If you find yourself asking, “What percent of day traders make money?”, you’re certainly not alone. The question of what percentage of day traders make money is on the mind of almost every new trader. They are seeking to understand the real odds of success before diving into the fast-paced world of day trading.

You’ve likely heard the intimidating rumors and are searching for a clear answer: what is the percentage of day traders that make money, and more specifically, what percentage of day traders actually make money after accounting for all fees and losses? Check out the full article to see the detailed statistics and key insights for aspiring day traders.

Key takeaways:

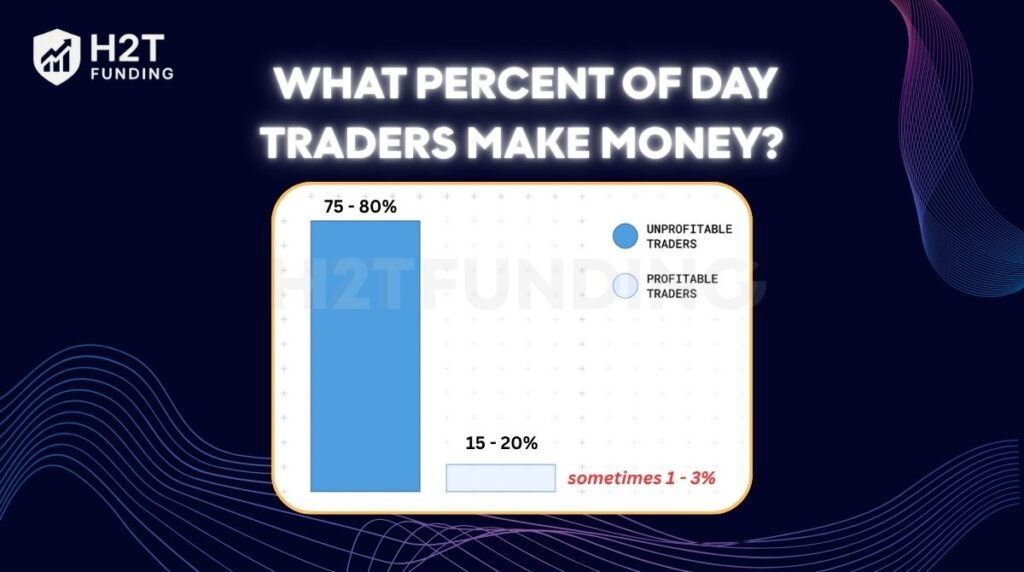

- What percent of day traders are profitable? Studies show a very small percentage, often cited around 15% to 20% and sometimes as low as 1-3%, are consistently profitable in the long run.

- The vast majority of day traders lose money due to a combination of psychological factors, poor risk management, and a lack of a tested trading strategy.

- Success is not random; it is typically the result of immense discipline, continuous learning, and a robust, well-executed trading plan.

- While the odds are steep, they are not insurmountable. Aspiring traders can improve their chances by focusing on education, emotional discipline, and sound money management principles.

1. What is day trade?

Think of day trading like being a high-speed merchant. Instead of buying goods to sell next month, you buy and sell them on the very same day to capture a quick profit.

Day trading is the practice of buying and selling financial instruments within a single trading day, ranging from seconds to hours, with the goal of profiting from short-term price movements. Day traders close their positions before the market closes to avoid overnight risk and typically focus on volatile assets that provide frequent trading opportunities.

Day trading strategies can be applied across various asset classes, including stocks, currencies, commodities, cryptocurrencies, and bonds. Having a clear understanding of what a trading plan is essential, as it helps guide entry and exit decisions and ensures trades align with your strategy.

Here is a simple example:

- 10:00 AM: A trader sees that Stock ABC is gaining momentum and buys 100 shares at $50.00 per share.

- 1:30 PM: The stock price rises to $50.75 due to positive market news.

- 1:31 PM: The trader immediately sells all 100 shares, locking in a profit of $0.75 per share (or $75 total, before commissions).

This fast-paced approach is completely different from long-term investing (buying and holding for years) or even swing trading (holding for several days or weeks). Success relies heavily on skills like technical analysis (reading price charts), capitalizing on market volatility, and making swift, unemotional decisions.

2. What percent of day traders make money?

This question gets to the heart of the day trading dream and directly addresses the overall success rate. When people ask what percentage of day traders are successful, the statistical reality is often sobering.

While there isn’t one single, universally agreed-upon statistic, a wide range of studies and industry reports all point to the same conclusion: only a very small fraction of day traders achieve sustainable success.

- A landmark 2019 study of day traders in the Brazilian futures market found a staggering result: just 3% of them make money, showing that experience alone does not guarantee success.

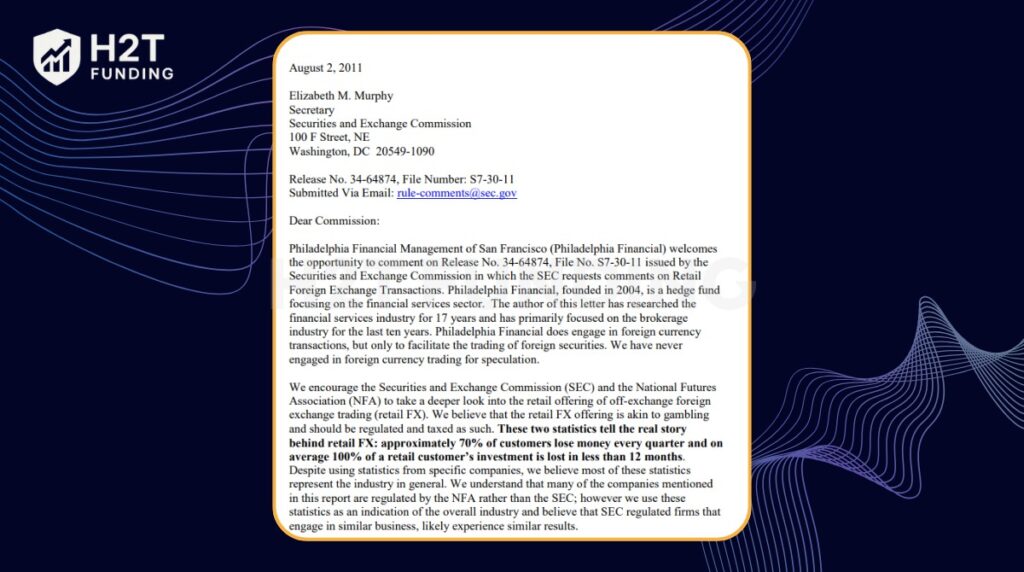

- While a specific, overarching report from the U.S. Securities and Exchange Commission (SEC) on this topic is not commonly cited, mandatory disclosures from U.S. forex brokers provide consistent insight. This data regularly shows that, on average, around 30% of retail traders make money every single quarter.

