The FunderPro vs 5ers decision presents a critical choice for traders: do you prefer a direct evaluation model or a program built for long-term, exponential growth? FunderPro offers a clear, rule-based challenge, appealing to disciplined traders who can meet specific targets. In contrast, 5ers focuses on nurturing a real-funded mindset from day one, prioritizing risk management for sustainable scaling.

This definitive comparison breaks down every critical aspect of the 5ers vs FunderPro debate, from evaluation difficulty to profit potential. At H2T Funding, we believe in empowering traders with transparent information.

This guide will help you identify the firm that aligns perfectly with your strategy, risk tolerance, and career goals. Dive in to see which platform offers the best opportunity for you.

Key Takeaways:

- FunderPro utilizes a classic multi-phase evaluation challenge to grant funding, whereas 5ers offers multiple programs, including a unique Bootcamp and a Hyper-Growth model focused on scaling capital from the start.

- The FunderPro vs The5ers comparison shows different risk approaches. FunderPro has standard daily and max drawdown limits, while 5ers implements specific consistency rules and has varying policies on news trading depending on the program.

- 5ers is renowned for its aggressive scaling plan, allowing traders to double their account size at every 10% milestone, up to $4M. FunderPro also offers a scaling plan, but the structure and growth potential differ significantly.

- FunderPro is often a better fit for systematic traders who are confident in passing a structured challenge. 5ers appeals to both beginners (with its Bootcamp program) and experienced traders aiming for massive, long-term capital growth.

- Both firms provide access to popular trading platforms like MT5. They offer a similar range of tradable assets, including Forex, indices, and commodities, ensuring traders have access to diverse markets.

1. Overview of FunderPro and 5ers

FunderPro and 5ers represent two distinct paths in the proprietary trading world. FunderPro offers a structured, evaluation-based model designed to identify disciplined traders through a clear challenge process. This approach is direct and goal-oriented.

In contrast, 5ers, established in 2016, champions a long-term scaling journey with multiple funding tracks. They focus on cultivating a real-funded mindset from the start, prioritizing robust risk management and sustained growth over quick wins.

Criteria Table – Overview

| Criteria | FunderPro | 5ers |

|---|---|---|

| Founded / Trust | 2023 / Registered Company | 2016 / Highly Trusted |

| Evaluation Models | 2-Phase Challenge | 1-Step, 2-Step, 3-Step |

| Account Sizes | $25k – $200k | $5k – $250k (Initial) |

| Asset Classes | Forex, Indices, Crypto, Metals, Energies | Forex, Indices, Crypto, Metals, Commodities |

| Trading Platforms | MT5, cTrader, TradeLocker | MT5, cTrader |

| Profit Split | 80% (Up to 90% with Add-on) | Up to 100% at advanced scaling stages |

| Minimum Days | 5 Trading Days | 3 Trading Days (Varies by Program) |

| Scaling Programs | Yes, claimed potential up to $5M | Yes, up to $4M |

| Execution Speed | Market-competitive | Market-competitive |

| Commissions | Standard | Standard |

| Payouts | Weekly schedule (execution reliability reported as mixed) | Bi-weekly |

| Risk Restrictions | Daily & Max Drawdown | Daily & Max Drawdown, Consistency Rules |

This initial overview highlights a core difference: FunderPro tests your ability to pass a standardized challenge, while 5ers assesses your potential for long-term growth through more diverse programs. Your choice will depend on whether you want a straightforward gateway to funding or a comprehensive scaling partnership.

Quick Verdict: Which Firm Is for You?

| Choose FunderPro if… | Choose 5ers if… |

|---|---|

| You are a systematic trader confident in passing a 2-phase challenge. | You are seeking a trusted partner for long-term capital growth. |

| Your top priority is receiving weekly payouts. | You want an aggressive scaling plan that can double your account. |

| You need maximum platform flexibility (including TradeLocker). | You are a beginner who needs a structured program like the Bootcamp. |

| Your strategy relies heavily on unrestricted news trading. | A long-standing, proven reputation for trust and reliability is your deciding factor. |

Important Risk Disclosure

Before proceeding, it is crucial to understand the inherent risks of prop firms. While they offer a fantastic opportunity, success is not guaranteed. Keep in mind:

- Challenges are a risk: The evaluation fee is typically non-refundable if you fail. Treat it as an investment in your career.

