Building a personal budget is more than just tracking expenses. One of the smartest ways to prepare for future costs is by using a sinking fund. These are specific savings set aside for predictable but irregular expenses. This makes them especially useful as sinking funds for beginners who are just starting to manage their money more intentionally.

In this guide, H2T Funding will share 10 real-life sinking fund examples that I’ve either used myself or helped friends and clients implement. Each of them can make your financial life more predictable and much easier to manage.

Key takeaways

- A sinking fund is money saved for expected but irregular expenses. It differs from an emergency fund, which is for unexpected costs.

- Using multiple sinking fund categories (holidays, medical care, repairs, etc.) makes budgeting clearer.

- The sinking fund formula is: Total Cost ÷ Timeframe = Monthly (or Weekly) Savings.

- You can set up and manage a sinking fund by choosing a goal, setting a timeline, dividing the cost, and tracking savings with automation or apps.

1. What does a sinking fund mean?

A sinking fund is a way to prepare for future expenses by saving a small amount over time. You might wonder, Why is it called a sinking fund? The term originally comes from business and accounting, where companies set aside money to “sink” or pay off debt over time.

It’s different from an emergency fund, which handles surprises. A sinking fund is for expected, irregular expenses like car repairs, annual bills, or holiday travel.

My own wake-up call was a sudden $700 car repair bill. One minute I was driving to work, the next I was staring at a mechanic’s estimate that completely derailed my budget for the next three months. Paying it off with a credit card and the interest that came with it was the moment I knew I had to find a smarter way to save for these kinds of things.

So, how does this work in practice? Let’s break it down with ten real-life examples. Seeing what is sinking fund is with an example is the best way to understand how to put the concept into practice for your own goals.

2. Advantages and disadvantages of a sinking fund

In personal finance, a sinking fund acts as a safety net that helps individuals prepare for planned expenses without relying on debt. While it offers strong benefits, there are also a few drawbacks to consider before setting one up.

| Advantages | Disadvantages |

|---|---|

| Builds discipline by encouraging regular savings for specific goals. | Requires consistent contributions, which may strain monthly budgets. |

| Reduces reliance on credit cards or loans when big expenses arise. | Funds are tied up for future use, limiting flexibility for immediate needs. |

| Provides peace of mind knowing money is available for emergencies or large purchases. | If priorities change, reallocating the sinking fund can be inconvenient. |

| Makes budgeting clearer by separating money for predictable expenses (car repairs, vacations, holidays). | It may feel slow to grow, which can discourage some savers. |

Overall, a sinking fund strengthens financial stability by spreading out costs over time, making it easier to handle large or irregular expenses without disrupting your main budget.

