Prop firms fund skilled traders to trade the firm’s capital under clear risk rules, then split profits. Put simply, you trade bigger without risking your own principal, but you must pass an evaluation and respect drawdown limits.

As a trader who has gone through this journey, I know the biggest challenge isn’t just passing the test; it’s knowing who to trust. The market is noisy, and without a clear understanding of how do prop firms work, you risk wasting both time and money.

In this complete beginner’s guide, H2T Funding will pull back the curtain on the entire prop firm model. Keep reading to learn exactly how to get funded and secure your profits.

Key takeaways

- A prop firm provides its capital to traders, who then use that money to trade the markets. This model allows talented individuals to trade significant funds without risking their personal savings.

- How do prop firms work? Traders must first pass an evaluation or challenge to prove they can generate profits while managing risk. After passing, they receive a funded account and split the profits with the firm, typically keeping 70-90%.

- How they enforce rules: Every funded account operates under strict risk parameters, including a maximum daily loss and an overall drawdown limit. Violating any of these rules results in the immediate termination of the account.

- How prop firms make money: Their business model relies on two main income streams: the fees traders pay for evaluations and the firm’s share of the profits generated by their successful funded traders.

- How to identify a legit firm: A trustworthy prop firm is always transparent about its rules, offers a clear and reliable payout process, and has a verifiable track record within the trading community.

1. What is a prop firm?

A proprietary trading firm (prop firm) is essentially a company that backs traders with its own capital.

Think of it this way: instead of risking your own life savings, you first pass a test, often called an evaluation or challenge to prove your skills. If you succeed, the firm gives you a funded account to trade. When you make a profit, you keep the majority (typically 70-90%), and they keep the rest.

Honestly, this model solves the biggest problem many talented traders face: you might have a winning strategy, but not the $50,000 in the bank needed to make a real living from it.

That’s the key difference between a prop firm and a broker:

- A broker gives you access to the market to trade your money. The risk is 100% yours.

- A prop firm gives you access to their money, and they manage their capital risk through strict rules (such as understanding what a drawdown in trading is). Your only financial risk is the one-time fee for the evaluation.

In short, this partnership model is what trusted prop firms, a fact often validated through trader reviews, are built on: they provide the capital and the rules, while you provide the disciplined skill.

2. Key characteristics of prop firms

Honestly, once you’ve seen how prop firms work from the inside, you start realizing they all share the same DNA: capital, rules, profit share, and discipline. Still, the small differences in how each part is managed can completely change your trading experience. Let’s unpack the core traits that define every legitimate proprietary trading firm.

2.1. Capital allocation

The biggest draw of prop trading is simple: you trade the firm’s money, not your own.

Instead of depositing $10,000 of personal savings, you might start with a $50,000 or even $200,000 funded account after passing a challenge. The firm assumes the financial risk, and in return, it expects you to follow rules that protect that capital.

For example, firms like FTMO or The5ers use evaluation phases to test consistency before unlocking real capital. It’s like a paid internship; you prove skills first, then get the job.

That’s also why funded traders often say this setup forces them to treat trading like a business instead of a gamble.

2.2. Profit sharing

Prop firms don’t pay salaries. Instead, you earn based on your performance through profit splits, which are usually 70–90% in favor of the trader.

Let’s say you earn $10,000 in profit on your funded account: you keep $8,000, and the firm keeps $2,000. That’s fair; they provided the capital and took on the risk if you lost.

Some firms even offer 100% profit for the first few payouts as a welcome bonus, but remember: if it sounds too good to be true, check their terms twice. A transparent payout policy is a good sign you’re dealing with a real, long-term firm, not a quick cash grab.

2.3. Risk management rules

If there’s one thing that separates winners from blown accounts, it’s respecting the rules. Prop firms impose strict drawdown limits as a core part of their risk management framework to prevent reckless trading. Many also require minimum trading days and enforce a what is consistency rule in trading, meaning you can’t just win big in one day and call it done.

These rules might feel limiting at first, but in truth, they’re training tools disguised as restrictions. They force you to think like a professional: plan your trades, control exposure, and walk away when it’s not your day. This structure is exactly how to be more disciplined in your trading and build long-term habits.

2.4. Trading platforms & tools

A proper prop firm doesn’t just hand you capital; it provides access to technology and the best trading tools to help you trade better. Most firms integrate with platforms like MT4, MT5, NinjaTrader, or TradingView, offering direct access to real-time data, automated trade journaling, and performance dashboards.

These tools help traders analyze what works, what doesn’t, and how to scale smarter. Personally, I’ve seen traders improve drastically once they started tracking risk-to-reward and win rate trends through these dashboard things retail traders often skip.

So yes, capital and payouts attract you, but it’s the structure and rules that keep you alive. Once you understand that balance, you start to see prop trading not just as an opportunity, but as a disciplined path to becoming a consistently profitable trader.

Read more:

3. How do prop firms work (Step-by-step)

If you’ve ever wondered how prop firms work behind the scenes, honestly, it’s not as mysterious as it looks. Think of it as a professional partnership: you bring the brains (trading skill), and they bring the brawn (deep pockets).

Put simply, you trade their money, and you both split the loot. But you can’t just walk in and ask for a check; you have to earn your seat at the table. The journey of how to get a funded trading account is a structured path. Here is the exact process most traders follow:

- Step 1: Register for a Challenge

- Step 2: Pass the Evaluation

- Step 3: Get Funded

- Step 4: Trade and Get Paid

Now, let’s explore each of these steps below.