- Rule violations are instant: A single bad trade can breach the daily or max drawdown limit, resulting in account termination.

- Payouts are not guaranteed: Payouts are contingent on profitability and adherence to all rules, which are subject to change. Always trade responsibly.

Disclaimer: Rules, pricing, and trading conditions may change over time. Traders should always verify the latest terms directly on the official FunderPro vs 5ers websites before purchasing any challenge.

FunderPro

#1

Account Types

1-step and 2-step

Trading Platforms

MT5, TradeLocker, cTrader

Profit Target

5% – 10%

Our take on FunderPro

FunderPro positions itself as a direct and modern prop firm. It provides traders with a clear, two-phase evaluation to secure funding quickly and efficiently.

My impression is that FunderPro is built for traders who are confident in their strategy and want a no-nonsense path to a funded account. The focus is on passing the evaluation and starting payouts quickly, with weekly withdrawals being a key feature. This model is ideal for systematic traders who have a proven edge and can consistently meet profit targets under pressure.

| 💳 Challenge Fee | $69 – $1,121 |

| 👥 Account Types | 1-step and 2-step |

| 💰 Profit Split | 80% – 90% |

| 💵 Account Size | $5K – $200K |

| ⏱️ Time Limit | No time limit |

| 🎯 Profit Target | 5% – 10% |

| 📊 Trading Platforms | MT5, TradeLocker, cTrader |

| 🛍️ Asset Types | FX, Indices, Crypto, Stocks, Metals, Energies, Futures |

The5ers

#2

Account Types

1-step, 2-step, 3-step

Trading Platforms

MT5, cTrader

Profit Target

5% – 10%

Our take on The5ers

The5ers has been a prominent and highly respected name in the industry since 2016. They offer a unique approach centered on sustained growth and trader development through various specialized programs.

My take is that 5ers operates more like a long-term funding partner than just an evaluation service. Their entire ecosystem is designed to find and scale talented traders, not just test them.

The availability of different models like the Bootcamp for beginners and Hyper-Growth for aggressive traders shows a commitment to fitting the trader, not the other way around. This firm is an excellent fit for traders with a long-term vision.

| 💳 Challenge Fee | $22 – $850 |

| 👥 Account Types | 1-step, 2-step, 3-step |

| 💰 Profit Split | 50% – 100% |

| 💵 Account Size | $2.5K – $250K |

| ⏱️ Time Limit | No time limit |

| 🎯 Profit Target | 5% – 10% |

| 📊 Trading Platforms | MT5, cTrader |

| 🛍️ Asset Types | Forex, Indices, Commodities, Crypto |

Read more:

2. FunderPro vs 5ers comparison: Core models and key rules

The fundamental difference between FunderPro and 5ers lies in their evaluation models and the specific rules that govern them. These rules directly impact your trading strategy, risk management, and overall experience with the firm. Understanding these distinctions is crucial to selecting the right partner for your trading journey.

2.1. Funding model & evaluation difficulty

The path to a funded account varies significantly between the two firms. FunderPro uses a traditional two-phase challenge, a familiar format for many traders. In contrast, 5ers provides a menu of options, including one, two, and three-step programs, each with unique difficulty levels and targets designed for different types of traders.

| Criteria | FunderPro | 5ers |

|---|---|---|

| Evaluation Required | Yes, 2-Phase Challenge | Yes (1, 2, or 3-Step, depending on program) |

| Profit Target | 10% (Phase 1), 5% (Phase 2) | Varies, e.g., 8% (High Stakes, Phase 1) |

| Time Pressure | None | None |

| Psychological Stress | High initial pressure due to the 10% target | Varies; can be lower on multi-step programs |

| Overall Difficulty | Higher initial hurdle, simpler structure | More flexible but potentially more complex to choose |

In short, FunderPro presents a single, more demanding initial challenge. In the 5ers vs FunderPro debate, 5ers offers an easier entry point with a lower profit target in its popular High Stakes program, but its real test lies in maintaining the discipline required for its long-term scaling model.