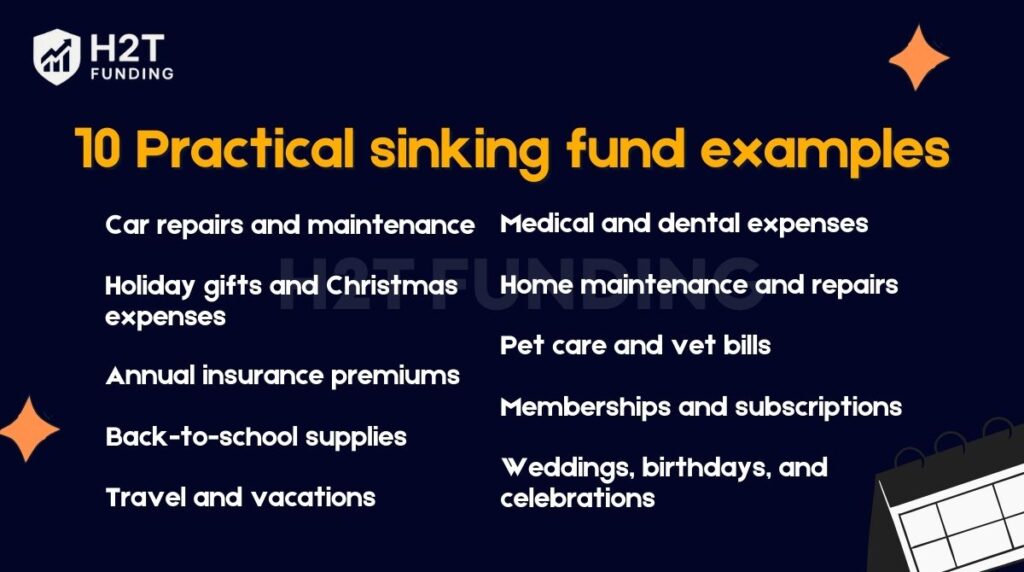

3. 10 Practical sinking fund examples

To make the sinking fund more concrete, here are ten real-life categories where it can help. Each shows how a sinking fund works in practice:

#1. Car repairs and maintenance

Purpose: Regular vehicle upkeep, such as tire replacements, oil changes, and inspections.

- Estimated cost: $600/year

- Monthly savings: $50/month

Car issues rarely wait for payday. Setting aside a fixed amount ensures you’re never caught off guard.

According to AAA, the average annual cost of car maintenance is over $500. Planning for this helps avoid using credit cards in emergencies.

#2. Holiday gifts and Christmas expenses

Purpose: Gifts, decorations, and festive meals during the holiday season.

- Estimated cost: $1200/year

- Monthly savings: $100/month

Example: If you celebrate Christmas and buy for 10+ people, $1200 is a safe benchmark. Planning keeps your December stress-free and your credit card balance low.

Continue reading: 10+ save money challenge ideas to grow your savings

#3. Annual insurance premiums

Purpose: Auto, home, or health insurance premiums are often paid yearly.

- Estimated cost: $1000/year

- Monthly savings: ~$83/month

Many insurance companies offer discounts for annual payments. With a sinking fund, you can take advantage of those savings.

Tip: Review your policies each year during renewal to make sure you’re not overpaying, and learn smart ways how to prioritize expenses to keep your budget balanced.

#4. Back-to-school supplies

Purpose: Books, uniforms, laptops, or fees at the start of a new school year.

- Estimated cost: $600/year per child

- Monthly savings: $50/month

This fund is vital for parents. It can also cover mid-year expenses like extracurriculars or technology upgrades. For families with older kids, check out these budgeting tips for college students to better prepare for higher education costs.

#5. Travel and vacations

Purpose: Flights, lodging, food, and activities.

- Estimated cost: $3000/year

- Monthly savings: $250/month

A planned vacation is less stressful when it’s prepaid. Use this fund to cover big summer trips or winter getaways.

Bonus tip: Use a separate travel fund account to avoid dipping into it accidentally.

Don’t miss out: How to save for a big purchase: Real tips that work

#6. Medical and dental expenses

Purpose: Co-pays, dental cleanings, prescription glasses, or orthodontics.

- Estimated cost: $1200/year

- Monthly savings: $100/month

While health insurance covers major events, out-of-pocket costs add up. A sinking fund bridges the gap.

Expert insight: The National Association of Dental Plans notes that the average American spends ~$360 annually on dental care alone.

To avoid budget strain, explore ways how to improve your personal cash flow so you can handle these recurring costs more comfortably.

#7. Home maintenance and repairs

Purpose: Routine upkeep like HVAC checks, plumbing, or paint touch-ups.

- Estimated cost: 1% of home value/year (e.g., $3000 on a $300K home)

- Monthly savings: $250/month

Homeownership comes with surprise costs. This fund keeps you ready for the unexpected, like a broken appliance. For those who also manage rental properties or side ventures, learning effective budgeting strategies for businesses can help balance both personal and business expenses more effectively.

#8. Pet care and vet bills

Purpose: Vaccinations, grooming, emergencies.