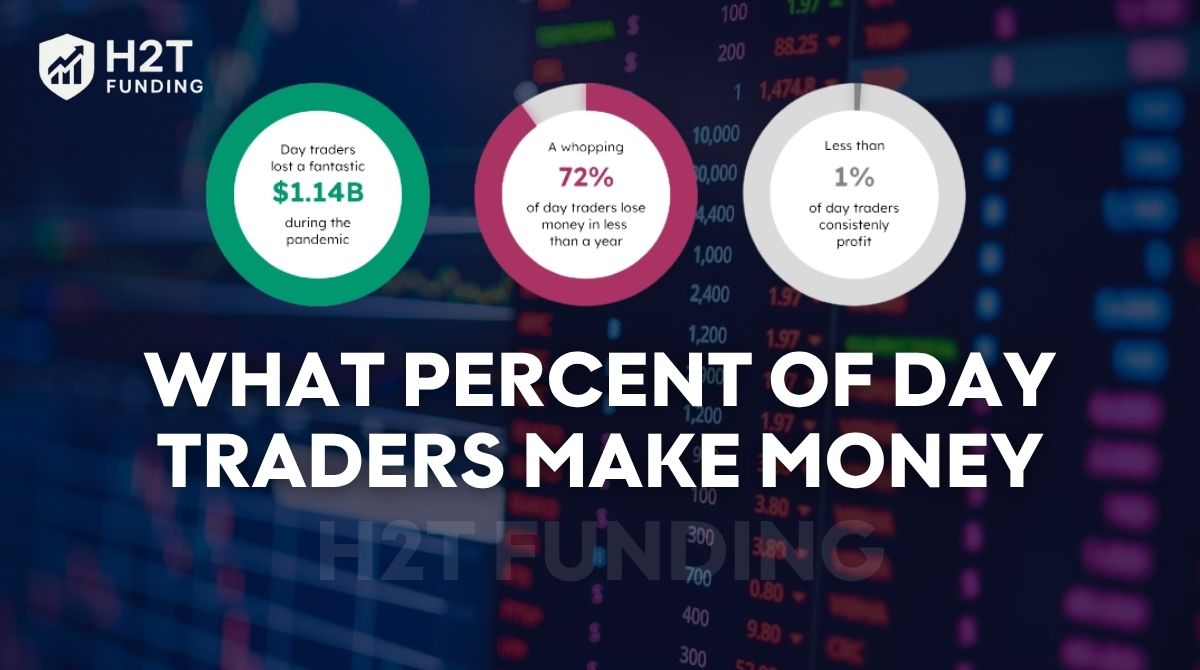

- A multi-year analysis in Taiwan, detailed in a paper by academics Brad Barber and Terrance Odean reviewing data from 1992 to 2006, discovered that less than 1% of the most active day traders were able to earn profits after accounting for fees.

- Perhaps most tellingly, this high-stakes activity often yields worse results than simply doing nothing at all. One analysis, also from Barber and Odean’s research, found that U.S. day traders underperformed a simple market index significantly, meaning their efforts resulted in substantial losses compared to a passive investment strategy.

These dismal statistics from different markets and time periods all point to the same undeniable conclusion: the evidence is overwhelming that the vast majority of people who attempt day trading will ultimately lose money.

Discover:

3. What percent of day traders lose money?

So, what percentage of day traders lose money? While the focus is often on the winners, this inverse statistic is far more telling. The percentage of day traders who lose money is overwhelmingly high. Research consistently shows that the vast majority of participants do not succeed.

According to multiple landmark studies and reports, the percentage of day traders who lose money is exceptionally high.

- A landmark 2019 study titled “Day Trading for a Living?” by Fernando Chague, Rodrigo De-Losso, and Bruno Giovannetti analyzed traders in the Brazilian equity futures market. Their definitive research found that 97% of all individuals who persisted for more than 300 days lost money.

- Further reinforcing these findings, extensive research on the Taiwan Stock Exchange by academics Brad M. Barber and Terrance Odean concluded that less than 1% of day traders are able to predictably and reliably earn profits after fees are considered.

- In the United States, a widely cited statistic attributed to the Financial Industry Regulatory Authority (FINRA) indicates that around 72% of day traders end the year with financial losses.

- This is consistent with earlier findings, such as a 1999 report from the North American Securities Administrators Association (NASAA), which, in an analysis of accounts at one day trading firm, found that 70% of customers lost money.

The challenges faced by day traders become even clearer when attrition (quit rates) and profitability are examined side-by-side over time. The following table compiles figures frequently cited in financial literature, drawing from influential academic research by professors like Brad M. Barber and Terrance Odean, as well as analyses of brokerage data from various studies.

| Timeframe | Percentage of traders who quit (Attrition Rate) | Percentage of traders who are profitable |

|---|---|---|

| Within 1 month | Approximately 40% | Data not specified for this timeframe |

| Over 6 months | Data not specified for this timeframe | Approximately 13% |

| Within 1 year | More than 85% fail or quit | Less than 15% |

| Within 2 years | Approximately 80% | Data not specified for this timeframe |

| Within 3 years | Approximately 87% | Data not specified for this timeframe |

| Over 5 years | Approximately 93% | Approximately 1% |

4. How much do day traders make a day

For the small percentage of day traders who are consistently successful, income is neither standard nor predictable. Their earnings can vary dramatically from day to day, making consistent returns the exception rather than the rule.

Because of this volatility, answering what percentage day traders make a day with a single number is impossible. Instead of a fixed dollar amount, many professional traders aim for a certain percentage return on their capital. For example, 0.5% to 1% per day, but even this is a goal, not a guarantee. Some days will be profitable, while others will result in a loss.

