How does Apex Trader Funding work? It offers a low-barrier entry for traders to access funding without risking personal capital. In short, it allows you to prove your skills through simulated evaluations and, if successful, trade with real capital under specific rules.

Ready to dive deeper into how this funding model can change your trading journey? Keep reading to uncover how Apex helps you trade big without risking your own money.

Key takeaways

- Apex Trader Funding allows futures traders to access real capital by passing a rules-based evaluation in a simulated environment.

- Traders can choose from account sizes ranging from $25,000 to $300,000, each with its own profit targets, drawdowns, and contract limits.

- Passing the evaluation requires meeting profit goals, following strict risk parameters, and completing the minimum number of trading days.

- Apex offers a 100% profit share on the first $25,000 and up to 90% after, with bi-weekly payouts and no personal capital risk.

- The program is best suited for disciplined futures traders who understand drawdown mechanics and can maintain consistency under strict rules.

1. What is Apex Trader Funding?

In recent years, proprietary trading firms (or prop firms) have emerged as a game-changer in the trading world. Apex Trader Funding is one such firm focusing primarily on futures trading.

While traditional brokers require you to trade with your own funds, Apex and similar prop firms fund you after you prove your skills through their evaluation process. What makes Apex stand out is:

- A strong niche in futures trading, primarily using NinjaTrader.

- Flexible evaluation rules and affordable monthly fees.

- Fast-growing community with transparent operations.

According to NinjaTrader Ecosystem, over 85% of Apex users are futures-focused day traders, indicating its unique market fit. This aligns with many apex trader funding reviews that praise its ease of use and accessibility.

2. Who is Apex Trader Funding for? (and who it’s not for)

Before diving in, ask yourself: Does Apex align with your trading style and goals?

2.1. Who should consider Apex Trader Funding?

- Day traders focus on futures markets like E-mini S&P 500 (ES), Nasdaq (NQ), and others.

- Traders with limited capital but strong strategies and discipline.

- Individuals are looking for low-cost evaluation programs.

2.2. Who should NOT consider Apex?

- Traders who prefer stocks, options, or forex markets.

- Individuals with little to no experience in trading.

- Traders are unwilling to follow strict risk rules (like daily loss limits).

Now that you understand who Apex is best suited for, let’s take a closer look at how the entire process works, from evaluation to getting funded, in the next section.

3. How does Apex Trader Funding work?

Apex Trader Funding operates on a performance-based funding model. It allows traders to prove their skills in a simulated environment before gaining access to real capital. Here’s a detailed breakdown of how the process works:

3.1. Select your evaluation account

Apex offers multiple account sizes ranging from $25,000 to $300,000, each with its own profit target, trailing threshold, and contracts. You choose the account that matches your trading style and goals.

| Account Size | Contracts | Profit Target | Trailing Threshold |

|---|---|---|---|

| $25,000 | 4 (40 micros) | $1,500 | $1,500 |

| $50,000 | 14 (140 microseconds) | $3,000 | $2,500 |

| $100,000 | 17 (170 microseconds) | $6,000 | $3,000 |

| $150,000 | 17 (170 micros) | $9,000 | $5,000 |

| $250,000 | 27 (270 micros) | $15,000 | $6,500 |

| $300,000 | 35 (350 micros) | $20,000 | $7,500 |

The trailing threshold is the maximum amount your account balance can drop from its highest point. It follows your equity as it grows. If your account balance peaks at $55,000 and the trailing drawdown is $2,500, your minimum allowed balance becomes $52,500.

Exceeding this limit means you fail the evaluation. Managing this level is critical for passing and staying funded.

Tip: Most new traders start with the $50K account, offering a balanced mix of contract size, realistic profit target, and manageable drawdown.

