In the world of proprietary trading, are you a marathon runner or a sprinter? This single question gets to the heart of the FundedNext vs Funding Pips debate. One firm builds traders for the long haul with structured challenges and disciplined scaling, rewarding endurance and consistency. The other empowers traders to seize opportunities with explosive speed, offering maximum flexibility and rapid rewards.

Choosing between them isn’t about finding a better prop firm; it’s about finding the one that matches your unique trading DNA. Forget surface-level comparisons; this is a clash of philosophies.

Let the experts at H2T Funding guide you through every critical rule, payout structure, and piece of community feedback to reveal which platform will truly unlock your potential.

Key Takeaways

- FundedNext offers a highly structured environment with both CFD and Futures models, catering to traders who prefer clear rules and a defined path for long-term scaling.

- Funding Pips champions simplicity and speed with aggressive challenge models and fewer restrictions, making it a strong choice for confident traders who value flexibility.

- The firms’ trading policies differ significantly; for example, Funding Pips allows weekend holding and has no mandatory stop-loss rule, offering greater strategic freedom.

- While both provide attractive profit splits, their payout models and processing speeds vary. Funding Pips is known for offering faster and more frequent withdrawal cycles.

- Both firms have earned strong community trust, but often for different reasons: traders praise FundedNext for its robust support system, while Funding Pips is celebrated for its straightforward rules.

- The best choice depends entirely on your style: disciplined, methodical traders often prefer FundedNext, while aggressive, short-term traders may find a better fit with Funding Pips.

1. Overview of FundedNext and Funding Pips

In the fierce competition of the prop trading industry, FundedNext and Funding Pips have emerged as two dominant forces with impressive global reach, yet they operate on fundamentally different philosophies.

FundedNext establishes itself as a comprehensive ecosystem for traders seeking long-term growth. In contrast, Funding Pips champions a built by traders, for traders approach, prioritizing speed, simplicity, and unparalleled flexibility.

This initial overview will compare their core offerings, providing a high-level look at what each firm brings to the table for aspiring and experienced traders.

Criteria Table – Overview

| Criteria | FundedNext | Funding Pips |

|---|---|---|

| Founded / Trust | UAE-based, global operations with a strong corporate structure and brand promise. | Dubai-based, built by traders, with a focus on clear rules and a strong community. |

| Evaluation Models | Multiple diverse models (Stellar 1-Step, 2-Step, Lite, Instant, Futures Rapid & Legacy). | Simplified and aggressive models (1-Step, 2-Step, 2-Step Pro). |

| Account Sizes | $5,000 to $200,000 (CFD), $25,000 to $100,000 (Futures). | $5,000 to $100,000. |

| Asset Classes | Forex, Indices, Commodities, Crypto, Futures. | Forex, Indices, Commodities, Crypto. |

| Trading Platforms | MT4, MT5, cTrader, Match-Trader, Tradovate, NinjaTrader. | MetaTrader 5, Match-Trader, cTrader. |

| Profit Split | Up to 90% (CFD), Up to 100% (Futures). | Up to 100% with various reward cycles. |

| Minimum Days | Varies by model; some challenges have no minimum, while others may require a few trading days. | Typically requires a minimum of 3 trading days for 2-Step evaluations. |

| Scaling Programs | Structured scaling plan up to $4 million. | Scaling up to $300,000 available. |

| Execution Speed | Stable execution across top-tier platforms. | Fast execution in a simulated environment. |

| Commissions | Competitive low commissions. | Standard commissions apply to trades. |

| Payouts | Guaranteed within 24 hours (with a $1,000 bonus for delays). | Multiple reward cycles: weekly, bi-weekly, on-demand. |

| Risk Restrictions | Clear rules on daily/max loss, hyperactivity, and gambling behavior. | More relaxed rules, no mandatory stop loss, but IP monitoring. |

This table clearly shows that the choice between FundedNext and Funding Pips is a choice between structure and flexibility. One is designed for methodical growth, the other for aggressive opportunity-seeking. The following sections will dive deeper into what this means for you as a trader.

