When it comes to swing trading vs day trading, day trading is best for traders who have the time, focus, and stress tolerance to trade actively during market hours. Swing trading is better suited for busy traders who prefer patience, structured analysis, and holding positions for several days.

Because these two styles demand very different lifestyles, choosing the wrong one is a common reason many traders struggle to stay consistent or burn out early. From our experience at H2T Funding, this mistake doesn’t just create frustration; it often leads to wasted time and unnecessary capital losses.

That’s why the real question isn’t just about swing trading vs day trading – which is more profitable, but rather which one you can realistically sustain. This guide breaks down the true day-to-day reality of both approaches so you can choose a trading style that fits your schedule, personality, and long-term goals.

Key takeaways

- Day trading focuses on short-term price movements, relies heavily on technical analysis, and requires traders to react quickly to market volatility while managing precise entry and exit points within the same session.

- Swing trading aims to capture broader market trends, using higher-timeframe price patterns and holding trading positions for several days to benefit from larger market dynamics.

- The main differences lie in time commitment, risk tolerance, capital requirements, and the type of trading tools or charting systems each style demands; day trading also faces higher transaction costs and requires stronger emotional control.

- The right strategy depends on the trader: day trading suits those who enjoy speed and constant action, while swing trading fits people with limited screen time who prefer thoughtful analysis and less pressure.

1. Understand day trading

Most people have heard of day trading, but the reality is often different from the hype. We want to show you what it truly takes to trade this way, based on what we’ve seen work for traders.

1.1. What is day trading & how does it work?

The number one rule is simple: you end the day with cash. No positions are held overnight. This means you don’t have to worry about some late-night news story wrecking your account before the market opens.

This isn’t about catching big, multi-day trends. It’s about grabbing small, consistent profits from the market’s tiny daily swings. You’re in, you’re out. To do this consistently, you rely heavily on charting software and need a fast, reliable trading platform.

1.2. Pros and cons of day trading

We’ve seen many traders start day trading with confidence, only to struggle when the mental pressure and constant screen time set in. Day trading offers unique benefits, but it comes with serious challenges. It’s vital to be honest with yourself about both sides of the coin.

Pros:

- You sleep well at night. When the market closes, your money is safe from any overnight drama.

- You learn fast. You know if your strategy worked in hours, not weeks. The feedback loop is immediate.

- There’s always action. In a busy market, there’s a constant stream of potential trades from open to close.

Cons:

- It’s a mental grind. Staring at screens and making high-stakes decisions for hours on end can and will burn you out.

- It chains you to your desk. This is not a casual hobby. If you’re not watching the market, you’re not making money.

- Commissions are a constant battle. Those small fees on every single trade can easily wipe out a day’s profits.

The data highlights how difficult this path really is. A large-scale study conducted by the Brazilian Securities and Exchange Commission (CVM) found that around 97% of more than 1,600 day traders who continued trading for over 300 days ultimately lost money (Chague, De-Losso & Giovannetti, Day Trading for a Living?, 2019).

In addition, research published in the Financial Analysts Journal reported that the average net annual return of day traders was approximately –$750, meaning the typical trader lost money after costs (Jordan & Diltz, The Profitability of Day Traders).

So, before committing fully, it’s worth asking yourself whether day trading is truly worth it, given the intense pressure, time commitment, and ongoing costs involved.

1.3. Tools used in day trading

Day trading is a game of speed and information. Your gear can either give you an edge or hold you back. You wouldn’t show up to a race in street shoes, and you can’t day trade effectively with subpar tools. Here’s the essential, non-negotiable kit.

- A professional charting platform: This is your command center. You need a high-quality platform that delivers clean, real-time data and allows you to analyze price action without lag or glitches.

- A direct-access broker: When a millisecond can cost you money, the speed of your broker is everything. A direct-access broker gives you the fastest possible route to the market, helping to minimize costly slippage.

- A rock-solid internet connection: This is the lifeline for your entire operation. A lag spike or outage during a critical trade is a recipe for disaster. Many serious traders pay for a primary and a backup connection for this reason.

