When a close friend of mine passed The 5ers Bootcamp and received his first funded account within weeks, I knew this prop firm deserved a deeper look.

As someone who’s worked closely with multiple proprietary trading models and regularly consults for traders navigating the prop space, I’ve seen how the right firm can shape, or stall, a trader’s journey.

In this 5ers prop firm review, I’ll walk you through the platform’s biggest strengths, its limitations, and whether the evaluation fee truly delivers value.

Whether you’re a trader eyeing a low-risk pathway to scale capital or just comparing your options, this honest breakdown will help you decide if The5ers is the right fit for your trading goals.

Disclaimer: Rules, pricing, and trading conditions may change over time. Traders should always verify the latest terms directly on the official The5ers websites before purchasing any challenge.

1. Our Take on The 5ers

The5ers, founded in 2016 by Gil Ben Hur, is a globally recognised prop trading firm headquartered in Israel with an office in London.

It empowers traders by providing access to funded accounts up to $4 million, focusing on forex, commodities, indices, and cryptocurrencies. Known for its trader-friendly approach, The5ers has earned a stellar 4.9/5 rating on Trustpilot from over 15,000 reviews.

What sets The5ers apart is its flexible evaluation process with no time limits, allowing traders to progress at their own pace.

The firm offers three distinct funding programs: Bootcamp, High Stakes, and Hyper Growth, catering to various skill levels and trading styles. Its commitment to transparency and robust support makes it a top choice for serious traders.

Here’s a snapshot of The5ers’ key features:

1. Funding programs:

- Bootcamp: Low-cost entry ($95-$350), three-phase evaluation, ideal for beginners.

- High stakes: Two-phase challenge ($39-$545), suits experienced traders, accounts up to $100,000.

- Hyper growth: Instant funding ($260-$850), up to 100% profit split, for confident traders.

2. Trading conditions:

- Platform: MetaTrader 5 (MT5) with spreads from 0.0 pips.

- Leverage: Up to 1:100, depending on the program.

- Assets: Forex, metals, indices, crypto, and stocks (via dedicated accounts).

3. Pros and cons:

- Pros: No evaluation time limits, high profit splits (50%-100%), responsive support, and extensive educational resources.

- Cons: Evaluation fees may be steep for beginners, strict 5% daily drawdown limit.

| Feature | Details |

|---|---|

| Trustpilot rating | 4.9/5 (15,000+ reviews) |

| Profit split | 50%-100% based on program and performance |

| Account scaling | Up to $4 million with consistent 10% profit milestones |

| Evaluation time limit | None, trade at your own pace |

| Support | Live chat, email, phone (7:00-17:00 GMT, Sunday-Thursday) |

The5ers stands out for its clear rules, competitive trading conditions, and focus on long-term trader growth. While evaluation fees and strict drawdown rules may challenge newcomers, the firm’s scalability and support make it ideal for disciplined traders.

For those seeking a reliable prop firm, The5ers offers a structured path to manage significant capital.

2. Funding programs at The5ers

The5ers offers three distinct funding programs tailored to different trader profiles, experience levels, and risk appetites: Bootcamp, High Stakes, and Hyper Growth. Each program provides a pathway to trade with significant capital, up to $4 million, while emphasising discipline and risk management.

To provide a clear comparison, a table summarising the key features of these programs is included after the detailed breakdowns. Whether you’re a novice or a seasoned trader, The5ers has a program to align with your strategy and ambitions.

| Feature | Bootcamp | High Stakes | Hyper Growth |

|---|---|---|---|

| Account sizes | $20,000 $100,000 $250,000 | $5,000 $10,000 $20,000 $60,000 $100,000 | $10,000 $20,000 $40,000 |

| Entry fee | $95-$225 (plus $205-$525 if funded) | $39-$545 (refunded if funded) | $260-$850 (non-refunded) |

| Evaluation phases | 3 (6% profit target each) | 2 (8% phase 1, 5% phase 2) | None (instant funding) |

| Profit split | 50%-100% | 80%-100% | 50%-100% |

| Daily drawdown | 4% | 5% | 3% |

| Total drawdown | 8% | 10% | 6% |

| Leverage | Up to 1:10 | Up to 1:100 | Up to 1:30 |

| Scaling | 5% per 5% profit, up to $4M | Double per 10% profit, up to $4M | Double per 10% profit, up to $4M |

| Minimum profitable days | None | 3 per phase (0.5% min profit) | None |

| Payout frequency | Bi-weekly, first after 14 days | Bi-weekly, first after 14 days | Bi-weekly, first after 14 days |

| Best for | Beginners, cost-conscious traders | Experienced, high-risk traders | Confident traders seeking instant funding |

