Are you tired of failing evaluations simply because the rules don’t match your strategy? The debate of Apex Trader Funding vs Topstep is critical because picking the wrong partner can drain your wallet faster than the market itself.

While both are giants in futures trading, they serve completely different needs. One focuses on building sustainable habits, while the other prioritizes raw speed and execution volume for pros.

This article exposes the fine print regarding drawdowns, payouts, and hidden fees. H2T Funding will provide the transparency you need to stop guessing and start earning with the right prop firms. Let’s determine which of these prop firms aligns best with your career goals.

Key takeaways:

- Apex Trader Funding is a high-leverage capital provider designed for speed and scaling, best suited for experienced traders who can manage a live trailing drawdown.

- Topstep operates as a talent incubator focused on building disciplined traders through education, support, and safer risk parameters like the End-of-Day drawdown.

- Choose Apex if you are a confident, veteran trader who wants maximum flexibility, the ability to manage 20 accounts, and can navigate complex payout rules.

- Choose Topstep if you are a new or developing trader who prioritizes safety, educational support, and a simple, reliable path to getting paid.

1. Apex Trader Funding vs Topstep: Overview and quick comparison table

Navigating the specifications of prop firms can be overwhelming due to the fine print. To save you time, we have compiled a side-by-side comparison of the essential metrics. This table highlights the primary differences in account structures between Apex Trader Funding and Topstep.

| Aspect | Apex Trader Funding | Topstep |

|---|---|---|

| CEO | Darrell Martin | Michael Patak |

| Funding Models | 1-step | 2-step (Trading Combine) |

| Account Size | $25K – $300K | $50K – $150K |

| Profit Split | 100% first $25K profit, then 90% | 100% first $10K profit, then 90% |

| Profit Target | 6% | 6% |

| Payout Frequency | Twice per month, once payout conditions are met | 5 Winning days (Net PnL each day +$150 or more) |

| Time Limits | No time limit | No time limit |

| Minimum Trading Days | 7 days | 2 days for Combine |

| Daily Loss Limit | None | TopstepX uses trader-set PDLL; legacy platforms still use fixed DLL |

| Maximum Loss Limit | Trailing threshold: ~3% – 4% depending on account size | Trailing Drawdown (varies by account) |

| Instruments | Futures contracts | Futures contracts |

| Platforms | Rithmic, NinjaTrader, Tradovate, and WealthCharts | TopstepX |

| News/Weekend Trading | News and weekend trading allowed, but no hedging/straddling during major news events | News allowed with caution; overnight/weekend holding strictly prohibited |

| Starting Fees | $177/month | $49/month |

Disclaimer: Rules, pricing, and trading conditions may change over time. Traders should always verify the latest terms directly on the official Apex Trader Funding and Topstep websites before purchasing any challenge.

The statistics above only tell half the story. Continue reading below for a deep dive into the evaluation process and hidden rules that truly impact your success.

Apex Trader Funding

#1

Account Types

1-step

Trading Platforms

Tradovate, Rithmic, WealthCharts

Profit Target

6%

Our take on Apex Trader Funding

Apex Trader Funding operates as a high-octane capital provider for confident, experienced traders. Their entire model is built for speed and scale, stripping away the hand-holding to offer raw leverage and flexibility.

However, this freedom comes at a steep price. The live trailing drawdown and complex payout rules act as a ruthless filter, rewarding flawless execution while severely punishing the slightest misstep. It’s a professional’s tool, not a training ground.

| 💳 Challenge Fee | From $196 |

| 👥 Account Types | 1-step |

| 💰 Profit Split | 90% – 100% |

| 💵 Account Size | $25K – $300K |

| ⏱️ Time Limit | No time limit |

| 🎯 Profit Target | 6% |

| 📊 Trading Platforms | Tradovate, Rithmic, WealthCharts |

| 🛍️ Asset Types | Equity Indices, Currencies, Commodities, Interest Rates, Crypto |

Topstep

#2

Account Types

2-step

Trading Platforms

TopstepX

Profit Target

6%

Our take on Topstep

Topstep positions itself as a genuine talent incubator, prioritizing the long-term development of a trader over rapid funding. Their rules, from the EOD drawdown to the Scaling Plan, are guardrails designed to build discipline.

