Every year, when the news about the UK Budget starts up, a lot of people with pensions begin to worry about the same thing. They ask themselves a simple but important question: Should I take my tax-free lump sum before the budget?

It’s a common fear: What if the government changes the rules and you lose out? This guide, H2T Funding, is here to help you figure that out. We’ll walk you through how it all works, look at the good and bad sides of taking your money early, and help you decide what feels right for you.

Key takeaways

- A tax-free lump sum is up to 25% of your pension that can be withdrawn without income tax, normally from age 55 (57 from April 2028).

- The maximum amount is capped at £268,275 across all pensions, affecting only those with pots above £1,073,100.

- Taking it before the Budget may lock in today’s rules and provide certainty, but risks losing long-term pension growth.

- Past Budgets have shown pensions are a target for reform, and speculation about cuts fuels pressure to withdraw early.

- Whether to take a tax-free lump sum now or wait depends on your financial needs, retirement timeline, and comfort with potential policy changes.

1. What is a tax-free lump sum?

A tax-free lump sum is the portion of your pension that you can withdraw without paying income tax. In the UK, this is usually up to 25% of your total pension pot, provided you meet the eligibility rules.

You can normally access this benefit from age 55 (rising to 57 from April 2028). The withdrawal must be taken as one or more lump sums, rather than as regular income, to remain tax-free. In very limited cases, such as a serious illness lump sum, access can be granted earlier.

This flexibility makes the tax-free lump sum one of the most popular features of UK pensions, allowing retirees to clear debts, fund home improvements, or support major life plans without triggering an immediate tax bill.

2. What is the maximum tax-free lump sum?

While the standard rule allows you to withdraw 25% of your pension tax-free, there is a cap on the total amount. This is known as the Lump Sum Allowance (LSA) and is currently set at £268,275 across all your pensions combined.

The cap only applies if your pensions together exceed £1,073,100 in value. For those with large pots, the situation may be more complex due to protected allowances or an enhancement factor applied under older pension rules.

Example: If you hold two pensions worth £400,000 and £800,000, you could take 25% from the first pot (£100,000). From the second pot, however, you would be limited to £168,275 (about 21%), because the overall maximum tax-free allowance is capped at £268,275.

Don’t miss out: How to backtest a trading strategy: The ultimate A-Z guide

3. Should I take my tax-free lump sum before the budget

So, what’s the right move? Honestly, there’s no one-size-fits-all answer. It really depends on your own situation.

The main reason people think about taking it now is for peace of mind. You get your cash in your hands, and you don’t have to worry about the government changing the rules later. It can feel like the safest option.

But here’s the big reason to wait: Your pension is like a special savings account where your money can grow without being taxed. As soon as you take it out, that money loses its special protection. If you don’t have a solid plan for the cash, you could be missing out on valuable growth that you’ll need for your future.

It all boils down to this: If you truly need the cash now, or the worry is affecting your sleep, taking it might make sense. But if there’s no urgent need, patience usually better protects your financial security and investment opportunities.

Furthermore:

4. How the budget can impact tax-free lump sum rules

The UK Budget is one of the most important financial events of the year. It sets out the government’s spending priorities and tax policies, and it can directly affect how pensions and retirement benefits are treated.

For anyone considering a tax-free lump sum, the budget is a key moment to watch, as new rules or restrictions could impact your entitlement.

4.1. What is the UK Budget?

The UK Budget is an annual statement delivered by the Chancellor of the Exchequer. It outlines the government’s economic plans, including tax policies, pension rules, and welfare reforms. Because pensions are a key tax relief, the Autumn Budget is when savers watch closely for possible changes to lump sum rules.

In practice, this means the Chancellor has the power to adjust the UK tax-free pension lump sum rules, either by reducing the percentage available, lowering the overall allowance, or tightening eligibility. These changes are not guaranteed, but the risk increases during times of fiscal pressure.

4.2. Past changes and signals from the Treasury

The Treasury has made several pension-related adjustments in recent years, which highlight the possibility of further reforms. For example, the Lifetime Allowance (LTA) and the Annual Allowance (AA) have been frozen, reduced, or revised in past Budgets to limit tax advantages for higher earners.

While last year’s Budget did not alter the 25% tax-free entitlement, reports in outlets like the Telegraph and Guardian suggested that capping or reducing lump sum benefits was considered as part of cash-raising measures.

With speculation continuing ahead of the 2025 Budget, many savers are questioning whether their current pension freedoms will remain untouched.

For now, no official policy change has been announced, but the signals from the Treasury show that tax-free pension perks are always under review. This uncertainty explains why some retirees choose to secure their lump sum early, while others prefer to wait for clarity.

