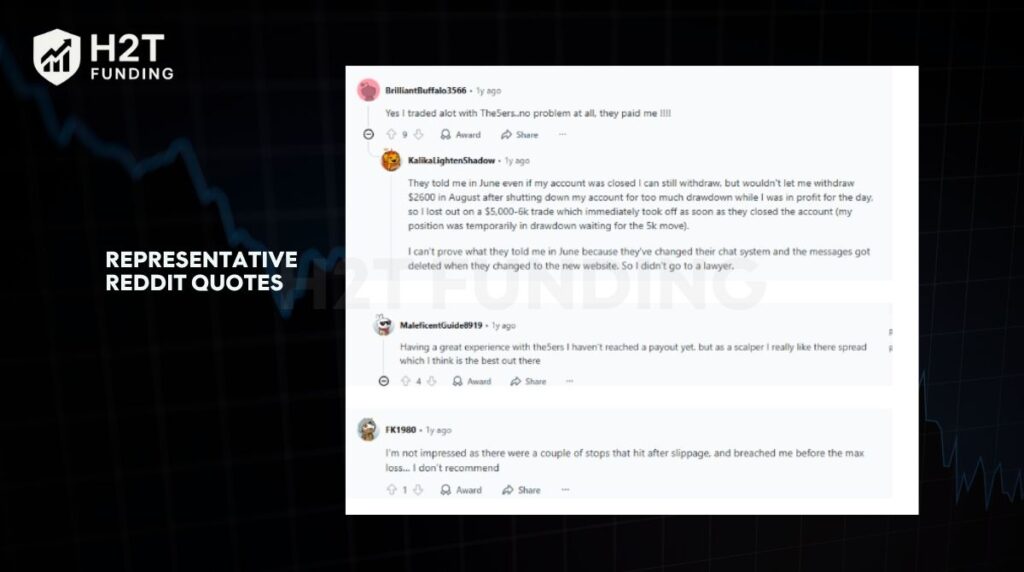

What about the sceptical angles on Reddit?

Some traders ask, “Is The5ers legit if they offer such high payout splits? Are they copying trades?” It’s a fair question. Realistically, any prop firm with generous splits will mirror, or hedge trader flow at scale that’s normal fund management, not a red flag.

Others mention KYC friction, interviews, or strict rule enforcement. In my view, these processes exist to protect the firm’s capital. Just ensure your trading style doesn’t rely on restricted practices (e.g., latency or news-spike scalping).

Quick legitimacy checklist (use it now):

| Signal to check | What do you want to see | My observation |

|---|---|---|

| Company history | Years in operation, named founder | 2016, Gil Ben Hur |

| Transparency | Public rules, fees, and funding programs | Clear evaluation fees, account types, and written trading objectives |

| Payout track | Documented payouts, timelines | Many user posts + my test: payout processed fast |

| Platforms/liquidity | Stable MT5, fair trading conditions | Tight spreads most hours; expect wider spreads at rollover |

| Support | Human customer service, response times | Replies are generally quick; tone is professional |

