So, you’re looking into how to create Maven Trading account? You’ve picked a good one, as it’s one of the fastest-growing prop trading firms out there. The good news is that the whole process from registering to getting verified only takes a few minutes before you can start trading.

In this guide, H2T Funding will break down everything you need for a smooth start, covering all the key details about account types, funding, and conditions.

Key takeaways:

- How to create a Maven Trading account takes just a few minutes: register → verify KYC → choose an account type → start trading.

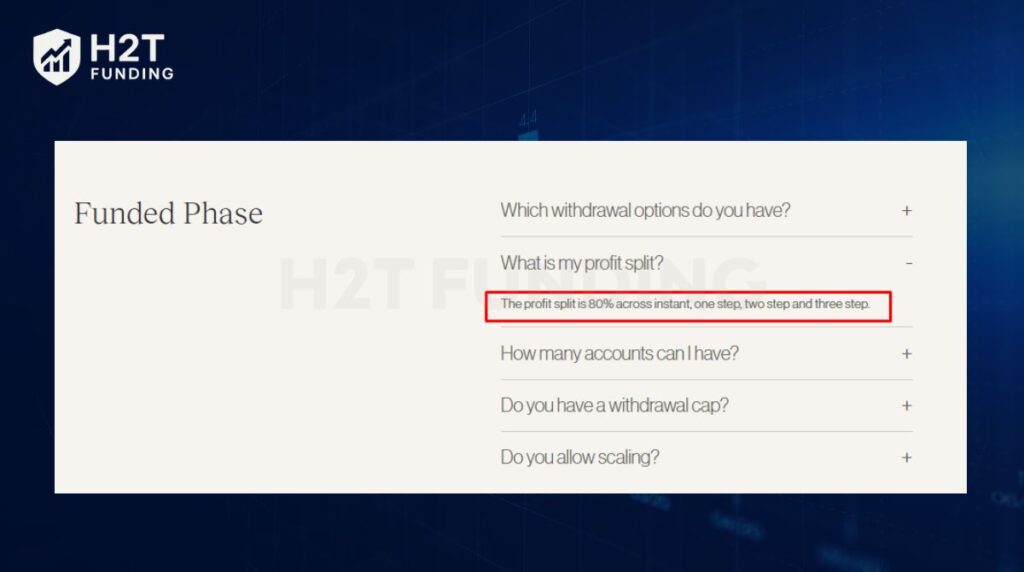

- Maven Trading is a prop trading firm founded in 2022, giving traders access to funded accounts and up to an 80% profit split.

- Three main trading account types: Demo (risk-free), Evaluation (1-step, 2-step, 3-step), and Instant (start right away).

- Before creating your account, prepare your email, phone number, KYC documents, and a valid payment method.

- Clear withdrawal process: the first payout can be requested after 10 business days, with a maximum withdrawal of $10,000 per 30-day cycle, with multiple payout methods supported.

- Follow strict trading rules focused on disciplined risk management and strategy consistency. For Instant and Mini accounts, the Consistency Rule applies: your best trading day cannot exceed 20% of total profit, and all accounts must avoid HFT, martingale, or arbitrage strategies.

1. What is Maven Trading, and why should you open an account?

Maven Trading is a modern prop trading firm founded in 2022 by Jon Alexander, designed to help traders access significant trading capital without risking their own money. To understand how prop trading firms like Maven operate and generate revenue, you can read our detailed guide on how prop firms make money.

Instead of trading with small personal accounts, you can join evaluation challenges to prove your skills. Once you pass, you gain access to funded accounts where you keep most of the trading profits while Maven covers potential losses.

The platform provides both 1-step and 2-step trading challenges, giving flexibility for different skill levels. These challenges simulate real market conditions with fair trading rules, so you can practice discipline, test trading strategies, and sharpen risk management in a controlled environment.

If you’re still deciding which platform to start with, check our comparison on how to choose a prop firm to find the best fit for your trading style and goals.

So, what’s the big deal with Maven Trading? First and foremost, it’s the access to significant trading capital, something most personal accounts can’t offer. Once you prove your skills, you get to keep a huge chunk of your trading profits, thanks to a generous profit split of up to 80%.

Just as important, they’re known for fast payouts and reliable client support. Plus, having no strict trading duration really takes the pressure off, and you get to be part of an active trading community to share your trading experience.

With a focus on secure trading conditions and transparent payout models, Maven Trading has become one of the top-rated prop trading firms on Trustpilot, holding around a 4.6/5 rating. Opening an account here means not only trading with higher capital but also being part of a trusted trading community.

2. Account types on Maven Trading

Maven Trading provides different account options to suit both beginners and experienced traders. If you’re comparing which prop firms offer the easiest setups or lowest trading requirements, check our guide on the easiest prop firms to pass for more insights.

Each type is designed to balance risk management, growth potential, and trader flexibility. By understanding the structure of these accounts, you can choose the right path for your trading journey.

2.1. Demo account

If you are new to trading, the demo account is the safest way to start:

- Best for beginners who want a risk-free start.

- Let’s practice strategies, test the trading platforms (MetaTrader 5, cTrader, Match-Trader), and understand the trading rules.

- No deposit or KYC is required at this stage.