- A live news feed: Markets move on headlines. A real-time news service lets you see the information that’s driving volatility the instant it’s released, often before the move is fully reflected on the charts.

Day trading is a high-performance profession. It gives you the safety of ending each day with cash, but in return, it demands professional-grade tools, your undivided attention, and the mental resilience to thrive under constant pressure.

If you’re serious about pursuing this path, it helps to understand how to become a day trader and make money with the right skills, tools, and expectations from the start.

2. Understanding swing trading

If day trading is a sprint, then swing trading is more like a strategic marathon. This approach isn’t about capturing the market’s daily noise; it’s about having the patience to catch a much larger, more significant move.

2.1. What is swing trading & how does it work?

Swing trading is to capture a single swing or wave in a market trend. We aren’t concerned with the tiny ticks up and down. It aims to identify a developing trend, enter a position, and hold for several days or even weeks to ride that move to its logical conclusion.

This means you will be holding positions overnight, which is a key difference from day trading. Success here relies less on speed and more on solid analysis and patience. You’ll spend more time analyzing daily and weekly charts to find high-probability setups and less time staring at a one-minute chart.

2.2. Pros and cons of swing trading

This slower, more methodical style offers a completely different experience with its own set of benefits and risks.

Pros:

- You get your life back. You can absolutely be a successful swing trader with a full-time job. You do your analysis at night, set your trades, and let the market do the work.

- Fewer trades, bigger profits. You’re aiming for a much bigger piece of the pie on each trade. One good swing trade can easily make you more than a stressful week of day trading.

- It’s a calmer way to trade. Since you’re not making split-second decisions, there’s more time to think and far less emotional pressure.

Cons:

- Overnight risk is always there. This is the big one. Bad news can hit while you’re asleep, and the market can open far from where it closed, leading to a major loss.

- It demands real patience. You might wait all week for just one good setup. If you crave constant action, this style will be incredibly frustrating for you.

- Your money gets tied up. While a trade is active for two weeks, that capital is locked in. You can’t use it for another great setup that might appear tomorrow.

2.3. Tools used in swing trading

Your toolkit for swing trading is less about raw speed and more about the quality of your analysis.

- Clean charting software: You need a solid platform that focuses on clean daily and weekly chart data. Your ability to spot long-term patterns and draw accurate trendlines is your bread and butter here.

- A good stock scanner: You can’t manually look through 1,000 charts every night. A scanner does the heavy lifting, finding and filtering stocks that meet your specific technical criteria.

- An economic calendar: A surprise interest rate announcement can instantly kill a perfect trend. You absolutely must know when major economic reports are scheduled to avoid getting blindsided.

Swing trading is a game of patience and analysis. It offers incredible flexibility and significant profit potential. The catch is that you must be comfortable with overnight risk and have the discipline to wait for only the best setups.

To refine this analysis even further, knowing when to use simple vs exponential moving averages can further improve how you identify and manage swing trade trends.

3. What are the key differences between swing trading and day trading?

To truly understand what swing trading vs day trading is, looking at each style individually isn’t enough; putting them head-to-head is where the lightbulb really goes on. This side-by-side breakdown highlights the practical trade-offs that will ultimately shape your trading lifestyle.

| Feature | Day Trading | Swing Trading |

|---|---|---|

| Time Commitment | It’s a 9-to-5 job. You have to be at your desk when the market is moving. It’s not something you can fit in during your lunch break; it demands your full attention. | It fits your schedule. The real work gets done after hours, analyzing charts and planning your next move. This makes it a perfect fit for people with other jobs. |

| Personality Fit | You need a steady hand. It’s a high-pressure environment that demands discipline and the ability to make fast decisions without getting emotional. | Patience is your superpower. You have to be okay with waiting days for the perfect trade and then have the conviction to hold it through minor dips and bumps. |

