You want to start trading with Topstep, but still feel unclear about the different costs. Many traders are unsure about what they will actually pay. In reality, there are two main types of fees: the monthly subscription fee during the Trading Combine and the activation fee when you unlock a funded account.

In this guide, H2T Funding breaks down exactly how much is Topstep activation fee is vs. the Topstep monthly fee, so you can budget your futures trading like a real investment. With clear examples and comparisons, you’ll see the full picture, no hidden surprises.

Key takeaways

- The Topstep activation fee is always $149, no matter if you choose a $50k, $100k, or $150k account.

- This cost is different from the Topstep monthly fee you pay during the Trading Combine. Activation is a one-time payment to open your funded account.

- Refunds are generally not offered: once paid, the activation fee is locked in as part of your Topstep account setup, unless waived through a special promotion such as TopstepVIP.

- Extra costs include data subscriptions (Topstep covers one exchange by default starting July 22, 2025), round-trip commissions, and platform licenses, which vary in a live trading environment.

- Managing expenses smartly, like starting with one exchange, keeping accounts active, and watching commissions, improves your performance statistics and protects your profits.

1. What is the Topstep activation fee?

The Topstep activation fee is a one-time charge that you pay only after passing the Trading Combine and qualifying for a funded account. It works as the entry cost to move from simulated trading into real capital provided by Topstep.

This fee is different from the monthly subscription. The subscription covers your time in the Combine, where you prove consistency and meet profit targets under strict rules. Once you succeed, the subscription stops, and the activation fee becomes your next step.

If you’re also wondering what platform does Topstep use, understanding this distinction is crucial. Many traders mistakenly think the activation fee is a monthly cost, but it is not. It’s paid just once to launch your funded account and begin trading in live market conditions.

Clear separation helps you focus on performance in a stable trading environment before moving to live capital.

Exception: Topstep occasionally runs special programs such as TopstepVIP, where the activation fee and Combine fees are waived for three months. These limited promotions temporarily override the standard no-refund rule.

2. How much is Topstep activation fee

The Topstep activation fee is a flat $149 for each Express Funded Account you unlock after completing the Trading Combine program. This charge applies no matter which account size you choose, whether it’s the $50k, $100k, or $150k option.

So, if you’re asking how much is activation fee for Topstep or how much is the activation fee for Topstep is, the answer is always $149. Unlike the subscription fee you pay during evaluation, this is a one-time cost that activates your funded account and gives you access to real trading capital.

Activation fee by account size

| Account Size | Activation Fee | Notes |

|---|---|---|

| $50,000 | $149 | Paid after passing the Trading Combine |

| $100,000 | $149 | The same one-time fee applies |

| $150,000 | $149 | Required for each funded account |

This simple structure means you pay the same flat fee, no matter which account size you choose. If you pass multiple Trading Combines, you’ll need to pay the activation fee for each Express Funded Account you want to open.

Read more:

3. Topstep activation fee refund

The activation fee at Topstep is non-refundable and does not affect your payout policy once you’re funded. Once you make the payment and activate your Express Funded Account, you cannot request the money back, even if you decide not to trade.

You have 30 days from the date you pass the Trading Combine to pay the activation fee. If you miss this deadline, your funded account invitation may expire. This makes it clear that the $149 fee is your one-time ticket to live trading, not an ongoing charge.

There are a few important things to keep in mind:

- A word of caution: if you activate the wrong account, that fee is gone for good. I’ve heard stories of traders, in their excitement after passing, clicking too fast and choosing the wrong Combine account. Take an extra 10 seconds to match the account ID with your Trade Report.

- If you face technical issues during setup (for example, your Express Funded Account does not appear after payment), the Trader Support Team can help resolve the issue.

- Refunds are not offered if you fail to maintain your funded account or if it’s closed due to inactivity or violations of risk rules.

The Topstep-funded account fees structure designates the activation fee as a distinct, one-time charge, separate from other costs such as account resets or subscriptions. The $149 payment is for account activation and is not an ongoing expense.

For more details on Topstep’s account rules and risk parameters, check out does Topstep have trailing drawdown.

4. Does the activation fee include the monthly fee?

No, the activation fee and the monthly subscription fee are two completely different costs. The monthly fee is what you pay during the Trading Combine to keep your simulated trading account active. While proving consistency, hitting the profit target, and respecting the maximum loss limit. In short, the Topstep monthly fee applies to the Combine only; activation is a one-time cost to start live trading.

