Passing a prop firm challenge is often the first big hurdle for traders looking to access capital without risking their own money. However, prop trading firms vary widely in quality and offerings. Some offer easier rules, more flexible trading conditions, and even allow the use of trading bots or EAs (Expert Advisors).

In this guide, we explore the easiest prop firms to pass in 2026, based on updated industry comparisons, pass rate criteria, and user feedback. Whether you’re a beginner or looking for a second chance, this article will help you choose the right firm and pass with confidence.

1. What makes a prop firm easy to pass?

Before jumping into the list, it’s essential for you to understand what makes a prop firm challenge more accessible than others. “Easy” doesn’t mean risk-free, but rather implies that the firm’s rules are more lenient or trader-friendly for you.

1.1. Key factors that affect your pass rate

Several elements influence how hard or easy it is to pass a prop trading challenge:

- Profit target vs. drawdown: Firms with lower profit targets and higher drawdown tolerance are naturally easier to pass.

- Time limits: Certain prop firms impose tight time limits, while others offer unlimited time.

- Trading style flexibility: Firms that allow scalping, news trading, and overnight positions reduce limitations on your strategy.

- Consistency rules: These are often hidden challenges; firms without such rules are more beginner-friendly.

1.2. EA (Expert Advisor) & strategy freedom

A key factor for many traders is whether the firm allows automated strategies or copy trading. In 2026, more firms are beginning to support this approach, but conditions still vary widely:

- Some firms ban EAs entirely.

- Others allow EAs but require prior approval.

- A few embrace automated strategies and even provide their own dashboards or APIs.

2. Top 12 easiest prop firms to pass in 2026

Here is the list of the 12 prop firms considered the easiest to pass in 2026, based on criteria such as flexibility of rules, success rates, allowance of EA/copy trading, and challenge time limits.

2.1. The 5%ers (Instant Funding)

The 5%ers stands out with its instant funding model – no challenge required like traditional prop firms. Traders can start trading a live funded account immediately after registration, with a low profit target and no time limit. This makes it ideal for those who want to avoid pressure from deadlines and prefer to trade using EAs or longer-term swing strategies.

- Strengths: No challenge, no time limit, supports EA usage.

- Best for: Traders who want instant funding with low pressure and long-term strategies.

2.2. Fidelcrest (Micro Account)

The Fidelcrest Micro Account is beginner-friendly, requiring a profit target as low as 5% and allowing a 10% maximum drawdown. The challenge fee is low, and the 30-day time limit is reasonable for traders to prove their skills without rushing. They also allow EA use after approval.

- Strengths: Low cost, flexible rules, beginner-friendly.

- Best for: New traders or those looking to recover from previous failures.

2.3. SurgeTrader

SurgeTrader features a simple one-phase evaluation with no consistency rule or daily drawdown requirements. There is no time limit, and EAs are allowed, enabling traders to focus fully on their strategy without worrying about deadlines.

- Strengths: One phase only, no time limit, no consistency rule.

- Best for: Experienced traders wanting fast funding.

2.4. FTUK (Instant Funding)

With FTUK, you can start trading a live funded account immediately without any challenge. They support EA, grid, and scalping strategies and offer flexible drawdown limits. This is a top choice for those with proven trading systems.

- Strengths: No challenge, supports automated trading and EAs.

- Best for: Algo traders and EA users wanting to save time.

2.5. FundedNext (Evaluation Program)

FundedNext offers various account options, including an evaluation program with a high 12% drawdown and a moderate profit target. They allow copy trading and EAs on some programs a big plus for automated system users.

- Strengths: Flexible rules, allows copy trading and EA under certain conditions.

- Best for: Traders with copy systems or EAs needing risk control.

2.6. Lux Trading Firm

Lux Trading Firm uses an “institutional-style” funding model – you start with a 60-day evaluation account and get funded progressively. They allow EA use with prior approval. Lux is highly rated for transparency and in-depth support.

- Strengths: Long-term funding model, EA approved after review.

- Best for: Professional traders or those seeking long-term funding.

2.7. True Forex Funds

This is one of the most popular firms among EA traders. True Forex Funds has a reasonable 8% profit target, 10% drawdown, and a 30-day limit. They are flexible with EA use as long as the rules are followed.

- Strengths: Good EA support, transparent evaluation.

- Best for: EA users, bot traders, and scalpers.

