If you’re preparing for a prop firm challenge with Topstep, Take Profit Trader, or similar companies, you’ve likely come across the Consistency Rule. At its core, consistency in trading means keeping your strategy stable and ensuring profits are spread out across multiple days, not just relying on one lucky trade.

Consistency in trading often decides whether you succeed in learning how to get a funded trading account or face rejection, even if you’ve already hit the profit target. It’s one of the main reasons traders fail challenges despite showing overall profitability.

In this guide, I’ll break down the consistency rule. But more importantly, I’m going to share the painful (and expensive) lessons from my own journey. My goal is to save you the frustration I went through, so you can walk into your next evaluation feeling prepared, not just hopeful.

Key Takeaways

- Consistency rule is a prop firm requirement that ensures traders generate profits in a balanced way, spreading gains across multiple days instead of relying on one or two big wins.

- The purpose of the consistency rule is to enforce risk control, steady growth, disciplined execution, sustainable profits, and stronger trader confidence.

- Traders often fail the prop firm challenge by taking oversized trades, inconsistent position sizes, or ignoring firm-specific consistency guidelines.

- Passing evaluations requires steady lot sizing, balanced daily targets, and tracking profit distribution across sessions.

1. What is consistency rule in trading?

The consistency rule in trading is a requirement set by many prop firms to make sure traders generate profits in a balanced and steady way. Instead of making most of the gains in one or two days, traders are expected to spread their performance across the evaluation period.

You can explore more about this concept in our detailed guide on how funded trading accounts work.

In simple terms, consistency means your trading results should reflect a repeatable strategy rather than one lucky trade. For example, if you hit a $10,000 profit target, but $9,000 came from a single day, most firms would flag that as inconsistent.

On the other hand, making $500–$1,000 steadily over several days is seen as proof of discipline. To measure this, many firms apply a Consistency Rule Calculator, which checks the ratio between your best trading day and your overall profit. A common formula is:

(Best Day’s Profit ÷ Total Profit) × 100 ≤ 30%

That means no single day’s gain should account for more than 30% of your total profit. If you earn $10,000 overall, your biggest single-day win should ideally stay under $3,000 to pass the rule. This calculator ensures traders rely on sustainable strategies instead of high-risk bets.

1.1. What is a 20% consistency rule?

The 20% consistency rule means no single trading day should account for more than 20% of your total profit.

For example, if you make $10,000 in an evaluation, no day’s gain should exceed $2,000. This ensures you don’t rely on one “all-in” trade.

1.2. What is the 45% consistency rule?

The 45% consistency rule is one of the most lenient forms. Here, nearly half of your total profit can come from a single day.

For example, if your profit target is $10,000, you’re allowed to make up to $4,500 in one day. This rule is often used by firms that value flexibility but still want some form of balance.

1.3. What is the 30% consistency rule?

Some prop firms apply a 30% consistency rule, which is slightly more flexible. Here, you can earn up to 30% of your profits in one day. So if your total profit is $12,000, the maximum allowed for a single day would be $3,600. It gives traders more breathing room but still rewards steady growth.

1.4. What does the 40% consistency rule mean?

With the 40% consistency rule, no day can exceed 40% of your total profits. For instance, if you close $8,000 in profit overall, the highest you can make in one session is $3,200. While this version is looser, it still prevents traders from hitting almost everything in one trade.

2. Why do prop firms apply this rule?

Prop firms introduce the consistency rule to filter out traders who rely on luck rather than skill. A trader who makes 90% of their profits in a single day could just as easily lose it the next day. By spreading profits evenly, firms can identify who truly has a stable and repeatable strategy.

This rule is not a technical indicator; it’s a behavioral assessment tool. Prop firms use it to evaluate how disciplined you are in position sizing, risk management, and execution under different conditions. Keeping a detailed trading journal is one of the best ways to track these habits and prove your consistency over time.

From the firm’s perspective, funding a trader is an investment. They want to partner with people who can deliver consistent results over months, not just one winning streak. That’s why understanding and adapting to this rule is key if you want to secure long-term funding.

3. Purpose and benefits of the consistency rule

The consistency rule in trading exists to ensure that traders don’t rely on one-off luck but demonstrate sustainable and repeatable performance. For prop firms, funding traders is an investment; they need proof that you can manage risk responsibly and generate steady growth across different market conditions.

Here’s a closer look at the real benefits of what is the consistency rule in trading:

- Risk management: Prevents oversized trades and reduces the chance of sudden drawdowns.

- Steady growth: Encourages gradual profit accumulation rather than one-off wins.

- Disciplined trading: Reinforces consistent position sizing and execution.

- Sustainable profits: Builds a smoother equity curve that can last long term.

- Confidence building: Helps traders trust their strategy instead of chasing luck.

- Account protection: Reduces impulsive overtrading and safeguards funded capital.

The consistency rule is more than a hurdle; it’s a framework that builds discipline, confidence, and sustainable profits. By treating it as a guide instead of an obstacle, traders can improve their chances of success in both prop firm challenges and real-world trading.

Practical tools like backtesting a trading strategy and practicing on a demo trading account are excellent ways to prepare for applying the rule effectively.

4. What type of consistency rule is the best?

Different prop firms use different versions of the consistency rule; some are stricter, others more flexible. The best type really depends on your trading style and how naturally your profits are spread.

- 20–30% rules: Best for traders who aim for steady daily gains, such as day traders or swing traders who scale in and out of positions.

- 40–45% rules → More suitable for scalpers or traders who rely on fewer setups but expect higher returns per trade.

- Moderate rules (around 30%) -> Often balance both sides, providing discipline without being overly restrictive.

From my perspective, the best consistency rule is the one that aligns with your strategy without forcing you to trade unnaturally. If the rule matches how you already manage risk, compliance feels effortless, and your performance appears smooth to the prop firm.

Ultimately, the ideal consistency rule isn’t about which number is lowest or highest, but about how well it fits your approach. Traders who align their strategies with the 4 trading sessions often find it easier to maintain steady performance, since they can take advantage of liquidity and volatility at the right times.

5. How the consistency rule works

Prop firms enforce the consistency rule by analyzing how your profits are distributed across multiple trading days. The goal is not just to see if you hit the profit target, but to evaluate whether your growth is stable and repeatable over time.

Imagine a trader with a $10,000 target. If 90% of that profit ($9,000) comes from a single day and the remaining $1,000 is scattered across nine days, the account would likely be flagged as inconsistent. Even though the target is met, the equity curve shows dependence on one high-risk trade rather than a systematic strategy.

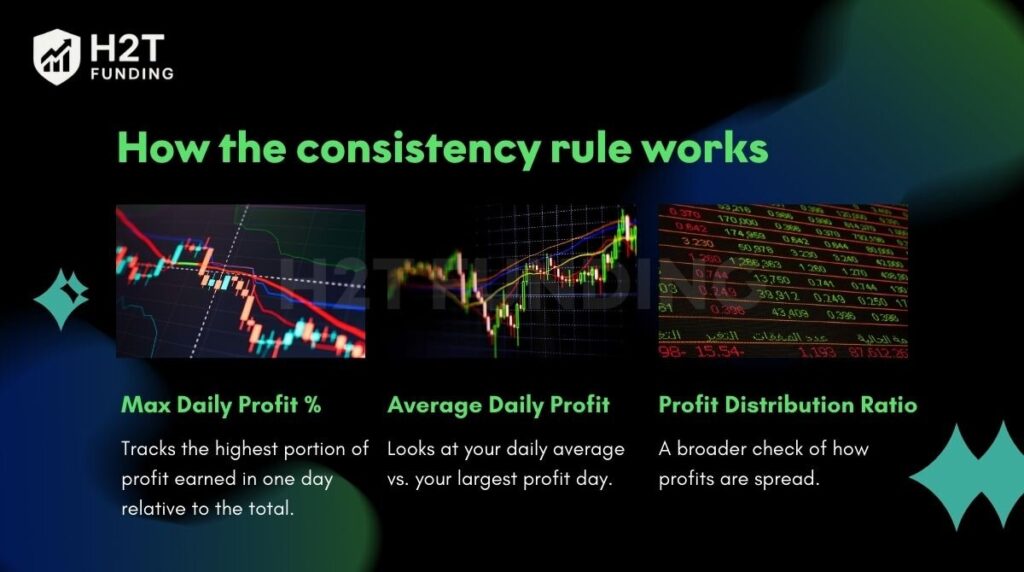

To measure this, firms typically use three main metrics:

1. Max Daily Profit %: Tracks the highest portion of profit earned in one day relative to the total.

Example: Under a 30% rule, if your total profit is $12,000, no day can exceed $3,600. Anything above suggests reliance on one-off trades.

2. Average Daily Profit: Looks at your daily average vs. your largest profit day.

Example: If your average is $800, but one day shows $5,000, the gap indicates inconsistency. Balanced traders usually keep their best day within 2–3x of their daily average.

3. Profit Distribution Ratio: A broader check of how profits are spread.

Example: Earning roughly 10–15% of total profit across most trading days signals consistency, while having 70–80% clustered in one or two days signals risk.

Prop firms often review the equity curve as well. A smooth, upward-sloping balance graph shows discipline, while a jagged curve with big spikes and sharp drops indicates high-risk behavior.

In essence, the consistency rule works by ensuring your profit growth is balanced across time. The more evenly distributed your daily results are, the more confident a prop firm will be in your ability to manage risk and deliver sustainable performance, qualities they value before allocating real capital.

6. Illustrative example of Consistency Rule

When I first faced the consistency rule in trading, I underestimated its importance. At Topstep, the rule, the Consistency Target was clear: It requires that a trader’s best-performing day must not exceed 50% of their total profits. To me, hitting the profit target was all that mattered until I learned the hard way.

Case 1 – My own failure at Topstep

My first direct encounter with the consistency rule was a classic case of misplaced confidence. During a Topstep evaluation, I identified what I considered a high-probability setup and decided to increase my position size significantly to maximize the opportunity.

The trade worked out, generating a huge gain that made up nearly 70% of the profit target in just one session. At the time, I saw this as proof of skill and spent the rest of the challenge trading lightly, focused only on protecting the profit, convinced I had already secured a pass.

However, the evaluation result was a failure, citing an “inconsistent profit distribution.” The lesson was immediate and clear: a single, large win, however skillful it may seem, is viewed by prop firms as an indicator of high-risk behavior, not a sustainable strategy.

May you want to know: Consistency rule on Topstep Express Account explained

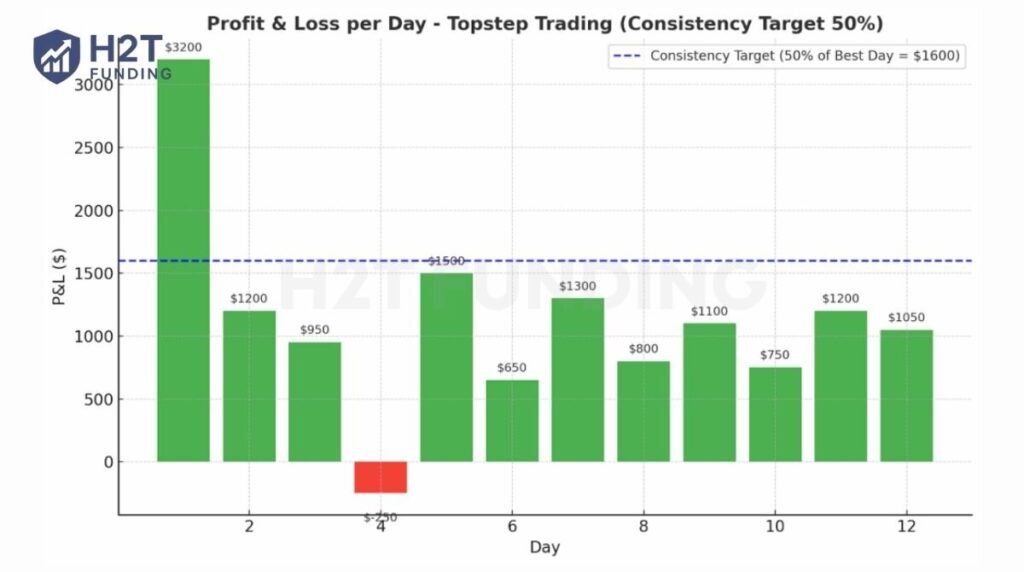

Case 2 – My friend’s steady success

By contrast, my trading friend Evelyn took a much steadier path. She kept her daily gains balanced so that no single day went above 30% of her total profits, staying comfortably within Topstep’s 50% Consistency Target.

Over 12 days, she averaged $650–$1,500 per session, showing steady discipline. Her equity curve rose gradually without sharp spikes, and she passed her Topstep evaluation successfully.

Her P&L looked something like the table below. Notice she had strong days and weaker days; she even had a small losing day in there, which is realistic, but her biggest win was only around 22% of her total profit. Her gradual equity curve was proof of a solid system, which is what prop firms are actually looking for.

| Day | P&L |

|---|---|

| 1 | $3,200 (best day) |

| 2 | $1,200 |

| 3 | $950 |

| 4 | $ – 250 |

| 5 | $1,500 |

| 6 | $650 |

| 7 | $1,300 |

| 8 | $800 |

| 9 | $1,100 |

| 10 | $750 |

| 11 | $1,200 |

| 12 | $1,050 |

| Total | $13,950 |

Looking at this distribution, Evelyn’s best day was only 23% of her total profit, far below the 50% rule. This highlights how consistent results, not one-off big wins, are what prop firms look for. Tools like a free trading simulator can help you practice this approach and train for steadier equity curves.

These two cases show how the consistency rule in trading is more than a technicality. It’s a measure of discipline, risk control, and long-term sustainability. If your profit distribution mirrors the steady equity curve in the chart, you’ll not only pass evaluations but also trade with greater confidence and stability.

Continue reading:

7. Common mistakes that traders make

Many traders fail not because they can’t reach the profit target, but because they break the consistency rule without realizing it. Here are the most common pitfalls I’ve seen (and experienced myself):

- All-in trades: Risking a huge portion of capital in one day, creating profit spikes far beyond the allowed 20–25%.

- Last-minute gambling: Taking oversized trades near the end of the challenge to “catch up,” which often causes rule violations.

- Uneven position sizing: Trading 10 lots one day and 0.5 lots the next shows inconsistency in risk management.

- Ignoring firm-specific rules: Every prop firm defines consistency differently (50% at Topstep, 30–40% at others). Not reading the rules carefully is a costly mistake.

- Overtrading on volatile days: Traders may push harder on trending days, generating most profits at once and breaking distribution requirements.

Most consistency rule violations aren’t due to bad strategies; they happen because traders ignore risk control and firm guidelines. Avoiding these mistakes is often the key difference between failing and securing a funded account.

8. How to comply with and overcome the consistency rule

Passing a prop firm evaluation isn’t just about reaching the profit target; it’s about proving that your trading results are stable over time. To stay within the consistency rule, traders need both discipline and planning.

Here’s what worked for me after failing twice:

- Keep position sizes steady: Maintain similar lot sizes and risk percentages each day to avoid uneven results.

- Avoid oversized bets: Don’t let a single day account for more than 20–25% of your total profit, as this will flag inconsistency.

- Follow a clear daily plan: Trade with predefined setups and targets instead of chasing random opportunities.

- Track daily metrics: Use your prop firm’s dashboard to monitor profit distribution, average daily profit, and risk exposure in real time.

- Spread profits intentionally: Aim for moderate wins across multiple days (e.g., $500–$1,000 daily) instead of pushing for huge spikes.

By applying these methods, I finally passed Topstep on my third attempt. More importantly, the habits carried over: when I tried FundedNext later, I found it much easier to meet their 50% consistency requirement because I was already trading in a stable, disciplined way.

Remember: Keeping your trades balanced and tracking your progress closely, you can meet both the profit target and the consistency rule, giving yourself the best chance to secure funding.

See more:

9. Is the Consistency Rule Really Important?

The consistency rule in trading plays a critical role in how prop firms evaluate traders. While profit targets show your potential, consistent trading reveals whether those results are the product of a structured approach or just a lucky streak.

The consistency rule is not always applied in the same way across firms. At one stage, FTMO enforced the 25% rule very strictly, rejecting many traders who concentrated profits in just a few days. In recent updates, however, they have relaxed this requirement to make challenges more accessible.

By contrast, other firms such as Topstep or Take Profit Trader still maintain strict consistency limits, using them as a way to judge the true quality and repeatability of a trader’s strategy.

So, what happens if I do not maintain the consistency rule limits? Failing to respect these limits usually leads to rejection, even if the profit target has been achieved. Prop firms apply this filter to ensure that traders can deliver sustainable performance once real capital is on the line.

