The Hankotrade vs OANDA comparison is a frequent topic for traders deciding between aggressive trading conditions and established regulatory security. Hankotrade is ideal for those seeking high leverage and massive deposit bonuses through an ECN model. OANDA suits professional traders who prioritize top-tier regulation, institutional execution, and seamless TradingView integration.

Choosing the right broker depends on your risk tolerance and whether you value offshore flexibility or domestic safety. H2T Funding evaluates these platforms to ensure you make an informed decision for your capital. Read our full analysis below to discover which broker aligns with your specific strategy and financial goals.

Key takeaways:

- Is OANDA safe? Yes, it is a globally regulated broker with 25 years of history, while Hankotrade operates as an offshore ECN/NDD broker for maximum trading freedom.

- Hankotrade offers significantly higher leverage at 1:500, while OANDA follows strict regulatory caps that limit margin options for retail traders.

- For technology, OANDA provides a seamless TradingView experience, while Hankotrade features the proprietary HankoX platform with built-in MAM and API support.

- Is Hankotrade legit for small accounts? It allows entries from just $15, making it more accessible than OANDA’s professional Elite Trader tiers.

- In terms of costs, Hankotrade’s ECN Plus account offers ultra-low $1 commissions, while OANDA rewards high-volume traders via volume-based cash rebates.

- Hankotrade is best for aggressive scalpers seeking high leverage and crypto-based anonymity, while OANDA is the ideal choice for risk-averse professionals requiring top-tier regulatory protection.

1. Overview of Hankotrade and OANDA

Navigating the forex and CFD market requires choosing a broker that matches your capital size and risk appetite. Hankotrade is an offshore ECN broker designed for high-growth strategies. OANDA is a veteran institution that, according to its official company timeline, was recently acquired by the prop firm giant FTMO.

Hankotrade: Operating under an ECN/NDD model, it focuses on providing raw spreads and massive leverage up to 1:500. It is popular for its crypto-friendly environment and attractive deposit bonus programs.

OANDA: Founded in 1996, OANDA is a globally recognized broker regulated by the CFTC and NFA. It offers institutional-grade execution and is a preferred partner for TradingView users.

Criteria Table – Overview

| Criteria | Hankotrade | OANDA |

|---|---|---|

| Founded / Trust | 2018 (Hank White) | 1996 (Acquired by FTMO) |

| Broker Model | ECN / NDD | Core Pricing / Spread-only |

| Min. Deposit | $15 (STP Account) | Varies by Region |

| Asset Classes | Forex, Crypto, Indices, Metals | Forex, Indices/Commodity CFDs, Crypto |

| Trading Platforms | HankoX, MT4 | OANDA Trade, MT4, TradingView |

| Max Leverage | 1:500 | 1:50 (US) / Varies globally |

| Commissions | $0 to $2 per side | Based on Core Pricing |

| Bonus Offers | Offers periodic deposit bonuses | Volume-based Rebates |

| Execution Speed | Instant / NDD | Award-winning / Institutional |

| Regulation | Offshore (No Tier-1 Regulation) | Multiple Top-tier (FCA, NFA) |

Small-cap traders seeking bonuses should choose Hankotrade. Professionals who prioritize safety and regulatory compliance will find OANDA superior.

Disclaimer: Rules, pricing, and trading conditions may change over time. Traders should always verify the latest terms directly on the official Hankotrade vs OANDA websites before purchasing any challenge.

1.1. Hankotrade

Hankotrade has built a reputation as a high-speed, client-friendly broker. It is perfect for traders who want to maximize their margin and avoid strict domestic trading limitations.

Hankotrade – Key Facts

| Criteria | Hankotrade’s Offering |

|---|---|

| Account Fee | $0 Fee; Min. Deposit from $15 |

| Account Types | STP, ECN, ECN Plus |

| Profit Model | 100% to Trader |

| Account Size | No maximum limit |

| Time Limit | None |

| Profit Target | N/A (Direct Brokerage) |

| Trading Platforms | HankoX, MT4 |

| Asset Types | Forex, Indices, Crypto, Metals |

Pros & Cons – Hankotrade

Pros:

- An extremely low minimum deposit of $15 for STP accounts.