| The Biggest Risk | Sudden intraday moves. A surprise headline can turn your day upside down in minutes. All of your risk is packed into the hours the market is open. | The overnight gap. You can go to bed with a winning trade and wake up to a losing one because of news that broke while you were asleep. This is the price of admission. |

| How You Make Money | Small wins, repeated often. The goal is to stack up a lot of small, consistent profits from the day’s tiny price swings. The feedback is instant. | Fewer trades, bigger wins. You’re aiming to catch a much larger piece of a trend. The profit potential on a single trade is much higher, but it can take weeks to play out. |

| Your Go-To Tools | Speed is your advantage. A fast broker, real-time data feeds, and a live news service are non-negotiable. Your tools are built for instant reaction. | Analysis is your advantage. A powerful scanner to find opportunities, clean daily charts to analyze trends, and an economic calendar are your essential gear. |

Here’s the bottom line: This isn’t just a choice between two trading strategies. It’s a choice between two very different lifestyles. Day trading forces you to live on the market’s clock. Swing trading lets you build the market around your own clock, but it requires a higher risk tolerance for things you can’t control.

Understanding the four major trading sessions can help you decide when each style fits best into your daily routine. It’s also critical to grasp what leverage is in trading, as it affects risk very differently in day trading versus swing trading.

4. Which trading style is right for you? Swing trading or day trading

We’ve laid out the facts, but now it’s time for the most important part: figuring out where you fit in. This isn’t about which style is better; it’s about which style is better for you.

| Trading style | Best for |

|---|---|

| Swing Trading | Traders with a full-time job or limited screen time. People who prefer calm, planned decisions over constant action. Those comfortable holding positions overnight. Traders who enjoy analysis and waiting for high-quality setups. Anyone seeking flexibility rather than daily market pressure. |

| Day Trading | Traders who can commit several focused hours during market sessions. People who thrive under pressure and enjoy fast decision-making. Those who want instant feedback and short-term results. Traders who prefer closing all positions before the market closes. Anyone willing to treat trading like a full-time job. |

Read on to break down lifestyle, risk tolerance, and personality traits that separate swing traders from day traders.

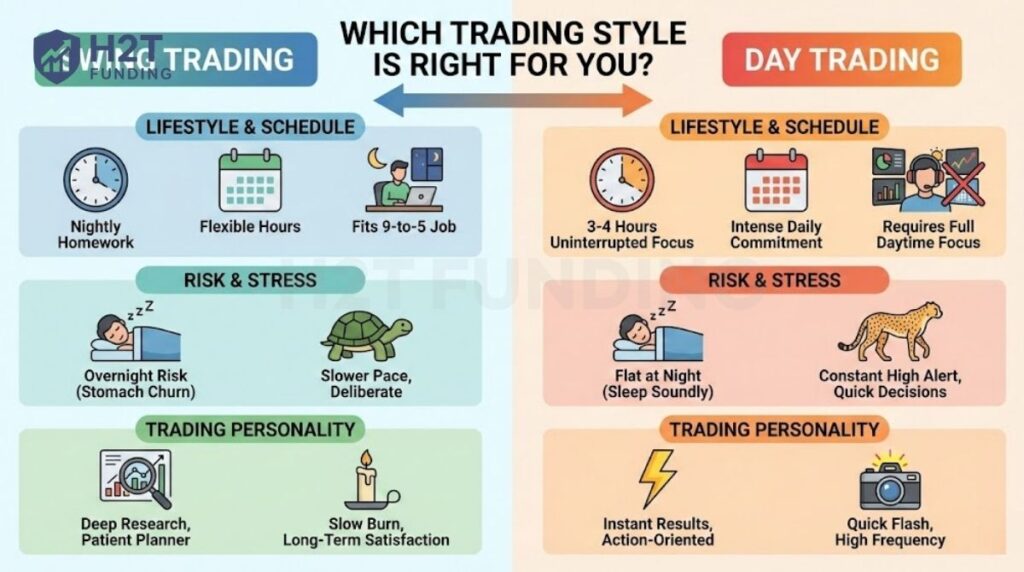

4.1. Assess your lifestyle and daily schedule

Your calendar doesn’t lie. It’s the single biggest factor that will make or break your trading career.

