When traders look for a prop firm, the first question is always the same: Can I trust this firm, and are the rules fair? Trade The Pool offers equity traders a chance to manage more buying power without using personal funds. With access to up to $200K, stocks, ETFs, including penny stocks, it attracts those limited by retail brokers.

But promises are only part of the story. Rules, payout terms, and restrictions often decide if a trader can succeed or fail. In this Trade The Pool review, I will break down its programs, costs, and conditions. You’ll also see my personal verdict on whether this prop firm is worth your time compared to others.

Disclaimer: Rules, pricing, and trading conditions may change over time. Traders should always verify the latest terms directly on the official Trade The Pool websites before purchasing any challenge.

1. Our take on Trade The Pool

Trade The Pool is an Israeli-based prop firm launched in 2022 and led by CEO Michael Katz. Backed by the respected The5ers team, it quickly earned attention for offering stock traders a structured way to access more capital. Its model centers on stocks and ETFs, with a framework known as Limited Risk Trading.

What really stands out to me is how it combines larger buying power, up to $200K, with clear rules that prevent reckless risk. The partnership with Interactive Brokers adds credibility, and the access to more than 12,000 instruments feels generous for both day and swing traders.

Still, the standard 70/30 profit split and equity-only focus make it less appealing if you want broader markets like forex or crypto.

Pros and Cons of Trade The Pool

| Pros | Cons |

|---|---|

| Led by CEO Michael Katz, backed by The5ers | The default profit split is 70/30, lower than some peers |

| Access to over 12,000 instruments (stocks, ETFs, penny stocks) | Restricted to equities, no forex or crypto |

| Partnership with Interactive Brokers for stability | Overnight rules can limit swing or news trading |

| Flexible evaluations (one-step, two-step) | Evaluation targets and timelines may feel strict |

| Built-in scaling plan, up to $200K buying power | Fewer promotions and incentives than competitors |

This Trade The Pool prop firm review highlights how it has carved a niche for equity traders who want to scale without risking personal savings. Its transparency and strong leadership are reassuring, and the broad stock access is a real plus.

Yet, for multi-asset traders or those chasing higher splits, the limitations may feel restrictive. Overall, it’s a strong choice if your focus is on equity markets with a structured growth path.

2. Trade The Pool funding program

Trade The Pool offers a variety of funding options designed for both day traders and swing traders. Each program comes with clear targets, daily loss limits, and maximum loss thresholds.

What stands out is the flexibility: traders can now choose between two distinct paths: Beginner or Advanced, depending on experience and trading discipline. Entry fees scale with account size, making it possible to start small or scale up to as much as $200K in buying power.

| Account Size | Target | Daily Pause | Max Loss | Min. Positions | Trading Period |

|---|---|---|---|---|---|

| $2,000 (Swing) | 15% | 3% | 7% | 5 | 100 days |

| $5,000 (Day) | 6% | 2% | 4% | 10 | Unlimited / 60 days |

| $10,000 (Swing) | 15% | 3% | 7% | 5 | 100 days |

| $25,000 (Day) | 6% | 2% | 4% / 3% | 10 / 20 | Unlimited / 60 days |

| $20,000 (Swing) | 15% | 3% | 7% | 5 | 100 days |

| $50,000 (Day) | 6% | 2% | 4% / 3% | 10 / 20 | Unlimited / 60 days |

| $40,000 (Swing) | 15% | 3% | 7% | 5 | 100 days |

| $100,000 (Day) | 6% | 2% | 4% / 3% | 10 / 20 | Unlimited / 60 days |

| $200,000 (Day) | 6% | 2% | 4% / 3% | 10 / 20 | Unlimited / 60 days |

2.1. For a day trading trader

Day traders at Trade The Pool can select between Beginner and Advanced accounts. Both use the same equity-based model with strict risk management, but differ in timing, risk tolerance, and evaluation style. This gives intraday traders the freedom to pick an account that best suits their tempo and comfort level.

2.1.1. Beginner account

The Beginner account is ideal for day traders who prefer freedom without a fixed deadline. It allows unlimited time to reach the target but still enforces clear daily and maximum loss limits. If you value trading at your own pace and dislike time pressure, this model works best.

| Criteria | Details |

|---|---|

| Account Size | $5K – $200K |

| Fee Range | $59 – $1,475 |

| Profit Target | 6% |

| Daily Pause | 2% |

| Max Loss | 4% |

| Min. Positions | 10 trades |

| Trading Period | Unlimited |

| Profit Split | 70/30 |

| Consistency Rule | 50% |

| Trade Duration | Min 30 seconds |

| Trade Range | Min 10 cents |

| Cash-out Rules | Withdrawals every 14 days, at least 3 profit days with 0.5% |

| Free Add-ons | Real-time data free, Trading Booster optional (smaller accounts) |

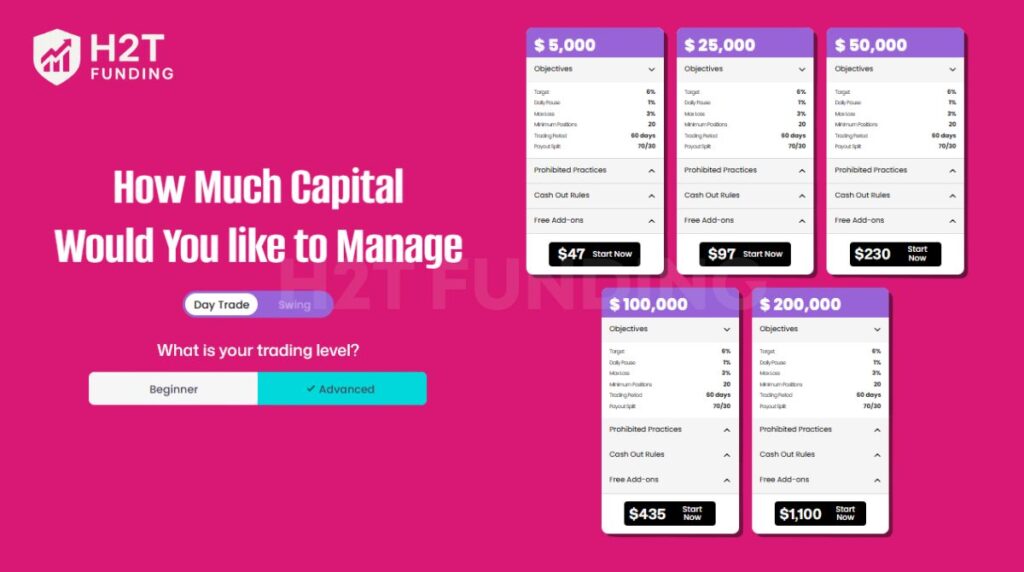

2.1.2. Advance account

The Advance account fits traders who like structure and accountability. It introduces a 60-day time frame and tighter drawdown control, rewarding consistency over speed. While cheaper in fees, it demands a disciplined approach to pass the evaluation phase.