- Often provides large deposit bonuses to boost trading margin.

- Supports crypto-native funding using BTC, USDT, and USDC.

- Zero restrictions on EAs, scalping, or hedging strategies.

Cons:

- Operates as an offshore broker without top-tier regulatory oversight.

- Commission-free STP accounts have higher spreads starting from 0.7 pips.

1.2. OANDA

OANDA represents the “Gold Standard” in the Hankotrade vs OANDA review regarding transparency. Its 2025 acquisition by FTMO, as stated on the company’s history page, creates a powerful synergy between retail brokerage and prop trading technology.

OANDA – Key Facts

| Criteria | OANDA’s Offering |

|---|---|

| Account Fee | $0 Fee; Min. Deposit varies by region |

| Account Types | Standard, Elite Trader |

| Profit Model | 100% to Trader; Rebates up to $17/M |

| Account Size | No maximum limit |

| Time Limit | None |

| Profit Target | N/A (Direct Brokerage) |

| Trading Platforms | OANDA Trade, MT4, TradingView |

| Asset Types | Forex, Indices, Crypto, & Metal CFDs |

Pros & Cons – OANDA

Pros:

- Highly regulated by the NFA, CFTC, and FCA for maximum safety.

- Award-winning mobile app and industry-leading TradingView charting.

- Professional Elite Trader program with dedicated relationship managers.

- Extensive historical currency data dating back to the mid-1990s.

Cons:

- Leverage is strictly limited by regional regulators (e.g., 1:50 in the US).

- Crypto trading is “execution-only” through the Paxos partner exchange.

Read more:

2. Hankotrade vs OANDA comparison: Core models and key rules

The core models of Hankotrade and OANDA present a clear divide between offshore freedom and regulated structure. While both are direct brokers, their fundamental rules on funding, risk, and strategy shape entirely different trading experiences. Understanding these differences is crucial for any trader weighing their options.

2.1. Funding model & access difficulty

Neither Hankotrade nor OANDA requires a performance evaluation, as they are direct funding brokers, not proprietary trading firms. The “difficulty” lies in the accessibility of their accounts and the psychological demands of their respective environments. You simply deposit funds and begin trading immediately with both.

| Criteria | Hankotrade | OANDA |

|---|---|---|

| Evaluation Required | No (Direct Broker) | No (Direct Broker) |

| Profit Target | N/A | N/A |

| Time Pressure | None | None |

| Psychological Stress | From high leverage & offshore risk | From regulatory limits & precision needs |

| Overall Difficulty | Easy to start, harder to manage risk | Higher entry barrier, stable environment |

Hankotrade offers an easier start for traders with small capital. OANDA provides a more sustainable and regulated path for serious, well-capitalized traders.

2.2. Drawdown, consistency & risk rules

Unlike prop firms, brokers do not enforce arbitrary drawdown or consistency rules. Your primary risk limit is the margin close-out level, where the broker automatically liquidates positions to prevent a negative balance. The main difference in risk comes from the leverage offered.

| Criteria | Hankotrade | OANDA |

|---|---|---|

| Max Drawdown | 50% Margin Close-Out Level | ~50% Margin Close-Out (Varies by region) |

| Daily Loss Limit | N/A (Direct Broker) | N/A (Direct Broker) |

| Trailing Drawdown | N/A | N/A |

| Consistency Rules | N/A | N/A |

| Rule Strictness | Flexible; high leverage allowed | Strict; low leverage enforced by law |

Both brokers have similar margin-call triggers. However, OANDA’s regulated environment imposes stricter inherent risk controls through its mandatory low-leverage policy.

