Imagine two dojos, both promising to forge elite warriors. The first hands you a sword on day one and challenges you to a duel. Win, and you are instantly recognized as a master. The second guides you through rigorous katas, disciplined training, and structured sparring, building your skills from the ground up before you face your ultimate test.

This is the essence of the Take Profit Trader vs Topstep dilemma. It’s not a question of which prop firm is better, but which training ground is built for your specific fighting style. Forget the simple pros-and-cons lists.

At H2T Funding, we are taking you inside the ring. We’ll dissect the core philosophy, psychological demands, and true cost of each path. This will help you choose the arena where you’re destined to succeed.

Key Takeaways

- Take Profit Trader offers a direct funding path with a single evaluation step, ideal for traders ready to prove profitability quickly. Topstep provides a developmental journey through its multi-step Trading Combine, focusing on building consistent, healthy trading habits.

- The firms handle risk differently. Take Profit Trader uses a forgiving End-of-Day drawdown in its test but a stricter, intraday trailing drawdown in its PRO accounts. Topstep’s Maximum Loss Limit is based on your closing balance, offering more breathing room for intraday positions.

- Take Profit Trader allows traders to request payouts from day one in a PRO account (after building a profit buffer), rewarding immediate success. Topstep’s model is exceptionally generous, letting traders keep 100% of their first $10,000 and 90% after.

- Answering the “is Take Profit Trader legit” and “is Top Step Trader legit” questions, extensive reviews confirm that both firms pay traders. The choice is not about legitimacy, but about finding the best operational fit.

- Your personal trading style is paramount. If you are an experienced, self-reliant trader who values speed and autonomy, Take Profit Trader is likely your best fit. If you are a trader who benefits from structure, coaching, and a strong community support system, Topstep is the clear winner.

1. Overview of Take Profit Trader and Topstep

In the competitive landscape of futures trading, two names consistently stand out: Take Profit Trader and Topstep. While both firms provide a clear path for traders to get funded, they operate with distinct philosophies. Understanding this core difference is the first step in making an informed decision.

Take Profit Trader has carved out a niche with its streamlined, one-step evaluation process. Their model is built for speed and simplicity, appealing to confident, independent traders who are ready to prove their skills and access profits quickly.

Conversely, Topstep represents a more established, developmental model. With a history dating back to 2012, their focus is on building healthier habits through structured education, robust coaching, and their signature evaluation.

Criteria at a Glance

| Criteria | Take Profit Trader | Topstep |

|---|---|---|

| Founded / Trust | Strong industry reputation & Trustpilot rating | Established since 2012, highly trusted |

| Evaluation Models | One-Step Evaluation | Two-Step Trading Combine® |

| Account Sizes | $25K, $50K, $75K, $100K, $150K | $50K, $100K, $150K |

| Asset Classes | Futures Only | Futures Only |

| Trading Platforms | Supports NinjaTrader, Tradovate, TradingView, etc. | Supports multiple platforms + proprietary TopstepX™ |

| Profit Split | 80/20 (PRO), 90/10 (PRO+) | 100% of first $10K, then 90/10 |

| Minimum Days | 5 Days | 2 Days |

| Scaling Programs | Progression to PRO+ Account | Dynamic Live Risk Expansion |

| Market Data Providers | Uses professional data providers like Rithmic and CQG. | Uses professional data providers and a dedicated feed for TopstepX™. |

| Commissions | Fixed: 5/0.50 per round trip | Varies by platform (TopstepX is commission-free) |

| Payouts | Day-one withdrawals (after buffer is met) | After 5 winning days |

| Risk Restrictions | End-of-Day Drawdown (Test); Intraday Trailing (PRO) | End-of-Day Maximum Loss Limit |

The table highlights a clear divergence. Take Profit Trader appeals to traders who prioritize speed and a simple evaluation. Topstep, with its robust framework and coaching, is built for those seeking a more guided path to becoming consistently funded. Let’s break down each firm in greater detail.

Disclaimer: Rules, pricing, and trading conditions may change over time. Traders should always verify the latest terms directly on the official Take Profit Trader vs Topstep websites before purchasing any challenge.