Once you pass the evaluation, that subscription ends. At this stage, you pay the activation fee as a one-time charge to start your Express Funded Account. This means activation is not tied to recurring monthly payments; it’s a separate step.

For example, if a trader joins the $50k Combine, they first cover the monthly fee to trade under evaluation. After completing it, they stop paying the subscription and instead pay the activation fee to unlock their funded account. This separation helps traders budget more accurately and avoid confusing the two.

If you’re also handling verification or relocation matters, see KYC can I change countries Topstep for how Topstep manages account identification and country updates.

5. Payment instructions and important notes

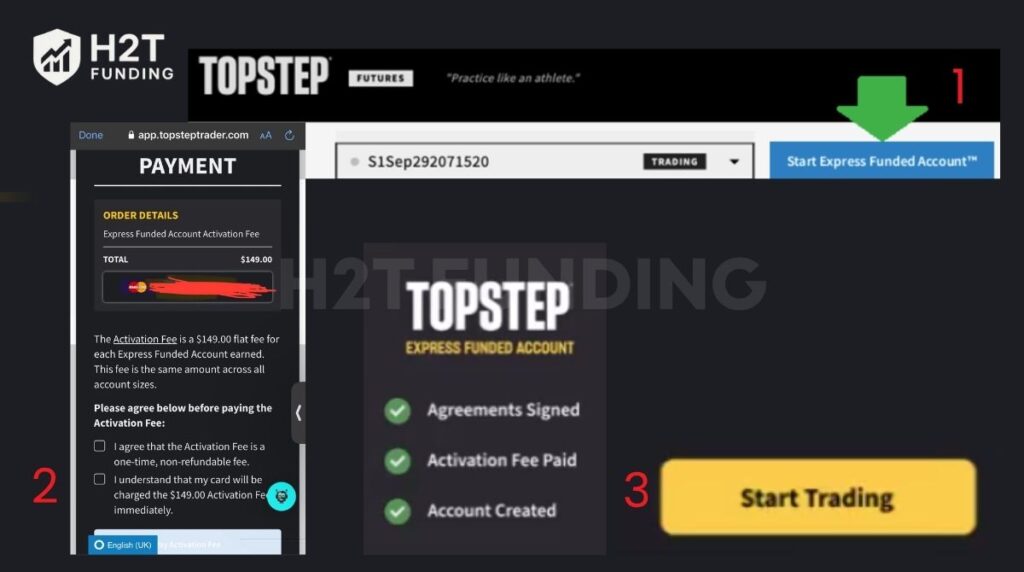

Paying the activation fee is straightforward, but it’s important to follow these steps carefully to avoid any delays. Many traders rush through the process and either select the wrong account or forget the final step of creating the funded account. To make sure your Topstep account activation goes smoothly, follow these steps in order:

- Step 1: Open the correct passed Combine account.

- Step 2: Verify account details before payment.

- Step 3: Review and accept all agreements.

- Step 4: Pay the activation fee.

- Step 5: Create the Express Funded Account (don’t skip this).

- Step 6: Start trading once the setup is complete.

Follow the detailed guide below to complete each step without errors.

5.1. Step 1: Open the right passed Combine account

Log in → Trade Report → click Start Express Funded Account on the specific Trading Combine you want to activate.

5.2. Step 2: Verify the account details

Before paying, match the account label/ID with your Trade Report. If you passed more than one, choose the exact account you intend to fund.

5.3. Step 3: Review and accept agreements

Read the Let’s Get Started page → Continue → review the Express Funded Account Agreement and Activation Fee Agreement → check both acknowledgment boxes → Continue.

5.4. Step 4: Pay the activation fee

Enter debit/credit card details on the payment page → click Process my payment → wait for Payment Successful.

5.5. Step 5: Create the funded account (don’t skip)

Click Create Express Funded Account to finalize your activation. Trust me on this one. After the payment goes through, many traders think they’re done and close the window. This final click is the most common reason for activation delays, so make sure you complete it.

5.6. Step 6: Finish and start trading

You’ll see Tips from our Coaches → click Start Trading to return to the dashboard; your new account will appear there.