| Criteria | Details |

|---|---|

| Account Size | $5K – $200K |

| Fee Range | $47 – $1,100 |

| Profit Target | 6% |

| Daily Pause | 1% |

| Max Loss | 3% |

| Min. Positions | 20 trades |

| Trading Period | 60 days |

| Profit Split | 70/30 |

| Consistency Rule | 30% (only during evaluation) |

| Trade Duration | Min 30 seconds |

| Trade Range | Min 10 cents |

| Cash-out Rules | Withdrawals every 14 days, no minimum profit days required |

| Free Add-ons | Real-time data free, Trading Booster optional (small acc) |

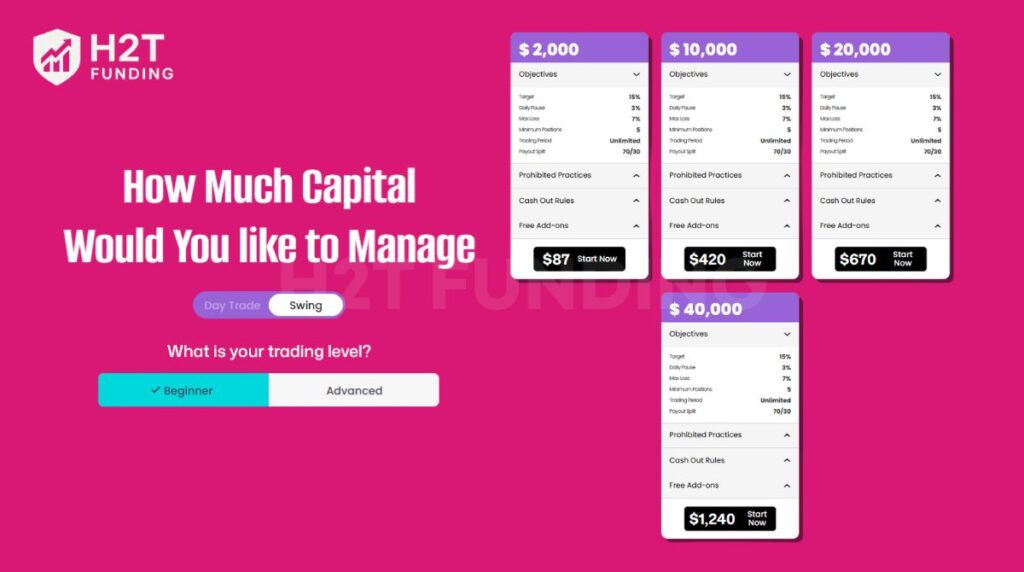

2.2. For swing trader

This program is designed for multi-day positions, making Trade The Pool swing trading a suitable choice for traders who prefer holding setups for several days.

2.2.1. Beginner account

The Beginner swing account allows unlimited time to achieve the 15% target while maintaining higher loss buffers. It’s designed for traders who manage multi-day positions and prefer a relaxed timeline to hit goals.

| Criteria | Details |

|---|---|

| Account Size | $2K – $40K |

| Fee Range | $87 – $1,240 |

| Profit Target | 15% |

| Daily Pause | 3% |

| Max Loss | 7% |

| Min. Positions | 5 trades |

| Trading Period | Unlimited |

| Profit Split | 70/30 |

| Consistency Rule | 50% |

| Trade Duration | Min 30 seconds |

| Trade Range | Min 10 cents |

| Cash-out Rules | Withdrawals every 14 days, at least 3 profit days with 0.5% |

| Free Add-ons | Real-time data free, Trading Booster optional (smaller acc) |

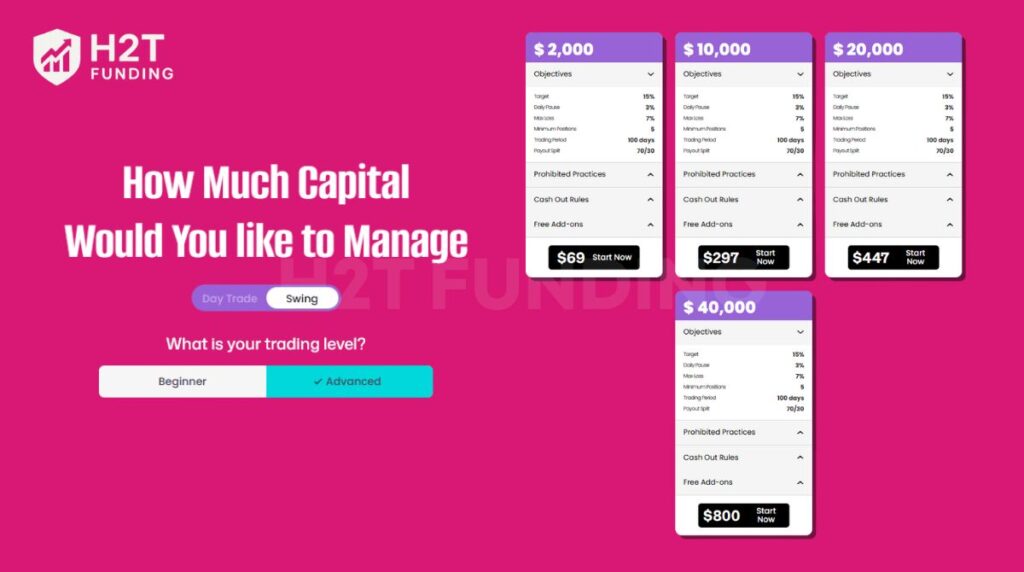

2.2.2. Advance account

The Advance swing account tightens the structure with a 100-day limit. The rules push traders to hit the 15% target under a deadline, with a consistency requirement applied during evaluation. Fees are lower, but you need a solid plan to succeed under the clock.

| Criteria | Details |

|---|---|

| Account Size | $2K – $40K |

| Fee Range | $69 – $800 |

| Profit Target | 15% |

| Daily Pause | 3% |

| Max Loss | 7% |

| Min. Positions | 5 trades |

| Trading Period | 100 days |

| Profit Split | 70/30 |

| Consistency Rule | 30% (only during evaluation) |

| Trade Duration | Min 30 seconds |

| Trade Range | Min 10 cents |

| Cash-out Rules | Withdrawals every 14 days, no minimum profit day required |

| Free Add-ons | Real-time data free, Trading Booster optional (small acc) |

Verdict on Trade The Pool funding program

When I look at Trade The Pool’s funding options, I see both strengths and weak spots. On the plus side, the choice between Flexible and Disciplined accounts feels practical.

