Securing a funded account is a game-changer, but the path you choose is critical. In the crowded prop firm space, the E8 Funding vs FTMO debate stands out. One is known for its modern, flexible approach, while the other is the industry’s established benchmark.

H2T Funding will break down the crucial differences, from their challenge rules and profit splits to scaling plans and hidden fees. This guide provides the clarity you need to confidently decide which firm truly offers the better deal for your personal trading style and goals.

Key takeaways

- FTMO is the trusted industry benchmark, offering a structured path, higher leverage, and unmatched reliability for disciplined traders.

- E8 Funding is the flexible modern challenger, providing multiple challenge types, lower fees, and access to the futures market.

- Choose FTMO if you prioritise reputation, a proven system, and require higher leverage or zero commission on indices.

- Choose E8 Funding if you want the fastest funding path (1-step), need to trade futures, or prefer lower entry costs and more aggressive scaling.

1. Overview of E8 Funding vs FTMO

Both FTMO and E8 Funding stand as top contenders in the proprietary trading space, but they cater to traders with very different philosophies. FTMO represents the established, standardised path to a funded account, trusted by thousands globally. E8 Funding, on the other hand, champions flexibility and modern options, aiming to fit a wider range of trading styles.

This quick comparison table lays out their core features side by side, giving you a powerful first look at their fundamental differences.

| Aspect | E8 Funding | FTMO |

|---|---|---|

| CEO | Dylan Elchami | Otakar Suffner |

| Funding Models | 1-step, 2-step, 3-step | 2-step |

| Account Size | $5K – $500K | $10K – $200K |

| Profit Split | 80% – 100% | 80% – 90% |

| Profit Target | 4% – 8% | 10% (Step 1) 5% (Step 2) |

| Payout Frequency | Bi-weekly or on-demand payouts | On-demand after 14 days |

| Time Limits | No time limit | No time limit |

| Minimum Trading Days | No minimum trading days | 4 days |

| Daily Loss Limit | 3% – 9.2% | 5% |

| Maximum Loss Limit | 4% – 14% | 10% |

| Instruments | Forex, Commodities, Indices, Crypto, Energy, Futures | Forex, Commodities, Indices, Stocks, Crypto |

| Platforms | MT5, cTrader, Match Trader, TradeLocker, E8 Futures | MT4, MT5, cTrader, DXtrade |

| News/Weekend Trading | Weekend holding allowed; News restricted to funded accounts | Weekend holding restricted (standard); News restricted on funded accounts |

| Starting Fees | $40 | €155 (~$178) |

Disclaimer: Rules, pricing, and trading conditions may change over time. Traders should always verify the latest terms directly on the official E8 Funding and FTMO websites before purchasing any challenge.

E8 Funding

#1

Account Types

1-step

Trading Platforms

MT5, cTrader, Match Trader, TradeLocker

Profit Target

6%

Our take on E8 Funding

E8 Funding is our top pick for traders valuing flexibility. By offering multiple evaluation paths, they empower you to choose a challenge that fits your style. It is crucial, however, for traders to read the terms carefully, as funded accounts operate in a simulated environment with real payouts, not on a live market account.

However, this freedom comes with a clear expectation: you must be a genuinely skilled, individual trader. Their strict consistency rules and policies against mass-copying strategies show they are looking for sustainable talent, not just traders who get lucky with one big move.

| 💳 Challenge Fee | $40 – $4,460 |

| 👥 Account Types | 1-step |

| 💰 Profit Split | 80% – 100% |

| 💵 Account Size | $5K – $500K |

| ⏱️ Time Limit | No time limit |

| 🎯 Profit Target | 6% |

| 📊 Trading Platforms | MT5, cTrader, Match Trader, TradeLocker |

| 🛍️ Asset Types | Forex, Commodities, Indices, Crypto, Energy, and Futures |

FTMO

#2

Account Types

2-step

Trading Platforms

MT4, MT5, cTrader, DXTrade

Profit Target

5% – 10%

Our take on FTMO

FTMO is the undisputed industry benchmark, and for good reason. They are our top recommendation for traders who prioritise structure, discipline, and long-term reliability. Their standardised 2-step challenge, while demanding with its 10% profit target, has become a globally recognised rite of passage that proves a trader’s consistency.