For more insight: What are the 4 trading sessions? A beginner’s guide

5. Pros and cons of taking your lump sum before the budget

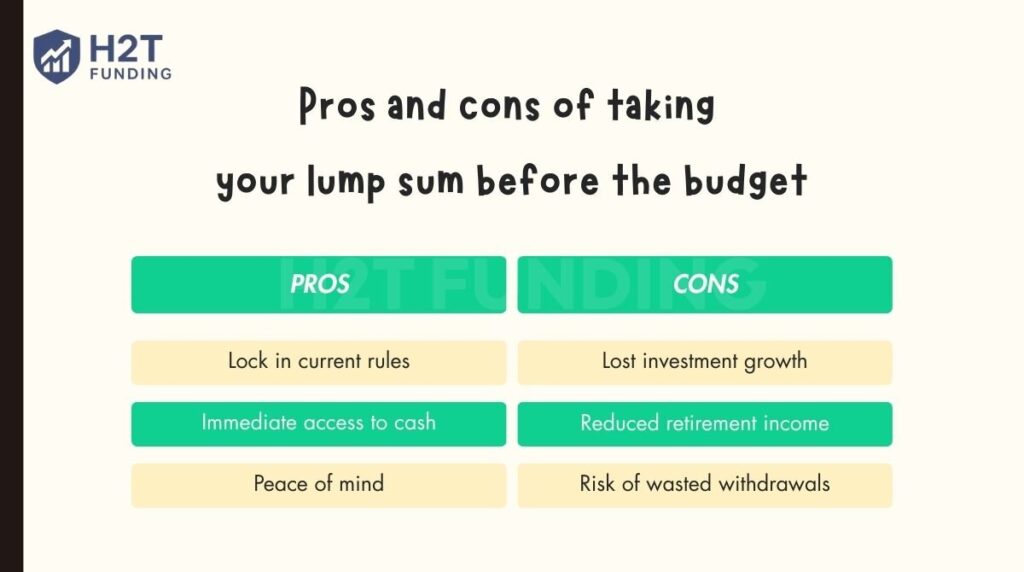

Deciding whether to withdraw your pension cash early is not straightforward. While it can secure today’s benefits, it may also reduce future growth. Here are the key pros and cons to weigh before acting.

Pros of taking your lump sum early

- Lock in current rules: Withdrawing now ensures you benefit from the existing UK tax-free pension lump sum rules, avoiding uncertainty about future changes.

- Immediate access to cash: The money can be used to pay off debts, build an emergency fund, or support retirement needs without delay.

- Peace of mind: Many retirees prefer certainty over speculation, especially when rumors of pension lump sum tax changes in 2025 create anxiety.

Cons of taking your lump sum early

- Lost investment growth: By removing funds from your pension, you forgo potential long-term growth, and withdrawing during a market downturn could crystallise losses.

- Reduced retirement income: Taking cash early could lower your future drawdown options and overall pension flexibility.

- Risk of wasted withdrawals: If you don’t need the money immediately, pulling it out may be unnecessary and could even impact your tax planning later.

In summary, taking a tax-free lump sum before budget announcements can protect you from potential rule changes, but it comes with trade-offs that could weaken long-term retirement security.

Dive deeper with this article: How do funded trading accounts work? A beginner’s guide

6. Key questions to ask before making the decision

Before choosing whether to take your lump sum now or wait until after the Budget, it’s worth asking yourself some key questions. These will help clarify if early withdrawal truly fits your goals.

- Do you need the cash right now? If the money is required for urgent needs, such as clearing debt or covering living costs, taking it early might make sense. But if you have no immediate use, keeping it invested could be wiser.

- Do you have a plan for the funds? Without a clear purpose, withdrawing may weaken your long-term finances. Think about whether you will invest the cash, spend it on essentials, or risk letting it sit idle in low-return accounts.

- Do you believe the Budget will change the rules? If you are highly concerned about possible pension lump sum tax changes in 2025, acting now could secure your benefits. Otherwise, waiting might avoid premature decisions.

- Have you spoken to a professional adviser? A financial planner can help you assess how a withdrawal affects not just your pension, but your overall financial strategy and the potential tax implications.

- How will this affect your future income tax? Even though the lump sum itself is tax-free, withdrawing can change how the rest of your pension is drawn. This might push your taxable income into a higher bracket later.

Answering these questions gives you a clearer picture of whether accessing your tax-free lump sum before the Budget is a sound decision or an unnecessary risk.

Explore the full article: How to get a funded trading account with The Funded Trader

7. Case scenarios when it makes sense

Deciding when to take your pension lump sum depends heavily on your circumstances. Below are a few common scenarios where accessing the cash early or waiting might make sense.