2.3. News, overnight & strategy policies

A key part of the Hankotrade vs OANDA debate is strategy freedom. Hankotrade’s offshore status allows it to offer a completely unrestricted trading environment. OANDA supports professional strategies but operates within the clear boundaries set by global regulators.

| Policy | Hankotrade | OANDA |

|---|---|---|

| News Trading | Fully Permitted | Allowed; slippage warnings apply |

| Overnight Trading | Allowed (Swap-free option) | Allowed (Standard financing costs) |

| Weekend Trading | Closed (Forex); 24/7 (Crypto) | Closed (Forex); 24/7 (Crypto) |

| EA / Automation | Fully Permitted | Allowed via MT4 & API |

| Allowed Strategies | Scalping, Hedging, Arbitrage | All standard professional strategies |

Hankotrade offers near-total freedom, making it a good choice for aggressive EAs. OANDA supports all standard strategies reliably within a secure, regulated framework.

3. Hankotrade vs OANDA review: Fees, refunds, and cost efficiency

Cost efficiency is a critical factor in the Hankotrade vs OANDA review, directly impacting a trader’s profitability. Hankotrade prioritizes ultra-low commissions and zero transaction fees, while OANDA offers transparent, all–inclusive pricing models with opportunities for high-volume rebates. Your trading style will determine which structure is more cost-effective.

| Criteria | Hankotrade | OANDA |

|---|---|---|

| Fee Type | Commission + Raw Spread | Spread-only or Commission + Core Spread |

| Refund Policy | N/A (Direct Broker) | N/A (Direct Broker) |

| Challenge Cost | N/A | N/A |

| Transparency | Clear commission structure | Fully transparent, award-winning pricing |

| Added Fees | Zero deposit/withdrawal fees | Potential wire fees; inactivity fees apply |

| Payout Cycle | Fast crypto withdrawals (often same-day) | Standard 1-5 business day withdrawals |

For traders using crypto and seeking the lowest possible commissions per trade, Hankotrade is more cost-efficient. For high-volume traders who can benefit from rebates and prefer traditional banking, OANDA offers better long-term value and clarity.

4. Hankotrade vs OANDA debate: Profit split and scaling potential

In the Hankotrade vs OANDA debate, both brokers let traders keep 100% of their profits, but they offer vastly different paths to maximizing earnings and growth. Hankotrade focuses on boosting initial capital with large bonuses. OANDA rewards consistent, high-volume trading through its exclusive loyalty program.

| Criteria | Hankotrade | OANDA |

|---|---|---|

| Profit Potential | 100% to Trader + Deposit Bonus Offers | 100% to Trader + Volume Rebates |

| Growth Programs | IB Affiliate Program (up to $12/lot) | Elite Trader Program (5–17M rebate) |

| Payout Frequency | On-demand, instant via crypto | 1-5 business days via bank transfers |

| Minimum Payout | No minimum specified | No minimum specified |

| Withdrawal Conditions | Bonus funds are not withdrawable | Rebates are credited as cash monthly |

Traders aiming for rapid account growth with upfront capital boosts will prefer Hankotrade’s bonus model. Career traders planning for long-term, high-volume activity will find OANDA’s Elite Trader rebates far more lucrative and sustainable.

5. OANDA vs Hankotrade: Platforms and tradable markets

The OANDA vs Hankotrade comparison reveals a technological clash between a proprietary ECN environment and a regulated, multi-platform ecosystem. Hankotrade’s HankoX platform is built for speed and simplicity. OANDA, however, offers a wider array of assets and integrates seamlessly with the industry’s most powerful charting tools.

| Criteria | Hankotrade | OANDA |

|---|---|---|

| Trading Platforms | HankoX (Web, App), MT4 | OANDA Trade, MT4, TradingView |

| Asset Classes | 62 Forex pairs, Metals, Indices, Crypto CFDs | 68+ Forex pairs, Indices, Commodities, and Crypto CFDs (region-dependent) |

| Execution Speed | Instant NDD Execution | Award-winning, low-latency |

| Commissions & Fees | From $1-$2/side (ECN+) to $0 (STP) | Spread-only or Core + Commission |

| Trader Dashboard | Simple, integrated client portal | Advanced, with performance analytics |

For traders who prioritize a native TradingView experience and a diverse range of CFD products, OANDA is the clear winner. Traders who prefer a streamlined, high-speed proprietary platform with ultra-low commissions should opt for Hankotrade.

