Securing reliable capital is the fastest way to accelerate your futures trading career, but hidden rules can often destroy your progress. You need a funding partner that honors withdrawals and supports your growth, rather than one that hides behind complex, unbeatable rules.

In this comprehensive comparison of Apex vs Take Profit Trader, H2T Funding will break down every detail, from evaluation costs to withdrawal efficiency. Whether you prioritize the massive scalability of Apex Trader Funding or the rapid payout speed of Take Profit Trader, we help you decide which firm truly fits your goals.

Key takeaways

- Apex Trader Funding is built for high-volume execution, allowing traders to manage up to 20 accounts simultaneously with frequent, low-cost evaluations.

- Take Profit Trader prioritizes speed and user experiences, featuring industry-leading 24-hour payouts and simplified rules with no minimum trading days on PRO accounts.

- Choose Apex Trader Funding if you utilize trade copiers to scale horizontally, want to trade Crypto futures, or prefer the lowest upfront entry costs via sales.

- Choose Take Profit Trader if you prioritize immediate liquidity with Day One withdrawals, prefer a friendlier End-of-Day drawdown, or require seamless TradingView integration.

1. Overview of Apex Trader Funding vs Take Profit Trader

Apex Trader Funding dominates the market with high accessibility and massive scaling options for diverse trading strategies. In contrast, Take Profit Trader focuses on a premium environment with industry-leading payout speed and simplified rules. The table below outlines their fundamental differences at a glance.

| Aspect | Apex Trader Funding | Take Profit Trader |

|---|---|---|

| CEO | Darrell Martin | James Sixsmith |

| Funding Models | 1-step | 1-step |

| Account Size | $25K – $300K | $25K – $150K |

| Profit Split | 100% first $25K profit, then 90% | 80% (PRO) – 90% (PRO+) |

| Profit Target | 6% | 6% |

| Payout Frequency | Twice per month, once payout conditions are met | Anytime when meeting minimum profit/buffer requirements |

| Time Limits | No time limit | No time limit |

| Minimum Trading Days | 7 days | 5 days on test phase No minimum trading days on PRO/PRO+ account |

| Daily Loss Limit | None | None |

| Instruments | Futures contracts | Futures contracts |

| Platforms | Rithmic, NinjaTrader, Tradovate, and WealthCharts | NinjaTrader, TradingView, Tradovate, Quantower, R|Trader, and more |

| News/Weekend Trading | Allowed | Not allowed on PRO account |

| Starting Fees | $177/month | $150/month |

Disclaimer: Rules, pricing, and trading conditions may change over time. Traders should always verify the latest terms directly on the official Apex and Take Profit Trader websites before purchasing any challenge.

Main differences at a glance:

- Take Profit Trader offers faster and more flexible payouts, allowing withdrawals anytime once the minimum conditions are met.

- Apex Trader Funding provides larger scaling potential, offering account sizes up to $300K compared to Take Profit Trader’s $150K cap.

- Apex allows traders to manage multiple accounts at once (up to 20), a strong advantage for traders running larger or diversified strategies.

- Apex limits payouts to twice per month, while Take Profit Trader supports on-demand payouts.

- Take Profit Trader has a broader platform support compared to Apex’s more limited list.

- Take Profit Trader restricts news/weekend trading on PRO accounts, while Apex allows news and weekend trading without limitations.

Dive into the details below to discover which model aligns best with your specific financial goals.

Apex Trader Funding

#1

Account Types

1-step

Trading Platforms

Tradovate, Rithmic, WealthCharts

Profit Target

6%

Our take on Apex Trader Funding

Led by Darrell Martin, Apex Trader Funding is the powerhouse for volume traders, offering account sizes up to $300K. Their standout feature is the ability to trade 20 accounts at once, making it the ultimate choice for those using trade copiers to scale their income.