- Do you have a day job? If you work a 9-to-5, day trading is not an option. Period. You can’t give the market the focus it needs. Swing trading is practically designed for your schedule, letting you do your homework at night.

- Can you truly get 3-4 hours of uninterrupted focus? Be honest. If you have kids at home, a needy pet, or constant interruptions, the intense focus day trading requires is going to be impossible to maintain.

4.2. Determine your risk tolerance and stress levels

How you handle risk is a core part of your trading DNA.

- Can you sleep with a position open? If the thought of a trade going against you while you’re asleep makes your stomach churn, the overnight risk of swing trading is going to torture you. The “flat at night” rule of day trading might be your saving grace.

- How do you handle pressure? Day trading is like being in a constant state of high alert. You have to make quick calls with real money on the line. If that sounds like a nightmare, the slower, more deliberate pace of swing trading will be a much better fit.

4.3. Understand your trading personality

Finally, consider what actually motivates you. What kind of process do you enjoy?

- Do you need instant results? If you’re someone who needs to see results quickly and enjoys being in the thick of the action, the high trading frequency of day trading will feel exciting and engaging.

- Are you a patient planner who enjoys the hunt? If you find satisfaction in doing deep research, forming a thesis, and patiently waiting for it to play out over weeks, then you have the mindset of a swing trader. For you, the slow burn is more rewarding than the quick flash.

To put it simply: Day trading is for the person with ample time, a high tolerance for stress, and a need for immediate action. Swing trading is for the patient planner with a day job who can handle the uncertainty of overnight holds in exchange for a more flexible lifestyle. Neither is better, but one is likely a much better fit for you.

If you’re unsure which path fits you right now, that’s normal. Most traders don’t fail because they lack knowledge, but because they start with the wrong expectations. By focusing on your schedule, stress tolerance, and personality, as outlined above, you can make a smarter choice and build consistency over time.

Final checklist before choosing your trading style:

- Can you consistently dedicate time during market hours?

- Are you comfortable holding positions overnight?

- Do you prefer fast decisions or planned analysis?

- Can you handle frequent stress and screen time?

- Does your current lifestyle support this style long-term?

If you answered yes more often on one side, that trading style is likely the better fit for you. No matter which path you choose, having clear financial goals will give your trading direction and purpose. Just as importantly, long-term success depends on building a strong trading discipline, regardless of the style you follow.

5. A step-by-step guide to getting started

You’ve picked your path, and now the real work begins. The biggest mistake you can make at this stage is rushing in with real money. You have to earn the right to risk your capital, and that starts with practice.

5.1. Your first steps as a day trader

Success here is built on repetition and discipline. Treat this like your apprenticeship.

- Become a one-trick pony: Don’t try to learn ten different setups. Pick one simple trading strategy, like a basic breakout, and learn it inside and out until it’s second nature.

- Live on a simulator: Open a demo account and treat every single trade like it’s real. The goal isn’t to rack up a high score; it’s to prove to yourself that your strategy actually works.

- Write down your rules: Create a simple, one-page trading plan. What will you trade? When will you trade it? How much will you risk? When will you stop for the day? This document is your boss.

- Start small when you go live: Once you can follow your rules and be profitable on the simulator, you can start with real money. Use the smallest position size your broker allows. The goal is to learn how to handle the emotional pressure.

5.2. Your first steps as a swing trader

This path is all about high-quality decisions, not high frequency. Here’s where to focus.

- Master the daily chart: The daily chart tells the story. Before you do anything else, get good at identifying the main market trend and the obvious support and resistance levels. Good technical analysis starts here.

- Keep a “no-risk” trading journal: Before you fund an account, start tracking trades on paper. Write down your entry, your stop, and your target. Then just watch what happens over the next week. This builds incredible patience.