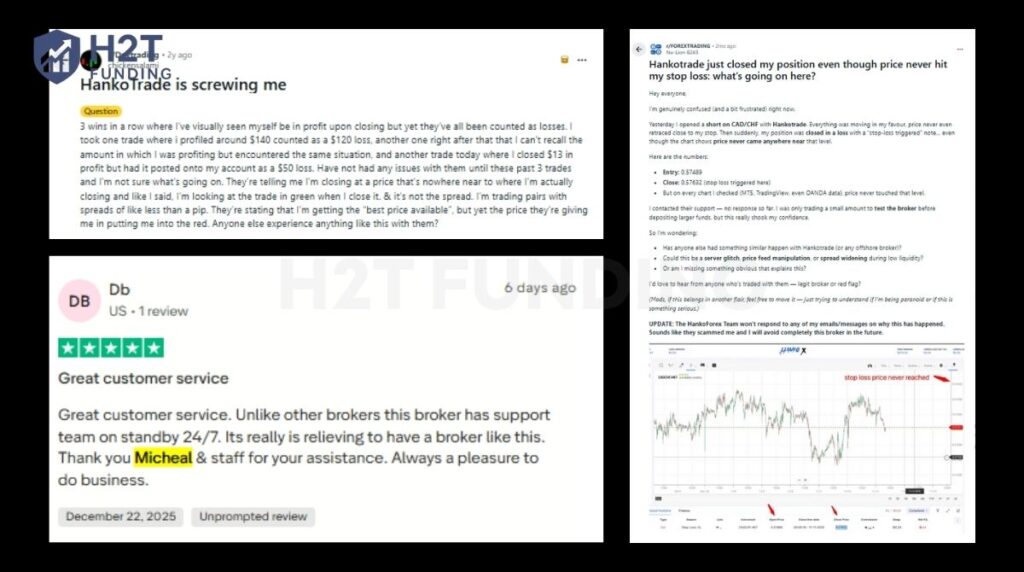

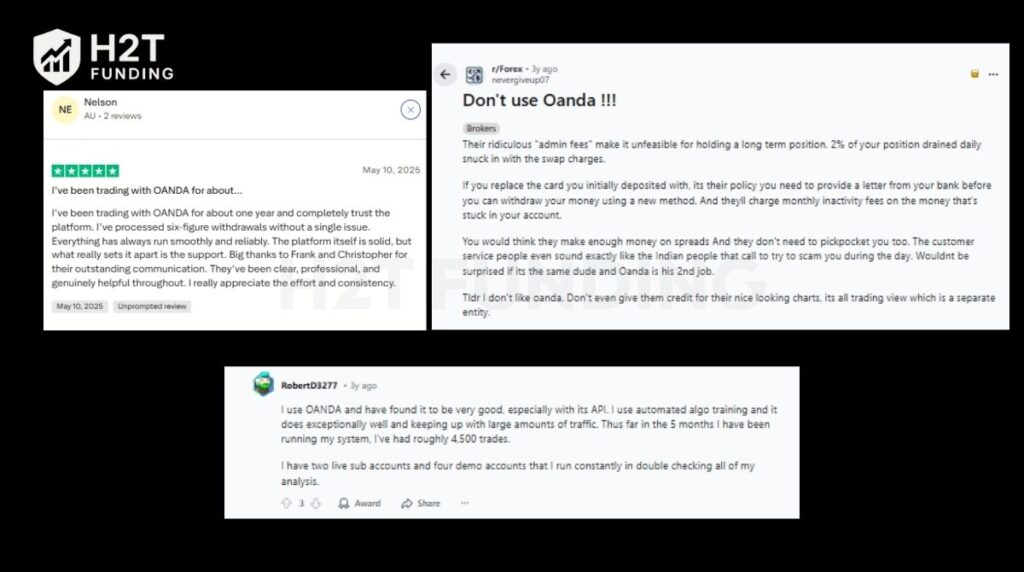

6. Payout & trust: Hankotrade and OANDA Reddit and Trustpilot reviews

Community feedback is the ultimate test of a broker’s reliability, offering real-world answers to the questions “Is Hankotrade safe?” and “Is OANDA legit.” We’ve analyzed discussions on Reddit and Trustpilot to understand the true user experience beyond the marketing materials.

