The Funded Trader vs E8 Funding review presents a choice between a highly structured, diverse evaluation firm and a modern, tech-centric proprietary trading platform. The Funded Trader excels with various challenge types like Knight and Royal, while E8 Funding (now E8 Markets) focuses on speed, automation, and user-friendly dashboards.

H2T Funding analyzes these differences to help you find the perfect fit. Read now!

Key takeaways:

- The Funded Trader (TFT): Offers a wide range of evaluation process models, including the Knight, Royal, and Dragon Challenges. They provide flexible rules such as balance-based drawdown and options for up to 95% profit split scaling.

- E8 Funding (E8 Markets): Known for its E8 One and E8 Signature accounts. They emphasise speed with a first payout possible in as little as 3 days and feature a highly automated, custom-built dashboard.

- Both firms provide access to Forex, indices, metals, and crypto, ensuring traders can diversify their portfolios regardless of the firm they choose.

- Choose TFT if you prefer structured challenges with high capital scaling potential (up to $2.5M). Choose E8 if you value fast execution, superior charting tools, and a streamlined evaluation path.

- Traders seeking a community-driven environment often lean towards TFT, while those prioritising technology and rapid scalability prefer E8.

1. Overview of each firm: The Funded Trader vs E8 Funding

This comparison isn’t just about specs; it’s about finding a home for your trading strategy. The Funded Trader vs E8 Funding comparison essentially boils down to a choice between a structured, community-heavy ecosystem and a sleek, tech-first execution machine.

Honestly, I see TFT as the Swiss Army Knife with options for everyone, while E8 is like a sports car, fast, modern, and efficient.

Here is a quick snapshot of how these two industry giants stack up against each other.

| Criteria | The Funded Trader (TFT) | E8 Markets (formerly E8 Funding) |

|---|---|---|

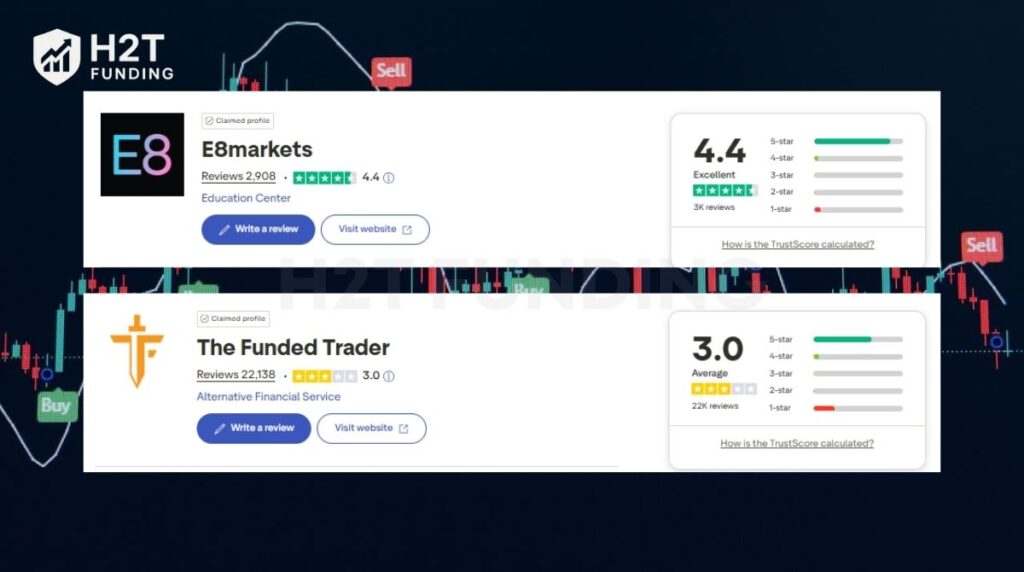

| Trustpilot Score | 3.0/5 (Average – Recent delays reported) | 4.4/5 (Excellent – Highly consistent) |

| Founded / Reputation | 2021 / Large community but mixed trust | 2021 / Strong tech & payout reputation |

| Evaluation Process | 1-Step, 2-Step, 3-Step (Dragon) | 1-Step, 2-Step, 3-Step |

| Key Models | Knight, Royal, Dragon, Standard | E8 One, E8 Signature |

| Account Sizes | Up to $600k (simulated) | Up to $500k (simulated) |

| Asset Classes | Forex, indices, metals, crypto | Forex, indices, crypto, commodities (metals, energies), futures |

| Trading Platforms | cTrader, Match-Trader, Platform 5 (Non-US only) | Match-Trader, cTrader, TradeLocker, MetaTrader 5 |

| Profit Split | Up to 95% (VIP) | 80% default, scale to 100% |

| Payouts | Weekly / Bi-weekly | Fast (First payout in 8 days) |

| Trading Style | Flexible (News/Weekend allowed on specific accounts) | Flexible (News allowed, Automated) |

Disclaimer: Rules, pricing, and trading conditions may change over time. Traders should always verify the latest terms directly on the official The Funded Trader and E8 Funding websites before purchasing any challenge.

At a glance, both firms look impressive, don’t they? But strictly speaking, the user experience is where they really drift apart. I believe you need to look past the spreadsheet to see which one actually supports your growth. Let’s dive deeper into the specifics, starting with the community giant.

The Funded Trader

#1

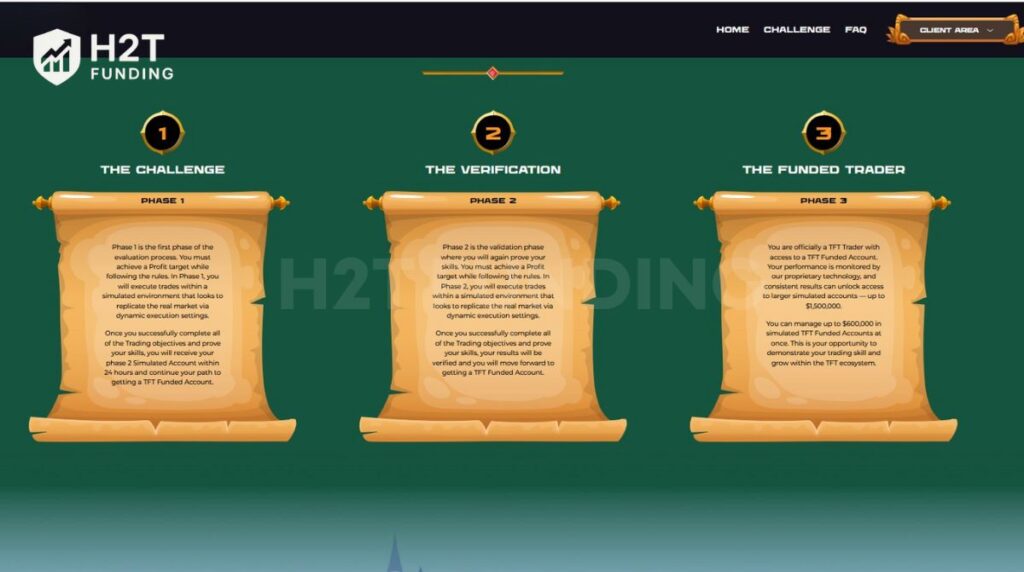

Account Types

1-step, 2-step, and 3-step

Trading Platforms

MT5, cTrader, Match Trader

Profit Target

5% – 10%

Our take on The Funded Trader

If you ask me, The Funded Trader feels like a Kingdom built for serious grinders. They offer a massive variety of evaluation models, which is perfect if your trading style requires specific conditions.

For example, if you need to hold trades over the weekend or use EAs freely, the Royal Challenge is a lifesaver. Their community support is huge, and they really focus on rewarding consistent traders with high capital scaling.

| 💳 Challenge Fee | $42 – $1,100 |

| 👥 Account Types | 1-step, 2-step, and 3-step |

| 💰 Profit Split | 80% – 99% |

| 💵 Account Size | $5K – $200K |

| ⏱️ Time Limit | No time limit |

| 🎯 Profit Target | 5% – 10% |

| 📊 Trading Platforms | MT5, cTrader, Match Trader |

| 🛍️ Asset Types | Forex, Commodities, Indices, Crypto |

E8 Funding

#2

Account Types

1-step

Trading Platforms

MT5, cTrader, Match Trader, TradeLocker

Profit Target

6%

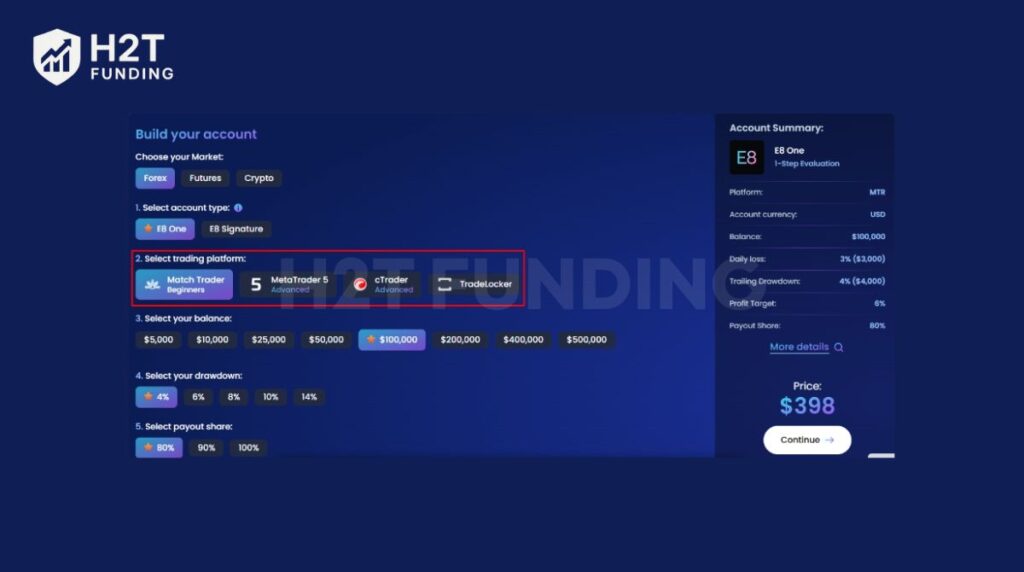

Our take on E8 Funding

Now known as E8 Markets, this firm is what I’d call user-experience heaven. The first thing you notice is their custom dashboard; it’s incredibly clean and intuitive. From my perspective, E8 is ideal for traders who want simplicity and speed.

There are no minimum trading days on most programs, meaning if you are good enough, you can get funded fast. It’s less about navigating complex rules and more about pure execution.

| 💳 Challenge Fee | $40 – $4,460 |

| 👥 Account Types | 1-step |

| 💰 Profit Split | 80% – 100% |

| 💵 Account Size | $5K – $500K |

| ⏱️ Time Limit | No time limit |

| 🎯 Profit Target | 6% |

| 📊 Trading Platforms | MT5, cTrader, Match Trader, TradeLocker |

| 🛍️ Asset Types | Forex, Commodities, Indices, Crypto, Energy, and Futures |

Read more:

2. Core models & key rules of The Funded Trader and E8 Funding

When you look at The Funded Trader and E8 Funding, the real difference lies in the rulebook. I’ve seen many traders fail not because they couldn’t trade, but because they picked a model that fought against their natural habits. Let’s break down the rules, as understanding them is the first step in learning how to get a funded trading account without getting trapped.

2.1. Profit targets & minimum trading days

Here is the thing: speed isn’t everything, but waiting around when you have already won is annoying. The Funded Trader usually requires a few days of patience to prove you aren’t just getting lucky.

On the flip side, E8 Markets (E8 Funding) lets you pass the moment you hit the target. If you are a scalper who hits 10% in one morning, E8 lets you move on instantly.

| Feature | The Funded Trader (TFT) | E8 Markets |

|---|---|---|

| Phase 1 Target | 8% – 10% (Depends on Challenge) | 8% (Signature) / 10% (E8 One) |

| Phase 2 Target | 5% (Standard/Royal/Dragon) | 5% (Signature) |

| Min Trading Days | Usually 5 days (Royal/Knight) | 0 days (No minimum) |

| Time Limit | Unlimited | Unlimited |

Simply put, TFT asks for consistency by enforcing a minimum trading period, which works well if you have patient trading strategies. However, E8 wins on efficiency; if you hit your profit targets in a single day, you are through to the next stage immediately.

2.2 Drawdown & daily loss limits

This is where your risk management skills are truly tested. To be honest, I think the way these firms calculate drawdown can make or break your account. TFT generally sticks to static or equity-based rules depending on the challenge, while E8 offers some dynamic scaling options that can be a bit tricky if you aren’t paying attention.

| Feature | The Funded Trader (TFT) | E8 Markets |

|---|---|---|

| Max Overall Loss | 10% (Standard/Royal) – 12% (Knight) | 8% (Scalable up to 14%) |

| Daily Loss Limit | 5% (Calculated on Balance or Equity) | 3% – 6% (Customizable risks) |

| Drawdown Type | Balance / Equity-based | Static / Trailing (E8 One) |

TFT offers slightly higher buffer room with a standard 10-12% max loss, making it feel a bit safer for swing traders facing market volatility. E8 Funding starts with a tighter 8% limit. However, they allow you to scale up your drawdown allowance as you profit. Honestly, this is a fantastic feature for reducing financial risk in the long run.

2.3 News, overnight, automation policies

This section is vital because nothing hurts more than losing an account. After all, you forgot to close a trade on Friday. The Funded Trader and E8 Funding have very different vibes here. If you rely on automated trading (EAs) or holding trades while you sleep, pay close attention.

| Feature | The Funded Trader (TFT) | E8 Markets |

|---|---|---|

| News Trading | Allowed (Royal/Knight) / Restricted (Standard) | Allowed |

| Overnight Holding | Allowed | Allowed |

| Weekend Holding | Allowed (Royal/Knight) / Restricted (Standard) | Allowed |

| EA / Bot Trading | Varies (Allowed on Royal/Knight; Banned on Rapid) | Allowed (All Accounts) |

If you want total freedom, E8 Markets is arguably the better choice because they don’t really restrict news or weekend holding on their main accounts. If you rely on bots, be careful with The Funded Trader.

Automation is strictly prohibited on their Rapid Challenge, and you must purchase an “add-on” to use EAs on the Standard Challenge. However, their Royal, Knight, and Dragon models allow full automation by default. In contrast, E8 Markets allows EAs across the board without extra fees.

3. Fees, refunds & cost efficiency of The Funded Trader and E8 Funding

Let’s be real for a second, nobody likes paying fees. But in this game, you have to spend money to make money. The trick is making sure you aren’t overpaying for a challenge you might not even like. When I look at the pricing structures of The Funded Trader and E8 Funding, I see two different philosophies: one loves discounts, and the other loves simplicity.

The Funded Trader is famous for its constant stream of promotions. If you are patient and wait for a coupon code, you can snag a challenge at a bargain price. E8 Markets (E8 Funding) tends to be more consistent with their pricing, offering competitive rates upfront without making you hunt for a discount code every single time.

| Criteria | The Funded Trader (TFT) | E8 Markets |

|---|---|---|

| Fee Type | One-time evaluation fees | One-time evaluation fees |

| Refund Policy | 100% Refundable with first payout | 100% Refundable with first payout |

| Cost (100k Account) | ~$489 – $549 (varies by challenge) | ~$398 – $458 (Standard/E8 One) |

| Discounts | Frequent high % coupons | Occasionally, less aggressive |

| Hidden Costs | None (Spreads are raw) | None (Commission-free options) |

If you are tight on budget and love a good deal, TFT is probably your winner because their coupons can knock huge chunks off the price.

However, E8 often feels more cost-efficient in terms of value because its lower raw spreads might save you money on execution costs in the long run. Plus, both refund your fee when you succeed, so the risk is technically the same if you are a winning trader.

4. Profit split & scaling programs of The Funded Trader and E8 Funding

Passing the challenge is just the warm-up; the real goal is keeping the money flowing. This is where profit split and scaling come into play. You don’t want to be stuck with a small account forever, right?

The Funded Trader has a massive edge here for long-term players. Their VIP program allows you to keep up to 95% of your profits, which is almost unheard of.

E8 Funding sticks to a solid 80% split, which is industry standard, but they win on how fast you can get your money. Managing your cash flow is easier with E8 because you can request your first payout in as little as 8 days.

| Criteria | The Funded Trader (TFT) | E8 Markets |

|---|---|---|

| Profit Split | 80% standard, scales to 95% | 80% standard, scales to 100% (Drawdown) |

| Scaling Programs | Kings Program (Add 25% capital) | Balance scaling with drawdown benefits |

| First Payout | ~21 days (Standard) or 7 days (Knight) | 8 days (Fast processing) |

| Processing Time | 1-2 days | Fast (often same-day approval) |

| Withdrawal Methods | Crypto (USDT, BTC), Deel | Crypto (USDT, USDC), Bank Wire |

| Minimum Payout | usually >$10 | Flexible |

If your main priority is maximising every single dollar you earn, TFT’s scaling plan and 95% split are unbeatable. But if you need liquidity fast, maybe to pay bills or fund another account, E8 Markets is superior. Getting paid in 8 days changes the game for your personal cash flow. Both firms offer reliable withdrawal methods via crypto, ensuring you get your funds without hassle.

5. Payout rules comparison: The Funded Trader vs E8 Funding

Getting funded is one thing, but actually withdrawing your profits is what matters most. When comparing The Funded Trader vs E8 Funding payout policies, you will see a clash between flexible “on-demand” options and traditional structured cycles. However, you must remember that rules on paper don’t always match the current reality, especially with the recent delays reported by TFT users.

| Feature | The Funded Trader (TFT) | E8 Markets |

|---|---|---|

| First Payout Eligibility | 7 Days (Knight Challenge) / ~21 Days (Standard) | 8 Days (Standard) / As little as 3 days (PRO) |

| Subsequent Payouts | Bi-weekly (14 Days) | On-Demand (Anytime eligible) |

| Profit Split | 80% up to 95% (VIP) | 80% up to 100% (Scaling) |

| Processing Time | Currently experiencing delays (Weeks) | Fast (Typically 24-48 hours) |

| Methods | Crypto (USDT, BTC), Deel | Crypto (USDT, USDC), Rise, Bank Wire |

| Minimum Payout | Generally >$10 | Flexible |

If cash flow is your priority, E8 Markets is the clear winner here. Their “on-demand” system allows you to access your funds much faster without waiting for a fixed payday. While The Funded Trader has decent terms on their Knight Challenge, the current backlog of payments and operational issues makes them a risky choice if you need money in your bank account quickly.

6. Platforms & tradable assets of The Funded Trader and E8 Funding

Let’s be honest, your platform is your workspace. If it lags, you lose. Comparing The Funded Trader and E8 Funding in this regard reveals a shift in the industry away from legacy software toward modern solutions. I think this transition actually benefits us, traders, by providing better tools.

The Funded Trader has adapted well, offering reliable options like cTrader and Match-Trader. On the other hand, E8 Markets feels like it was built by tech geeks (in a good way). Their integration of TradeLocker with TradingView charting tools is a dream for technical analysts.

| Criteria | The Funded Trader (TFT) | E8 Markets |

|---|---|---|

| Trading Platforms | cTrader, Match-Trader, Platform 5 (Non-US only) | Match-Trader, cTrader, TradeLocker, MetaTrader 5 |

| Asset Classes | Forex, indices, metals, crypto | Forex, indices, crypto, commodities (metals, energies), futures |

| Execution Speed | Reliable / Standard | Low Latency / Ultra-Fast |

| Dashboard | Functional, Kingdom Themed | Custom-built, Sleek, & Intuitive |

| Crypto Trading | Available (Varies by platform) | Available (Weekend trading supported) |

If your priorities lean toward a modern, glitch-free trading experience, E8 takes the crown here. Their dashboard is arguably the best in the business, clean, fast, and informative.

However, TFT provides a solid variety of trading instruments, ensuring you can execute your strategy across all major markets without issues. Ultimately, both give you the tools to hit your goals, but E8 feels slightly sharper for the modern-day trader.

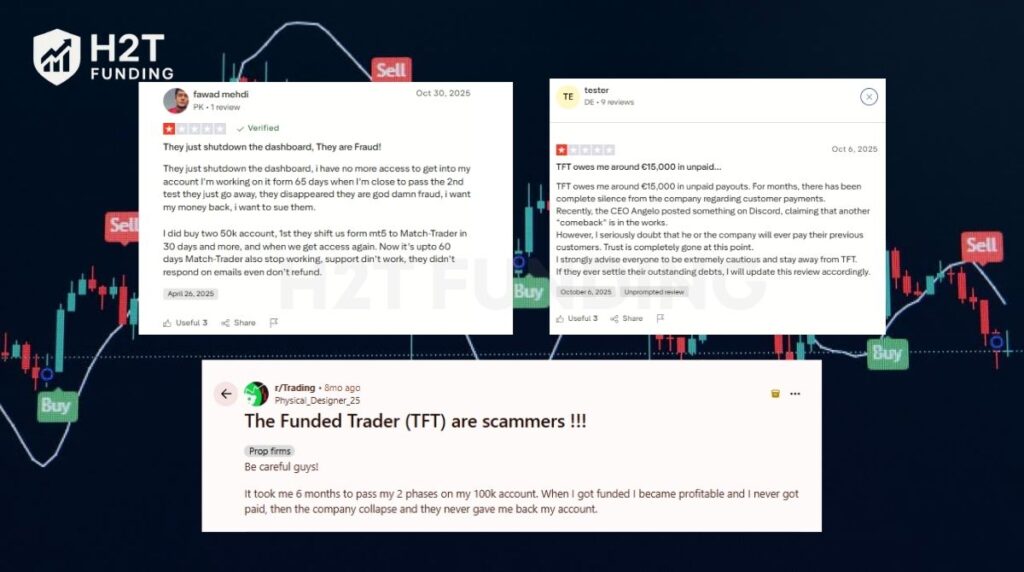

7. Payout & trust: The Funded Trader vs E8 Funding Reddit and Trustpilot

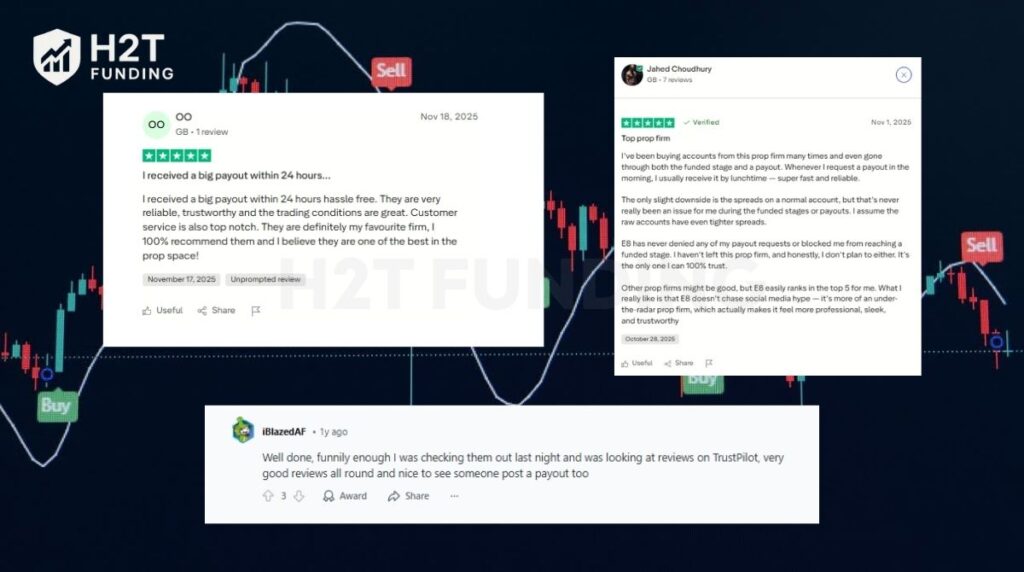

This is the most critical section of the entire review. You can have the best dashboard in the world, but if the firm doesn’t pay you, it’s worthless. The Funded Trader and E8 Funding have historically been giants, but recently, their paths have diverged significantly in terms of public trust and trading experience.

To be honest, the numbers don’t lie.

Looking at the latest Trustpilot data, E8 Markets maintains a strong 4.4/5 – Excellent rating, with users praising their reliability. In contrast, The Funded Trader currently sits at a 3.0/5 – Average rating, with a visible increase in 1-star reviews related to payout delays and migration issues.

While TFT used to be the King, E8 is currently the one operating like clockwork. The difference here is night and day. E8 Markets is currently winning the trust game by simply doing what they promise: paying out on time, typically within 24 hours. They don’t seem to have messy rules regarding minimum payout thresholds that trap traders.

However, TFT is currently in a danger zone with their community. The complaints about migration delays and missing funds are too frequent to ignore.

While they still offer a wide range of trading instruments, the risk of not being able to withdraw your profits is a major concern right now. If community support and safety are your top priorities, E8 is clearly the safer bet at this moment.

8. Which prop firm is more legit?

Let’s be real. In this industry, legit doesn’t just mean having a registered business entity or a nice logo. To a trader, legit means solvency: Do they actually pay out when you win?

Based on the current data, here is the hard truth:

E8 Markets is currently the definition of legit. They have successfully navigated a rebrand, maintained a high 4.4/5 Trustpilot score, and most importantly, users are consistently posting payout proofs arriving within 24 – 48 hours. They are operating transparently and efficiently.

The Funded Trader, on the other hand, is currently in a grey zone. While they are a massive, established brand and not a fake website, their operational struggles are undeniable. With a 3.0/5 rating and floods of complaints regarding months-long payout delays and platform lockdowns, they are facing a serious liquidity bottleneck.

Right now, E8 Markets is the more legitimate and safer option. Entrusting your funds to TFT at this moment is a gamble on whether they can fix their internal issues before your withdrawal is due.

9. Which prop firm is easier to pass?

Let’s be real for a moment. Easy is subjective. What works for a sniper might be a nightmare for a swing trader. But if we look strictly at the math, the specific drawdown traps, and the rules, we can see a clear winner depending on how you trade.

Honestly, I think E8 Markets takes the lead for aggressive traders. Why? Because they have 0 minimum trading days. If you catch a massive news move and hit your target in 2 hours, you are done. You don’t have to place fake micro-lot trades for a week just to satisfy a rule.

On the other hand, The Funded Trader (specifically the Royal Challenge) is often considered easier for traders who hate trailing drawdown. Their drawdown is calculated based on balance (or equity at the end of the day), which gives you breathing room that E8’s trailing models might not.

Here is a breakdown of the difficulty factors:

| Difficulty Factor | The Funded Trader (Royal/Standard) | E8 Markets (E8 One/Signature) | Winner |

|---|---|---|---|

| Time Limit | Unlimited (Relaxed) | Unlimited (Stress-free) | Tie |

| Minimum Trading Days | Typically 5 days | 0 Days (Instant Pass) | E8 Markets |

| Profit Target (Phase 1) | 8% – 10% | 8% – 10% | Tie |

| Drawdown Calculation | Balance/Equity based (Friendlier) | Trailing / Static (Stricter) | The Funded Trader |

| Hardest Rule (The Trap) | Daily Loss Limit: Calculated on equity/balance, it can catch you if you float huge losses. | Trailing Drawdown: (On E8 One) Lock-in rules follow your highest unrealised profit, limiting room to breathe. | The Funded Trader |

| Support for Newbies | Extensive educational resources | Minimal, focuses on tools | The Funded Trader |

| Estimated Difficulty | Moderate: Better buffer for swing trading drawdowns. | High: Trailing drawdown requires precision execution. | Depends on Style |

If you want speed and have precision, E8 Markets is technically faster to pass because there are fewer hurdles to jump over. Simple as that. However, beware of the trailing drawdown on their E8 One account; it is the number one reason traders fail there. If you need a safety net for your trades to breathe overnight without hitting a trailing stop, TFT’s structure is mathematically much more forgiving. Choose the one that doesn’t fight your strategy.

10. Who should choose which firm?

Choosing a prop firm is a lot like dating; you have to find the one that puts up with your bad habits and appreciates your good ones. Seriously, knowing how to choose a prop firm is not just about picking the one with the biggest capital number; it is about finding the one that actually fits how you trade day-to-day.