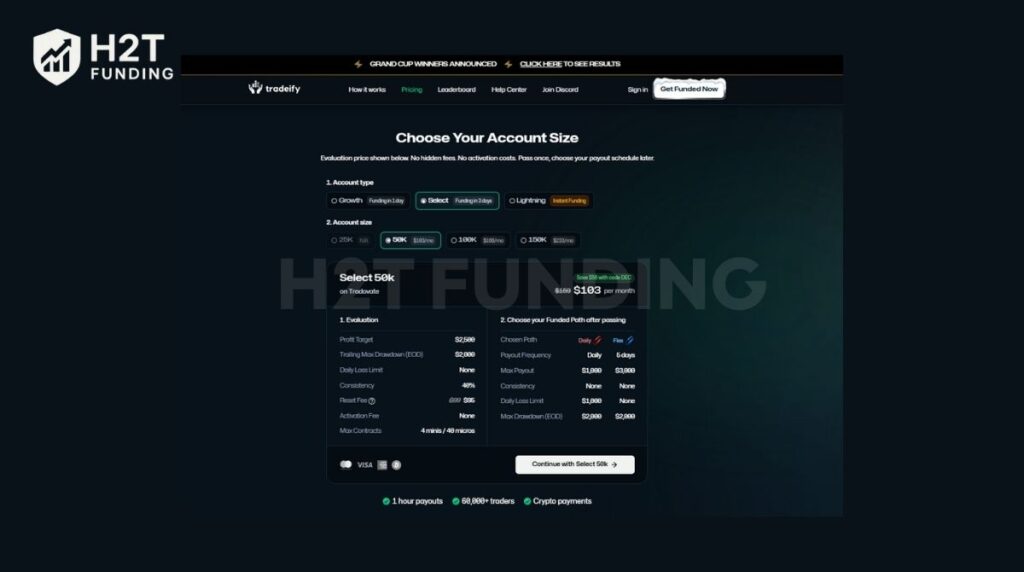

Step 1: Pick Your Battle (The Registration)

First, you choose a challenge size that fits your ambition, say, a $10,000 or $100,000 account. You’ll pay a one-time fee to enter the “Evaluation Phase.” I think of this fee as your “skin in the game.” It proves you’re serious and not just gambling for fun.

Step 2: The Trial by Fire (Evaluation Phase)

This is where most people stumble. Your goal? Hit a profit target (usually +8% to +10%) without breaking the rules. The hardest part isn’t making the money; it’s staying within the drawdown limits. If you lose more than 5% in a day, you’re out. It’s tough, but that’s how they filter out the gamblers from the pros.

Step 3: The Consistency Check (Verification Phase)

Many top-tier firms require a second phase. Why? Because anyone can get lucky once. In this step, the rules are usually relaxed; maybe you only need a +5% gain. They just want to see that your strategy wasn’t a “one-hit wonder.”

Step 4: The Golden Ticket (Funded Account)

Pass both stages, and you’re in! You get a “Funded Account.” Now, the profits are real. You’ll typically keep 80% to 90% of what you earn, while the firm takes a small cut for providing the capital.

Let’s look at a quick math example:

- Starting Balance: $10,000

- Your Performance: You hit an 8% gain ($800 profit).

- The Split (80/20): You pocket $640, and the firm keeps $160.

- Your Risk: Just the initial fee you paid at Step 1. Your personal savings stay safe.

To be honest, it’s a brilliant deal if you have the discipline. You get to scale your income without the gut-wrenching fear of losing your own rent money. But remember: the moment you stop respecting their risk rules, the partnership ends. It’s a performance-based job, plain and simple.

4. How does a prop firm make money?

Here’s something most traders quietly wonder: if I’m trading their money, how does the prop firm actually profit? It’s a fair question, especially with so many firms popping up lately. The answer isn’t a mystery, but it’s layered. While we have a full guide explaining how do prop firms make money, understanding the basics helps you tell the legit companies from the sketchy ones.

Here’s the quick breakdown of how they profit:

- Evaluation and challenge fees

- Profit splits from funded traders

- Reset, subscription, and add-on services

- Data, volume, and partnerships

Now, let’s look at each one.

4.1. Evaluation and challenge fees

This is the firm’s main, steady income stream. Before trading real funds, you pay a challenge or evaluation fee typically anywhere between $50 and $1,000, depending on the account size.

That fee covers access to the platform, performance tracking, and evaluation management. If you pass, great, they fund you. If you fail, they keep the fee and use it to support payouts for successful traders.

It might sound harsh, but it’s what makes the model sustainable. Some firms, like FTMO or FundedNext, even refund that fee once you become funded, turning it into a kind of “earn-your-way-back” investment.

In short:

- The firm earns when traders join or restart.

- You gain access to capital and the chance to profit if you can trade well enough.

4.2. Profit splits from funded traders

The second revenue source comes from the firm’s share of your profits. When you make money, the firm usually earns 10–30% of your profit.

For example, if you earn $5,000 with an 80/20 split, you keep $4,000, and the firm keeps $1,000. This alignment is why legit firms want you to succeed. The more consistent traders they have, the more stable their own profits become.

You’ll notice that the best firms, like The5ers or Topstep, focus heavily on education and risk coaching because a profitable trader means recurring revenue for them.

4.3. Reset, subscription, and add-on services

Not every firm sticks to one-time evaluations. Some introduce:

- Reset fees when traders violate a rule but want to restart immediately.

- Monthly subscription models with smaller fees and rolling payouts.

- Affiliate programs or educational packages for traders who refer others or need training.

These extras diversify their income and stabilize cash flow. However, too many “upsells” or unclear pricing can be a red flag. If a firm makes more money from your mistakes than from your success, that’s a warning sign.

