Quick Answer: FunderPro or FTMO? FunderPro is the ideal choice for traders who want flexible rules and rapid, daily payouts. In contrast, FTMO is a better fit for those who prioritize a structured process, proven reputation, and long-term discipline. Neither firm is absolutely “better,” only the one that best matches your trading style.

Choosing the right proprietary trading firm can be a defining moment in a trader’s career. The FunderPro vs FTMO decision represents a classic dilemma: do you opt for a modern firm with flexible rules or an established industry leader with a structured evaluation? Each path offers unique advantages, and the “better” choice is not always obvious, depending entirely on your personal trading style and goals.

This decision directly impacts your potential for growth, your daily trading experience, and your payout frequency. Here at H2T Funding, we understand the weight of this choice. Dive into our detailed FunderPro vs FTMO review to see a transparent breakdown of their models, rules, and costs, helping you select the perfect partner for your trading journey.

Key Takeaways

- FunderPro provides flexible one-phase and two-phase challenges designed for speed, while FTMO offers a highly structured, industry-standard two-step evaluation process focused on consistency.

- The Funderpro vs FTMO debate often highlights different risk parameters. FunderPro uses a consistency rule for certain accounts, whereas FTMO applies stricter restrictions on news and weekend trading for its funded traders.

- FunderPro stands out with its potential for daily payouts on Pro accounts. FTMO provides a reliable bi-weekly payout schedule and a well-defined scaling plan that increases the profit split to 90%.

- Traders have access to popular platforms like MetaTrader 4, MetaTrader 5, and cTrader with both firms. The specific range of tradable assets, including forex, indices, and crypto, is extensive for both.

- The ideal choice depends on your trading profile. FunderPro appeals to traders who prioritize flexibility and rapid payouts, while FTMO is a better fit for those who prefer a proven, structured system with a long-standing reputation.

1. Overview of FunderPro and FTMO

FunderPro and FTMO represent two powerful but different paths to a funded trading account. Founded around 2023, FunderPro embodies a modern, agile approach, focusing on flexible evaluations and extremely fast payouts. In stark contrast, FTMO, an industry benchmark since 2015, offers a highly structured evaluation process that prioritizes discipline and proven consistency over speed.

This fundamental difference creates a clear choice for traders based on their priorities.

Criteria Table – A Quick Overview

| Criteria | FunderPro | FTMO |

|---|---|---|

| Founded / Trust | Founded c. 2023 by Gary Mullen & Owen Morton. | Established in 2015, a long-standing industry leader. |

| Evaluation Models | Flexible 1-Phase & 2-Phase Challenges. | Standardized 2-Step Evaluation (Challenge & Verification). |

| Account Sizes | $5,000 to $200,000. | $10,000 to $200,000 (up to $400k total allocation). |

| Asset Classes | Forex, Indices, Commodities, Stocks, Crypto. | Forex, Indices, Commodities, Stocks, Crypto. |

| Trading Platforms | MetaTrader 5, cTrader, TradeLocker. | MetaTrader 4, MetaTrader 5, cTrader, and DXtrade. |

| Profit Split | Up to 90%. | Up to 90% (with Scaling Plan). |

| Minimum Days | No minimum trading days with an add-on. | 4 days per evaluation stage. |

| Scaling Programs | Yes, with potential to scale up to $5 million. | Yes, with potential to scale up to $2 million. |

| Execution Speed | Standard market execution. | Simulates real market execution with minor delays. |

| Commissions | Yes, on funded accounts for specific assets. | Yes, applied to simulate real market conditions. |

| Payouts | Daily, Weekly, or Bi-weekly options available. | Bi-weekly default payout cycle. |

| Risk Restrictions | Daily/Max Drawdown; Consistency Rule on some accounts. | Daily/Max Drawdown; Strict news & weekend rules. |

This overview clearly frames the Funderpro vs FTMO comparison. FunderPro is designed for traders who value operational speed and rule flexibility. FTMO, on the other hand, is built for traders who prefer a proven, systematic journey with one of the most reputable names in the business. Let’s explore each firm’s specific offerings.

