The Funded Trading Plus vs FTMO decision is a choice between two distinct paths to a funded account. Funded Trading Plus offers unmatched adaptability, providing diverse paths like a one-step evaluation and more relaxed trading rules. FTMO, on the other hand, provides a highly disciplined path through its world-renowned evaluation, which has become the benchmark for serious traders.

This is not just a comparison of features; it’s an analysis of philosophies. We at H2T Funding have examined the fine print, from drawdown rules to community feedback, to help you understand which firm’s approach will truly elevate your trading. Let’s find the right fit for you.

Key Takeaways

- Funded Trading Plus is ideal for experienced traders who value flexibility, diverse funding models, and fewer restrictions. FTMO is best suited for traders who want to prove their skills against a rigorous, industry-standard benchmark and thrive within a structured environment.

- Your journey differs significantly. Funded Trading Plus offers multiple ways to get funded, including one-step and instant options. FTMO focuses exclusively on mastering its globally recognized 2-Step Challenge.

- If you are a swing or news trader, Funded Trading Plus provides more freedom, with more lenient rules on holding positions over weekends and during major news events.

- Both firms have clear drawdown limits, but Funded Trading Plus offers a wider variety of drawdown types (e.g., static vs. trailing) across its different account programs.

- You can earn up to a 90% profit share with both firms. Both also feature robust scaling plans that reward consistent traders by increasing their account capital over time.

1. Overview of Funded Trading Plus and FTMO

Funded Trading Plus and FTMO are two of the most respected names in the proprietary trading firm industry, yet they serve traders from different perspectives. Funded Trading Plus has built its reputation on offering unparalleled flexibility, providing multiple evaluation models and more relaxed rules for traders who value freedom and adaptability.

In contrast, FTMO is the industry pioneer, known for its rigorous and standardized evaluation process that has become the global benchmark for proving trading discipline and consistency.

This initial comparison table provides a high-level overview of what each prop firm brings to the table.

| Criteria | Funded Trading Plus | FTMO |

|---|---|---|

| Founded / Trust | Founded in 2021, quickly gained a strong reputation for being trader-centric. | Founded in 2015, widely regarded as the industry pioneer and benchmark for trust. |

| Evaluation Models | Offers multiple models: One-Step, Two-Step, and Instant Funding. | Primarily known for its highly structured Two-Step Evaluation Process. |

| Account Sizes | From $12,500 up to $200,000. | From $10,000 up to $200,000. |

| Asset Classes | Forex, Indices, Commodities, and Crypto. | Forex, Indices, Commodities, Stocks, and Crypto. |

| Trading Platforms | MT5, cTrader, DXtrade, Match-Trader. | MT4, MT5, cTrader, and DXtrade. |

| Profit Split | Up to 100% (with add-ons), standard at 80%. | Up to 90%. |

| Minimum Days | Varies by program, some as low as 0 or 3 days. | 4 trading days for each evaluation step. |

| Scaling Programs | Ambitious scaling plans up to $2.5 million. | Clear, performance-based scaling up to $2 million. |

| Execution Speed | Simulated-live environment with realistic conditions. | Simulated-live environment with realistic conditions, including minor delays. |

| Commissions | Competitive and transparent fees, varying by platform and asset. | Low, transparent commissions designed to mimic real market conditions. |

| Payouts | Fast and reliable, with weekly or bi-weekly options available. | Reliable and processed bi-weekly, with payouts typically handled within 1-2 business days. |

| Risk Restrictions | Flexible rules, no restrictions on news trading or weekend holding in many programs. | Strict rules on news trading and weekend holding for standard funded accounts. |

From this overview, it’s clear that your choice depends heavily on your personal trading style. Traders seeking a fast, flexible path may lean towards Funded Trading Plus. In contrast, those wanting to validate their skills against a global standard may prefer FTMO.

Disclaimer: Rules, pricing, and trading conditions may change over time. Traders should always verify the latest terms directly on the official Funded Trading Plus vs FTMO websites before purchasing any challenge.

Funded Trading Plus

#1

Account Types

1-Step, 2-Step, and Instant Funding

Trading Platforms

MT5, cTrader, Match Trader, DXTrade

Profit Target

5% – 10%

Our take on Funded Trading Plus

Funded Trading Plus enters the market with a clear and powerful message: trading should be flexible. The firm has designed its programs to remove many of the common restrictions that traders face at other firms.