2.2. Standard evaluation accounts (1-Step, 2-Step, 3-Step)

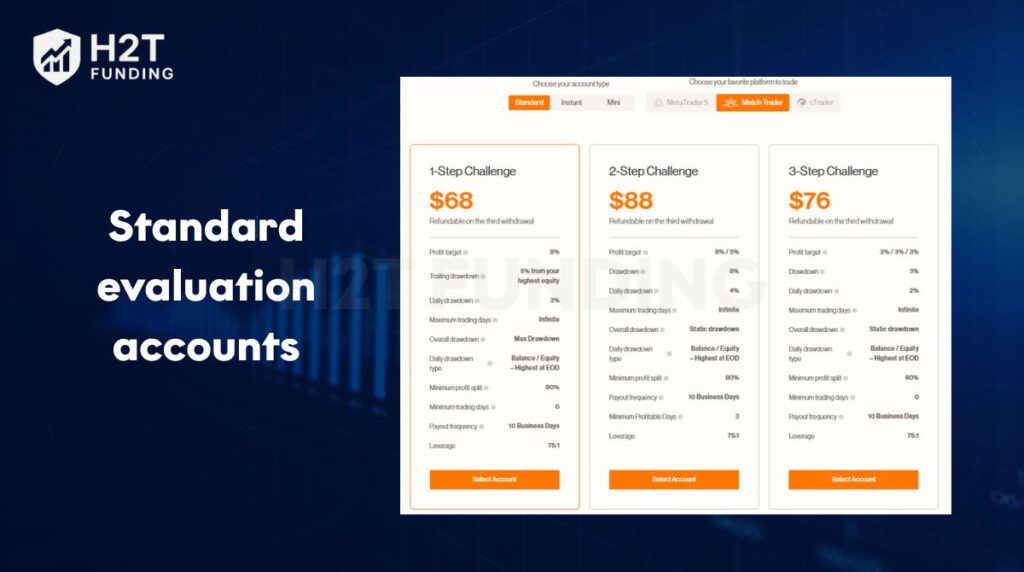

For traders ready to prove their skills, Maven offers three evaluation models. Each challenge has its own balance between entry cost, profit targets, and drawdown rules:

- 1-Step Challenge: Fastest path to activation. Profit target 8%, trailing drawdown 5%, minimum profit split 80%.

- 2-Step Challenge: Balanced option. Profit target 8% (phase 1) and 5% (phase 2), with up to 8% drawdown.

- 3-Step Challenge: Lowest entry cost. Profit target 3% per phase, with 3% drawdown.

- All evaluations come with the following: If you want to explore firms that require fewer active trading days during their challenges, our detailed comparison of prop firms with the lowest minimum trading days might help you find the most flexible option.

- Infinite trading duration (no time limits).

- Ability to hold trades over weekends.

- Swap-free option and unique buyback feature.

- Payouts every 10 business days.

| Challenge Type | Profit Target | Drawdown | Daily Drawdown | Profit Split | Fee (refundable, $10k account) |

|---|---|---|---|---|---|

| 1-Step | 8% | 5% trailing | 3% | 80% | $38 |

| 2-Step | 8% / 5% | 8% static | 4% | 80% | $44 |

| 3-Step | 3% / 3% / 3% | 3% static | 2% | 80% | $34 |

Once you understand these trading rules and account metrics, you’ll be ready to plan your strategy effectively. To improve your pass rate, read our full tutorial on how to pass a prop firm challenge. It covers proven tactics for evaluation phases, risk control, and drawdown management.

2.3. Instant accounts

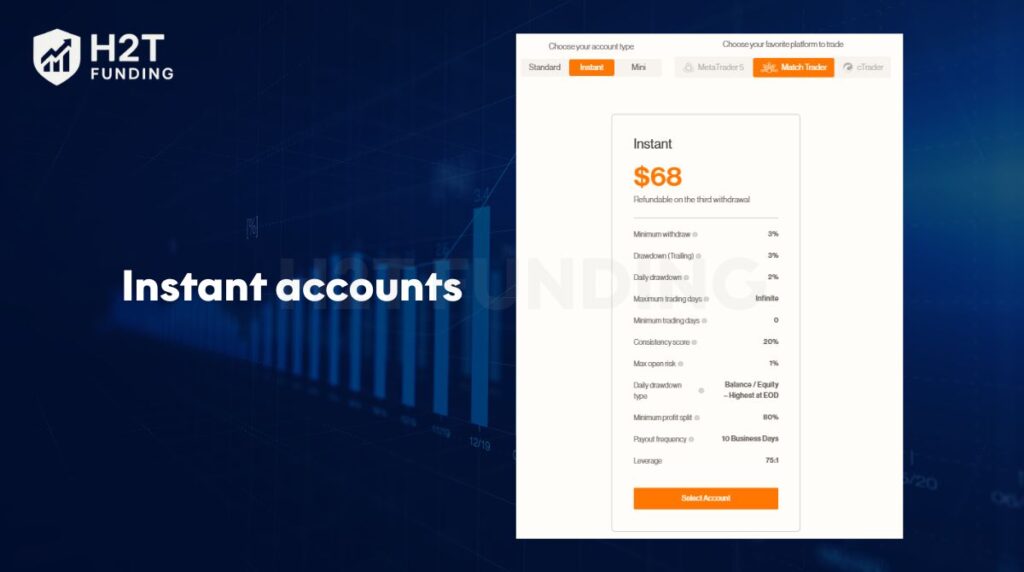

For traders who prefer to start right away, the Instant account provides direct access to simulated capital without going through evaluations:

- Higher upfront fee but immediate access to trading.

