In the prop trading arena, the FundedNext vs The5ers debate is a clash of titans. On one side, FundedNext stands as the modern gladiator, offering a high-speed sprint to capital with flexible, adaptable rules. On the other hand, The 5%ers plays the role of the seasoned master, guiding traders through a structured marathon designed for disciplined, long-term growth.

This isn’t about choosing which firm is better; it’s about discovering which philosophy matches your trading soul. At H2T Funding, we’ve done the heavy lifting for you. Dive into our definitive comparison to see which of these giants will help you forge not just a funded account, but a lasting career.

Key takeaways

- FundedNext prioritizes flexibility, speed, and diverse options, making it a dynamic environment for various trading styles. The5ers, in contrast, offers a highly structured, long-term growth journey designed to build discipline and consistent performance over time.

- FundedNext provides multiple direct paths to funding, including its popular 1-Step and 2-Step Stellar challenges. The5ers employs unique, multi-stage programs like the 3-step Bootcamp and the 1-step Hyper-Growth, where each stage is a milestone in itself.

- Both firms enforce strict drawdown limits. However, The5ers applies a daily loss protection mechanism in some programs. For instance, its Hyper Growth model may restrict trading for the day when the limit is reached, offering a more forgiving environment for certain errors.

- FundedNext offers a straightforward scaling plan up to $4 million with a profit split reaching 90%. The5ers features an aggressive growth model, doubling your account size at every 10% profit milestone in its Hyper Growth plan, with a profit share that can reach 100% at higher scaling levels.

- If you are an experienced, aggressive trader seeking flexibility, multiple account options, and rapid funding, FundedNext is likely your better fit. If you are a systematic trader who values a disciplined, predictable, and long-term scaling plan with mentorship, The5ers offers a more tailored path.

1. Overview of FundedNext and The5ers

FundedNext and The5ers are two of the most respected names in proprietary trading, yet they cater to different trader archetypes. FundedNext positions itself as a modern, agile firm offering diverse evaluation models, aggressive scaling, and exceptional flexibility. It’s designed for traders who value speed and multiple pathways to funding. A detailed FundedNext prop firm review often highlights its trader-friendly rules.

In contrast, The5ers operates with a more structured, long-term philosophy. It focuses on cultivating trading discipline through milestone-based programs that reward consistency. This firm is built for traders who see its funding programs as a progressive career path, not just a one-time challenge.

Criteria Table – Overview

| Criteria | FundedNext | The5ers |

|---|---|---|

| Founded / Trust | Global fintech company, high Trustpilot rating | Established in 2016, with a strong industry reputation |

| Evaluation Models | 1-Step, 2-Step, Instant Funding | 1-Step, 2-Step, 3-Step (Bootcamp) |

| Account Sizes | $6k – $200k (CFDs) / $25k – $100k (Futures) | $5k – $250k |

| Asset Classes | Forex, Indices, Commodities, Crypto | Forex, Metals, Indices, Crypto |

| Trading Platforms | MT4, MT5, cTrader, Match-Trader | MT5 |

| Profit Split | Up to 90% | Up to 100% |

| Minimum Days | Varies by program (some have 5 days) | Varies (some have 3 profitable days) |

| Scaling Programs | Up to $4 Million | Up to $4 Million (doubles on target) |

| Execution Speed | Optimized execution environment | Competitive raw spreads |

| Commissions | Low and competitive | Competitive raw spreads |

| Payouts | On-demand, within 24 hours | 14-day cycle |

| Risk Restrictions | Fixed drawdown, no trailing on most models | Fixed and trailing drawdown options |

This high-level FundedNext vs. The5ers already shows a clear divide. FundedNext appeals to traders seeking speed, flexibility, and a wide array of platform choices. In contrast, The5ers attracts those who prefer a disciplined, milestone-driven path with aggressive scaling potential. The following sections will dive deeper into what this means for you.

Disclaimer: Rules, pricing, and trading conditions may change over time. Traders should always verify the latest terms directly on the official FundedNext vs The5ers websites before purchasing any challenge.