(Note: Information collected and updated on December 29, 2025)

On Trustpilot, Hankotrade earns many positive reviews, with users frequently praising the fast and helpful customer support team for resolving issues. However, as with many offshore brokers, Trustpilot reviews should be interpreted cautiously and alongside independent community feedback.

However, a different story emerges on Reddit forums like r/Forex and r/Daytrading. Here, traders raise serious concerns about slippage, stop-loss hunting, and the inherent risks of using an unregulated broker.

As a regulated veteran, OANDA’s reputation for trust is well-established. Many users on Reddit and Trustpilot defend it as a reliable, professional broker, especially for US residents. Its seamless integration with TradingView and robust API are frequently praised.

Despite this, some traders on Reddit highlight operational frustrations. Common complaints revolve around a strict withdrawal hierarchy policy, inactivity fees, and customer service that some feel has become less effective since being outsourced.

Sentiment Summary

| Category | Hankotrade | OANDA |

|---|---|---|

| Payout Reliability | Fast for crypto; some Reddit users report delays. | Generally reliable; some complaints about policy-based withdrawal issues. |

| Rule Enforcement | Offshore flexibility; some allege unfair stop-outs. | Strict adherence to AML and regulatory policies. |

| Support Quality | Excellent and highly praised on Trustpilot. | Mixed; some find it professional, others find it unhelpful. |

| Common Complaints | Slippage, execution quality, and lack of regulation. | Withdrawal hierarchy, admin fees, and perceived high spreads. |

The community sentiment reinforces the core trade-off. Hankotrade’s trust is built on exceptional, personal customer support, but this is set against trader concerns about execution and regulation. OANDA’s trust is institutional and proven over decades, though some users find its corporate policies and fees frustrating.

7. Hankotrade vs OANDA: Which broker is easier to trade with?

For beginners and small-account traders, Hankotrade is undeniably easier to start with due to its low entry barrier and simple rules. OANDA, while offering a more stable environment, presents a higher initial hurdle due to its professional focus and stricter regulatory compliance.

| Criteria | Winner | Notes |

|---|---|---|

| Profit Target | Both | Neither broker imposes profit targets on traders. |

| Drawdown Strictness | Both | Both use a standard 50% margin close-out rule. |

| Rule Complexity | Hankotrade | Far fewer restrictions on leverage and strategy. |

| Overall Difficulty | Hankotrade | A $15 deposit makes it the most accessible choice. |

If easier means a lower barrier to entry and fewer restrictions, Hankotrade is the clear winner. Its minimal deposit requirement and high leverage allow new traders to get started quickly. However, OANDA’s structured and regulated environment could be considered “easier” for professionals who value long-term stability and predictability over initial accessibility.

8. Hankotrade and OANDA: Which broker suits your trading style?

Choosing between Hankotrade and OANDA ultimately depends on your individual trading style, risk tolerance, and long-term goals. Each broker is uniquely positioned to serve different types of market participants. This section breaks down which platform is the best choice for you.

| Trader Type | Best Choice | Why |

|---|---|---|

| Beginners | Hankotrade | Low $15 minimum deposit and high leverage make it highly accessible for learning. |

| Systematic Traders | OANDA | Superior API, deep historical data, and TradingView integration are ideal for algos. |

| Swing Traders | Both | Hankotrade’s swap-free option vs. OANDA’s stability for long-term holds. |

| Scalpers | Hankotrade | Ultra-low commissions ($1/side) and instant execution are perfect for high-frequency trading. |

| Risk-Averse Traders | OANDA | Top-tier regulation by the NFA and CFTC provides unmatched security and peace of mind. |

| Traders Aiming for Large Capital | OANDA | The Elite Trader program and institutional reputation are built for serious, high-volume professionals. |

If you are an aggressive scalper or a beginner starting with minimal capital, Hankotrade’s high-leverage and low-cost structure is the better fit. If you are a systematic trader or a professional who prioritizes regulatory safety and long-term growth, OANDA is the superior choice.