- Estimated cost: $600–$1000/year per pet

- Monthly savings: ~$75/month

Whether it’s flea meds or surgery, pets come with real costs. A fund ensures you can give them the best care without budget panic. To stay financially prepared, it also helps to learn how to stop overspending so pet expenses don’t derail the rest of your budget.

#9. Memberships and subscriptions

Purpose: Annual renewals like gym, Amazon Prime, Spotify, or professional licenses.

- Estimated cost: $300/year

- Monthly savings: $25/month

Auto-renewals sneak up. A sinking fund ensures you’re prepared without monthly surprises.

#10. Weddings, birthdays, and celebrations

Purpose: Hosting or attending events, gifts, or travel.

- Estimated cost: $1200/year

- Monthly savings: $100/month

Whether it’s your wedding, a milestone birthday, or simply attending family gatherings, celebrations can quickly add up. Setting aside a sinking fund keeps these joyful moments stress-free. You can also try creative budget challenge ideas to save faster and make event planning more manageable.

Some of these, like home maintenance or retirement travel, can even be considered long-term sinking funds categories, since they require saving over several years.

View more:

4. How to set up and manage a sinking fund

Creating a sinking fund is straightforward and works well alongside frameworks like the 50/30/20 budget rule. Think of it as breaking a big expense into smaller, manageable steps:

- Step 1: Choose your goal

- Step 2: Set your timeline and savings target

- Step 3: Divide the total by months or weeks

- Step 4: Automate or track manually with tools

Keep reading to see detailed examples and methods you can apply today.

4.1. Choose your specific goal

Start by identifying the exact purpose of your sinking fund. Clarity drives motivation; you’re far more likely to stay consistent when the goal feels tangible.

- Instead of: “Travel Fund”

- Say: “Italy Vacation – May 2026”

Make a list of upcoming expenses within the next 6 to 24 months. You can even create a high-priority and low-priority sinking funds list, so you know which goals to tackle first. These could include:

- Annual car insurance premiums

- Holiday gift shopping

- Back-to-school supplies

- Weddings or family events

- Home repairs or upgrades

A good rule of thumb is to only set up a sinking fund for goals you can clearly define with a dollar amount and a due date.

4.2. Set your timeline and savings target

Once your goal is defined, calculate the total amount needed and when you’ll need it. This basic sinking funds formula helps you break down big goals into smaller, achievable steps.

Savings Target ÷ Timeframe = Monthly or Weekly Contribution

For example:

- Goal: $1,200 for Italy trip

- Timeline: 12 months

- Monthly savings needed: $100/month

- Weekly savings needed (optional): $25/week

Tip: If your budget is tight, you can extend the timeline or adjust the goal size to reduce the monthly burden.

4.3. Divide the total by months or weeks

A large goal can feel overwhelming. By breaking it into smaller, manageable pieces, you increase your chance of sticking to the plan.

- Monthly contributions work well if you get paid once a month.

- Weekly savings may be easier to handle if your cash flow is tight or irregular.

You can also sync your savings contributions with your pay cycle to make it seamless.

4.4. Automate or track manually

Now it’s time to put your plan into action. You have several methods to manage your sinking fund, so choose one that suits your personality and financial habits:

Option 1: Budgeting apps

Use digital tools like:

- YNAB (You Need A Budget): Excellent for goal-based savings.

- Goodbudget: Great for envelope-style savings on your phone.

Option 2: Bank automation

Set up automatic transfers from your main account to a separate savings account each payday.

- Name the account according to your goal (e.g., “Italy Trip Fund”)

- Set and forget it, let automation build your fund in the background.

Option 3: Cash envelopes

Prefer to save in cash? Use labeled envelopes or jars for each sinking fund.

- Physically divide your money after every paycheck

- Great for people who like tactile systems or want to limit digital spending

Setting up a sinking fund is simple once you have a clear goal and timeline. Use the formula to divide big expenses into small, regular payments. Choose a method that fits you: automation, apps, or cash envelopes. This way, future costs feel manageable, not overwhelming.