4.4. Data, volume, and partnerships

The lesser-known layer: some firms partner with brokers or liquidity providers. They benefit from trade volume and data analytics, since thousands of traders create valuable market flow information. The firm may also earn rebates or discounts from the broker based on trading activity.

This doesn’t hurt you as a trader; it just means the firm has multiple revenue legs, which often translates into better sustainability (and faster payouts).

The real business model: Balance and trust

At the end of the day, a good prop firm doesn’t rely on people failing. It depends on a balance: most traders will fail challenges, but the few who succeed and stay consistent cover those costs and generate profit for both sides.

That’s the healthy version of the model mutual benefit. The unhealthy version? Firms that keep changing rules, delay payouts, or push endless resets to squeeze short-term income.

When in doubt, check the firm’s transparency:

- Do they clearly explain payout timelines?

- Is the evaluation structure simple to understand?

- Are their rules visible on the website, not buried in fine print?

If all that checks out, you’re likely dealing with a real prop firm, not a fee-farm disguised as one.

Truth be told, prop firms work best when traders treat them like partners, not sponsors. The moment you start thinking, “How can I help the firm profit while I profit too?” is also when you’ll start trading more professionally.

5. Prop firms in forex trading

If you’ve ever wondered how prop firms work in forex, the answer lies in the market’s unique characteristics. Most firms focus on Forex for a good reason: it offers everything a What is a prop firm Forex needs, including high liquidity, 24/5 market access, and endless opportunities. Honestly, once you understand how prop models and Forex fit together, you’ll see why this pairing dominates.

5.1. The 24/5 playground for global traders

Forex never sleeps. From the moment Sydney opens to the time New York closes, there’s always a market moving somewhere.

That means traders from any time zone can take part in a huge advantage for prop firms that recruit globally. When I first joined a prop firm years ago, I could trade before work and after dinner, something you can’t really do with stocks or futures tied to one exchange. This flexibility makes Forex the perfect testing ground for new traders.

5.2. High liquidity, low costs, fast execution

Prop firms love Forex because its high market liquidity means orders fill instantly, spreads are tight, and transaction costs stay low. For traders, this means you can execute strategies like scalping or intraday trading without worrying about huge slippage or commissions eating your profits. For firms, it means they can manage thousands of accounts at once without liquidity bottlenecks.

Let’s say you’re trading EUR/USD with a $100,000 funded account:

- Average spread: ~0.3 pips

- Commission: $3–5 per lot round turn

- Execution speed: milliseconds

That level of efficiency is what makes Forex prop accounts both profitable and scalable.

5.3. Leverage and accessibility

Forex allows higher leverage than most financial markets, sometimes up to 1:100 or more. Now, leverage can be dangerous if abused, but within a prop firm’s rules, it gives you flexibility to manage position sizes properly. For example, risking just 1% per trade with 1:50 leverage lets you target reasonable profits without overexposing your account.

Prop firms use this to test how you handle power under pressure. Can you resist the urge to over-leverage when the setup looks “too good”? That’s exactly what they’re looking for: self-control, not just skill.

5.4. Constant market movement

Constant market movement = Constant opportunity

Currencies react to everything: interest rates, inflation data, and even political tweets. That volatility, while scary to beginners, creates consistent opportunities for trained traders.

Prop firms thrive on this. It means their traders can find setups every day instead of waiting weeks for the right stock pattern. It also allows the firm to evaluate traders faster since there’s more data, more trades, and more proof of consistency.

If we put it simply:

| Factor | Why it matters to prop firms |

|---|---|

| Liquidity | Smooth execution and minimal slippage |

| Global Access | 24/5 activity across all time zones |

| Low Barriers | Easy for beginners to join and scale |

| Leverage | Allows flexibility and testing of risk control |

| Volatility | Creates constant opportunities for evaluation |

Because of all that, Forex has become the backbone of modern prop trading. Firms for futures, equities, and other derivatives exist, too, but they usually require higher margins and may have more complex rules.

For many new traders, starting with a Forex prop firm is like learning to drive on an open highway. You still need discipline, but there’s more room to make mistakes and learn.

If you treat it seriously, Forex prop trading can become a bridge between retail and professional trading, letting you scale without risking your life savings.

6. Benefits and risks of trading with prop firms

Let’s be honest, prop trading looks exciting from the outside: “Trade big capital. Keep most of the profits. Risk none of your own money.” Sounds perfect, right? But like anything in the markets, it comes with both sides of the coin. I’ve seen traders thrive under prop firm structures, and I’ve also seen talented people lose accounts just because they misunderstood the rules.

So before jumping in, it’s worth understanding the real benefits and the potential downsides without the hype.

6.1. Benefits: Why prop trading appeals to so many traders

So, what’s the big deal with prop firms? Honestly, it’s because they offer a direct solution to the biggest roadblocks that hold most traders back. While the promise of “trading big capital” gets all the attention, the real benefits go much deeper than just the money. It’s about creating a professional environment that forces you to level up your entire approach to trading.

6.1.1. Access to large capital without personal risk

This is the main reason traders flock to prop firms. You can manage a $50,000 or even $200,000 account without putting up that money yourself. That’s massive if you’re confident in your skills but don’t have a big bankroll.

You pay a small evaluation fee (often refundable if you pass) and trade the firm’s capital instead. If you lose, you lose the account, not your savings. That’s a powerful deal: low financial risk, high growth potential.

6.1.2. A structured path to professional trading

Trading solo can feel lonely with no rules, no feedback, just you and the screen. Prop firms fix that. They give you a rule-based framework that forces discipline: max daily loss, consistency, risk limits.

It’s tough love, but it works. I’ve coached traders who struggled for years alone, then suddenly became consistent once they had to follow prop firm rules. Those limits turn chaos into structure, and structure is what makes you profitable long-term.