The firm’s entire ecosystem, from the advanced Account MetriX analytics to the structured scaling plan, is built to foster disciplined and professional traders. While they are less flexible and more expensive than newer firms, choosing FTMO is an investment in a proven and highly reputable system that has stood the test of time.

| 💳 Challenge Fee | €89 – €1,080 |

| 👥 Account Types | 2-step |

| 💰 Profit Split | 80% – 90% |

| 💵 Account Size | $10K – $200K |

| ⏱️ Time Limit | No time limit |

| 🎯 Profit Target | 5% – 10% |

| 📊 Trading Platforms | MT4, MT5, cTrader, DXTrade |

| 🛍️ Asset Types | Forex, Commodities, Indices, Stocks, Crypto |

Explore more:

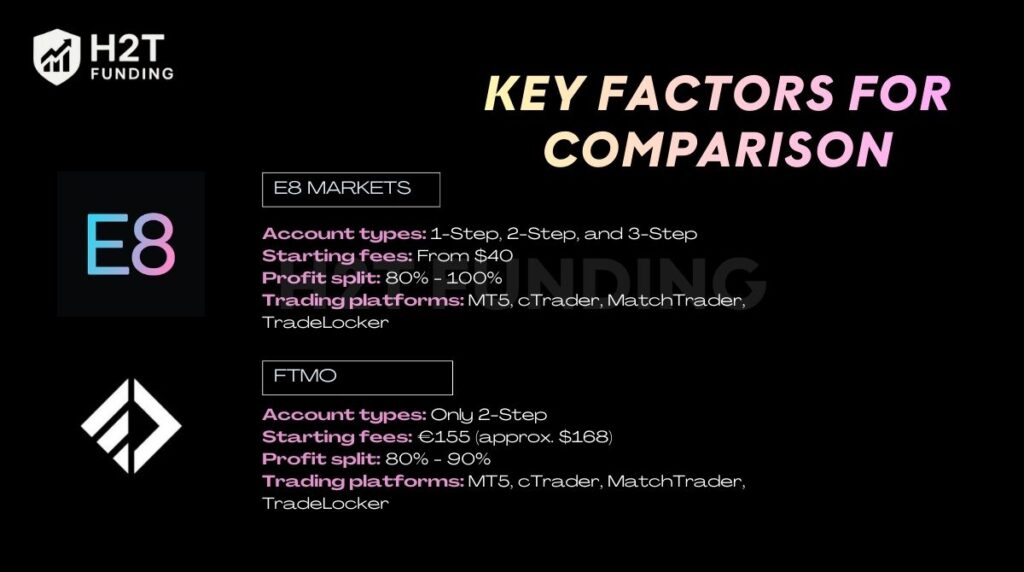

2. Key factors for comparison: E8 Funding vs FTMO

The true value of a prop firm is found in the details that govern your daily trading. These factors, from the challenge structure and fees to profit splits and risk rules, are what ultimately determine your potential for success.

Let’s break down these critical factors to see how E8 Funding vs FTMO truly stack up in practice.

2.1. The evaluation process: A challenge structure breakdown

To get funded, you first have to pass a test, and the firms have very different ways of doing this. E8 Funding lets you choose from several types of tests, so you can pick the one that feels right for you. In contrast, FTMO has one standard 2-step challenge that everyone takes.

This initial choice will significantly influence your journey to a funded account.

| Feature | E8 Funding | FTMO |

|---|---|---|

| Available Models | Multiple: 1-Step, 2-Step, and 3-Step evaluations. | One standardised 2-Step process. |

| Profit Target (Phase 1) | Varies: 6% (1-Step) to 8% (2-Step). | 10% |

| Profit Target (Phase 2) | Varies: 4% (2-Step) or 5% (3-Step). | 5% |

| Minimum Trading Days | No minimum trading days required. | 4 days required for each phase. |

| Core Philosophy | Provide flexibility and choice for various trading styles. | Test for consistency and discipline. |

E8 Funding’s main advantage is giving traders choices. The 1-step evaluation is the quickest way to get funded if you are confident in your skills. The 3-step model is a cheaper option to get started. This variety lets you pick a test that actually matches your personal trading style.