FundedNext

#1

Account Types

1-step, 2-step, and Instant Funding

Trading Platforms

MT4, MT5, cTrader, Match Trader

Profit Target

4% – 10%

Our take on FundedNext

FundedNext has rapidly become a dominant force in the prop trading industry, known for its modern approach and trader-centric policies. It’s an excellent choice for confident traders who want flexibility in their trading styles and a fast track to substantial capital, backed by a firm that prioritizes quick payouts.

| 💳 Challenge Fee | $32 – $1,099 |

| 👥 Account Types | 1-step, 2-step, and Instant Funding |

| 💰 Profit Split | 80% – 95% |

| 💵 Account Size | $2K – $200K |

| ⏱️ Time Limit | No time limit |

| 🎯 Profit Target | 4% – 10% |

| 📊 Trading Platforms | MT4, MT5, cTrader, Match Trader |

| 🛍️ Asset Types | Forex, Indices, Commodities, Crypto, CFDs |

The5ers

#2

Account Types

1-step, 2-step, 3-step

Trading Platforms

MT5, cTrader

Profit Target

5% – 10%

Our take on The5ers

As one of the industry’s pioneers, The5ers has built its reputation on a foundation of discipline and long-term partnership. The firm is ideal for systematic traders who value a clear, structured pathway with an emphasis on career growth and aggressive account scaling. Their models are designed to build successful traders from the ground up.

| 💳 Challenge Fee | $22 – $850 |

| 👥 Account Types | 1-step, 2-step, 3-step |

| 💰 Profit Split | 50% – 100% |

| 💵 Account Size | $2.5K – $250K |

| ⏱️ Time Limit | No time limit |

| 🎯 Profit Target | 5% – 10% |

| 📊 Trading Platforms | MT5, cTrader |

| 🛍️ Asset Types | Forex, Indices, Commodities, Crypto |

Read more:

2. FundedNext vs The5ers comparison: Core models and key rules

The heart of the FundedNext vs The5ers debate lies in their core models and key rules. These parameters define the entire trading experience, from the initial challenge to long-term scaling. How a firm structures its profit targets, drawdown limits, and daily rules directly impacts a trader’s strategy and psychological state. This section breaks down those critical differences.

2.1. Funding model & evaluation difficulty

The evaluation models at FundedNext and The5ers are built on different philosophies, each with unique evaluation phases and trading objectives. FundedNext offers a more direct, sprint-like approach with its clear 1-Step and 2-Step challenges.

In contrast, The5ers presents a marathon, with multi-stage programs like Bootcamp and Hyper Growth designed to methodically build a trader’s discipline over time.

| Criteria | FundedNext | The5ers |

|---|---|---|

| Evaluation Required | Yes (1-Step, 2-Step, or Instant) | Yes (1-Step, 2-Step, or 3-Step) |

| Profit Target | 5% to 10%, depending on the model and phase | 5% to 10%, depending on the program and phase |

| Time Pressure | None (Unlimited time on all challenges) | None (Unlimited time on all challenges) |

| Psychological Stress | Focused on passing distinct phases quickly | Spread across multiple, smaller milestones |

| Overall Difficulty | More straightforward; clear pass/fail objectives | More complex; requires sustained discipline over stages |

In conclusion, the FundedNext evaluation model is generally more direct and may feel easier to start for traders who prefer a clear, single objective. The5ers’ approach is more intricate and requires greater patience, but its milestone-based structure can reduce the psychological pressure of hitting a single, large profit target.

2.2. Drawdown, consistency & risk rules

Risk rules are non-negotiable in prop trading, and this is a core part of any The5ers vs FundedNext review. While both firms are strict, their approach to drawdowns and consistency varies significantly, which can make or break a trader’s journey.

| Criteria | FundedNext | The5ers |

|---|---|---|

| Max Drawdown | 8% to 10% (Fixed, not trailing on Stellar models) | 4% to 10% (Can be fixed or trailing, depending on model) |

| Daily Loss Limit | 4% to 5% (Fixed) | 3% to 5% (Some programs may temporarily restrict trading instead of an immediate breach) |

| Trailing Drawdown | No trailing drawdown on its main Stellar CFD models | Yes, on some programs like Hyper Growth (until locked) |

| Consistency Rules | Primarily on Futures models; less restrictive on CFD | Integrated into the model (e.g., minimum profitable days) |

| Rule Strictness | High, but the rules are very clear and simple | High, but with unique forgiving features like the Daily Pause |

In conclusion, FundedNext offers simpler, fixed drawdown limits, which many traders find easier to manage and less stressful than trailing drawdowns. The5ers incorporates more nuanced rules, like a feature in some programs that may pause trading for the day upon hitting the loss limit, reflecting its deep focus on long-term risk management.