Disclaimer: Rules, pricing, and trading conditions may change over time. Traders should always verify the latest terms directly on the official FundedNext vs Funding Pips websites before purchasing any challenge.

FundedNext

#1

Account Types

1-step, 2-step, and Instant Funding

Trading Platforms

MT4, MT5, cTrader, Match Trader

Profit Target

4% – 10%

Our take on FundedNext

FundedNext positions itself as a comprehensive and highly structured proprietary trading firm. It provides a clear, multi-faceted pathway for traders who value discipline and a variety of options to prove their skills.

This firm is built for the methodical trader who appreciates having distinct choices between CFD and Futures markets. It suits individuals who want a long-term partnership with a firm that offers a robust scaling plan and has clear, though sometimes strict, rules of engagement. The overall experience feels professional and well-supported.

| 💳 Challenge Fee | $32 – $1,099 |

| 👥 Account Types | 1-step, 2-step, and Instant Funding |

| 💰 Profit Split | 80% – 95% |

| 💵 Account Size | $2K – $200K |

| ⏱️ Time Limit | No time limit |

| 🎯 Profit Target | 4% – 10% |

| 📊 Trading Platforms | MT4, MT5, cTrader, Match Trader |

| 🛍️ Asset Types | Forex, Indices, Commodities, Crypto, CFDs |

Funding Pips

#2

Account Types

1-step, 2-step, and Instant Funding

Trading Platforms

MT5, cTrader, Match Trader

Profit Target

5% – 10%

Our take on Funding Pips

Funding Pips operates on a philosophy of being built by traders, for traders, emphasizing simplicity and maximum flexibility. It strips away many of the complex restrictions found at other firms to create a more direct path to funding.

This firm is ideal for confident, aggressive traders who want to operate with fewer constraints. If you dislike mandatory stop losses, want the freedom to hold trades over the weekend, and desire fast, frequent payouts, Funding Pips is designed for you. Its streamlined evaluation process rewards quick, decisive action and consistent performance.

Beyond these core facts, it’s important to note the specific rules for their popular 2-Step model. Traders are required to trade for a minimum of 3 days in the evaluation phase. The risk parameters are also clearly defined, with a 5% maximum daily loss and a 10% maximum overall loss, ensuring a structured yet flexible challenge.

| 💳 Challenge Fee | $29 – $555 |

| 👥 Account Types | 1-step, 2-step, and Instant Funding |

| 💰 Profit Split | 80% – 100% |

| 💵 Account Size | $5K – $100K |

| ⏱️ Time Limit | No time limit |

| 🎯 Profit Target | 5% – 10% |

| 📊 Trading Platforms | MT5, cTrader, Match Trader |

| 🛍️ Asset Types | FX, Metals, Indices, Energy, Crypto, CFD |

Read more:

2. FundedNext vs Funding Pips comparison: Core models and key rules

The real identity of a prop trading firm is revealed in its rulebook. While profit targets and account sizes are important, the specific rules governing evaluations, risk, and strategy are what truly define a trader’s experience. This is where the core philosophies of FundedNext and Funding Pips diverge most sharply, creating two distinct paths to a funded account.

2.1. Funding model & evaluation difficulty

The journey to becoming a funded trader begins with the evaluation process. Both firms use a multi-phase challenge to test a trader’s skill, but the subtle differences in their models can significantly impact the psychological experience and perceived difficulty.

| Criteria | FundedNext | Funding Pips |

|---|---|---|

| Evaluation Required | Yes, across all standard CFD and Futures models. | Yes, for all funding models offered. |

| Profit Target | Industry-standard targets, typically 8% in Phase 1 and 5% in Phase 2, with variations for different models (e.g., 6% for Funding Pips’ Pro model). | Industry-standard targets, typically 8% in Phase 1 and 5% in Phase 2, with variations for different models (e.g., 6% for Funding Pips’ Pro model). |

| Time Pressure | None. All challenges operate with no time limits. | None. All challenges operate with no time limits. |

| Psychological Stress | It can be lower due to simpler core rules, but the flexibility may encourage overly aggressive trading for some. | Can be lower due to simpler core rules, but the flexibility may encourage overly aggressive trading for some. |

| Overall Difficulty | Difficulty lies in maintaining discipline and adhering to a stricter set of conduct rules over time. | Difficulty lies in managing risk effectively without the guardrails of stricter rules; it tests self-discipline. |

Funding Pips may feel easier to start for experienced traders due to its simpler rulebook and emphasis on core metrics. However, FundedNext’s structured approach is designed to build the discipline needed for long-term, sustainable trading, which can be a better foundation for new traders.