2.2. Drawdown, consistency & risk rules

Risk management rules are the guardrails of any prop firm, and this is where philosophies diverge. Both firms use standard daily and maximum drawdown limits based on the initial balance, avoiding the dreaded trailing drawdown that penalizes profitable traders. However, 5ers introduces another layer of scrutiny.

| Criteria | FunderPro | 5ers |

|---|---|---|

| Max Drawdown | 10% (Static) | 10% (Static on High Stakes) |

| Daily Loss Limit | 5% (Static) | 5% (Static on High Stakes) |

| Trailing Drawdown | No | No |

| Consistency Rules | No | Yes, prevents “one lucky trade” scenarios |

| Rule Strictness | Standard and clear | High, with an emphasis on consistent performance |

Ultimately, FunderPro’s rules are straightforward: stay within the loss limits. The FunderPro vs 5ers comparison shows that 5ers is stricter, as it demands not just profitability but consistent, repeatable performance, filtering out traders who rely on luck.

2.3. News, overnight & strategy policies

A firm’s policy on trading styles can make or break a trader’s edge. Both firms are quite flexible, allowing overnight and weekend positions, which is great for swing traders. They also permit the use of EAs and automated strategies, provided they do not fall into prohibited categories like copy trading from others.

| Policy | FunderPro | 5ers |

|---|---|---|

| News Trading | Generally allowed, subject to anti-abuse rules | Restricted on some programs (e.g., High Stakes) |

| Overnight Trading | Allowed | Allowed |

| Weekend Trading | Allowed | Allowed |

| EA / Automation | Allowed (with restrictions) | Allowed (with restrictions) |

| Allowed Strategies | Scalping, Swing, Day Trading | Scalping, Swing, Day Trading |

The most significant difference here is news trading. FunderPro offers more freedom for news-based strategies. Traders considering 5ers must carefully review the news trading rules for their chosen program to avoid accidental violations during high-impact events.

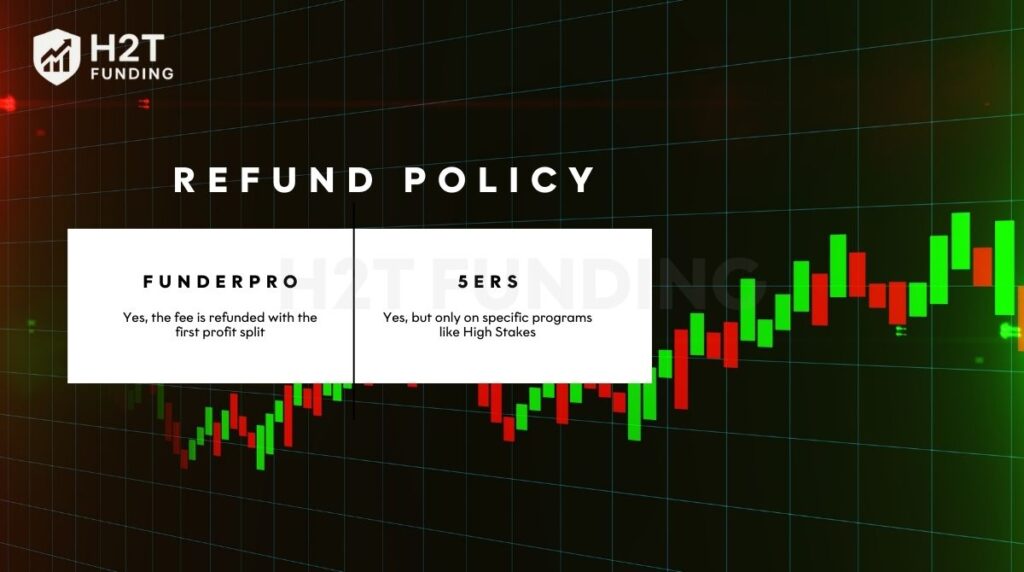

3. FunderPro vs 5ers review: Fees, refunds, and cost efficiency

A prop firm’s cost efficiency is measured by its entry fees, refund policies, and how quickly you can access your profits. This aspect of the FunderPro vs 5ers review reveals different approaches to value. FunderPro emphasizes rapid payouts, while 5ers focuses on offering one of the lowest entry points in the industry, making it highly accessible.