Take Profit Trader

#1

Account Types

1-step

Trading Platforms

NinjaTrader 8, Tradovate, TradingView

Profit Target

6%

Our take on Take Profit Trader

Take Profit Trader positions itself as the no-nonsense funding company for skilled traders. Its model is built around a single, clear objective: prove you can trade consistently, and get paid from day one of your PRO account. This straightforward approach makes it an excellent choice for experienced individuals who don’t need extensive hand-holding and value efficiency above all else.

| 💳 Challenge Fee | $150 – $360 |

| 👥 Account Types | 1-step |

| 💰 Profit Split | 80% – 90% |

| 💵 Account Size | $25K – $150K |

| ⏱️ Time Limit | No time limit |

| 🎯 Profit Target | 6% |

| 📊 Trading Platforms | NinjaTrader 8, Tradovate, TradingView |

| 🛍️ Asset Types | Futures, Agricultural, Metals, Energy |

Topstep

#2

Account Types

2-step

Trading Platforms

TopstepX

Profit Target

6%

Our take on Topstep

Topstep is one of the original pioneers in the prop trading industry, with a reputation built on trust and trader development since 2012. Their entire ecosystem, from the evaluation to their free coaching, is designed to build better traders with healthier habits. This makes it an ideal environment for individuals who value a structured path, dedicated mentorship, and expert guidance, helping them become successful funded traders.

| 💳 Challenge Fee | $49 – $149 |

| 👥 Account Types | 2-step |

| 💰 Profit Split | 90% – 100% |

| 💵 Account Size | $50K – $150K |

| ⏱️ Time Limit | No time limit |

| 🎯 Profit Target | 6% |

| 📊 Trading Platforms | TopstepX |

| 🛍️ Asset Types | Futures Contracts |

Read more:

2. Take Profit Trader vs Topstep comparison: Core models and key rules

The path to getting funded at Take Profit Trader and Topstep differs dramatically in its structure, speed, and the psychological demands placed on the trader. This section dissects the core evaluation process and the critical rules that govern your journey at each firm.

2.1. Funding model & evaluation difficulty

The fundamental difference in their funding models creates two very distinct experiences. Take Profit Trader offers a high-intensity sprint, while Topstep guides you through a structured marathon.

| Criteria | Take Profit Trader | Topstep |

|---|---|---|

| Evaluation Required | Yes, a single-step test | Yes, the multi-step Trading Combine® |

| Profit Target | Standard, relative to account size (single hurdle) | Standard, relative to account size (achieved across steps) |

| Time Pressure | Low (monthly subscription, no deadline to pass) | Low (monthly subscription, no deadline to pass) |

| Psychological Stress | High but brief, as everything rides on one test | Sustained but structured, requiring longer-term discipline |

| Overall Difficulty | Lower barrier to entry, but requires immediate high performance | More complex rules, but rewards sustained discipline |

In essence, Take Profit Trader offers a quicker path that suits traders confident in their ability to perform under pressure. Topstep’s Trading Combine, while having more complex rules like the Topstep daily loss limit, provides a structured environment that rewards patience and long-term consistency.

2.2. Drawdown, consistency & risk rules

Effective risk management is where the operational differences between these two firms become most apparent. Their specific drawdown rules and other policies directly impact daily trading decisions and are the hard lines that determine success or failure.

| Criteria | Take Profit Trader | Topstep |

|---|---|---|

| Max Drawdown | End-of-Day Trailing (Test); Intraday Trailing (PRO) | End-of-Day Maximum Loss Limit |

| Daily Loss Limit | None | Yes (objective is being removed for TopstepX accounts) |

| Trailing Drawdown | Trails unrealized profit intraday on PRO accounts | Stops trailing once it reaches the initial account balance |

| Consistency Rules | 50% max profit on one day; 5-day minimum to pass | 50% max profit on one day; 2-day minimum to pass |

| Rule Strictness | Lenient on the test, but very strict on the PRO account drawdown | More objectives overall, but more forgiving on intraday volatility |

Ultimately, Take Profit Trader’s rules are simpler during the test but become significantly stricter on the PRO account’s intraday drawdown. Topstep presents more objectives upfront but offers a more stable, predictable risk environment once you understand its framework.