2.2. Drawdown, consistency & risk rules

Risk management rules are the true differentiators in this FundedNext vs Funding Pips comparison. These policies directly impact how a trader manages capital and navigates market volatility, revealing each firm’s approach to trust and risk.

| Criteria | FundedNext | Funding Pips |

|---|---|---|

| Max Drawdown | 10% on most CFD models; varies on Futures models. | 10% on 2-Step models; varies on other models. |

| Daily Loss Limit | 5% on most CFD models; not present on all Futures models. | 5% on 2-Step models. |

| Trailing Drawdown | Uses a trailing End-of-Day (EOD) system for Futures, which locks at the initial balance. | Typically uses a fixed drawdown based on initial balance (not trailing). |

| Consistency Rules | No consistency rule on popular Stellar models, but present on the Legacy Futures challenge. | No consistency rule during the evaluation, but present on the reward stage for some models. |

| Rule Strictness | Higher. Enforces specific policies against Gambling Behavior and Hyperactivity. | Lower. Focuses primarily on core drawdown limits, offering more freedom. |

FundedNext places a heavy emphasis on protecting its capital through detailed behavioral rules, ensuring only disciplined traders qualify for performance rewards. In contrast, Funding Pips provides a longer leash, trusting experienced traders to manage their own risk within broader, more flexible boundaries.

2.3. News, overnight & strategy policies

A trader’s strategy is only as good as the freedom their firm allows. This section breaks down the crucial policies on news trading, holding positions, and using automation, highlighting the significant differences in flexibility offered by each firm.

| Policy | FundedNext | Funding Pips |

|---|---|---|

| News Trading | Allowed across all CFD and Futures accounts. | Allowed across all accounts. |

| Overnight Trading | Allowed for CFDs. Strictly prohibited for Futures (positions auto-closed daily). | Allowed across all CFD accounts. |

| Weekend Trading | Allowed for CFDs. Strictly prohibited for Futures. | Allowed across all CFD accounts. |

| EA / Automation | Allowed, but with specific rules requiring unique strategies and customization. | Allowed. |

| Allowed Strategies | Most are allowed, but there is a long list of prohibited exploitative methods (HFT, Tick Scalping). | Generally permissive, with fewer explicit restrictions on styles like scalping. |

This is where Funding Pips shines for CFD traders, offering near-total strategic freedom. Traders can implement swing and long-term strategies without worrying about daily closures.

While FundedNext offers great flexibility for its CFD models, its Futures schedule is rigid and non-negotiable. This is a critical factor for any trader whose strategy requires holding positions beyond a single day. This makes a deep Funding Pips review essential for swing traders.

3. FundedNext vs Funding Pips review: Fees, refunds, and cost efficiency

The upfront cost of a prop firm challenge is a crucial factor for every trader. Beyond the initial fee, the true value lies in the refund policies, payout frequency, and overall cost efficiency. This section of the FundedNext vs Funding Pips review examines how each firm structures its costs and what traders can expect in return for their investment.

| Criteria | FundedNext | Funding Pips |

|---|---|---|

| Fee Type | One-time fee for each challenge attempt. | One-time fee for each challenge attempt. |

| Refund Policy | Offers a 100% refund of the fee with the first payout on most models (Passing Reward). | 100% refund of the fee is also standard after passing the evaluation. |

| Challenge Cost | A 100k Stellar 2-Step challenge is $529. Costs vary significantly across different account models. | A 100k 2-Step challenge is also $529, offering competitive pricing. |

| Transparency | All fees are clearly stated upfront. There are no hidden monthly charges or activation fees for funded accounts. | The fee structure is straightforward. The firm clearly states fees are for operational costs, not investments. |

| Added Fees | Traders are responsible for gateway transfer charges during payouts. | Payouts via cryptocurrency are subject to service, exchange, and transaction fees. |

| Payout Cycle | Payouts are on-demand after an initial period. Guaranteed 24-hour processing. | Offers multiple payout cycles, including weekly, bi-weekly, and on-demand, providing exceptional speed. |