However, the platform is built for execution, not comfort, featuring a strict Live Trailing Threshold that punishes volatility. This mechanic forces you to be a sniper, taking profits quickly, as holding through deep pullbacks can fail your account even if the trade eventually hits your target.

| 💳 Challenge Fee | From $196 |

| 👥 Account Types | 1-step |

| 💰 Profit Split | 90% – 100% |

| 💵 Account Size | $25K – $300K |

| ⏱️ Time Limit | No time limit |

| 🎯 Profit Target | 6% |

| 📊 Trading Platforms | Tradovate, Rithmic, WealthCharts |

| 🛍️ Asset Types | Equity Indices, Currencies, Commodities, Interest Rates, Crypto |

Take Profit Trader

#2

Account Types

1-step

Trading Platforms

NinjaTrader 8, Tradovate, TradingView

Profit Target

6%

Our take on Take Profit Trader

Take Profit Trader operates like a professional trading desk, prioritizing speed over leverage. Unlike competitors, they have removed the minimum trading days on PRO/PRO+ accounts, allowing skilled traders to get funded immediately.

The biggest advantage is the Anytime Payout policies (Day One withdrawals), which consistently deliver via Wise. While their 80/20 split is lower than Apex, the smoother platform options (TradingView supported if you bring your own license) and clearer rules make them attractive for active manual traders.

| 💳 Challenge Fee | $150 – $360 |

| 👥 Account Types | 1-step |

| 💰 Profit Split | 80% – 90% |

| 💵 Account Size | $25K – $150K |

| ⏱️ Time Limit | No time limit |

| 🎯 Profit Target | 6% |

| 📊 Trading Platforms | NinjaTrader 8, Tradovate, TradingView |

| 🛍️ Asset Types | Futures, Agricultural, Metals, Energy |

Suppose you want a clearer look at how Apex actually works in real trading conditions. Watch the full Apex review on YouTube here to see whether it’s the right fit for your trading style.

If you’re comparing more prop firms, check out our guides. We cover FundedNext vs Goat Funded Trader, FTMO vs The 5%ers, and FTMO vs The Funded Trader to see how Apex stacks up against other major competitors.

2. A detailed comparison of Apex vs Take Profit Trader

To make an informed decision, we must analyze the rules, costs, and hidden constraints of each firm. This section breaks down the critical metrics that determine your probability of success.

2.1. Evaluation program

While both firms share similar profit requirements, the structural rules regarding drawdowns define your actual probability of passing. Apex Trader Funding provides a vast array of connections (Rithmic/Tradovate) and account types up to $300K. In contrast, Take Profit Trader focuses on a streamlined experience with friendlier drawdown rules on their Pro style accounts.

| Feature | Apex Trader Funding | Take Profit Trader |

|---|---|---|

| Evaluation Type | 1-Step Evaluation | 1-Step (Pro & Pro+) |

| Account Sizes | $25K to $300K | $25K to $150K |

| Profit Target | Typically 6% (varies by account) | Typically 6% |

| Drawdown Type | Live Trailing Threshold (Intraday) | EOD Trailing Drawdown (End-of-Day) |

| Minimum Trading Days | 7 Days | 0 Days (Pro Account) |

Apex is the king of variety, offering specialized Static accounts (no trailing drawdown) and massive $300K Full accounts compatible with Tradovate and mobile. However, their standard Trailing Threshold moves with your unrealized profits (live), which is a notorious difficulty spike for volatile strategies.

Take Profit Trader shines with its user-friendly EOD trailing drawdown, which significantly reduces pressure during the trading day. With the removal of minimum days to pass on Pro accounts, it offers the fastest route to funding for skilled manual traders who want to avoid time-wasting hurdles.