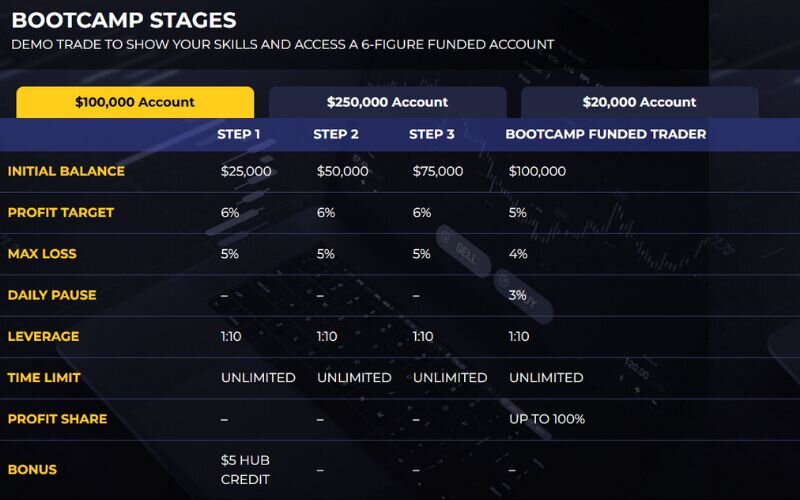

2.1. Bootcamp program

The Bootcamp Program is The5ers’ most affordable entry point, designed for traders who want to prove their skills with minimal upfront investment. It features a three-phase evaluation on demo accounts, emphasising consistency, discipline, and sound risk management.

Key program features include The 5ers bootcamp rules:

- Stop-loss required: All trades must include an SL, with a maximum 2% risk per position.

- Violation policy: 5 SL violations lead to account termination.

- Daily loss pause (funded only): If a funded trader loses 3% in one day, trading is paused until the next session.

- Trading rules:

- Holding positions overnight and on weekends is allowed (higher swaps on indices).

- News trading is permitted, except for bracket orders during major events.

- Inactivity rule: Accounts inactive for 14+ days are closed, unless manually frozen through the dashboard.

- Leverage: Up to 1:10, applicable to forex, metals, indices, and stocks.

- No minimum trading days: Traders can complete each phase at their own pace.

Once funded, traders start with a 50/50 profit split, which increases as account equity grows:

- 75% at $25,000

- 80% at $2 million

- 100% at $2.5 million

Additionally, scaling continues in 5% increments for every 5% profit earned, up to $4 million. High-performing traders also unlock monthly salaries, starting at $4,000/month from $350,000, and $10,000/month once $500,000 is reached.

Bootcamp program fee structure

| Account Size | Step 1 Balance | Step 2 Balance | Step 3 Balance | Funded Account | Initial Fee | Final Fee |

|---|---|---|---|---|---|---|

| $20,000 | $5,000 | $10,000 | $15,000 | $20,000 | $95 | $205 |

| $100,000 | $25,000 | $50,000 | $75,000 | $100,000 | $225 | $350 |

| $250,000 | $50,000 | $100,000 | $150,000 | $250,000 | $350 | $500 |

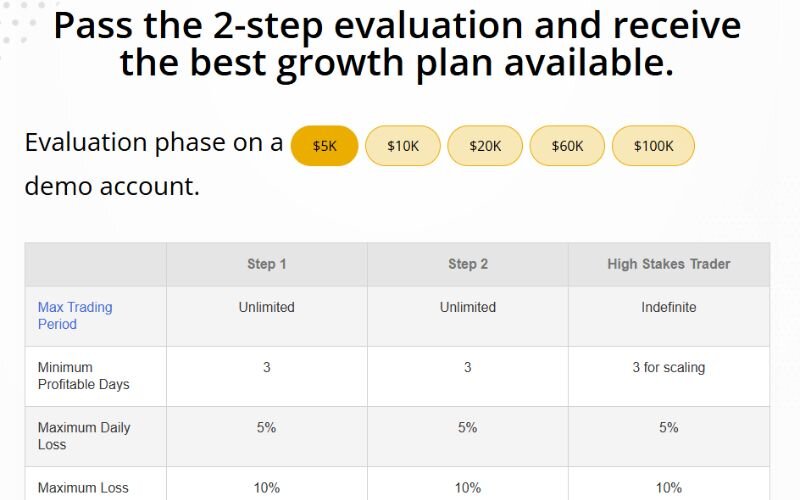

2.2. High Stakes program

The High Stakes Program is tailored for seasoned traders who are comfortable with risk and aim for aggressive growth. This two-phase evaluation offers 1:100 leverage, refundable entry fees, and profit splits up to 100%, making it one of the most rewarding paths for high-performance traders.