| Criteria | FunderPro | 5ers |

|---|---|---|

| Fee Type | One-Time Evaluation Fee | One-Time Fee (Varies by program) |

| Refund Policy | Yes, the fee is refunded with the first profit split | Yes, but only on specific programs like High Stakes |

| Challenge Cost | Starts at $149 for a $25k account | Starts at just $39 for a $5k High Stakes account |

| Transparency | High, no hidden fees | High explicitly states no hidden or recurring fees |

| Added Fees | None | None |

| Payout Cycle | Weekly | Bi-weekly (every 14 days) |

In conclusion, your choice depends on your financial priorities. 5ers offers an exceptionally low barrier to entry, making it one of the most cost-effective options to start. However, FunderPro provides faster access to your earnings with its weekly payout cycle, which can be a significant advantage for traders looking for more frequent cash flow.

4. FunderPro vs 5ers debate: Profit split and scaling potential

The ultimate goal for any funded trader is to maximize earnings through favorable profit splits and aggressive account scaling. The FunderPro vs 5ers debate is particularly intense in this area, as both firms offer compelling but structurally different paths to substantial capital. 5ers is famous for its hyper-growth model, while FunderPro attracts traders with a high standard split and rapid payouts.

| Criteria | FunderPro | 5ers |

|---|---|---|

| Profit Split | Standard 80%, scalable to 90% | Up to 100% at advanced scaling stages |

| Scaling Plans | Yes, claimed potential up to $5 Million | Select programs can double the account at profit milestones, up to $4M |

| Payout Frequency | Weekly | Bi-weekly (every 14 days) |

| Minimum Payout | Minimum payout thresholds apply | Minimum payout thresholds apply |

| Withdrawal Conditions | Withdrawals are available once payout cycle conditions are met. | First payout after 14 days on a funded account |

Ultimately, the choice comes down to your growth strategy. FunderPro offers a simpler, high-percentage split and faster payout frequency. However, 5ers provides an unparalleled opportunity for exponential capital growth, rewarding consistent profitability with one of the most aggressive and well-regarded scaling plans in the entire industry.

5. 5ers vs FunderPro: Platforms and tradable markets

A prop firm’s technology and market access are critical for effective trade execution. In the 5ers vs FunderPro comparison, both firms provide access to robust platforms and a wide array of asset classes, ensuring traders have the tools they need. However, FunderPro stands out by offering a broader selection of trading platforms, which can be a deciding factor for some traders.

| Criteria | FunderPro | 5ers |

|---|---|---|

| Trading Platforms | MT5, cTrader, TradeLocker | MT5, cTrader |

| Asset Classes | Forex, Indices, Crypto, Metals, Energies | Forex, Indices, Crypto, Metals, Commodities |

| Execution Speed | Market-competitive | Market-competitive |

| Commissions & Fees | Standard, competitive spreads | Standard, competitive spreads |

| Trader Dashboard | Modern and user-friendly | Comprehensive and data-rich |

In summary, while both firms offer excellent market access, FunderPro has a clear advantage in platform diversity, supporting TradeLocker in addition to the platforms offered by 5ers. This makes it a more flexible choice for traders who have a strong preference for a specific platform outside of MT5 or cTrader.

6. Payout & trust: FunderPro and 5ers Reddit and Trustpilot reviews

A prop firm’s reputation is ultimately built on its track record of paying traders and enforcing rules fairly. To get an unfiltered view, we turn to community platforms like Reddit and Trustpilot. These sources provide real-world accounts that cut through marketing promises, revealing the true trader experience.