2.3. News, overnight & strategy policies

Both firms are designed for day traders, which is reflected in their strict policies against holding positions overnight or during major news events. Understanding these limitations is crucial for strategy alignment.

| Policy | Take Profit Trader | Topstep |

|---|---|---|

| News Trading | Restricted during major events (FOMC, NFP, CPI) | Restricted during major economic releases |

| Overnight Trading | Prohibited. All positions must be closed daily. | Prohibited. All positions must be closed daily. |

| Weekend Trading | Prohibited. | Prohibited. |

| EA / Automation | Strictly Prohibited. All trades must be manual. | Not supported on TopstepX™. Copy trading is allowed on other platforms. |

| Allowed Strategies | All manual day trading strategies (e.g., scalping) | All manual day trading strategies (e.g., scalping) |

This policy alignment shows that both firms are built for disciplined, manual day traders focused on core trading instruments. Neither fully supports automated trading or EAs, but Topstep offers slightly more flexibility with its permissions for copy trading on select platforms.

3. Take Profit Trader vs Topstep review: Fees, refunds, and cost efficiency

The structure of monthly fees and other costs is a critical factor, as these expenses directly impact your overall profitability. Both Take Profit Trader and Topstep operate on a monthly subscription model, but their pricing philosophies and additional costs cater to different types of traders.

| Criteria | Take Profit Trader | Topstep |

|---|---|---|

| Fee Type | Monthly subscription | Monthly subscription (Two paths available) |

| Refund Policy | No refunds on subscription fees. | No refunds on subscription fees. |

| Challenge Cost | $150 to $360 per month, depending on account size. | Standard: $49 to $149/mo + $129 Activation Fee No Activation: $89 to $189/mo |

| Transparency | Very high. All costs (subscription, resets) are clearly stated. | Very high. All costs for both paths are clearly outlined. |

| Added Fees | $100 for an account reset. | The reset fee is the same as the monthly price. Level 2 data is an optional add-on. |

| Payout Cycle | No fees on payouts over $250. | No fees on payouts. |

In short, Take Profit Trader’s pricing is straightforward, with a higher monthly entry cost but no activation fee. Topstep’s two-path system offers incredible flexibility. Traders can choose a lower monthly fee if they anticipate taking longer to pass, or a higher monthly fee for the lowest all-in cost upfront. This makes Topstep potentially more cost-effective for traders who need time to develop their trading strategies.

4. Take Profit Trader vs Topstep debate: Profit split and scaling potential

The ultimate goal for any funded trader is getting paid, and the payout structure at each firm directly reflects their core philosophy. This is a critical part of the Take Profit Trader vs Topstep debate, as the potential for profit and account growth can vary significantly.

| Criteria | Take Profit Trader | Topstep |

|---|---|---|

| Profit Split | 80/20 on PRO accounts, moving to a 90/10 split on PRO+ accounts. | 100% of the first $10,000, then an industry-leading 90/10 split. |

| Scaling Plans | A progression to a live PRO+ account with better terms and access to more trading capital, overcoming initial profit limitations. | Dynamic Live Risk Expansion, where your daily loss limit and max contract size grow with your account balance. |

| Payout Frequency | Can request payouts from day one in a PRO account. | Can request payouts after accumulating five winning days per request. |

| Minimum Payout | No official minimum, but a $50 fee applies to withdrawals of $250 or less. | $125. |

| Withdrawal Conditions | The trader must first build a profit buffer equal to the max drawdown amount. | Requires five winning days (Net PNL of $150+ each) to enable a withdrawal request. |

In conclusion, Topstep offers a phenomenally attractive profit split, especially for traders who can generate a large initial profit. Take Profit Trader, however, offers faster access to capital. Its day-one withdrawal policy is ideal for traders who prefer more frequent, smaller payouts.