2.2. Challenge rules & consistency

Understanding the fine print is often the difference between a funded account and a failed evaluation process. Apex Trader Funding focuses on a hands-off approach during the test phase, but tightens up later, while Take Profit Trader enforces specific structural rules to filter for professional behavior.

| Feature | Apex Trader Funding (Evaluation) | Take Profit Trader (Test Phase) |

|---|---|---|

| Consistency Rule | None during Evaluation (Applies to Funded PA) | 50% Consistency Rule (No single day > 50% of total profit) |

| Minimum Trading Days | 7 Days | 5 Days (Test Phase), 0 Days (Pro/Pro+) |

| Trade Close-Out | Must close all trades by 4:59 PM ET | Must trade at least once per week to stay active |

| Account Expiry | Failed accounts are disabled after 8 days if not reset | Must maintain activity; inactivity can lead to closure |

Apex Trader Funding is lenient during evaluations, allowing huge windfalls without consistency caps. However, you must close trades by 4:59 PM ET sharp. Failure to do so results in immediate account liquidation.

Take Profit Trader demands discipline with a 50% consistency rule to prevent gambling. Once you reach the Pro stage, this rule is removed, rewarding skilled traders. You must also trade once weekly to keep the account active.

2.3. Trading restrictions

Restrictions define your execution strategy. Apex Trader Funding offers maximum freedom for aggressive trading styles. Take Profit Trader creates a regulated environment, mimicking a professional trading desk.

| Restriction | Apex Trader Funding | Take Profit Trader |

|---|---|---|

| News Trading | Allowed (Trade during any news) | Prohibited (Flat 1 min before/after FOMC, NFP, CPI, etc.) |

| Holding Overnight | No (Close by 4:59 PM ET) | No (Intraday only) |

| Hedging/Counter | Allowed (in separate accounts) | No Counter Positions (in the same or related products) |

| Algo/Bots | Allowed | Prohibited (Manual trading only) |

| Limit Up/Down | Standard market rules | Strict: Liquidation if holding into a Limit Up/Down |

Apex Trader Funding wins on flexibility, allowing trading through high-impact news like NFP. They also permit automated bots, making them ideal for volatility traders and algo developers.

Take Profit Trader prohibits news trading (FOMC, CPI) and requires you to be flat 1 minute before each event. Holding positions in Limit Up/Down halts causes immediate liquidation. This structure suits methodical, manual traders, while news snipers belong at Apex.

2.4. Account fees, activation, and resets

Smart traders look past the sticker price to calculate the Total Cost of Ownership. This includes how much it costs to get back in the game if you stumble and what fees await you at the finish line. One firm rewards patience with automatic resets, while the other offers a premium fast-track for those willing to pay for speed.

| Feature | Apex Trader Funding | Take Profit Trader |

|---|---|---|

| Reset Fees (Evaluation) | $80 (Rithmic) $100 (Tradovate) | $100 – All account sizes on the test account $449 – $1499 on PRO account |

| Reset on Renewal | Free Automatic Reset if failed upon renewal | No auto-reset mentioned (Standard billing) |

| Activation Fee | Monthly fee of $85 – $105 or a Lifetime payment fee from $130 – $360 | $150 – $360$/month, depending vary account sizes |

| PRO Account Resets | Not available (Must pass new eval) | Allowed up to 3 times |

| Refund Policy | No refunds on resets | No refunds on resets |

For traders on a budget, the Free Reset on Renewal policy from Apex Trader Funding is a financial lifesaver. If an account fails to renew its monthly subscription, it automatically resets for free, effectively saving the standard $80-$100 fee. This makes it incredibly forgiving for those learning the ropes.

Conversely, Take Profit Trader offers a unique buy-back option for funded traders. Most firms make you restart from zero after blowing a live account, but TPT lets you instantly reset a PRO account with a premium fee starting at $449. This is expensive, but for a professional who made a rare mistake, the ability to skip the evaluation entirely is a powerful convenience.

You can learn more about this fee structure on the Take Profit Trader activation fee.