- The participation fee may vary depending on the account type and current conditions. All fees are refundable after the third payout. For example, the fee for a $10,000 Instant account can fluctuate, so always check the latest pricing on the official website before creating your trading account.

- Same risk management rules as evaluation accounts, but you can begin trading immediately.

With this variety, Maven ensures that every trader, from cautious beginners to ambitious professionals, can find an account type that matches their needs and goals.

2.4. Mini account

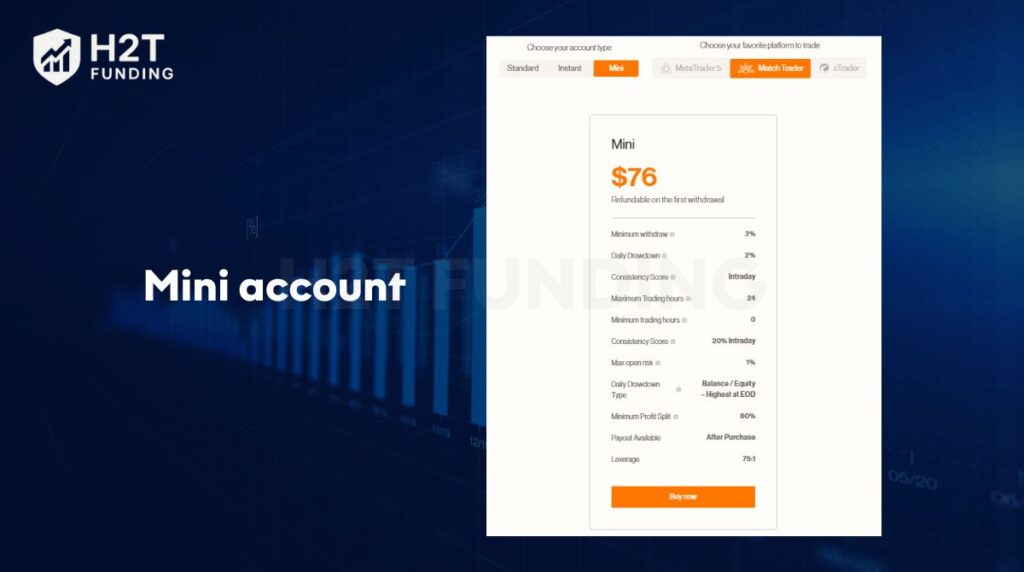

The Mini account is Maven’s most affordable option, ideal for traders who want to start small before committing to larger evaluation challenges.

- One-time participation fee of $76, refundable after your first withdrawal.

- Offers real market conditions with controlled risk parameters.

- Allows you to test Maven’s trading environment while building confidence with minimal capital.

This entry-level plan bridges the gap between the demo and evaluation accounts, helping beginners gain practical experience with real performance metrics.

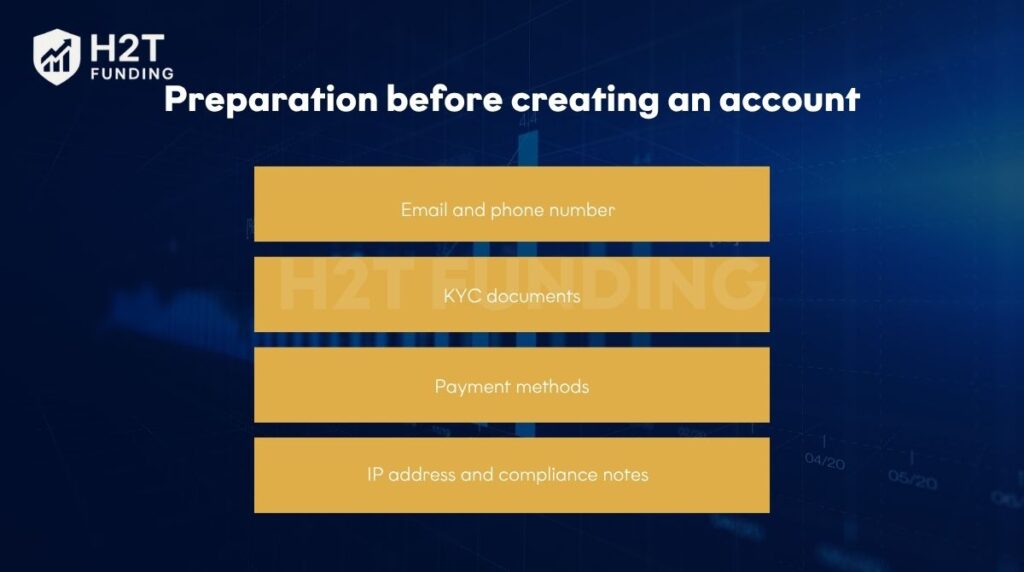

3. Preparation before creating an account

Before you begin the registration process with Maven Trading, it’s essential to have the right details and documents prepared. This step ensures that your trading account is created without delays and that your KYC verification goes through smoothly.

If you’re curious about what happens when traders change their country or region during verification, check out our full guide on KYC and country changes in prop firms like Topstep.