From a personal perspective, the firm feels less like an examiner and more like a partner. It gives you multiple ways to prove your skills, which feels empowering. It is best suited for confident traders who want a direct path to funding. The firm offers this with fewer hoops to jump through.

| 💳 Challenge Fee | $119 – $4,500 |

| 👥 Account Types | 1-Step, 2-Step, and Instant Funding |

| 💰 Profit Split | 80% – 100% |

| 💵 Account Size | $5K – $200K |

| ⏱️ Time Limit | No time limit |

| 🎯 Profit Target | 5% – 10% |

| 📊 Trading Platforms | MT5, cTrader, Match Trader, DXTrade |

| 🛍️ Asset Types | Forex, Indices, Commodities, Metals, Crypto |

FTMO

#2

Account Types

2-step

Trading Platforms

MT4, MT5, cTrader, DXTrade

Profit Target

5% – 10%

Our take on FTMO

FTMO is the firm that arguably created the modern prop trading industry as we know it. Its evaluation process is the gold standard, designed to identify disciplined traders who can perform consistently under pressure.

My impression of FTMO is one of unwavering professionalism and structure. It feels like a financial institution that has perfected its method for finding top talent. It is the ideal choice for traders who want to prove they can succeed in a challenging, rule-based environment and earn a certification that carries weight throughout the industry.

| 💳 Challenge Fee | €89 – €1,080 |

| 👥 Account Types | 2-step |

| 💰 Profit Split | 80% – 90% |

| 💵 Account Size | $10K – $200K |

| ⏱️ Time Limit | No time limit |

| 🎯 Profit Target | 5% – 10% |

| 📊 Trading Platforms | MT4, MT5, cTrader, DXTrade |

| 🛍️ Asset Types | Forex, Commodities, Indices, Stocks, Crypto |

Read more:

2. Funded Trading Plus vs FTMO comparison: Core models and key rules

The rules of a prop firm define the trader’s experience. This section is a direct Funded Trading Plus vs FTMO comparison. We will explore the core models and key rules to help you find the best fit.

2.1. Funding model & evaluation difficulty

A firm’s funding model is the gateway to a funded account. The structure of the evaluation directly impacts the difficulty and psychological pressure a trader will face.

| Criteria | Funded Trading Plus | FTMO |

|---|---|---|

| Evaluation Required | Yes, offers 1-Step and 2-Step evaluations, plus an instant funding model that bypasses the challenge. | Yes, a mandatory 2-step evaluation (Challenge and Verification) is required for all traders. |

| Profit Target | Varies by program. The 1-Step requires 10%, while the 2-Step models range from 6% to 10% per phase. | 10% for the Challenge (Step 1) and a reduced 5% for the Verification (Step 2). |

| Time Pressure | None. All programs feature unlimited trading days to pass the evaluation. | None. FTMO also removed its time limits, allowing traders to pass at their own pace. |

| Psychological Stress | Lower to moderate. The availability of instant funding and simpler evaluations reduces pressure for many. | High. The structured, multi-phase process and strict rules create a high-pressure environment. |

| Overall Difficulty | More accessible. With multiple paths and more lenient rules, it’s generally easier to secure a funded account. | More challenging. The rigid, standardized process is designed to filter for only the most disciplined traders. |

For traders looking for a faster and more straightforward start, Funded Trading Plus offers more accessible entry points. In contrast, FTMO’s model is more demanding, designed to build discipline for long-term trading. If you choose this path, understanding how to pass the FTMO challenge is your next critical step.

2.2. Drawdown, consistency & risk rules

Drawdown rules are the most critical aspect of any prop firm evaluation. They dictate your risk parameters and are the primary reason traders fail challenges.

| Criteria | Funded Trading Plus | FTMO |

|---|---|---|

| Max Drawdown | Varies. Offers both static and trailing drawdown options, with limits from 6% to 10%. | 10% Maximum Loss. This is a static limit based on the initial account balance. |

| Daily Loss Limit | Varies between 3% and 5%, depending on the selected program. Some models are balance-based, others equity-based. | 5% Maximum Daily Loss. This rule is consistent across all account sizes and evaluation stages. |

| Trailing Drawdown | Yes, on some programs. The Experienced Trader program uses a trailing drawdown, but others use a static one. | No. FTMO’s drawdown is always static, which many traders find easier to manage. |

| Consistency Rules | No. The firm does not enforce consistency rules, giving traders more freedom in their approach. | No. While it encourages consistency, FTMO does not have a formal consistency rule. |

| Rule Strictness | Moderate. The rules are clear but offer more flexibility, especially regarding drawdown type and news trading. | High. The rules are strict, non-negotiable, and form the core of the FTMO experience. |

In short, Funded Trading Plus provides traders with more choices in how they manage risk, particularly with its varied drawdown models. FTMO offers a simpler, though stricter, set of risk rules that are predictable and consistent across the board.