Disclaimer: Rules, pricing, and trading conditions may change over time. Traders should always verify the latest terms directly on the official Funderpro vs FTMO websites before purchasing any challenge.

FunderPro

#1

Account Types

1-step and 2-step

Trading Platforms

MT5, TradeLocker, cTrader

Profit Target

5% – 10%

Our take on FunderPro

FunderPro makes a bold entrance by directly addressing the common pain points of funded traders. My personal impression is that this firm is built for the now; it’s a direct response to frustrations like slow payouts and overly rigid rules. This modern philosophy makes it a powerful contender for disciplined traders who are confident in their strategy and want to scale quickly without unnecessary delays.

| 💳 Challenge Fee | $69 – $1,121 |

| 👥 Account Types | 1-step and 2-step |

| 💰 Profit Split | 80% – 90% |

| 💵 Account Size | $5K – $200K |

| ⏱️ Time Limit | No time limit |

| 🎯 Profit Target | 5% – 10% |

| 📊 Trading Platforms | MT5, TradeLocker, cTrader |

| 🛍️ Asset Types | FX, Indices, Crypto, Stocks, Metals, Energies, Futures |

FTMO

#2

Account Types

2-step

Trading Platforms

MT4, MT5, cTrader, DXTrade

Profit Target

5% – 10%

Our take on FTMO

FTMO is the undisputed heavyweight champion of the prop trading world, known for its rigorous and respected evaluation. My take on FTMO is that it’s the industry’s rite of passage, built on a “no shortcuts” philosophy that commands respect. It is the go-to firm for systematic traders who value a proven track record, comprehensive support tools, and a clear path toward long-term growth.

| 💳 Challenge Fee | €89 – €1,080 |

| 👥 Account Types | 2-step |

| 💰 Profit Split | 80% – 90% |

| 💵 Account Size | $10K – $200K |

| ⏱️ Time Limit | No time limit |

| 🎯 Profit Target | 5% – 10% |

| 📊 Trading Platforms | MT4, MT5, cTrader, DXTrade |

| 🛍️ Asset Types | Forex, Commodities, Indices, Stocks, Crypto |

See more:

2. FunderPro vs FTMO comparison: Core models and key rules

The core models and rules of a prop firm are what truly define the trader’s journey. This section breaks down the evaluation difficulty, risk parameters, and trading policies to reveal how each firm operates.

2.1. Funding model & evaluation difficulty

The path to a funded account differs significantly between these two firms. FunderPro offers multiple pathways, including a faster one-phase challenge, while FTMO maintains its proven two-step process.

| Criteria | FunderPro | FTMO |

|---|---|---|

| Evaluation Required | Yes, 1-Phase or 2-Phase options are available. | Yes, a mandatory 2-Step Evaluation is required. |

| Profit Target | Higher in Phase 1 (10%) but offers a 1-Phase option. | More balanced targets across two steps (10% then 5%). |

| Time Pressure | None. Unlimited trading period on all challenges. | None. Unlimited trading period on all challenges. |

| Psychological Stress | Lower due to flexibility and lack of time limits. | Higher due to its structured process and industry reputation. |

| Overall Difficulty | Potentially easier due to the 1-Phase option. | More demanding due to the mandatory two steps. |

In conclusion, FunderPro offers a quicker and potentially easier start for skilled traders via its one-phase challenge. FTMO presents a more challenging but highly reputable path that builds discipline and is structured for long-term consistency.