6.1.3. Mentorship, tools, and community support

Good prop firms don’t just fund you; they equip you. You’ll often get access to:

- Trading platforms (MT4, MT5, NinjaTrader, TradingView)

- Performance dashboards and analytics

- An active Community of traders via Discord or Telegram.

- Training and mentorship programs through webinars and coaching.

This sense of community can keep you motivated because trading alone at 2 a.m., perhaps during one of the what are the 4 trading sessions, is way easier when you know hundreds of others are grinding beside you.

6.1.4. Opportunity to scale and earn more

Once you prove consistency, many firms let you scale your capital automatically. For example, FTMO and Topstep can double your funded account every few months if you meet certain performance targets.

That’s something no retail broker offers; it’s like a promotion based on skill, not seniority.

6.2. Risks: What are the disadvantages of prop firms?

Now for the other side of the coin. While the benefits are compelling, it’s crucial to walk into prop trading with your eyes wide open. The model offers you capital, but it’s not a free pass; it’s a high-performance environment with a strict rulebook.

Understanding the potential downsides isn’t about being negative; it’s about being prepared. Let’s break down the challenges you’ll likely face.

6.2.1. Strict rules and high pressure

Prop trading isn’t as “free” as some YouTubers make it sound. You have to follow risk limits to the letter. One slip, like exceeding the daily drawdown by $1, and your account could be terminated.

It can feel harsh, especially when emotions kick in. But that’s how firms protect their capital (and test yours).

6.2.2. Upfront and hidden fees

Evaluation fees, resets, or re-entries can add up. Some shady firms even change rules mid-challenge or make payout conditions vague.

That’s why it’s crucial to read the fine print before signing up. If the fee structure looks more profitable for the firm than for the trader, that’s your red flag.

6.2.3. Psychological pressure

Trading psychology becomes a major hurdle when trading with someone else’s money. You’re constantly aware that mistakes have consequences, not financial, but reputational. I’ve seen traders freeze up mid-trade or exit too early simply because they feared breaking a rule.

Prop trading rewards calm, mechanical execution. If your emotions aren’t under control, funded accounts can expose that faster than anything else.

6.2.4. Limited flexibility and strategy restrictions

Some firms ban certain strategies like high-frequency trading, news trading, or EAs (bots). You need to make sure your preferred style fits the firm’s policies before joining. If you’re a short-term scalper, but the firm enforces a minimum trade duration, that’s going to clash fast.

Prop trading can be life-changing when you use it to grow your skills and manage bigger capital responsibly. But it can also drain you if you treat it like a shortcut.

The goal isn’t just to “get funded.” It’s to stay funded, trade with discipline, and build a track record you can be proud of.

Read more:

7. Prop firm evaluation process explained

If you’ve ever thought, Why do I have to pass a challenge first? You’re not alone. This Trader evaluation process is what separates real prop firms from those just selling accounts. It’s the firm’s way of filtering out impulsive traders and finding those who can handle money like professionals.

I’ve gone through (and failed) my fair share of evaluations, so I can tell you this part isn’t about luck. It’s about proving consistency, control, and patience.

The purpose behind the evaluation:

At its core, the evaluation is a risk filter that solves a major problem for traders. For example, figuring out the smallest account size to trade futures on your own can be daunting, as it often requires significant personal capital. Prop firms offer an alternative: they test your ability to follow rules, manage drawdowns, and hit profit targets before giving you access to large funds.

Think of it like a pilot simulator. Before flying real passengers, you prove you can handle turbulence without panicking. If you pass, you’ve shown you can protect their capital, and that’s worth funding.

Different firms use different structures:

| Model | Description | Typical Target | Common Firms |

|---|---|---|---|

| Two-Phase Challenge | Pass two stages with separate profit targets. Phase 1 tests profitability, Phase 2 confirms consistency. | Phase 1: +8–10% Phase 2: +5% | FTMO, The5ers |

| One-Phase Challenge | Pass a single stage, often with tighter rules or higher drawdown sensitivity. | +10% | FundedNext, MyFundedFX |

| Instant Funding | Skip the evaluation by paying a higher upfront. Risky, but faster. | None | MFFX, The Funded Trader Plus |

Pro tip: If you’re new, start with a two-phase model. It gives you breathing room to adjust between phases and refine your approach.

Key rules to expect (and respect): Every firm has variations, but most enforce these golden rules:

- Profit target: 8–10% in the evaluation, lower in verification.

- Max daily loss: Usually 4–5%.

- Max total drawdown: Around 8–10%.

- Minimum trading days: Often 5–10 to prevent luck-based passes.

- Consistency rule: Your biggest winning day can’t exceed 30–40% of total profit.

Break any one of these by even a few dollars, and your account is terminated. That’s why seasoned traders keep checklists before each session. It’s not paranoia; it’s survival.

Common mistakes that cause failures: After watching dozens of traders attempt challenges, these are the patterns I see most:

- Overtrading after a loss: Trying to “earn it back” ruins more accounts than bad strategies ever will.

- Ignoring daily loss limits: Thinking “it’s just $50 over,” that’s how you fail by noon.

- Trading news events blindly: Spikes can wipe out accounts faster than you can refresh MT5.

- No journaling: Not reviewing trades means repeating mistakes endlessly.

If you treat an evaluation like a real account with daily targets, rest days, and pre-planned risk, your odds shoot up dramatically.

Tips to pass your evaluation the smart way: Here’s what worked for me (and the traders I’ve mentored):

- Trade small first week: Focus on staying alive, not hitting targets.

- Use fixed position sizing: No random lot sizes. Keep risk per trade under 1%.