3.1. Email and phone number

Your contact information is the foundation of your account. Make sure you:

- Use a valid and active email. Each trader is allowed only one email for the entire Maven journey.

- Provide a correct phone number, as it will be used for verification and direct client support.

3.2. KYC documents

Identity verification is a mandatory step before accessing any funded accounts. To avoid rejection, keep in mind:

- Submit an official government-issued ID, such as a passport, national ID, or driver’s license.

- Ensure that your ID details match the personal information you provide at checkout.

- Never use someone else’s ID; doing so will result in automatic rejection.

- In specific regions, like Nigeria, additional requirements may include a selfie and a national ID number.

- Once you start trading, your personal details cannot be changed.

3.3. Payment methods

Payment is the next step to activate your chosen account type. Be ready with:

- Credit/debit cards (Visa, Mastercard, American Express).

- Digital currencies, if you prefer crypto payments.

- Remember: the card must be in your name. Using another person’s card will cause your KYC to fail.

3.4. IP address and compliance notes

Maven enforces strict rules to protect the fairness of its prop trading environment. You should:

- Keep your IP address consistent with your registered region. Sudden changes may require proof, such as travel tickets.

- Accept and follow Maven’s Terms & Conditions, which also state that you are responsible for paying taxes in your country of residence.

To understand how such compliance policies and trading limitations differ across other platforms, explore our in-depth article on common prop firm rules, covering KYC, drawdown, and payout restrictions.

By preparing these essentials ahead of time, you avoid common mistakes that could delay account creation. With everything ready, the process will take only a few minutes, setting you up for a smooth start in your trading journey.

4. How to create Maven Trading account (step-by-step)

Opening an account on Maven Trading is straightforward, but you should follow each step carefully to avoid mistakes during registration or KYC verification.

To help you understand how to create a Maven Trading account, here’s a quick overview of the entire setup process before we dive into details:

- Step 1: Access the official Maven Trading website and select your preferred account type (1-Step, 2-Step, 3-Step, or Instant).

- Step 2: Fill in your personal information accurately.

- Step 3: Provide payment details for your selected challenge or Instant plan.

- Step 4: Confirm your order and complete the payment process.

- Step 5: Verify your email and receive your trading platform credentials.

- Step 6: Complete the KYC verification process.

- Step 7: Start trading and work toward your funded account.

Once all documents and details are ready, the entire account activation process typically takes less than 15 minutes.

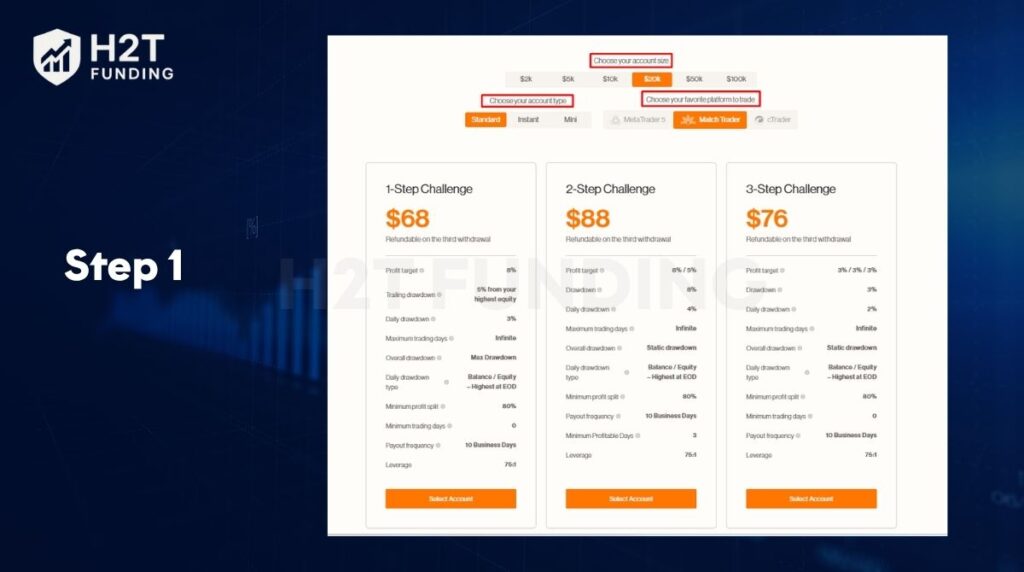

4.1. Step 1: Access the official website and select a challenge

Go to the official Maven Trading website. From the homepage, choose the account size (e.g., $2k, $5k, $10k, $50k, or $100k) and the type of evaluation you prefer (1-Step, 2-Step, 3-Step, or Instant). Each plan has different profit targets and drawdown rules, so select the one that aligns with your trading strategies. Once decided, click Buy Now.

