Navigating the world of proprietary trading firms often leads to several critical questions for the modern trader: Does Topstep allow automated trading? More specifically, does Topstep allow algorithmic trading, and can you use bots on Topstep?

You’ve likely spent months, if not years, perfecting a trading bot or an automated strategy, and now you want to unleash its potential with a firm like Topstep. But the fear of violating a hidden rule and losing your account is real.

You’re not alone. Many traders are looking to automated trading to save time, eliminate emotional decisions, and execute with precision. This guide provides a clear, comprehensive answer to whether Topstep permits automated trading, what the specific rules are, and how their policies compare to other major prop firms.

Key takeaways:

- Does Topstep allow automated trading? Yes, Topstep automated trading is allowed. Topstep permits the use of automated strategies in both the Trading Combine and Funded Accounts, but with strict rules and disclaimers.

- API is key: For advanced automation, Topstep offers the TopstepX™ API, allowing developers and serious traders to build, test, and run their custom strategies.

- Prohibited conduct is paramount: All automated strategies must comply with Topstep’s list of prohibited trading behaviors, which bans exploiting the system, high-frequency trading, and other manipulative practices.

- You are fully responsible for your automated system. Topstep provides no technical support for bots and is not liable for any losses they cause.

1. Why are traders interested in automated trading

The rise of algorithmic trading has reshaped financial markets, and the prop trading space is no exception. Traders are increasingly drawn to automation for several compelling reasons:

- Eliminating emotion: Bots and algorithms execute trades based on predefined logic, removing the fear, greed, and hesitation that can sabotage a manual trader’s performance.

- Speed and efficiency: An automated system can identify and execute opportunities far faster than any human, which is critical in fast-moving futures markets.

- Backtesting and optimization: You can rigorously test a strategy on historical data to validate its effectiveness before risking capital, a cornerstone of algorithmic development.

However, this interest is often met with apprehension. Prop firms are known for their stringent rules, and traders worry that running a bot could lead to an instant disqualification. The primary concern is navigating the firm’s specific regulations to ensure its automated strategy is fully compliant.

2. Does Topstep allow automated trading?

So, is algo trading allowed on Topstep? The short answer is a definitive yes. To be clear, does Topstep allow trading robots and other automated strategies? It does, in both the Trading Combine evaluation and in a Funded Account.

However, this permission comes with important caveats. Topstep emphasizes that the trader is fully responsible for their automated system. While the firm offers excellent trader support for platform and account issues, this support does not extend to third-party software. The firm will not:

- Assist in setting up or configuring automated strategies.

- Troubleshoot any technical issues or errant trades caused by your bot.

- Make exceptions or grant refunds for losses resulting from a strategy’s malfunction.

Essentially, if you use a bot, you must own its performance and its failures entirely.

For developers and traders who demand more control, Topstep has introduced TopstepX™ API Access. This powerful feature is designed specifically for building, managing, and automating custom trading strategies and tools. It provides direct access to Topstep’s market data and order routing through REST and WebSocket APIs, supporting popular programming languages like Python, Java, and… NET.

3. Topstep’s official rules on automated trading

Understanding the official TopStep trading rules is crucial for any trader using automation. The firm maintains a strict framework to ensure fairness and realistic trading practices. These rules apply throughout your journey, from meeting the initial eligibility criteria and paying the activation fee or monthly cost, to achieving the profit target without violating the consistency target.

The firm’s stance is clear: automated trading is allowed if your strategy is replicable and sustainable in live markets. New users often ask is TradingView connection with Tradovate through Top Step free. While integration is supported, fees and access may vary, so confirm before using bots or EAs. Here’s a quick breakdown of the rules:

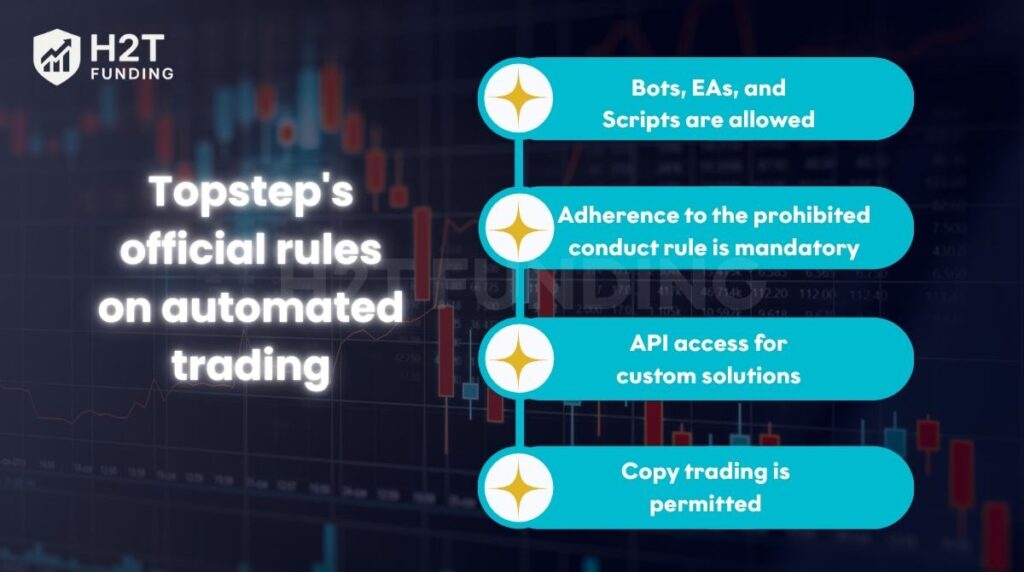

3.1. Bots, EAs, and Scripts are allowed (with conditions)

Topstep explicitly permits the use of trading bots, Expert Advisors (EAs), and custom scripts. There is no blanket ban on automated systems. However, the responsibility for the performance and behavior of these tools falls entirely on you, the trader. Topstep will not provide technical support for third-party software or compensate for losses caused by a bot’s malfunction.

Example: If you build an automated strategy on a supported platform like NinjaTrader or TradingView to trade E-mini S&P 500 futures, it is perfectly acceptable. However, if your script accidentally opens 100 lots instead of 10 and causes you to hit your Maximum Loss Limit, the responsibility is yours alone.

3.2. Adherence to the prohibited conduct rule is mandatory

Any automated strategy, regardless of its sophistication, is subject to Topstep’s list of Prohibited Conduct. This is the most critical rule to understand. Your bot cannot engage in activities such as:

- High-frequency trading (HFT) strategies generate an excessive number of orders and cancellations.

- Exploiting arbitrage opportunities between different data feeds.

- Using algorithms designed to take advantage of the simulated environment’s mechanics, which would not work in a live market.

Example: A trader develops a scalping bot that executes hundreds of trades within a few seconds to exploit tiny, fleeting price discrepancies in the data feed. This would likely be flagged as prohibited HFT or an exploitative strategy, leading to account termination.

3.3. API access for custom solutions

For traders who want to build their own systems from the ground up, Topstep offers the TopstepX™ API. This is the recommended path for advanced automation. The API provides direct access to market-level 1 data and level 2 data streams and order execution, but it comes with the same stringent rules.

It is not a backdoor to engage in prohibited high-frequency trading. Some traders may also run into technical setup issues, such as asking TopstepX why are my 2 charts mirroring together, which typically relates to platform configuration rather than the trading rules themselves.

3.4. Copy trading is permitted

Topstep allows the use of copy trading tools to duplicate your own trades across multiple Topstep accounts that you personally own and manage. The TopstepX™ platform even has a built-in trade copier for this purpose. Using a third-party copy trading service to blindly follow signals is not permitted. You must be the one actively managing the trading decisions and strategy.

Example: You are trading in three separate Trading Combines. You can use a copy trading tool to execute a trade on your main account and have it instantly replicated on the other two. This is compliant. However, subscribing to a signal service that automatically places trades in your Topstep account is forbidden.

4. Prohibited trading strategies at Topstep

Whether you are trading manually or with a bot, Topstep strictly forbids certain strategies. Violating these rules can lead to the termination of your account. Key prohibited activities include:

- Exploiting errors: Using any strategy designed to take advantage of errors in the service, such as price display glitches or data feed delays.

- Manipulative practices: Engaging in disruptive trading like spoofing or placing trades outside the best bid or offer.

- Unfair advantage: Using any software, artificial intelligence, or high-speed data entry that manipulates, abuses, or provides an unfair edge.

- Unrealistic fills: Adopting strategies that would not be viable in a live market due to their reliance on simulated fill mechanics.

- Account stacking: Repeatedly trading aggressively, hitting the Maximum Loss Limit, and then switching to another account to repeat the process.

Read more:

5. Why does Topstep restrict certain types of automation?

Prop firms like Topstep have a vested interest in fostering responsible and sustainable trading. Their restrictions on automation are not meant to stifle innovation but to manage risk and ensure fairness. The primary reasons include:

- Promoting fair play: The rules create a level playing field, preventing traders from using exploitative algorithms that couldn’t succeed in real-world market conditions.

- Managing systemic risk: Certain types of high-frequency trading (HFT) can strain platform infrastructure and are not aligned with the firm’s risk management protocols.

- Compliance with exchanges: As a gateway to live markets, Topstep must ensure its traders’ activities comply with the rules and regulations of the exchanges, like the CME Group.

- Focus on trader skill: Topstep’s goal is to fund skilled traders. They want to see strategies that demonstrate a genuine market edge, not just the ability to exploit a simulated environment.

6. Comparing Topstep with other prop firms on automation

Topstep’s approach to automation differs slightly from other popular firms. Here’s a quick comparison:

- Topstep: Focuses on futures trading and encourages automation primarily through its dedicated TopstepX™ API for custom strategies. It allows third-party tools but places full responsibility on the trader.

- FTMO: A well-known forex-focused firm, FTMO explicitly allows the use of Expert Advisors (EAs) and automated strategies. However, they prohibit strategies that exploit platform mechanics, perform arbitrage, or engage in high-frequency trading.

- The 5%ers: This firm also permits EAs and automated trading but has strict rules. Prohibited practices include latency arbitrage, tick scalping, and using third-party EAs where the trader does not possess the source code.

Topstep’s key emphasis is on its robust API for custom solutions. In contrast, firms like FTMO and The 5%ers focus more on commercial EAs for platforms like MetaTrader.

Here is a comparative analysis of Topstep and other leading prop firms:

| Feature | Topstep | FTMO | The 5%ers |

|---|---|---|---|

| Allows Automation | Yes | Yes | Yes |

| Primary Market | Futures (CME, Eurex) | Forex, Indices, Crypto, Commodities | Forex, Indices, Metals |

| Key Platforms | TopstepX™, NinjaTrader, TradingView, Quantower, etc. | MT4, MT5, cTrader | MT5 |

| API Access | Yes (TopstepX™ API) – Encouraged for custom strategies. | No direct trading API for clients. | No direct trading API for clients. |

| Key Restrictions | Prohibits HFT, manipulative/ exploitative strategies, and strategies not viable in live markets. Full trader responsibility. | Prohibits HFT, latency arbitrage, multi-account copy trading (except for account management), and some “black-box” EAs. | Prohibits HFT, latency arbitrage, tick scalping, and using EAs from the MQL5 market without proof of ownership/strategy knowledge. |

| Copy Trading | Allowed between a trader’s own accounts. | Restricted. Not allowed between different users. Allowing others to pass challenges for others is a breach. | Allowed between a trader’s own accounts. |

7. Alternatives for automation enthusiasts at Topstep

If building a custom strategy via API is daunting, consider these simpler alternatives, all managed from your trader dashboard:

- Semi-automated trading: Use bots or scripts to generate alerts based on predefined conditions during official trading hours, but execute the trades manually. This keeps you in full control while leveraging the analytical power of automation.

- Trade copiers: Topstep explicitly allows the use of trade copiers to replicate trades across multiple accounts you own.

- Use automation for practice: Leverage bots and algorithmic tools in a demo account to refine your discretionary futures trading strategy.

- Leverage Topstep’s Benefits: Remember that benefits like commission-free trading on a certain number of contracts apply whether you trade manually or with a bot, maximizing your profit potential.

Maybe you like: How many Funded Accounts can I have with Topstep

8. FAQs

Automated trading can be profitable, but it is not a guarantee. Profitability depends entirely on the strength of the strategy, proper risk management, and market conditions. A flawed strategy will only lose money faster when automated.

Yes, automated and algorithmic trading are legal in financial markets. However, all automated activities must comply with the regulations of the exchanges and the terms of service of the brokerage or prop firm you are using.

Yes, you can use trading bots on Topstep, provided they adhere to all of the company’s rules and do not engage in prohibited conduct. This directly answers the common query, “Can you use bots on Topstep?”.

The TopstepX™ platform is available through all major web browsers, which allows for trading on mobile devices.

Topstep’s framework is less centered on the MetaTrader-style EA ecosystem. While you can use automated strategies on supported platforms like NinjaTrader or Quantower, the primary method for advanced automation is now the TopstepX™ API.

Yes, Topstep offers the TopstepX™ API specifically for traders and developers to connect their own software, run scripts, and automate strategies.

Prop firms use sophisticated monitoring tools to analyze trading activity. They detect prohibited strategies by identifying trading patterns that are impossible for a human. This includes activities like high-frequency trading (HFT), exploiting unrealistic fills, or spoofing.

Topstep does not typically make exceptions to its rules. All traders, regardless of their professional background, must adhere to the same terms of service and list of prohibited conduct. The TopstepX™ API is the designated path for professional algo traders.

Besides Topstep, many other prop firms allow algorithmic trading, including FTMO, The 5%ers, and others. However, each has its own specific set of rules and limitations, so it is crucial to read their guidelines carefully.

9. Conclusion

So, does Topstep allow automated trading? The answer is a definitive yes, provided you operate within their clear and sensible guardrails. Topstep actively embraces technology, offering robust API access for serious developers while maintaining a fair and level playing field for every trader.

However, it’s crucial to recognize that automated trading is a powerful tool, not a “holy grail.” Your success hinges on the quality of your strategy, diligent risk management, and absolute compliance with Topstep’s rules. The key is to treat your bot not as a hands-off money machine, but as an instrument that demands your constant oversight and management.

Mastering these elements is what separates funded traders from the rest. For more guidance and practical strategies, check out our Prop Firm & Trading Strategies category of H2T Funding to help you manage drawdowns and maximize your chances of trading success.