2.2. Drawdown, consistency & risk rules

Risk management rules are non-negotiable in prop trading. While both firms enforce strict drawdown limits, their approach to consistency and other rules creates different trading environments.

| Criteria | FunderPro | FTMO |

|---|---|---|

| Max Drawdown | 6% (One-Phase) or 10% (Two-Phase), fixed from start. | 10% fixed from the initial account balance. |

| Daily Loss Limit | 3% (One-Phase) or 5% (Two-Phase). | 5% of the initial account balance. |

| Trailing Drawdown | No. FunderPro does not use a trailing drawdown. | No. Drawdowns are fixed, not trailing. |

| Consistency Rules | Yes. Applied to Pro and One-Phase challenges. | No. Does not enforce a specific consistency rule. |

| Rule Strictness | More lenient on trading style, stricter on consistency. | Stricter on event-based trading (news/weekends). |

Ultimately, FunderPro places a higher emphasis on consistent daily performance with its specific rule. In contrast, FTMO offers more freedom in day-to-day trading style but imposes stricter boundaries around market events.

2.3. News, overnight & strategy policies

A trader’s strategy can live or die by a firm’s policies on news trading and automation. Here, the differences are stark, especially once a trader is funded.

| Policy | FunderPro | FTMO |

|---|---|---|

| News Trading | Allowed during challenges. Forbidden on funded accounts unless you have the Swing add-on. | Allowed during challenges. Heavily restricted on standard funded accounts. |

| Overnight Trading | Permitted. | Permitted. |

| Weekend Trading | Allowed only with the purchase of the Swing add-on. | Not allowed on standard funded accounts. A Swing account type is available. |

| EA / Automation | Yes, provided the trader owns the EA and it does not exploit platform inefficiencies. | Yes, with similar restrictions to prevent abuse and strategy duplication. |

| Allowed Strategies | Hedging and scalping are permitted. Martingale is allowed but discouraged. | Hedging, scalping, and other common strategies are allowed if they are not exploitative. |

To summarize, FunderPro offers a slight edge in flexibility with its simple Swing add-on, which unlocks news and weekend trading. FTMO separates these into different account types, requiring traders to choose their style from the beginning. Both firms embrace automated strategies but maintain strict fair-use policies.

3. FunderPro vs FTMO review: Fees, refunds, and cost efficiency

The upfront cost and refund policies are critical factors in any trader’s decision. Both firms offer a refundable fee structure, but the details of their pricing and payout cycles create different value propositions.

| Criteria | FunderPro | FTMO |

|---|---|---|

| Fee Type | One-time fee per challenge attempt. | One-time fee per challenge attempt. |

| Refund Policy | Fee is credited back with the first reward on One-Phase and Classic challenges. Pro challenge fees are not refunded. | The fee is fully refunded with the first profit split from the FTMO Account. |

| Challenge Cost | Competitively priced, with a range of account sizes starting from $5k. | Industry-standard pricing, with frequent discounts. The smallest account is $10k. |

| Transparency | All costs are clearly stated upfront. Add-on prices are shown at checkout. | Highly transparent. All fees are clearly listed with no hidden charges. |

| Added Fees | Optional fees for add-ons like the Swing Account or 90/10 profit split. | No mandatory added fees. The Swing account is a separate account type, not an add-on. |

| Payout Cycle | Offers Daily, Weekly, and Bi-weekly options, enabling faster access to capital. | Standard bi-weekly payout cycle, starting 14 days after the first trade. |

In short, FTMO offers a simpler, universal refund policy, returning the fee to every successful trader. FunderPro’s policy is more nuanced, but its faster payout cycles can significantly improve a trader’s personal cash flow and overall cost efficiency once funded.