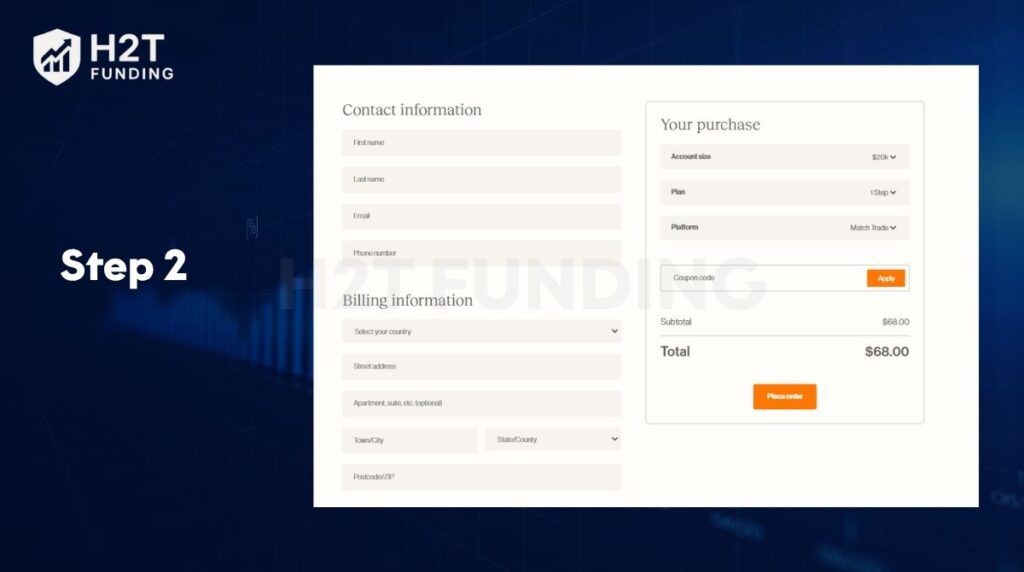

4.2. Step 2: Fill in your personal details

On the checkout page, enter accurate personal information. This will later be checked against your ID during KYC:

- Full name (exactly as shown on your ID).

- Email address (unique for each trader).

- Country, city, and full residential address.

- Postal/ZIP code.

- Mobile phone number.

At this stage, you will also choose your trading platform (MetaTrader 5, Match-Trader, or cTrader).

4.3. Step 3: Provide payment information

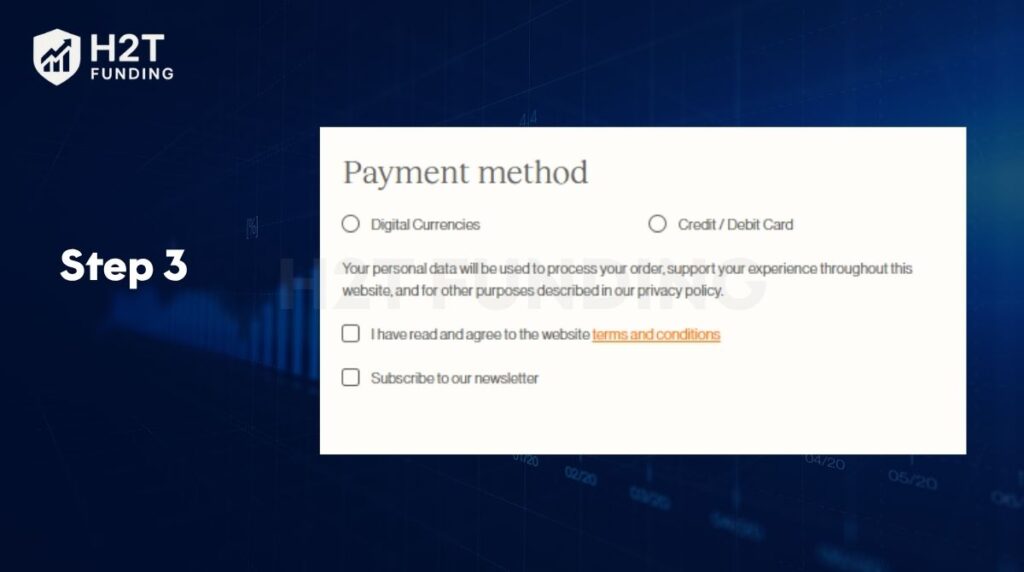

Select your preferred payment method:

- Credit or debit card (Visa, Mastercard, American Express).

- Digital currencies (e.g., Bitcoin, Litecoin, USDT).

Note: The payment method must match the trader’s name. Using someone else’s card or wallet can cause account suspension during KYC.