FTMO’s 2-step test is tough and designed to find traders who can profit consistently. The rules are strict, but they provide a very clear and respected way to get a funded account. For many traders, passing the FTMO challenge rules is seen as a real accomplishment.

2.2. Challenge fees and refund policies

The fee to take a challenge is your only financial risk, so understanding the cost and how you get it back is essential. Both firms require an upfront payment, but their pricing structures and refund conditions have important differences. This determines how accessible each firm is and how they reward your success.

Here is how their fee and refund policies compare directly.

| Feature | E8 Funding | FTMO |

|---|---|---|

| Starting Fee | From $40 for a $5k account. | From €155 (approx. $168) for a $10k account. |

| Refund on Success | Yes. The fee is also refunded with your first profit split. | Yes. The fee is fully refunded with your first profit split. |

| Refund Before Trading | Yes, if requested within 30 days with no trades. | Yes, if requested within 14 days with no trades. |

| Crypto Payment Refund | No, refunds are not processed for crypto payments due to AML rules. | No, refunds are not processed for crypto payments. |

E8 Funding is significantly more accessible with a much lower starting fee. This allows traders to test their skills with less upfront risk. Their policy of refunding the fee upon success makes them highly competitive and attractive for new traders.

FTMO’s pricing is higher, reflecting its position as an established industry leader. Their refund policy is a core part of their model: pass the evaluation, and your initial investment is returned. This serves as a powerful incentive for dedicated traders.

Ultimately, your choice here depends on your budget. E8 Funding is the clear winner for affordability, while FTMO’s higher fee is often seen as the price for entry into a highly reputable system.

If you’re considering your total investment before joining FTMO, you can also review how many FTMO accounts you can have to plan your scaling strategy.

2.3. Profit split & account scaling plans

Once you are funded, your focus shifts to two things: the performance rewards you can earn and how fast you can trade with more capital. The profit split is your direct reward, while the account scaling plan is your path to a larger career. The firms have fundamentally different approaches to growth.

This is where you decide if you prefer a steady, predictable climb or a rapid, performance-based expansion.

| Feature | E8 Funding | FTMO |

|---|---|---|

| Default Profit Split | 80% (Can be higher on select plans) | 80% |

| Maximum Profit Split | Up to 100% on select plans | 90% (achieved through scaling plan) |

| Scaling Method | Payout Scaling – account grows with each payout. | Formal Scaling Plan based on long-term performance. |

| Scaling Trigger | With every single payout request. | Every 4 months, if a 10% profit is met. |

| Growth Amount | The full amount of the profit requested. | +25% of the original account balance. |

E8 Funding’s approach to account scaling is far more aggressive and dynamic. By adding your payout directly to your balance, they allow you to compound your success instantly. A single profitable month can dramatically increase your trading capital and drawdown limits, offering one of the fastest growth tracks in the industry.

When it comes to scaling options, FTMO provides a structured, long-term growth path. Their plan rewards consistent profitability over four months with a significant 25% capital increase and a top-tier 90% profit split. This model is ideal for traders who value stability and a predictable career progression.

2.4. Risk management on drawdown limits

This is the most critical rule in prop trading. A single violation will immediately end your challenge or funded account. Understanding exactly how each firm calculates your loss limits is essential for survival and long-term success. Your entire risk management strategy must be built around these numbers.

Let’s compare their drawdown rules side-by-side.

| Feature | E8 Funding | FTMO |

|---|---|---|

| Daily Drawdown | Customizable, often starting at 4%. | Fixed at 5% of the initial account balance. |

| Maximum Drawdown | Customizable, often starting at 8%. | Fixed at 10% of the initial account balance. |

| Calculation Method | The daily loss is also based on the daily starting balance. | The daily loss is based on the balance at the start of the day. |

The industry standard 5%/10% rule from FTMO is clear, predictable, and non-negotiable. This fixed system forces traders to adopt a disciplined approach from day one. Because there is no room for adjustment, it greatly simplifies risk calculations.