5. Comparing a sinking fund with other accounts

It’s easy to confuse a sinking fund with a general savings or emergency fund, but they each have a very specific job to do for your money. Knowing how each works makes budgeting smoother and keeps your financial goals on track.

5.1. Sinking fund vs Savings account

Both involve saving for the future, but they’re not the same. A savings account is simply where your money is stored, while a sinking fund is a method that assigns a clear purpose and deadline to each goal. This makes it easier to manage categories like holidays, clothing, or home renovations.

If you use one savings account for everything: medical care, vacations, or entertainment, the lines blur quickly. By creating separate sinking funds, you can see exactly how close you are to each goal and avoid overspending money meant for something else.

Here are 20 common sinking fund categories you might consider:

- Emergency fund

- Short-term savings

- Transportation

- Medical care

- Giving

- Birthdays

- Holidays

- Other celebrations

- Pets

- Entertainment

- Technology

- Home repairs

- Home decor

- Home renovations

- Clothing

- Beauty & grooming

- Subscriptions

- Vacations

- Extracurriculars

- College tuition

Splitting your money into clear sinking fund categories, you give every dollar a job. Whether it’s medical care, holidays, or home renovations, the cost feels manageable because you’ve planned ahead.

5.2. Sinking fund vs. Emergency fund

A sinking fund is for predictable expenses you know are coming, such as college tuition, annual insurance, or beauty care. It uses a simple formula: divide your total target by the months left to set up regular contributions.

An emergency fund, on the other hand, covers the unexpected. Car accidents, sudden medical bills, or job loss can’t be planned, but you need cash ready to handle them. While a sinking fund is for the known, the emergency fund is your safety net for the unknown.

Sinking funds are goal-driven tools, savings accounts are general storage, and emergency funds are crisis protection. Together, they give you structure for planned costs and resilience when life surprises you.

6. FAQs

An example is setting aside $50 each month for car repairs. Over a year, that gives you $600 to handle unexpected maintenance without dipping into emergency savings or credit.

Start with 1–3 based on your priorities. As you get more comfortable, add more. Too many at once can feel overwhelming.

Use a high-yield savings account or a budgeting app with digital envelopes. Keep the funds easily accessible but separate from your main checking account.

No. Sinking funds are for planned expenses, while emergency funds cover unplanned events like job loss or medical emergencies.

It depends on your goal. Save the exact amount you’ll need by the deadline. Formula: Total cost ÷ months = monthly savings. Example: $1,200 vacation ÷ 12 months = $100/month.

Absolutely. They help you plan, avoid debt, and stay in control of your budget. Think of them as stress-free savings for future expenses.

The basic rules of sinking funds are simple: set a clear purpose, define the total amount you’ll need, and give yourself a timeline to reach it. Then, divide that amount into smaller monthly or weekly contributions and keep the money separate from your everyday spending.

The sinking fund method is a savings approach where you set aside a fixed amount regularly to cover a future expense. For example, if you know you’ll need $1,200 for car insurance in a year, you can save $100 each month. By the time the bill is due, the full amount is ready without disrupting your main budget.

A good sinking fund is one that’s clearly defined with a purpose, a target amount, and a timeline. For most people, useful sinking funds include categories such as annual insurance premiums, vacation savings, or medical expenses. The best sinking fund fits your lifestyle and ensures you won’t need to rely on debt when those costs arrive.

7. Conclusion

Sinking funds are one of the most powerful tools in personal finance. They bring structure, reduce stress, and help you plan for the expenses that used to throw off your entire budget.

By implementing even one or two of these sinking fund examples, you’re already on the path to more confident and proactive money management.

Start with high-priority sinking funds such as car maintenance or insurance, since these expenses are unavoidable. Remember, the goal isn’t to create a perfect, complex system overnight. The small amounts you set aside today will bring you significant peace of mind down the road.

Want to level up your financial planning strategy? Explore our Budgeting Strategies or visit the H2T Funding for more guides and tools.