Key program features include:

- Stop-loss rule: Not mandatory, but strict risk control is essential to stay within the 5% daily and 10% total drawdown limits.

- Profit day requirement: Traders must log at least 3 profitable days per phase, with a minimum of 0.5% gain per day to progress.

- Daily drawdown cap: A 5% daily loss, calculated from the previous day’s closing balance, triggers evaluation failure or funded account pause.

- Trading rules:

- Holding trades overnight and through weekends is allowed.

- News trading is permitted, except for bracket orders within ±2 minutes of high-impact events.

- Inactivity rule: Accounts are deactivated after 30 consecutive days without trading activity.

- Leverage: Up to 1:100 on all supported asset classes, including forex, metals, indices, crypto, and stocks.

- No time limit: Traders have unlimited time to complete each phase as long as the account remains active.

Scaling plan & trader benefits of high stakes program:

Once funded, traders begin with an 80% profit split, which increases as performance milestones are met:

- 100% profit split at higher funding levels

- Scaling follows a 10% profit = 10% account growth model

In addition, funded traders receive fixed monthly salaries:

- $4,000/month at $350,000 account level

- $10,000/month at $500,000

The maximum funding path reaches $4 million for consistent, high-performing traders.

| Account Size | Profit Target | Max Loss | Leverage | One-Time Fee | Profit Share |

|---|---|---|---|---|---|

| $5,000 | 8% (Step 1), 5% (Step 2) | 10% | 1:100 | $39 | 80% – 100% |

| $10,000 | 8% (Step 1), 5% (Step 2) | 10% | 1:100 | $68 | 80% – 100% |

| $20,000 | 8% (Step 1), 5% (Step 2) | 10% | 1:100 | $165 | 80% – 100% |

| $60,000 | 8% (Step 1), 5% (Step 2) | 10% | 1:100 | $329 | 80% – 100% |

| $100,000 | 8% (Step 1), 5% (Step 2) | 10% | 1:100 | $545 | 80% – 100% |

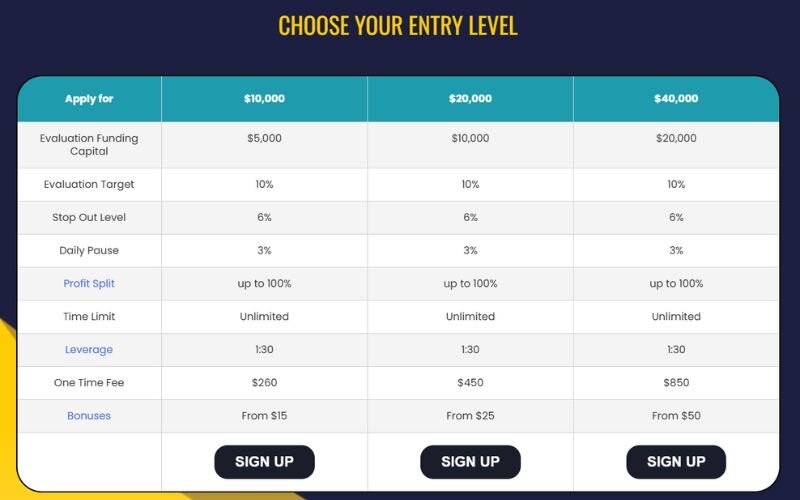

2.3. Hyper Growth program

The Hyper Growth Program is The5ers’ most aggressive funding track, offering traders immediate access to live capital, no evaluation phase required.

Traders start with a funded capital of $5,000 to $20,000, depending on their chosen plan. Every time a 10% profit target is reached, the account doubles in size, with potential to grow up to $4 million. Unlike other models, the profit split can reach 100%, and traders also earn bonus payouts on top of performance milestones.

Key program features include:

- Instant funding: No demo phase, traders are funded with live capital from day one.

- Aggressive scaling: Double your account every time you reach a 10% profit target, up to $4 million.

- Profit split structure: Starts at 50% and can grow to 100% as traders meet scaling milestones.

- Bonus rewards: Traders receive cash bonuses to their HUB after completing each level, on top of their profit share.