Giving traders the ability to customize their drawdown is a significant advantage for E8 Funding. This allows you to tailor the account’s risk parameters to your specific trading style. You can choose a lower drawdown for a cheaper fee or a higher one for more breathing room during volatile periods.

2.6. Trading rules

Beyond passing the challenge, your long-term success depends on navigating the firm’s daily trading rules. This is where you find the fine print that defines your trading freedom. FTMO has a famously structured rulebook, while E8 Funding offers more flexibility but has specific rules to prevent system gaming.

Here’s how their strategic freedoms compare.

| Feature | E8 Funding | FTMO |

|---|---|---|

| News Trading | Restricted (±5 mins) on funded accounts. | Restricted (±2 mins) on standard funded accounts. |

| Weekend/Overnight | Generally allowed. | Not allowed on standard-funded accounts (allowed on Swing accounts). |

| EA (Bot) Usage | Allowed, but strictly one unique strategy per user. | Allowed, with a focus on responsible risk. |

| Copy Trading | Allowed, but not between two E8 evaluation accounts. | Allowed, but group/mass copying is prohibited. |

| Consistency Rule | Yes, a mandatory rule: 40% for E8 One, Classic & Track, and 35% for E8 Signature | No mandatory rule. Provides a Consistency Score for guidance only. |

E8 Funding offers more strategic freedom, but this comes with strict conditions. Their mandatory consistency rule, where your best day cannot exceed 35-40% of total profits, is a significant challenge. Combined with the one unique strategy rule for EAs, it’s clear they are looking for traders with a consistently repeatable edge, not those relying on single, lucky trades.

A very controlled trading environment is created on FTMO’s standard accounts to protect capital. The restrictions on news and weekend holding are strict, but can be bypassed by choosing the Swing account type. Importantly, their Consistency Score is an educational tool which reduces pressure on traders who have an exceptionally profitable day.

2.5. Trading platforms and available instruments

The tools you trade with and the quality of your market access are fundamental to your success. Both firms provide access to powerful trading platforms and a wide range of assets. However, their offerings are tailored for different types of traders, with one clear winner for futures and another for stock CFDs.

This is especially important for U.S. traders, who face specific platform restrictions.

| Feature | E8 Funding | FTMO |

|---|---|---|

| Trading Platforms | MT5, cTrader, MatchTrader, TradeLocker. | MT4, MT5, cTrader, and DXtrade. |

| Key Instruments | Forex, Indices, Commodities, Crypto. | Forex, Indices, Commodities, Crypto. |

| Specialty Assets | Futures. | Stock CFDs. |

| U.S. Trader Platforms | TradeLocker and MatchTrader only. | DXtrade only. |

The inclusion of Futures is a game-changing advantage for E8 Funding, attracting a more professional segment of traders. They focus on modern trading platforms like TradeLocker and MatchTrader, which are their designated solutions for a seamless experience for U.S. traders. This makes them a top choice for those wanting to trade products like the S&P 500 futures.

A comprehensive suite of platforms, including the classic MT4, makes FTMO a solid choice for many traders. Their key advantage is offering stock CFDs, which provide a great opportunity for those who specialize in equities. For traders in the US, access is streamlined through their proprietary DXtrade platform.

3. Explained FTMO vs E8 Funding trading conditions: Leverage, and commissions

The trading conditions a firm offers can significantly eat into your profits. Low commissions, tight spreads, and fair leverage are not just small details; they are critical factors that determine your net earnings. A profitable strategy can become a losing one if the trading costs are too high.

Let’s dissect how the two firms compare on these essential metrics.

| Trading Condition | FTMO | E8 Funding |

|---|---|---|

| Max Leverage (Forex) | Up to 1:100 | Up to 1:50 |

| Max Leverage (Indices) | Up to 1:50 | Up to 1:25 |

| Commission (Forex) | ~$5 per lot | ~$5 per lot (raw spread accounts) |

| Commission (Indices) | $0 | ~$6 per lot (raw spread accounts) |

| Commission (Crypto) | 0.065% per trade volume | $35 per lot |

For traders who require more buying power, FTMO offers a clear advantage with significantly higher leverage. The 1:100 leverage on forex and 1:50 on indices allows for greater flexibility in position sizing compared to E8’s more conservative limits. This can be a deciding factor for many experienced traders.