2.3. News, overnight & strategy policies

A firm’s policies on trading styles determine whether your specific strategy is viable on their platform. This is a crucial factor for news traders, swing traders, and those using automated systems.

| Policy | Funded Trading Plus | FTMO |

|---|---|---|

| News Trading | Generally Allowed. Most programs permit news trading, offering more freedom than many competitors. | Restricted to standard accounts. Traders must close positions on affected instruments 2 minutes before and after major news. The Swing account allows news trading. |

| Overnight Trading | Allowed. Traders can hold positions overnight without any restrictions. | Allowed. Holding trades overnight is permitted. |

| Weekend Trading | Allowed. This flexibility extends beyond normal trading hours, permitting traders to hold positions over the weekend on all programs. | Restricted to standard accounts. The Swing account type is required to hold trades over the weekend. |

| EA / Automation | Allowed. Traders can use Expert Advisors and other bots, provided they don’t use prohibited strategies. | Allowed. EAs are permitted, but traders must ensure their strategy is unique to avoid violating copy trading rules. |

| Allowed Strategies | Most strategies are welcome, reflecting the firm’s focus on flexibility. | Most strategies are allowed, but they must be compatible with real market conditions. |

Ultimately, Funded Trading Plus offers significantly more freedom regarding trading strategies, making it a superior choice for news traders and swing traders. FTMO provides a path for these styles through its Swing account, but its standard offering is more restrictive.

3. Funded Trading Plus vs FTMO review: Fees, refunds, and cost efficiency

The cost of an evaluation is a key factor for every trader. This section compares fees, refunds, and cost-efficiency in our Funded Trading Plus vs FTMO review. Our goal is to show which prop firm offers better long-term value.

| Criteria | Funded Trading Plus | FTMO |

|---|---|---|

| Fee Type | One-time fee for each evaluation or instant funding account. No recurring charges. | One-time fee for each FTMO Challenge. No monthly subscriptions. |

| Refund Policy | Program-dependent. Refunds are available on certain evaluation programs after reaching a profit milestone, but are not offered on the Prestige or Master programs. | 100% refund of the initial fee with the first profit split from the FTMO Account, regardless of the profit amount. |

| Challenge Cost | Highly competitive. A $100k two-step evaluation starts from $399 (Prestige Pro). A one-step evaluation is $499. | Competitive. A $100k FTMO Challenge costs €540 (approx. $580). |

| Transparency | Very transparent. All costs are clearly stated upfront with no hidden charges. | Fully transparent. The fee is the only cost, and all terms are clearly defined. |

| Added Fees | None. There are no hidden fees or charges during the funded trading process. | None. FTMO does not charge any additional or hidden fees. |

| Payout Cycle | Flexible options, including weekly and bi-weekly withdrawals, allow faster access to profits. | Bi-weekly payout cycle by default, ensuring regular and predictable access to earnings. |

In terms of cost-efficiency, Funded Trading Plus often presents a lower upfront cost for its evaluations and offers more diverse programs, including instant funding. However, FTMO’s universal refund policy on its renowned two-step evaluation provides excellent long-term value for traders who successfully pass the evaluation process.

4. Funded Trading Plus vs FTMO debate: Profit split and scaling potential

A generous profit share and a clear path to a larger account are vital for a long-term trading career. This section examines the scaling potential and profit split structures at both Funded Trading Plus and FTMO, revealing which firm offers a better road to significant capital growth.

| Criteria | Funded Trading Plus | FTMO |

|---|---|---|

| Profit Split | Starts at 80% and can be upgraded to 90% or even 100% with certain add-ons. | Starts at 80% and increases to 90% for traders who qualify for the Scaling Plan. |

| Scaling Plans | Aggressive and flexible. Traders can scale their accounts up to a maximum balance of $2.5 million by consistently hitting profit targets. The rules for scaling can vary between trading programs. | Structured and time-based. Requires traders to generate a 10% net profit over a four-month period. The account balance is increased by 25% at each successful review, up to $2 million. |

| Payout Frequency | Highly flexible. Offers weekly, bi-weekly, or on-demand withdrawals depending on the program, allowing for quicker access to profits. | Bi-weekly. Payouts can be requested every 14 days, providing a regular and predictable payment schedule. |

| Minimum Payout | Low minimums, often as little as 1% of the initial balance, with no fees. | No minimum payout amount is specified, giving traders flexibility in when they withdraw. |

| Withdrawal Conditions | Straightforward. Requires a signed contract and verified KYC. Some scaling plans may require a withdrawal before the account size can be increased. | Simple process. Requires a signed contract and identity verification. Fee refund is processed with the first payout. |