7.1. Scenario 1: Near retirement and worried about policy changes

If you are close to retirement and feel anxious about possible restrictions, taking your lump sum early can provide certainty. It allows you to secure current benefits and move forward with confidence in your financial planning.

7.2. Scenario 2: No immediate need for the money

For those who do not require cash right away, leaving the funds invested may be more beneficial. Later, you may even convert your pension into an annuity for guaranteed income. This way, your pension continues to grow, and you can make a decision later with more clarity once policy updates are announced.

7.3. Scenario 3: Urgent investment or personal need

In cases where you need to fund a house purchase, settle a mortgage, or cover a large expense, withdrawing now could be the right call. Immediate access to tax-free cash gives flexibility even if long-term growth potential is reduced.

The right timing depends on whether certainty, growth, or liquidity is most important to you. Each scenario shows that personal context matters more than speculation, making tailored advice essential.

Dive deeper with this article:

8. Expert opinions and budget predictions

Pension specialists stress that rumours about cutting the 25% tax-free entitlement surface regularly, but they are still only speculation. Helen Morrissey from Hargreaves Lansdown warns that taking cash too soon could backfire, as money withdrawn from a pension loses its tax benefits and may face capital gains, dividend, or inheritance tax.

Another critical point advisers often raise is pension “recycling.” I want to emphasize this: taking tax-free cash with the intention of reinvesting it back into a pension is a red flag for HMRC and can lead to severe tax penalties.

It’s a sophisticated area where professional guidance isn’t just recommended; it’s essential. The broader political signals only add to the uncertainty, making a calm, strategic approach more important than ever.

Gary Smith at Evelyn Partners adds that while the 25% lump sum is highly valued, it does not always have to be taken in one go. For many retirees, spreading withdrawals gradually alongside taxable income can be more efficient. He cautions against rushing, as it may limit long-term flexibility and reduce overall retirement income.

Finally, political signals are adding to uncertainty. Prime Minister Keir Starmer has warned of a “painful” Budget, and reports suggest officials are considering cutting the lump sum cap from £268,275 to £100,000.

Experts, however, believe any changes would likely include transitional protections, giving savers time to adapt rather than facing overnight cuts.

9. FAQs

You can usually take up to 25% of your pension pot tax-free, subject to the current lifetime cap of £268,275 across all pensions. Anything above this amount will be taxed as income.

There are rumours that the rule could be tightened, but no confirmed plans exist yet. Experts believe that even if changes are made, transitional arrangements would likely protect current entitlements.

Yes. The tax-free portion does not need to be taken all at once. Many savers choose to withdraw it in segments over time, often alongside taxable income, to spread out their tax exposure.

If no changes are introduced, waiting allows your pension to remain invested and grow tax-efficiently. You won’t lose your entitlement, and you may end up with a larger pot to draw from later.

The lump sum itself is tax-free, but withdrawing it may influence how you draw the rest of your pension. If you take taxable income alongside it, you could move into a higher income tax bracket.

In most cases, you cannot access pension funds before age 55 (rising to 57 from April 2028). Early access is only allowed in very limited circumstances, such as severe ill health or as part of a death benefit paid to beneficiaries.

It depends on your situation. Taking it early secures today’s rules, but you could lose future investment growth. If you don’t need the cash immediately, waiting may be safer until changes are confirmed.

That depends on government policy. If the tax-free allowance is reduced, future withdrawals could face income tax, though there may be transitional protections or support measures. However, nothing has been formally announced yet.

The Budget could change pension rules, but details remain uncertain. Recent speculation suggests limits may be tightened, though experts expect savers would be given time to adjust.

The most efficient approach is often to spread withdrawals over time, using tax allowances wisely. Combining smaller lump sums with ISAs, pension sharing arrangements, or partner pensions can help minimise future tax bills.

The main drawbacks are losing future investment growth and exposing funds to other taxes like capital gains, dividends, or inheritance tax. Acting without a clear plan may also reduce long-term retirement income and affect access to means-tested support in later life.

In total, you can take up to 25% of your pension value, capped at £268,275 across all schemes. Beyond that, withdrawals are taxed as income at your marginal rate.

10. Conclusion

So, after all that, what’s the final answer? Should I take my tax-free lump sum before the budget?

The truth is, the best answer for you won’t come from guessing what politicians might do. It comes from looking at your own life. The choice is simple: do you need the security of having the cash now, or would you rather give your money more time to grow for your future?

Focus on what you actually need the money for. That’s always the smartest way to make a big financial decision.

For more insights on protecting your retirement income and planning, explore our Budgeting Strategies guides at H2T Funding. You’ll find practical tips to help you make confident financial choices.