When you see figures for annual income, it’s vital to view them with caution, especially when considering how much the average person makes from day trading. Some data suggests an “average” annual income for a U.S. day trader falls between $96,000 and $116,000. However, these numbers can be highly misleading for a few critical reasons:

- They often fail to distinguish between independent retail traders and salaried professionals working at financial firms.

- The “average” is heavily skewed upwards by the enormous earnings of a very small number of elite traders.

- Most importantly, these averages completely ignore the vast majority of traders who struggle to break even or end up losing money.

The reality for most is that the daily income is negative. For the successful few, it is a fluctuating figure, not a steady paycheck.

5. Why do most day traders lose money?

The high failure rate in day trading isn’t due to bad luck; it stems from a combination of predictable and preventable factors. Understanding these pitfalls is the first step toward avoiding them.

5.1. Overtrading and indiscipline

A common pitfall is the psychological compulsion to always be in a trade. This leads to overtrading, executing a high volume of trades without a statistical edge, which erodes capital through commissions and small losses.

Studies show that commissions averaging around $30 per round-trip trade (Jordan & Diltz, 2003) can quickly eat into small gains. Learning how to be more disciplined in your trading is often the first step to breaking this cycle.

5.2. Inadequate risk management

The failure to implement and adhere to strict risk management protocols is a leading cause of account depletion. The bedrock of sustainable trading is capital preservation, which many novices neglect in the pursuit of quick profits. Leverage makes this worse: while it magnifies potential gains, it also accelerates losses and can wipe out accounts rapidly during volatile swings.

5.3. Absence of a vetted trading strategy

Entering the market without a clearly defined, backtested strategy is akin to navigating without a map. Many losing traders operate on emotion or intuition rather than a system with proven positive expectancy.

Barber et al. (2014) found that less than 1% of day traders consistently earned positive returns after transaction costs. This shows that even strategies appearing profitable in theory often fail in practice once fees and slippage are included.

5.4. Emotional control issues

The psychological pressures of trading are immense. Fear of missing out (FOMO), greed, and the inability to accept a loss can lead to impulsive and irrational decisions. This often manifests as chasing losses or abandoning a sound strategy after only a few setbacks.

Slippage, the difference between expected and actual trade execution, adds further frustration, with research (Loras, 2024) showing that realistic slippage modeling can turn a seemingly profitable system into an unprofitable one, reinforcing poor emotional reactions.

6. What separates the successful few

While the statistics are daunting, profitability is not impossible. Those who succeed consistently despite the statistics are daunting, but profitability is not impossible. Those who succeed consistently cultivate specific habits and mindsets that set them apart from the crowd.

- Discipline and adherence to a trading plan: Successful traders treat trading like a business. They develop a detailed trading strategy and stick to it religiously, avoiding emotional decisions. Many also keep records through a trading journal, and beginners often search for what a trading journal is to understand how this tool supports consistent improvement.

- Focus on risk management: The top traders are masters of defense. They are obsessed with managing risk, often utilizing a favorable risk/reward ratio on every trade and always using stop-loss orders to define their maximum loss. Before trading with real money, many practice these skills using a safe environment, often introduced in guides such as a demo trading account explained.

- Operating with a Statistical Edge: Profitable traders do not rely on intuition or guesswork. Their actions are dictated by a trading system that has been rigorously backtested to confirm a positive expectancy. This expectancy represents a statistical probability of profitability over a large number of trades.

- A long-term mindset and continuous learning: They view trading as a skill to be mastered over time, not a get-rich-quick scheme. They are constantly learning, adapting their strategies to changing market inefficiencies, and analyzing their trading performance to identify areas for improvement.

Read more:

7. Can you increase your odds of success?

Yes, while you cannot eliminate risk, you can significantly improve your chances of joining the successful minority through dedicated and intelligent preparation. If not armed with a plan, you are almost certain to join the losing group. This is true whether you are trading independently or aiming to understand Prop Firm Rules.

- Start with a demo account: Before risking real money, test your strategies in a simulated environment. This allows you to gain experience with market dynamics and refine your approach without financial consequences, which is an important step if you want to learn how to pass a prop firm challenge.

- Keep a detailed trading journal: Record every trade, including your reasons for entry and exit, the outcome, and your emotional state. This practice helps you identify patterns in your behavior, learn from mistakes, and hold yourself accountable.