- No time restrictions: Unlimited time to scale. Complete Level 1 as soon as the target is hit, no minimum days or trades required.

Flexible strategy rules:

- Holding positions overnight and on weekends is allowed

- News trading is allowed (excluding bracket strategies near major events)

- Indices may carry higher weekend swap rates

Risk controls:

- Stopout level: 6% max loss from initial capital; hitting this level terminates the account

- Daily loss pause: 3% daily loss temporarily disables the account until the next trading day (00:00 MT5 server time)

Payouts and activity rules:

- First payout is eligible 14 days after funding; subsequent payouts are every two weeks

- Payout cycle resets each time the account is scaled

- Inactive accounts (30+ days) will be closed

Supported markets: Forex, metals, indices, and cryptocurrencies

| Applied Account Size | Funded Capital | Profit Target | Stopout (Max Loss) | Daily Loss Pause | Leverage | Profit Split | One-Time Fee |

|---|---|---|---|---|---|---|---|

| $10,000 | $5,000 | 10% | 6% | 3% | 1:30 | Up to 100% | $260 |

| $20,000 | $10,000 | 10% | 6% | 3% | 1:30 | Up to 100% | $450 |

| $40,000 | $20,000 | 10% | 6% | 3% | 1:30 | Up to 100% | $850 |

The5ers provides three distinct funding programs, each tailored to different trading styles and risk appetites. The Bootcamp has a structured evaluation process. High Stakes is ideal for high leverage and faster scaling, while Hyper Growth enables scaling up to $4M. Each program comes with its own set of rules and payout terms, so traders need to evaluate them carefully before committing.

3. Trading rules and conditions

The5ers’ trading rules ensure traders demonstrate skill and discipline while protecting the firm’s capital. These rules vary by program (Bootcamp, High Stakes, Hyper Growth) but focus on drawdown limits, profit targets, and trading restrictions. The table below summarises the key rules for clarity.

| Rule | Bootcamp | High Stakes | Hyper Growth |

|---|---|---|---|

| Daily drawdown | 4% of the previous day’s equity/balance | 5% of the previous day’s equity/balance | 3% of the previous day’s equity/balance |

| Total drawdown | 8% of the initial balance | 10% of the initial balance | 6% of the initial balance |

| Profit target | 6% per phase (3 phases) | 8% (Phase 1), 5% (Phase 2) | 10% for scaling milestones |

| Minimum profitable days | None | 3 per phase (0.5% min profit/day) | None |

| Stop-loss requirement | Max 2% risk per position | Recommended, not mandatory | Recommended, not mandatory |

| News trading | Allowed | No orders 2 min before/after red news | Allowed |

| Leverage | Up to 1:10 | Up to 1:100 | Up to 1:30 |

| Inactivity period | 14 days | 30 days | 30 days |

Key notes for traders:

- Exceeding drawdown limits results in account termination.

- Prohibited strategies include high-frequency trading, arbitrage, and system exploitation.

- Demo accounts are used during evaluations; successful trades may be mirrored in live accounts managed by The5ers’ professionals.

- No time limits for evaluations, but accounts expire after inactivity (pause via dashboard to avoid this).

Tip: Use stop-losses and small position sizes to stay within drawdown limits, especially in volatile markets.

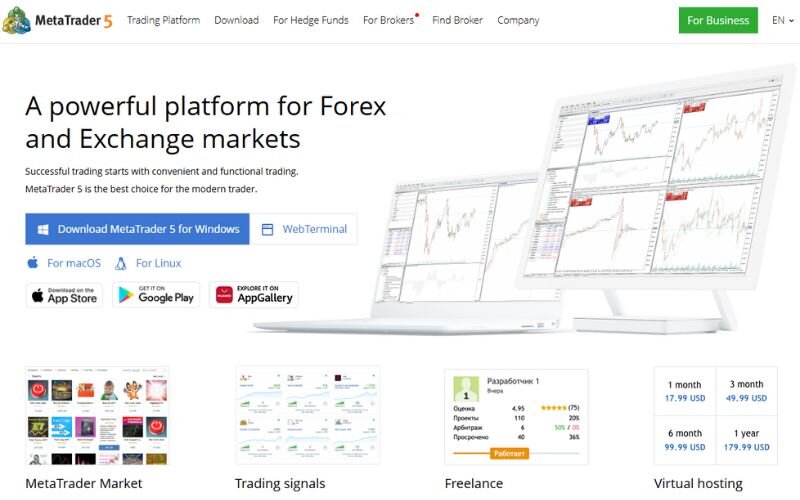

4. Trading platform and tools

In this 5ers prop firm review, it’s evident that The5ers equips traders with a reliable and flexible technology stack. The firm offers two trading platforms, MetaTrader 5 (MT5) and Match-Trader, each designed to suit different experience levels and trading styles.