4. FunderPro vs FTMO debate: Profit split and scaling potential

Profit split and scaling potential are where a prop firm truly invests in its traders. FunderPro and FTMO both offer attractive profit shares and clear paths to account growth, but they cater to different trader ambitions regarding speed and structure.

| Criteria | FunderPro | FTMO |

|---|---|---|

| Profit Split | Up to 90% (available as an add-on or standard on some Pro accounts). | Starts at 80% and increases to 90% through the Scaling Plan. |

| Scaling Plans | Yes. According to the firm’s scaling plan, you can scale up to a $5 million account by hitting a 10% profit target over three consecutive months. | Yes. Scale up to a $2 million account by meeting a 10% profit target over a four-month cycle. |

| Payout Frequency | Daily, Weekly, or Bi-weekly. This is a significant advantage for capital flow. | Bi-weekly. Payouts can be requested every 14 days. |

| Minimum Payout | 1% of the initial balance for Pro accounts; $100 for Classic and One-Phase. | No minimum profit target on funded accounts, but payouts are on a fixed schedule. |

| Withdrawal Conditions | Simple request process via the dashboard. According to the firm, requests are typically processed within one business day, though user experiences may vary. | Straightforward requests through the trader portal are processed within 8 hours on average. |

In summary, FunderPro offers a higher ultimate scaling cap and unmatched payout speed, making it ideal for traders focused on rapid growth and immediate cash flow. FTMO provides a more methodical scaling plan that rewards long-term consistency with a permanent increase to a 90% profit split, appealing to traders with a steady, long-horizon strategy.

5. FTMO vs FunderPro: Platforms and tradable markets

A prop firm’s technology and market access are the foundations of a trader’s success. Both FTMO and FunderPro provide access to top-tier platforms and a diverse range of assets, ensuring traders have the tools they need to perform.

| Criteria | FunderPro | FTMO |

|---|---|---|

| Trading Platforms | MetaTrader 5, cTrader, and TradeLocker. | MetaTrader 4, MetaTrader 5, cTrader, and DXtrade. |

| Asset Classes | A wide selection of Forex, Indices, Metals, Energies, Stocks, and Cryptocurrencies. | An extensive list of Forex, Indices, Commodities, Stocks, and Cryptocurrencies. |

| Execution Speed | Simulated execution designed to reflect real market conditions. | Simulates real market conditions, which may include minor, realistic execution delays. |

| Commissions & Fees | Charged on funded accounts for Forex | Simulates real market commissions to test trader profitability under realistic conditions. |

| Trader Dashboard | A modern, user-friendly dashboard for tracking challenge progress and requesting payouts. | A comprehensive “Account MetriX” dashboard with in-depth analytics and trading tools. |

Ultimately, FTMO holds a slight advantage with its inclusion of MetaTrader 4 and DXtrade, offering a broader choice of platforms. However, both firms provide excellent market access and sophisticated dashboards, ensuring neither platform will be a limiting factor for a skilled trader.

6. Payout & trust: FunderPro and FTMO Reddit and Trustpilot reviews

Theoretical comparisons are useful, but nothing tells the real story like trader experiences. We delved into Trustpilot, Reddit (r/Forex, r/Trading), and other forums to gauge the true sentiment surrounding payout reliability, rule enforcement, and overall trust for both FunderPro and FTMO.

(Note: Information collected and updated on January 19, 2026)

Here’s what traders are actually saying about them.

