Calculating pips in Forex involves finding the difference in a currency pair’s price, typically at the fourth decimal place (0.0001) for most pairs, or the second (0.01) for JPY pairs. The final monetary value of this price movement then depends directly on your trade size, also known as the lot size. Correctly determining this value is a non-negotiable skill for any serious trader.

While the concept seems simple, understanding how to calculate pips in forex accurately across different pairs is what separates guessing from strategic trading. This comprehensive guide from H2T Funding will break down everything you need to know. Mastering this is your first step toward effective risk management and success as a funded trader.

Key Takeaways

- Pip is the smallest whole unit of price movement in forex, used as a standard unit.

- The standard is 0.0001 for most currency pairs and 0.01 for pairs involving the Japanese Yen (JPY).

- You can find the number of pips by simply subtracting the entry price from the exit price.

- The core formula is: Pip Value = (Pip Size / Exchange Rate) x Lot Size.

- Pips are fundamental for calculating profit/loss and setting precise Stop Loss and Take Profit levels.

1. What are pips in forex trading? The foundation of profit

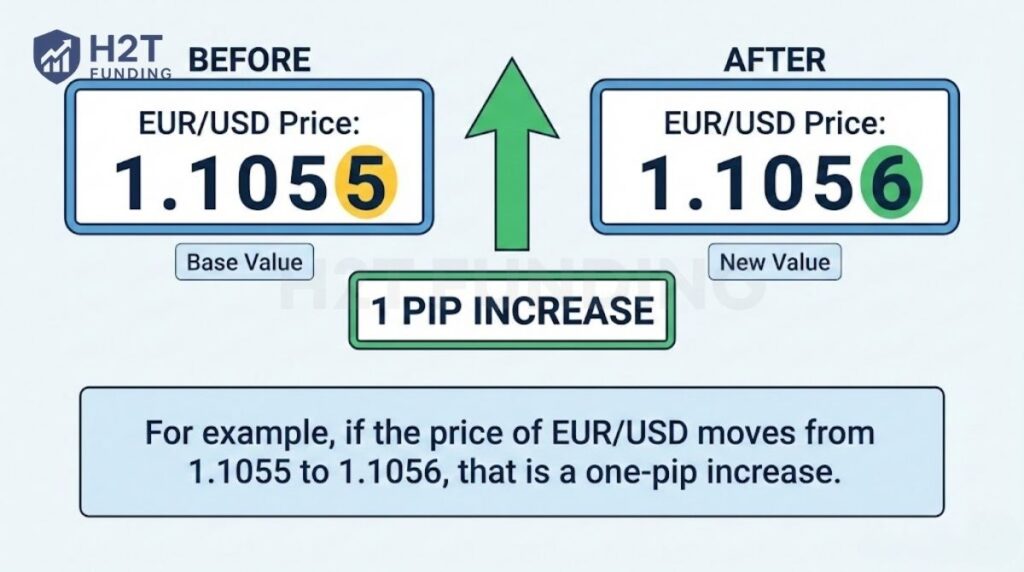

A pip, short for “Percentage in Point,” is the standard unit for measuring the change in value between two currencies. Think of it as the fundamental building block for all your profit and loss calculations in forex trading. When an exchange rate changes, the pip is the smallest whole unit that reflects that movement.

For most currency pairs, a pip is a one-digit movement in the fourth decimal place. For example, if the price of EUR/USD moves from 1.1055 to 1.1056, that is a one-pip increase. Understanding this concept is essential, as it’s one of the core financial terms every beginner should know.

A pipette is simply a fractional pip, representing one-tenth of a standard pip. Many brokers now provide 5-decimal quotes to offer more precise pricing, and this final digit is the pipette. This increased precision can be important, especially for traders who use strategies that capitalize on very small price changes.

For instance, in a quote like 1.10552, the final digit ‘2’ is the pipette. This is sometimes also referred to as a “point”.

The easiest way to visualize this is with a table:

| Term | Decimal Place (Non-JPY) | Decimal Place (JPY) | Example (EUR/USD Quote: 1.08550) |

|---|---|---|---|

| Pip | 4th (0.0001) | 2nd (0.01) | The digit 5 represents the pip. |

| Pipette | 5th (0.00001) | 3rd (0.001) | The digit 0 represents the pipette. |

2. How to calculate pips in forex?

The exact calculation method for a pip’s value depends on the specific currency pair you are trading. However, the process is straightforward once you understand the two key factors that determine the final monetary outcome of any trade: your lot size and the pip size of the currency.

2.1. Understanding lot size and pip size

Before you can determine a pip’s worth, you must know your trade volume, or lot size. Lot size refers to the number of units of the base currency you are trading, and it is the single biggest factor that multiplies the value of each pip movement. A larger lot size means each pip change has a greater impact on your balance.

Here are the standard lot sizes in forex trading:

- Standard Lot: 100,000 units.

- Mini Lot: 10,000 units.

- Micro Lot: 1,000 units.

2.2. Step-by-Step Calculation with Examples

Counting the number of pips in a price move is a simple act of subtraction. The main thing to remember is which decimal place you should be looking at. This is the foundation for learning how to calculate pip movement in forex.

2.2.1. For Non-JPY Pairs (e.g., EUR/USD, GBP/USD)

For the vast majority of pairs, the pip is the fourth decimal place (0.0001). To find the number of pips between two prices, you subtract one from the other.

- Example: Imagine the price for EUR/USD moves up from 1.0750 to 1.0785.

- Calculation: 1.0785 – 1.0750 = 0.0035.

- Result: This 0.0035 change represents a 35-pip move.

2.2.2. For JPY Pairs (e.g., USD/JPY)

The key exception to this rule is any pair that includes the Japanese Yen (JPY) as the counter currency. For these pairs, a pip is the second decimal place (0.01). This is a critical distinction when you need to calculate pips for USDJPY.

- Example: Let’s say the quote for USD/JPY falls from 155.20 to 155.00.

- Calculation: 155.20 – 155.00 = 0.20.

- Result: This 0.20 change represents a 20-pip move.

Mastering this simple subtraction is the first crucial step. Once you can confidently count the pip movement, you’re ready to translate that number into its actual monetary worth, the part that truly matters for your trading account.

2.3. How to calculate pips in XAUUSD

Unlike forex currency pairs, XAUUSD (Gold) does not use traditional pips. Gold price movements are measured in points, which directly reflect changes in the price of gold quoted in USD. Many traders still casually call these movements “pips,” but for accuracy and risk management, understanding the correct calculation is critical.

XAUUSD is usually quoted with two decimal places, for example, 2350.50. In most trading platforms:

- 1 point = 0.01 USD

- 100 points = 1.00 USD price movement

So if XAUUSD moves from 2350.50 to 2351.50, the price change is:

- $1.00

- 100 points (often incorrectly referred to as “100 pips”)

To calculate the price movement, simply subtract the entry price from the exit price:

Price Movement = Exit Price − Entry Price

Example: Buy XAUUSD at 2350.20, sell at 2352.70

2352.70 − 2350.20 = 2.50

This equals a $2.50 move, or 250 points.

To calculate profit or loss, you must factor in lot size. Most brokers define:

1.00 lot XAUUSD = 100 ounces of gold

Profit/Loss = Price Movement × Contract Size × Lot Size

Example:

- Price move: $2.50

- Lot size: 1.00

- Contract size: 100 oz

Profit = 2.50 × 100 × 1.00 = $250

If trading 0.10 lot, the same move would result in $25.

A common mistake is treating XAUUSD like a forex pair (such as EUR/USD) and applying pip rules like 0.0001 = 1 pip or assuming $10 per pip. This approach is incorrect for gold and often leads to serious position-sizing and risk-management errors.

The safest method is to always calculate XAUUSD trades based on actual dollar price movement and lot size, not traditional pip formulas.

3. How to calculate pip value?

Knowing your trade moved 50 pips is good, but it’s meaningless until you can translate that into a real dollar amount. The monetary worth of a pip is what determines the actual profit or loss reflected in your trading account. The specific calculation changes slightly depending on the structure of the currency pair, specifically, which currency is the base and which is the quote.

3.1. Formula for pairs with USD as the quote currency (e.g., EUR/USD, GBP/USD)

This is the most straightforward calculation. It applies when the USD is the second currency listed in the pair (the counter currency). In these cases, the pip value is fixed and does not fluctuate with the exchange rate.

- The Formula: Pip Value = Lot Size x 0.0001

- Example: Let’s say you trade 1 Mini Lot (10,000 units) of EUR/USD.

- Calculation: 10,000 (units) x 0.0001 = $1.00

This means for every one-pip move in your favor, you earn $1; for every pip against you, you lose $1. This simple math is why learning how to calculate pips in forex EURUSD is often the first example for beginners.

3.2. Formula for pairs with USD as the base currency (e.g., USD/CHF, USD/CAD)

When the USD is the first currency listed (the base currency), the calculation has one extra step. Because the pip’s value is technically in the counter currency (like Canadian Dollars), you must convert it back to USD using the current exchange rate.

- The Formula: Pip Value = (Lot Size x 0.0001) / Current Exchange Rate

- Example: You trade 1 Standard Lot (100,000 units) of USD/CAD, and the current price is 1.3700.

- Calculation: (100,000 x 0.0001) / 1.3700 = $7.30

In this case, each pip of movement is worth approximately $7.30. This demonstrates how the pip value changes from pair to pair.

3.3. How to calculate pips for gold (XAUUSD) and indices (NAS100)

It is a common point of confusion, but assets like Gold (XAU/USD), Silver, or indices like the NAS100 are not measured in pips. Their movements are measured in points, which correspond directly to the asset’s price, usually US dollars. Therefore, calculating price movement for XAUUSD doesn’t involve the same pip logic as forex pairs.

Example: If the price of XAU/USD moves from $2350.50 to $2351.50, that is a $1.00 move.

Value: The monetary value of a $1 move in XAUUSD depends entirely on your broker’s contract specification.

For many brokers, 1 standard lot represents 100 ounces of gold, meaning a $1 move equals $100.

However, traders must always verify the contract size in their trading platform.

Understanding this distinction is crucial when you start trading different asset classes beyond standard forex pairs.

3.4. How to calculate pip value when your account currency is not USD

When your account currency differs from the quote currency, the pip value must be converted using the relevant exchange rate.

Most traders rely on pip calculators to avoid errors in this scenario.

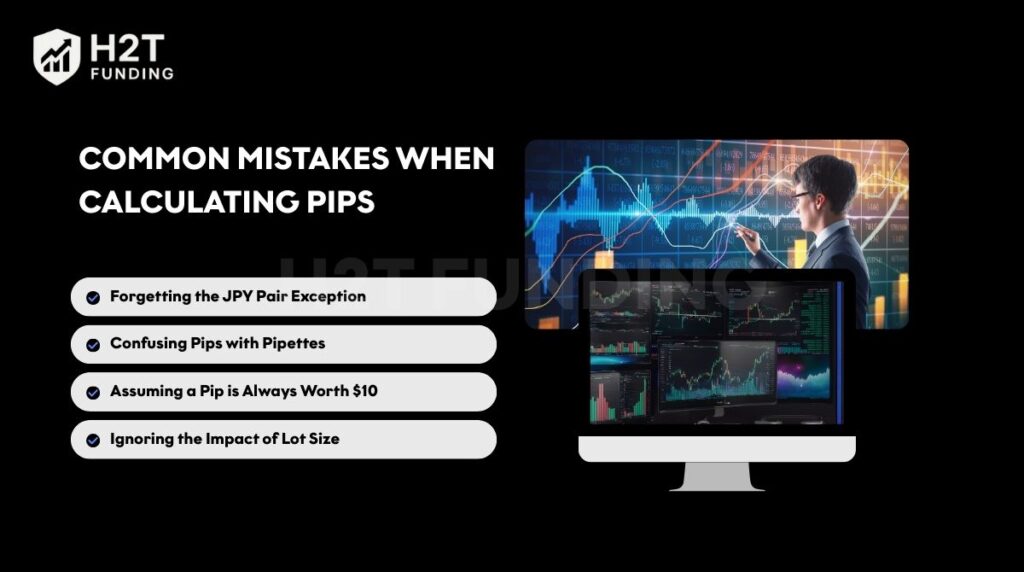

4. Common mistakes when calculating pips and how to avoid them

Knowing the formulas is one thing, but avoiding common pitfalls is what ensures your calculations are consistently accurate. An error here can lead to flawed risk management and unexpected outcomes.

Here are the most frequent mistakes traders make.

4.1. Forgetting the JPY Pair Exception

This is arguably the most common error for new traders. They learn the four-decimal rule and apply it universally. This leads to incorrect calculations for any pair involving the Japanese Yen, like GBP/JPY.

- The Mistake: Applying the 0.0001 pip size to a currency pair like USD/JPY or GBP/JPY.

- How to Avoid It: Always remember this simple rule: If JPY is the counter currency, a pip is the second decimal place (0.01). No exceptions.

4.2. Confusing Pips with Pipettes

With most brokers now offering five-decimal pricing, it’s easy to mistake the final digit for a full pip. This can cause you to overestimate your potential profit or loss by a factor of ten, a massive difference.

- The Mistake: Reading the fifth decimal digit as a full pip.

- How to Avoid It: On a standard 5-digit quote, the fourth digit is the pip, and the fifth is the pipette. Always focus on the fourth digit for your primary calculation.

4.3. Assuming a Pip is Always Worth $10

Many traders hear that “one standard lot is $10 a pip” and treat it as a universal law. This is a dangerous oversimplification. While it is a close approximation for pairs like EUR/USD, it is not accurate for all currency pairs.

- The Mistake: Believing a standard lot always yields a fixed $10 per pip.

- How to Avoid It: Understand that this is only an estimate for specific pairs. The true value depends on the currency pair and the current exchange rate, as seen with USD/CAD.

4.4. Ignoring the Impact of Lot Size

Some traders meticulously count their pip movement on a chart but fail to connect it to their trade size. They then wonder why a 20-pip gain resulted in a tiny profit, or why a small pip loss created a significant drawdown. This is a core part of how to use pips in forex trading.

- The Mistake: Calculating pip movement without understanding why the monetary gain or loss is so small or large.

- How to Avoid It: Always factor in your lot size (Micro, Mini, or Standard). It is the primary multiplier of your pip’s final monetary value.

By being mindful of these common errors, you can ensure your calculations are always precise. This attention to detail is a hallmark of a disciplined trader and prevents costly, unforced errors in your risk management.

5. Practical tools for faster pip calculation

While understanding the manual formulas is essential for a solid foundation, professional traders rely on tools for speed and accuracy in their daily operations. Manual calculations can be slow and prone to error, especially in a fast-moving market. Using dedicated tools ensures you get the right numbers instantly.

5.1. Using the measurement tool on TradingView

For traders who analyze charts, the platform itself offers the quickest way to measure pip distance. Learning how to calculate pips in Forex TradingView is a valuable skill that streamlines analysis. The process is simple and intuitive.

On a TradingView chart, select the “Ruler” or “Price Range” tool from the left-hand toolbar. Click on your intended entry price and drag the cursor to your target or stop-loss level. The tool will instantly display the price change, the number of bars, and, most importantly, the total pip movement. This is an excellent way to learn how to calculate pips on a forex chart visually.

5.2. Leveraging Online Pip Calculators

For a comprehensive calculation that includes monetary value, the best tool is a dedicated pip calculator. Nearly all brokers and major financial websites offer a free pip calculator that does all the heavy lifting for you. This is the easiest way to learn how to calculate a pip value at Forex without complex math.

You simply input the currency pair you are trading, your intended lot size, and your account currency. The calculator will then instantly provide the exact value of a single pip. This tool is indispensable for precise risk management and for understanding how the price per pip in forex changes between different pairs.

By integrating these practical tools into your trading routine, you can move past the manual math and focus more on your strategy. This allows for faster, more confident decision-making, which is critical for success in the dynamic world of forex.

6. FAQs

The value of 1 pip depends entirely on two factors: the currency pair you are trading and your lot size. For a standard lot (100,000 units) of EUR/USD, one pip is typically worth about $10. For a micro lot (1,000 units) of the same pair, it’s worth only $0.10.

No, this is a common misconception. A pip is only worth approximately $10 when trading a standard lot on pairs where the U.S. dollar is the quote currency (like EUR/USD or GBP/USD). For other pairs or different lot sizes, the monetary value will be different.

You calculate pip profit by multiplying the number of pips you gained by the specific monetary value of each pip for your trade. The formula is simple: Profit = Pips Gained x Pip Value. This is how to calculate profit in forex using pip for any trade.

This is entirely dependent on your trade size. To give you perspective: On a Mini Lot (~$1 per pip on EUR/USD): 20 pips = $20; 100 pips = $100. On a Standard Lot (~$10 per pip on EUR/USD): 20 pips = $200; 100 pips = $1,000.

The spread is the cost of entering a trade. It is the gap between a pair’s ask price (where you buy) and its bid price (where you sell). This cost is measured in pips. So, if a spread is 2 pips, the price must move 2 pips in a favorable direction for the trade to break even.

Yes, and this is a critical distinction. For any pair involving the Japanese Yen, a pip is the second decimal place (0.01), not the fourth. All calculations of how to calculate JPY pips in forex must use this adjusted pip size.

Cryptocurrencies like BTCUSD are typically measured in points or price units rather than traditional forex pips, although some platforms may use the term “pip” internally. Their movements are measured in points, which directly correspond to price changes (e.g., dollars and cents). For example, a move in Gold from $2300 to $2301 is a 1-point move, not a pip move.

You find the pip distance between your entry price and your desired stop-loss price. The calculation of pips in forex for a stop loss is: For a Buy Trade: Entry Price – Stop Loss Price For a Sell Trade: Stop Loss Price – Entry Price

Exchange rate fluctuations are the primary reason a pip’s monetary value changes. You’ll notice this most in pairs where USD is the base currency, like USD/CAD. As that pair’s price moves, its quote currency’s value shifts relative to the dollar, directly altering each pip’s final monetary worth.

On a standard 5-digit quote (e.g., 1.08550), the fourth digit (the second 5) is the pip. To count pips, use the “Crosshair” tool. Click and drag it between two price levels; it will show the distance in points (pipettes). Simply divide that number by 10 to get the correct pip count.

For beginners, this is generally not a good strategy. Focusing on a fixed pip target can lead to forced, emotional trades. A professional approach focuses on a consistent trading process and solid risk management, allowing profits (in pips) to be the outcome of good decisions.

Yes, indirectly. While it’s not a magic formula, a deep understanding of pip value is critical for the risk management required to grow a small account. It allows you to calculate precise position sizes (e.g., using micro-lots) so you only risk 1-2% of your capital per trade, which is the cornerstone of long-term growth.

7. Conclusion

Mastering how to calculate pips in forex is more than just a technical exercise; it’s about understanding the fundamental language of profit and loss. From knowing the difference between a pip and a pipette to applying the correct formulas for JPY pairs and understanding the impact of lot size, every detail matters.

Now that you have a firm grasp on this crucial skill, the next step is to integrate it into a winning trading plan. H2T Funding invites you to continue your learning journey by exploring our Prop Firm & Trading Strategies category, where you’ll find advanced techniques and insights to help you pass funding challenges.