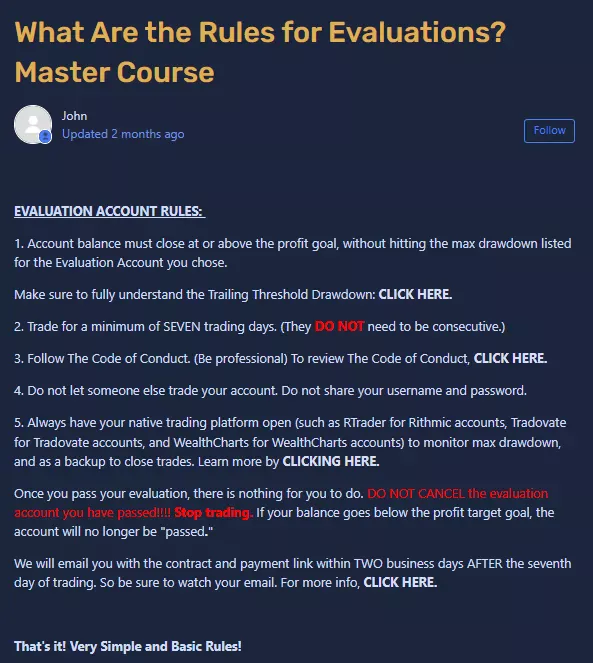

3.2. Pass the evaluation phase

You’ll need to trade in a simulated environment using live market data. During this stage, you must:

- Reach the designated profit target within the account size you selected.

- Adhere to strict risk management rules (no exceeding daily or trailing drawdown limits).

- Trade a minimum number of days (usually 7-10 days).

Breaking any rule, such as hitting a loss limit, results in failing the evaluation. However, Apex allows you to reset and try again.

3.3. Verification phase (optional)

Some accounts may require a second phase called verification. This involves similar rules but typically with a reduced profit target. The goal here is to confirm that your success was not just luck, but skill and consistency.

3.4. Receive your funded account

After passing all phases, you receive a live funded account from Apex. You can now trade real capital with the same risk limits and payout structure. Importantly, you’re not risking your own money.

3.5. Withdraw your profits

Once you’re funded, Apex allows you to request withdrawals, but there are specific conditions you must meet to become eligible:

- Profit split: Apex offers a highly attractive profit split. You receive 100% of the first $25,000 in profit for each account. After this threshold, the profit share is 90% for you and 10% for Apex.

- Minimum trading days: You need to complete at least 8 active trading days in the live funded account before making your first withdrawal.

- Payout schedule: Withdrawals are processed bi-weekly (e.g., on the 1st and 15th of each month).

- Withdrawal limits: There’s no hard cap on how much you can withdraw, but the amount must come from realized profits, not account balance inflation.

Apex generally offers an 80%–90% profit split, depending on your program and any active promotions. Promotions occasionally offer 100% profit retention for the first $25,000, making it even more lucrative to get started during discount windows.

4. Trading platforms and tools compatible with Apex

Apex integrates seamlessly with several leading platforms to support futures trading:

- NinjaTrader: Apex’s primary platform. Offers charting, order flow, and automation tools.

- Rithmic: High-speed data feed used during evaluations.

- Quantower and Tradovate: Supported via third-party bridges.

Useful tools provided include:

- Trade copier for managing multiple accounts.

- Real-time performance dashboards.

- API access for custom indicators and bots.

5. Pros and cons of Apex Trader Funding

| Pros | Cons |

|---|---|

| No capital risk: You trade with Apex’s funds. | Strict payout rules: Profit withdrawals follow time and profit constraints. |

| Flexible rules: Compared to other prop firms, Apex has easier trailing drawdowns. | No stock trading: Futures only. |

| Low cost: Subscriptions start under $100/month with frequent discounts. | No stock trading: Futures only. |

| Fast scaling: Opportunities to manage multiple funded accounts. |

See more related articles:

6. Common mistakes that cause new traders to fail the Apex evaluation

Even skilled traders can fail Apex’s evaluation if they don’t fully understand the rules or overlook small yet critical requirements. Many of these mistakes stem not from poor strategy but from misinterpreting program mechanics, especially among new or self-taught traders.

Common mistakes include:

- Misunderstanding the trailing threshold: Many think it’s static, but it moves up with your highest account balance, making it harder to preserve capital if you’re too aggressive.

- Violating daily loss limits: Surpassing this limit, even once, leads to instant failure with no warning buffer.

- Using prohibited trading strategies: Techniques like latency arbitrage or tick scalping are forbidden. Traders who use manual, clean setups are usually safe.