I know some days I trade better without a countdown, so having the unlimited option makes sense. At the same time, I admit that a deadline can be useful; without it, I sometimes drag trades longer than needed.

The fees are another mixed bag. Starting small is affordable, but once you aim for $100K or $200K, the cost jumps quickly. Personally, I find that a bit hard to justify unless you’re confident in your strategy. I also think the consistency rules add structure, but they can feel restrictive, especially if your style relies on uneven profit distribution.

3. Trade The Pool rules

Trade The Pool is very clear about its trading framework. The firm doesn’t leave much to guesswork, which I appreciate because it reduces the chance of being caught out by vague rules. Still, some of these restrictions feel strict if you’re used to full freedom, so it’s important to understand what’s allowed and what’s off-limits before diving in.

3.1. Allowed trading practices

These are the trading activities you’re free to use under Trade The Pool’s framework. They give flexibility for both day and swing strategies, provided you respect volume and timing rules.

- Holding positions overnight (with minimum volume conditions)

- Weekend holds for swing accounts

- Pre-market and after-hours trading

- Use of Trader Evolution features (DOM, Level 2, market depth tools)

- Account growth through structured scaling when profit targets are hit

- Trading U.S. stocks and ETFs across different liquidity tiers

3.2. Prohibited trading practices

The firm also enforces a strict list of restrictions. These rules are designed to limit reckless behavior, though in practice, they may feel restrictive for active traders.

- Trading halted stocks or placing orders during halts

- Opening trades on symbols that move 8%+ in four minutes (high volatility ban)

- Holding or opening positions in stocks with earnings due the same day

- Overnight or pre/post-market trading in low-volume stocks (<200K regular, <20K extended)

- Positions closed in under 30 seconds or without a minimum 10-tick profit

- Inactivity for 14 days (in Flexible accounts) leading to disqualification

Verdict on Trade The Pool trading rules

I see these rules as a mix of support and challenge. On the positive side, the overnight and weekend options are a big plus, and the transparency makes planning trades easier. If you want a broader view of how different firms set their frameworks, you can also check this overview of prop firm rules for comparison.

On the downside, the volatility restrictions and profit cap rules can limit big wins, which feels frustrating if you thrive on momentum trading. Personally, I think these rules favor consistency over aggression, good for disciplined traders, but not ideal if your edge relies on high-volatility setups.

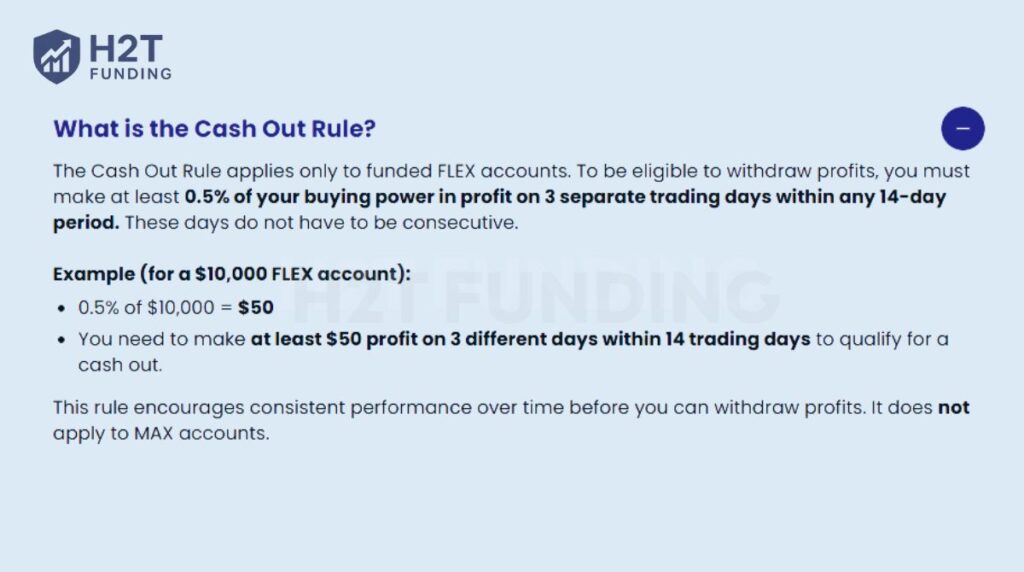

4. Trade The Pool payout rules

Payouts at Trade The Pool become available once you pass the evaluation and secure a funded account. The firm requires traders not only to reach profit goals but also to show consistent performance. This setup may feel demanding, but it reflects the standards of real capital allocation.

- Minimum profit: $300 net after closing all trades and orders

- Cycle: Payouts allowed every 14 days, starting from the funding date

- Consistency: At least 0.5% profit on three different days within the cycle (Flex accounts)

- Profit split: Standard 70/30, with higher tiers offering up to 80/20

- Payout methods: Bank wire, cryptocurrency, and in some cases, credit card or e-wallet

- Processing time: Usually 3–5 business days after approval

- Buffer rule: Once equity reaches 3× daily loss limit, the drawdown shifts to the initial balance; withdrawing too much after this reset can terminate the account

Verdict on Trade The Pool payouts

The multiple payout methods, including crypto and wire, make the process flexible compared to some firms. The $300 minimum is fair, though the consistency requirement may frustrate traders who rely on fewer but larger wins.

For me, the toughest element is the buffer reset; it forces careful planning, or else a withdrawal can put the whole account at risk. Overall, the payout system is reliable, but it suits disciplined traders more than those chasing big one-off trades.