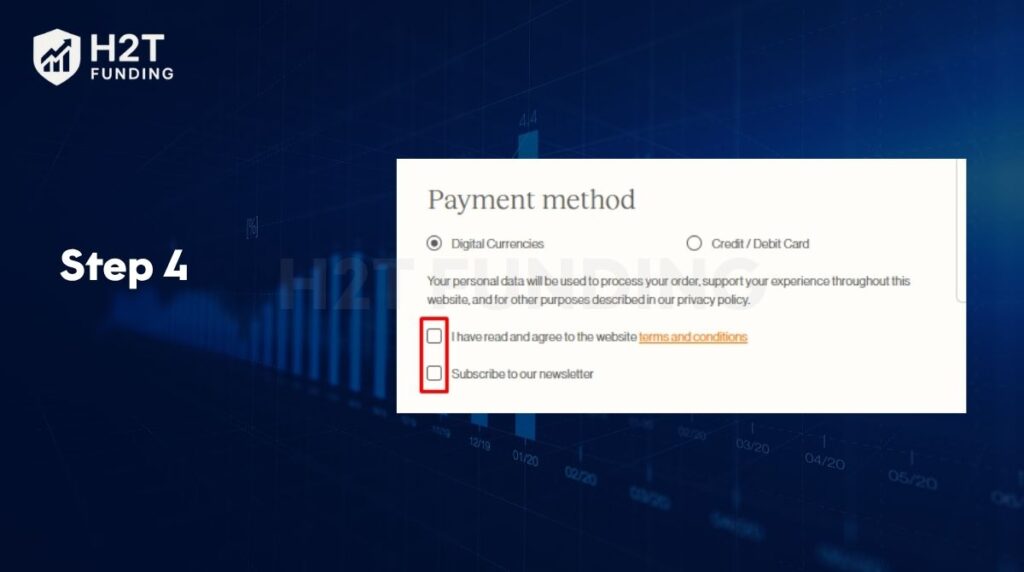

4.4. Step 4: Confirm order and complete purchase

Review your chosen plan, coupon (if any), and total fee. Tick the required checkboxes for agreeing to Terms & Conditions and residency requirements. Click Complete Payment to finalize. Allow up to 10 minutes for payment confirmation.

4.5. Step 5: Verify your email and receive login credentials

After payment is confirmed, Maven will send your login credentials to the registered email. This includes account details for the selected trading platform.

4.6. Step 6: Complete KYC verification

Before you can withdraw profits from a funded account, you must complete KYC:

- Identity verification: Passport, National ID, or Driver’s License.

- Proof of residence: Utility bill or recent bank statement.

- Additional requirements may apply depending on your country (e.g., selfie with ID).

4.7. Step 7: Start trading

Evaluation accounts: Trade until you meet the profit target while respecting the drawdown rules. Once passed, Maven upgrades you to a funded account with an 80% profit split.

Instant funding accounts: Begin trading right away. The minimum profit threshold for withdrawals does not apply equally across all account types. For the Mini account, you need to reach 3% profit to qualify for a one-time payout.

For Instant accounts, the main condition is the Consistency Rule (the best trading day cannot exceed 20% of total profits). For standard evaluation accounts, you only need to meet the profit target and complete KYC before entering the payout model.

5. How to deposit and withdraw money in Maven Trading

Managing deposits and withdrawals with Maven Trading is simple, but it’s important to understand the rules clearly. This ensures your funds are processed quickly and you avoid mistakes that could delay payments.

Deposits: Activating your account:

Before trading, you need to pay the refundable fee for your chosen challenge or Instant account. Here’s what to expect:

- Payment options: Credit/debit cards (Visa, Mastercard, Amex) and digital currencies (Bitcoin, Litecoin, USDT).

- Processing time: Most payments are confirmed within 10 minutes. For crypto, network confirmation may add a little extra time.

- Important rule: The card or wallet used must be in your own name. Using someone else’s details will cause KYC failure later.

- Access to account: Once the fee is confirmed, you receive your login credentials via email and can begin trading right away.

Withdrawals: Payouts and profit split:

The most attractive part of Maven is its clear and consistent payout model. Every trader keeps 80% of their earnings, regardless of account type.

General payout rules:

- The first withdrawal is available after 14 days, and traders can then opt for a 7-day payout cycle.

- The maximum withdrawal allowed is $10,000 for each rolling 30-day cycle.

- The rule requiring 3 trading days with 0.5% profit per day is not part of Maven Trading’s official guidelines. It should not be seen as a mandatory condition in the withdrawal process.

- Processing time: usually 1 business day, faster than many competitors.

Special case: Mini and Instant accounts:

- Mini challenge: The mini account allows you to withdraw once you reach a minimum profit of 3%. After the payout is processed, the account automatically closes. This mini challenge is a smaller, special option separate from the main funded accounts. This is the fastest way to experience prop trading with small initial capital while still testing the real-market environment.

- Instant funding: Skip the challenge phase and withdraw once you hit the minimum profit. The same risk management rules apply (2–3% daily drawdown, trailing 3–5%).

Payout methods supported: Maven provides flexibility for traders across different regions:

- Crypto payments: Bitcoin, Ethereum, USDT, Litecoin.

- Direct bank transfer: Available in supported countries (e.g., Nigeria, South Africa, Kenya, and Ghana).

- Payment gateway (RisePay): Covers most other global regions.

- Currently, Neteller and Skrill are not supported.

The combination of fast processing, clear profit split, and multiple payout methods makes Maven a reliable option. With more than $2M already paid to traders worldwide, the firm has built a reputation for transparency and trust in the trading community. Maven is also exploring new features such as performance bonuses for top traders, giving additional rewards beyond the standard payout model.

6. Quick registration tips and avoiding common mistakes

In theory, creating a trading account is simple, but from my trading experience, I’ve seen so many people get held up by small, avoidable mistakes. Here are a few tips to save you the headache:

- Use your main email and phone number: I always recommend using the email you check daily. This is where all login details and payout confirmations will arrive. If you use a random email, you might miss important updates. The same goes for your phone number. Make sure it’s active for verification codes.

- Get your KYC documents ready beforehand: Trust me, nothing is more frustrating than getting delayed because of a blurry ID photo. My first time, I rushed it and had to re-upload. Make sure you take a clear, well-lit picture of your passport or ID where all four corners are visible before you even start. Take a clear photo with good lighting and ensure all corners of the document are visible. Having these ready before checkout saves time.

- Stick to one identity across everything: A common error is using a different name on your card, email, or ID. I’ve seen traders fail KYC simply because they paid with a relative’s card. Always use your own details consistently; this keeps your funded account safe.