- Trading outside permitted times: Certain accounts restrict trading during major news events or market closings. Failing to verify time rules can void your session.

- Not meeting minimum hold time: Some Apex rules require that trades remain open for a minimum duration, especially in larger or verification-phase accounts.

- Failing to complete enough trading days: Even if you hit your profit target in 2 days, you still need to trade actively for 7–10 days to qualify.

Expert insight: Apex’s evaluation process is rule-based, not discretionary. This implies that every failure may be linked to a rule infraction rather than a personal opinion. Understanding these rules in advance gives you a clear edge.

7. Tips to successfully pass your Apex evaluation

Success in Apex’s evaluation phase is less about chasing big wins and more about showing consistency, discipline, and rule compliance. Here’s how to stay on track:

Best practices to improve your success rate:

- Use a single consistent strategy: Traders who perform best typically stick to one method and refine it, instead of jumping between systems.

- Respect daily and trailing drawdowns: Plan your max risk per trade around these limits to avoid accidental rule violations.

- Document each trade in a journal: Record why you entered, how you exited, and what you learned. This feedback loop increases discipline and self-awareness.

- Avoid high-volatility timeframes: News spikes can breach limits even if your direction is correct. Only trade news if your strategy is built for it.

- Trade during your peak focus hours: Identify when you’re most alert and consistent, and avoid trading late at night or when emotionally drained.

- Stay updated on Apex rules: Apex may change trading restrictions or payout rules depending on promotions or platform updates. Read the rulebook before each cycle.

- Limit your trades per session: Quality > quantity. Overtrading increases emotional risk and often leads to avoidable mistakes.

Pro tip from funded traders: Those who pass often treat the evaluation like a live account, not a game. The mindset shift from “pass quickly” to “trade professionally” makes a measurable difference.

8. Alternatives to Apex Trader Funding

While Apex Trader Funding offers a low-cost, beginner-friendly way to access funded futures accounts, it might not be the best fit for everyone. If you’re exploring other proprietary trading firms, here are three trusted alternatives worth considering:

8.1. FTMO – The industry leader with global recognition

FTMO is often considered the gold standard in proprietary trading. Known for its structured evaluation process and professional approach, FTMO has funded thousands of traders worldwide.

Key differences:

- High credibility: Founded in 2014, with over 10,000 traders funded annually.

- Two-phase challenge: Includes Evaluation and Verification.

- Generous payouts: Up to 90% profit share.

- Trading platforms: MetaTrader 4, MetaTrader 5, and cTrader are supported.

Best for: Experienced traders looking for a reputable and structured firm.

8.2. The5ers – Flexible, conservative funding model

The5ers stands out for offering instant funding options and a low-risk approach, especially appealing to swing traders and part-time market participants.

Key differences:

- Instant funding is available alongside traditional evaluation.

- Great for swing and low-frequency traders with no minimum daily trading requirements.

- Trade directly via TradingView or MetaTrader.

- Offers more leniency with rule breaches compared to Apex or FTMO.

Best for: Risk-averse traders seeking stability and flexible trading conditions.

Comparison Table

| Prop Firm | Max Capital | Profit Split | Evaluation Model | Ideal For |

|---|---|---|---|---|

| Apex | $300,000 | 80–90% | 1-phase or 2-phase | Futures traders & beginners |

| FTMO | $400,000 | 80–90% | 2-phase | Mid-to-advanced level traders |

| The5ers | $200,000 | 50–75% | Instant or Evaluation | Swing traders, conservative style |