In terms of cost efficiency, both firms are highly competitive. The choice often comes down to a trader’s cash flow needs. FundedNext’s 24-hour payout promise provides immense security, ensuring withdrawal speed is not a concern.

However, Funding Pips’ flexible and frequent payout cycles are a massive advantage for traders who prefer to withdraw profits more regularly, making it a very compelling option. A thorough Funding Pips review often highlights this as a key benefit.

4. FundedNext vs Funding Pips debate: Profit split and scaling potential

In the fierce competition of prop trading, earning potential is the ultimate goal. While both firms offer generous payout structures, their approaches to scaling accounts and the conditions for withdrawal create different long-term opportunities. This section dives into how each firm rewards successful traders and supports their growth.

| Criteria | FundedNext | Funding Pips |

|---|---|---|

| Profit Split | Up to 90% for CFD traders and up to 100% for Futures traders. | Up to 100% with certain payout cycle choices. |

| Scaling Plans | Highly structured plan to scale capital up to $4 million based on consistent performance over a four-month period. | Offers scaling up to $300,000, providing a solid growth path for profitable traders. |

| Payout Frequency | On-demand payouts are available after an initial period, with a 24-hour processing guarantee. | Offers unmatched frequency with weekly, bi-weekly, and on-demand options available from the start. |

| Minimum Payout | No minimum for crypto withdrawals. | $500 minimum for Bank Transfer and Rise payouts; no minimum for crypto. |

| Withdrawal Conditions | Traders must meet specific performance criteria over four consecutive months to be eligible for scaling up. | Traders must have all trades closed before requesting a payout and adhere to specific request windows (e.g., Tuesdays). |

The debate over Funding Pips vs Funded Next, which is better on this front, comes down to ambition versus speed. FundedNext’s $4 million scaling plan is one of the most ambitious in the industry, appealing to traders with long-term career goals.

In contrast, Funding Pips’ rapid and flexible payout cycles make it a top contender for traders looking for prop firms with the fastest payouts, perfect for those who prioritize accessing profits quickly. This makes it a compelling choice versus a firm with different long-term promises.

5. FundedNext vs Funding Pips: Platforms and tradable markets

A trader’s success depends heavily on the quality and reliability of their trading environment. The choice of platforms and the range of available assets are critical components that can either support or hinder a trading strategy. This section compares the technological infrastructure and market access provided by both firms.

| Criteria | FundedNext | Funding Pips |

|---|---|---|

| Trading Platforms | Unmatched diversity: Offers MT4, MT5, cTrader, Match-Trader, and dedicated Futures platforms like Tradovate and NinjaTrader. | Industry standard selection: Provides access to MT5, cTrader, and Match-Trader. |

| Asset Classes | Extensive range: Traders can access Forex, Indices, Commodities, Crypto (CFDs), and a full suite of Futures products. | CFD-focused: Offers Forex, Indices, Commodities, and Crypto. No Futures market access. |

| Execution Speed | Provides stable and reliable execution through a simulated environment connected to top-tier liquidity providers. | Ensures fast and efficient trade execution within its simulated trading environment. |

| Commissions & Fees | Offers some of the most competitive commission rates in the prop trading industry, maximizing trader profits. | Standard swap rates and commissions apply, with clear information available inside the platform. |

| Trader Dashboard | A comprehensive dashboard for tracking progress, managing accounts, and requesting payouts. | A user-friendly dashboard that allows for easy switching between accounts and managing reward cycles. |

FundedNext is the undisputed winner for traders who demand platform diversity and access to the Futures market. Its superior trading conditions, driven by a vast selection of platforms, ensure nearly every trader can use their preferred setup.