2.8. MyFundedFX

MyFundedFX impresses with its no time limit policy, allowing traders to focus on quality over speed. With a high 12% drawdown, it offers a great chance for those who failed challenges elsewhere.

- Strengths: No deadlines, high drawdown, supports diverse strategies.

- Best for: Beginners or traders needing a second chance without time pressure.

2.9. E8 Funding

E8 Funding features a modern dashboard, a 30-day challenge period, and a 5% drawdown, which is lower than average. However, EAs are not allowed, so it suits only manual traders.

- Strengths: Modern interface, fast funding process.

- Best for: Manual traders who prefer a clean dashboard.

2.10. Bespoke Funding Program

Bespoke Funding stands out with a strong community and clear evaluation policies. EA use is allowed if the rules are followed. They provide good educational materials and strategy guidance, increasing passing chances.

- Strengths: Strong community support, strategic guidance, and EA allowed.

- Best for: Traders needing guidance and active community support.

2.11. Blue Guardian

Blue Guardian is one of the most transparent and accessible firms in 2026. They allow EAs, news trading, and have no hidden rules. The user interface is friendly, and the evaluation system is clear.

- Strengths: Transparent rules, EA & news trading allowed.

- Best for: Traders who want clarity and good risk control.

2.12. TopTier Trader

Finally, TopTier Trader is a must-know for easy-to-pass firms. They offer flexible trading conditions, no consistency requirement, and allow EA use, reducing psychological barriers for new traders.

- Strengths: No consistency rule, flexible strategy use.

- Best for: Beginners or those who want to test various strategies.

Below is a curated list of 12 prop trading firms that are widely considered the easiest to pass in 2026. We’ve evaluated them based on pass rates, rule flexibility, EA allowance, and trader feedback.

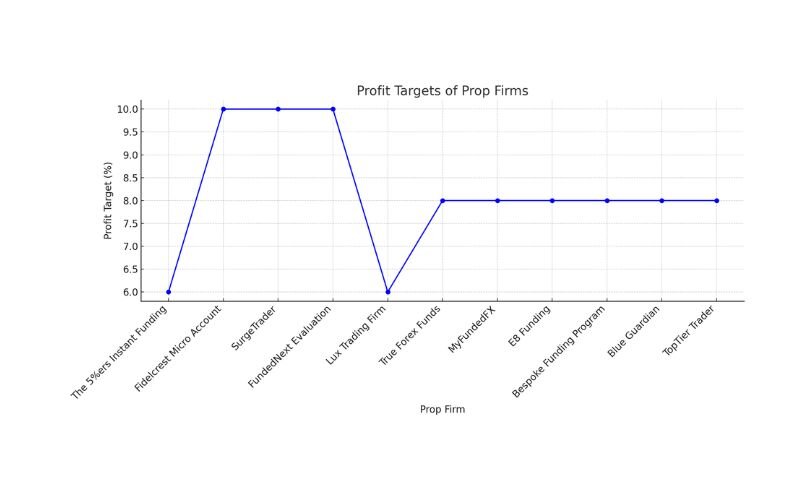

| Prop Firm | Profit Target | Max Drawdown | Time Limit | EA Allowed | Notes |

|---|---|---|---|---|---|

| The 5%ers Instant Funding | 6% | 4% | No time limit | Yes | No challenge stage, instant capital |

| Fidelcrest Micro Account | 5-10% | 10% | 30 days | Yes | Good for beginners, low fees |

| SurgeTrader | 10% | 5% | No time limit | Yes | One-phase challenge, fast evaluation |

| FTUK Instant Funding | None | 5% | No challenge | Yes | Start live instantly, great for EAs |

| FundedNext Evaluation | 10% | 12% | 30 days | Yes (select plans) | Allows copy trading |

| Lux Trading Firm | 6% | 4% | 60 days | Yes (with approval) | Institutional-style funding |

| True Forex Funds | 8% | 10% | 30 days | Yes | Popular with EA users |

| MyFundedFX | 8% | 12% | No time limit | Yes | Offers no-time challenges |

| E8 Funding | 8% | 5% | 30 days | No | Manual trading only |

| Bespoke Funding Program | 8% | 10% | 30 days | Yes | Strong community support |

| Blue Guardian | 8% | 10% | 30 days | Yes | Transparent rules, EA-friendly |

| TopTier Trader | 8% | 10% | 30 days | Yes | Flexible trading conditions |

Note: Criteria can change. Always review each firm’s official website or FAQ section before applying.

