Ever stared at your credit card statement, wondering, ‘What was that $50 pharmacy run for?’ or ‘Did I really get another manicure?’ Personal care spending often feels small and scattered, making it easy to lose track.

That’s why truly understanding whats included in the personal care section of a budget is the first step to mastering your money without giving up the routines that make you feel your best.

In this guide, I’ll walk you through what truly belongs in this section, how to budget for it effectively, and practical strategies to save without sacrificing your well-being.

Key Takeaways:

- Personal care covers routine expenses for hygiene, grooming, and overall well-being, not luxury or entertainment spending.

- Common personal care categories include hygiene products, skincare & cosmetics, professional grooming services, health & wellness, and clothing care.

- New clothes, hobbies, pet care, and childcare do not belong in the personal care budget and should be tracked separately.

- Personal care typically takes about 3%–7% of take-home pay, depending on lifestyle and priorities.

- Basic hygiene items are “needs,” while services and luxury products are “wants” under the 50/30/20 budgeting rule.

- Tracking spending for 30 days is the fastest way to understand and control personal care expenses.

- Regular monthly reviews help prevent overspending without sacrificing your self-care routine.

1. What is the personal budget for care?

Personal care in budgeting refers to the regular expenses you make to maintain hygiene, grooming, and overall well-being. These aren’t luxuries; they’re the basics that keep you feeling confident and presentable every day.

This category covers anything you use regularly to stay clean, feel good physically, and appear well-kept in both social and professional settings. It’s important to distinguish it from spending on entertainment or household items, which belong in separate budget categories.

When clearly defined, personal care becomes a manageable part of your financial plan, not an afterthought.

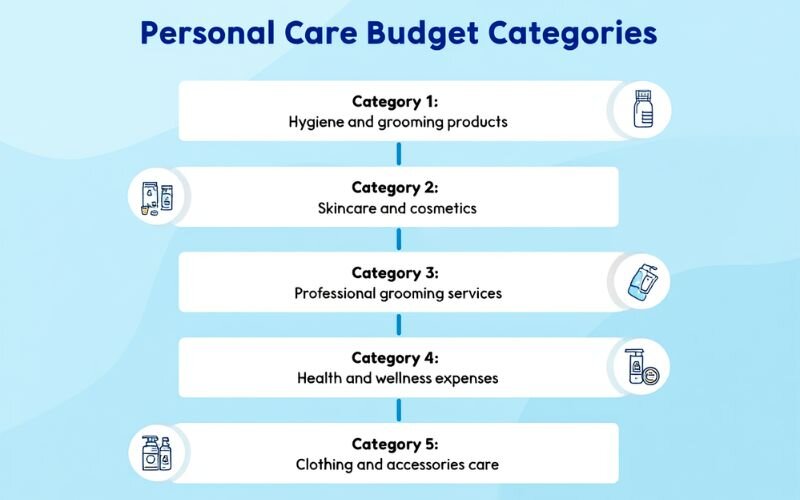

2. Exactly whats included in the personal care section of a budget

My first step to examine whats included in the personal care section of a budget was to break everything down into smaller chunks. It stopped me from getting overwhelmed and helped me truly understand my own spending. Here’s how I categorize things, and you can use it as your own starting checklist:

2.1. Category 1: Hygiene and grooming products

These are the everyday basics, items you use routinely to stay clean, fresh, and well-groomed. I always recommend starting with this category when creating your personal care budget.

- Hair products: Shampoo, conditioner, styling gel or mousse,…

- Body care: Body wash, soap bars, deodorant, body lotion,…

- Oral hygiene: Toothpaste, toothbrushes, mouthwash, dental floss,…

- Shaving and hair removal: Razors, shaving cream, wax, tweezers,…

- Feminine hygiene: Pads, tampons, menstrual cups, panty liners,…

2.2. Category 2: Skincare and cosmetics

This category includes products used to care for your skin and apply makeup. These items help maintain a clean, healthy appearance and are part of many people’s regular routines.

- Facial skincare: Cleanser, toner, serum, moisturizer, sunscreen, face masks,…

- Makeup: Foundation, powder, mascara, lipstick, eyebrow pencil,…

- Makeup removal: Cleansing water or oil, cotton pads

2.3. Category 3: Professional grooming services

These are services you pay for to maintain your appearance and hygiene, often performed by trained professionals.

- Haircuts, hair styling, hair coloring at salons

- Manicures and pedicures

- Spa services: facials, body scrubs, massages

- Other treatments: waxing, laser hair removal, eyelash extensions

2.4. Category 4: Health and wellness expenses

Expenses in this category focus on maintaining your body and mind in good condition. They often go hand-in-hand with other personal care habits.

- Gym memberships or fitness classes (yoga, pilates, etc.)

- Vitamins and dietary supplements

- Over-the-counter medications (pain relievers, cold medicine, allergy pills)

2.5. Category 5: Clothing and accessories care

Maintaining the condition of what you wear is part of presenting yourself well. This includes basic upkeep, not new purchases.

- Laundry and dry cleaning services

- Clothing and shoe repairs

- Shoe polish and leather care products

3. What’s not typically included in a personal care budget? (common mistakes to avoid)

Many people mis categorize expenses when setting up their personal care budget. Understanding whats included in the personal care section of a budget also means knowing what doesn’t belong; this helps you avoid budget distortions and plan more accurately.

Below are common items that are often confused with personal care, but should be tracked under different categories:

- New clothing and footwear: Belongs in your “Clothing” budget

- Pet care: Food, grooming, and vet visits fall under “Pet expenses.”

- Childcare: Diapers, baby formula, and babysitting costs go in “Childcare.”

- Hobbies and entertainment: Movie tickets, books, and streaming services fit under “Entertainment.”

Misplacing these items can lead to overspending or underestimating certain categories. Keeping clear boundaries between expenses gives you a more accurate picture of where your money really goes.

See more articles:

4. How much should you budget for personal care?

Budgeting for personal care isn’t a one-size-fits-all process. The amount you set aside depends on your income, lifestyle, and which items in this category are essential to you.

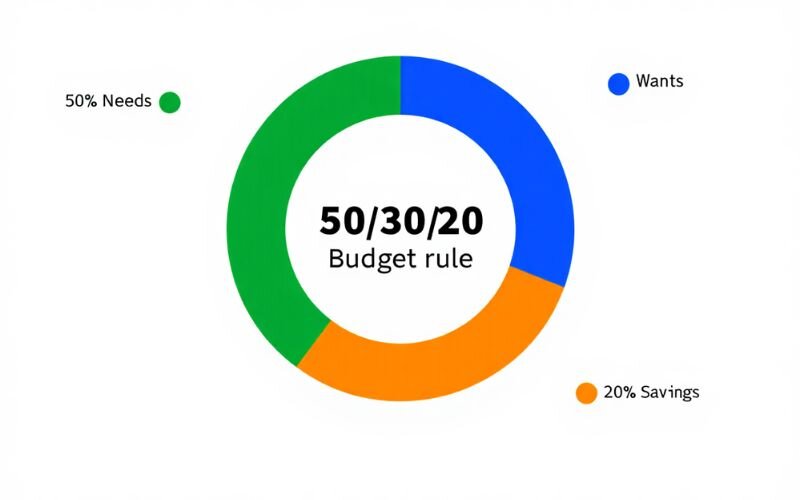

4.1. The 50/30/20 rule and where personal care fits

According to the 50/30/20 budget rule, your income should be divided into three parts: 50% for needs, 30% for wants, and 20% for savings or debt repayment.

Personal care spans both needs and wants. Basic hygiene products like toothpaste and soap fall under “needs.” Meanwhile, services such as massages or luxury skincare often count as “wants.” Classifying them correctly helps keep your budget balanced and intentional.

4.2. Finding the average cost of personal care per month

From what I’ve seen with people around me across different income levels, personal care spending usually ranges from 3% to 7% of take-home pay, depending on lifestyle and priorities.

For example, someone living in a major city with regular salon visits and branded skincare products might easily spend over $150/month, while someone with a minimalist routine could stay under $50.

Personally, I’ve found that people who track expenses carefully often settle into a comfortable monthly range, typically $80 to $120, that covers both essentials and a few self-care extras. The key is not the number, but how consistently it aligns with your needs and habits.

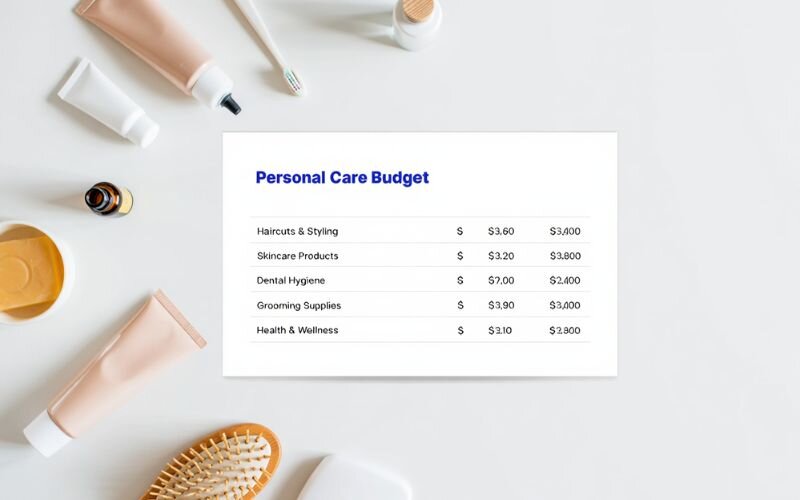

4.3. A quick example of calculating your personal care budget

Let’s say your monthly take-home income is $3,000. If you allocate 4% of that to personal care, your monthly budget would be $120. Here’s how that amount could be divided:

| Item | Estimated Cost | Notes |

|---|---|---|

| Haircuts | $40 | Once per month |

| Hygiene essentials | $30 | Shampoo, soap, toothpaste |

| Skincare products | $10 | Moisturizer lasts 2–3 months |

| Gym membership | $40 | Monthly subscription |

| Total | $120 |

How much you should budget for personal care depends on your priorities, but most people fall into a predictable range. Using a percentage-based method, supported by real expense tracking, gives you the flexibility to care for yourself without disrupting your broader financial goals.

5. How to create and manage your personal care budget in 4 simple steps

I’ll be honest: it was my end-of-year credit card statement that forced my hand. Tucked between familiar expenses, the ‘miscellaneous’ category was mysteriously bloated. After some digging, I realized a significant chunk was from ‘just browsing’ trips to the beauty store, pricey specialty shampoos, and spontaneous manicures. I decided to face it head-on.

There was no complex system, just a simple notebook, and these four steps helped me regain control without feeling like I was making a sacrifice.

If you’re in the same place, you can apply this approach too. It’s straightforward, realistic, and surprisingly effective.

5.1. Step 1: Track your spending for 30 days

For 30 days, write down every personal care purchase, no matter how small. You can use a simple notebook, a Google Sheet, or any budgeting app you’re comfortable with. I used Google Sheets and color-coded each category, which helped me spot patterns easily.

By the end of the month, you’ll have a clear picture of where your money’s going, and which items are essential vs. impulse.

5.2. Step 2: Set a realistic budget number

After tracking your spending, the next step is to look at the numbers and set a limit that feels sustainable. When I finally added everything up, the final number was a genuine surprise. It wasn’t that I was being intentionally reckless; it was simply that all those small, unmonitored purchases had quietly snowballed into a significant amount. I didn’t cut everything out, but I knew I needed to make some smart adjustments.

I set a monthly limit that covered my essentials plus a little extra for flexibility. You can do the same, just base it on what you actually use, not what you wish you used. The goal isn’t to restrict, but to give yourself a clear, comfortable range to work with.

5.3. Step 3: Add a “personal care” line to your budget tool

Once I had my number, I added “Personal Care” as its own line in my monthly budget tracker. Before that, I used to lump it under “Miscellaneous,” which made it impossible to see where the money actually went.

I used a basic Google Sheet with columns for date, item, cost, and notes. You can highlight this category in a different color so it’s easy to track. The key is to treat personal care as a real, consistent part of your budget, not just an afterthought.

It only took me a few minutes to set up, but it made a huge difference in how I managed my spending month to month.

5.4. Step 4: Review and adjust monthly

At the end of each month, take a few minutes to compare your planned budget with actual spending. Some items may last longer than expected; others might need more frequent restocking.

If a category consistently goes over or under, you need to adjust the budget for the next month. Small, regular reviews help prevent overspending and keep your budget aligned with real needs, without requiring drastic changes.

6. 5 smart tips to reduce your personal care spending

Once I had my budget number, the next challenge was actually sticking to it. At first, I was worried it meant giving up the routines I enjoyed. But it turned out that a few smart shifts in my habits and shopping made all the difference. Here are five tips that have genuinely worked for me:

- Buy smarter, not more: Look for discounts, use loyalty points, or buy essentials like shampoo and toothpaste in bulk. Multi-use products, like tinted moisturizers or all-in-one body wash, can also cut down spending without cutting quality.

- Try simple DIY alternatives: Homemade face masks using oatmeal, yogurt, or honey often work just as well as store-bought versions. At-home manicures and basic grooming can also save a surprising amount over time.

- Extend time between services: Stretch out appointments like haircuts or spa visits by a few weeks. For example, switching from a 6-week to an 8-week haircut schedule can reduce annual salon expenses significantly.

- Choose value over brand: Instead of high-end salons or luxury creams, look for well-reviewed, affordable alternatives. Many drugstore products offer great results without the markup.

With a few simple changes in habits, it’s possible to maintain a solid personal care routine without overspending. Focus on consistency, not perfection, and choose value-driven decisions that support both your well-being and your wallet.

Maybe you’re interested in:

7. FAQs

Start with essentials like shampoo, toothpaste, soap, deodorant, and basic grooming, such as haircuts. These are daily-use items and easy to track when building your first budget.

A personal care budget is money you set aside for your own self-care. Direct payments for care are government-provided funds (common in the UK) for people who need professional support due to health conditions or disabilities.

Other key categories include housing, transportation, food, entertainment, clothing, education, and savings. Each should have its own line in your budget to stay organized.

There’s no fixed number, but a good range is 3–7% of your after-tax income. For most people, this works out to around $50–$200 per month, depending on lifestyle, habits, and personal priorities.

8. Conclusion

Ultimately, defining whats included in the personal care section of a budget isn’t about restriction; it’s about empowerment. It transforms guilty pleasures into intentional choices. Instead of feeling a pang of regret over a new moisturizer, you can enjoy it confidently, knowing it’s part of the plan.

Start building your plan today, and turn self-care into a smart, sustainable part of your financial journey. A clear plan helps you avoid waste, control overspending, and still enjoy the things that make you feel your best.

If you’re ready to build a smarter, more balanced budget, explore more tips and guides in the Budgeting Strategies section at H2T Funding. Small changes today can lead to long-term peace of mind.