(Note: Information collected and updated on Jan 12, 2026)

Sentiment Summary

| Criteria | FunderPro | 5ers |

|---|---|---|

| Payout reliability | Mixed. Some users confirm payments, but there are significant complaints about delays and denials. | Overwhelmingly Positive. Widely regarded as one of the most reliable firms for payouts. |

| Rule enforcement | Inconsistent. Reports of accounts being terminated for unclear reasons or disputed rule violations. | Strict but Fair. Praised for having clear rules and enforcing them consistently. |

| Support quality | Mixed. Some users report helpful agents, while many complain about slow or non-existent responses to critical issues. | Generally Praised. Support is frequently described as responsive, professional, and helpful. |

| Common complaints | Payout delays, incorrect profit deductions, platform execution issues (slippage), and unresponsive support. | Strict rule interpretation, KYC processing delays, and occasional spread spikes during high volatility. |

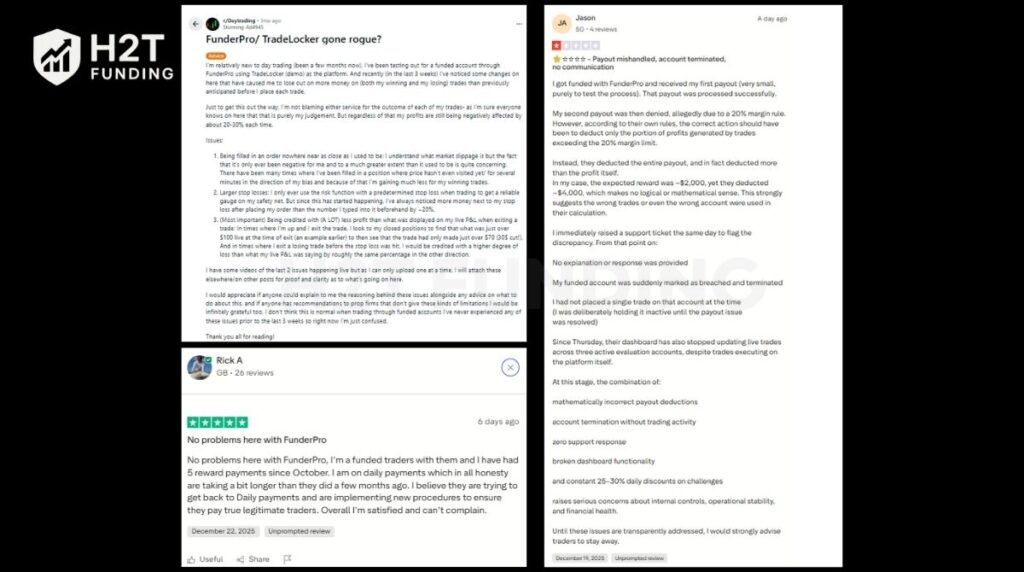

FunderPro: Mixed Community Feedback

Online discussions about FunderPro reveal a community with varied opinions. While some traders report positive experiences, a noticeable volume of complaints has been reported on platforms like Trustpilot and Reddit, primarily related to payout delays and rule interpretation.

Based on publicly available user discussions, we have gathered some examples. These reports often highlight challenges with payout disputes and platform issues.

These user accounts suggest a pattern of challenges with FunderPro. The primary issues revolve around payout processing and inconsistent rule application. While some traders are getting paid, the risk of encountering a serious, unresolved problem appears to be higher than with more established firms.