While Funding Pips offers a solid CFD environment, it cannot match the breadth of options at FundedNext. This is a critical point when considering Funding Pips vs Funded Next, which is better for specialized traders.

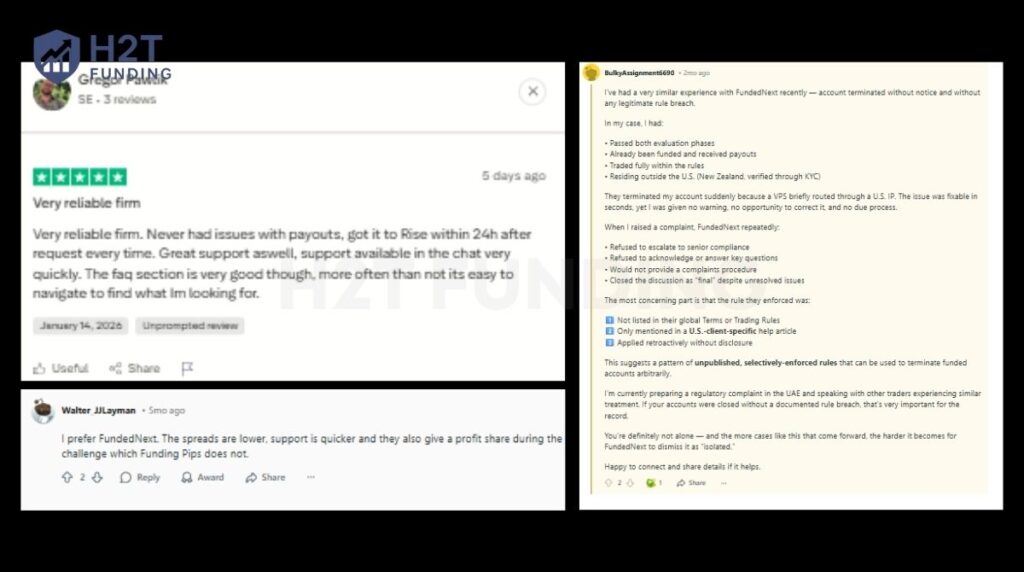

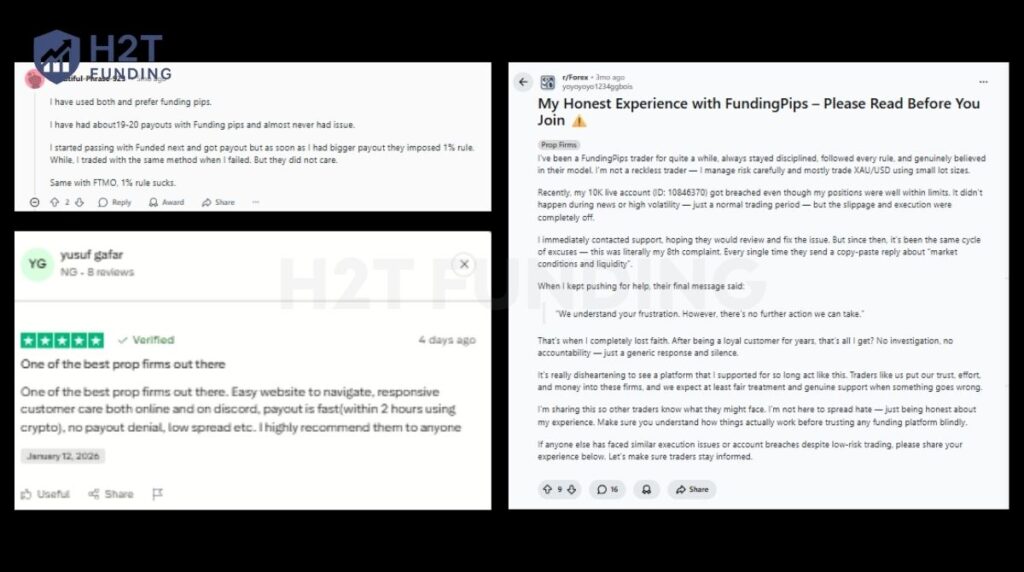

6. Payout & trust: FundedNext and Funding Pips Reddit and Trustpilot reviews

A prop firm’s promises are only as good as its reputation. To get a true measure of trust, we dive into the raw feedback from real traders, analyzing countless Funding Pips vs Funded Next Reddit threads and Trustpilot reviews.