I’ve broken it down simply so you can stop guessing and start trading.

| Trader Type | Best Choice | Why |

|---|---|---|

| Beginners | E8 Markets | The dashboard is cleaner, rules are simpler to grasp, and fees are generally wallet-friendly. |

| Consistency Traders | The Funded Trader | Their structured evaluation and huge scaling plans reward steady, disciplined growth over time. |

| Fast-Paced Scalpers | E8 Markets | Zero minimum trading days plus ultra-fast execution means you get in, get out, and get paid. |

| Crypto-Focused Traders | E8 Markets | Excellent conditions for crypto assets, with weekend trading often supported on key accounts. |

| Risk-Averse Traders | The Funded Trader | The Royal Challenge’s balance-based drawdown gives you much more room to breathe than trailing stops. |

| Automated Trading Users | E8 Markets | Their tech stack offers low latency and tight spreads, which is a paradise for bots. |

| Long-Term Traders | The Funded Trader | If you want a career, their scaling plan up to $2.5M is the ultimate goal to aim for. |

If you are just starting and get overwhelmed by complex rules, go with E8. It’s just fewer headaches. But if you are a veteran who knows how to manage risk and wants to build a massive capital empire, TFT is where you want to plant your flag.

11. FAQs

Honestly, the main difference is structure vs. speed. The Funded Trader offers highly structured evaluations (1, 2, and 3-step models) with risk management that is generally friendlier because it’s often based on your account balance. E8 Funding (E8 Markets), on the other hand, focuses on speed with a trailing drawdown on some accounts, which moves up as you profit. This makes E8 strictly harder in terms of risk management but faster to complete.

This is huge. If you need money fast, E8 is the winner. They allow you to request your first payout in just 8 days. That is amazing for maintaining positive cash flow. The Funded Trader offers a higher potential split (up to 95%), but their payout schedule is slower (bi-weekly or monthly initially), and recent delays have frustrated many users.

I have to give this to E8 Markets. Their integration with TradeLocker brings TradingView charting directly into your execution platform. It is super smooth. Plus, their low-latency servers are built for automated trading, so your bots won’t slip as much as they might elsewhere.

Yes, absolutely. They recently rebranded to E8 Markets and hold a very high trust score (4.4/5). Traders post payment proofs daily. They are one of the few firms that actually pay out consistently right now.

From what we see in the community, yes. Most traders report receiving their money within 24 hours of the request. It’s incredibly reliable compared to the industry standard.

Simply put, this usually refers to a risk management rule where you are not allowed to risk more than 2% of your account balance on a single trade. E8 Funding vs The Funded Trader doesn’t always enforce this as a hard rule on every account. However, you should follow it anyway. Honestly, it is the only way to survive their daily drawdown limits.

I’d say E8 Markets. The dashboard is just easier to understand. You don’t have to navigate a maze of complex rules or hidden breach conditions. You trade, you track your progress on a clean interface, and you pass.

It depends on your weakness. If you struggle with time limits or trailing drawdown, The Funded Trader (specifically the Royal Challenge) is easier because the drawdown is static/balance-based. But if you are a good trader who just hates waiting, E8 is easier because you can pass instantly without minimum trading days.

E8 Markets takes this one. Their tech infrastructure is built for speed. Spreads are generally tighter, and execution is snappier, which is critical if you are a scalper.

Yes, they are. Both allow crypto trading. However, E8 Markets is often preferred because their execution on crypto pairs during the weekend is very smooth, and they have clear rules regarding holding positions.

Currently, I would recommend the platforms offered by E8 Markets (Match-Trader or TradeLocker). They offer a seamless, modern experience with excellent execution speed and stability. While The Funded Trader provides popular options like cTrader, their recent migration struggles have impacted platform reliability for many users, making E8 the safer choice for a live funded environment right now.

12. Conclusion

So, who actually wins The Funded Trader vs E8 Funding battle? Honestly, it comes down to whether you are building an empire or looking for a quick paycheck.

If you are an architect planning for the long haul with massive capital ($2.5M+) and have the patience to navigate potential delays, The Funded Trader still offers the structure you need. However, if you are a racer who values speed, zero minimum trading days, and most importantly, getting paid on time, E8 Markets is currently the safer, more reliable choice.

Visit H2T Funding today to compare the latest offers and start your trading journey!