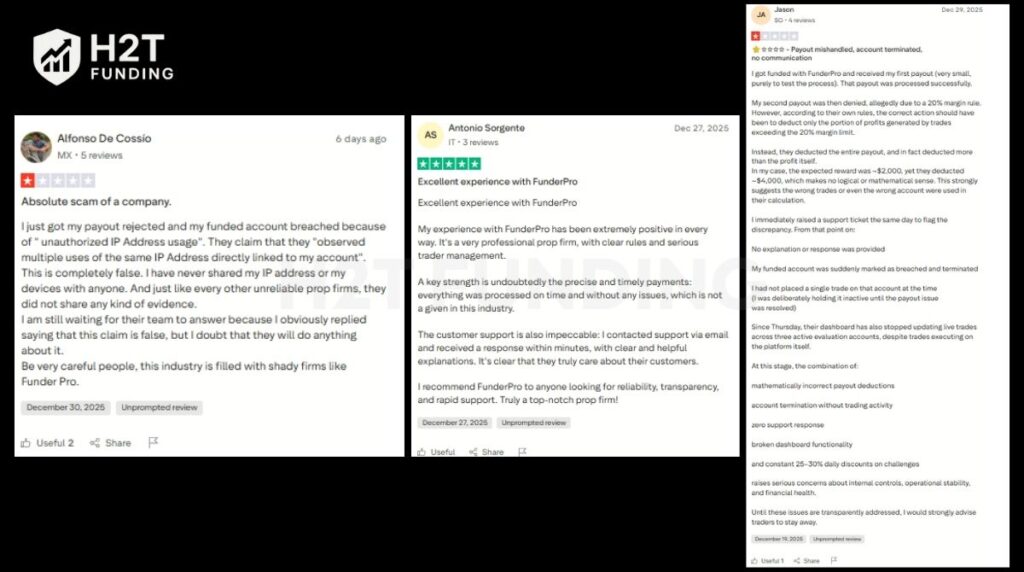

FunderPro’s reviews show a mix of strong satisfaction and significant frustration, which is common for a newer firm establishing its processes.

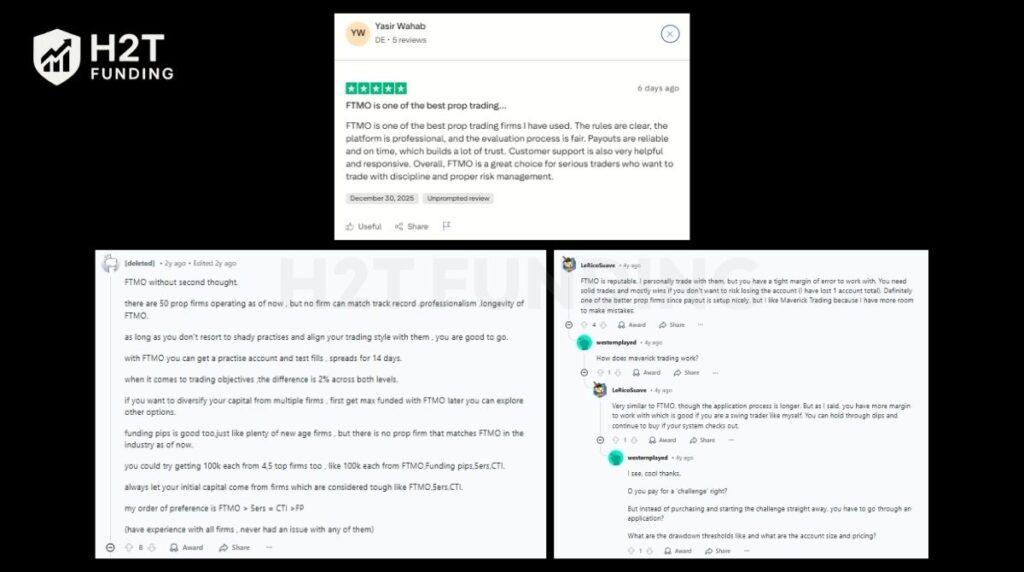

FTMO’s reputation is overwhelmingly positive, with traders consistently praising its professionalism and reliability. However, its strict rules are a recurring point of discussion.

The community feedback paints a clear picture.

FunderPro is seen as a high-potential firm with an innovative model, especially its fast payouts. However, the negative reviews consistently point to issues with payout delays, unclear rule enforcement (especially regarding IP addresses and margin), and support responsiveness. These appear to be growing pains as the firm scales.

FTMO, on the other hand, enjoys a stellar reputation for payout reliability and professionalism. Nearly every positive review confirms that if you follow the rules, you will get paid promptly. The primary “complaint” isn’t about legitimacy but about the strictness of its rules, which many traders also acknowledge as being fair and clearly defined. The consensus is that FTMO is tough but trustworthy.