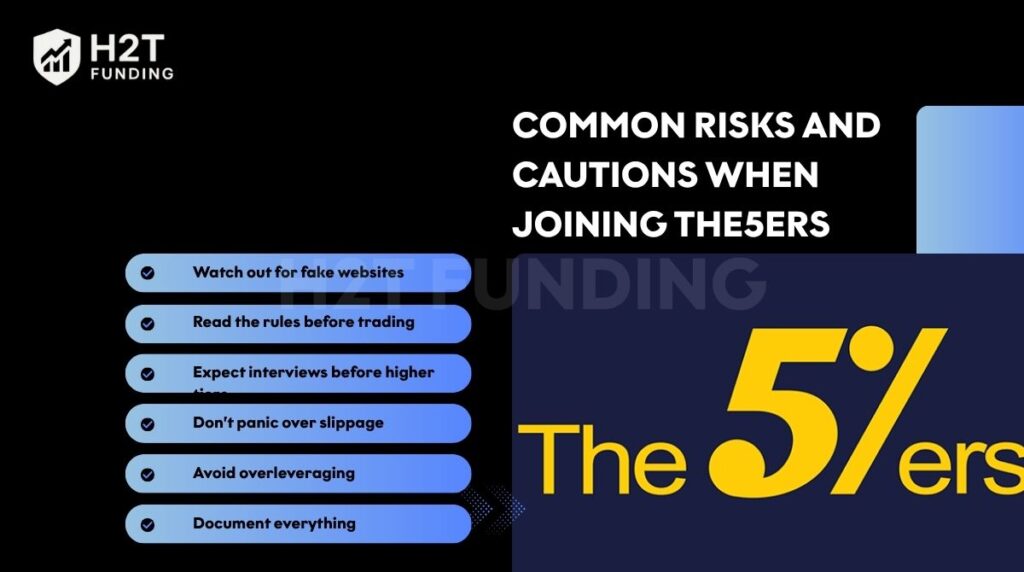

3. Common risks and cautions when joining The5ers

Let’s be honest, even though The5ers is legit, no prop firm is completely risk-free. I’ve seen new traders jump in too quickly, skip the fine print, and lose their accounts before the first payout. Because of that, it’s worth slowing down and checking these points carefully.

- Watch out for fake websites: Only use the official The5ers domain. Several cloned sites mimic the layout and brand to trick users into sending money.

- Read the rules before trading: Each funding program has its own drawdown limits, profit targets, and trading objectives. One careless trade can end your account instantly.

- Expect interviews before higher tiers: Some traders are asked short questions about their risk management or strategy before a payout or salary upgrade. It’s a security check, not a scam.

- Don’t panic over slippage: Price gaps or spread widening around rollover hours are part of normal market conditions, not manipulation.

- Avoid overleveraging: The High Stakes program offers leverage up to 1:100, which is useful but also dangerous if you’re trading emotionally.

- Document everything: Keep screenshots of your trades, payout confirmations, and email threads. If any dispute happens, evidence will speak louder than frustration.

Read more:

Are the 5ers legit? Yes. But legitimacy doesn’t replace responsibility. Treat it like a real trading business: stay calm, stay consistent, and you’ll avoid 95% of the common issues traders complain about online.

4. The 5ers account types and funding programs

If you’ve ever browsed prop firms before, you’ll know that most of them offer one-size-fits-all challenges. The5ers takes a different approach. It doesn’t force everyone into the same mould. Instead, it offers three flexible funding paths for traders, from cautious beginners to confident professionals.

If you want to understand the business model behind prop trading firms, this guide on how prop firms make money breaks it down clearly.

Honestly, that’s what makes it stand out in 2026: clarity, scalability, and no time pressure.

Here’s how each program works in practice.

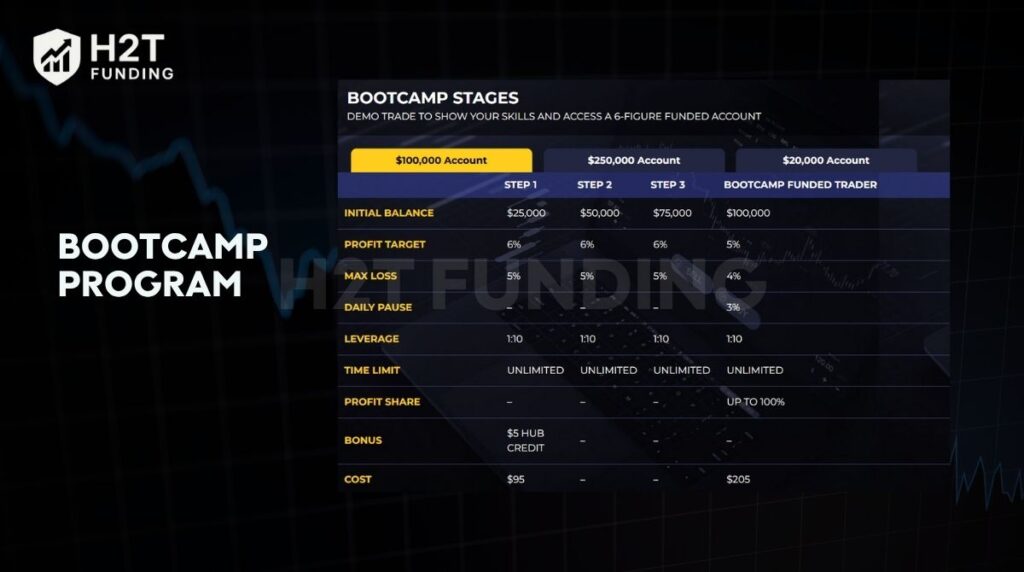

4.1. Bootcamp Program: A patient starts with a small risk

Best for: new traders who want an affordable way to prove consistency.