(Note: Information collected and updated on January 20, 2025)

These forums serve as the ultimate litmus test, revealing patterns in payout reliability, customer support quality, and how rules are enforced in real-world scenarios. Below, we’ll examine what traders are actually saying about their experiences.

The feedback paints a clear picture. FundedNext is praised for its professionalism and fast payouts, with many traders highlighting the responsiveness of its support team.

The community’s trust in their payout system is exceptionally high. However, the most common complaints consistently revolve around strict rule enforcement. Some traders report that their accounts were closed for nuanced violations related to IP addresses, copy trading, or trading behavior.

On the other hand, Funding Pips receives rave reviews for its simplicity, speed, and incredible payout flexibility. Traders love the straightforward rules and the ability to withdraw profits quickly, seeing the challenge as a final test of their training rather than a complex bureaucratic hurdle.

The most prominent complaints tend to focus on trade execution quality, specifically slippage, where some users feel the simulated environment did not perform as expected, leading to account breaches. This creates a clear trade-off for prospective traders to consider.

7. FundedNext vs Funding Pips: Which prop firm is easier to pass?

For many traders, the search for the easiest prop firms to pass is a top priority. While easy is subjective, we can objectively measure the difficulty of FundedNext and Funding Pips by comparing the core parameters that lead to success. The answer depends heavily on what a trader considers to be the biggest obstacle.

| Criteria | Winner | Notes |

|---|---|---|

| Profit Target | Both | Both firms have adopted the industry standard of 8% and 5% targets for their primary 2-Step challenges, making them equal on this metric. |

| Drawdown Strictness | Funding Pips | Funding Pips primarily uses a fixed drawdown based on the initial balance. This approach is often considered more straightforward and less stressful than the trailing EOD drawdown in FundedNext’s Futures models. |

| Rule Complexity | Funding Pips | With far fewer behavioral rules to monitor (e.g., no strict gambling or hyperactivity clauses), traders can focus almost exclusively on their P&L, reducing the risk of a non-financial breach. |

| Overall Difficulty | Funding Pips | By combining a simpler drawdown rule with less complex behavioral policies, Funding Pips presents fewer potential points of failure, making its evaluation theoretically easier to pass for a disciplined trader. |

So, in the FundedNext vs Funding Pips which is better debate for passing evaluations, Funding Pips is objectively easier. Its streamlined rulebook and less restrictive drawdown policies mean traders have fewer variables to manage.

However, it’s crucial to remember that this ease comes with a trade-off: the lack of stricter rules places the full burden of risk management and discipline squarely on the trader’s shoulders.

8. FundedNext and Funding Pips: Which prop firm suits your trading style?

This final Funding Pips vs Funded Next review moves beyond rules and focuses on personality, aligning each firm with the trading styles they best support. This section provides clear recommendations for different types of traders, helping you find the ideal fit based on the detailed comparisons we’ve covered.

| Trader Type | Best Choice | Why |

|---|---|---|

| Beginners | FundedNext | Its structured environment, clearer behavioral rules, and robust support system provide a safer framework for traders who are still developing their discipline and risk management skills. |

| Aggressive traders | Funding Pips | The combination of fewer rules, faster payout cycles, and higher flexibility rewards traders who are confident in their strategy and want to capitalize on opportunities quickly without excessive restrictions. |

| Scalpers | Funding Pips | Funding Pips’ tolerance for high-frequency activity and fewer behavioral rules gives these traders more freedom to execute their strategy without fear of a breach. |

| Swing traders | Funding Pips | The ability to hold trades over the weekend on CFD accounts is a game-changer for swing traders. This feature, which is core to Funding Pips’ offering, is not available on FundedNext’s Futures accounts. |

| Risk-averse traders | FundedNext | The firm’s emphasis on risk management, including its strict policies against gambling behavior, creates a trading environment that naturally aligns with a more cautious and methodical approach. |

| Traders aiming for $1M+ capital | FundedNext | Its well-defined scaling plan, which reaches up to $4 million in capital, offers a clear, long-term career path for ambitious traders who can demonstrate consistent profitability over time. |