2.5. Trading platforms and data fees

Your execution speed and trading technology are the backbone of your strategy. Some firms force you into a single platform, while others offer a buffet of choices. It’s crucial to know if you are paying extra for the privilege of real-time data or a platform license.

| Feature | Apex Trader Funding | Take Profit Trader |

|---|---|---|

| Data Feed | Rithmic or Tradovate | CQG or Rithmic |

| Data Fees | Included ($55 Value) in subscription | Included in subscription price |

| Platform License | NinjaTrader License Included ($75 Value) | NinjaTrader License Included |

| Key Platforms | NinjaTrader 8, Tradovate, Rithmic, R Trader | TradingView, NinjaTrader, Tradovate, Quantower,… |

| Mobile App | Yes (via Tradovate/NinjaTrader Mobile) | Yes (via Tradovate/TradingView) |

Value seekers will find Apex Trader Funding hard to beat because it includes a free NinjaTrader license key. For traders who rely on this platform, this saves a significant monthly expense that other firms essentially pass on to you. Their Rithmic connection also powers a vast array of professional order flow tools.

On the other hand, Take Profit Trader offers both CQG and Rithmic, depending on the account type. NinjaTrader requires a personal license, while TradingView is supported if you already have a brokerage-enabled plan. WealthCharts is available on certain plans but not by default. All market data fees are included in your subscription.

2.6. Profit split & scaling plans

Your share of the earnings and the ability to grow define the long-term viability of prop trading firms. While one firm focuses on horizontal scaling (multiple accounts) with strict growth rules, the other prioritizes simplicity, allowing you to trade full size immediately without complex barriers.

| Feature | Apex Trader Funding | Take Profit Trader |

|---|---|---|

| Profit Split | 100% of first $25k, then 90/10 | 80/20 PRO account90/20 PRO+ account |

| Scaling Type | Horizontal (Max accounts per trader is 20) | None (Static Account Size) |

| Scaling Rules | Strict: Max 50% contracts until buffer is built | No Scaling Rules (Trade full size Day 1) |

| Violation Penalty | Payout denied + Account reset + 8 penalty days | Not Applicable |

Apex Trader Funding offers the industry’s most aggressive profit split, letting you keep 100% of the first $25,000 per account. However, you must navigate a strict Contract Scaling Rule that caps you at half contracts until a profit buffer is built. Violating this, even accidentally, results in denied payouts and a forced reset, delaying your income by at least 8 days.

In contrast, Take Profit Trader does not offer traditional scaling plans, and they market this as a feature, not a bug. There are No Scaling Rules, meaning you can trade the full contract size from Day 1 without restriction.

3. Trading conditions: Leverage and commissions

Both firms offer competitive pricing, but their leverage caps differ significantly. Apex Trader Funding is built for aggressive scaling, offering higher contract limits on similar account sizes (e.g., 10 contracts on a $50k account vs. 6 at TPT).

| Feature | Apex Trader Funding (Rithmic/Tradovate) | Take Profit Trader (WealthCharts) |

|---|---|---|

| Max Contracts ($50k) | 10 Contracts (100 Micros) | 6 Contracts (60 Micros) |

| Max Leverage (Top Tier) | 35 Contracts ($300k Acc) | 15 Contracts ($150k Acc) |

| Commissions (ES/NQ) | ~$3.10 Round Turn | ~$3.10 Round Turn |

| Crypto Futures | Yes (MBT, MET allowed) | No (Not supported on WealthCharts) |

| EUREX Access | Yes (DAX, Euro Stoxx) | No (US Markets Only) |

Apex Trader Funding is the clear winner for asset diversity. They are one of the few firms offering Micro Bitcoin (MBT) and Micro Ether (MET) futures, as well as EUREX products like DAX. If your strategy involves crypto or European indices, Apex is your only viable choice here. Their leverage on larger accounts (up to 35 contracts) is also massive, catering to heavy hitters.

Take Profit Trader matches Apex on the core US indices (ES, NQ) with identical round-turn commissions of roughly $3.10. Their TPT leverage is more conservative, capping at 15 contracts on the $150k account. However, this forced discipline aligns with their goal of long-term survival.

Notably, TPT does not support crypto futures on its WealthCharts platform, focusing strictly on traditional commodities and indices.

Learn more about these rules in our detailed guide on the consistency rule for Apex.