- Create your pre-trade checklist: Never enter a trade just because it looks good. Have a checklist. Is it with the trend? Is the potential reward at least double the risk? Are there any big news events this week? If you can’t check all the boxes, you don’t take the trade.

- Protect your capital at all costs: When you do go live, your number one job is to not lose money. Risk only a tiny sliver (1-2%) of your investment capital on any single idea. Staying in the game is the only way to win it.

Both paths start the same way: learning the basics, practicing, and managing risk carefully. The specific trading styles are different, but this process helps you build skill and prepare for real market conditions while limiting unnecessary losses.

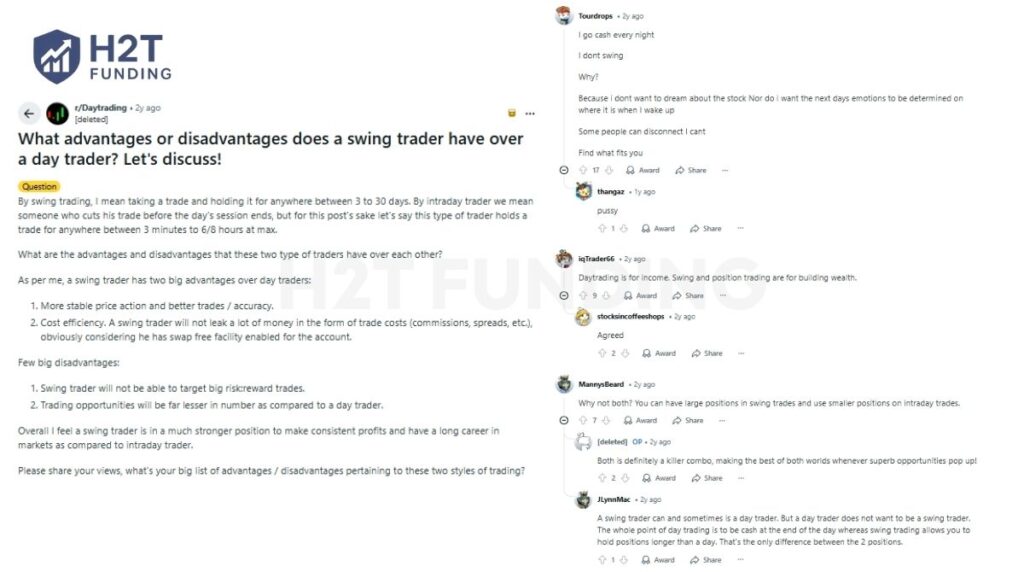

6. Discussions on the community about swing trading vs day trading on Reddit

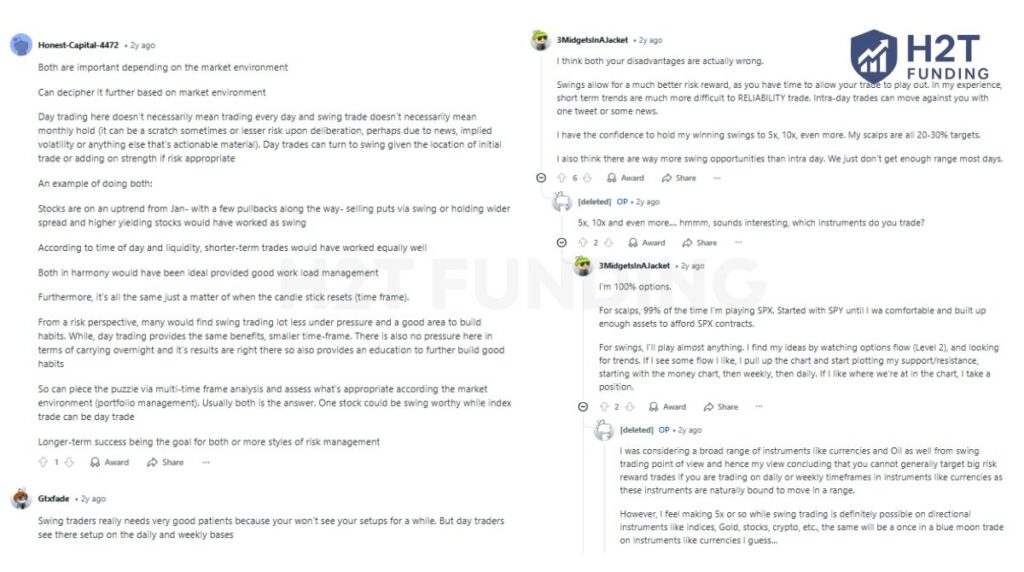

Theory is helpful, but the real insights often come from traders in the trenches. On communities like Reddit, the swing trading vs day trading debate is constant, and a few key themes always emerge from the noise.

Many traders see the two styles serving completely different purposes. One popular view is that day trading is treated like a job for generating active income, while swing trading is seen as a tool for building long-term wealth. This shifts the focus from which is better to what is my goal right now?

The psychological aspect is huge. A lot of day traders simply say they go cash every night because they refuse to carry the mental stress of an open position into the next day. For them, peace of mind is worth more than any potential overnight gain.

However, many experienced traders don’t stick to just one style. They argue that the smart play is to adapt to the current market environment. A clear, trending market might be perfect for a swing trade, while a volatile, news-driven day is an opportunity for a quick day trade.

And what about swing trading vs day trading profits? Some of the most interesting discussions push back on the idea that more trades equal more money. Many swing traders argue that their patience allows for much larger wins, stating they can hold for 5x or 10x gains, a level of profit that’s practically impossible to hit in a single day.

Ultimately, the community debate highlights one crucial fact: the choice isn’t about finding a technically superior strategy. It’s about aligning your approach with your personal goals (income vs. wealth), your psychology (stress vs. patience), and the current market reality.