- Stop trading after 2–3 good setups per day: Don’t overtrade out of excitement.

- Take screenshots & notes: Track emotions, setups, and results daily.

- Treat it like live capital: The mindset difference alone changes everything.

Always remember, the evaluation is less of a race and more of a mirror that reflects your discipline. Passing means the firm is offering a partnership built on trust and performance, not simply handing you cash. Should you fail, consider it another lesson in your trading education, a tuition fee nearly every professional has paid at some point.

8. Trading strategies commonly used in prop firms

For anyone learning how to get into prop trading, the next question is always the same: What strategy actually works in a funded account?

Truth is, there’s no single magic system. Whether you rely on technical analysis or fundamental analysis to exploit market inefficiencies, success with prop firms comes down to finding the right trading strategies that work within their rules. Certain trading styles fit prop firm conditions better than others because they balance risk and consistency.

8.1. Scalping – Precision over perfection

Scalping is like sprinting fast, intense, and unforgiving. You’re aiming for small profits from tiny price movements, usually within minutes.

In prop accounts, scalping can work if the firm allows it. Some restrict news scalping or ultra-short trades due to liquidity spikes.

When done right, scalping helps you:

- Lock in small, frequent gains to hit targets steadily.

- Avoid overnight risk, since trades close quickly.

- Build discipline by following strict entry/exit rules.

But here’s the catch: you need laser focus and emotional control. One impulsive click can wipe out 10 good trades.

Example: A trader with a $50,000 funded account risks 0.5% per trade, targeting 1% profit. After 10 consistent wins, they’re halfway to passing Phase 1. Not flashy, just focused.

8.2. Day trading – The prop firm sweet spot

If there’s a golden middle ground, this is it. Day trading fits most prop firm rules perfectly. You open and close all positions within the same day, avoiding overnight risk while still capturing larger moves than scalpers.

Why it works so well in prop environments:

- Firms often require a minimum number of trading days, which day trading fulfills easily.

- It allows for controlled risk, usually 1–2% per trade.

- It allows you to adapt to changing market conditions, whether the market is trending or ranging.

It’s also mentally cleaner. When you log off at the end of the session, no open trades haunt your sleep.

8.3. Swing trading – Slow, strategic, and sustainable

Swing trading is for the patient ones, the traders who’d rather make a few quality trades a week than dozens daily. You hold trades for several days to weeks, aiming for bigger price swings driven by technical and fundamental setups.

It’s perfect for traders who have full-time jobs or prefer calmer analysis sessions. But there’s a trade-off:

- Some prop firms don’t allow weekend holds or high drawdowns, which limits swing setups.

- You’ll need to manage wider stop losses and smaller position sizes.

Still, swing traders often have higher win rates and lower emotional burnout, making this a great fit for long-term funded traders.

Strategy comparison at a glance:

| Strategy | Trade duration | Risk level | Ideal for | Prop firm compatibility |

|---|---|---|---|---|

| Scalping | Minutes | High | Quick decision-makers | Moderate (rule-dependent) |

| Day Trading | Hours | Medium | Active traders | High |

| Swing Trading | Days–Weeks | Low–Medium | Strategic planners | Medium–High (depends on rules) |

A common mistake I see: traders adapting their style to the firm’s rules instead of finding a firm that suits their style. If you’re naturally a swing trader, join a firm that allows weekend holds and flexible drawdowns. If you thrive in fast-paced setups, pick one that supports short-term trades and tight spreads.

Your personality defines your trading edge. The best prop traders don’t copy others; they sharpen what already fits them.

9. Technical insights – Key metrics that matter

Most traders think passing a prop challenge is all about hitting the profit target. But the truth? Profit is just one metric. Prop firms are obsessed with how you make that profit, not just how much. They’re watching everything: your drawdown, consistency, risk per trade, and even how long you hold positions.

Let’s break down the key performance metrics that really matter, the ones that decide whether you get funded or get that dreaded “violation” email.

9.1. Profit target – The obvious gatekeeper

This is your first big milestone. Most firms set a profit target between 8–10% for the initial evaluation phase.

Simple math: If you’re trading a $50,000 account with a 10% target, you need to make $5,000 before breaking any rules.

Sounds easy? Not quite, because you have to do it while respecting every other metric below. That’s the real test.

9.2. Drawdown limits – Your survival rule

Drawdown is the total loss from your peak equity. Firms usually apply two limits:

- Daily Drawdown (Max Daily Loss): 4–5% of your balance or equity per day.

- Overall Drawdown (Max Loss): 8–10% total before disqualification.

Here’s an example: You start with $50,000.

- Max daily loss: $2,500

- Max total drawdown: $5,000

Hit either, and you’re out, even if you were one trade away from passing. That’s why top traders say: “Protecting your account is step one. Profits come after.”

9.3. Consistency rule – The discipline test

Many prop firms now include a “consistency rule,” meaning your biggest winning day can’t exceed a certain percentage of total profit (often 30–40%). Why? Because they don’t want gamblers. They want steady, repeatable performance. If you made $4,000 in one day and only $500 across all others, it looks like luck, not skill.

To stay safe:

- Spread your profits over multiple sessions.

- Keep your risk fixed per trade.

- Avoid all-in moments just to finish early.

Consistency isn’t sexy, but it’s what gets you funded and keeps you there.

9.4. Risk-to-Reward Ratio (R: R)

This measures how much you risk compared to how much you gain. Most funded traders aim for at least 1:1.5 or 1:2, meaning you risk $100 to make $150–200.

If your R: R is too low (say 1:0.5), you’ll struggle to recover from losses, even with a high win rate. Remember: prop firms reward smart risk managers, not just lucky streaks.