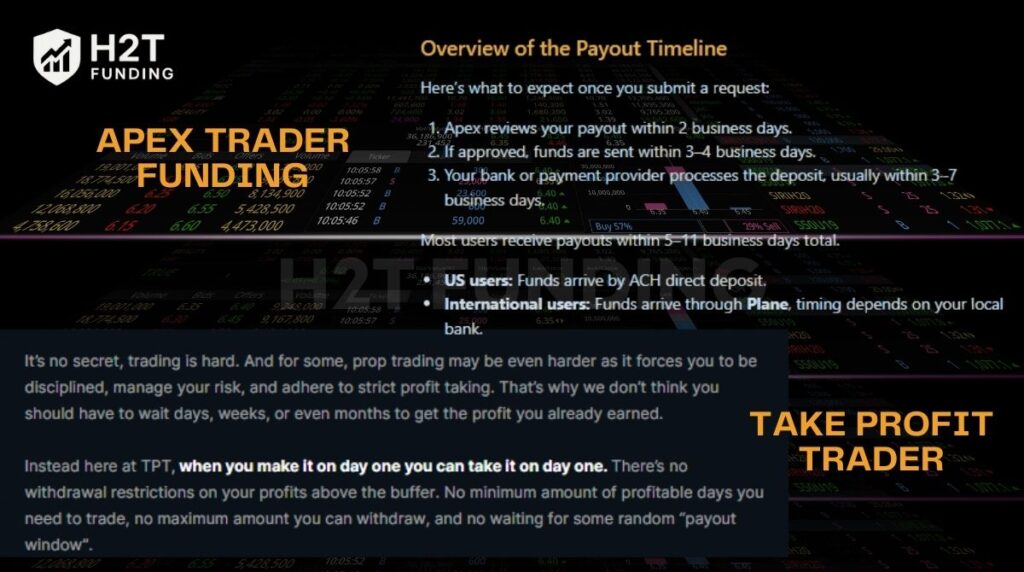

4. Apex vs Take Profit Trader payout process

Getting funded is pointless if you cannot access your capital efficiently. Apex utilizes a batch-processing model suitable for bulk withdrawals, while TPT payout rules prioritize speed once a strict safety margin is secured.

| Feature | Apex Trader Funding | Take Profit Trader |

|---|---|---|

| Payout Frequency | Request every 8 trading days | Day One withdrawals (After buffer) |

| Processing Time | 5-11 Business Days (Total) | Typically 24 Hours |

| Withdrawal Buffer | Safety Net (Drawdown + $100) | Buffer Zone (Equal to Max Drawdown) |

| Max Withdrawal | Capped first 5 months ($1.5k – $3.5k) | Uncapped (Above buffer) |

| Profit Split | 100% first $25k, then 90/10 | 80/20 standard split |

Traders prioritizing scale will find the flexible withdrawal methods and multi-account payout structure on Apex highly lucrative. You can request withdrawals from up to 20 separate accounts every 8 trading days, allowing for massive cumulative income despite the initial caps and the slower 5-11 day processing window.

For full details, see how does Apex Trader Funding work.

Conversely, if liquidity is your main goal, the ability to withdraw immediately after building a profit buffer on Take Profit Trader offers unmatched speed. However, you must treat the Buffer Zone (e.g., $2,000 on a $50k account) as a permanent bond; withdrawing these specific funds results in immediate account termination.

5. Education and customer support

Nothing is more frustrating than a technical glitch with no one to talk to. Your trading experience with support often defines your longevity with a firm. We analyzed whether these companies treat you like a partner or just another ticket number.

| Feature | Apex Trader Funding | Take Profit Trader |

|---|---|---|

| Support Method | Help Desk Tickets (Self-Service) | Live Chat (AI Agent First) |

| Availability | 24/7 Ticket Submission | Sunday 6 PM – Friday 4:30 PM EST |

| Response Speed | Varies (Queue-based system) | Fast (Once past AI Agent) |

| Education | Database & FAQs | Free Trade Context Mentorship |

The support model at Apex Trader Funding reflects its size: efficient but impersonal. You are expected to be self-sufficient, relying on a vast FAQ database before submitting a ticket. Be warned that sending multiple follow-up tickets will actually push you to the back of the queue, rewarding patience over persistence.

