Stuck in the debate of Funding Pips vs The Funded Trader? While one firm sets the industry standard for speed and reliability, the other offers unmatched flexibility for complex strategies. Choosing the wrong partner could mean missing out on faster payouts or getting stopped out by rigid rules.

H2T Funding has analysed every detail from spread costs to withdrawal reliability to bring you this transparent comparison. Dive into our breakdown below to discover which proprietary trading firm truly aligns with your goals and keeps your capital safe.

Key takeaways

- The Funded Trader provides a wider array of challenges (Standard, Royal, Knight), including one-step and two-step evaluations. Funding Pips focuses on streamlined one-step and two-step models, emphasising speed and simplicity.

- Both firms offer generous profit splits, starting around 80%. The Funded Trader offers a scaling plan that can potentially increase your profit share to 90%. Meanwhile, Funding Pips provides an aggressive path for top traders to earn a full 100% split.

- Funding Pips distinguishes itself with its “Tuesday Payday” feature, allowing for near-instant payouts. The Funded Trader follows a more traditional biweekly payout timeline, which may suit traders who prefer a consistent schedule.

- Both firms provide access to popular trading platforms like MT5. However, rules around news trading and weekend holding differ; Funding Pips generally imposes restrictions on funded accounts, whereas The Funded Trader offers more flexibility, particularly in its Knight’s Challenge.

- The Funded Trader has built a large, gamified “Trading Kingdom” community, appealing to traders who enjoy a competitive and interactive environment. Funding Pips focuses on efficient customer support and straightforward trading conditions, attracting traders who prioritise performance and quick withdrawals.

1. An overview of Funding Pips and The Funded Trader

When you dive into this Funding Pips vs The Funded Trader review, you’re looking at two fundamentally different approaches to prop trading. It’s not just about which one is “better,” but which one is better for you. To put it simply, one firm is built for speed and efficiency, while the other is built for community and flexibility.

Funding Pips, on the one hand, is all about execution. We think their model is designed for traders who want a straightforward path to getting funded. They focus on providing a simple, fast, and no-frills experience. This makes them a strong contender for day traders and scalpers who prioritise quick payouts and clear rules.

The Funded Trader, in contrast, has built an empire around its community. They’ve created a gamified environment called the Trading Kingdom that thrives on competition and interaction. With a massive variety of challenge options and more lenient rules on things like news trading, they appeal to traders who want flexibility and a strong sense of belonging.

High-Level Comparison

| Criteria | Funding Pips | The Funded Trader |

|---|---|---|

| Core Philosophy | Speed, Simplicity, Fast Payouts | Community, Flexibility, Gamification |

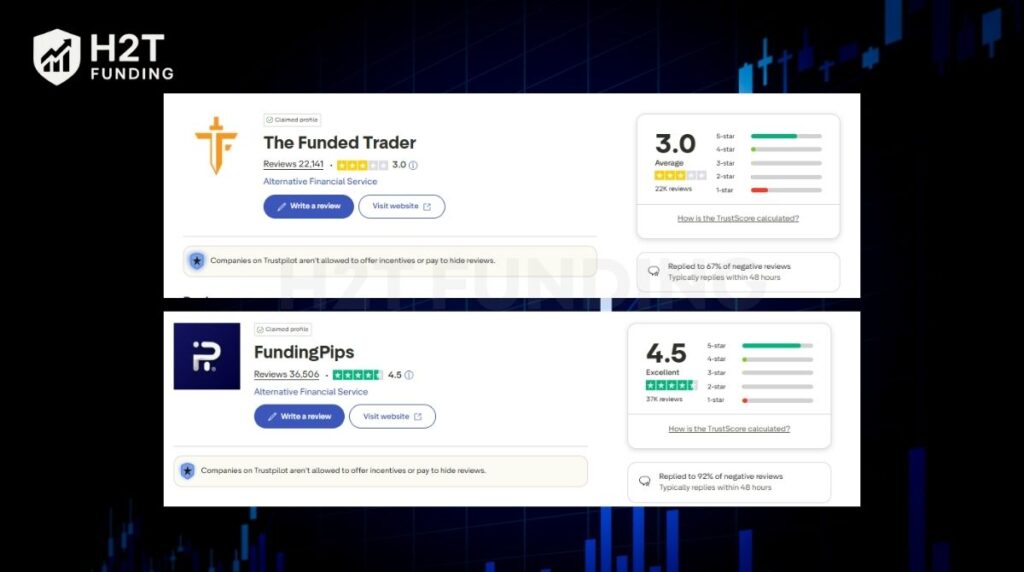

| TrustPilot Rating | 4.5/5 from 36,000+ reviews | 3.0/5 from 22,000+ reviews |

| Challenge Models | 1-Step, 2-Step | 1-Step, 2-Step, 3-Step (Standard, Royal, Knight, Dragon) |

| Tradable Assets | Forex, Indices, Metals, Energies, Crypto CFDs | Forex, Indices, Metals, Energies, Crypto CFDs |

| Platforms | MT5, cTrader, Match Trader | MT4, MT5, cTrader |

| Profit Split | Up to 100% | Up to 90% |

| Payout Schedule | On-Demand & Tuesday Payday | Bi-weekly (after first payout) |

| Scaling Plan | Yes, up to $2 million | Yes, up to $2 million |

Disclaimer: Rules, pricing, and trading conditions may change over time. Traders should always verify the latest terms directly on the official Funding Pips and The Funded Trader websites before purchasing any challenge.

Funding Pips

#1

Account Types

1-step, 2-step, and Instant Funding

Trading Platforms

MT5, cTrader, Match Trader

Profit Target

5% – 10%

Our take on Funding Pips

Frankly, Funding Pips has carved out a niche for itself by prioritising what many performance-focused traders care about most: getting paid quickly.

Their standout The Tuesday Payday feature is a game-changer, breaking the traditional biweekly or monthly payout timeline. They offer a streamlined evaluation process through both one-step and two-step challenges. Their dashboard is clean, and the trading conditions generally feature competitive spreads, which is a huge plus.

| 💳 Challenge Fee | $29 – $555 |

| 👥 Account Types | 1-step, 2-step, and Instant Funding |

| 💰 Profit Split | 80% – 100% |

| 💵 Account Size | $5K – $100K |

| ⏱️ Time Limit | No time limit |

| 🎯 Profit Target | 5% – 10% |

| 📊 Trading Platforms | MT5, cTrader, Match Trader |

| 🛍️ Asset Types | FX, Metals, Indices, Energy, Crypto, CFD |

The Funded Trader

#2

Account Types

1-step, 2-step, and 3-step

Trading Platforms

MT5, cTrader, Match Trader

Profit Target

5% – 10%

Our take on The Funded Trader

The Funded Trader is, without a doubt, a giant in the prop trading space, largely because they built a massive and loyal community. Their “Trading Kingdom” isn’t just a marketing gimmick; it’s a hub for competition, learning, and interaction.

This firm shines in its flexibility. This firm supports a wide range of trading strategies. They are also one of the few that allow news trading on most challenges, which is a critical factor for many traders.

| 💳 Challenge Fee | $42 – $1,100 |

| 👥 Account Types | 1-step, 2-step, and 3-step |

| 💰 Profit Split | 80% – 99% |

| 💵 Account Size | $5K – $200K |

| ⏱️ Time Limit | No time limit |

| 🎯 Profit Target | 5% – 10% |

| 📊 Trading Platforms | MT5, cTrader, Match Trader |

| 🛍️ Asset Types | Forex, Commodities, Indices, Crypto |

Read more:

2. Core models & key rules: Funding Pips vs The Funded Trader

Even though they are both prop firms, let’s be real, the actual day-to-day trading experience between Funding Pips and The Funded Trader feels worlds apart. It all comes down to the rules they set. One firm prioritises a straightforward, almost rigid structure, while the other gives you a whole playground of options, each with its own specific rulebook.

2.1. Profit targets & minimum trading days

This is where you first see their different philosophies in action. What’s more important to you: a quick sprint or the flexibility to choose your own race?

| Criteria | Funding Pips | The Funded Trader |

|---|---|---|

| Core Design Philosophy | Built for speed | Built for choice & flexibility |

| Profit Targets | Phase 1: 8% Phase 2: 5% (2-step challenges) | Standard: 8% Royal: 8% Knight (1-step): 10% |

| Minimum Trading Days | No minimum trading days; pass as soon as targets are met | 0 minimum trading days on most challenges also allows fast progression |

| Speed Advantage | Extremely fast due to simple, uniform rules | Fast potential, but varies depending on challenge type |

To put it simply, both firms let you pass quickly, but The Funded Trader’s variety of challenges means you have to pick the one that fits your target expectations. Funding Pips keeps it uniform and simple.

2.2. Drawdown & daily loss limits

Here’s where risk management comes into play. Honestly, how a firm calculates your drawdown can make or break your trading career.

| Rule Type | Funding Pips (Standard 2-Step) | The Funded Trader (Standard 2-Step) | The Funded Trader (Knight 1-Step) |

|---|---|---|---|

| Max Drawdown | 10% (Static) | 10% (Static) | 6% (Static) |

| Daily Drawdown | 5% (Static) | 5% (Static) | 3% (Relative) |

What this means for you:

- Funding Pips keeps it consistent across the board. The 5% daily and 10% max drawdown are easy to track and manage.

- The Funded Trader offers different risk parameters for different challenges. Their Standard Challenge mirrors Funding Pips. However, the popular Knight’s Challenge has a tighter 3% relative daily drawdown, which can be trickier for beginners to manage as it trails your account’s high water mark. You really need to read the fine print here.

2.3. News, overnight & automated trading policies

Trading freedom is a huge deal. Can you hold trades over the weekend? Can you trade during a FOMC announcement? Let’s break it down.

| Criteria | Funding Pips | The Funded Trader |

|---|---|---|

| Automated Trading (EAs) | Allowed, but no high-frequency bots or trade copying. Strategy must be original. | Allowed, same restrictions: no HFT bots or copied trades. Strategy must be original. |

| Overnight / Weekend Holding | Permitted for most accounts. | Permitted across most challenges. |

| News Trading | Allowed during evaluation phases. Restrictions apply to funded accounts (e.g., no opening/closing trades within ~2 minutes of major news). | No major news restrictions for most challenges. Especially flexible in the Knight Challenge. |

| Best For | Traders who prefer a conservative, controlled environment around news events. | Traders whose strategies rely on volatility or news-driven setups. |

In short, The Funded Trader gives you more freedom, particularly around high-impact news. FundingPips is a bit more conservative, which could be seen as a built-in safety measure to protect both you and the firm from extreme volatility.

Read more: Does FundingPips Have a Risk Management Tool – Secure Your Funded Account

3. Fees, refunds & cost efficiency of Funding Pips and The Funded Trader

At the end of the day, the upfront fee is your skin in the game. It’s the cost of the job interview. So, how do these two firms stack up when it comes to your wallet? In my view, one is clearly the budget-friendly option, while the other positions itself as a premium choice with more bells and whistles.

| Criteria | Funding Pips | The Funded Trader |

|---|---|---|

| Fee Type | One-time, upfront evaluation fee. | One-time, upfront evaluation fee. |

| Refund Policy | Yes. The evaluation fee is refunded with your first profit split. | Yes. The evaluation fee is refunded with your first profit split. |

| Typical Cost ($100k) | ~$399 for a standard 2-step challenge. | ~$499 for a standard 2-step challenge. |

| Transparency | Very high. What you see is what you get. | High. All costs are clearly stated, but the variety of add-ons can change the final price. |

| Hidden Fees | Some users have noted small fees for crypto withdrawals. | Generally, no hidden fees. |

FundingPips is, frankly, the more cost-effective choice for most traders.

- Their challenge fees are consistently lower across comparable account sizes. For a trader trying to manage their risk management budget, saving $100 on a $100k challenge is significant.

- The refund policy is straightforward and works exactly as you’d expect. Pass the challenge, get your first payout, and your initial fee comes back to you. It makes the initial investment feel much less risky.

The Funded Trader often comes with a higher price tag, and there’s a reason for it.

- You’re not just paying for an account; you’re buying into an entire ecosystem. The higher fee helps support the massive community, frequent competitions, and the added trading flexibility (like unrestricted news trading).

- Think of it this way: the extra cost is for the premium features. If your strategy relies on news trading, paying more for a TFT account is a wise investment. It’s more cost-effective in the long run than getting stopped out of a trade on a stricter platform.

Ultimately, your choice here depends on your budget and priorities. If your primary concern is the lowest possible entry cost for a high-quality prop firm’s experience, FundingPips is hard to beat. If you value flexibility and community above all else and are willing to pay a premium for it, then The Funded Trader is a worthy investment.

4. Profit split & scaling of Funding Pips and The Funded Trader

Let’s be honest, this is the part everyone truly cares about. Passing the challenge is great, but the real goal of prop trading is to earn a significant profit share and scale your account to life-changing levels. So, how do our two contenders handle your success? One firm gets you your money faster, while the other offers a more structured ladder of growth.

| Criteria | Funding Pips | The Funded Trader |

|---|---|---|

| Default Profit Split | 80% | 80% (Can be 75% on some instant models) |

| Scaling Plan | Yes, scales up to $2 Million with a 90% and even 100% split for top traders. | Yes, scales up to $2 Million with a 90% split. |

| Payout Frequency | On-demand. Famously offers Tuesday Payday for rapid, weekly withdrawals. | Bi-weekly. Your first payout is available after 21 days, then every 14 days after that. |

| Scaling Conditions | Achieve a 10% profit target within a three-month period to be eligible for a 25% account increase. | Achieve a 10% profit target over a three-month period, with at least two profitable months, to be eligible for a 25% account increase. |

FundingPips is the champion of withdrawal speed.

- Their Tuesday Payday system is a massive advantage. For a trader who has a great week and wants to secure their profits, not having to wait weeks is a huge psychological and financial win. It’s all about giving you control over your earnings, and frankly, it builds a ton of trust.

- The path to a 90% or even 100% profit split is an incredibly powerful incentive. It tells the trader, “Perform well, and we will reward you better than almost anyone else.” This is designed for the confident, consistently profitable trader.

The Funded Trader builds a long-term career path.

- While their biweekly payout is more traditional, their scaling plan is robust and deeply integrated into their ecosystem. The plan is clear and structured, and feels like climbing the ranks in their Trading Kingdom.

- What they might lack in payout speed, they make up for with performance rewards and a constant stream of competition. The opportunity to scale is not just a feature; it’s part of the community experience. This approach appeals to traders who are methodical and focused on steady, long-term growth within a supportive environment.

So, what’s the bottom line? If your priority is getting your hands on your profits as quickly as possible and maximising your split, FundingPips has a clear edge. If you prefer a more structured, long-term growth plan with a strong community backing, The Funded Trader has built an excellent framework for that journey.

5. Platforms & tradable assets of Funding Pips and The Funded Trader

Let’s talk about the actual tools you’ll be using every single day. A great strategy means nothing without a reliable platform and good market access. In this area, both firms provide professional-grade tools, but they focus on slightly different things. To me, one feels like a finely tuned F1 car built purely for speed, while the other is a robust all-terrain vehicle, equipped to handle any path you choose.

| Criteria | Funding Pips | The Funded Trader |

|---|---|---|

| Trading Platforms | MT5, cTrader, Match Trader | MT4, MT5, cTrader |

| Instruments | Forex, Indices, Metals, Energies, Crypto CFDs | Forex, Indices, Metals, Energies, Crypto CFDs |

| Execution Quality | Optimised for speed and low spreads, suggesting a quality liquidity provider. | Generally reliable, built to handle a massive volume of traders. |

| Leverage | Up to 1:100 on FX pairs. | Up to 1:200 on some challenges (e.g., Royal). |

| Dashboard | Clean, minimalist, and performance-focused. | Integrated hub for trading, community, and competitions. |

FundingPips focuses on execution excellence.

- What we really appreciate here is their emphasis on providing a high-performance simulated trading environment. By offering MT5 and cTrader, they cater to modern traders who demand fast execution and advanced charting tools.

- Their spreads are consistently competitive, which is a massive factor for scalpers and day traders. It’s clear they’ve prioritised this. Their dashboard is no-nonsense; it gives you the data you need without the clutter, letting you focus purely on your trading.

The Funded Trader focuses on comprehensive options.

- The big standout for The Funded Trader is their inclusion of MT4. For the thousands of traders who have built their strategies and automated systems (EAs) on MT4 over the years, this is a non-negotiable feature. It shows they understand the legacy needs of the trading community.

- Their instrument list is vast, giving you the ability to pivot between markets as opportunities arise. Their dashboard is more than just a stats page. It’s the central hub for your entire journey in the “Trading Kingdom,” connecting your account, progress, and the community. It’s a complete experience.

6. Payouts & trust: What are real traders saying about Funding Pips and The Funded Trader

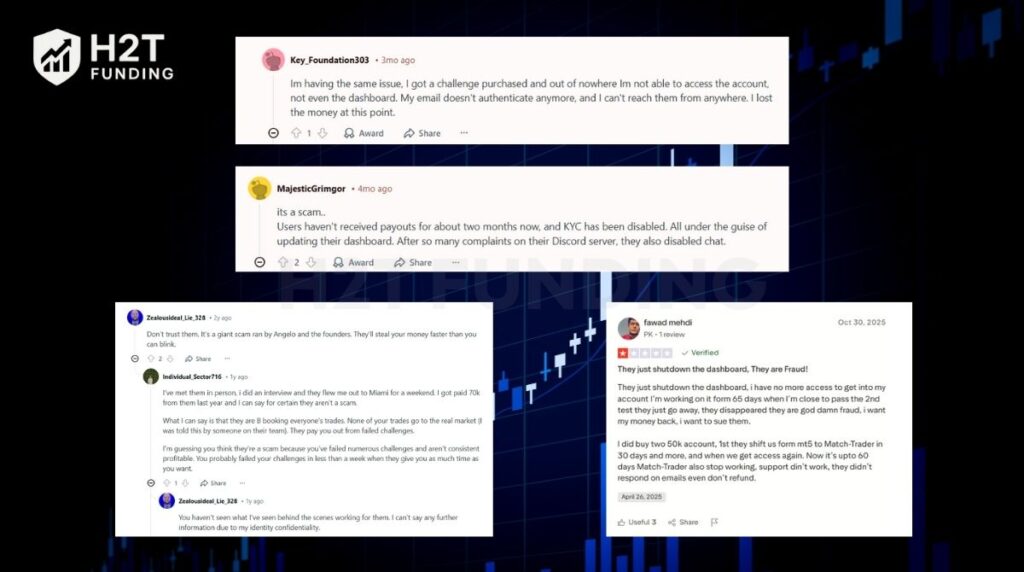

Alright, let’s cut through the marketing noise. A prop firm can promise the moon, but what truly matters is its reputation on the ground. Does it pay out consistently? Is the customer support helpful when things go wrong?

This is where raw, unfiltered feedback from traders becomes the most valuable tool in your due diligence. We’ve sifted through forums like Reddit and review sites like Trustpilot to get a pulse on what the community really thinks.

Below, we’ll look at some real conversations and reviews. Pay attention not just to the star ratings but to the details in the comments. That’s where you find the truth about a firm’s character.

FundingPips has built a reputation for reliability. The consensus is simple: if you play strictly by their rules, you can expect fast and consistent payouts. Most complaints come from traders who unintentionally broke a specific rule. Therefore, trust in FundingPips is high, but it demands your full attention to detail.