5. Topstep vs Take Profit Trader: Platforms and tradable markets

Both Topstep and Take Profit Trader are dedicated futures-only prop firms, providing traders with access to professional-grade tools and a wide range of CME Group products. The primary distinction lies in Topstep’s development of a proprietary platform, which offers a more integrated user experience.

| Criteria | Take Profit Trader | Topstep |

|---|---|---|

| Trading Platforms | Extensive third-party support for platforms like NinjaTrader, Tradovate, and TradingView, allowing for flexible setups including potential VPS integration for stable connectivity. | Supports all major third-party platforms plus its own proprietary TopstepX™ platform, which features integrated TradingView charts. |

| Asset Classes | Futures and Micro Futures contracts on CME, CBOT, NYMEX, and COMEX. | Futures and Micro Futures contracts on the CME Group exchanges. |

| Market Data Providers | Relies on industry-standard providers like Rithmic and CQG for data transmission. | Relies on industry-standard providers and offers a dedicated feed for its TopstepX™ platform. |

| Commissions & Fees | Fixed commissions: $5 per round trip for minis and $0.50 for micros. | Varies by platform. TopstepX™ is commission-free, though standard clearing fees apply. |

| Trader Dashboard | Functional dashboard for basic account management and tracking key performance metrics, rules, and credentials. | Modern, intuitive dashboard with integrated digital coaching features (Coach T™). |

In summary, both firms offer excellent platform choices and access to the same core futures markets. Take Profit Trader offers broad platform compatibility. However, Topstep elevates the experience with its custom-built TopstepX™ platform and a feature-rich dashboard. This gives Topstep a slight edge in technology and user integration.