Ultimately, your choice depends on what you value most. If you seek a structured, long-term partnership with a clear path to significant capital, FundedNext is the superior option. If your priority is maximum strategic freedom, fewer rules, and rapid access to your profits, then Funding Pips is unequivocally the better fit. A FundedNext review Reddit thread may offer more personal anecdotes, but this breakdown covers the core strategic differences.

9. FAQs

Yes, FundedNext is widely regarded as an excellent prop firm, especially for traders seeking structure and a wide variety of trading options. It is known for its diverse account models (including Futures), strong customer support, and a reliable payout system backed by a 24-hour processing guarantee.

Yes, Funding Pips is a highly-rated prop firm, particularly favored by traders who value flexibility and speed. It stands out for its simplified rules, no mandatory stop-loss requirement, weekend holding on CFD accounts, and extremely fast, flexible payout cycles.

Neither is definitively better; they are suited for different traders. FundedNext is better for methodical traders who want a structured path, excellent trading conditions, and a high scaling ceiling. Funding Pips is better for aggressive traders who prioritize strategic freedom, fewer rules, and rapid payouts.

FundedNext is generally considered more suitable for beginners. Its stricter behavioral rules and highly structured environment can help new traders develop essential discipline and risk management habits. The flexibility of Funding Pips might be overwhelming for those still learning.

FundedNext offers on-demand payouts with a guaranteed 24-hour processing time. Funding Pips provides more frequent options, allowing traders to choose from weekly, bi-weekly, or on-demand payout cycles, often processing them within hours.

Yes, absolutely. Based on extensive community feedback and thousands of Trustpilot reviews, FundedNext has a strong reputation for processing payouts reliably and quickly. Their brand promise to pay $1,000 extra for any delay beyond 24 hours further solidifies their commitment.

Yes, FundedNext is a legitimate and well-established proprietary trading firm with a registered corporate entity in the UAE and a global operational presence. Its high Trustpilot score and large community of funded traders confirm its legitimacy.

Yes, Funding Pips is a legitimate prop trading firm registered in Dubai. It has a strong and positive reputation in the trading community, backed by thousands of verified reviews praising its straightforward approach and reliable payout system.

Yes, FundedNext accepts clients from the United States. However, U.S. traders are restricted to using specific trading platforms like cTrader and Match-Trader for CFDs due to regulations.

Funding Pips offers trading on three popular platforms: MetaTrader 5 (MT5), cTrader, and Match-Trader.

The 1% rule is not a standard, universal rule at FundedNext, but refers to their Gambling Behavior policy. Professional traders typically risk around 1% per trade. FundedNext monitors for traders consistently risking a huge portion of their daily loss limit on single trades, an all-in behavior. If such a pattern is detected, the firm may enforce a rule limiting risk per trade to instill better risk management. This often appears in community discussions on platforms like FundedNext Reddit.

The cost for a $15k FundedNext account varies by model. For the popular Stellar 2-Step challenge, the fee for a $15k account is $119. Prices for other models, like Stellar 1-Step or Stellar Lite, will differ.

Traders should primarily consider their trading style, need for flexibility, and long-term goals. Key factors include: the strictness of the rules, allowance for weekend/overnight holding, payout frequency, available asset classes (CFD vs. Futures), and the firm’s scaling potential.

10. Conclusion

The FundedNext vs Funding Pips debate boils down to a simple choice: structure or freedom. If your goal is a long-term career built on discipline, diverse markets, and a massive scaling plan, FundedNext is the clear winner. If you are a confident trader who demands strategic freedom, fewer rules, and the fastest possible payouts, Funding Pips is unequivocally the better fit.

To see how other firms compare and find your perfect match, explore more expert reviews in the Compare category on the H2T Funding blog.