When it comes to trading costs, the difference is stark. The zero-commission trading on indices at FTMO is a massive benefit for anyone trading instruments like the US30 or DAX. Furthermore, their percentage-based fee on crypto is far more cost-effective than the very high flat-rate commission charged by E8 Funding.

4. The payout process

A firm’s payout system reflects its reliability and commitment to its traders. A smooth, fast, and transparent process is a sign of a trustworthy partner. Both firms have streamlined their withdrawal systems, but they differ in frequency, available methods, and minimum withdrawal amounts.

Here’s a breakdown of how you can access your profits.

| Feature | E8 Funding | FTMO |

|---|---|---|

| Payout Frequency | On-demand, as soon as profit is made (bi-weekly for some plans). | On-demand, after a minimum of 14 days from the first trade. |

| Processing Time | 1-2 business days for processing, up to 5 total for funds to arrive. | 1-2 business days. |

| Payment Methods | Bank transfer (via Plane), Cryptocurrencies (via Rise). | Bank transfer, Skrill, and Cryptocurrencies. |

| Minimum Payout | $50 for bank transfer, $250 for crypto (via Rise). | $20 for bank wire, $50 for crypto. |

The payout system at FTMO is known for its reliability and speed. Their 14-day cycle provides a consistent schedule, and the low minimum withdrawal amounts make it easy to access smaller profits. Offering direct crypto withdrawals is a major convenience for many international traders, making it a top choice in the best prop firms in Canada.

Offering Payout on Demand gives E8 Funding a competitive edge, but it’s important to understand the conditions. While highly flexible, eligibility often depends on your specific account type and meeting certain criteria, such as the Best Day Rule, before a withdrawal can be processed.

For traders looking for alternatives in Asia, E8 Funding is often compared among the best prop firms in Singapore, thanks to its flexible withdrawal options.

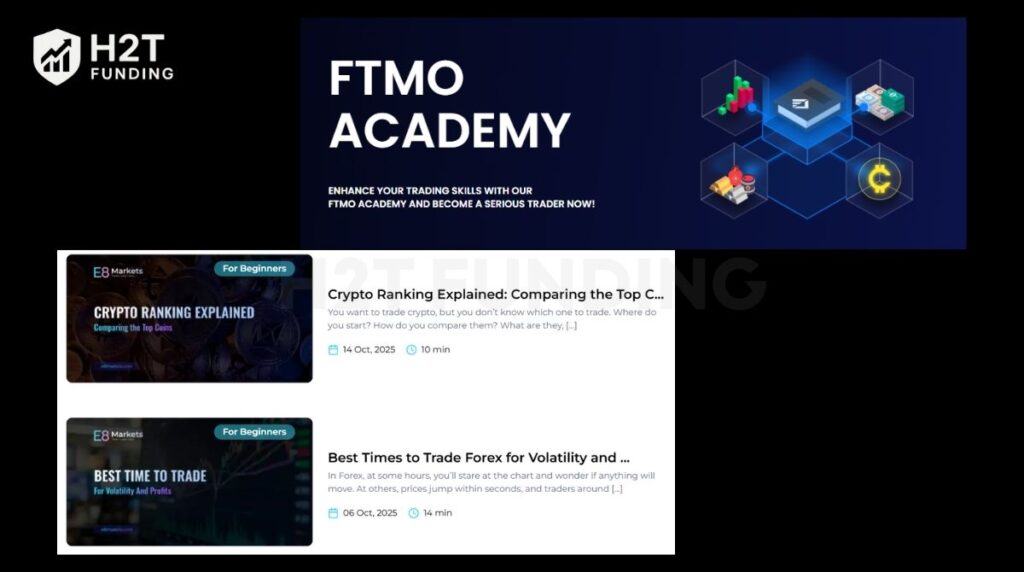

5. Trader support and educational resources

Excellent support and valuable learning materials are signs that a prop firm is invested in your long-term success. While both firms offer solid customer service, their approach to trader education and community building is quite different. One acts as a formal academy, while the other focuses on community-driven support.