- Double-check your details before submitting: It might sound obvious, but mistakes in your address or postal code can lead to unnecessary verification issues. I always reread my form twice before hitting “Complete Payment.”

- Don’t use VPNs or change IP location: Maven is strict about IP consistency. If you log in from different countries without proof of travel, it could raise red flags. Personally, I avoid VPNs during the registration and KYC process.

- Be realistic about your first plan: If you’re new, start small. I started with a $5k 2-step challenge to test their system before moving to larger accounts. It reduced my pressure, and I still got a good feel of their trading rules and payout process.

In short, the registration process at Maven Trading isn’t difficult, but being careful from the start saves you time later. With the right preparation, you can get your account approved quickly and focus on what really matters in your trading performance.

Once your account is live, stay disciplined and follow trading rules such as the Consistency Rule, which limits profits from a single trading day. Learn more in our guide on what the Consistency Rule in trading is and how it impacts your payouts and long-term results.

7. Common errors when creating and using Maven accounts

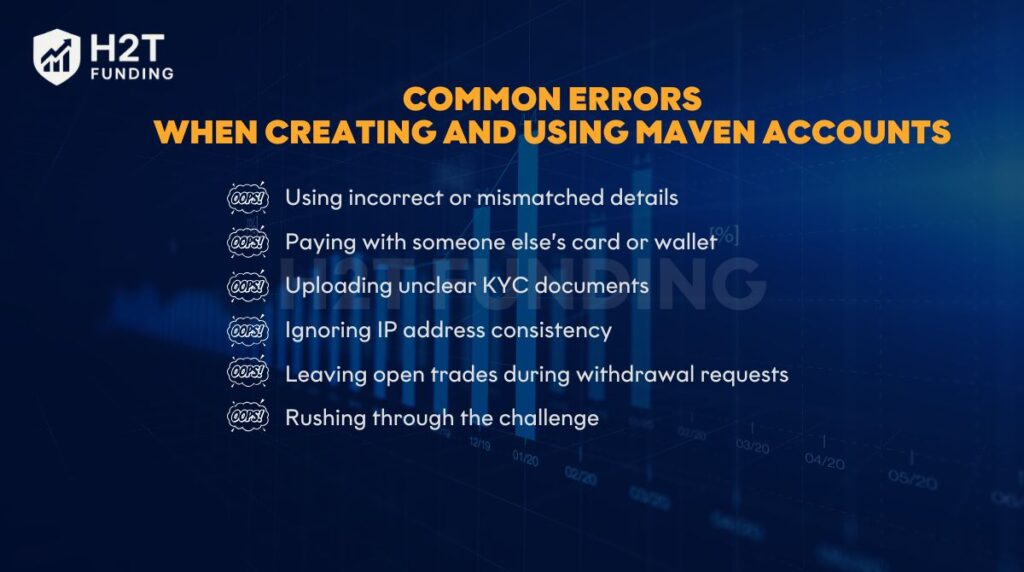

Even though the registration flow at Maven Trading is designed to be simple, many traders still face issues because of small oversights. From my observation, these are the most common mistakes that can slow you down or even block your account.

7.1. Using incorrect or mismatched details

Many traders fail KYC verification because their name or address doesn’t exactly match their ID. Even a small typo can cause rejection. Always ensure your full name, address, and date of birth are identical across your ID, payment method, and registration form.

7.2. Paying with someone else’s card or wallet

Maven strictly enforces its rule: the payment method must belong to the account holder. If you use a friend’s card, your account may get suspended when you reach the payout stage. This is one of the most common reasons for blocked funded accounts.

7.3. Uploading unclear KYC documents

Submitting low-quality scans or cropped ID photos is another frequent error. Documents must be clear, well-lit, and show all corners. Proof of residence (like a utility bill) must also be recent, usually within the last 90 days.

7.4. Ignoring IP address consistency

Maven checks if your IP address is stable. Logging in with VPNs or from different countries without proof of travel can trigger account reviews. Traders often overlook this, but it’s a strict rule that protects the integrity of the trading evaluation.

7.5. Leaving open trades during withdrawal requests

Some traders forget that all positions must be closed before requesting a payout. An open position, even if profitable, will block the request. Always close trades and double-check your account balance before submitting.

7.6. Rushing through the challenge

New traders sometimes treat the evaluation as a race, opening oversized positions to hit profit targets quickly. This often leads to breaching drawdown limits or breaking trading rules. Maven allows unlimited trading days and uses that flexibility instead of forcing trades.

Most errors with Maven accounts come from rushing or skipping details. If you take the time to prepare documents and use your own payment method, your account will stay secure. By following the rules, your path to trading profits will be much smoother.

8. Comparison: How to create a Maven Trading account vs other prop firms

When traders search for how to create a Maven Trading account, one of the most common questions is how its sign-up process compares with other major prop trading firms like FTMO, Topstep, The5ers, or FundedNext.