See more related articles:

3. Should you use an EA to pass prop firm challenges?

EAs (Expert Advisors) or trading bots are powerful tools, but they aren’t a magic bullet. Depending on the firm, they can either be an asset or lead to disqualification.

3.1. Pros and cons of EA use

Pros:

- Automates strategy execution

- Removes emotional bias

- Allows 24/5 trading

Cons:

- Some EAs violate firm policies

- Might not deliver consistent results in turbulent markets

- Less flexibility during sudden market changes

3.2. Prop firms that allow eas in 2026

If you prefer algorithmic trading, look for firms that either explicitly allow or support EAs:

- The 5%ers: EA-friendly, especially on instant funding models

- FundedNext: Supports copy trading and select EA usage

- True Forex Funds: Highly regarded by algo traders

- FTUK: Ideal for EA and grid systems

- Blue Guardian & MyFundedFX: Support EAs with transparency

4. How to pass a prop firm challenge easily? Tips to pass a prop firm challenge easily

Passing a challenge is about more than just picking the easiest firm. Being ready and maintaining focus are essential for strong performance.

4.1. Strategy tips

- Use a backtested, proven strategy with a consistent risk-reward ratio.

- Aim for high-probability setups rather than frequent trades.

- Prioritise protecting your capital rather than chasing rapid gains.

4.2. Psychological preparation

- Treat demo challenges like real accounts.

- Avoid overtrading, revenge trading, or jumping strategies.

- Set daily loss limits and take scheduled breaks.

5. Which prop firm is best for you?

Choosing the best prop firm depends on your trading style, goals, and psychological profile. Consider the following questions to guide your decision:

- Is your trading style more hands-on or algorithm-driven?

- Can you trade within tight timeframes, or do you need more flexibility?

- Are you a scalper, swing trader, or algo trader?

If you’re unsure, start with firms that offer free trials or low-cost entry, such as FTUK or Fidelcrest. You can also refer to our complete prop firm comparison guide for side-by-side evaluations.

6. FAQs about passing prop firms

Some firms, like FundedNext, allow copy trading, but check their specific rules.

True Forex Funds, FundedNext, and The 5%ers are among the most EA-friendly.

Topstep and Apex Trader Funding are often cited, but rules differ from forex-focused firms.

Yes. FTUK and The 5%ers offer instant funding with no challenge.

FTUK and The 5%ers (Instant Funding) are widely regarded as the easiest due to no challenge stage and flexible rules. For challenge-based options, MyFundedFX and SurgeTrader are often considered beginner-friendly.

Prop firms like FTMO, MyFundedFX, and True Forex Funds are known for fast and reliable payouts, often within 1–2 business days once the payout is requested.

Pass rates vary, but industry estimates suggest that only 5–15% of traders pass challenges on their first attempt. Firms with no or one-phase challenges tend to have higher success rates.

7. Final thoughts

Finding the easiest prop firms to pass in 2026 can dramatically improve your chances of becoming a funded trader. In this guide, we’ve broken down what makes a prop firm easier, from low profit targets and flexible rules to EA support and no time limits.

Here’s a quick recap of some of the easiest prop firms to pass this year:

- FTUK (Instant Funding) – No challenge stage, ideal for EA users

- The 5%ers (Instant Funding) – No time limit, fast-track to live funding

- Fidelcrest (Micro Account) – Beginner-friendly, low profit targets

- MyFundedFX – No time pressure, supports a variety of strategies

- SurgeTrader – One-step evaluation, no daily drawdown limits

- True Forex Funds – Trusted by EA traders, high pass rates

- FundedNext – Allows EAs and copy trading on selected accounts

These firms stand out because they offer more relaxed rules, better flexibility, and higher success rates, making them perfect choices for both beginners and experienced traders looking for a smoother path to funding.

Whether you’re using a manual strategy or automated bots, choosing the right firm is key to passing with confidence. Take time to evaluate your goals, trading style, and comfort level with risk before committing.

Need help choosing the best prop firm for your strategy? Subscribe to and Prop Firm & Trading Strategies of H2T Funding for expert reviews, comparison guides, and the latest insights into the easiest prop firms to pass in 2026.