Both firms offer excellent long-term potential, but they cater to different ambitions. Funded Trading Plus provides a faster, more aggressive scaling path for traders aiming for rapid growth. FTMO offers a more methodical and steady journey, rewarding long-term consistency and solid risk management.

5. FTMO vs Funded Trading Plus: Platforms and tradable markets

The quality of your trading environment, from the platforms you use to the assets you trade, is non-negotiable. This section compares the supported platforms and range of trading instruments available at both firms, ensuring your preferred setup is available.

| Criteria | Funded Trading Plus | FTMO |

|---|---|---|

| Trading Platforms | Offers a wide range: MT5, cTrader, DXtrade, and Match-Trader. This gives traders an extensive choice. | Provides industry-standard platforms: MT4, MT5, cTrader, and DXtrade. (Platform availability is region-dependent). |

| Asset Classes | A comprehensive selection including Forex, Indices, Commodities, and Cryptocurrencies. | An extensive list that includes Forex, Indices, Commodities, Stocks, and Cryptocurrencies. |

| Execution Speed | Provides a simulated-live environment designed to closely mimic real market execution without artificial delays. | Also uses a simulated-live environment, which includes minor, realistic execution delays to prepare traders for real-world trading conditions. |

| Commissions & Fees | Competitive and transparent trading fees. Spreads and commissions are low and vary by platform and asset. | Low and clear trading fees. Commissions are designed to be some of the most competitive in the industry, reflecting real market costs. |

| Trader Dashboard | A modern dashboard that provides key metrics, withdrawal requests, and account management tools. | A highly detailed dashboard (Account MetriX) offering in-depth analytics, a trading journal, and performance tracking. |

Both firms provide an exceptional trader experience with top-tier technology and a wide array of assets. A common question on “Funded Trading Plus reddit” threads is about platform variety, where Funded Trading Plus shines with its inclusion of Match-Trader. However, FTMO’s analytics dashboard is widely considered one of the best in the industry for performance review.

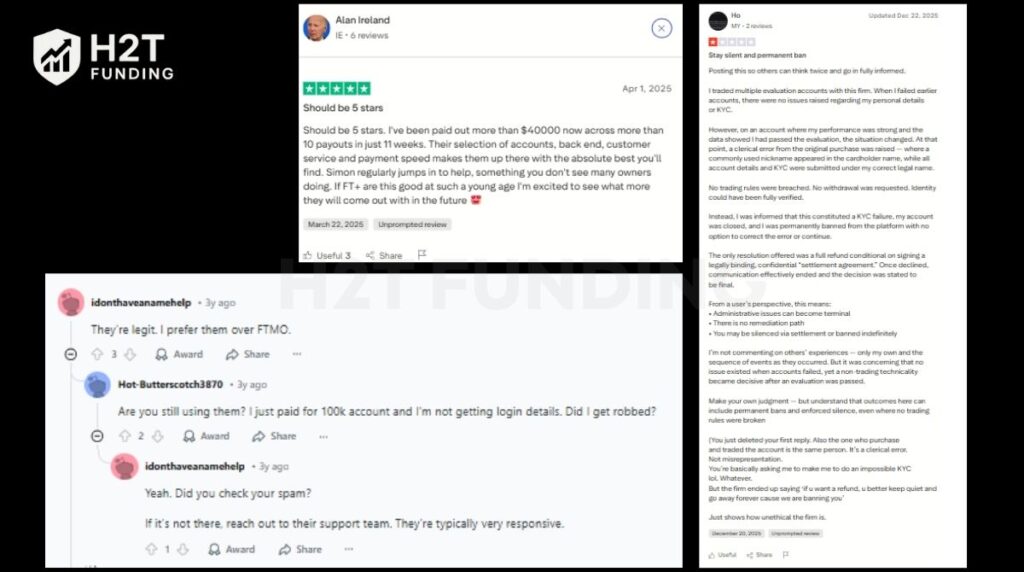

6. Payout & trust: Funded Trading Plus and FTMO Reddit and Trustpilot reviews

While marketing promises are one thing, authentic community feedback from platforms like Reddit and Trustpilot reveals the true trader experience. We’ve analyzed countless discussions to gauge sentiment on payout reliability, rule enforcement, and overall trustworthiness for both firms.