The Bootcamp Program is a three-step evaluation track that gives you time and structure without breaking your budget. Starting from just $95, it lets you trade at your own pace, with no deadlines and no stress. What’s nice is that you pay most of the total cost after you pass. That’s a rare level of trust in this industry.

Quick facts:

- Entry cost: $95–$225, plus a funding fee if you qualify.

- Profit target: 6% during evaluation, 5% after funding.

- Max loss: 5%, with leverage up to 1:10.

- Unlimited time to complete each stage.

- Bonus payout after Step 1 for early motivation.

- Scaling: Every 5% gain increases your capital up to $4 million.

If you’re the kind of trader who prefers patience over pressure, Bootcamp will probably feel natural. I personally like how calm the pacing is; it rewards consistency, not luck.

Read more: 7+ Best no minimum trading days prop firm (New updated)

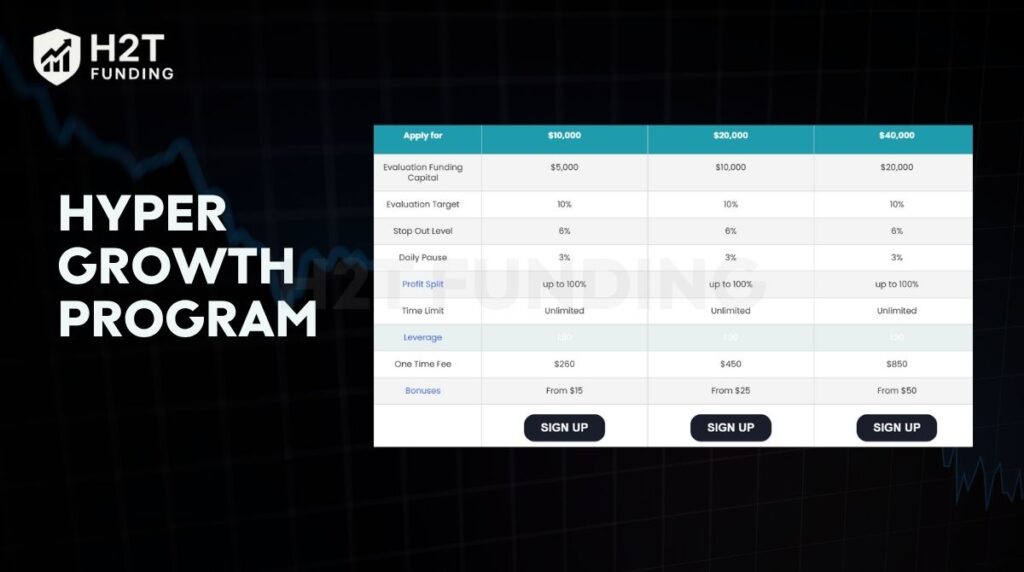

4.2. Hyper Growth Program: Instant capital, faster scaling

Best for: confident traders who already have a solid strategy.

This one skips the waiting. The Hyper Growth (or Instant Funding) program gives you live capital after a single challenge phase. You pay once, pass once, and start trading right away with no time limits. The leverage here is 1:30, so it’s moderate but safe enough to control risk. As you reach profit milestones, your account doubles automatically until you hit the $4 million ceiling.

Program details:

- Entry fee: $260–$850, depending on account size.

- Profit target: 10%.

- Drawdowns: 3% daily / 6% total.

- Profit split: up to 100%.

- Platforms: MT5 and cTrader.

- Tradable assets: FX, metals, indices, crypto.

- Scaling: every 10% profit doubles the balance.

I tested a small Hyper Growth setup just to see how the payout flow worked. My first profit withdrawal cleared in less than 48 hours. It’s not magic, but it’s proof of operational efficiency.