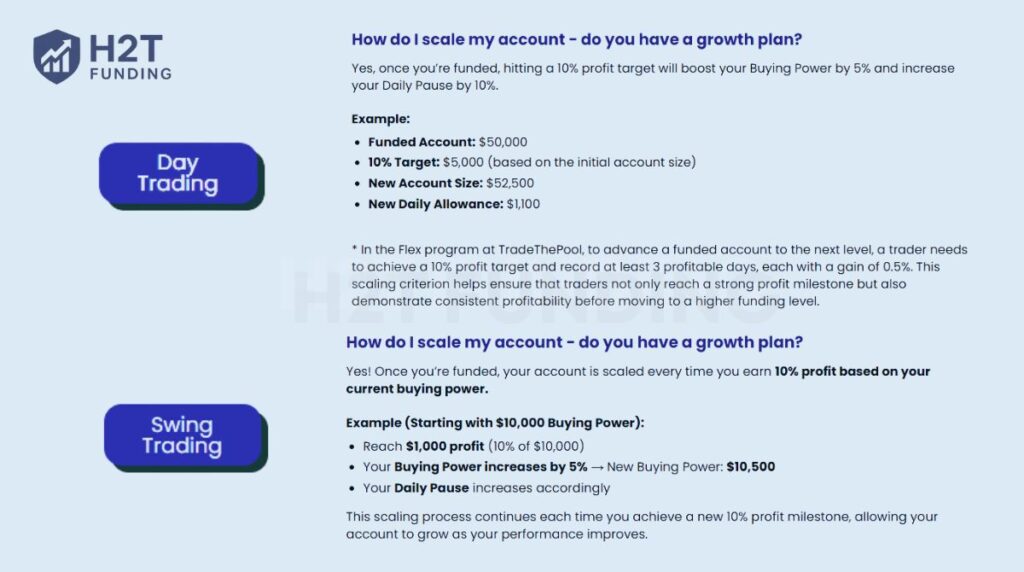

5. Trade The Pool scaling plan

Scaling at Trade The Pool is tied directly to profit milestones. Once you reach a 10% gain on your account, the firm boosts both your buying power and your daily pause limit. This design rewards consistency and gives traders more room to grow without rushing the process.

- Scaling trigger: Every 10% profit based on the initial account size

- Growth model: Buying power increases by 5% at each milestone

- Risk buffer: The daily pause level rises by 10%, giving slightly more tolerance for drawdowns

- Applies to both day trading and swing accounts after funding

- Progress continues each time you achieve a new 10% profit milestone

Example 1: If you start with a $50,000 funded account and earn $5,000 profit, your account scales to $52,500, and your daily pause rises from $1,000 to $1,100.

Example 2: On a smaller swing account with $10,000 buying power, hitting $1,000 profit boosts buying power to $10,500. The daily pause also adjusts upward, giving more breathing room as you grow.

Verdict on Trade The Pool scaling

The scaling model is straightforward and tied to clear numbers. Reach 10% and you unlock the next reward tier. This approach helps the firm stand out in the broader Trade The Pool competition among equity-focused prop firms.

The structure is easy to follow, reducing confusion and giving traders more confidence when planning their growth. However, the increases are incremental, so progress may feel slow for those expecting rapid jumps in buying power. Overall, this is a steady, reliable framework that works best for disciplined traders who prefer compounding gradually.

6. Cost & commissions of Trade The Pool

Like most prop firms, Trade The Pool charges commissions to cover transaction costs and to reflect real market trading. The good point is that rates are fixed and transparent, so there’s no hidden spread markup. Still, if you trade very actively, these small costs can add up over time.

- Commission rate: $0.005 (½ cent) per share

- Minimum charge: $0.75 per filled order

- Consistency: Same rates apply in both evaluation and funded accounts

Example 1: Buy 50 shares of AAPL in one order → commission = $0.75 (minimum applies)

Example 2: Buy 200 shares of AAPL in one order → commission = $1.00 (200 × $0.005)

Verdict on Trade The Pool commissions

I find the commission model fair since it mirrors what many direct-access brokers charge. For swing traders taking fewer positions, the costs are almost negligible. But if you scalp in and out of stocks with high volume, the minimum $0.75 per order can start to eat into profits.

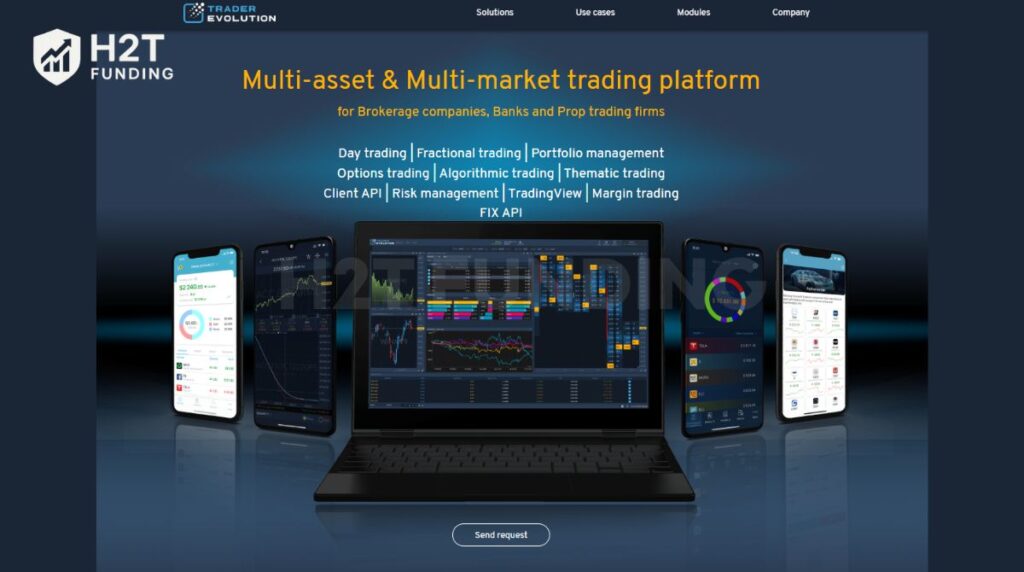

7. Trading platform

Trade The Pool equips its traders with TraderEvolution, a professional-grade platform tailored for active equity trading. The system is customized to fit the firm’s program rules, so it’s important to use the official documentation to avoid compliance mistakes.

- Desktop (Windows) client is the flagship, offering full functionality and advanced tools

- Mobile apps available for iOS and Android, supporting on-the-go monitoring

- Web-based client accessible across browsers for quick login without software installation

- Platform features include market depth, DOM (Depth of Market), scalper window, and stock scanners

- Customizations may differ from the vendor’s manual, so traders should rely on TTP’s own guides

- The firm reserves the right to change or upgrade systems at any time

Verdict on Trade The Pool trading platform

TraderEvolution gives direct access to professional tools like DOM and depth analysis, which many retail platforms lack. Having desktop, mobile, and web versions means I’m not tied to one setup, which fits modern trading habits. The only drawback is the learning curve; new users might find the system complex at first.