7. FunderPro vs FTMO: Which prop firm is easier to pass?

Determining which prop firm is easier to pass depends on a trader’s individual strengths. However, by breaking down the core objectives, we can identify which firm offers a more straightforward path to a funded account.

| Criteria | Winner | Notes |

|---|---|---|

| Profit Target | FTMO | FTMO’s 5% target in the second phase is half of FunderPro’s 10% target for its One-Phase challenge, making the overall journey less demanding. |

| Drawdown Strictness | Both | Both firms have similar drawdown limits (around 10% max and 5% daily), with FunderPro offering slightly lower limits on its 1-Phase challenge. |

| Rule Complexity | FTMO | FTMO has a simpler rulebook during the evaluation, with no consistency rule to monitor. FunderPro’s consistency rule adds an extra layer of complexity. |

| Overall Difficulty | FunderPro | The existence of a One-Phase challenge gives FunderPro the edge. For a skilled trader, passing one stage is objectively easier than passing two. |

In conclusion, FunderPro is likely easier to pass for confident and experienced traders due to its one-phase challenge option. This model represents one of the most effective strategies for how to pass a prop firm challenge by meeting the profit target in a single step. For traders who prefer a more gradual process with a lower profit target in the final stage, FTMO’s two-step evaluation might feel more manageable.

8. FunderPro and FTMO: Which prop firm suits your trading style?

The best proprietary trading firm is the one that aligns perfectly with your specific trading style. Different models, rules, and payout structures are designed to support different types of traders on their path to profitability.

Here’s a breakdown of which firm is the better fit for various trader profiles.

| Trader Type | Best Choice | Why |

|---|---|---|

| Beginners | FTMO | Its structured 2-step process, extensive educational resources, and clear rules provide a solid foundation for developing discipline. |

| Systematic Traders | FTMO | The firm’s entire model is built on consistency and rule-following, which aligns perfectly with traders who operate a systematic, non-discretionary strategy. |

| Swing Traders | FunderPro | The Swing Account add-on is a simple, flexible solution that allows holding trades over the weekend without needing a separate account type. |

| Scalpers | FunderPro | The potential for daily payouts is a massive advantage for high-frequency traders who generate consistent, smaller profits and value rapid cash flow. |

| Risk-Averse Traders | FTMO | With its long-standing reputation for reliability and a fixed, predictable process, FTMO offers greater peace of mind for cautious traders. |

| Traders Aiming for >$1M Capital | FunderPro | FunderPro’s scaling plan explicitly goes up to $5 million, offering a higher ceiling for ambitious traders focused on long-term capital growth. |

Ultimately, the choice is clear. If you are a scalper, a swing trader, or someone who prioritizes flexible rules and the fastest possible payouts, FunderPro is built for you. If you are a beginner, a systematic trader, or someone who values reputation and a structured path to steady growth, FTMO remains the undisputed industry standard.

9. Common mistakes when choosing between FunderPro and FTMO

Even after selecting the right firm, many traders fail by overlooking critical details specific to each model. Avoiding these common mistakes is just as important as passing the challenge itself.

Here are the key pitfalls to watch out for:

- Choosing FunderPro but Ignoring the Consistency Rule: Many traders are attracted to FunderPro’s fast payouts, but fail to monitor their daily performance. A single oversized, profitable trade can breach the consistency rule on Pro or One-Phase accounts, jeopardizing their funded status even if they are profitable overall.

- Choosing FTMO and Trading Major News Events: Traders who pass the FTMO challenge sometimes forget that the rules change once they are funded. They continue to trade high-impact news on a standard funded account, violating the “2-minute rule” and leading to account termination.

- Using a “One-Size-Fits-All” EA or Bot: Some traders apply the same Expert Advisor across both firms without adjustments. An EA designed for scalping on FunderPro might not respect FTMO’s news restrictions, while a strategy for FTMO might not be aggressive enough to capitalize on FunderPro’s structure.