9. Real traders’ reviewers on Apex Trader Funding

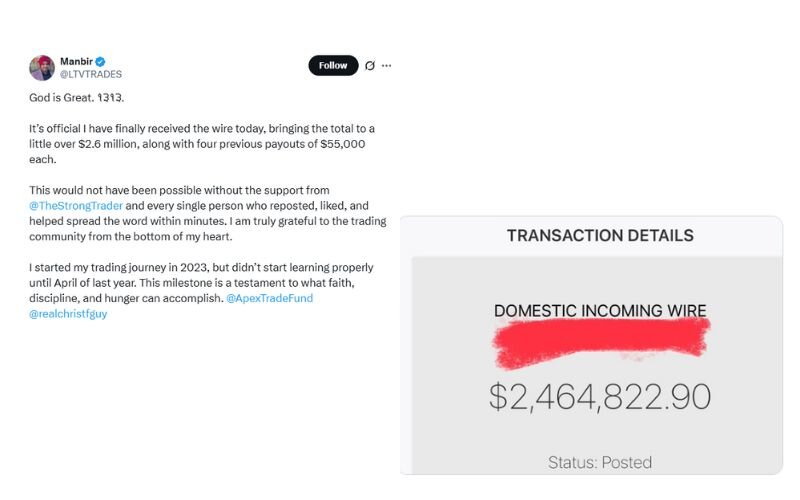

When evaluating whether a prop firm is truly legitimate, nothing speaks louder than real trader results. And Apex Trader Funding has no shortage of proven payouts from funded traders who’ve gone through the process and succeeded.

Take @LTVTRADES (Manbir) for example, who recently shared a screenshot of a $2.46 million wire transfer, bringing his total payout from Apex to over $2.6 million, including four previous $55,000 withdrawals.

Starting his journey in 2023, Manbir credited his growth to faith, discipline, and the opportunity Apex provided. His transparency and success offer compelling proof that with consistency, Apex can be a powerful launchpad for futures traders.

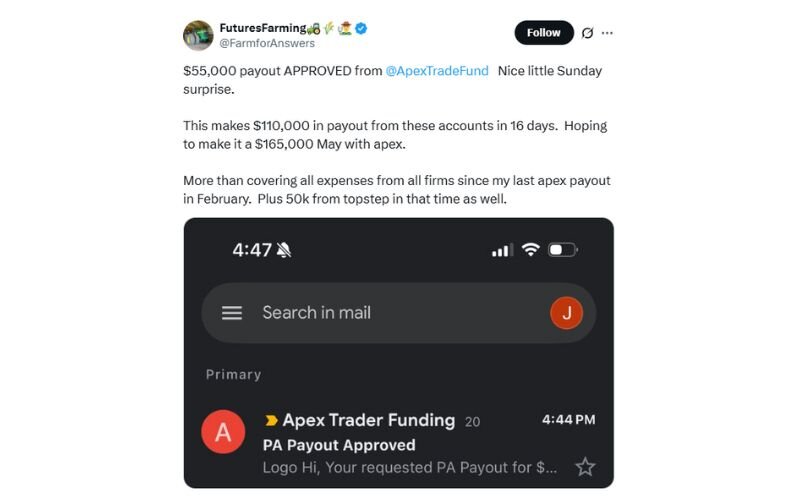

Another trader, @FarmforAnswers, shared a payout confirmation email showing a $55,000 withdrawal approved by Apex. In just 16 days, this trader received $110,000 in payouts from multiple accounts, aiming for a $165,000 target in a single month.

Read more:

10. FAQs

Experienced futures traders who follow strict risk rules and focus on consistency.

Apex offers funded accounts up to $300,000, and you can operate multiple accounts simultaneously.

Yes. Funded traders receive real payouts via Apex’s structured withdrawal system.

Your account will be disqualified. You must restart the evaluation phase.

Yes. Apex has been featured by NinjaTrader and used by thousands of traders globally. Always read their terms before applying. Many apex trader funding reviews validate their legitimacy.

11. Conclusion

So, how does Apex Trader Funding work? It empowers futures traders to access significant trading capital without risking their own money by passing a clearly structured evaluation process. With account sizes ranging from $25K to $300K, transparent rules, and a fast onboarding system, Apex stands out as one of the most accessible prop firms in 2026.

That said, Apex is not for everyone. It’s best suited for disciplined futures traders who can follow strict risk parameters and are committed to building long-term trading consistency.

My verdict: Apex offers one of the lowest-cost, futures-focused funding models with great scaling potential. For traders ready to take the next step, the $50K account is an ideal starting point.

To discover more about prop firms, check out H2T Funding or explore our Prop Firm & Trading Strategies to find the best options tailored for you.