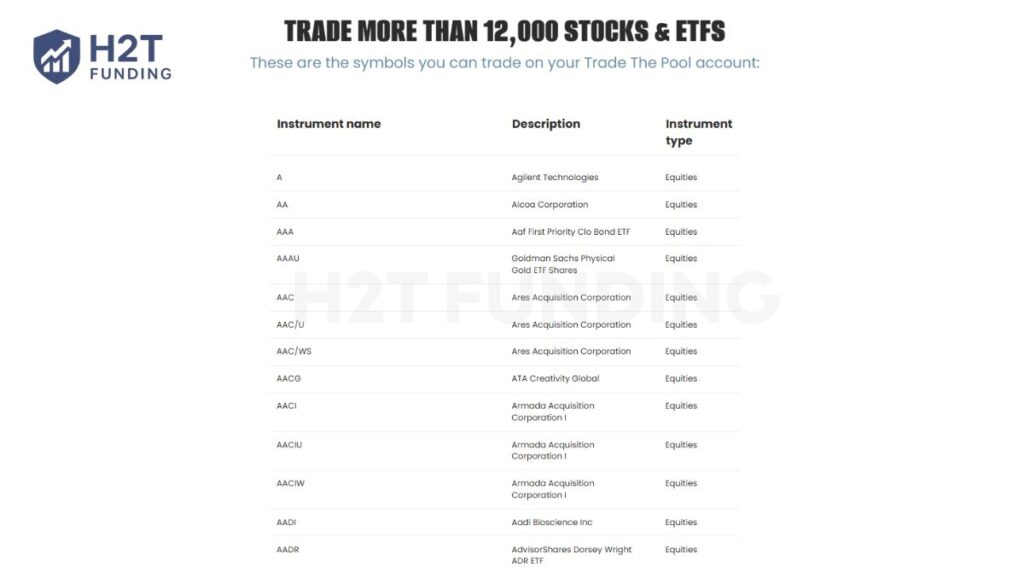

8. Trade The Pool instruments and trading hours

Trade The Pool gives traders access to a wide range of U.S. equity products. The selection includes common stocks and exchange-traded products, designed to reflect what professional equity desks typically trade. This makes it suitable for both short-term strategies and longer-term stock picking.

Available instruments include:

- Stocks listed on U.S. exchanges (Nasdaq and others)

- ETFs, ETNs, and other exchange-traded products (ETPs)

- Warrants and select equity-linked instruments

Trading is not limited to regular market hours. The platform also supports extended sessions, though with stricter conditions to manage risk.

Market hours covered:

- Regular trading hours: 09:30 – 16:00 ET (Monday–Friday)

- Pre-market: 04:00 – 09:40 ET (limit orders only)

- After-market: 16:00 – 20:00 ET (limit orders only)

- Stop loss and market orders do not trigger outside of regular hours

- U.S. market holidays may shorten or suspend trading, and traders must track these changes themselves

Verdict on Trade The Pool instruments and hours

The product coverage is strong for equity specialists; over 12,000 tradable symbols are more than enough to build strategies. Pre-market and after-hours access is a clear advantage, but the limit-order restriction in those sessions may frustrate momentum traders.

9. Education & resource

Trade The Pool mainly focuses on providing capital, but it does include some learning tools for traders. The resources are not as broad as what you’d find with large brokers, yet they cover key areas that help you adapt to the platform and refine your approach.

Educational resources available:

- Video on Demand covering trading concepts and platform use

- Trading books curated for equity-focused strategies

- Transition guides, such as Forex to Stocks and Futures to Stocks, for traders shifting asset classes

- Platform tutorials and walkthroughs for TraderEvolution

- Risk management guidelines and reminders tied to program rules

- Best practice notes on consistency, trade duration, and profit caps

Verdict on Trade The Pool education

TTP’s educational package is useful for onboarding, especially if you’re new to stocks after trading other markets. The transition guides are a smart touch. That said, the resources are fairly basic compared to firms with full academies or structured courses. I’d use TTP’s materials to get comfortable with the rules and platform, but I’d still rely on external education for deeper strategy development.

10. Customer support

Trade The Pool provides multiple ways for traders to reach out if they run into issues. The support team is available during fixed office hours, and while not all channels are offered, the basics are covered well enough for most situations.

Trade The Pool contact support availability:

- Office hours: Sunday–Thursday, 07:00 – 17:00 GMT; Fridays, 07:00 – 12:00 GMT

- Email support: help@tradethepool.com

- Live chat: Available directly on the official website

- Ticket system for structured requests

- FAQ section, covering common account and trading questions

- Active Trade The Pool Discord, where traders can ask questions, share setups, and follow announcements

- No phone, Telegram, or WhatsApp support

Many traders also check Trading Pool Discord review posts in community channels to see how responsive the moderators are and how helpful the server discussions can be.

Office locations:

- Headquarters: 2 HaTidhar Street, Raanana, Israel

- UK Office: Enstar House, 168 Praed Street, London, United Kingdom

Verdict on Trade The Pool customer support

The support coverage is decent but not exceptional. The email and live chat options are reliable, and the ticket system helps with tracking issues.

However, the absence of instant community channels like Discord or Telegram may feel limiting compared to other modern firms. The support hours suit European and Middle Eastern traders best, but U.S.-based traders may find the timing less convenient.