If you see “Express Funded Account Not Created”, you need to return to Dashboard → select the same passed Combine → click Create Express Funded Account again. Do not re-pay. If it persists, contact Trader Support via Windy.

Timing and policy notes

- You must pay within 30 days of passing the Combine, or the invitation may expire.

- If you pass on Friday, you can pay after the Trade Report updates; the account shows when markets reopen Sunday at 5:00 PM CT.

- If you already hold the maximum of five Express Funded Accounts or an active Live Funded Account, the activation button will appear inactive on your dashboard. This restriction exists because Topstep limits the number of funded accounts you can run at the same time.

- Your funded account must show at least one trade every 30 days to remain open.

- If you break a rule during the Trading Combine, such as hitting the Maximum Loss Limit, you’ll need to pay a small reset fee to start again under the same subscription. The cost depends on your account size, typically $49 for $50k, $99 for $100k, and $149 for $150k accounts.

- Remember, the activation fee is separate from other charges, such as the subscription fee during the Combine or the Topstep reset fee, which only applies if you restart your evaluation.

These checks prevent activation mistakes and keep your performance statistics clean for future reviews.

6. Compare Topstep’s activation fee with other prop firms

When evaluating prop trading firms, it’s common for traders to compare not only profit splits and account sizes but also the fees associated with each. Topstep stands out because its activation fee is fixed at $149, regardless of whether you start with a $50k, $100k, or $150k account.

By contrast, many forex-focused firms such as FTMO, The5ers, Funding Pips, or FundedNext don’t use the same activation model. Instead, they usually charge an upfront challenge fee, which you pay before entering the evaluation. These fees vary by account size and are often higher for larger accounts.

| Firm | Account Sizes | Challenge/Activation Fee | Profit Split | Key Notes |

|---|---|---|---|---|

| Topstep | $50k – $150k | $149 activation fee (after passing) | 90% – 100% | Monthly subscription during Combine + one-time activation |

| FTMO | $10k – $200k | €89 – €1,080 upfront | 80% – 90% | No activation fee, but a challenge fee must be paid upfront |

| The5ers | $5k – $250k | $39 – $850 upfront | 50% – 100% | Lower entry cost for small accounts, scaling available |

| Funding Pips | $5k – $100k | $29 – $529 upfront | 80% – 100% | Challenge-based, fee increases with account size |

| FundedNext | $5k – $200k | $32 – $1,099 upfront | 80% – 95% | Refundable fee if trader passes, no separate activation |

Pros and cons of Topstep’s cost structure

Pros:

- The activation fee is transparent and fixed, so you know exactly what you’ll pay after passing.

- Subscription model spreads the cost monthly instead of requiring a large upfront challenge fee.

- Strong profit split (up to 100%) compared to other firms.

Cons:

- The structure requires two separate payments: a monthly subscription during the Combine, followed by a one-time activation fee.

- Non-refundable activation fee means there’s no flexibility if you change your mind after qualifying.

- Compared with firms like FTMO or FundedNext, where challenge fees can be refunded, Topstep’s activation fee is always a sunk cost.

Overall, Topstep’s pricing is better suited for traders who prefer smaller monthly payments during evaluation and are comfortable with a fixed activation charge later. In contrast, firms like FTMO or The5ers may appeal to traders who prefer to pay once upfront and potentially get that fee refunded.

For additional costs tied to live trading, you can also check how much are market data fee for Topstep to understand the ongoing data expenses after activation.

7. How to minimize costs when trading with Topstep

If you’re wondering how much Topstep costs in the long run, the answer depends on how you manage your account. Smart traders reduce expenses by limiting data subscriptions, focusing on a smaller set of instruments, and staying active to avoid reactivation.

Without proper management, these expenses can reduce overall profitability. However, traders can implement several practical steps to minimize their costs.

- Start with just one exchange subscription and expand later.

- Time your funded account to begin on the first of the month.

- Focus on a smaller set of instruments with reasonable fees.

- Choose a cost-efficient trading platform.

- Keep the account active to avoid reactivation fees.

Plan your approach early to cut unnecessary expenses and trade more effectively.

7.1. Manage data subscription fees wisely

CME Exchange data normally costs $133 per month per exchange, billed to the credit card linked to your first Live Account. Subscribing to multiple exchanges (CME, NYMEX, COMEX, CBOT) can total more than $500 monthly.