This structured environment, which emphasizes realistic profit targets over risky trades, makes it the gold standard for traders seeking a sustainable career path. They trade a bit of flexibility for a massive increase in safety, support, and payout reliability, making them a partner you can trust.

| 💳 Challenge Fee | $49 – $149 |

| 👥 Account Types | 2-step |

| 💰 Profit Split | 90% – 100% |

| 💵 Account Size | $50K – $150K |

| ⏱️ Time Limit | No time limit |

| 🎯 Profit Target | 6% |

| 📊 Trading Platforms | TopstepX |

| 🛍️ Asset Types | Futures Contracts |

Read more prop firm comparison:

2. A deep dive comparison: Key factors Apex Trader Funding vs Topstep for traders

Success in this industry depends heavily on understanding the fine print, as it directly governs your daily trading experience. Beyond the advertised capital, the specific rules and hidden restrictions often determine your actual probability of securing a payout. Understanding these nuances is essential to avoiding unexpected account breaches.

Let’s dive into the evaluation process details below.

2.1. Evaluation process

The performance evaluation process for a funded account differs significantly between these two giants. Apex Trader Funding focuses on raw speed with a One Simple Step model, while Topstep utilizes the Trading Combine to verify your ability to manage risk over luck.

| Feature | Apex Trader Funding ($25K – $300K) | Topstep ($50K – $150K) |

|---|---|---|

| Model | 1-Step Evaluation | Trading Combine |

| Profit Target | $1,500 – $20,000 (6%) | $3,000 – $9.000 (6%) |

| Min. Trading Days | 7 Days | 2 Winning Days |

| Drawdown Type | Live Trailing (Harder) | End-of-Day (Easier) |

| Account Scaling | Full size in evaluation, but scaling rules apply to the funded account | Scaling Plan applied |

Apex Trader Funding is the winner for aggressive traders who want immediate access to full leverage. The 7-day requirement is a formality if you hit your profit targets early.

However, Topstep offers a fairer evaluation environment. Their End-of-Day drawdown allows you to recover from intraday mistakes without failing, making it the superior choice for long-term sustainability.

Once you pass the Trading Combine rules, you move to the Topstep Express Funded Account. For traders leaning toward Topstep, our analysis of the Topstep funded account rules helps clarify how their Trading Combine works in practice.

2.2. Consistency rules

The path to a funded trading account is paved with rules designed to separate luck from skill. Understanding how each firm defines consistent trading is the first step to staying in the game.

| Feature | Apex Trader Funding | Topstep |

|---|---|---|

| Consistency Rule | 30% Rule (Applied at Payout) | 50% Rule (Applied in the Combine) |

| Explanation | No single day can profit >30% of the total balance | The best day cannot exceed 50% of the total profit |

| Min. Trading Days | 7 Days (Flipping allowed for day count) | 2 Days (In Combine) / 5 Winning Days (Funded) |

I prefer Topstep’s approach for building sustainable habits. By enforcing the 50% rule during the evaluation, they force you to prove your trading strategies are repeatable, saving you from failing on a live account later.

The Apex 30% rule is a silent killer for aggressive traders. Imagine hitting a massive +$10,000 day on a funded account. You’re effectively locked out of withdrawing until you trade many more days just to dilute that profit percentage. It forces trader discipline at the most painful moment, payment time.

If you want a more detailed breakdown of their evaluation rules and hidden triggers, you can explore our guide to the Apex Trader Funding consistency rule.

2.3. Trading rules restriction

While challenge rules measure your performance, trading restrictions define the hard boundaries you cannot cross. Violating these often results in an instant account termination, regardless of your P&L.

| Trading rules | Apex Trader Funding | Topstep |

|---|---|---|

| News Trading | Allowed, but with a One-Direction rule | Allowed, but News Exploitation is banned |

| Copy Trading & VPN | Allowed, designed for multi-account use | Strictly Prohibited, high risk of a ban |

| Overnight Holding | Prohibited (Close by 4:59 PM ET) | Prohibited (Close by 3:10 PM CT) |

| Position Sizing | Contract Scaling rule applies (trade half size until buffer is met) | Scaling Plan (Leverage is earned) |

| Flipping / Sim Abuse | Allowed to meet the day count | Banned (Must be legitimate trades) |

Topstep creates a highly regulated environment that supports specific trading styles while mimicking a traditional trading floor. Their ban on VPNs and external copy trading is designed to verify individual human skill and prevent bots from gaming the system. The Scaling Plan reinforces proper risk management.

Apex offers greater operational freedom, making it a hub for tech-savvy and multi-account traders. Allowing VPNs and copy trading gives you immense trader autonomy. However, this freedom comes with sharp, specific rules, like the prohibition on hedging during news, which can instantly trap unwary traders.

2.4. Trading platforms and market access

The technology you use is your direct connection to the market. A reliable platform and a wide range of products are non-negotiable for a professional trader.