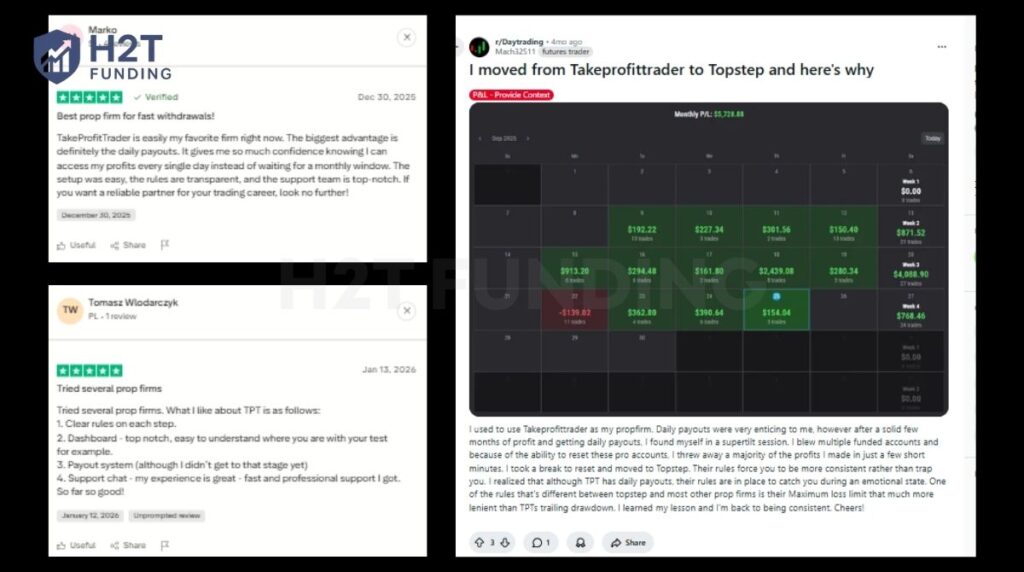

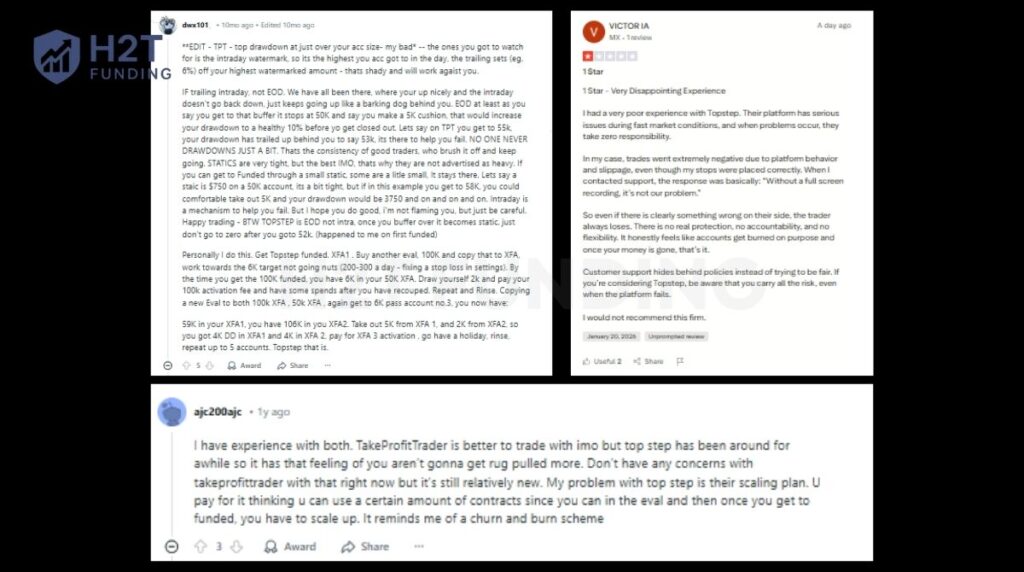

6. Payout & trust: Take Profit Trader and Topstep Reddit and Trustpilot reviews

A firm’s reputation hinges on its withdrawal policies and fair rule enforcement. Understanding specifics, like how does Topstep payout works, is critical. To get a true measure of trust, we must analyze unfiltered community feedback regarding payout speed, customer service, and common frustrations.

Below, we’ve gathered a selection of recent, representative reviews that capture the general sentiment surrounding each firm. These comments provide raw insight into payout speed, customer service quality, and the most common frustrations traders face.

The community feedback paints a clear and consistent picture. Take Profit Trader is widely praised for its fast, no-nonsense payouts and simple evaluation rules. However, it draws significant criticism for its strict intraday trailing drawdown on PRO accounts, which many traders find difficult to navigate after passing the more lenient test.

Topstep, in contrast, is respected for its longevity, trader-friendly EOD drawdown, and outstanding profit split. The most common complaints are aimed at the technical performance of its proprietary TopstepX™ platform and the restrictive scaling rules that limit contract sizes on newly funded accounts. Ultimately, both firms are viewed as legitimate and do pay their traders, but each comes with a distinct set of operational challenges that a trader must be prepared to face.

7. Take Profit Trader vs Topstep: Which prop firm is easier to pass?

Take Profit Trader is objectively easier to pass due to its one-step evaluation and simpler rule set during the test phase. While “easier” is subjective, the path to a funded account at Take Profit Trader has significantly fewer obstacles and can be completed much faster than at Topstep.

| Criteria | Winner | Notes |

|---|---|---|

| Profit Target | Take Profit Trader | Both firms have comparable profit targets relative to account size, but TPT only requires you to hit the target once. Topstep’s target is effectively split across its evaluation steps. |

| Drawdown Strictness | Take Profit Trader | During the evaluation, TPT’s End-of-Day drawdown is more forgiving than Topstep’s Maximum Loss Limit, which can feel tighter as it stops trailing once it hits the initial balance. |

| Rule Complexity | Take Profit Trader | The one-step evaluation has simpler evaluation requirements. While Topstep’s rules are more complex, some traders consider its EOD drawdown one of the most trader-friendly rules in the industry. |

| Overall Difficulty | Take Profit Trader | The combination of a single profit target, a more lenient evaluation drawdown, and fewer rules makes the initial test demonstrably easier and faster to pass. |

Ultimately, if your sole objective is to pass an evaluation as quickly as possible, Take Profit Trader is the clear winner. However, it is crucial to remember that the rules change significantly once you are funded. Topstep’s evaluation, while more difficult, is designed to prepare you for the exact risk parameters you will face in a funded account, potentially leading to greater long-term success.