This is a key factor for traders who are still developing their skills.

| Feature | E8 Funding | FTMO |

|---|---|---|

| Educational Content | Blog & Help Centre: Articles and guides on specific topics. | FTMO Academy: A structured, in-depth learning portal. |

| Support Channels | Email, 24/7 Live Chat. | Email, Live Chat, Phone Support. |

| Community | A fast-growing and active Discord community. | Large, established global community. |

| Performance Tools | Standard dashboard analytics. | Account MetriX: Advanced performance analytics. |

The strength of E8 Funding lies in its vibrant and active Discord community. This provides a space for traders to connect, share ideas, and find support in real-time. While their formal educational resources are more basic, this community-centric approach is highly valuable for collaborative learning and staying engaged with the market.

For traders seeking structured education, FTMO is the undisputed leader. The FTMO Academy is a comprehensive resource that covers everything from basic concepts to advanced strategies. Paired with their advanced Account MetriX analytics tool, they provide an ecosystem built for serious trader development.

6. Common mistakes when taking the E8 or FTMO evaluation

Passing an E8 or FTMO evaluation is less about finding the perfect strategy and more about avoiding preventable mistakes. Both firms focus heavily on discipline, consistency, and risk management. Here are the most common errors traders make, and why they lead to failure.

6.1. Misunderstanding the daily loss limit calculation

This is the number one reason traders fail. The daily loss limit is not just a number; it’s calculated based on a specific time zone and method that can be confusing.

- A common FTMO pitfall: The 5% daily loss resets at midnight Central European Time (CET), not your local time or the server time on your platform. A trader in the US could think they are starting a new day, place a trade, and instantly fail because it’s still the previous day according to FTMO’s clock.

- A common E8 Funding pitfall: Their drawdown is often calculated from equity, not just the balance at the start of the day. This means a profitable open trade that pulls back can still violate the daily loss limit, even if your account balance never went down that far.

6.2. Over-risking to chase the profit target

The pressure to hit the profit target often leads to disastrous risk-taking. Traders abandon their strategy and start gambling, hoping for one big win to pass the challenge.

- With FTMO’s 10% target: This high target can create immense psychological pressure. Traders may feel forced to risk 2-3% per trade, which is unsustainable and leaves no room for a losing streak. One or two bad trades can quickly end the challenge.

- With E8 Funding’s consistency rule: Even if you hit the profit target with one massive trade, you can still fail. Their mandatory “Best Day Rule” on payouts is designed to penalize this exact behaviour. They want to see consistent, steady gains, not one lucky home run.

6.3. Ignoring the hidden costs in your stop-loss

Many traders set their stop-loss exactly at their maximum loss limit, forgetting that other costs are factored into the final calculation. This is a simple but fatal mistake.

- Commissions: If your maximum allowed loss is $500 and your commission per trade is $7, placing your stop-loss exactly at –$500 will actually bring your total loss to –$507, which violates the rule. You must always set your stop-loss at a level that includes all trading fees.

- Slippage: During volatile news or market events, your stop-loss may not execute at the exact price you set. This slippage can cause your loss to exceed the limit. It is always safer to give yourself a buffer and never trade right up to the maximum loss line.

In summary, success in these challenges hinges on defence, not just offence. Pay meticulous attention to the time zone, understand how drawdown is calculated, and always factor commissions and potential slippage into your risk. These small details are what separate funded traders from those who fail.