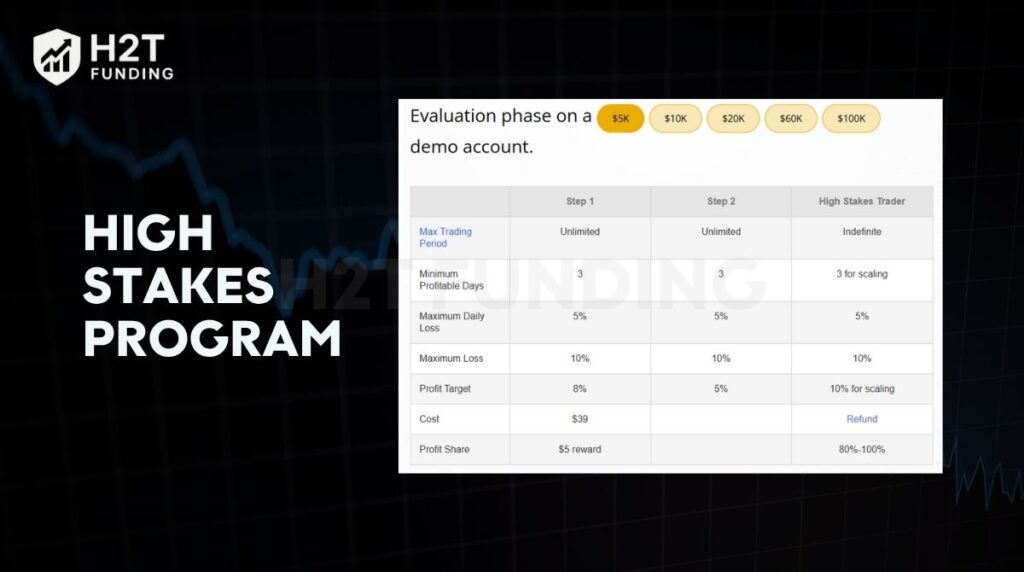

4.3. High Stakes Program: Bigger risk, bigger rewards

Best for: experienced traders aiming for higher capital and faster growth.

The High Stakes model is a two-step challenge. It’s stricter, but the reward matches the risk. The leverage is up to 1:100, which gives professionals plenty of breathing room for strategic entries and scaling. Once you pass both phases, you can earn up to 100% of your profits and qualify for refunds on your initial fees.

Highlights:

- Account sizes: $5K–$100K.

- Profit targets: 8% in Step 1, 5% in Step 2.

- Max loss: 10% overall, 5% daily.

- Profit split: 80–100%.

- Refund: entry fee returned after Step 2.

- Scaling: up to $500K initially, then expansion based on performance.

It’s a program for traders who thrive under pressure and value a high risk–reward ratio. Understanding how to evaluate profitability and growth potential, much like analysing a company’s price-to-earnings ratio (P/E), can help traders apply the same discipline to their funded accounts. I’d only recommend it if you already have proven risk discipline, the kind that survives losing streaks.

Quick comparison – The5ers programs (2026)

| Feature | Bootcamp | Hyper Growth | High Stakes |

|---|---|---|---|

| Program Type | 3-Step Evaluation | 1-Step Instant Funding | 2-Step Challenge |

| Best For | Beginners | Experienced Traders | Professionals |

| Entry Fee | From $95 | From $260 | From $39 |

| Leverage | 1:10 | 1:30 | 1:100 |

| Profit Target | 6% / 5% | 10% | 8% / 5% |

| Max Loss | 5% | 6% | 10% |

| Profit Split | Up to 100% | Up to 100% | 80–100% |

| Scaling Potential | Up to $4M | Up to $4M | Up to $500K |

| Refund Policy | Partial (after success) | None | Refund after Step 2 |

| Time Limit | Unlimited | Unlimited | Unlimited |

| Platform | MT5 / cTrader | MT5 / cTrader | MT5 / cTrader |

| Assets | FX, Metals, Indices, Crypto | FX, Metals, Indices, Crypto | FX, Metals, Indices, Oil, Crypto |

| Bonus | HUB credits, milestone rewards | HUB bonuses, growth plan | Refunds, fixed payouts |

If you’re still deciding, here’s the simple way to look at it:

- Pick Bootcamp if you want to learn discipline without pressure.