9. FAQs

Yes, OANDA is fully legal and regulated in the United States. It is registered with the Commodity Futures Trading Commission (CFTC) and is a member of the National Futures Association (NFA), making it a top-tier choice for US residents.

No, Hankotrade is not a regulated US broker. It operates as an offshore entity, which means it does not hold licenses from American regulators like the CFTC or NFA.

Yes, US citizens can typically open accounts with Hankotrade. As an offshore broker, it is not subject to the same strict regulations as US-based firms, allowing it to offer services and high leverage to clients in the United States.

The provided information does not specify a list of restricted countries for Hankotrade. Offshore brokers often have fewer country-based restrictions, but it is always best to check their official website for the most current information.

OANDA can be a good choice for beginners who prioritize safety and education. Its award-winning platform and learning resources are very helpful. However, the low leverage required in the US may be challenging for beginners starting with very small capital.

OANDA’s spreads may appear high on its standard, commission-free “Spread-only” accounts. The broker builds its trading fees directly into the spread on this account type. For tighter spreads, traders can use their “Core Pricing” model, which offers raw spreads plus a commission.

OANDA’s spreads are competitive, particularly on its “Core Pricing + Commission” accounts. While standard spreads are not the absolute lowest, the Elite Trader program’s cash rebates make it very cost-effective for active, high-volume traders.

On its standard account, OANDA’s typical spreads for major pairs are around 1.7 to 1.9 pips. For example, the provided data shows a spread of 1.7 pips for EUR/USD and 1.8 pips for GBP/USD. These are variable and can widen during volatile market conditions.

The “better” broker depends entirely on your trading priorities. For traders seeking higher leverage and crypto funding, a broker like Hankotrade may be preferred. For those who demand top-tier regulation and institutional tools, OANDA remains a leading global choice.

Both OANDA and FXCM are major, long-standing brokers catering to similar clients. The choice often comes down to personal preference for platform features and user experience. OANDA is particularly noted for its powerful API and seamless TradingView integration.

The main cons reported by users include low leverage due to regulation, a strict withdrawal “hierarchy policy,” and potential inactivity fees. Some traders also feel the standard account spreads are not ideal for aggressive scalping strategies.

The most significant recent event was OANDA’s acquisition by the global prop trading firm FTMO, as announced on their official history page. This move marks the beginning of a new trading powerhouse, combining OANDA’s established brokerage services with FTMO’s modern prop trading infrastructure.

You can withdraw from Hankotrade primarily through cryptocurrencies like Bitcoin, Ethereum, and USDT. The process is initiated via the client dashboard. While often fast, some users have reported delays, so processing times can vary.

Hankotrade is considered a higher-risk broker because it operates offshore and does not hold licenses from tier-1 regulators. While many users report positive experiences, the lack of formal regulatory protection is a critical factor to consider.

Neither broker is “better” overall; the best choice depends on your needs. Hankotrade is better for traders who prioritize high leverage, low commissions, and crypto funding. OANDA is better for professionals who require the highest level of regulatory security and a stable, long-term trading environment.

10. Conclusion

The Hankotrade vs OANDA debate presents a fundamental choice between aggressive freedom and institutional security. OANDA, with its top-tier regulation and recent acquisition by FTMO, stands as a pillar of trust and a safe harbor for professional, risk-averse traders

Hankotrade, in contrast, serves a vital niche for scalpers and small-account traders who demand high leverage, ultra-low commissions, and the operational flexibility that only an offshore ECN broker can provide.

Ultimately, your decision should reflect your risk tolerance. If you are a trader who values regulatory protection above all else and plans to trade significant volume, OANDA is the superior choice. If your strategy thrives on maximum leverage and minimal costs, and you are comfortable with the risks of an unregulated environment, Hankotrade offers the more compelling package.

To further explore which platform aligns with your financial goals, check out more in-depth broker and prop firm comparisons on the H2T Funding blog.

Source: