Audacity Capital vs FundedNext represents a choice between two distinct funding philosophies: a path without a traditional pass/fail challenge, or a high-stakes evaluation. Audacity Capital provides capital access to traders without a multi-phase challenge, but applies ongoing risk and consistency reviews. In contrast, FundedNext offers a structured evaluation path for those who can hit clear targets to unlock massive scaling rewards.

This isn’t just a difference in rules; it’s a test of your psychological strengths. One rewards patient discipline, the other rewards performance under pressure. At H2T Funding, we’ve analyzed dozens of prop firms and thousands of trader reviews to bring you the deepest insights.

This guide provides the clarity you need to choose the firm that truly fits your trading DNA. Read now!

Key Takeaways

- Audacity Capital offers instant funding programs that prioritize consistency, providing a faster path to a live account. FundedNext uses structured multi-phase challenges (like the Stellar 2-Step) designed to thoroughly test and reward skilled traders.

- FundedNext generally provides a higher profit share, reaching up to 95%, along with a 15% reward from the challenge phase and a more aggressive scaling plan. Audacity Capital offers a straightforward split that can scale up to 90% based on performance.

- Audacity Capital has stricter rules on consistency. In contrast, FundedNext is more flexible, allowing news trading, overnight holds, and the use of EAs, though it has its own set of detailed regulations to follow.

- FundedNext provides a broader range of platforms, including MT4, MT5, cTrader, and Match-Trader, while Audacity Capital focuses primarily on the widely used MT5 platform.

- Both are established firms. Audacity Capital has a long-standing reputation since 2012, building trust through its history. FundedNext has rapidly grown into a major industry player, backed by a massive user base and positive Trustpilot reviews.

- Audacity Capital is often better for experienced, consistently profitable traders seeking immediate funding without evaluation pressure. FundedNext appeals to a wider range of traders, including beginners, who are confident in their ability to pass a clear, rule-based challenge for significant rewards.

1. Overview of Audacity Capital and FundedNext

Audacity Capital and FundedNext represent two fundamentally different approaches to proprietary trading. Audacity Capital operates as an established, professional firm offering a direct funding path that prioritizes long-term consistency. In contrast, FundedNext is a modern, feature-rich firm built around structured, high-reward evaluation challenges designed to identify and scale top trading talent.

The choice between them depends entirely on your confidence, trading style, and career goals. One offers a partnership based on a proven track record, while the other offers a clear path to high rewards through a performance-based test.

Criteria Table – A High-Level Overview

| Criteria | Audacity Capital | FundedNext |

|---|---|---|

| Founded / Trust | Established in 2012, London-based | Founded in 2022, High Trustpilot score, rapid growth |

| Evaluation Models | Challenge & Direct Funding programs (with ongoing reviews) | 1-Step, 2-Step, Lite & Instant Challenges |

| Account Sizes | $5k – $240k | $6k – $200k (CFDs) |

| Asset Classes | Forex, Indices, Metals, Energies, Crypto | Forex, Indices, Commodities, Crypto |

| Trading Platforms | MT5 & DXtrade | MT4, MT5, cTrader, Match-Trader |

| Profit Split | Up to 90% (Starts at 75%) | Up to 95% (under scaling conditions), plus a 15% Challenge Reward |

| Minimum Days | 3-4 days (Challenge) | 2-5 days (Challenge) |

| Scaling Programs | Up to $2 Million | Up to $4 Million (subject to long-term performance conditions) |

| Commissions | Standard | Very competitive; low spreads |

| Payouts | Bi-weekly (after first month) | On-demand (after first cycle) |

| Risk Restrictions | Strict consistency rules | Flexible (Allows News, EAs, Weekend Holds) |

Disclaimer: Rules, pricing, and trading conditions may change over time. Traders should always verify the latest terms directly on the official Audacity Capital vs FundedNext websites before purchasing any challenge.

The bottom line is clear. If you value a straightforward path to a live account and trust in a firm’s long history, Audacity Capital is a strong contender. However, if your goal is to maximize your profit split, leverage flexible rules, and engage in a highly rewarding scaling plan, FundedNext presents a more compelling offer.

Audacity Capital

#1

Account Types

1-step, 2-step and instant funding

Trading Platforms

MT5, DXTrade

Profit Target

5% – 10%

Our take on Audacity Capital

Audacity Capital positions itself as a veteran in the prop trading space. Founded in 2012, it projects an image of stability and professionalism, appealing to traders who see themselves as partners rather than just challengers. This firm is best suited for disciplined traders who have a consistent strategy and want to bypass complex evaluation hurdles to start earning quickly.

Important Note: According to official information, Audacity Capital currently does not offer services to residents of the United States.

| 💳 Challenge Fee | $49 – $2,399 |

| 👥 Account Types | 1-step, 2-step and instant funding |

| 💰 Profit Split | 50% – 90% |

| 💵 Account Size | $3K – $240K |

| ⏱️ Time Limit | No time limit |

| 🎯 Profit Target | 5% – 10% |

| 📊 Trading Platforms | MT5, DXTrade |

| 🛍️ Asset Types | Forex, Indices, Commodities, Metals, Crypto |

FundedNext

#2

Account Types

1-step, 2-step, and Instant Funding

Trading Platforms

MT4, MT5, cTrader, Match Trader

Profit Target

4% – 10%

Our take on FundedNext

FundedNext has rapidly become a dominant force in the prop firm industry by offering what modern traders demand: flexibility, high rewards, and transparency. It’s built for confident traders who are ready to prove their skills in a structured environment to unlock industry-leading benefits. This makes the FundedNext prop firm ideal for both ambitious newcomers and experienced traders seeking the best possible conditions.

| 💳 Challenge Fee | $32 – $1,099 |

| 👥 Account Types | 1-step, 2-step, and Instant Funding |

| 💰 Profit Split | 80% – 95% |

| 💵 Account Size | $2K – $200K |

| ⏱️ Time Limit | No time limit |

| 🎯 Profit Target | 4% – 10% |

| 📊 Trading Platforms | MT4, MT5, cTrader, Match Trader |

| 🛍️ Asset Types | Forex, Indices, Commodities, Crypto, CFDs |

Read more:

2. Audacity Capital vs FundedNext comparison: Core models and key rules

The fundamental difference between Audacity Capital and FundedNext lies in their funding models and the rules that govern them. Audacity Capital offers pathways that can lead to instant funding, focusing on a trader’s ability to maintain steady returns over time.

FundedNext, on the other hand, uses a more traditional but highly rewarding challenge-based system, designed to filter for traders who can perform under pressure and meet clear targets.

2.1. Funding Model & Evaluation Difficulty

The path to a funded account at each firm is designed to test different psychological and strategic strengths. One prioritizes immediate but controlled trading, while the other demands exceptional performance within a structured, multi-stage evaluation.

| Criteria | Audacity Capital | FundedNext |

|---|---|---|

| Evaluation Required | Optional; Instant funding is available | Yes, for all primary account models |

| Profit Target | Higher (e.g., 10% in Phase 1) | Lower (e.g., 8% in Phase 1) |

| Time Pressure | None; unlimited trading days | None; unlimited trading days |

| Psychological Stress | Lower initial pressure but high stress from consistency rules | High initial pressure to pass, but more freedom afterward |

| Overall Difficulty | Easier to start, harder to maintain consistency | Harder to start, easier to manage once funded |

In short, Audacity Capital is easier to begin with due to its instant funding option, but its strict consistency rules can make it difficult to maintain the account long-term. FundedNext presents a more difficult initial hurdle, but its flexible rules offer a more sustainable path for growth once you are funded.

2.2. Drawdown, Consistency & Risk Rules

Risk management rules are where these two firms diverge the most. Audacity Capital’s approach is defined by its strict Consistency Score, which can terminate an account even if it’s profitable. FundedNext provides more generous drawdown limits and greater freedom, trusting traders to manage their own risk within clear boundaries.

| Criteria | Audacity Capital | FundedNext |

|---|---|---|

| Max Drawdown | Higher (15% in Challenge, 10% Live) | Lower (10% standard) |

| Daily Loss Limit | Higher (7.5% in Challenge, 5% Live) | Lower (5% standard) |

| Trailing Drawdown | No (Fixed drawdown) | No (Fixed drawdown on Stellar models) |

| Consistency Rules | Extremely Strict (Consistency Score) | None (on Stellar models) |

| Rule Strictness | Very High | Moderate |

Ultimately, Audacity Capital’s rules are designed to enforce a specific, low-risk trading style, which can feel restrictive. FundedNext also offers significant freedom. However, that freedom exists within its own strict framework, which includes policies against gambling behavior and excessive margin usage.

2.3. News, Overnight & Strategy Policies

A trader’s strategy is only as good as the rules allow. Here, FundedNext offers a clear advantage with one of the most flexible policy sets in the industry. Audacity Capital, while allowing some flexibility, places a greater emphasis on creating a controlled trading environment.

| Policy | Audacity Capital | FundedNext |

|---|---|---|

| News Trading | Allowed (in Challenge programs, restricted in Direct Funding) | Allowed |

| Overnight Trading | Allowed | Allowed |

| Weekend Trading | Allowed | Allowed |

| EA / Automation | Allowed (with restrictions) | Allowed (with restrictions) |

| Prohibited Strategies | Martingale, HFT, Group Hedging | Wide range, including Gambling Behavior, HFT, Account Rolling |

Both firms permit common professional strategies like holding trades overnight and trading during news events. However, FundedNext’s explicit allowance of EAs and more relaxed overall framework gives it a significant edge for systematic and technically-driven traders.

3. Audacity Capital vs FundedNext review: Fees, refunds, and cost efficiency

When it comes to cost, both firms offer competitive entry points, but their value propositions are quite different. FundedNext stands out with its 100% refundable fee and a 15% reward from the challenge phase, making it potentially free to join for profitable traders. Audacity Capital also offers a fee refund, but its overall cost efficiency depends on which funding model you choose.

| Criteria | Audacity Capital | FundedNext |

|---|---|---|

| Fee Type | One-time Challenge Fee | One-time Challenge Fee |

| Refund Policy | Yes (applies only to Challenge programs, not Direct Funding) | Yes, 100% refund with the first payout |

| Challenge Cost | Highly competitive (e.g., ~$51 for $5k) | Very competitive (e.g., $59 for $6k) |

| Transparency | Clear pricing, no hidden fees | Fully transparent, no hidden fees |

| Added Fees | None (standard commissions/swaps) | None (standard commissions/swaps) |

| Value Add | Instant funding option | 15% challenge profit share |

In conclusion, FundedNext offers a superior value proposition for traders confident in passing the challenge. The combination of a refundable fee and the 15% challenge reward means you not only get your money back but also get paid for the evaluation itself.

Audacity Capital remains a cost-effective choice, especially for its instant funding models, but lacks the extra financial incentives that make FundedNext so appealing.

4. Audacity Capital vs FundedNext debate: Profit split and scaling potential

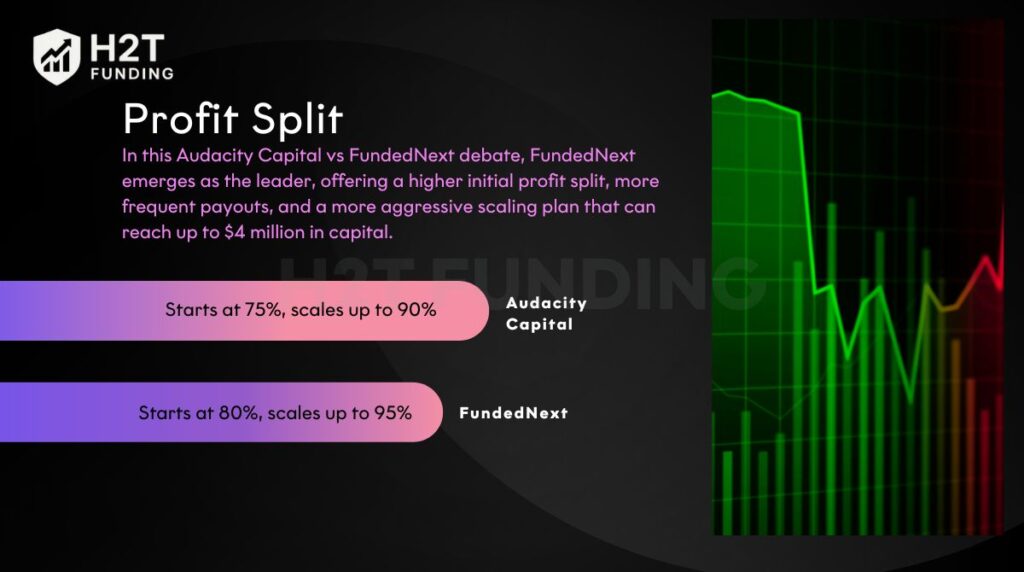

In this Audacity Capital vs FundedNext debate, FundedNext emerges as the leader, offering a higher initial profit split, more frequent payouts, and a more aggressive scaling plan that can reach up to $4 million in capital. Audacity Capital provides a solid, professional scaling path, but with a slower start and less frequent withdrawal options.

| Criteria | Audacity Capital | FundedNext |

|---|---|---|

| Profit Split | Starts at 75%, scales up to 90% | Starts at 80%, scales up to 95% |

| Scaling Plans | Account doubles up to $2 Million | Scales by 40% every 4 months up to $4 Million |

| Payout Frequency | Bi-weekly (after the first 30 days) | On-demand after the first trading cycle |

| Minimum Payout | No official minimum | No official minimum |

| Withdrawal Conditions | Must maintain consistency | Must achieve 10% growth in 4 months for scaling |

In summary, FundedNext is the clear winner for traders focused on maximizing their earnings and growing their capital aggressively. Its higher profit share, rapid scaling, and flexible payout system are designed to reward top performers.

Audacity Capital offers a respectable and professional growth path, but it cannot match the sheer earning potential and speed offered by FundedNext’s modern, trader-centric model.

5. FundedNext vs Audacity Capital: Platforms and tradable markets

When comparing FundedNext vs Audacity Capital on technology and market access, FundedNext offers significantly more choice and flexibility. It supports a wide array of industry-leading platforms and provides a slightly broader range of tradable assets, including a larger selection of cryptocurrencies. Audacity Capital focuses on providing a stable, professional environment primarily through MT5 and now DXtrade for US clients.

| Criteria | Audacity Capital | FundedNext |

|---|---|---|

| Trading Platforms | MT5 & DXtrade | MT4, MT5, cTrader, Match-Trader |

| Asset Classes | Forex, Indices, Commodities, Crypto | Forex, Indices, Commodities, Crypto |

| Commissions & Fees | Standard industry rates | Very competitive, with raw spreads |

| Trader Dashboard | Functional and clear | Modern, feature-rich, and comprehensive |

In conclusion, FundedNext provides a superior technological experience for the modern trader. The freedom to choose between MT4, MT5, cTrader, and Match-Trader, combined with highly competitive trading costs, gives it a distinct advantage.

Audacity Capital delivers a reliable and professional trading environment, but its limited platform options may not satisfy traders who prefer alternatives to the MetaTrader ecosystem.

6. Payout & trust: Audacity Capital and FundedNext Reddit and Trustpilot reviews

A prop firm’s reputation is ultimately decided by its traders. While marketing promises can be attractive, real-world experiences shared on platforms like Reddit and Trustpilot reveal the truth about a firm’s reliability, support, and integrity. In this section, we analyze the community sentiment surrounding both Audacity Capital and FundedNext.

(Note: Information collected and updated on Jan 16, 2025)

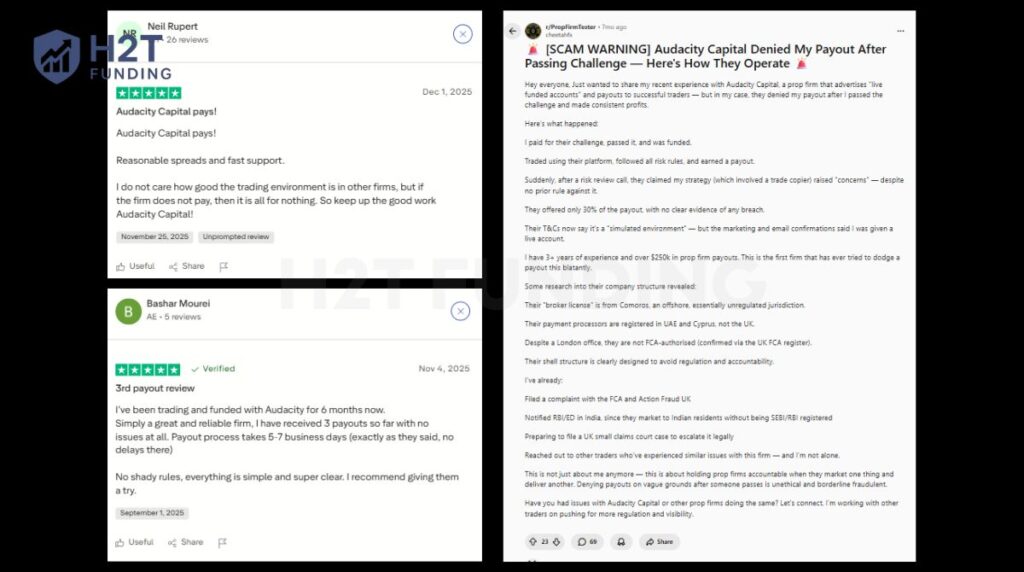

Audacity Capital’s long history gives it a degree of credibility, and its Trustpilot page is filled with positive reviews praising its customer support, straightforward dashboard, and reliable payouts. Many traders appreciate its professional feel and long-standing presence in the industry.

However, digging deeper into Reddit forums like r/PropFirmTester reveals a more troubling picture. Multiple traders have posted detailed accounts of payout denials, often citing vague rule breaches that were not clearly defined in the terms of service.

However, digging deeper into Reddit forums like r/PropFirmTester reveals a more complex picture. Some users have posted detailed accounts of payout denials, often citing vague rule breaches that were not clearly defined in the terms of service. These community reports suggest concerns regarding the transparency of rule enforcement for larger payouts.

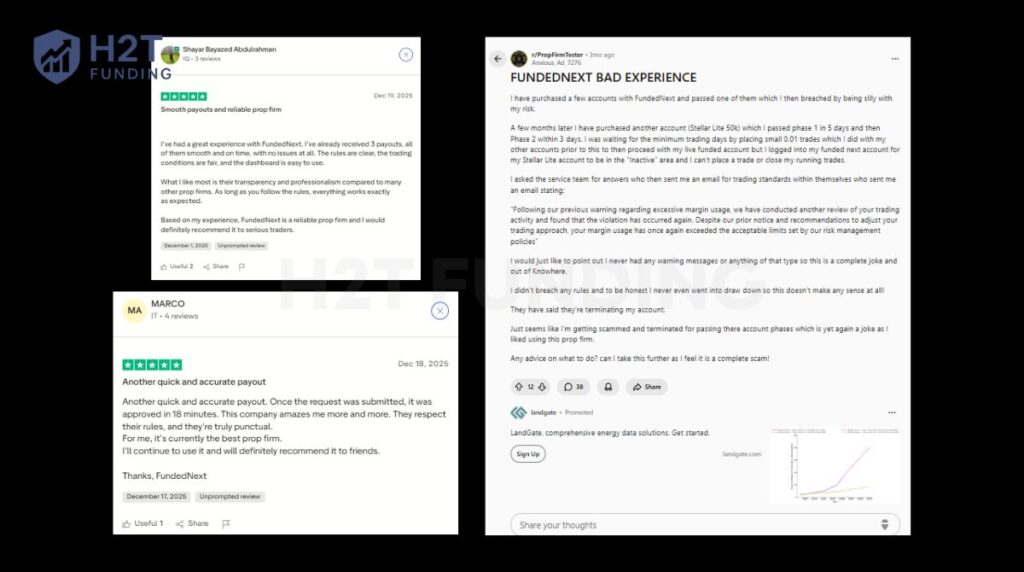

FundedNext boasts an impressive 4.5-star rating on Trustpilot from over 53,000 reviews, making it one of the most well-regarded firms in the industry. The sentiment is overwhelmingly positive, with traders praising the clear rules, fast payouts (often within hours), excellent 24/7 support, and flexible trading conditions. Many users confirm that FundedNext is legit. It is a question easily answered with a yes after receiving their first withdrawal.

Here is a sample of the community feedback:

Despite the praise, FundedNext is not immune to criticism. Some traders on Reddit have reported issues with account terminations, often related to rule breaches they were unaware of, such as margin usage or device sharing.

For example, user Anxious_Ad_7276 detailed an account termination for excessive margin usage without receiving a prior warning. While many of these cases appear to stem from misunderstandings of the firm’s comprehensive rules, they highlight the need for traders to be extremely diligent.

Sentiment Summary

| Aspect | Audacity Capital | FundedNext |

|---|---|---|

| Payout Reliability | Mixed. Many receive smaller payouts, but serious allegations exist for larger amounts. | Very High. Widely praised for fast and consistent payouts. |

| Rule Enforcement | Strict and sometimes unclear. The consistency rule is a major point of contention. | Strict but generally clear. Most issues arise from traders not reading all the rules. |

| Support Quality | Generally praised for being responsive and helpful. | Excellent. 24/7 support is consistently rated as a top feature. |

| Common Complaints | Denied payouts on vague grounds; restrictive consistency rules. | Account terminations for margin/device rules; KYC process delays. |

Ultimately, while both firms have their supporters, FundedNext currently enjoys a stronger and more transparent reputation within the trading community. The sheer volume of positive reviews and verified payouts provides a higher level of trust. Audacity Capital’s reputation is marred by serious, documented complaints that potential traders should not ignore.

7. Audacity Capital vs FundedNext: Which prop firm is easier to pass?

For traders looking to get funded, FundedNext is generally perceived as the easier prop firm to pass due to its lower profit targets and more straightforward, flexible rules during the evaluation phase. While Audacity Capital offers an instant funding route that bypasses a challenge altogether, its evaluation models are hindered by higher targets and complex consistency requirements that can be difficult to navigate.

| Criteria | Winner | Notes |

|---|---|---|

| Profit Target | FundedNext | 8% target is more achievable than Audacity’s 10% in Phase 1. |

| Drawdown Strictness | Audacity Capital | Offers slightly more generous drawdown limits during the challenge. |

| Rule Complexity | FundedNext | No complex consistency rules during the evaluation. |

| Overall Difficulty | FundedNext | Lower targets and simpler rules create a clearer path to passing. |

To be clear, if your goal is simply to pass an evaluation challenge, FundedNext presents fewer obstacles. The firm sets a clear, attainable goal without adding confusing layers like a Consistency Score.

Audacity Capital’s instant funding model is the easiest way to get capital, but it isn’t an evaluation. For their challenges, the rules make the path to a funded account more difficult than it first appears.

8. FundedNext and Audacity Capital: Which prop firm suits your trading style?

Choosing between FundedNext and Audacity Capital depends entirely on your personal trading style, experience level, and long-term goals. The best firm for a disciplined swing trader may be the worst choice for an aggressive scalper. This table breaks down which firm is the ideal fit for you.

| Trader Type | Best Choice | Why |

|---|---|---|

| Beginners | FundedNext | Clear rules, lower profit targets, and no complex consistency requirements make it a more forgiving learning environment. |

| Systematic Traders (EAs) | FundedNext | Explicitly allows the use of EAs and offers multiple platforms (MT4/MT5) that are ideal for automated strategies. |

| Swing Traders | FundedNext | Allows overnight and weekend holding without restrictive consistency rules, which is crucial for longer-term positions. |

| Scalpers | FundedNext | Offers tighter spreads, lower commissions, and a wider variety of platforms better suited for high-frequency strategies. |

| Risk-Averse Traders | Audacity Capital | The instant funding model allows traders to avoid the high-pressure environment of an evaluation challenge. |

| Traders Aiming for >$1M Capital | FundedNext | Features a more aggressive and higher-capped scaling plan, with the potential to manage up to $4 million in capital. |

In conclusion, FundedNext is the more versatile and rewarding option for the majority of modern trading styles. Its flexibility, superior technology, and ambitious scaling program cater directly to systematic, swing, and short-term traders.

Audacity Capital carves out a niche for experienced, highly consistent traders who prioritize immediate access to capital and value a long-standing, professional partnership above all else.

9. Common mistakes traders make when choosing Audacity Capital or FundedNext

Choosing the wrong firm for your trading style is the single biggest mistake a trader can make, often leading to frustration and lost fees. Many traders get lured in by a single attractive feature like instant funding or a high profit split while ignoring the rules that will ultimately determine their success or failure.

9.1. Ignoring Audacity Capital’s strict consistency rule

The most common mistake traders make with Audacity Capital is underestimating its Consistency Score. Attracted by the promise of instant funding or unlimited trading days, many assume it’s an easy path. They then trade their normal, profitable strategy, which might include a few large wins, to quickly hit a target.

This directly violates the firm’s core principle, which penalizes irregular profit days. As a result, traders find their accounts terminated even while in profit, leading to immense frustration. They fail to realize that Audacity Capital isn’t just looking for profitable traders; it’s looking for a specific type of consistently profitable trader.

9.2. Misinterpreting FundedNext’s flexibility as a lack of rules

With FundedNext, the critical error is confusing its flexible policies with having no rules at all. Traders hear “news trading allowed” and “no consistency rules” and immediately adopt a high-risk, all-or-nothing approach to pass the challenge quickly.

However, they overlook FundedNext’s strict policies against “Gambling Behavior” and “excessive margin usage.” While you won’t be penalized for one big winning day, the firm’s risk team will flag and potentially terminate accounts that demonstrate unsustainable, high-risk tactics. Flexibility is a privilege, not a license for recklessness.

9.3. Choosing based on payouts, not personal trading style

Perhaps the most fundamental mistake is selecting a firm based on a single metric, like the profit split, instead of overall compatibility. A trader might be drawn to FundedNext’s 95% split but possesses a slow, steady style that would thrive in Audacity Capital’s instant funding model without the pressure of a challenge.

Conversely, a scalper might choose Audacity for its long reputation, only to find their high-frequency strategy is choked by the rigid consistency rules. The result is the same: a profitable strategy fails because it’s forced into an incompatible environment.

In summary, the key is self-awareness. Before choosing, you must honestly assess your trading style. Do you produce steady, predictable returns, or do you excel in short bursts of high performance? Answering that question will prevent you from making these common and costly mistakes.

10. FAQs

Yes, Audacity Capital accepts clients from the United States. They provide the DXtrade platform specifically for US-based traders to ensure compliance and market access.

Yes, FundedNext is fully available to traders in the USA. They offer a selection of platforms for US clients, including cTrader and Match-Trader, ensuring they can participate in all available CFD challenges.

Audacity Capital is a prop firm that offers traders capital through several programs. You can either pass a one or two-step evaluation (the Ability Challenge) or apply for their instant funding program (FTP), which bypasses the challenge phase for traders who can demonstrate consistent profitability.

FundedNext is a prop firm that provides capital to traders who successfully pass an evaluation. Traders choose a challenge model (like the Stellar 2-Step), pay a one-time fee, and trade in a simulated environment to meet specific profit targets without breaching drawdown rules. Once passed, they receive a funded account and earn up to 95% of the profits they generate.

FundedNext is generally considered better for beginners. Its evaluation challenges have clearer, more straightforward rules and lower profit targets, which creates a more forgiving environment for traders who are still developing their skills and consistency.

FundedNext’s evaluation challenges are easier to pass due to their lower profit targets and lack of complex consistency rules. However, Audacity Capital offers an instant funding model that is the absolute fastest way to get capital, as it skips the evaluation process entirely.

Audacity Capital is a long-standing firm founded in 2012 that has paid out to many traders. However, its reputation is mixed. While many users report positive experiences, there are also serious, documented allegations on platforms like Reddit regarding large payout denials, which raise significant trust concerns.

Yes, FundedNext is widely considered a legitimate and reliable prop firm. It has an overwhelmingly positive reputation on Trustpilot with over 53,000 reviews, and is praised by the community for its fast, consistent payouts and transparent rules.

The main disadvantages of Audacity Capital are its extremely strict consistency rules, which can penalize profitable traders for having irregular gains. Other drawbacks include its limited platform selection and serious community complaints about payout denials.

The primary disadvantages of FundedNext are that an evaluation is required to get a funded account (no instant funding), and its wide variety of account models can be confusing for new users. Some traders have also reported issues with rule enforcement related to margin usage or device sharing.

Audacity Capital is significantly stricter on consistency. It employs a Consistency Score that can lead to account termination even if you are profitable. FundedNext does not have such rules on its main challenge models, focusing only on the clear daily and maximum drawdown limits.

FundedNext creates high initial pressure to pass the challenge, but the pressure eases significantly once you are funded. Audacity Capital has lower initial pressure but high ongoing pressure due to the constant need to maintain a specific consistency score, which can be psychologically demanding.

FundedNext has a more aggressive scaling program, allowing traders to grow their account up to $4 million through a structured 40% increase every four months. Audacity Capital’s scaling plan is also robust, allowing accounts to double up to a maximum of $2 million.

Based on their official rules, FundedNext does not have a hard 1% rule that limits your risk per trade. However, their policy on Gambling Behavior warns against excessive risk, noting that professional traders typically risk no more than 1%, and may flag accounts that consistently use excessive margin as engaging in prohibited strategies.

The cost for a $15,000 challenge at FundedNext varies by model. For the popular Stellar 2-Step challenge, the one-time fee is $119, which is fully refundable upon receiving your first payout from the funded account. The Stellar 1-Step challenge for the same size costs $99.

11. Conclusion

The Audacity Capital vs FundedNext choice is simple. Audacity Capital is for the proven, consistent trader seeking an immediate professional partnership. FundedNext is the clear winner for ambitious challengers who want flexible rules, a higher profit share, and a faster path to scaling massive capital. One rewards patience, while the other rewards performance.

Choosing the right environment is critical for your success. H2T Funding’s goal is to provide the clarity you need to make the best decision. Explore our other in-depth prop firm comparisons to find the perfect funding partner for your trading style.