MetaTrader 5 (MT5)

MetaTrader 5 is the primary platform used by The5ers across most challenges and funded accounts. Known for its speed, depth, and automation capabilities, MT5 is best suited for traders looking for advanced charting and algorithmic strategy execution.

Key features of MT5 with The5ers:

- Multi-asset access: Trade forex, indices, metals, crypto, and stocks

- Advanced tools: Over 30 indicators, 9 chart timeframes, and full customisation

- Expert Advisor support: Automated trading enabled via EAs

- Low spreads & high leverage: Spreads from 0.0 pips; leverage up to 1:100 (varies by program)

- Device flexibility: Available on desktop, browser, and mobile (iOS & Android)

Traders are granted MT5 access immediately after joining any challenge or program. Setup is straightforward, with credentials delivered via email and accessible through the trader HUB.

Trader Dashboard & Proprietary Tools

Beyond the platforms, The5ers provides a proprietary trader dashboard and downloadable custom indicators to help traders stay compliant and manage capital effectively.

- Dashboard functions: Monitor drawdown, profit targets, and trade history; pause inactive accounts

- Exclusive indicators:

- Max Position Size Tool: Calculates the largest allowed position based on current equity.

- Risk Exposure Tool: Displays total risk in real time across all open positions.

- Educational support: Live trading rooms, weekly webinars, and Portfolio Analyst sessions guide traders on strategy and performance

These additions further reinforce The5ers’ commitment to transparency and trader development, hallmarks of a credible prop firm, as seen across multiple reviews, including this The5ers H2T Funding review.

Whether you’re a seasoned trader using automated systems on MT5 or a beginner seeking simplicity, The5ers ensures a flexible and well-supported trading environment. Their platforms are paired with risk tools, education, and real-time dashboards, creating a comprehensive ecosystem for traders at all levels.

5. Costs and profit sharing

The5ers offers transparent pricing and attractive profit-sharing models across its funding programs. Costs involve one-time evaluation fees, while profit splits start at 50% and can reach 100% based on performance.

| Feature | Bootcamp | High Stakes | Hyper Growth |

|---|---|---|---|

| Entry fee | $95-$225 (plus $205-$525 if funded) | $39-$495 (refunded if funded) | $260-$850 (non-refunded) |

| Profit split | 50%-100% | 80%-100% | 50%-100% |

| Payout frequency | Bi-weekly, first after 14 days | Bi-weekly, first after 14 days | Bi-weekly, first after 14 days |

| Payout methods | Bank transfer, Crypto, Riseworks | Bank transfer, Crypto, Riseworks | Bank transfer, Crypto, Riseworks |

| Min. withdrawal | $150 | $150 | $150 |

Key notes for traders:

- Bootcamp’s low initial fee is ideal for beginners, but additional costs apply if funded.

- High Stakes fees are refunded upon passing, making it cost-effective for skilled traders.

- Hyper Growth’s higher fees reflect instant funding, with no evaluation needed.

- Profit splits scale with performance; hitting 10% profit milestones often unlocks 100% splits.

- Payouts are processed every two weeks via bank transfer, cryptocurrency, or Riseworks, with a $150 minimum.

Tip: Compare fees to your budget and trading confidence to choose the best program.

6. Financial Markets and Leverage

A crucial part of any 5ers prop firm review is understanding what traders can access in terms of markets and leverage. The5ers offers exposure to a total of 38 trading instruments, spanning multiple asset classes. This balanced selection gives traders the ability to apply diverse strategies across global financial markets.

Available Markets

The5ers provides access to four main asset classes:

| Asset Class | Number of Instruments | Examples |

|---|---|---|

| Forex Pairs | 26 | EUR/USD, GBP/USD, USD/JPY, AUD/CAD, EUR/JPY |

| Indices | 6 | NAS100, US30, SP500, DAX30, UK100, JPN225 |

| Commodities | 4 | Gold (XAU/USD), Silver (XAG/USD), US Oil, UK Oil |

| Cryptocurrencies | 2 | Bitcoin (BTC/USD), Ethereum (ETH/USD) |

Forex dominates the list, offering a wide range of both major and minor currency pairs. Traders who specialise in macro strategies can benefit from the inclusion of global indices, while those looking to diversify into physical assets can trade metals and oil. Crypto enthusiasts also have access to the two most liquid coins, Bitcoin and Ethereum, offering volatility and opportunity.