2.3. News, overnight & strategy policies

A trader’s freedom is defined by a firm’s policies on different trading styles and market events. The flexibility to trade during news or hold positions overnight is a critical factor for many, and it’s an area where this FundedNext vs The5ers review finds notable differences.

| Policy | FundedNext | The5ers |

|---|---|---|

| News Trading | Fully allowed on all CFD accounts | Allowed to hold trades, but prohibits executing orders 2 mins before/after news on High Stakes |

| Overnight Trading | Allowed | Allowed |

| Weekend Trading | Allowed | Allowed |

| Automated Trading / EAs | Allowed, with restrictions against exploitative EAs | Allowed, with similar restrictions against prohibited strategies |

| Allowed Strategies | Wide variety, including scalping (excluding tick scalping) | Flexible, accommodating many styles within their ruleset |

FundedNext provides slightly more trading freedom, particularly with its unrestricted approach to news trading execution. However, both firms give traders ample room for various legitimate strategies across multiple trading platforms. Adhering to these policies is essential for securing the high profit split offered, a detail often discussed in FundedNext Reddit threads.

3. FundedNext vs The5ers review: Fees, refunds, and cost efficiency

Cost efficiency is a crucial factor when choosing a prop trading firm. This FundedNext vs The5ers review examines not just the upfront challenge cost but also the long-term value offered through refund policies and payout structures. Both firms operate on a one-time fee model, but their approaches to refunds and overall value differ significantly.

| Criteria | FundedNext | The5ers |

|---|---|---|

| Fee Type | One-time fee per challenge | One-time fee per challenge |

| Refund Policy | Full refund with the first payout from the funded account | Full refund with the first payout from the funded account (High Stakes) |

| Challenge Cost | Highly competitive (e.g., $59 for a $6k account) | Very competitive (e.g., $39 for $5k High Stakes) |

| Transparency | No hidden fees, all costs are stated upfront | No hidden fees, clear and transparent pricing |

| Added Fees | None; no monthly or recurring charges | None; no subscription or recurring charges |

| Payout Cycle | On-demand, eligible from day one on a funded account | Every 14 days, starting 14 days after getting funded |

In conclusion, both firms offer excellent value with competitive, transparent pricing and no hidden fees. FundedNext gains an edge with its on-demand payout cycle, giving traders faster access to their earnings.

The5ers also provides great value with its low-cost entry points, making it accessible for traders on a budget. For those wondering how to buy The5ers account, the process for their High Stakes and Bootcamp programs is straightforward.

4. FundedNext vs The5ers debate: Profit split and scaling potential

A prop firm’s true value is revealed in its profit-sharing and growth opportunities. The FundedNext vs The5ers debate intensifies here, as both firms offer compelling but structurally different paths to earning significant income and managing larger capital. This section compares how each firm rewards and grows its successful traders.

| Criteria | FundedNext | The5ers |

|---|---|---|

| Profit Split | Starts at 80%, scales up to 90% | Starts at 80%, can reach 100% at higher scaling levels or via fixed payouts |

| Scaling Plans | Offers a performance-based scaling plan that can increase account size over time, up to a maximum of $4 million, based on program-specific consistency rules. | Doubles account balance at every 10% profit milestone (Hyper Growth), up to $4M |

| Payout Frequency | On-demand, processed within 24 hours | Every 14 days |

| Minimum Payout | No minimum amount specified | No minimum amount specified |

| Withdrawal Conditions | Eligible for payout immediately after receiving a funded account | Eligible for first payout 14 days after receiving a funded account |

In conclusion, The5ers offers a more aggressive and potentially faster scaling plan, with its unique double your account model and the possibility of a 100% profit split. However, FundedNext provides unparalleled speed and flexibility with its on-demand, 24-hour payout promise.

The choice here is between the explosive, milestone-driven growth of The5ers and the steady, flexible performance rewards offered by FundedNext.