The Funded Trader, on the other hand, is currently surrounded by serious trust issues. Recent feedback isn’t just about slow payments; it’s a wave of complaints about being locked out of accounts during platform “migrations” and a lack of communication. Despite their large community, the risk of losing access to your account and profits appears significant, making them a much riskier choice at present.

7. Which prop firm is easier to pass?

The passing difficulty between Funding Pips and The Funded Trader depends mainly on their evaluation rules. However, when comparing them directly, Funding Pips is generally considered easier to pass for most traders due to its simpler, more consistent rule structure.

| Criteria | Funding Pips | The Funded Trader | Which Is Easier? |

|---|---|---|---|

| Profit Targets | Phase 1: 8%Phase 2: 5% | Standard: 8%Royal: 8%Knight 1-step: 10% | Funding Pips (Lower targets overall) |

| Daily Drawdown | 5% static | 4–5% (varies by challenge)Knight: 3% relative | Funding Pips (Simpler, less strict) |

| Max Drawdown | 10% static | 8–10% depending on the challenge | Funding Pips (More straightforward) |

| News Rules | News restricted to funded accounts | No news restrictions on most challenges | The Funded Trader (More flexible) |

| Rule Complexity | Very simple & uniform | Wide variety of challenge types with different rule sets | Funding Pips (Less confusing) |

Funding Pips is easier to pass for most traders. Because of its:

- Simpler, consistent rules

- Lower profit targets in 2-step challenges

- Static drawdown (easier to track than relative drawdown)

- No minimum trading days

- Less complexity compared to TFT’s multiple challenge types

The Funded Trader may be easier only for certain strategies, such as:

- News trading

- High-volatility setups

- Traders who want extremely flexible trade rules

But for the average trader seeking the highest pass rate, Funding Pips remains the more beginner-friendly and less risky choice.

8. Who should choose which firm?

So, after laying it all out, let’s get to the real question: which firm is the right fit for you? Honestly, there’s no single best choice, only the best choice for your specific trading personality and goals. It all comes down to what you value most in a simulated trading environment.

To make it simple, we’ve broken it down by trader type. Find yourself on this list, and your decision should become much clearer.

| Trader Type | Best Choice | Why It’s a Good Fit |

|---|---|---|

| The New Trader | Funding Pips | The rules are simpler, the cost is lower, and the process is less overwhelming. It’s a fantastic place to prove your strategy without too many variables. We’d still advise anyone new to practice on demo accounts first! |

| The Scalper / Day Trader | Funding Pips | This is a no-brainer. The tight spreads, fast execution, and lightning-fast Tuesday Payday payouts are practically built for high-frequency traders who want to secure profits quickly. |

| The Swing Trader | The Funded Trader | Their flexibility in holding trades over weekends and the variety of trading models available give you more room to let your positions breathe and develop over several days. |

| The News Trader | The Funded Trader | Again, an easy choice. Their explicit allowance for news trading on most challenges is a massive competitive advantage and a necessity for strategies that thrive on volatility. |

| The Risk-Averse Trader | Funding Pips | The rules are crystal clear and static. You always know exactly where your limits are, with no complex relative drawdowns to worry about. They don’t have official consistency rules, but their structure naturally rewards a disciplined approach. |

| The Competitive Trader | The Funded Trader | If you thrive on leaderboards and contests, this is your kingdom. Their massive community size and constant stream of competitions provide an engaging and motivating environment that no one else really matches. |

Ultimately, your choice reflects your trading philosophy.

- Choose Funding Pips if you are a disciplined, performance-driven trader. You value speed, efficiency, and clarity above all else. You want to execute your strategy with low costs, know the rules are simple, and get paid as fast as humanly possible.

- Choose The Funded Trader if you are a flexible, community-oriented trader. You want the freedom to trade your way, including during the new, and you thrive on the energy of competition. You’re willing to navigate a more complex system to gain access to that flexibility and be part of the industry’s largest community.

9. Frequently asked questions (FAQ)

We believe Funding Pips is more beginner-friendly. Its rules are simpler, the costs are lower, and the overall process is less complex. The Funded Trader’s vast array of options can be overwhelming for someone just starting out.