Take Profit Trader offers a more accessible Live Chat, though it is not instant human contact. You must first interact with an AI Agent to filter common queries before requesting a human specialist. Despite this initial automation layer, the ability to reach a real person during business hours is still significantly faster than waiting days for a ticket reply.

Read more related articles:

6. Apex vs Take Profit Trader: Which prop firm is better for you?

Not all prop firms are built the same. Some reward speed and simplicity, while others prioritize scale and strategy depth. Understanding your own trading style is the first step to choosing the right firm.

Apex Trader Funding is a strong fit for traders who:

- Run multiple accounts or use trade copiers.

- Trade crypto futures or European indices.

- Can manage intraday live trailing thresholds.

- Seek high profit splits and low-cost evaluations.

Take Profit Trader works best for traders who:

- Want fast access to funds via Day One withdrawals.

- Prefer simpler rules and easier drawdown management.

- Trade manually on TradingView or supported platforms.

- Are beginners or value educational support.

Apex is for those aiming to maximize growth and scale across multiple accounts, while Take Profit Trader is perfect for traders who prioritize liquidity, simplicity, and a smoother trading experience. Choosing the right firm depends on whether your goal is speed or scale.

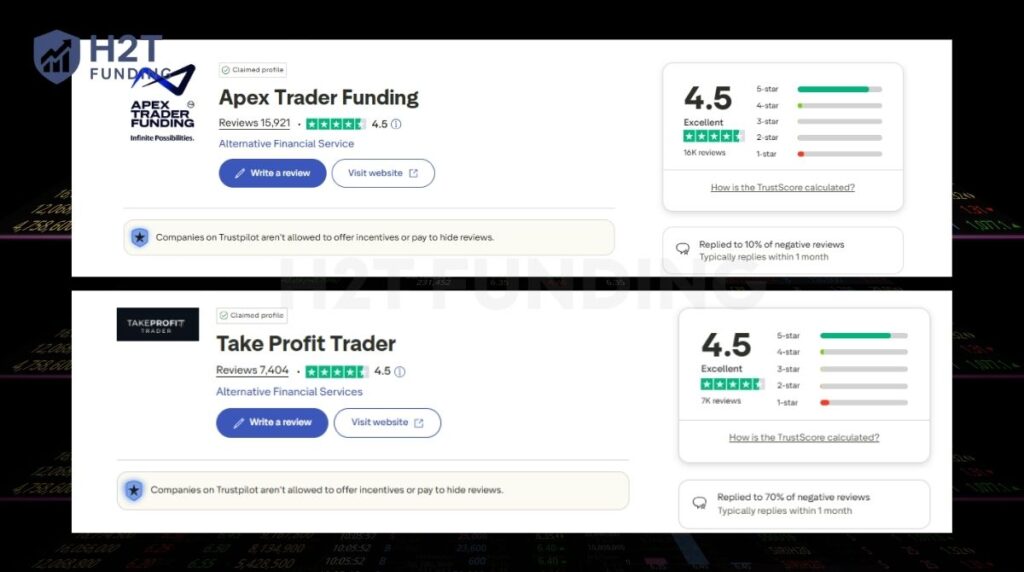

7. Community feedback on Reddit and Trustpilot with Apex vs Take Profit Trader

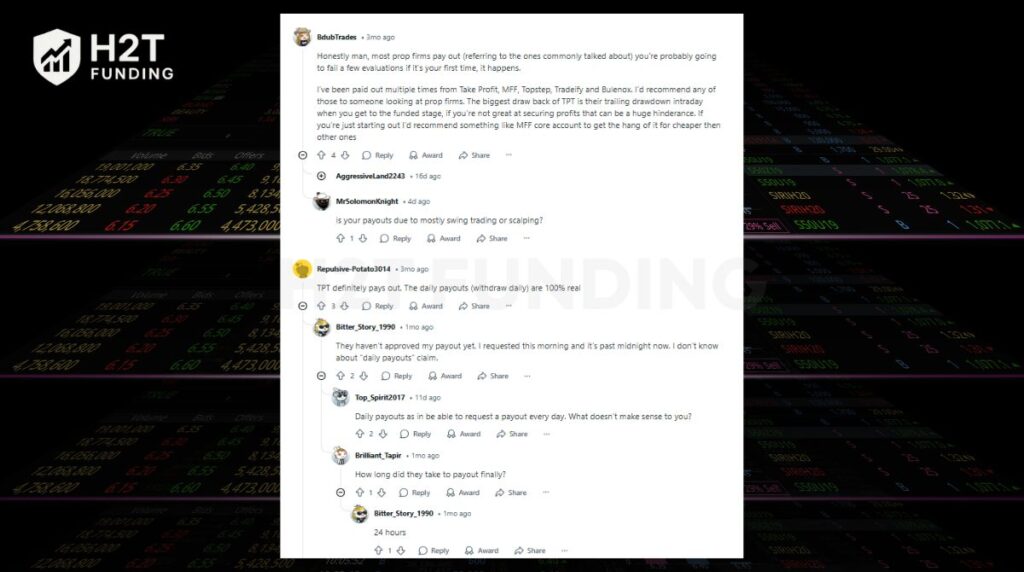

Marketing claims are one thing, but real trader feedback tells the true story. We analyzed thousands of trader reviews on Trustpilot and Reddit to see if these firms actually pay out or if they hide behind strict rules.

On Trustpilot, both firms hold an Excellent 4.5-star rating, proving they are legitimate options. Apex Trader Funding has a massive user base with nearly 16,000 reviews, reflecting its dominance in the futures market.

Take Profit Trader is also highly rated (7,000+ reviews), with specific praise for their customer support. Users frequently mention helpful staff members by name, highlighting a more personal experience compared to the automated nature of Apex.

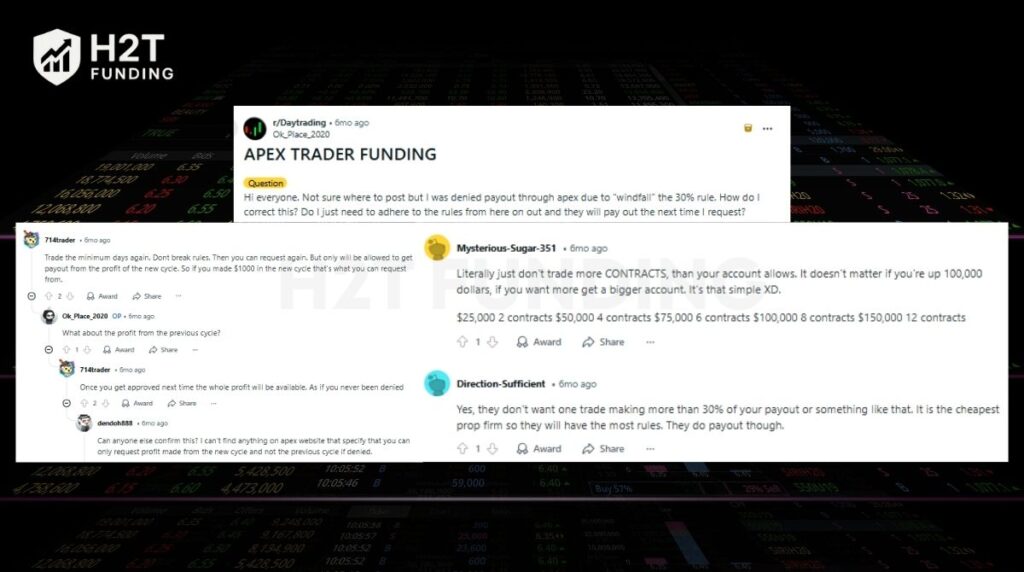

Besides that, the trader has a complaint regarding Apex Trader Funding is the 30% consistency rule during payouts on Reddit. As seen in the threads, if a single trade makes up more than 30% of your total profit, your withdrawal is denied.