5. FundedNext vs The5ers: Platforms and tradable markets

A trader’s toolkit is only as good as the platform and assets available. In this The5ers vs FundedNext comparison, the choice of technology and market access reveals a significant difference in philosophy. One firm prioritizes a wide array of choices, while the other focuses on perfecting a single, powerful environment.

| Criteria | FundedNext | The5ers |

|---|---|---|

| Trading Platforms | MT4, MT5, cTrader, and Match-Trader | MT5 only |

| Asset Classes | Forex, Indices, Commodities, Cryptocurrencies | Forex, Metals, Indices, Cryptocurrencies |

| Execution Speed | An optimized execution environment across all platforms | An optimized MT5 environment with competitive raw spreads |

| Commissions & Fees | Low and competitive, varies by platform | Highly competitive, transparent fees on MT5 |

| Trader Dashboard | Modern, intuitive dashboard with detailed analytics | Comprehensive dashboard integrated with the MT5 environment |

In conclusion, FundedNext is the clear winner for traders who demand platform variety, offering four of the industry’s leading options. This flexibility is a major advantage for those accustomed to a specific interface.

The5ers, by contrast, focuses exclusively on providing a highly optimized MT5 experience, which may appeal to traders who prefer to master a single, robust platform. Both firms offer a similar range of trading instruments.

6. Payout & trust: FundedNext and The5ers Reddit and Trustpilot reviews

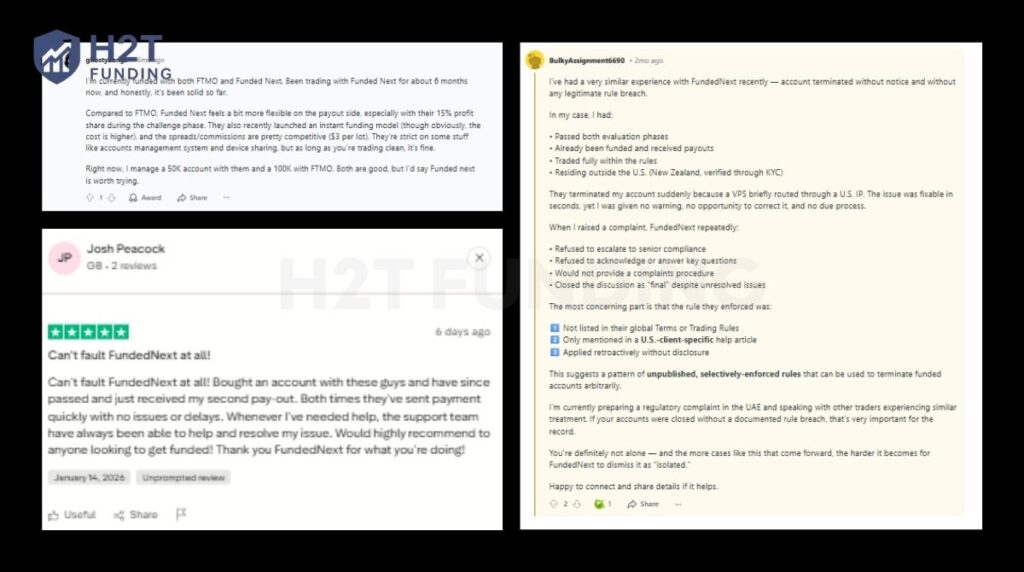

While a firm’s rules are important, the true measure of reliability is found in real trader experiences. We delved into community feedback, analyzing user reviews and searching for discussions like FundedNext vs The5ers reddit to get an unfiltered look at payout consistency. This is where we sift through praise and trader complaints to see what’s really happening.

Below, we’ve curated a balanced selection of both positive and negative comments. These testimonials provide a realistic picture of what you can expect when dealing with FundedNext and The5ers.

Community feedback for FundedNext is largely positive, with many traders praising the firm’s fast payouts and flexible rules. Positive FundedNext reviews frequently confirm that the company honors its 24-hour payout promise. However, some negative reviews point to strict enforcement of rules regarding account management and technicalities, which has led to disputes.