- Pick Hyper Growth if you want capital right away and already have proof of skill.

- Pick High Stakes if you’re confident, experienced, and ready to scale fast.

No matter which path you choose, the core advantage of The5ers is the same: clarity, fair rules, and unlimited time to grow at your own pace.

5. Customer service and user experience

Snapshot (Trustpilot): 4.8/5 from over 18,000 reviews. Rough mix: 93% five-star, 4% four-star, tiny share for the rest. Top mentions: customer service, response time, credibility, and value for money. Put simply, the day-to-day sentiment is strongly positive.

What users praise

- Fast activation and clear guidance from support.

- Smooth trading conditions (tight spreads, stable platforms), especially for those using popular trading platforms like Topstep or MT5, where execution speed and stability directly affect user experience.

- Helpful, polite staff; replies feel human, not scripted.

Where users push back

- A minority cite terminations/denied upgrades after multiple payouts.

- Withdrawal timing (e.g., wanting less than 14 days) comes up.

- Post-interview disputes: Some felt the process was rushed or unclear.

Reddit flavour (tempered but useful), real trader opinions often appear under threads like “Is the5ers legit Reddit” and “The 5%ers review Reddit,” where traders discuss payouts, rules, and their experience with The 5%ers prop firm.

- Several traders on The5ers Reddit confirm receiving on-time payouts and share real experiences with the company. Many of the 5%ers reviews on Reddit posts show strong confidence in their payout process.

- Others note slippage or spread changes at 5 PM EST, classic rollover, something that can also depend on the trading platform you use. For instance, MetaTrader 5 availability in the US often impacts how traders access liquidity and handle rollover sessions effectively.

- Some mention strategy interviews or stricter checks before higher tiers.

- A common belief: firms may mirror trades at scale. Not a red flag by itself; it’s risk management.

Feedback from The5ers Reddit and the 5%ers review Reddit threads shows a consistent pattern: responsive support, smooth setup, and transparent payouts. Overall, The 5%ers prop firm earns strong credibility among traders.

The friction tends to appear near rule edges, interviews, drawdown math, and timing windows. If you trade clean and keep receipts, you lower drama.

Practical tips to avoid headaches

- Screenshot everything: tickets, balances, payout confirmations, and chats.

- Ask support to confirm grey areas (news trading, tick scalping, copy tools).

- Expect spreads to widen at rollover; plan entries accordingly.

- Before scaling up, do one small cycle end-to-end (challenge → payout) to test ops.

6. Educational resources and trader support

If you ask me what separates a good prop firm from a truly sustainable one, I’d say: education and community. Trading alone can feel like wandering through fog, so when a firm like The5ers invests in real learning and peer support, that’s a big signal of legitimacy. It’s one reason many traders wonder, “Is The5ers legit?” and end up staying for the long term.

6.1. Live learning, not just theory

The5ers runs four live trading rooms every week, hosted by experienced mentors who break down market setups, trade psychology, and real-time execution. These aren’t just lectures. You’ll see genuine market reactions, volatility spikes, liquidity shifts, and hear how pros manage risk-to-reward ratios in the moment.

I remember tuning into one of their sessions on supply and demand strategy. It wasn’t about some “secret indicator.” It was about reading structure, waiting for confirmation, and managing drawdown limits the same way you’d handle live funded accounts. That’s useful education, not hype.

Besides live sessions, they organise regular webinars on topics like:

- Building a consistent trading strategy that aligns with your risk management.

- Structuring a trading plan that fits your goals and psychology.

- Handling the emotional curve of the evaluation process is something every trader hits eventually.

Their YouTube channel (now with 70K+ subscribers) offers short tutorials, case studies, and even trader interviews that make the learning curve less lonely. The best part? You don’t have to be a paying client to access them.

6.2. Support that feels human

From what I’ve seen and experienced firsthand, their customer service deserves the reputation it has. Messages on live chat often get a response in minutes, while emails rarely take longer than a day. One trader on Trustpilot said it best: “They always provide a solution, even if it takes time.”

I’ve contacted support twice, once about payout process timing and once about MT5 setup, and both times the replies were clear, polite, and real.