9.5. Win rate and average trade duration

Your win rate tells how often you’re right; your average trade duration shows your trading style.

- Scalpers might have 70–80% win rates with short trades (1–5 minutes)

- Swing traders might only win 50% of trades, but have huge R: R.

Firms analyze both to profile your risk behavior. Neither is “better”. What matters is that your stats align with your style and stay consistent.

9.6. Leverage usage

Most firms offer leverage from 1:30 to 1:100. While tempting, maxing it out is the easiest way to break drawdown rules. Experienced traders rarely use full leverage; instead, they calculate position sizes around 1–2% risk per trade. Leverage is like nitro: it can make you fly or make you explode. Know when to throttle.

9.7. Performance analytics – The secret dashboard

Modern prop firms track your entire trading behavior:

- Profit factor

- Equity curve stability

- Time in market

- Average pips per trade

- Daily consistency score

They use these metrics to decide who gets scaling opportunities or private funding offers. So if you treat your prop account like a professional trading business, clean stats, stable growth, and tight risk, firms will notice.

See more related articles:

10. How to choose the right prop firm for you

If you’ve ever Googled best prop firms, you already know there’s no shortage of choices. Everyone claims to have the “highest payout” or “easiest challenge,” but the real challenge of how to choose a prop firm isn’t about hype; it’s about finding one that fits your trading personality, goals, and discipline level.

Let’s break it down in plain terms.

10.1. Check the firm’s credibility first

Start with the basics. If a firm doesn’t clearly list its company registration, founders, or payment providers, walk away. Legit firms are proud of their transparency.

To verify legitimacy:

- Check their domain age (new = higher risk).

- Look for verified Trustpilot reviews and community mentions (Discord, Reddit, X).

- Avoid firms with payout complaints or “account bans” posted by multiple traders.

A good rule of thumb: if you can’t find real traders talking about payouts, that’s not a good sign.

10.2. Evaluate the cost vs. value

Prop firms aren’t free; you’ll pay a challenge fee or subscription. To help you compare, here is a short list of prop trading firms and their corresponding costs.

| Firm | Account Size | Evaluation Fee | Profit Split | Time Limit |

|---|---|---|---|---|

| FTMO | $100K | ~$549 | 80–90% | None |

| FundedNext | $50K | ~$299 | 90–95% | Flexible |

| The5ers | $100K | ~$575 | 75–90% | Unlimited |

| Topstep (Futures) | $50K | $165/mo | 90% | Ongoing |

Sometimes, a slightly higher fee gets you better support, faster payouts, or unlimited time, all of which matter more than saving $50 upfront.

10.3. Study the rules (Don’t assume they’re all the same)

No two prop firms operate identically. Some allow EAs and news trading; others ban them. Some have trailing drawdowns, others fixed.

Before joining, review:

- Profit target and drawdown rules

- Minimum trading days

- Weekend/overnight hold policy

- Reset fees or re-entry options

If the rules sound vague or constantly change, that’s a red flag. Transparency is non-negotiable.

10.4. Understand the support and trader experience

A great firm doesn’t just fund you, it supports you.

Things to look for:

- 24/7 chat or email support that actually responds

- Active trader community (Discord or Telegram)

- Access to trade analytics dashboards and journals

- Mentorship or educational resources

The best firms treat traders like partners, not customers. You’ll feel that difference the first time you ask for help and get a real answer instead of an auto-reply.

10.5. Match the firm to your trading style

This part’s often overlooked. If you’re a scalper, pick firms that allow short-term trades and fast execution (low latency, no trade duration limits). If you’re a swing trader, choose firms that allow weekend holds and wider stops.

You don’t adjust to their style; they should fit yours. Otherwise, even good trades might violate rules unintentionally.

10.6. Look at payout reputation

Payouts are where real trust is built.

Legit firms:

- Have clear payout schedules (biweekly or monthly)

- Offer multiple withdrawal methods (bank, crypto, Wise)

- Don’t delay or “review” payouts unnecessarily

10.7. Scalability and long-term growth

If you plan to trade professionally, look for scaling programs. Many top firms increase your funding by 25–100% every few months if you meet consistency metrics. This means you can grow from a $50K account to $200K+ without risking your own money. That’s the beauty of compounding skill instead of capital.

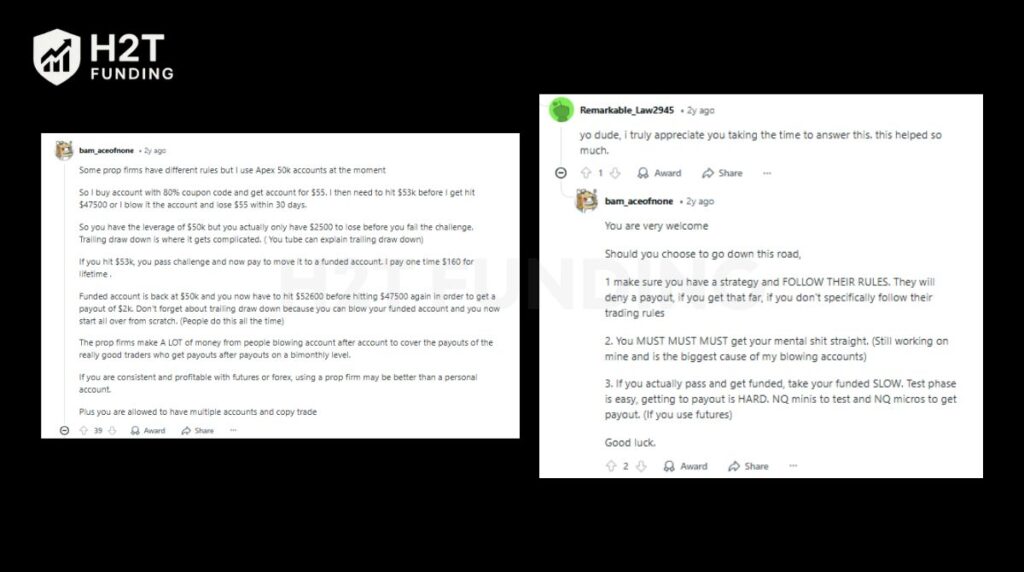

11. Community insights: How do prop firms work Reddit

Short version: The crowd is split. Many traders like the low personal risk, structured rules, and scaling across multiple accounts. Others warn about trailing drawdown traps, changing rules, payout friction, and “sim vs. live” confusion.