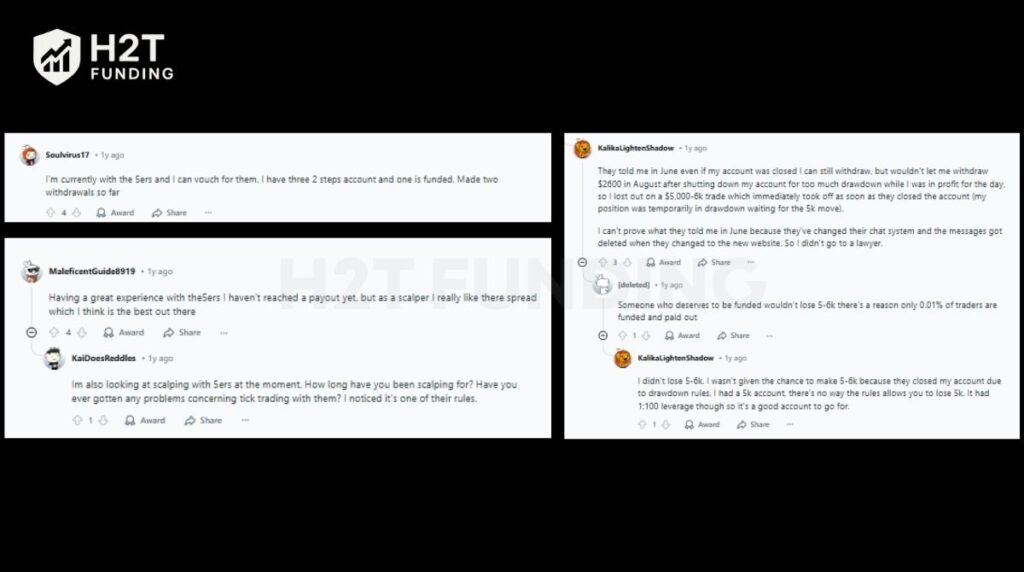

When traders ask, Is TheThe5ers legit? The community feedback and the firm’s long-standing reputation provide a strong answer. The firm is widely regarded as one of the original, legitimate players in the prop trading space.

Positive reviews frequently praise its professionalism, consistent payouts, and excellent trading conditions, especially the low spreads. Criticisms are less common but tend to focus on specific incidents of slippage or disputes after an account breach.

The community feedback shows that both firms are legitimate and consistently pay their successful traders. FundedNext earns high marks for its payout speed and modern feel, though some traders express frustration with its strict enforcement of background rules like device sharing and IP monitoring.

The5ers is praised for its longevity and excellent trading conditions, with the few notable complaints focusing on specific, situational disputes rather than systemic issues.

7. FundedNext vs The5ers: Which prop firm is easier to pass?

Deciding which prop firm is easier to pass depends on a trader’s individual strengths and weaknesses. The question isn’t just about the numbers but about the structure of the challenge itself. This breakdown compares the key factors that contribute to the overall difficulty of passing each firm’s evaluation.

| Criteria | Winner | Notes |

|---|---|---|

| Profit Target | The5ers | Both firms have comparable profit targets, typically ranging from 5% to 10%, depending on the program. Neither has a distinct advantage here. |

| Drawdown Strictness | FundedNext | FundedNext’s fixed, non-trailing drawdown on its popular Stellar CFD models is psychologically easier to manage for most traders compared to a trailing drawdown. |

| Rule Complexity | FundedNext | The rules for FundedNext’s evaluation models are generally more straightforward and direct. The5ers’ multi-stage programs add layers of complexity. |

| Overall Difficulty | FundedNext | Due to its simple rules, lack of a trailing drawdown, and clear pass/fail objectives, FundedNext presents a more direct and less complex path to getting funded. |

So, which prop firm is easier to pass?

For the majority of traders, FundedNext is easier to pass. Its combination of clear, straightforward rules, fixed drawdown limits, and unlimited time creates a less psychologically demanding environment. The absence of a trailing drawdown on its main Stellar CFD programs is a significant advantage, as it prevents the breathing room from shrinking as profits grow.

While The5ers’ models are designed for long-term success, their complexity requires more sustained discipline to navigate, especially under volatile market conditions, making the initial path to funding more intricate.

8. FundedNext and The5ers: Which prop firm suits your trading style?

Ultimately, the best choice in the FundedNext and The5ers matchup depends entirely on you. Your trading style, risk tolerance, and career goals will determine which firm’s ecosystem is the right fit. This table breaks down our recommendations for different types of traders.