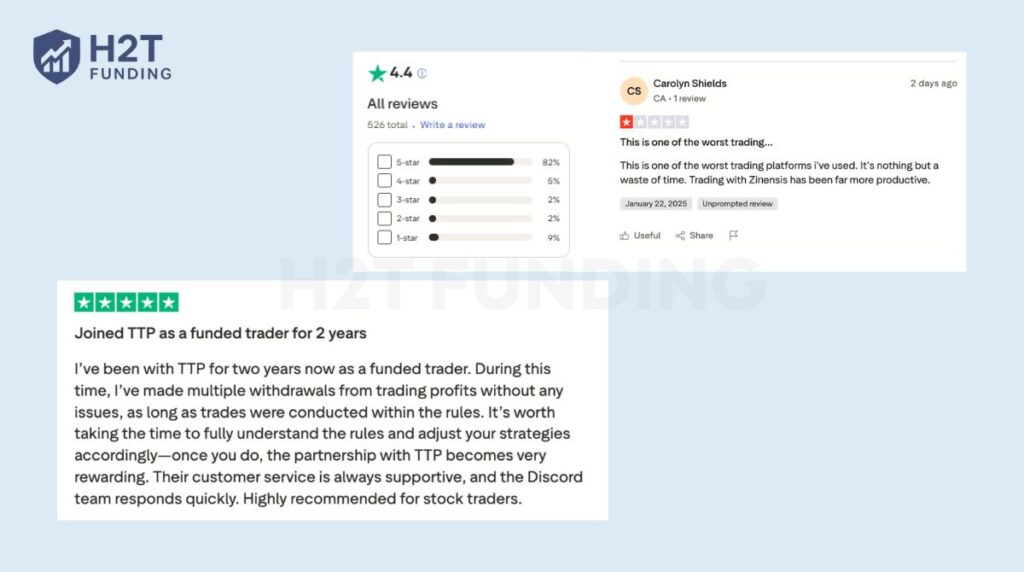

11. Real trader feedback on the community: Trade The Pool Reddit and Trustpilot

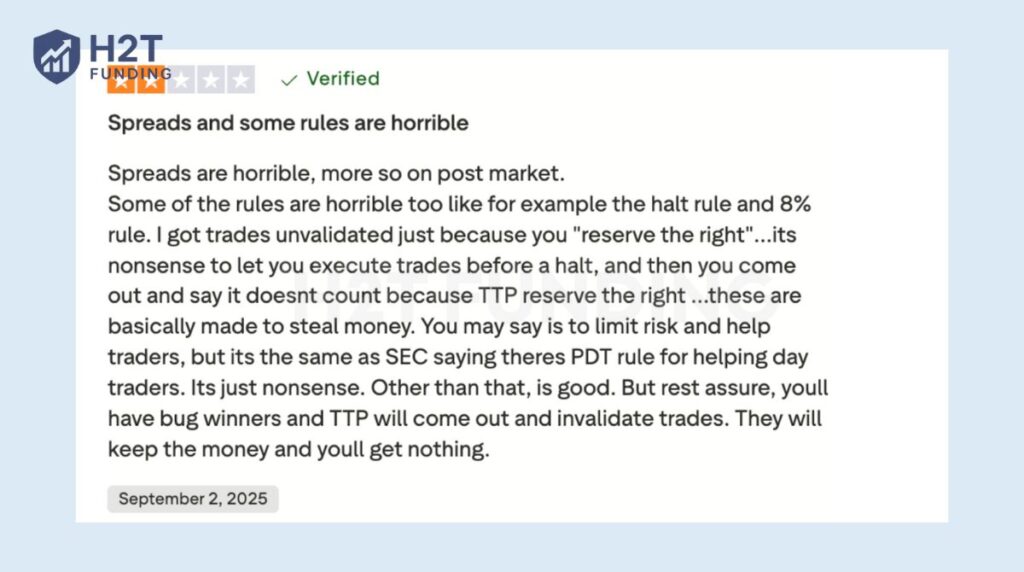

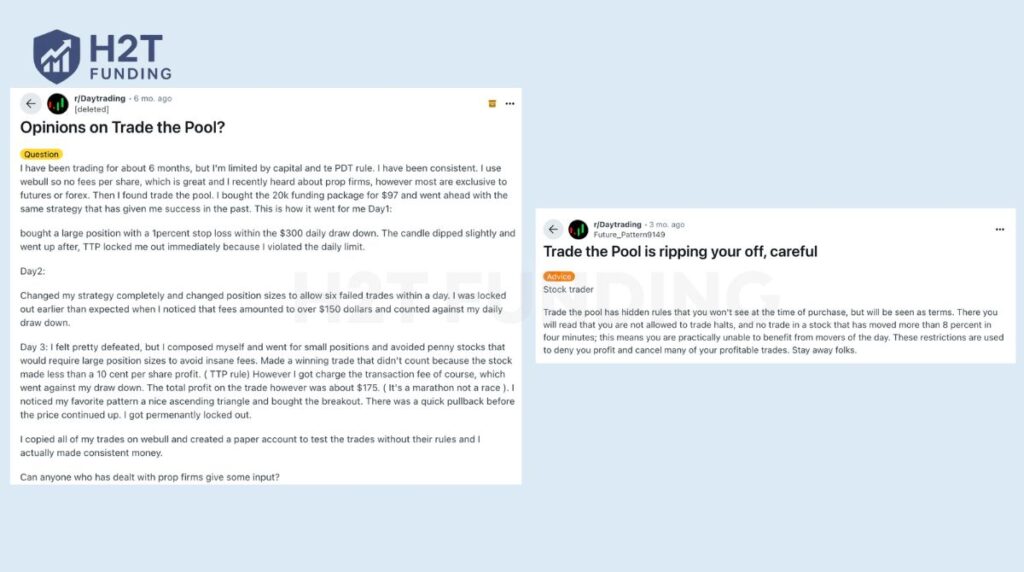

Trade The Pool currently holds a 4.4/5 rating on Trustpilot, with 82% of reviews being 5-star, and a similar sentiment is evident in many Trade The Pool review Reddit discussions. This suggests that most traders find the firm reliable, though there remains a notable minority voicing serious concerns.

Many traders report smooth payouts when they stick to the rules. One long-term user who has been with TTP for over two years shared that they made multiple withdrawals without issues and praised the quick response of customer support.

But not all experiences are glowing. Some traders complain about high spreads, especially in post-market trading, and strict enforcement of rules such as the halt rule or the 8% volatility restriction. These conditions sometimes lead to trades being invalidated, which leaves users frustrated.

Opinion on Trade The Pool reviews Reddit are split. Certain traders warn about “hidden rules” that only become clear after purchase, like restrictions on halted stocks or volatile movers. Others describe struggling in their first days due to fees and drawdown limits, but note that adapting strategies could make TTP workable.

The reputation of Trade The Pool is mixed but leans positive. Most satisfied users emphasize that success depends on carefully understanding the rules, while critics argue that those same rules can feel restrictive. For traders willing to play within these boundaries, TTP appears to deliver on payouts and support.