Let’s distill the most useful themes I’ve seen echoed by real traders.

Highlights from trader discussions:

- Capital ≠ cushion: Several futures traders point out that a “$50k account” often equates to ~$2.5k max loss because of trailing drawdown. In simple terms, you’re renting buying power under tight brakes.

- Pass → funded → payout loop: A common path is to hit the target → pay a one-time funding fee → trade back to a profit threshold → request payout. Many rinse and repeat this cadence.

- Multiple accounts + trade copier: Some experienced traders run 10–20 accounts and copy trades. They prefer scalping or quick intraday plays to meet rules and reduce overnight risk.

- Rule friction is real: Scaling limits, min trade days, no news trading, duration rules, and trailing drawdown shape behavior. Traders say this forces discipline, but also kills runners and can feel restrictive.

- Payout reputation matters most: People praise firms that pay on time and communicate clearly. Delays, sudden rule changes, or vague violations are red flags.

- Sim vs. live debate: Some community voices claim most “funded” accounts remain simulated until proven consistent; payouts are covered by fees + firm economics. Others note that certain firms copy trade top performers or transition to live after consistency.

- Costs add up: Traders stress never paying full price (affiliate codes are everywhere), and budgeting for resets/data where relevant.

- Mindset beats method: The most upvoted advice? Follow the rules. Keep risk tiny. Get your head right. Passing is “easy”; surviving to payout is the hard part.

Quick pros & cons (from real users):

| What traders like | What traders warn about |

|---|---|

| Low personal capital at risk | Trailing drawdown can nuke good swing ideas |

| Clear targets and structure | Rule complexity and moving goalposts at some shops |

| Scaling via multiple accounts | Payout delays/denials if rules aren’t followed perfectly |

| Community, coaching, dashboards | Fees/resets stack up; avoid paying list price |

| Faster path to meaningful size | Sim vs. live confusion; check transparency before joining |

Crowd-sourced tips you can actually use:

- Start with a free trial (if offered). Practice the rules, not just your entries.

- Trade tiny at first. Risk ≤ 1% per trade; many go 0.25–0.5% to survive daily loss caps.

- Scale up to the trailing line, then let runners once you’re above the threshold.

- Journal everything (screenshots + notes). You’ll spot the emotional triggers that cause violations.

- Verify payout cadence (biweekly/monthly/anytime) and methods (bank, Wise, crypto).

- Pick a firm that fits your style (news/scalping/swing rules). Don’t force your strategy to fit bad constraints.

- First payout is key. Many traders aim to cover all fees with the very first disbursement.

- Taxes: In the U.S., many report income as 1099-NEC; talk to a tax pro for your situation.

The community agrees on one thing: discipline wins. If you treat the firm like a partner, respect risk limits, and choose a transparent provider, you stack the odds in your favor. If not, fees + rules will chew you up.

12. Are prop firms legit?

Many are legitimate, but a few aren’t. The real ones are transparent about rules, payouts, and account types (sim vs. live) and don’t play games with fine print. Your job is to do basic due diligence before you pay a fee or start a challenge.

Quick reality check:

- Legit model: evaluation → risk rules → profit split → timely payouts.

- Shady model: vague T&Cs, moving rules, payout delays, aggressive upsells.

- In simple terms, firms that win long term want you to succeed (they share your profits).

Green flags (what I look for):

- Clear rulebook: daily loss, max drawdown, consistency, weekend/news policy spelled out.

- Payout clarity: schedule, methods (bank/Wise/crypto), min thresholds, typical review time.

- Track record: years in business, visible team, audit trails, active community presence.

- Support that answers: real humans, not canned replies; public status pages for incidents.

- Tools for growth: dashboards, journals, scaling plans, reasonable resets (not fee farming).

Red flags (walk away fast):

- Rules that change mid-challenge or are hidden behind multiple PDFs.

- Payout “reviews” with no timeline, or repeated “violations” after you profit.

- Only marketing, no substance: big influencers, zero concrete T&Cs.

- All upsell, no support: constant coupons, little transparency on sim vs. live routing.

- Too good to be true: extreme splits with zero friction, instant funding + tiny fees.

Simple due diligence checklist:

- Google the firm + payout proof” and “complaints”. Read both sides.

- Check community hubs (Discord/Reddit/Telegram) for consistent experiences.

- Ask one pre-sale question to support; judge the speed and quality of the answer.

- Read the rulebook out loud if you can’t explain it, don’t pay for it.

- Pilot first: use free trials or the smallest challenge to verify ops and payouts.

How to protect yourself (even if the firm is fine):

- Aim for the first payout quickly to cover all fees.

- Keep risk per trade tiny (≤1%) to avoid rule violations by accident.

- Document everything: screenshots of rules, trades, and support chats.

- Diversify exposure: don’t stake your month on a single firm or single account.

- Have a plan B: if a firm stumbles, your system should still work on another platform.