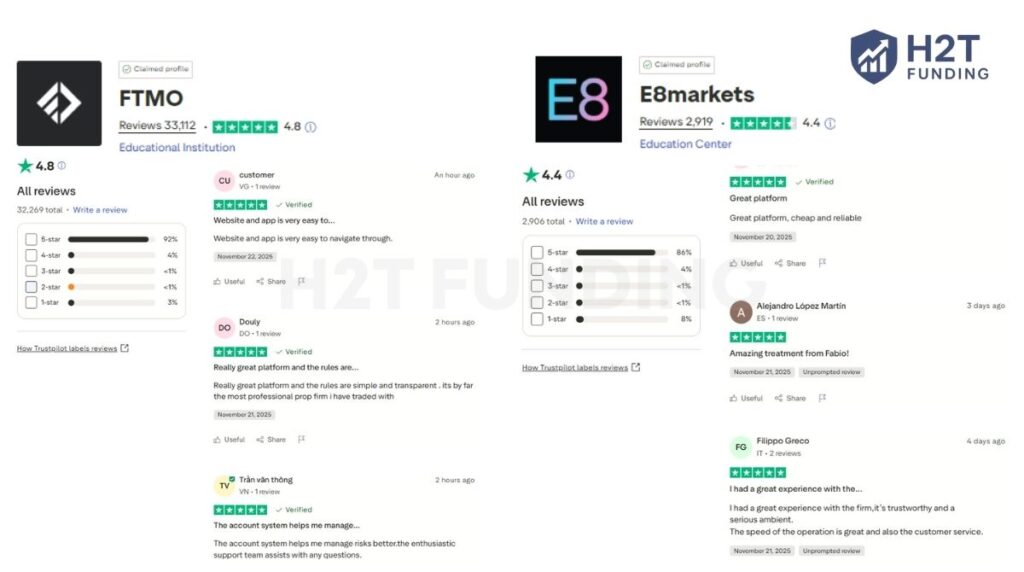

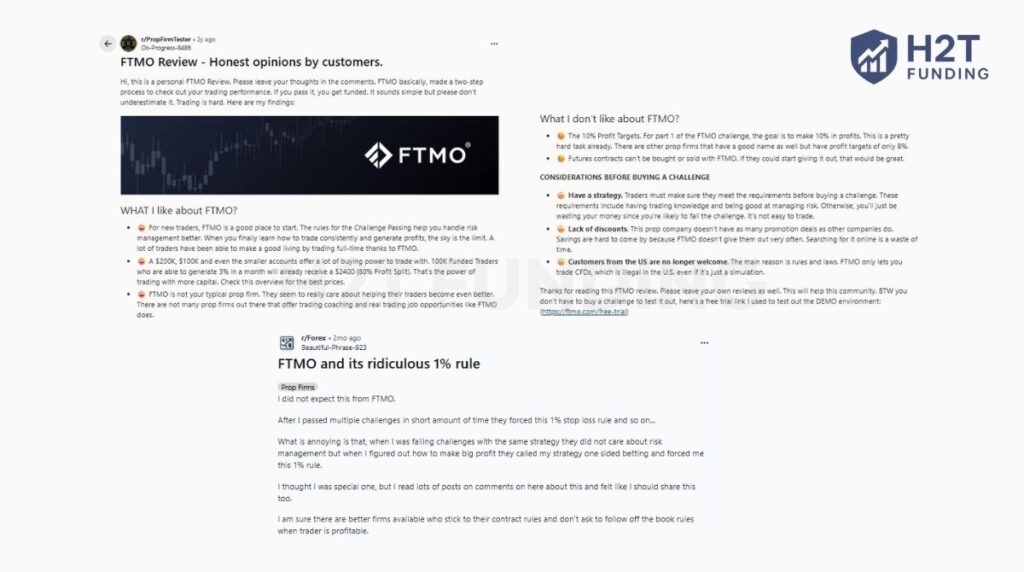

7. Real trader reviews from Reddit, Trustpilot about E8 Funding vs FTMO

A company’s marketing is one thing; the real experiences of its customers are another. We’ve analyzed feedback from platforms like Trustpilot and Reddit to get an unbiased view of what traders actually think. This gives us a clearer picture of each firm’s true strengths and weaknesses.

On Trustpilot, both firms earn excellent ratings, showing high customer satisfaction. FTMO has a top-tier score from over 32,000 reviews, highlighting its long-term reliability. E8 Funding is not far behind with a strong rating, often praised for its platform and fast support.

On Reddit, traders often recommend FTMO as a great place to learn discipline. Common complaints include the high 10% profit target and the lack of futures trading. Some successful traders also report facing stricter risk rules after becoming profitable.