The consensus across reviews is that both firms are legitimate and pay their traders. However, discussions often highlight the philosophical differences we’ve discussed. Many traders praise Funded Trading Plus for its flexibility and excellent customer service, while FTMO is consistently lauded for its professionalism and reliability.

Below are a few representative comments that capture the general sentiment. These screenshots from Reddit’s r/Forex and Trustpilot offer a glimpse into what real traders are saying.

As the community feedback illustrates, there is no single “best” choice, only the best fit for the individual trader. A recurring theme in discussions around “Is Funded Trading Plus legit” is a resounding yes, with traders frequently praising its payout speed and flexible rules.

At the same time, FTMO’s reputation for professionalism and reliability is consistently reinforced, making it a trusted choice for those who value structure and a proven track record.

7. Funded Trading Plus vs FTMO: Which prop firm is easier to pass?

For many traders, the most pressing question is straightforward: which evaluation is easier to pass? While success is never guaranteed, the structure and rules of a firm’s challenge can significantly impact your chances. This funded trader plus vs FTMO breakdown focuses purely on the difficulty of passing the evaluation.

| Criteria | Winner | Notes |

|---|---|---|

| Profit Target | Funded Trading Plus | FTMO’s 5% target in Step 2 is low. However, some Funded Trading Plus programs have a 6% target. This is less demanding than FTMO’s initial 10% hurdle. |

| Drawdown Strictness | Funded Trading Plus | The availability of static drawdown models and slightly more generous daily loss limits on certain programs gives traders more breathing room compared to FTMO’s rigid 5%/10% structure. |

| Rule Complexity | Funded Trading Plus | With no restrictions on news trading or weekend holding, traders have fewer rules to worry about. This simplifies the trading process and reduces the risk of accidental violations. |

| Overall Difficulty | Funded Trading Plus | Combining more accessible profit targets, flexible drawdown options, and fewer restrictive rules, its evaluation is more attainable for a wider range of trading styles. |

Funded Trading Plus is generally considered easier to pass.

If your primary goal is to secure a funded account with the path of least resistance, Funded Trading Plus is the clear winner. The firm’s variety of programs, including the popular Funded Trading Plus 100k account, and its more relaxed trading rules create a less pressured environment.

While FTMO’s challenge is an excellent test of discipline, the flexibility offered by Funded Trading Plus makes it a more attainable option for many traders.

8. Funded Trading Plus and FTMO: Which prop firm suits your trading style?

The best prop firm is the one that aligns seamlessly with your personal trading strategy. There is no one-size-fits-all answer in the Funded Trading Plus vs FTMO discussion. This table breaks down which firm is better suited for specific types of traders.

| Trader Type | Best Choice | Why |

|---|---|---|

| Beginners | FTMO | Its structured evaluation, clear rules, and extensive educational resources provide a disciplined framework that helps new traders build good habits from the start. |

| Systematic Traders | FTMO | Traders who rely on consistent, rule-based systems will appreciate FTMO’s predictable environment. The static drawdown and clear trading objectives are ideal for algorithmic or mechanical strategies. |

| Swing Traders | Funded Trading Plus | The ability to hold trades over the weekend and during news events without restriction makes it the superior choice for traders who operate on longer timeframes. |

| Scalpers | Both | Both firms offer excellent trading conditions with low spreads and commissions. However, the higher Funded Trading Plus leverage of 30:1 might give scalpers a slight edge. |

| Risk-Averse Traders | FTMO | The non-trailing (static) drawdown provides a fixed risk buffer that never moves. This predictability is ideal for traders who prioritize precise risk management and capital preservation. |

| Traders Aiming for $1M+ Capital | Funded Trading Plus | Its scaling plan is more aggressive, allowing traders to reach a $2.5 million account balance faster. This makes it a great choice for ambitious traders focused on rapid growth. |

In conclusion, your personal trading style is the ultimate deciding factor. Swing traders will find a better home at Funded Trading Plus. Meanwhile, systematic traders who value clear rules may find an FTMO account is a perfect fit.

Understanding what an FTMO trader is, a disciplined professional, is key to seeing if you align with their philosophy.