Better is subjective and depends on your style. Funding Pips offers a faster, more streamlined process. The Funded Trader offers more flexibility and choice with its various challenge models, like the Royal and Knight challenges.

Funding Pips is the clear winner here. Their “Tuesday Payday” and on-demand payout system is one of the fastest in the industry. The Funded Trader uses a more traditional bi-weekly payout schedule.

Both support modern platforms. FundingPips offers MT5, cTrader, and Match Trader. The Funded Trader offers MT4, MT5, and cTrader. TFT’s inclusion of MT4 is a key advantage for traders with existing EAs built for that platform.

Both have standard daily and maximum drawdown rules. However, FundingPips has more uniform rules across its accounts. Neither firm imposes strict, complex consistency rules like some competitors, focusing more on the drawdown limits.

Based on current trader feedback and operational status, Funding Pips has a much stronger reputation for stability. The Funded Trader has recently faced significant challenges, including platform shutdowns and widespread payout issues, raising serious questions about its long-term reliability.

Both firms are excellent in this regard. Most of their popular evaluation challenges have no minimum or maximum time limits, allowing you to trade at your own pace.

As of late 2026, Funding Pips holds a strong rating of around 4.5/5 stars. In contrast, The Funded Trader’s rating has fallen to approximately 3.0/5 stars, largely due to the recent wave of negative reviews regarding account access and payouts.

Funding Pips is widely regarded as a legitimate firm with a consistent track record of paying traders who follow the rules. The Funded Trader’s legitimacy is currently under heavy scrutiny. While they have paid out many traders in the past, the volume of recent unresolved issues makes them a high-risk choice.

For most challenges at both firms, there is no minimum trading day requirement. You can pass as soon as you meet the profit target.

Both firms primarily offer trading on Forex, Indices, Metals, and Crypto CFDs. Neither firm currently offers direct trading on futures contracts, which are typically found at specialised firms like Topstep.

This depends entirely on you. MT5 is the modern standard, cTrader is excellent for advanced order types and scalping, and MT4 (offered by TFT) has the largest library of custom indicators and EAs.

Both firms are on equal footing here. They both offer scaling plans that can take a trader’s account up to a maximum of $2 million.

This is a key difference. The Funded Trader is well-known for allowing news trading on most of its accounts. Funding Pips typically restricts trading on funded accounts during high-impact news events.

FundingPips, without question. Their weekly and on-demand payout system is significantly faster than The Funded Trader’s biweekly schedule.

The Funded Trader offers more overall flexibility due to its diverse account models and more permissive rules regarding trading styles, including news trading.

All prop firm challenges, including those from these two firms, are conducted on simulated trading accounts. Neither firm offers unlimited, free demo accounts for pure practice in the way a traditional broker does.

The Funded Trader historically boasts one of the largest and most active communities in the industry, known as the Trading Kingdom. FundingPips has a supportive community, but its community size is smaller and less central to its brand identity.

Main competitors include The Funded Trader, Topstep, My Forex Funds, and FTMO. These are other popular prop trading firms offering funded accounts and evaluation programs.

FundingPips was founded and is owned by Khaled Ayesh. He is an experienced trader who established FundingPips based on his real-world experience, practical lessons, and a commitment to supporting the global trading community.

It depends on your trading style: MT5: Modern standard, fast execution, advanced charting cTrader: Great for scalping and advanced order types MT4: Ideal if you already use custom EAs or indicators (offered by TFT)

9. Conclusion

So, the final analysis in the Funding Pips vs The Funded Trader debate comes down to a choice between proven reliability and high-risk flexibility. Funding Pips stands out as the clear choice for traders who prioritise speed, simplicity, and, most importantly, trust.

On the other hand, The Funded Trader offers a framework with incredible trading flexibility and a massive community. However, the firm is currently navigating severe operational and trust issues. While the potential for freedom is appealing, the widespread reports of locked accounts and unpaid profits make it an extremely risky proposition at this time.

For more in-depth comparisons and reviews of the industry’s leading prop firms, be sure to explore the H2T Funding blog.