8. Take Profit Trader and Topstep: Which prop firm suits your trading style?

The best prop firm for you depends entirely on your personal trading style, experience, and psychological makeup. There is no one-size-fits-all answer in the Take Profit Trader vs Topstep discussion; the right choice is the one that aligns with your strengths as a trader.

| Trader Type | Best Choice | Why |

|---|---|---|

| Beginners | Topstep | The structured Trading Combine, free coaching, and strong community support provide an invaluable educational framework that helps new traders build discipline and good habits. |

| Experienced Traders | Take Profit Trader | Confident, self-reliant traders will appreciate the fast one-step evaluation and the ability to access profits from day one, without needing the extra educational resources. |

| Discretionary Day Traders | Topstep | The End-of-Day drawdown rule offers more flexibility and breathing room for trades that need time to develop throughout the session without the stress of an intraday trailing stop. |

| Scalpers | Take Profit Trader | Scalpers who execute many small, quick trades will benefit from the simple evaluation and the potential for rapid, daily payouts once the initial profit buffer is established. |

| Risk-Averse Traders | Topstep | Topstep’s Maximum Loss Limit stops trailing at the starting balance, creating a fixed, static drawdown. This provides a clearer, more predictable risk parameter than an intraday trailing drawdown. |

| Traders Aiming for Large Funded Accounts | Both | Both firms offer account sizes up to $150,000 and have clear scaling paths. The choice depends on whether the trader prioritizes Topstep’s superior profit split or Take Profit Trader’s faster payout cycle. |

In short, your choice should be a reflection of your trading personality. If you are a seasoned trader who values speed and autonomy, Take Profit Trader is your arena. If you are a developing trader who thrives on structure, education, and more forgiving risk rules, Topstep provides the ideal ecosystem for long-term growth.

9. FAQs

Neither firm is universally “better”; the best choice depends entirely on the trader. Take Profit Trader is better for experienced traders who value a fast, one-step evaluation and immediate access to payouts. Topstep is better for traders seeking a structured, educational journey with robust coaching and more forgiving risk parameters in a funded account.

Yes, both Take Profit Trader and Topstep are widely regarded as legitimate and reputable prop firms. Both have extensive histories of paying out successful traders, which is verified by numerous reviews on Trustpilot and Reddit. The decision between them should be based on which firm’s model best fits your trading style, not on concerns about legitimacy.

No, Take Profit Trader does not have a stated maximum payout limit. In a PRO or PRO+ account, there are no caps on earnings or withdrawals. Traders can withdraw any amount as long as they respect the account’s risk rules.

The evaluation processes are fundamentally different. Take Profit Trader uses a simple one-step test with minimal rules. In contrast, Topstep uses a multi-step program called the Trading Combine®, which features more comprehensive trading rules and objectives designed to build disciplined habits over time.

The 50% consistency rule is a requirement for passing the Take Profit Trader evaluation. It states that your single most profitable trading day cannot account for more than 50% of your total net profits. This rule ensures that a trader’s success comes from consistent performance, not just one lucky trade.

Take Profit Trader is best for confident, experienced, and self-reliant futures traders. Its model is ideal for those who can consistently generate profit without needing external guidance and who value the speed of a one-step evaluation and the flexibility of day-one payouts.

Topstep is best for new and developing traders, as well as any trader who thrives in a structured environment. Its extensive free coaching, supportive community, and developmental Trading Combine® are designed to build skills and discipline for long-term success. The more forgiving End-of-Day drawdown rule also makes it suitable for risk-averse traders.

On Reddit, traders generally praise Take Profit Trader for its fast payouts but criticize its strict intraday drawdown. Topstep is respected for its fair EOD drawdown and great profit split, but users often complain about platform glitches and restrictive scaling rules on new funded accounts.

While both firms focus primarily on their evaluation programs, Topstep occasionally runs promotional trading contests and performance-based challenges. It is best to check their official websites or social media channels for any current events. Take Profit Trader does not typically focus on this model.

10. Conclusion

Ultimately, the choice between Take Profit Trader vs Topstep comes down to a single question: are you a sprinter or a marathon runner? If you are an experienced trader ready for a fast, direct path to funding and quick payouts, Take Profit Trader is your clear choice.

If you value a structured journey, world-class coaching, and more forgiving risk rules designed for long-term consistency, then Topstep provides the ideal environment to build your career. Both paths lead to a funded account, but only one aligns perfectly with your trading DNA.

For more in-depth analyses to help you find the right fit, explore other head-to-head matchups in our Compare Prop Firms section at H2T Funding.