Leverage Breakdown

Leverage varies depending on the program and asset class. The High Stakes Program is the most aggressive, providing up to 1:100 leverage on forex pairs. This is particularly attractive for experienced traders looking to maximise position size.

Typical leverage limits include:

- Forex: up to 1:100

- Commodities: approximately 1:33

- Indices: around 1:25

- Cryptocurrencies: lower, often capped at 1:2 due to high volatility

This structure gives traders the flexibility to apply risk based on strategy and market type. However, The5ers enforces strict drawdown rules to ensure that leverage is used responsibly.

7. Real trader reviews of The5ers Trustpilot ratings

The5ers has built a strong reputation among traders, reflected in thousands of reviews across platforms like Trustpilot, Reddit, and X. These reviews highlight the firm’s reliability, support, and funding opportunities, though some users note challenges with strict rules.

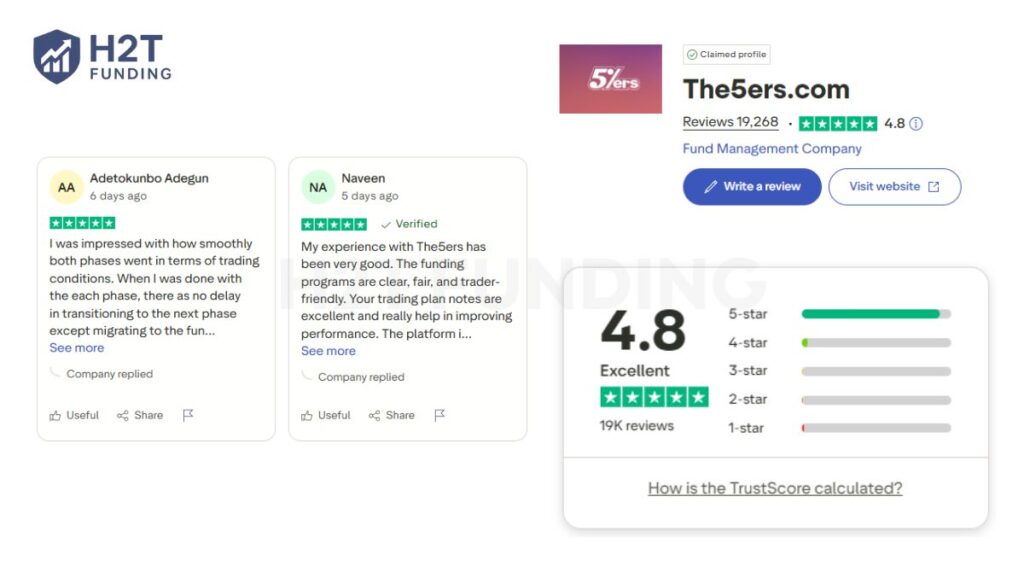

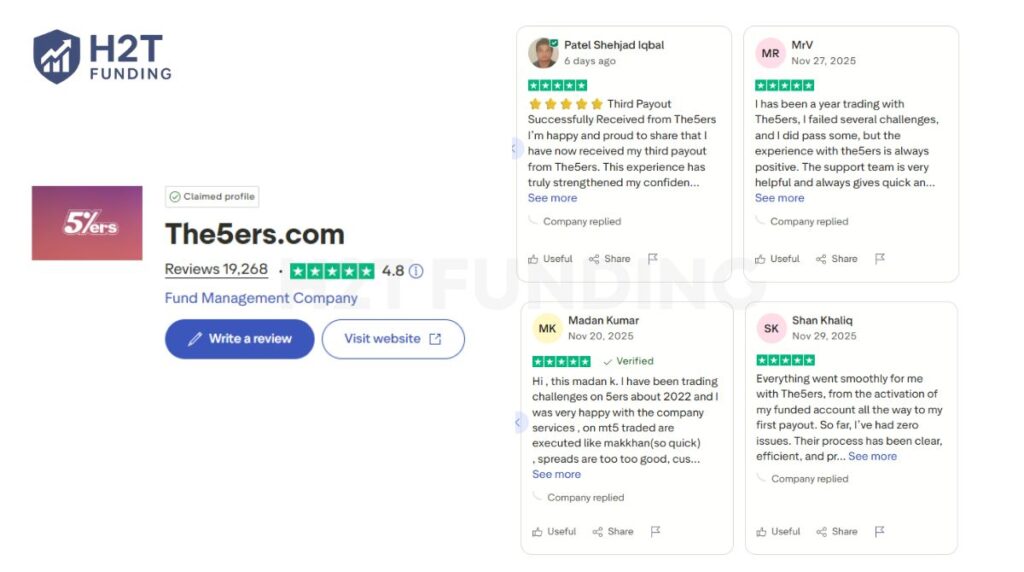

The5ers has earned widespread acclaim from traders on platforms like Trustpilot and Propfirm Match, showcasing its credibility in the prop trading space. With a 4.8/5 rating on Trustpilot from over 19,268 reviews, the firm is praised for rapid payouts and supportive customer service.