Are prop firms legit? Many are. But legitimacy is earned by clarity and behavior, not slogans. If a firm is open about how a prop trading account is evaluated, how profit sharing works, and how withdrawals are processed, and traders confirm it, then you’re likely in good hands.

13. FAQs – Frequently asked questions

Prop firms fund traders with company capital instead of client deposits. You pay a challenge or evaluation fee, prove consistency under strict rules, and if you pass, you get access to a funded account. The firm then splits profits with you, often 70–90% in your favor while taking no share of your losses.

You lose the account instantly, no exceptions. Every prop firm has a maximum daily loss and overall drawdown rule. For example, in a $50,000 challenge, exceeding a $2,500 loss might void your progress. Some firms offer account resets for a smaller fee so you can try again.

Usually, yes, as long as it follows firm rules. Most allow manual and algorithmic trading, but restrict high-frequency bots, latency arbitrage, or grid strategies that exploit demo server behavior. Always confirm this in the firm’s Terms & Conditions.

Payouts are typically made biweekly or monthly, via bank transfer, Wise, PayPal, or crypto. Some newer firms, like Traddoo or FundedNext, even allow on-demand withdrawals. You’ll receive between 70–90% of profits, depending on the firm and your consistency score.

Strict rules: daily loss caps, consistency rules, and time limits. No true capital ownership: the account isn’t yours. Fees can pile up: resets and re-challenges add cost. Psychological stress: Trading under rules can trigger overthinking. Some shady firms: delays or “violations” that seem arbitrary. Still, for disciplined traders, the model offers a cheaper way to scale without risking personal funds.

It varies wildly from $50 to $500 daily for skilled intraday traders, often targeting 0.5–2% returns. But remember: most traders don’t earn that consistently. Prop firms emphasize risk control over speed, so small daily profits add up over time.

This rule limits how much of your total profit can be earned in a single day, usually around 30% of your total gains during a payout cycle. It prevents traders from passing by luck or one oversized win. Example: if your goal is $6,000 profit, no more than $1,800 can come from a single trading day.

Yes, many firms allow multiple accounts or “account stacking”, often up to 10–20 at once. Advanced traders use trade copiers to mirror orders across accounts, scaling results efficiently, but each account must follow its own rules and drawdown limits.

Yes. In most countries, payouts are treated as independent contractor income. In the U.S., traders receive a 1099-NEC form. Always save payout records and consult a tax professional; even small accounts can trigger reporting obligations.

For a personal account, it’s extremely difficult as fees and small position sizes limit growth. This is why prop firms are a strong alternative. Instead of slowly growing $100, you can pay a similar fee for a challenge to access a $10,000+ account, offering far greater potential if you have a proven strategy.

2-Phase: The most common model. You pass an initial challenge (e.g., +8% profit target) and then a second, easier verification stage (e.g., +5% target) to prove consistency. 1-Phase: A faster but often higher-pressure model where you only need to pass a single evaluation stage to get funded. Instant Funding: You skip the evaluation entirely by paying a higher upfront fee for immediate access to a funded account, but often with stricter rules like trailing drawdowns.

Typical rules are designed to test risk management. This usually includes a Profit Target (around 8-10% to pass), a Max Daily Loss limit (often 4-5% of your starting balance), and a Max Total Drawdown limit (typically 8-12%) that you cannot breach.

Legitimate prop firms make money in two main ways: from the evaluation fees paid by the majority of traders who fail the challenges, and from taking a small share (usually 10-20%) of the profits from their successful funded traders. Many firms are legitimate, but their business model relies on a high failure rate.

Generally, yes, but with restrictions. Most firms allow EAs and copy trading, but often ban strategies that exploit demo environments, such as latency arbitrage or high-frequency trading bots. News trading is also restricted by many firms. Always read the firm’s specific rules before starting.

Getting funded depends on you; it can take anywhere from a few days to the full 30-60 day challenge period. Once funded, the first payout is typically available after 14 to 30 days, provided you are profitable and have followed all the rules.

If you violate any rule, your account is immediately terminated, and you forfeit your evaluation fee. However, most firms offer a “reset” option, allowing you to pay a discounted fee to start the same challenge over again without purchasing a new one at full price.

Yes. Virtually all legitimate prop firms require you to complete KYC (Know Your Customer) verification before processing your first payout. This is a standard legal requirement to prevent fraud and comply with anti-money laundering regulations.

The industry standards are MetaTrader 4 (MT4) and MetaTrader 5 (MT5), which are supported by the vast majority of firms. A growing number of firms also offer support for cTrader and, for futures traders, platforms like NinjaTrader.

Look for major red flags: vague or constantly changing rules, a history of delayed or denied payouts found in community reviews, no public-facing team or company history, and a business model that seems to profit more from endless resets than from successful traders. A trustworthy firm is transparent.

14. Conclusion

So, to recap, how does a prop firm work in reality? After cutting through all the marketing noise, it’s simple: you trade the firm’s capital, follow their rules, and share the profits. In exchange, they take on the financial risk, and you get a real shot at professional trading without investing tens of thousands upfront.

From everything we’ve explored, the prop firm model works best for traders who value discipline, structure, and consistency. It’s not a shortcut to wealth, but a framework to prove skill under pressure. Whether you’re scalping futures, day trading Forex, or testing strategies in a simulated environment, a prop firm can help you refine your edge if you respect its limits.

At H2T Funding, we believe understanding how prop firms operate is the first step toward trading with confidence. In our Prop Firm & Trading Strategies hub, you’ll find practical guides, community-tested insights, and honest breakdowns of top funding programs worldwide so you can choose the right partner, trade smarter, and protect your capital along the way.