Starting July 22, 2025, Topstep will cover the monthly data fee for one exchange, CME by default, for all Live Funded traders.

If your setups are focused on E-mini S&P, NASDAQ, or EUR futures, CME alone covers most of what you need. For traders in energy or metals, NYMEX and COMEX may make sense later. You can even contact the Funding Team to request a different exchange to be covered.

Tip: Align your account start date with the first day of the month. Because exchanges do not prorate fees, starting mid-month means paying for the full month with fewer trading days.

7.2. Reduce commission and trading fees

Every trade in a Live Funded Account incurs round-trip commissions and exchange fees. For instance, the E-mini S&P 500 and NASDAQ contracts are around $2.66–$3.70 per lot, while crude oil (CL) and gold (GC) are slightly higher. These fees mirror real brokerage costs and are deducted from your account balance.

Tip: Concentrate on instruments that fit your system and budget. By focusing on a core group of products, you avoid racking up high fees on trades you don’t really need.

7.3. Be strategic with platform licenses

Topstep covers many platform costs during the Combine, but once funded, the license or subscription is your responsibility. Depending on the platform, this can be an ongoing monthly expense. Some licenses also differ in cost depending on features and compatibility.

Tip: If you already use a licensed platform, check if it integrates with Topstep. Reusing what you have can help lower your overall trading expenses.

7.4. Keep your account active

To keep an Express Funded Account open, make at least one trade every 30 days. Even a micro lot counts. Many traders forget this and end up paying another activation fee just to restart. Mark a reminder on your trading calendar; it’s a simple move that saves you $149.

7.5. Take advantage of promotions and support

Topstep occasionally runs offers like TopstepVIP or CME data fee coverage, which can reduce or eliminate certain costs. Stay subscribed to their emails or follow their official Trade Desk updates; these small alerts can make a big difference to your yearly trading budget.

Reducing Topstep fees comes down to smart planning and disciplined execution. By limiting exchange subscriptions, monitoring commissions, managing platform choices, and staying active, you can keep costs manageable and focus more energy on building consistent performance.

8. FAQs

No. The activation fee is a one-time payment and is non-refundable. Once you activate your Express Funded Account, the payment cannot be reversed, even if you stop trading. However, Topstep may waive this fee during specific promotions, such as the TopstepVIP program, which includes free activation and Combine access for three months.

Yes. If your funded account is closed due to max loss or inactivity, you’ll need to pass the Trading Combine again. A new activation fee will be required to reopen it.

The activation fee is paid only once after passing the Combine to open a funded account. The reset fee, on the other hand, applies during the Trading Combine if you want to restart your evaluation without waiting for a new billing cycle.

Occasionally, Topstep runs promotions or offers discounts, but these are more common for subscription fees than activation fees. It’s best to follow Topstep’s official announcements or check community forums for updates (e.g., “How much is Topstep activation fee Reddit?”) for time-limited deals, though they’re usually for subscriptions.

No. The activation fee only opens your funded account. Data fees are billed separately in the Live Funded Account and depend on the exchanges you subscribe to. Starting July 2025, Topstep will cover CME data for one exchange by default.

Topstep uses a monthly subscription model during the Trading Combine. You pay the subscription fee until you pass. The activation fee itself is not monthly; it’s a single payment when you unlock your funded account. Think of it as monthly during evaluation, then a one-time Topstep account activation to go live.

The 50% rule means at least half of your total profits must come from days with smaller gains, not just one or two big winning days. This ensures you are consistent and disciplined, which is key to long-term funded trading success. The idea is to prove day-to-day consistency, not just spikes, aligning with Topstep’s trader evaluation standards.

9. Conclusion

Understanding how much is Topstep activation fee is essential before committing to the program. The one-time $149 payment may seem simple, but when combined with data fees and commissions, it becomes clear that successful traders must plan carefully. By separating the activation fee from monthly subscription costs, you avoid confusion and can manage your trading budget more effectively.

At H2T Funding, we encourage traders to look beyond the surface and see the full cost structure of any prop firm. This transparency helps you avoid hidden surprises and focus on what really matters: consistent performance and long-term growth.

If you found this guide useful, explore more in our Prop Firm & Trading Strategies section. You’ll find detailed breakdowns of other firms, practical trading payout tips, and strategies to help you thrive in the competitive world of funded trading.