Disclaimer: Trading involves significant risk, and past performance does not guarantee future results. This content is for educational purposes only and should not be considered financial advice.

7. FAQs

It’s all about the holding time. Scalpers hold for seconds to minutes. Day traders hold for minutes to hours, but always close before the end of the day. Swing traders hold for several days to a few weeks.

Neither. Profit comes from the trader’s skill and discipline, not the style. A great swing trader will always make more than a bad day trader, and vice versa.

Most experts agree that swing trading is a better starting point. The slower pace allows for more thoughtful decision-making and is far less stressful, creating a better learning environment.

Both are effective. Crypto’s high volatility is great for day trading’s quick profits and for swing trading’s massive, multi-week trends. The choice depends on your availability in a 24/7 market.

Yes, and many traders do. They might swing trade in a clear, trending market and day trade during a choppy, volatile market to adapt their strategy.

Enough to manage risk properly. A common rule is to risk no more than 1-2% of your account on a single trade. This is why prop firm accounts are popular, as they provide the necessary capital.

No. The better style is simply the one that fits your schedule, personality, and risk tolerance.

It’s a fundamental risk management rule: never risk more than 2% of your trading capital on a single trade. This ensures that one or two losses can’t wipe out your account.

This is the Pattern Day Trader (PDT) rule for stock trading in the US. It requires a $25,000 minimum account balance if you make more than three day trades in five days. This is a key reason the swing trading vs day trading forex debate is so popular, as that market, along with futures, does not have this capital requirement.

The main disadvantages are exposure to overnight risk from market gaps and the patience required. Your capital can be tied up for weeks, and you may go long periods without a valid trade setup.

8. Conclusion

The swing trading vs day trading debate is ultimately settled by looking in the mirror. If you have the time and mental fortitude for daily, high-pressure action, day trading is your arena. If you value flexibility and have the patience to let a plan unfold over weeks, swing trading is a far more sustainable path.

Now that you have your direction, the real work of mastering your craft begins. We invite you to continue your journey by exploring our in-depth guides in the Prop Firm & Trading Strategies section of H2T Funding to build the skills you need to succeed. Start your funded trader journey in a way that truly fits.