While each firm has a different evaluation structure, KYC procedure, and funding activation timeline, the overall goal is the same: proving trading discipline before accessing live capital. The table below gives a quick comparison to help you understand how Maven stands out in simplicity, payout speed, and flexibility.

| Prop Firm | Steps to Create an Account | KYC & Activation | Time Limit | Key Highlights |

|---|---|---|---|---|

| Maven Trading | Register → choose 1/2/3-Step or Instant → pay fee → verify email → complete KYC → trade → payout every 10 business days | Within 24 hours after payment confirmation | No time limit on evaluations | 80% profit split, 3% Mini payout option, Consistency Rule (best day ≤ 20% profit) |

| FTMO | Sign up → buy 2-Step Challenge (Step 1: Challenge → Step 2: Verification) → pass both → sign contract → KYC → funded | Takes 1–2 days after verification | 30 days + 60 days for each phase | Strict objectives, 90% profit split, well-known for transparency |

| Topstep | Register → enter Trading Combine® → meet profit target → pay activation → funded (Express Funded Account) | Activation after the Combine pass | No hard time limit | Focus on futures trading, monthly payouts, and risk education |

| The 5ers | Register → pick program (Bootcamp, Hyper-Growth, High Stakes) → trade → funded | KYC before funding | Varies by program | Offers both evaluation and Instant Funding models |

| Funded Next | Register → select Evaluation or Express plan → trade → pass → KYC → funded | 24–48 h verification | No strict time cap on certain plans | Up to 90% profit split, free trial option for beginners |

Quick insights:

- Maven vs. FTMO: Maven’s flexible 1/2/3-step or instant models let traders start faster, while FTMO enforces a fixed 2-step challenge with time limits.

- Maven vs. Topstep: Both focus on fast access to capital, but Topstep caters to futures traders, whereas Maven supports forex, commodities, and indices.

- Maven vs. The5ers: Both offer instant-style funding, but Maven’s Mini account (3% payout then close) is a quicker, low-risk testing ground.

- Maven vs. FundedNext: FundedNext allows flexible timelines like Maven, yet Maven’s 10-day payout cycle is one of the fastest in the industry.

Among leading prop trading firms, Maven Trading provides one of the most streamlined onboarding experiences, with minimal waiting, simple verification, and clear payout rules, making it an excellent choice for traders looking to scale their funded accounts efficiently.

9. FAQs

Yes. Maven Trading has been operating since 2022 as a prop trading firm and has built a solid reputation in the trading community. It is known for fast payouts, fair trading rules, and reliable client support.

Verification usually takes less than 24 hours once you submit clear documents. For KYC, you must provide an ID and proof of residence. Delays only happen if the information doesn’t match or the files are unclear.

Yes. A demo account is available for new traders to practice strategies and get familiar with the trading platforms before risking capital. For developers searching online, you might also see the term “how to create a Maven project in the command line,” but that is related to software development, not trading. Don’t confuse the two. Maven Trading is a prop firm for traders.

Yes. Maven offers MetaTrader 5 (MT5) along with Match-Trader and cTrader. The platforms ensure smooth market execution and support many trading instruments. Traders can choose from forex pairs, commodities, indices, and crypto to fit their strategies.

Maven Trading connects to trusted liquidity providers for fair market execution and competitive spreads, though the specific broker names are not publicly disclosed. The supported trading platforms include MetaTrader 5, cTrader, and Match-Trader. The specific broker may vary depending on the trading setup, and Maven does not disclose exact details publicly.

There is no traditional deposit since Maven operates on a challenge fee model. For example, a $10k 2-Step challenge costs $44 (refundable). For Instant funding, fees are slightly higher. This makes entry more affordable compared to the direct trading capital requirements at brokers.

No. Completing KYC verification is mandatory before requesting withdrawals. This ensures account security and compliance with international standards.

You can open multiple challenges under the same email, but all must use consistent details. Using different emails for separate accounts may cause issues during trading evaluation.

No. Maven offers an infinite trading duration, allowing traders to progress at their own pace without pressure. This high level of flexibility helps traders adapt their setup and apply different strategies without worrying about deadlines.

Payment confirmation usually takes 10 minutes for cards and up to a few hours for crypto. Once confirmed, credentials are sent immediately, and you can start your trading strategies. Maven does not charge hidden trading fees beyond spreads and commissions on the chosen trading platforms, which makes the withdrawal process more transparent.

Yes. With strong user feedback on TrustPilot and payouts already exceeding $2M globally, Maven is considered a reputable firm in the prop trading industry.

No. Maven’s fees are among the lowest compared to competitors. For example, a 3-step challenge at $10k starts at $34. Additionally, fees are refundable once you pass. The unique buyback feature adds extra flexibility if you fail but want to retry.

Yes. If you breach the drawdown limit, you can purchase a new challenge or use the buyback option. However, it’s always better to apply disciplined risk management to avoid reaching that point.

10. Conclusion

So there you have it. That’s how to create Maven Trading account from start to finish. The process isn’t complicated, but paying attention to the details is key. As long as you respect the trading rules and apply disciplined risk management, you’ll find Maven to be a reliable partner. With a clear payout model and a supportive trading community, it’s a solid choice in the prop trading industry.

For traders who are researching how to create a Maven trading account, success is more than just passing the evaluation. It also depends on maintaining consistent risk management and disciplined strategies.

At H2T Funding, we recommend Maven as a solid choice for both beginners and experienced traders. For those interested in earning beyond trading, the Maven Trading affiliate program is another option to generate income by referring new traders. If you want to explore more firms and strategies to sharpen your trading edge, check out our Prop Firm & Trading Strategies category for in-depth reviews and guides.