- Misunderstanding Weekend Holding Rules: A common error is holding positions over the weekend on a standard FTMO account or a FunderPro account without the Swing add-on. This is a hard breach for both firms and an easy way to lose a funded account.

In essence, the biggest mistake is failing to adapt your strategy to the specific rulebook of the firm you choose. Success comes not just from being a profitable trader but from being a compliant one.

10. FAQs – People Also Ask (Optimized)

“Better” depends on your trading style. Firms like FunderPro are considered strong alternatives, offering faster payouts and more flexible rules. However, FTMO remains a top choice for its long-standing reputation, structured evaluation, and comprehensive trader support.

No, FTMO is generally considered better for beginners. Its highly structured two-step evaluation process, extensive educational resources, and clear rules help new traders build discipline and strong risk management habits from the start.

FunderPro pays traders via profit splits from their funded accounts. Payouts can be requested through their dashboard and are typically processed to your chosen withdrawal method, such as bank transfer or crypto.

FunderPro is known for its fast payouts. While the official timeline can vary, they state that rewards are typically processed within one business day, with an average time of around 8 hours. Daily payout options are available for Pro accounts.

No. As of recent updates, FTMO’s standard services are not available to clients in the United States. They have partnered with OANDA to offer services to US traders through a separate, affiliated entity.

Yes, FTMO pays real money rewards to its funded traders. While you trade on a demo account with simulated capital, you receive a real profit split (up to 90%) based on your performance, which can be withdrawn.

FTMO does not have a 1% rule. This might be confused with FunderPro’s rule for Pro accounts, where traders can request a payout anytime their account is in profit by at least 1% of the initial balance.

The 2-minute rule applies to FTMO’s standard funded accounts. It prohibits traders from opening or closing trades on specific instruments within a two-minute window before and after a major news release to avoid excessive volatility.

The cost of the FTMO Challenge depends on the account size. Prices start at €155 (approximately $164) for a $10,000 account and go up to €1,080 (approximately $1,165) for a $200,000 account. This fee is fully refunded with your first profit split.

The top 5 prop firms often include FTMO, The 5%ers, FundedNext, Alpha Capital Group, and challengers like FunderPro. The “best” firm depends on a trader’s specific needs regarding rules, account size, and payout structure.

The CEO and Co-Founder of FunderPro is Gary Mullen. He co-founded the firm with Owen Morton with the mission of creating a more transparent and trader-friendly prop firm model.

FTMO does not officially stand for anything. The name originated from a project called “Získejúčet.cz” and was rebranded to FTMO as it expanded internationally. The letters do not form an acronym.

FunderPro is arguably easier to get funded with if you are an experienced trader. It’s one-phase challenge provides a direct, single-step path to a funded account, which is objectively faster and less complex than FTMO’s mandatory two-step process.

Yes, FunderPro is a legitimate proprietary trading firm. It offers real profit splits and has multiple user-reported payout proofs shared on social media and trading communities. However, as a newer firm, it has received mixed community reviews regarding rule enforcement and support.

Yes, FTMO is one of the most legitimate and reputable prop firms in the industry. Founded in 2015, it has a long and proven track record of paying out hundreds of millions of dollars to traders globally and holds an excellent rating on Trustpilot, confirming that top-tier prop firms are legit.

11. Conclusion

Ultimately, the FunderPro vs FTMO battle doesn’t have a single winner; it has the right choice for your specific trading profile. If you are a confident trader who values speed, flexible rules, and the industry’s fastest payout cycles, FunderPro is your clear choice.

Conversely, if you prioritize a proven, structured path, long-term consistency, and the peace of mind that comes with an unparalleled industry reputation, FTMO remains the gold standard.

Making the right decision is the first step toward a successful, funded trading career. To see how these two giants stack up against other leading firms, explore the complete library of in-depth Prop Firm Comparisons on the H2T Funding blog. Your ideal trading partner is waiting.