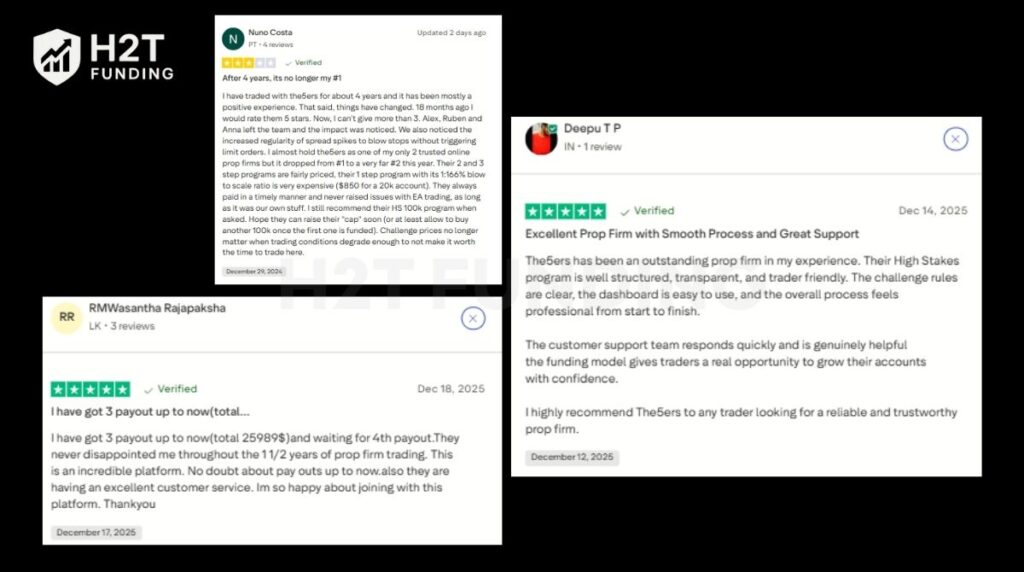

5ers: A Strong Reputation for Reliability

In contrast, 5ers enjoys a strong reputation backed by years of positive feedback. At the time of writing, the firm maintains an excellent Trustpilot rating of around 4.7-4.8 from tens of thousands of reviews, indicating high user satisfaction. Traders consistently praise the firm for its professionalism, transparent rules, and, most importantly, dependable payouts.

The following experiences from real traders showcase the firm’s commitment to building long-term, trusted relationships with its funded traders.

The community consensus is strong: 5ers is regarded as a reliable prop firm. While individual experiences can vary, the majority of feedback suggests that they honor their commitments and pay traders consistently.

7. FunderPro vs 5ers: Which prop firm is easier to pass?

Deciding which prop firm is easier to pass depends on how you define easy, as many factors are at play when looking for the easiest prop firms to pass. The difficulty is not just about profit targets; it’s a combination of rule complexity, drawdown limits, and the psychological pressure each model creates. A lower profit target might seem easier, but stricter underlying rules can quickly level the playing field.

| Criteria | Winner | Notes |

|---|---|---|

| Profit Target | 5ers | The 8% target in the High Stakes program is more attainable than FunderPro’s 10% in Phase 1. |

| Drawdown Strictness | Tie | Both firms use a fair, static 10% max drawdown and 5% daily loss, which is a clear industry standard. |

| Rule Complexity | FunderPro | Its rules are simpler, lacking the consistency requirements and specific news trading restrictions of 5ers. |

| Overall Difficulty | 5ers | The lower initial profit target gives traders more breathing room and reduces immediate pressure. |

Answering the question directly: 5ers is generally easier to pass, specifically because of its lower initial profit target. The 8% goal in their popular High Stakes program is a more realistic and less stressful hurdle than FunderPro’s 10%. While FunderPro’s rules are simpler on paper, the higher performance demand in Phase 1 makes it a tougher initial challenge for most traders.

8. FunderPro and 5ers: Which prop firm suits your trading style?

The best prop firm for you is the one that aligns seamlessly with your personal trading style, risk tolerance, and long-term ambitions. A platform that feels intuitive to one trader might feel restrictive to another. This section breaks down the ideal choice for various trader profiles in the FunderPro and 5ers matchup.