Discussions about E8 Funding frequently praise its flexibility and lower costs. Traders often celebrate passing the 1-step challenge and having more rule freedom. The main hesitation from the community is that it’s a newer firm compared to the industry giant, FTMO.

The community consensus is clear. FTMO is viewed as the highly reputable, albeit stricter and more expensive, industry standard. E8 Funding is seen as the more flexible, accessible, and modern challenger that is quickly building a strong reputation for itself.

8. Frequently Asked Questions (FAQ)

Easier depends on your trading style. E8 Funding offers lower profit targets on some plans and a 1-step challenge, which many find faster and simpler. FTMO’s 10% profit target in Phase 1 is a high bar, making it statistically harder, but its rules are very clear.

No. FTMO offers a wide range of assets, including forex, indices, and stock CFDs, but they do not currently provide access to the futures market. This is one of the biggest advantages of E8 Funding for traders who specialize in that instrument.

They are very similar. Both firms will refund your initial evaluation fee with your first profit split after you become a funded trader. This means if you successfully pass the challenge and make a profit, you get your upfront cost back.

With E8 Funding, yes, holding trades overnight and over the weekend is generally allowed. With FTMO, it depends on your account type. Their standard funded account does not allow it, but their “Swing” account is specifically designed for traders who need this freedom.

Both firms offer a path to a 90% profit split. FTMO increases your split from 80% to 90% as part of its scaling plan. E8 Funding also offers up to a 90% split and has had special programs offering up to 100%, making them highly competitive.

Better is subjective. FTMO is the industry benchmark for reliability and structure. Competitors like E8 Funding are better for traders who need more flexibility, lower costs, or access to specific markets like futures. No single firm is best for everyone.

Yes. E8 Funding is a reputable firm with a proven track record of paying its traders. They have processed millions of dollars in payouts, and positive payment proofs are widely available on platforms like Trustpilot and Discord.

Yes, but with platform restrictions. As of late 2026, U.S. traders at FTMO are directed to use the DXtrade platform, as MetaTrader (MT4/MT5) and cTrader are not available to them through the firm.

Yes, E8 Funding also accepts U.S. traders. Similar to FTMO, they have specific platforms designated for their US-based clients, which are typically TradeLocker and MatchTrader, to comply with regional regulations.

FTMO’s biggest advantage is its unmatched reputation and trust. Having been a market leader for years, they offer a proven, reliable pathway to funding and have a massive global community. Their brand is synonymous with legitimacy in the prop firm industry.

E8 Funding’s biggest advantage is its flexibility and accessibility. With multiple challenge types (1-step, 2-step, 3-step), lower starting fees, and the unique offering of futures trading, they cater to a much broader range of traders and strategies than most competitors.

Yes, E8 Funding (E8 Markets) is widely considered a legitimate and reputable prop firm. They have a strong rating 4.4/5 on Trustpilot, a large and active community, and a proven track record of processing millions of dollars in payouts to successful traders worldwide.

There is no official 3% rule at FTMO that will cause you to fail. Their strict, mandatory rules are the 5% Maximum Daily Loss and the 10% Maximum Overall Loss. The 3% rule is a widely recommended personal risk management guideline where traders stop for the day after a 3% loss to safely avoid ever breaking the official 5% limit.

9. Conclusion

The E8 Funding vs FTMO debate doesn’t have a single right answer; it has the right answer for you. Your choice depends entirely on your priorities as a trader. Both are legitimate, high-quality prop firms that offer a real opportunity to trade significant capital.

Choose FTMO if:

- You value reputation and reliability above all else.

- You thrive in a structured environment with clear, fixed rules.

- You want access to stock CFDs and advanced performance analytics.

Choose E8 Funding if:

- You need flexibility in your evaluation, with 1-step, 2-step, or 3-step options.

- You want to trade futures or require more freedom in your trading style.

- You are looking for a lower entry cost and a faster, more aggressive scaling plan.

Ultimately, the best decision comes from being well-informed. This comparison has laid out the facts, but your trading journey is just beginning.

To explore more in-depth prop firm reviews, uncover winning strategies, and find the tools you need to succeed, visit the H2T Funding blog. We provide expert insights to help you conquer any challenge and achieve your trading goals.