9. Common mistakes when choosing between Funded Trading Plus vs FTMO

Making the right choice between these two top-tier firms requires careful consideration. Many traders stumble by overlooking key details that don’t align with their needs. Avoiding these common mistakes can save you both time and money.

- Ignoring Drawdown Type: One of the biggest errors is failing to understand the difference between static and trailing drawdowns. A trader who isn’t prepared for a trailing drawdown on a Funded Trading Plus Experienced account can fail quickly. Conversely, choosing a static drawdown when you prefer more initial breathing room can be just as limiting.

- Focusing Only on Price: While FTMO may have a higher entry fee for a comparable account, its universal 100% refund policy can make it more cost-effective in the long run. Choosing a firm solely because it’s cheaper upfront, without considering the total value and refund potential, is a frequent misstep.

- Disregarding Trading Style: A swing or news trader who chooses a standard FTMO account will be severely restricted. It is crucial to match the firm’s rules with your actual trading strategy. Failing to do so is a recipe for frustration and potential rule violations.

- Underestimating Psychological Pressure: Many traders assume they can handle FTMO’s strict evaluation process, but falter under the pressure. Choosing the “harder” path to prove a point, rather than selecting the environment where you are most likely to succeed, is a common error in judgment.

Ultimately, the biggest mistake is not performing an honest self-assessment. Choosing the right firm requires you to know your trading style, risk tolerance, and psychological strengths inside and out.

10. FAQs

“Better” is subjective and depends on the trader. For those seeking flexibility, more funding models (like instant funding), and fewer restrictions on news trading, Funded Trading Plus is often considered a better alternative. For traders who value a structured, industry-standard evaluation and a long-standing reputation, FTMO remains a top choice.

Yes, FTMO services are available to US clients through a specific FTMO US entity. However, traders should be aware of key differences, including platform restrictions (MetaTrader and cTrader are not available) and potentially different trading conditions.

Yes, US citizens can use FTMO. However, they must sign up through the FTMO US website and are subject to specific platform restrictions, such as not being able to use MetaTrader or cTrader.

Absolutely. Funded Trading Plus is a legitimate and highly respected prop firm. They have a strong reputation for reliable payouts and transparent rules, backed by thousands of positive reviews on Trustpilot.

Yes, Funded Trading Plus has a proven track record of consistent and timely payouts. They offer flexible withdrawal options, including weekly and bi-weekly cycles, and are widely praised by traders for their reliability.

Yes, FTMO pays out real money. While you trade on a demo account, your simulated profits translate into real earnings. FTMO has paid out hundreds of millions to its traders and is known for its dependable payout process.

There is no single “best” firm for everyone. The best firm is the one that aligns with your trading style, risk tolerance, and goals. Both Funded Trading Plus and FTMO are considered top-tier options in the industry.

The cost varies. A Funded Trading Plus 100k account evaluation starts at $399 (for the Prestige Pro 2-Step model). An FTMO 100k Challenge costs €540 (approximately $580). Both fees are refundable upon receiving your first profit split.

FTMO’s Challenge fees range from €155 (for a $10k account) to €1,080 (for a $200k account). This is a one-time fee that is fully refunded if you pass the evaluation and receive your first payout.

This typically refers to the “Symbol Loss Limit” found in some programs at firms like Funded Trading Plus, which is not an industry-wide rule. For example, on their Prestige accounts, a trader cannot lose more than a set percentage (e.g., 2%) on a single trading symbol in one day.

FTMO does not officially stand for anything. The name originated from the founders’ initial project in the Czech Republic, and the “FTMO” brand was created for their international expansion.

Funded Trading Plus is generally considered easier to pass. Its flexible rules, variety of evaluation models (including one-step and instant funding), and more lenient trading conditions create a less pressured environment compared to FTMO’s strict, standardized challenge.

FTMO is often recommended for beginners. Its highly structured, two-step evaluation process forces new traders to develop strong discipline and risk management skills, which are essential for long-term success.

11. Conclusion

Ultimately, the Funded Trading Plus vs FTMO decision is not about choosing a winner, but about finding the right partner for your trading journey. Do you thrive on flexibility and want multiple paths to funding? Do you need freedom for news trading or holding trades over the weekend? If so, Funded Trading Plus is your ideal match.

Do you perform best within a structured, proven system? Do you want to validate your skills against an industry benchmark? In that case, FTMO provides the perfect environment.

We hope this detailed comparison has given you the clarity needed to make an informed decision. For more in-depth analyses of other leading prop firms, explore the comprehensive reviews and guides available on the H2T Funding blog.