12. How to sign up with The Pool Trader

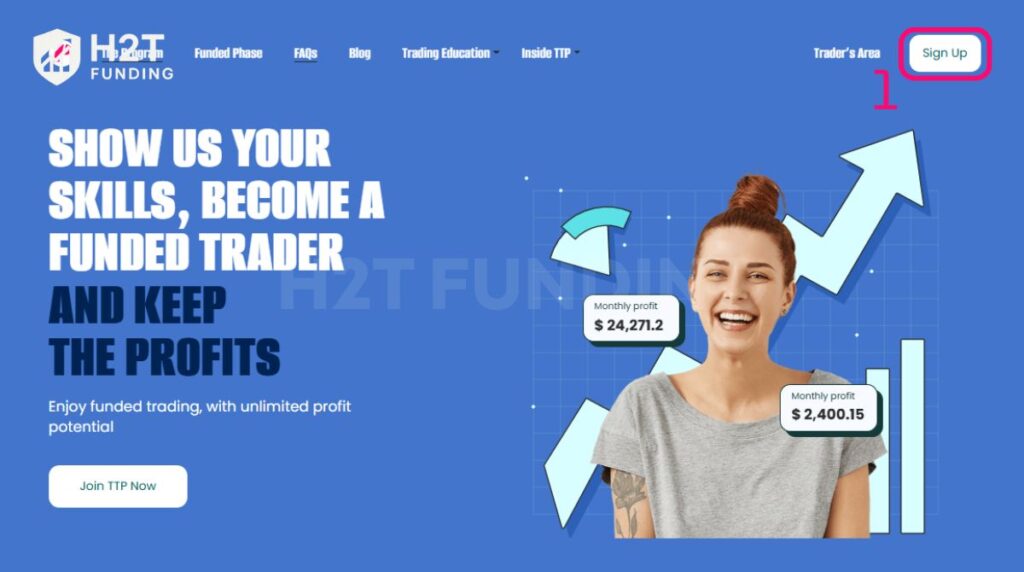

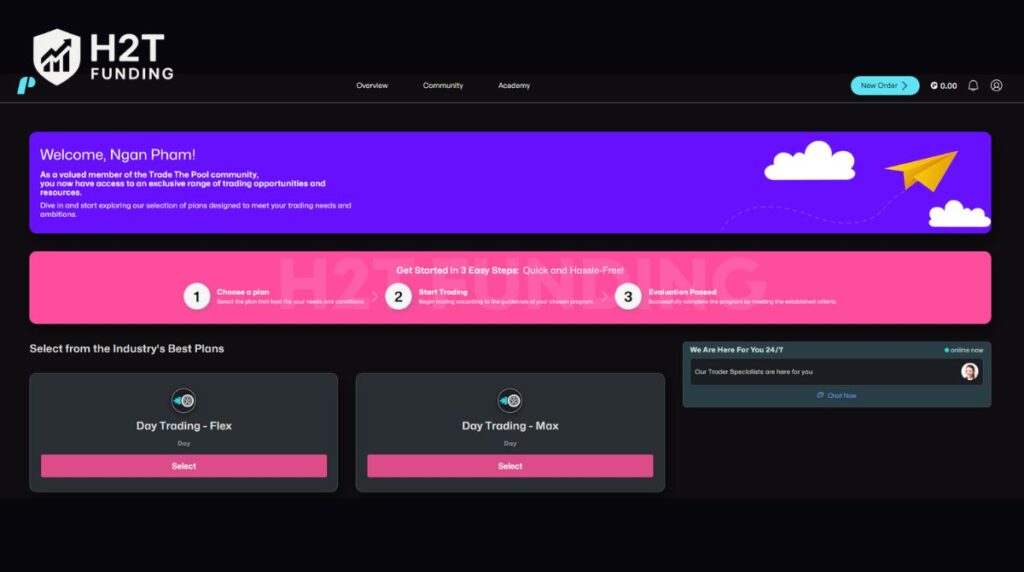

Getting started with Trade The Pool is a straightforward process, but it does require proper verification before you can access a funded account. The steps are designed to ensure both compliance and security, while giving traders a quick path to the dashboard.

12.1. Step 1: Go to the official website

Head over to Trade The Pool’s homepage and click on the “Sign Up” button. This will open the registration page, where you begin creating your account.

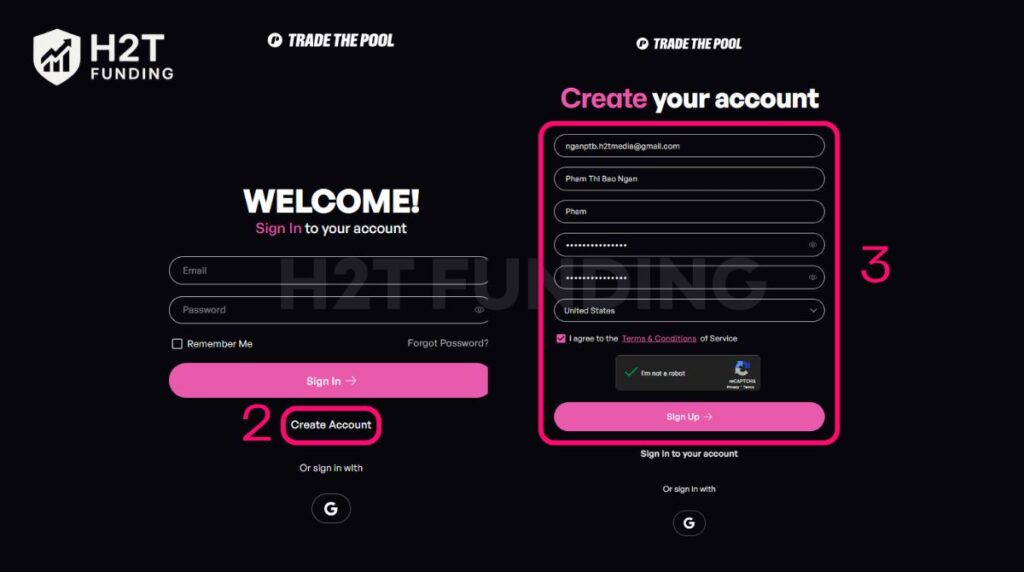

12.2. Step 2: Fill in your basic details

Provide your full name, country of residence, email address, and create a strong password. Confirm the form with the security check and submit it.

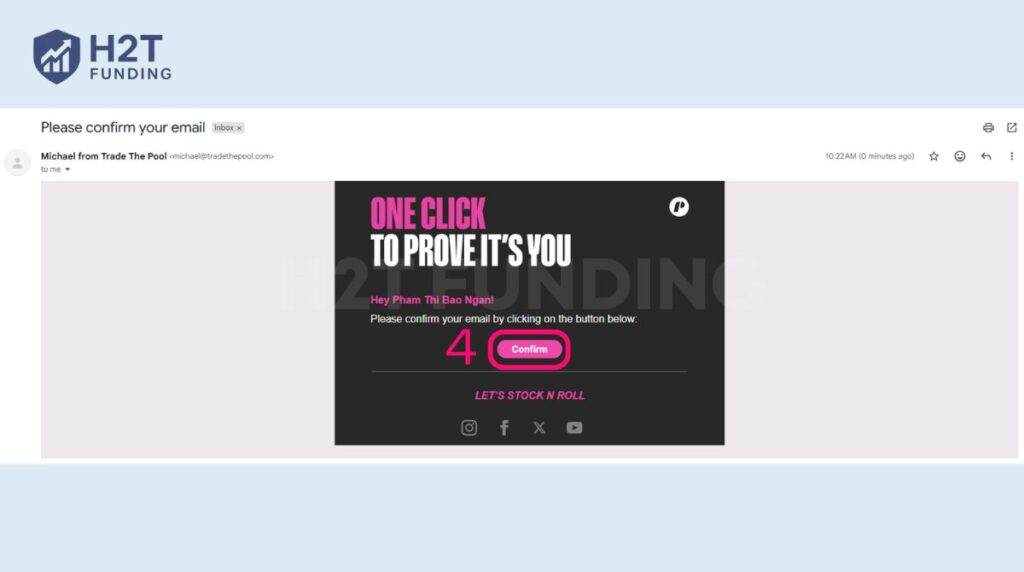

12.3. Step 3: Confirm your email

An activation link will be sent to your inbox. Clicking this link verifies your account and unlocks access to the client area.