2.4.1. Trading platforms

Both firms support industry-standard software, but their flagship platforms differ.

| Platform | Apex Trader Funding | Topstep |

|---|---|---|

| Primary Platforms | NinjaTrader, Tradovate, Rithmic | TopstepX™ ONLY (For new accounts) |

| Legacy Support | N/A | Existing accounts on other platforms can continue, but cannot be reset after Aug 1st. |

| Key Advantage | Flexibility & Choice: Supports third-party tools and custom setups. | Simplicity & Focus: A single, streamlined, easy-to-use platform. |

Crucial update: As of July 7th, 2025, Topstep is going all-in on its proprietary platform. This is a massive strategic shift that every trader needs to be aware of.

Existing accounts can still use their previous platforms, including TradingView integrations, and if you need help with the setup, see our guide on how to connect Topstep to TradingView.

Apex Trader Funding is now the undisputed choice for traders who demand flexibility. If your entire strategy is built around custom indicators in NinjaTrader, advanced automation, or connecting via Rithmic, Apex is your only viable path forward. They embrace the ecosystem of third-party tools.

Topstep, on the other hand, is betting everything on TopstepX. They claim traders perform better on their platform, so they are making it mandatory for all new accounts. This is a bold move. If you are a beginner or someone who hates dealing with technical issues, this is great news. TopstepX is clean, simple, and just works.

2.4.2. Tradable assets

Having access to the right markets is crucial for any trader. A great strategy is useless if the firm doesn’t offer the specific instruments you specialize in. Here’s a breakdown of the tradable assets available at both Apex Trader Funding and Topstep.

| Asset Class | Apex Trader Funding | Topstep |

|---|---|---|

| Equity Futures | Yes (ES, NQ, YM, RTY) | Yes (ES, NQ, YM, RTY) |

| Forex Futures | Limited | Yes (6A, 6E, 6J, etc.) |

| Metal Futures | Yes (GC, SI) | Yes (GC, SI, HG) |

| Energy Futures | Yes (CL, NG) | Yes (CL, NG) |

| Crypto Futures | Not specified | Yes (MBT, MET) |

While both offer popular products for futures trading (like ES and NQ), Topstep provides a significantly wider range of tradable assets. If you specialize in Forex futures (like the Euro) or want to trade Micro Bitcoin, Topstep is the only option. Apex focuses purely on the most liquid and common futures contracts.

2.5. Profit split & scaling plan

Getting funded is one thing; growing your account is another. The scaling plan dictates how quickly you can increase your leverage and income.

| Feature | Apex Trader Funding | Topstep |

|---|---|---|

| Profit Split | 100% of the first $25,000, then 90% | 100% of the first $10,000, then 90% |

| Scaling Logic | Unlock Full Size: Trade half-size until you build a profit buffer. | Gradual Increase: Earn more leverage as your account balance grows. |

| Enforcement | Strict: A single violation can deny a payout. | Lenient: A 10-second grace period for accidental errors. |

Apex Trader Funding’s profit split is more attractive upfront, letting you keep a larger initial sum. However, their scaling rule is a major hurdle. You are forced to trade with limited size until your account balance is well above the starting capital plus the drawdown. A single mistake here can cost you your entire payout.

Topstep’s Scaling Plan is far more forgiving and logical for long-term growth. As you can see in the chart above, you earn the right to trade more contracts as your P&L increases. This builds discipline and prevents you from over-leveraging after a few good trades. Their 10-second grace period for fat-finger errors is also a trader-friendly feature that Apex lacks. For sustainable growth, Topstep’s model is superior.

3. Break down the cost when choosing Apex Trader Funding vs Topstep

The price tag you see first is not the full story. Let’s break down the real costs you will face, both during the evaluation and after you get funded.

This is what you pay to try to pass the test. Topstep offers two paths: a cheaper Standard path with an activation fee, and a more expensive No Activation Fee path.

| Cost Component | Apex Trader Funding | Topstep (Standard Path) | Topstep (No Activation Fee Path) |

|---|---|---|---|

| Monthly Fees | $187 – $597 | $49 – $149 | $89 – $189 |

| Reset Fee | $80 (Rithmic & WealthCharts)$100 (Tradovate) | $49 – $149 | $89 – $189 |

| Activation Fee | None | $129 (One-time, after you pass) | None |

Topstep’s Standard Path is the cheapest way to start if you are on a budget. The low monthly and reset fees make it perfect for learning and trying multiple times. You just have to pay the one-time $129 fee after you pass.

Apex Trader Funding and Topstep’s No Activation Fee Path are more expensive upfront but simpler. You pay a higher monthly fee, but there are no surprise costs later.

So, what happens if you make a mistake after you’re funded?

| Scenario | Apex Trader Funding | Topstep |

|---|---|---|

| Funded Account Reset? | No. Account is terminated. | Yes, with the paid Back2Funded program. |

| What’s the process? | You must start over. Buy a new evaluation. | Pay a fee to reactivate the same funded account. |

| The Safety Net Cost | Cost of a new evaluation (e.g., $187+) | $499 for a 50K account (Up to 2 times) |

With Apex, if you break a rule on a funded account, it’s over. You lose everything and must pay for a new evaluation and start from scratch. There is no second chance. For a full explanation of what actually happens when an Apex-funded account breaks the rules, see our guide on resetting a funded Apex account.

The Topstep Back2Funded explained program is a huge safety net. Paying $499 to reactivate a 50K account is expensive. But it allows you to skip the entire evaluation process and get right back to trading your funded account. This can save you weeks or months of effort and is an invaluable feature for any serious trader.

Note: As of August 1, 2025, the old Reset-at-Rebill feature is no longer available. Previously, your account would automatically reset for free on your renewal date if you had failed. Now, you must use a manual reset. To compensate, Topstep now gives you one Bankable Reset for each monthly renewal, which you can save and use whenever you need it.

4. Risk management: Drawdown limits and daily loss

This is the single most important section of this entire comparison. More traders fail because of drawdown limits than for any other reason. While neither firm has a separate Daily Loss Limit, their maximum drawdown functions as one. However, how they calculate it is a night-and-day difference.

| Feature | Apex Trader Funding | Topstep |

|---|---|---|

| Drawdown Type | Live Trailing Drawdown | End-of-Day (EOD) Drawdown |

| How it’s Calculated | Follows the highest point of your life, unrealized P&L. | Based on your account balance at the end of the trading day. |

| Trader Impact | Punishing. Locks in risk as soon as a trade goes in your favor. | Forgiving. Allows you to recover from intraday dips. |

4.1. Apex’s Live Trailing Drawdown

Apex Trader Funding uses a live trailing drawdown, and it is notoriously difficult. This drawdown follows the highest point your account balance reaches, including unrealized profits.

Here is a clear Apex trailing threshold example:

- You start a $50K account with a $2,500 trailing threshold. Your failure point is $47,500.

- Your open trade goes +$1,000 in your favor. Your live balance is now $51,000.

- Instantly, your failure point is dragged up from $47,500 to $48,500.

- If the trade reverses and you close at breakeven ($50,000), your drawdown limit does not move back down. You now have less room for error than when you started.

This rule is a silent account killer. It creates immense psychological pressure to take profits too early, because every tick in your favor permanently increases your risk.

It’s a system that requires flawless execution regardless of market conditions, making it suitable only for experienced scalpers. For most traders, this is an unnecessary and brutal form of risk management.

4.2. Topstep’s End-of-Day Drawdown (EOD)

Topstep’s EOD drawdown is a trader’s best friend. It means your account is only evaluated based on its closing balance each day at 3:10 PM CT.

Imagine your account goes down $1,000 during the day, but you trade your way back to breakeven before the market closes. With Topstep, it’s like the dip never happened. This gives you crucial breathing room to manage trades and recover from mistakes.

This is, without a doubt, the single greatest advantage of trading with Topstep. It reflects how real trading works, where profits and losses fluctuate. This rule alone significantly increases your chances of long-term success because it doesn’t penalize you for normal market volatility.

If you’re new to Topstep and want to understand how the firm’s entire system works around this rule, see our detailed guide on how Topstep works.

Read more:

5. Apex Trader Funding vs Topstep payout structure

Getting paid is the ultimate goal. However, the process is far from simple. Both firms have a complex web of rules governing when you can withdraw, how much you can take, and what conditions you must meet.

| Payout Feature | Apex Trader Funding | Topstep |

|---|---|---|

| Profit Split | 100% of the first $25,000, then 90% | 100% of the first $10,000, then 90% |

| Requirement | 8 Trading Days (5 must be +$50) | 5 Winning Days (Days’ PNL > $150) |

| Consistency Rule | 30% Rule: Best day < 30% of total profit | None for payouts |

| Withdrawal Buffer | Safety Net: Must keep drawdown + $100 in account for first 3 payouts. | Eligible Payout Balance: Must keep balance above the level of your last payout. |

| Max Withdrawal Limit | Yes, for the first 5 payouts (e.g., $2,000 on a 50K account). | Yes, 50% of the account balance (up to $5,000) in the Express Funded Account. |

| Unrestricted Payouts | After the 5th approved payout. | After 30 winning days in a Live Funded Account (unlocks Daily Payouts). |

| Multi-Account Benefit | Each account has its own payout limit, allowing for massive scaling. | Payout split is tied to the trader, not the account. |

For the average trader, Topstep’s profit-sharing model and payout process are significantly simpler and more achievable. The 5 winning days rule is a clear, straightforward target. While the Eligible Payout Balance encourages you to grow your account, it’s a logical rule that promotes healthy trading habits and good risk management. You are not penalized for having one great trading day.

Apex Trader Funding, on the other hand, presents a far more challenging path, especially for the first few payouts. Their system is a complex maze of four different rules working at once: the 30% consistency rule, the Safety Net buffer, the minimum balance threshold, and the maximum payout caps. This structure is designed to weed out anyone who isn’t exceptionally consistent.

However, for elite traders, Apex offers unparalleled scaling potential. Their model is a high-barrier, high-reward system built for professionals.

- Massive scaling potential: The Apex 20-account scaling rule means each account has its own payout limit.

- Higher income ceiling: A skilled trader can withdraw significantly more money in a month than from a single Topstep account.

6. Support & Education: Which firm cares more?

Beyond the rules and platforms, the quality of support and educational resources can significantly impact your growth. One firm treats you like an independent contractor, while the other invests in you like a developing athlete.

| Feature | Apex Trader Funding | Topstep |

|---|---|---|

| Primary Support Channel | Ticket-based Help Desk (Email) | Multi-channel: Live Chat, Phone, Email, AI Bot, WhatsApp |

| Educational Approach | Self-Service: An extensive FAQ and a Master Training Course to read. | Interactive & Proactive: Live coaching, performance coaches, webinars, and a resource library. |

| Coaching | None | Yes, daily group coaching and a digital performance coach (Coach T). |

| Community | Facebook Group | Discord Community, live trading shows |

| Support Staff | Standard support team | Team includes funded traders and industry experts |

Topstep is in a completely different league when it comes to trader support and education. Their approach is holistic and designed to actively develop your skills.

They provide live group coaching, performance analysis, and a support team staffed by actual funded traders. The Coach T digital assistant and multi-channel support show a deep commitment to the trader’s journey.

Apex Trader Funding, by contrast, operates a lean, self-service model. Their support is built around an extensive FAQ library and a ticket-based help desk. While efficient, the responsibility to learn and troubleshoot falls entirely on you.

7. Who should choose Apex vs Topstep

So, which firm is the right one for you? It all comes down to where you are in your trading journey.

Choose Topstep if:

- You are building a long-term, sustainable trading career and prioritize learning.

- You value safety and fair rules, especially the forgiving End-of-Day drawdown.

- You want a simple and reliable payout process without complex consistency rules.

- You believe coaching and educational resources are essential for your growth.

Topstep is a structured, discipline-focused prop firm. Watch the detailed review video for a clear breakdown of its rules and payout system.

Choose Apex Trader Funding if:

- You are an experienced trader with a consistently profitable strategy.

- Your main goal is to scale aggressively across multiple accounts for maximum income.

- You have the discipline to master a live trailing drawdown and don’t need a safety net.

- You want maximum freedom and see restrictive rules like scaling plans as a bottleneck.

Apex Trader Funding is a high-intensity, scale-driven prop firm designed for experienced traders. See the in-depth video review for a concise breakdown of its evaluation, live drawdown, and payout model.

Ultimately, your choice reflects your current trading experience. Are you building the foundation of a skyscraper, or are you ready to place the final floors on a structure you’ve already built?

8. Apex Trader Funding vs Topstep review on Trustpilot and Reddit

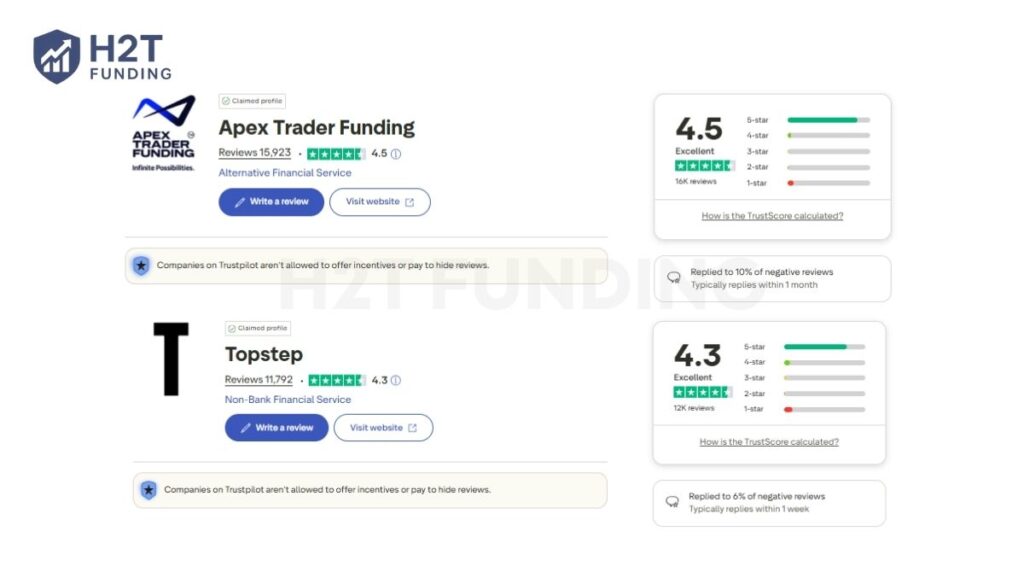

Official rules only tell half the story. To get the full picture, we need to look at what real traders are saying on public forums like Trustpilot and Reddit.

Apex Trader Funding boasts a stellar 4.5-star rating, with traders praising the simple one-step evaluation and the speed at which they can get funded. Meanwhile, Topstep’s strong 4.3-star rating is built on positive feedback about their user-friendly platform, valuable coaching, and fair risk parameters.

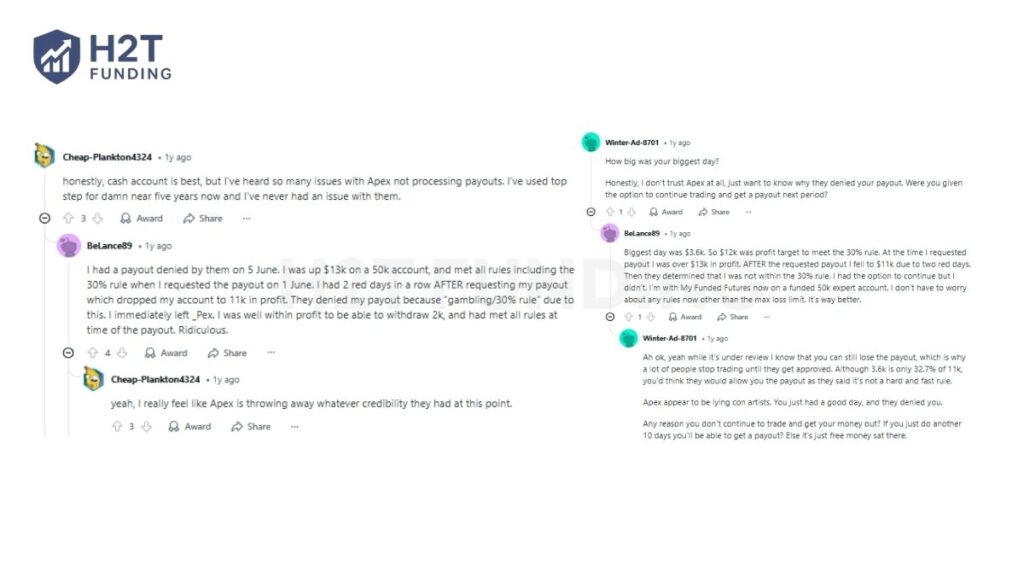

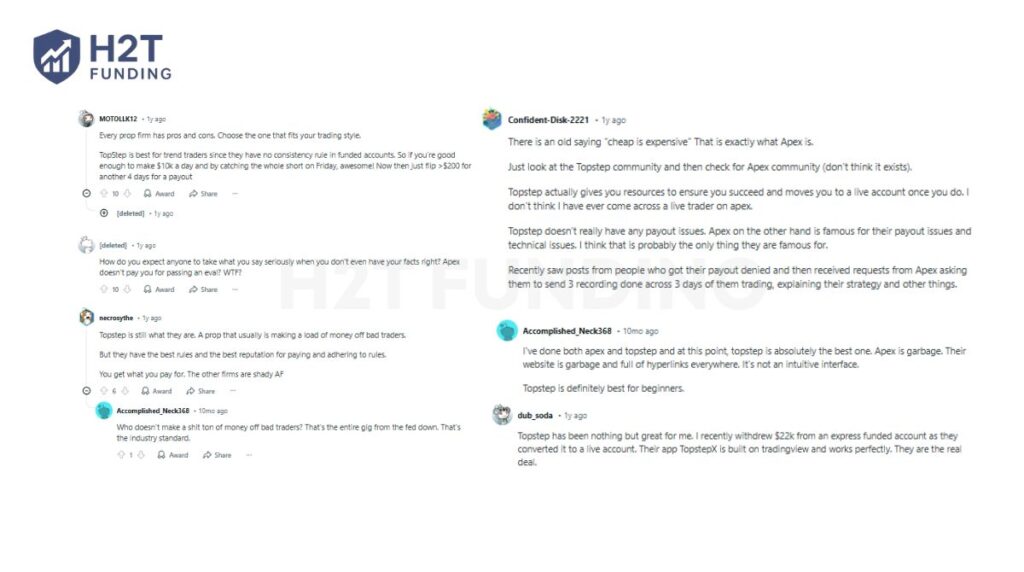

However, discussions on Reddit paint a more nuanced and critical picture, especially when it comes to getting paid. This is where the unfiltered experiences of traders reveal the true operational differences.

A significant number of Reddit threads are dedicated to traders experiencing payout denials from Apex Trader Funding. As the image shows, many feel trapped by the complex 30% consistency rule, claiming it is used to unfairly reject withdrawals. This has created a narrative that, while it’s easy to get funded by Apex, it’s difficult to get paid.

Conversely, the sentiment around Topstep is overwhelmingly positive regarding payouts. The common consensus on Reddit is that Topstep is fine and reliable. If you follow their clear rules, you will receive your money without issue.

Traders often recommend Topstep as the safer, more dependable choice for those who prioritize consistent income over aggressive, high-risk strategies.

9. Apex vs Topstep: Which prop firm is more legit?

Both Apex Trader Funding and Topstep are legitimate, registered companies that have funded thousands of traders. They are not scams. However, in the world of prop trading, legit often means: Do they pay out reliably and without hassle?

On this front, the community’s verdict is quite clear.

Topstep has built a rock-solid reputation for being trustworthy.

They have been in business since 2012 and have a long history of consistent payouts. While their rules can be tough, they are seen as transparent and fair. The general feeling among traders is simple: if you play by their rules, you will get your money.

Apex Trader Funding’s legitimacy is often questioned regarding its payout process.

While they are a massive firm that pays out millions, there is a significant and undeniable volume of complaints online. Many traders report having payouts denied due to the firm’s complex and sometimes confusing rules, particularly the 30% consistency rule. This creates a cloud of uncertainty that you don’t see with Topstep.

If by legit you mean a reliable partner with a transparent process and a stellar community reputation for paying traders, Topstep is the more legitimate choice.

If by legit you mean a real company that offers a path to funding, then Apex also fits. However, you must go in with the understanding that their payout process is stricter and has a higher rate of disputes.

10. Which firm should you choose? (based on trader type)

Alright, let’s cut to the chase. After comparing all the rules, costs, and real-world feedback, here is our final recommendation broken down by the type of trader you are.

10.1. For the beginner or developing Trader: Topstep is the better fit

If you are new to futures trading or still working toward consistent profitability, Topstep provides a safer, more structured environment to develop your skills.

Why Topstep is ideal for beginners:

- A safer drawdown model: Topstep uses an End-of-Day (EOD) drawdown, which does not trail your balance during the trading day. This is far more forgiving for developing traders and effectively functions as a safer version of a daily loss limit. You won’t get punished for normal intraday volatility.

- Scaling that encourages discipline: Topstep applies a contract scaling progression on funded accounts, allowing you to trade more size as you build sustainable profits, not immediately. This prevents reckless over-leveraging after a few good trades and reinforces long-term discipline.

- A clear, reliable payout process: Topstep’s payout rules are straightforward and consistent, giving new traders confidence that they will be paid for their performance.

- Real coaching and education: Topstep invests heavily in trader development through live coaching, webinars, and structured educational resources, something Apex does not provide.

If your priority is to learn properly, protect your capital, and build consistent habits, Topstep should be your first choice.

10.2. For the experienced and aggressive trader: Apex is your arena

If you are already a consistently profitable trader with strong risk management skills, Apex offers a more flexible and potentially more lucrative environment.

Why Apex suits advanced traders:

- Higher earning potential through scale: Apex allows traders to operate multiple funded accounts simultaneously (up to 20 per trader by default). This can dramatically increase income potential for traders with a strong strategy.

- Freedom to trade without heavy restrictions: Apex gives access to full buying power earlier than Topstep once you meet their scaling rule, and they do not impose restrictive coaching-style limitations.

- Trailing drawdown rewards precision: While Apex’s live trailing drawdown is unforgiving, experienced traders who already manage risk tightly can use it to scale profits quickly.

- Flexible payout structure: Apex offers 100% of the first portion of profits before moving to a 90% split, providing strong upside for fast-moving traders.

If you have discipline, a proven edge, and the ability to handle trailing drawdowns, Apex gives you maximum freedom and earning power.

10.3. For the trader in between: Start with Topstep, graduate to Apex later

If you’re not a complete beginner but also not fully confident in handling a live trailing drawdown, the best path is a progression:

- Start with Topstep to build consistency and mental discipline under a safer EOD drawdown.

- Use their structure, rules, and coaching to refine your strategy.

- Once you’re receiving payouts reliably, transition to Apex if you want higher scaling potential.

This approach minimizes risk while maximizing long-term profit opportunities.

11. Frequently Asked Questions (FAQs)

The main difference is their philosophy. Topstep focuses on building disciplined traders through structured rules, education, and a safer End-of-Day drawdown. Apex Trader Funding focuses on providing maximum capital and flexibility to experienced traders through a fast evaluation and fewer restrictions, but with a much stricter live trailing drawdown.

Better depends on your style. For traders seeking flexibility, high leverage, and the ability to scale across many accounts, firms like Apex Trader Funding can be considered a better alternative. However, for those who value safety, education, and payout reliability, Topstep remains the industry benchmark.

The 30% rule states that no single trading day can account for more than 30% of your total profit when you request a payout. For example, if you’ve made $10,000, your biggest winning day cannot be more than $3,000. It is a consistency rule designed to prevent withdrawals based on one lucky, high-risk trade.

The primary cons are its live trailing drawdown, which is very difficult for most traders to manage, and its complex payout rules. Many traders on platforms like Reddit report issues with payout denials related to the 30% consistency rule, creating a perception of unreliability.

Yes, Apex Trader Funding does pay out, and many traders have successfully received withdrawals. However, their payout process has more conditions (like the 30% rule and safety net buffer) than Topstep, leading to a higher rate of denied requests and community complaints.

Topstep is widely considered one of the best prop firms for beginners. Their focus on education, coaching, and rules that encourage good habits (like the Scaling Plan and EOD drawdown) provides a safe environment to learn. Apex Trader Funding is generally not recommended for beginners due to its punishing drawdown and complex rules.

Yes, and this is a key difference. Apex Trader Funding is built for multi-account trading, allowing you to manage and copy trades across up to 20 accounts. Topstep is more restrictive, focusing on the performance of a single trader within their ecosystem.

Topstep is significantly safer for a long-term career. Their End-of-Day drawdown, simpler payout rules, and the “Back2Funded” safety net are all designed to keep you in the game. Apex’s high-risk model, with its punishing drawdown and permanent termination of funded accounts, makes long-term survival much more difficult.

Yes, Apex Trader Funding is a legitimate company that pays out millions to traders. However, their legitimacy is often questioned by the community due to their very complex payout process, which leads to a high number of disputes and denied withdrawal requests.

Topstep is a highly legitimate and respected company in the industry, operating since 2012 with a strong reputation for paying traders. Prop firms themselves are not regulated like brokers because they use simulated funds and do not hold customer deposits for trading on live exchanges.

Apex is generally easier and faster to pass. It’s a single-step evaluation with fewer initial rules, allowing you to use full leverage quickly. Topstep’s Trading Combine is more challenging because its rules (like the 50% consistency rule) are specifically designed to filter for skill over luck.

The biggest risk is failing the evaluation due to their strict rules, particularly the Scaling Plan, which limits your initial position size. For new users, another risk is being limited to their proprietary TopstepX platform. However, the risk of unfair rule enforcement or payout denial is extremely low compared to many competitors.

12. Conclusion

The debate of Apex Trader Funding vs Topstep doesn’t have a single winner; it has the right choice for you. Your decision should be based on an honest assessment of your skills, discipline, and long-term goals.

- Choose Topstep if: You are a new or developing trader who values safety, education, and a clear, reliable path to getting paid. Their End-of-Day drawdown and coaching support are designed to build a sustainable career.

- Choose Apex Trader Funding if: You are an experienced, highly disciplined trader who can manage a live trailing drawdown and wants maximum flexibility to scale aggressively. Their model offers higher earning potential but comes with significantly higher risk and more complex payout hurdles.

At H2T Funding, we believe that understanding the fine print is the key to success. We hope this detailed comparison has provided the clarity you need to take the next step in your trading journey.

Ready to learn more? Explore our other in-depth reviews and trading strategy guides on the H2T Funding blog to further sharpen your edge in the market.