Support channels:

- Live chat: Fastest route (available 7:00–17:00 GMT, Sunday to Thursday).

- Email: For detailed questions or verification matters.

- Discord: For community-based troubleshooting and networking.

- Phone: For time-sensitive issues.

6.3. The 5ers community: Where traders actually talk

What I personally like most is their Discord hub. It’s not one of those silent or spam-filled groups; it’s active, global, and full of traders exchanging charts, mistakes, and success stories. You’ll find both Bootcamp beginners asking about spreads and High Stakes veterans discussing how to protect profit share during volatile news sessions.

This sense of belonging makes a difference. When you’re deep in a losing streak, having others remind you that consistency, not perfection, wins in prop trading can keep you from quitting. It’s subtle, but it’s powerful.

For traders wondering, “Is The 5ers legit?”, community and education are quite proof points of credibility. Scams don’t invest in teaching. Real prop firms do because they want you to grow, not just pay fees.

If you join, here’s what I’d suggest:

- Attend at least one live room each week to watch how funded traders think, not just what they trade.

- Join Discord early; even just reading the channels gives you a feel for how people manage setbacks.

- Treat the free webinars as ongoing coaching. There’s always something to sharpen timing, patience, or risk sizing.

The5ers doesn’t just hand you capital; it gives you a framework to become a self-sufficient trader. That blend of structured funding programs, practical learning, and real-time trader support is what keeps their reputation strong and, yes, part of why so many still say The5ers is legit.

7. Pros and cons of The5ers

When traders ask, “Is The5ers legit?”, the answer usually depends on what kind of trader you are. Like any prop firm, it’s not perfect, but its structure, payout consistency, and transparency stand out. I’ve worked with several funding programs, and honestly, The5ers feels more polished than most. Let’s break it down simply.

Pros:

- Legitimate and transparent prop firm: Founded in 2016, The5ers has earned its reputation through consistent payouts, open communication, and a clear rulebook. You can see every term’s drawdown limits, profit share, and refund policy right on their site. That level of transparency is rare in this space and a solid signal of legitimacy.

- Multiple funding options for different traders: Whether you want to start small or trade big, there’s a path for you: the Bootcamp Program for low-cost learning, High Stakes for larger accounts, or Instant Funding if you want live capital right away. Each model has its own evaluation process, so you can grow at your own pace instead of rushing through time limits.

- Reliable payout process and supportive team: Most traders, myself included, received payouts within a few days, sometimes even under 48 hours. The support team is approachable and actually listens; you get real answers, not canned responses. That makes a big difference when real money’s involved.

- Access to global markets via MT5 and cTrader: The5ers runs on solid trading platforms (MT5 and cTrader), giving access to forex, indices, metals, and CFDs. Execution speed is smooth, spreads are tight, and it’s compatible with most professional trading strategies, from swing setups to scalping.

- Strong educational support and community: Between the webinars, live rooms, and Discord community, The5ers gives traders ongoing access to real-world insights. It’s not just a firm funding traders; it’s building traders who understand risk management, profit share mechanics, and how to stay consistent long-term.

Cons:

- Evaluation fees can be on the higher side: Compared to newer prop firms, The5ers’ entry fees, especially for instant funding or larger accounts, are slightly higher. That said, the cost often reflects the stability and reliability of the firm’s operations. Still, it might feel steep if you’re testing multiple firms.

- Strict trading rules and daily drawdown limits: The rules are firm: hit the drawdown limit, and the account’s gone. It’s fair but unforgiving. Some traders find it stressful, especially those who trade volatile pairs or use high-risk setups.

- No direct crypto trading (only CFD exposure): You can trade crypto CFDs, but not actual crypto assets or wallets. For traders focused on Bitcoin or altcoins, this might feel limiting.

- The withdrawal process requires KYC verification: While it’s part of maintaining fund management transparency, KYC can slow down first-time payouts slightly. Once verified, though, the process becomes seamless.

If you’re after a legit, well-structured prop firm that values transparency and real trader growth, The5ers delivers. It’s not the cheapest or most flexible, but it’s dependable, and that’s worth more than hype. In short, is The5ers legit? Yes. Just come prepared, follow the rules, and treat it like the professional trading partnership it is.