12.4. Step 4: Complete KYC verification

Inside the dashboard, you’ll be asked to provide additional details like your date of birth, phone number, and address. You will also need to upload identity documents, such as a passport or driver’s license, and proof of address, like a utility bill or bank statement.

After you finish these steps, you can explore the evaluation programs, pick a funding level that fits you, and start trading according to TTP’s rules.

13. Compare Trade The Pool vs other prop firms

When deciding on a prop firm, it’s useful to compare Trade The Pool with other major players. Each firm has different funding models, evaluation phases, and market coverage, which makes them attractive to different types of traders.

| Criteria | Trade The Pool | Ment Funding | FXRK | Finotive Funding |

|---|---|---|---|---|

| Challenge Fee | $47 – $1,475 | $250 – $17,200 | $59 – $999 | $29 – $2,699 |

| Account Types | 1-step (Day & Swing) | 1-step evaluation | 1-step & 2-step | 1-step, 2-step, Instant Funding |

| Profit Split | 70% – 80% (some upgrades) | 75% – 90% | 80% – 90% | 65% – 100% |

| Account Size | $2K – $200K | $25K – $2M | $5K – $200K | $2.5K – $200K |

| Time Limit | Unlimited / 60–100 days depending on program | No time limit | No time limit | No time limit |

| Profit Target | 6% – 15% | 10% | 5% – 10% | 5% – 10% |

| Trading Platforms | TraderEvolution | MT4, MT5, Match Trader, DXTrade, cTrader | MT4, MT5 | MT5 |

| Markets Offered | Stocks & ETFs only | Forex, Crypto, Indices, Commodities, Stocks | Forex, Commodities, Stocks, Bonds, Futures, Digital assets | FX, Metals, Indices, Energy, Crypto, Stocks, CFDs |

| Scaling Plan | Yes, +5% BP & +10% DD after 10% profit | Yes | Yes | Yes |

| Unique Features | Backed by The5ers, focused on stock trading | Large account sizes up to $2M | Budget-friendly with low fees | Instant funding and 100% profit share option |

Summary:

- Trade The Pool is ideal for stock-focused traders who want access to U.S. equities and ETFs, but its strict rules may not suit high-frequency or news traders.

- Ment Funding fits those seeking very large account sizes and broader market access, though challenge fees are high.

- FXRK appeals to budget-conscious forex and multi-asset traders, offering flexible step options without time pressure.

- Finotive Funding is attractive for those who want instant funding or maximum profit share, but it requires comfort with MT5-only trading.

14. Countries restricted by Trade The Pool

While Trade The Pool aims to be a global prop firm, there are several regions where its services are not available. These restrictions are mainly due to compliance, regulatory limits, or risk management concerns. If you reside in one of the following countries, you cannot open an account or participate in any of TTP’s funding programs.

Restricted countries include:

- Afghanistan

- Burundi

- Central African Republic

- Cuba

- Congo Republic

- Crimea

- Democratic Republic of Congo

- Eritrea

- Guinea

- Guinea-Bissau

- Iraq

- Iran

- Israel

- Laos

- Lebanon

- Liberia

- Libya

- Myanmar

- North Korea

- Palestinian Territory

- Papua New Guinea

- South Sudan

- Sudan

- Somalia

- Syria

- Vanuatu

- Venezuela

- Yemen

Important note: Even if you try to register with a VPN, Trade The Pool officially blocks access from these territories. Traders should always check the firm’s updated terms of service before attempting to sign up.

15. FAQs

Yes, Trade The Pool is a legitimate prop firm backed by the same team that runs The5ers, a well-established name in the industry. It has been operating since 2022 and is registered in Israel, with an office in the UK.

You can trade U.S. equities, including stocks, ETFs, ETNs, warrants, and other exchange-traded products. Forex, crypto, and futures are not available.

Yes, short selling is allowed, even on penny stocks, provided the symbol is available on the platform and meets minimum volume requirements.

Once you pass the evaluation phase and complete KYC verification, funded accounts are usually activated within a few business days.

If you fail to reach the profit target or break a rule, your evaluation account closes. You can purchase a reset or start a new challenge to try again.

Yes, swing accounts allow overnight and weekend positions, but the stock must meet minimum liquidity requirements. Day trading accounts do not allow weekend holds.

Payouts are available every 14 days once you’ve earned at least $300 in net profits. Flex accounts also require three separate profit days of 0.5% or more. Payments are made via bank wire, crypto, or e-wallets.

Trade The Pool charges $0.005 per share with a minimum of $0.75 per order. This applies equally to evaluation and funded accounts.

Yes, TTP offers a 14-day free trial where traders can test the platform and rules before paying for a challenge.

The key difference is its focus on real stock trading rather than CFDs or forex. TTP also uses TraderEvolution as its platform and links directly to Interactive Brokers for execution.

Traders can access accounts up to $200K initially, with scaling options that allow balances to grow beyond this if consistent profits are achieved.

Yes, pre-market (04:00–09:40 ET) and after-market (16:00–20:00 ET) sessions are available, but only limit orders are allowed during these times.

16. Conclusion

Trade The Pool prop firm built for stock traders who want access to U.S. equities and ETFs without risking personal capital. Its clear rules, structured funding programs, and connection to The5ers make it a legitimate choice for disciplined traders.

Still, strict volatility limits and equity-only focus mean it won’t be the right fit for everyone. If your goal is consistency and gradual scaling, this prop firm can be a strong partner.

For traders researching alternatives, H2T Funding has a dedicated section on prop firm reviews where you can compare Trade The Pool with firms like Topstep, FXRK, and Finotive. Exploring these, like the Tradethepool review, will help you find the funding model, profit split, and trading conditions that best match your style.