The penalty is strict. If denied, you must trade another cycle (usually 8 days). Users confirm that you can often only withdraw the new profits made in this new cycle, not the previous balance, which frustrates aggressive traders.

Reddit users also confirm that Take Profit Trader honors their Day One withdrawal promise. Traders report receiving funds to their Wise accounts typically within 24 hours, verifying that the payout speed is real.

However, the main criticism is the intraday trailing drawdown. While the withdrawals are fast, veterans warn that the drawdown rules make it difficult to keep a funded account long-term if you do not lock in profits quickly.

Overall, both firms are legitimate and pay their traders. Apex Trader Funding is reliable but strict about consistency; one big, lucky trade can delay your payout by weeks. Take Profit Trader delivers on its promise of speed with 24-hour withdrawals, but its tight intraday drawdown rules mean you need excellent risk management to keep the account active.

8. FAQs

Take Profit Trader is generally better for beginners due to its simplified rules and free educational resources. Their Trade Context mentorship helps new traders understand market structure, while Apex Trader Funding assumes you already have a working strategy and focuses purely on providing capital.

Yes, but only with Apex Trader Funding. They allow trading on Micro Bitcoin (MBT) and Micro Ether (MET) futures. Take Profit Trader currently does not support crypto products on its WealthCharts or TradingView integrations, focusing strictly on traditional equity and commodity futures.

If you choose Apex Trader Funding to manage multiple accounts (up to 20), a VPS hosting solution is highly recommended to ensure your trade copier works without lag. For Take Profit Trader, which focuses on manual trading on a single or a few accounts, a VPS is usually optional unless your home internet is unstable.

Take Profit Trader is the winner for speed. They process withdrawals daily, and funds typically arrive in your Wise account within 24 hours. Apex Trader Funding uses a batch system where you request payout every 8 days, and the total processing time can take between 5 and 11 business days.

This rule applies when you request a payout. No single trading day can account for more than 30% of your total profit balance. If you have a massive windfall day, Apex Trader Funding may deny your payout to ensure you are trading consistently rather than gambling.

On their specific PRO accounts, Take Profit Trader often removes the Daily Loss Limit, allowing you to trade freely as long as you do not hit the maximum trailing drawdown. This offers more flexibility for swing traders compared to the strict daily caps found at other firms.

The Apex Trader Funding Live Trailing Threshold is considered harder because it trails your unrealized (open) profits during the trade. Take Profit Trader uses an End-of-Day (EOD) calculation, which is much friendlier as it allows your trade to breathe intraday without prematurely failing the account.

It depends on your goals. Take Profit Trader is better for fast withdrawals and simple rules. Apex is better for scaling, multi-account trading, and higher profit potential.

Profitability depends on your strategy, risk management, and consistency. Apex suits high-volume or automated trading, while Take Profit Trader suits manual, disciplined trading with fast access to funds.

Yes, the Apex app is legitimate. It allows traders to monitor accounts, check profits, and manage multiple funded accounts. However, it is mainly a management tool; trading execution usually happens on supported platforms like NinjaTrader or Tradovate.

9. Conclusion

Choosing between Apex vs Take Profit Trader is not about which firm is better, but which one fits your specific goals. Both are legitimate companies that pay out millions to traders, but they serve different needs.

- Apex Trader Funding suits volume traders seeking multi-account management, higher profit potential, and access to crypto futures.

- Take Profit Trader fits traders who value instant withdrawals, simpler rules, and a smoother, beginner-friendly experience.

Ultimately, the best choice depends on whether you prioritize scale or speed, complexity or simplicity.

At H2T Funding, we believe transparency is key to your success. To explore more options, reading other prop firm comparisons can provide additional insight and help you decide which platform aligns best with your strategy and growth goals.