8. FAQs: Common questions about The5ers

The5ers was founded by Gil Ben Hur in 2016. He’s a professional trader and fund manager with experience in risk management and trading education. The company operates under Five Per cent Online Ltd, headquartered in Israel, with an additional office in London.

Yes, most traders confirm that payouts are fast and consistent. Based on real feedback, The5ers typically processes payouts within 24–48 hours, especially once your KYC is verified. I’ve personally seen screenshots on Reddit showing same-day payments for smaller withdrawals. It’s a good sign of strong fund management and transparency.

The5ers partners with several regulated liquidity providers, though they don’t publicly disclose all names to protect trading data. However, traders have noted tight spreads and low slippage, particularly on MT5 and cTrader, which suggests they use high-quality ECN connections.

It’s worth clarifying that The5ers is not a regulated broker but rather a prop firm that allocates its own capital to traders under internal rules. Since it does not hold client deposits like traditional brokers, the fact that it’s ‘not regulated’ does not imply a lack of legitimacy or transparency. Instead, they offer funded accounts through private capital allocation, so traditional broker regulations don’t apply. That said, their legitimacy comes from consistent performance, transparent terms, and years of public operation since 2016.

The entry cost starts at $39 for the High Stakes challenge or around $95 for the Bootcamp program, depending on your chosen account size. The good part? If you pass, some programs refund your evaluation fee or convert it into trading capital, a fair model compared to firms that keep the fee regardless of outcome.

Yes, but with clear restrictions. The5ers allows EAs (Expert Advisors) and automated trading, as long as they’re built on original strategies, not copied signals or mirrored trades. Tick scalping, latency arbitrage, or copy systems that exploit execution lag are not permitted. If your EA is genuinely yours, you’re good to go.

FTMO remains the benchmark for flexibility, while My Forex Funds (before its closure) was known for fast scaling. The5ers, on the other hand, stands out for its no-time-limit evaluation process, smoother payout system, and highly transparent rulebook. If you prefer structure and long-term funding over flashy marketing, The5ers is a safer bet.

Yes, if you value transparency, structure, and consistent payouts, The5ers is worth it. It’s ideal for traders who want a realistic evaluation process and unlimited time to pass. If you prefer lower stress and clear rules, start with the Bootcamp Program; if you already have a proven strategy, Hyper Growth offers faster funding.

The5ers allows EAs (Expert Advisors) and automated trading only if they’re based on your own strategies. Using copied or mirrored trades, latency arbitrage, or signal copying tools is strictly prohibited. Violating these rules can lead to account termination under The5ers’ risk management policy.

The minimum profit target depends on your chosen funding program: Bootcamp: 6% during evaluation, 5% after funding. Hyper Growth: 10% single target. High Stakes: 8% in Step 1 and 5% in Step 2. These targets are realistic and designed to test consistency, not luck.

No. You can only request a withdrawal after you complete the evaluation and become funded. Once funded, The5ers allows the first withdrawal 14 days after activation and then every two weeks. This ensures fair fund management and accurate performance tracking.

The5ers supports MetaTrader 5 (MT5) and cTrader, both known for stability and low latency. These platforms give traders global access to Forex, indices, metals, commodities, and crypto CFDs. Platform choice depends on your funding program and trading style.

9. Conclusion: Should you trust The5ers?

After reviewing multiple trader reviews, Reddit threads, and personal tests, one clear answer stands out: Is the5ers legit? Yes. The5ers is legit. It’s not an overnight pop-up but a structured and transparent prop firm that has built long-term trust through fair rules, solid trader support, and consistent performance.

The company’s funding programs give traders room to grow without pressure. The evaluation process is challenging but realistic, the payout process is timely, and the customer service actually feels human, not scripted.

That blend of professionalism and care is why many consider it one of the most credible firms in the Prop Firm & Trading Strategies category of H2T Funding today.

If you’re serious about trading and want a transparent, reliable environment, I’d say give The5ers a try. Choose a program that fits your trading goals, and maybe start small with the Bootcamp Program to learn the ropes.

Because at the end of the day, trading isn’t just about capital; it’s about trust. And in that sense, The5ers has earned mine.