However, some traders report technical issues with the dashboard and inconsistent support, offering a balanced view for prospective users.

Trustpilot ratings:

- 5-star: 93% – Highlight fast payouts and clear evaluation processes.

- 4-star: 4% – Positive with minor suggestions for improvement.

- 3-star: <1% – Neutral, often citing strict drawdown rules.

- 2-star: <1% – Rare complaints about technical glitches.

- 1-star: 2% – Issues with dashboard accuracy or support delays.

User feedback:

- Phuc Cao (Trustpilot): “The5er so good propfirm, the name talk everything , be the 5% trader success. Patient and discipline, payout fast, support nice and fast.”

- Calvin (Propfirm Match): “This firm specifically has always been under my radar ever since i discovered the propfirm industry as i have never heard of any scams being done from this propfirm so i decided to try it out for myself and it has been life changing. im still starting with the 5k account, but i passed both phases, got funded and even got my first payout with them, all seemingly through a very smooth process if u dont cheat your way through!, customer support is always direct when im asking for questions regarding a specific problem.”

- Akshay (Trustpilot): “Bad customer support, Dashboard showing inaccurate data from 3 days, i have taken screenshot and shared to customer support, then also they don’t understand. Bad experience.”

Based on user reviews, The5ers excels in delivering fast payouts and a supportive environment, but it faces challenges with occasional technical issues that traders should consider.

The firm’s strengths include reliable withdrawals and a fair evaluation process, ideal for disciplined traders. On the other hand, dashboard inaccuracies and support inconsistencies need improvement. Potential users should weigh these factors and prioritise risk management to succeed with The5ers.

Strengths:

- Quick payouts, often processed within 1-3 days.

- Responsive support via live chat and Discord, resolving most issues promptly.

- Transparent rules with no time limits ease evaluation pressure.

- Trusted reputation, with no major scam reports.

Areas for improvement:

- Dashboard syncing errors can disrupt trade tracking.

- Inconsistent support for complex issues, leading to delays.

- Strict drawdown limits (3-5%) may challenge aggressive traders.

Key Takeaway: The5ers is highly regarded, with 93% of Trustpilot reviews giving 5 stars, reflecting its reliability and trader-focused approach. While technical glitches are rare, they can impact user experience. Traders should review recent feedback on Trustpilot and practice disciplined trading.

8. Customer support and educational resources

The5ers provides robust customer support and a wealth of educational resources to help traders succeed in their funding programs. Support is accessible through multiple channels, ensuring quick responses, while educational tools cater to both beginners and experienced traders.

| Feature | Details |

|---|---|

| Support channels | Live chat, Discord, email, phone (7:00-17:00 GMT, Sunday-Thursday) |

| Response time | Live chat: Often within minutes; email: Within 24 hours |

| Educational resources | Live trading rooms (4x/week), webinars, YouTube (73.3K subscribers) |

| Community | Active on Discord, Instagram (93.2K followers), and trading forums |

Key highlights:

- Support: Traders praise the 24/7 live chat and Discord for fast resolutions, with complex issues typically handled via email within a day. Phone support is available during GMT business hours, ideal for urgent queries.

- Education: Four weekly live trading rooms offer real-time market analysis, while webinars cover scalping, risk management, and supply/demand strategies. The YouTube channel provides free tutorials and trader success stories.

- Community engagement: The5ers fosters a vibrant community through Discord and Instagram, sharing tips, updates, and motivational content to keep traders engaged.

Tip: Join the Discord community for real-time support and insights from other traders, and attend live trading rooms to refine your strategies.

Read more: Is The5ers Legit? Review for Serious Traders

9. How to get started with The5ers

Getting started with The5ers is straightforward, allowing traders to quickly join a funding program and begin their journey toward managing significant capital. The process involves selecting a program, paying the evaluation fee, and either passing the evaluation or trading instantly, depending on the program.