| Trader Type | Best Choice | Why |

|---|---|---|

| Beginners | The5ers | The Bootcamp program offers a low-cost, structured path. With clear rules on minimum trading days and profit targets, it is perfect for learning discipline. |

| Systematic Traders | The5ers | The milestone-based growth of the Hyper Growth program perfectly aligns with traders who follow a strict, repeatable process and value a clear path. |

| Swing Traders | FundedNext | Its rules provide high trader flexibility, allowing overnight and weekend holding with fixed drawdowns, which gives swing traders the stability they need. |

| Scalpers | FundedNext | With multiple trading platforms and a reputation for fast execution, FundedNext offers a more versatile environment for high-frequency strategies. |

| Risk-Averse Traders | FundedNext | The fixed drawdown limits on Stellar models are predictable and less stressful, preventing the profit target from working against you. |

| Traders Aiming for $1M+ Capital | The5ers | The double your account scaling plan in the Hyper Growth model is one of the most aggressive and fastest ways to reach large capital levels in the industry. |

There is no one-size-fits-all answer. FundedNext excels for traders who prioritize flexibility, platform choice, and speed. It’s a modern environment for dynamic traders. The5ers is the superior choice for those who seek a disciplined, long-term career path with one of the most powerful scaling programs available.

9. FAQs

Yes, FundedNext is widely regarded as a very good prop firm. It is known for its flexible rules, fast payouts (often within 24 hours), multiple evaluation models, and support for various trading platforms. Its high rating on Trustpilot reflects strong positive community feedback.

Absolutely. The5ers has a long-standing reputation for consistent and reliable payouts since its founding in 2016. They are considered one of the most established and trustworthy firms in the industry, and successful traders regularly confirm receiving their profits.

Yes, FundedNext accepts clients from the USA. U.S. traders can participate in both CFD and Futures challenges, though platform availability is typically limited to cTrader and Match-Trader for CFDs to comply with regulations.

A 15k FundedNext Stellar 2-Step challenge account costs $119. This is a one-time fee that is fully refundable upon receiving your first payout from the funded account.

The cost for a 100k account varies: At FundedNext, a 100k Stellar 2-Step challenge costs $549. At The5ers, a 100k High Stakes challenge costs $545.

For most traders, FundedNext is considered easier to pass. This is primarily due to its straightforward rules and, most importantly, its fixed drawdown limits on Stellar models, which are psychologically less stressful than trailing drawdowns.

The5ers is generally better for beginners because of its Bootcamp program. This three-step challenge offers a low-cost entry and a structured environment designed to teach discipline and consistency, which are crucial skills for new traders.

Yes, The5ers is 100% legit. As one of the pioneering firms in the online prop trading industry (founded in 2016), it has a long and proven track record of funding traders and processing payouts reliably.

Yes, FundedNext is 100% legit. It has quickly become a top-tier firm with a massive global user base and thousands of positive reviews on Trustpilot confirming its reliability and consistent payout performance.

The main disadvantages of FundedNext stem from its strict rule enforcement. Key points include: A strict policy against hyperactivity (excessive trading messages). A zero-tolerance approach to prohibited strategies like account sharing, which can lead to account termination without warning.

The primary disadvantages of The5ers are its limited platform choice (MT5 only), lower leverage (1:30) on some of its popular programs, and more complex, multi-stage evaluation models that can be harder for some traders to navigate.

If you are a complete beginner, The5ers’ Bootcamp is an excellent first choice due to its educational structure. If you have some experience and value simplicity and flexibility, FundedNext’s Stellar 2-Step model is a fantastic and straightforward option for a first account.

The5ers has a more aggressive scaling plan, doubling the account size for every 10% profit target met in its Hyper Growth program. FundedNext offers a performance-based scaling plan where account size can increase over time based on consistent profitability, with the exact criteria varying by program.

FundedNext applies a 40% consistency rule on some of its Futures models, while its CFD challenges are less restrictive. In contrast, The5ers integrates consistency through requirements like minimum profitable days and its structured, multi-stage profit targets.

10. Conclusion

When comparing The5ers and FundedNext, the verdict is clear: the best firm depends entirely on your trading style. Both are elite, legitimate platforms that offer incredible opportunities, but they serve different masters.

FundedNext is the clear choice for the agile trader who demands speed, platform flexibility, and simple, direct rules. Its on-demand payouts and fixed drawdowns are built for those who want to earn quickly and with minimal friction. If you value modern efficiency, FundedNext is your partner.

The5ers is the definitive home for the disciplined, long-term trader. Its structured programs and unparalleled scaling plan are designed to systematically build a career, not just pass a test. If you see trading as a marathon focused on methodical growth, The5ers offers the perfect path.

To continue your research, explore more detailed prop firm showdowns in the Compare category at H2T Funding.