- Find a mentor or community: Learning from experienced traders can shorten your learning curve. A mentor can provide guidance, while a community of like-minded traders offers support and a space to share ideas.

- Manage your expectations: Understand that day trading is not a path to instant wealth. It requires patience, persistence, and a realistic view of potential returns and the time it takes to become consistently profitable.

Day trading is an incredibly demanding path that requires significant time, capital, and emotional control. Unless you are fully committed to rigorous education, disciplined practice, and strict risk management, long-term investing is a far more suitable strategy. For the dedicated few, it can be a path to financial independence, but it is an exceptionally difficult one.

8. FAQs

A significant majority of day traders quit within the first year, driven by the high rate of financial loss. According to a landmark academic study analyzing traders on the Taiwan Stock Exchange, the attrition rate is incredibly rapid: nearly 40% of all day traders quit within just one month. While the most cited statistic from this research is that 80% quit within two years, the initial drop-off highlights the reality that most new entrants are unable to withstand the immediate challenges and capital depletion, forcing them out of the market long before the first year is even complete.

The average income for day traders is difficult to pinpoint and varies widely. Some data sources suggest an average annual income for day traders between $96,000 and $116,000. However, these figures are misleading because they often include salaried institutional professionals and do not reflect the reality for most retail traders.

Generally, yes. Professional traders, especially those at proprietary firms, often have access to better technology, more capital, and a structured, collaborative environment. They typically earn a base salary plus a percentage of the profits they generate, while retail traders use their own capital and bear all the risks and costs themselves.

For a very small minority, yes. The direct answer to what percent of day traders are successful long-term is exceptionally low. Long-term profitability is possible but rare, with studies suggesting only 1% of traders can predictably profit after fees. It requires mastering trading psychology, maintaining strict discipline, and constantly adapting to changing market conditions.

In the U.S., a trader who executes four or more day trades within five business days is labeled a “pattern day trader.” This designation requires them to maintain a minimum account balance of $25,000. While you can start with less in other markets or with a cash account, having insufficient capital makes proper risk management and position sizing extremely difficult.

The “90% lose” figure is a widely cited rule of thumb that reflects the high failure rate. This is primarily due to a lack of education, poor risk management, emotional decision-making, and the absence of a tested trading plan. Many treat it like gambling rather than a serious business.

The 1% rule is a crucial risk management guideline stating that a trader should never risk more than 1% of their total trading capital on a single trade. For example, with a $30,000 account, you would not risk losing more than $300 on any one position. This rule is designed to preserve capital and ensure that a string of losses does not wipe out your account.

The average is heavily skewed by the few who are highly successful. The median experience is closer to breaking even or losing money. While some salary aggregators report figures over $100,000, it’s critical to understand that this is not typical for the vast majority of retail traders starting out.

Research shows that very few day traders make consistent profits. A study by Barber et al. (Journal of Financial Markets, 2003) found only about 20% were more than marginally profitable, and Investopedia (2024) notes just 3%–20% succeed consistently. Longer data from Unbiased (2024) shows only 13% are profitable after six months, dropping to under 1% over five years.

Estimates vary widely: Traders. MBA (2024) suggests some aim for 1% – 2% daily returns, or $250 – $500 on a $25,000 account, but CapTrader (2023) reports realistic averages closer to 0.033% – 0.13% per day, only $8 – $32 daily, highlighting how rare high, consistent returns are.

Most swing traders lose money, with VectorVest (2023) reporting up to 90% fail yearly, meaning only about 10% are profitable. The Robust Trader (2024) gives a similar figure, showing that less than 10% of active traders succeed, even though some report win rates of 40% – 60% on individual trades.

9. Conclusion

In the end, the question of what percent of day traders make money comes to a sobering conclusion: the proportion of individuals who achieve consistent success is exceptionally small. This low success rate is a reflection of an arduous path. The allure of quick profits often obscures the demanding realities of the profession, such as a steep learning curve and intense psychological pressure.

However, these statistics represent an outcome, not an inescapable fate. Profitability is achievable for the disciplined minority who treat day trading as a serious business, built on rigorous education and robust risk management.

For those committed to moving beyond the statistics and developing a professional edge, the Prop Firm & Trading Strategies section of H2T Funding offers resources designed to equip serious traders with the necessary frameworks to navigate the markets.