For traders, the consistency rule is not just about meeting firm requirements; it directly shapes the way you approach the markets and develop your skills:

- Discipline and strategy development: The rule forces traders to avoid gambling behavior and focus on building a repeatable edge rather than chasing one lucky trade.

- Risk management: By encouraging consistent performance, it helps traders spread risk more evenly and avoid overexposure in single trades or market events.

- Long-term performance: Traders who adapt to the consistency requirement often build stronger habits that improve their resilience and profitability over time.

The consistency rule is not just a technical requirement but a reflection of professional trading habits. Even when firms apply it differently, the underlying value remains the same: consistency separates short-term luck from genuine skill and prepares traders to manage capital responsibly.

10. Comparison between prop firms on consistency rule

Prop firms enforce the consistency rule differently. Some only apply it during evaluations, while others extend it into funded accounts. Knowing these differences helps traders choose the firm that best matches their trading style.

| Prop Firm | Consistency Rule | When Applied | Difficulty |

|---|---|---|---|

| Topstep | The best day must not exceed 50% of total profits. If exceeded, you must continue trading until the ratio is balanced. | Challenge (Combine phase) only | Medium |

| Take Profit Trader | The best day must not exceed 50% of total profits. | Challenge only | Medium |

| Earn2Trade | The best day must not exceed 30% of total profits. | Challenge only (LiveSim/Live exempt) | Hard |

| TradeDay | The best day must not exceed 30% of total profits. | Challenge only | Hard |

| OneUp Trader | Three other days combined must equal ≥ 80% of your best day’s profit. | Evaluation only (funded status unclear) | Hard |

| UProfit | The best day must not exceed 30% of total profits. Applied in Phases 1 & 2, removed in Phase 3 (funded). | Challenge and simulated funded stage | Hard |

| Elite Trader Funding | Previously required best day ≤ 40% of profits for payouts (rule unclear after Aug 2024). | Older funded accounts/status unclear | Medium |

The difficulty of passing consistency rules varies greatly. Traders should carefully match their trading style to the firm’s policy; scalpers may prefer looser rules, while steady day traders may adapt well to stricter ones.

To stay compliant, mastering tools like support and resistance levels and drawing a trendline in trading can help create smoother profit distributions.

11. FAQs

No. Consistency doesn’t mean you must win every trade; it means your profits are distributed evenly over time. Losses are expected, but as long as they’re controlled and your gains are steady, you’ll still be considered consistent.

The key is to adjust your position size, not your entire strategy. During volatile conditions, reduce risk per trade and keep profit targets realistic. This way, even if markets swing wildly, your results remain balanced across days.

If you exceed the limit (e.g., one day >25% of total profit), the account may be flagged. The best approach is to continue trading smaller sizes until the distribution evens out. Many firms allow this adjustment during the challenge.

It depends on the firm. Some, like Earn2Trade, apply consistency mainly in the challenge. Others, such as Apex or UProfit, extend it into funded or payout stages. Always review your firm’s rulebook before starting.

The “best” depends on your trading style. Day traders often prefer firms with strict but fair limits (like Earn2Trade’s 30% rule), while scalpers or swing traders may find looser models like Topstep’s 50% rule easier to work with.

Yes, firms don’t expect traders to hit exactly 50%. The rule simply means your best day should not exceed 50% (or 25–30%, depending on the firm) of total profits. As long as you stay under the threshold, you’re compliant.

12. Conclusion

The consistency rule in trading should not be seen as a barrier, but as a filter that distinguishes disciplined traders from those relying on chance. It ensures you trade with a repeatable system, balanced risk, and long-term sustainability, qualities that prop firms value most.

By fully understanding what is consistency rule in trading is, you can approach evaluations with confidence, avoid common mistakes, and build habits that carry over into real funded trading. Consistency doesn’t limit your potential; it amplifies it by proving your edge works over time.

If you are preparing for a prop firm challenge, make sure your strategy delivers more than profits; it must also deliver stability, day after day. That’s how you pass evaluations and grow as a professional trader.

Explore the Prop Firm & Trading Strategies category at H2T Funding for detailed guides and case studies. And if this article gave you clarity, share it with fellow traders or leave a comment about your own experience with consistency rules.