Step-by-Step process:

- Choose a program: Select from Bootcamp ($95-$225, three-phase evaluation), High Stakes ($39-$495, two-phase evaluation), or Hyper Growth ($260-$850, instant funding).

- Register: Sign up on The5ers’ website, complete KYC verification (ID and address proof), and choose your account size.

- Pay evaluation fee: Use bank transfer, cryptocurrency, or Riseworks. Fees are refunded for High Stakes upon passing, but are non-refundable for Bootcamp and Hyper Growth.

- Start trading: For Bootcamp and High Stakes, complete evaluation phases on a demo account; Hyper Growth provides immediate live trading access.

- Manage funded account: Once funded, trade within drawdown limits (3-5% daily) and withdraw profits bi-weekly (minimum $150).

Tip: Start with Bootcamp if you’re new to prop trading to minimise costs, and use the trader dashboard to track progress.

10. Comparing The5ers vs other prop firms

The5ers stands out in the prop trading industry for its flexible evaluation process and high profit splits, but how does it compare to other leading firms? Each firm offers unique advantages, from pricing to trading conditions, catering to different trader needs. Traders should consider their budget, trading style, and need for support when deciding.

| Feature | The5ers | FTMO | FundedNext |

|---|---|---|---|

| Established | 2016 | 2015 | 2022 |

| Account sizes | $5,000-$250,000 | $10,000-$200,000 | $6,000-$200,000 |

| Evaluation fee | $39-$850 (High Stakes refundable) | $170-$1,200 (refundable if funded) | $99-$999 (non-refunded) |

| Profit split | 50%-100% | 80%-90% | 80%-90% (15% during evaluation) |

| Evaluation phases | 1-3 (program-dependent) | 2 (10% + 5% profit targets) | 1-2 (8% + 5% profit targets) |

| Daily drawdown | 3%-5% | 5%-10% | 5%-6% |

| Total drawdown | 6%-10% | 10%-20% | 10%-12% |

| Leverage | Up to 1:100 | Up to 1:100 | Up to 1:100 |

| Time limit | None | 30-60 days | None |

| Trading platforms | MetaTrader 5, cTrader | MetaTrader 4/5, cTrader, DXtrade | MetaTrader 4/5, cTrader, Match-Trader |

| Tradable assets | Forex, metals, indices, crypto, stocks | Forex, indices, metals, crypto | Forex, indices, metals, crypto |

| Educational resources | Live trading rooms, webinars, YouTube (71.5K) | Trading academy, performance coaches, eBooks | Journaling tools, emotional intelligence course |

| Support channels | Live chat, Discord, email, phone | Email, live chat, phone | 24/7 live chat, dedicated account managers |

Tips from my experience:

- If you’re new to prop trading, I suggest starting with The5ers’ Bootcamp for its low $95 entry fee and flexible timeline, allowing you to learn without pressure.

- For advanced traders, I recommend The5ers’ High Stakes or FundedNext for their high leverage (1:100) and refundable fees, but practice on a demo to master their drawdown rules first.

- If education is your priority, I found FTMO’s coaching and eBooks invaluable, though you’ll need a bigger budget and faster trading pace to meet their deadlines.

- Always check recent Trustpilot reviews for each firm to confirm payout reliability and support quality before committing.

11. FAQs

Yes, The5ers is a legitimate prop firm founded in 2016, with a 4.8/5 Trustpilot rating from 15,000K+ reviews and no major scam reports.

Yes, funded accounts use real capital from liquidity providers, not demo funds, for live trading.

Profit splits range from 50% to 100%, depending on the program and performance, and are paid bi-weekly.

No free evaluations, but Bootcamp starts at $95, offering a low-cost entry.

Traders from most countries, including the US, can join if they meet KYC requirements.

Yes, swap-free accounts are available for certain programs, ideal for specific trading styles.

12. Conclusion – Is The5ers right for you?

The 5ers H2T Funding review reveals that The 5ers is a strong choice for disciplined traders who aim to scale their capital without risking personal funds. With a variety of funding programs, flexible evaluation processes, and robust trader support, The5ers is particularly well-suited for those looking to grow in a professional trading environment.

However, the upfront evaluation fees and strict trading rules may not appeal to beginners or those who prefer a more flexible trading style. As such, it’s essential to consider your trading goals, experience level, and preferred strategy before committing.

Still unsure? You can explore other prop firm reviews or dive deeper into valuable insights and comparisons on the H2T Funding, your trusted resource for prop trading firm analysis and professional trading guidance.