| Trader Type | Best Choice | Why |

|---|---|---|

| Beginners | 5ers | The Bootcamp program offers a structured, three-step learning curve with lower initial costs and clear progression. |

| Systematic Traders | FunderPro | The straightforward 2-phase challenge with clear profit targets and no consistency rule perfectly suits a rule-based system. |

| Swing Traders | Tie | Both firms allow holding trades overnights and weekends, accommodating longer-term strategies without restriction. |

| Scalpers | FunderPro | FunderPro’s unrestricted news trading policy provides more opportunities for high-frequency scalping strategies during volatile events. |

| Risk-Averse Traders | 5ers | Their long-standing, trusted reputation for payouts and fair rule enforcement provides greater peace of mind and security. |

| Traders Aiming for $1M+ Capital | 5ers | The famous hyper-growth scaling plan is specifically designed for exponential growth, making it the superior choice for ambitious traders. |

In conclusion, your trading personality should be the deciding factor. FunderPro is the optimal choice for disciplined, systematic traders who want a clear, unobstructed path to funding and fast payouts. In contrast, 5ers is the superior platform for traders focused on long-term, exponential growth and those who value a firm’s established trust and reliability above all else.

9. FAQs

Yes, absolutely. The5ers has one of the strongest reputations in the industry for reliable and timely payouts. With a history dating back to 2016 and an excellent Trustpilot score from thousands of reviews, they are widely considered a highly trustworthy firm that consistently pays its successful traders.

The5ers provides its traders with access to two of the most powerful and popular platforms in the industry: MetaTrader 5 (MT5) and cTrader.

No, The5ers prohibits strategies that involve copy trading from other individuals or signal services. Their goal is to fund traders based on their unique skills and strategies. Using an EA or automated software for your own strategy may be allowed, but copying others’ trades is a breach of their rules.

Most reputable prop firms, including The5ers and FunderPro, have strict rules against copy trading. They aim to fund individual talent, and copying trades from an external source makes it impossible to verify a trader’s unique edge. Always check the terms and conditions, as this is a widely prohibited practice.

It depends on the program. Some programs, like Hyper-Growth, allow news trading (excluding specific strategies like bracketing). However, the popular High Stakes program prohibits executing new orders two minutes before and after a high-impact news event. It is critical to check the specific rules for your chosen program to avoid violations.

There is no official “1% rule” mandated by The5ers. However, applying sound risk management, such as risking only 1-2% of your account per trade, is a professional standard that successful traders use. This practice helps traders stay well within the firm’s drawdown limits and manage risk effectively.

Yes. The evaluation or challenge phases are conducted on a demo account to test your skills. Once you successfully pass all the required stages and the KYC verification, you are granted access to a live funded account to trade with the firm’s real capital.

The5ers offers several reliable and modern payout solutions to accommodate its global traders. Common methods include bank transfers and crypto, often processed through third-party platforms like Deel. Specific options can be found in the trader’s dashboard once they are funded.

Yes, 5ers is widely regarded as one of the most trusted and reputable prop firms in the industry. Their long history since 2016, overwhelmingly positive community feedback, and a proven track record of consistent payouts make them a top choice for traders seeking reliability and security.

FunderPro processes payouts on a weekly basis, which is one of its main attractions. They offer various withdrawal methods, including bank transfers and crypto, allowing traders to access their profits quickly and conveniently.

The community sentiment on FunderPro is mixed. While some traders report successful and timely payouts, there is a significant volume of complaints on platforms like Trustpilot and Reddit regarding payout delays, inconsistent rule enforcement, and unresponsive customer support. Therefore, traders should exercise caution and conduct thorough due diligence.

10. Conclusion

Ultimately, the FunderPro vs 5ers debate concludes not with a single winner, but with a clear choice between two distinct trading philosophies. FunderPro offers a direct route for systematic traders confident in their ability to meet clear targets and who value the speed of weekly payouts and platform flexibility.

Conversely, 5ers stands as the superior choice for traders prioritizing long-term, exponential growth and the security that comes with a highly trusted, established firm.

Your decision should be a reflection of your personal strategy and career ambitions. Making the right choice is the first step toward a successful funded career, and H2T Funding is committed to providing the clarity you need. To continue your research, explore other in-depth prop firm comparisons and find the perfect partner for your trading journey.