The Trading Pit is a multi-asset proprietary trading firm backed by Pinorena Capital, providing Futures, Stocks, and CFDs to traders globally. They distinguish themselves with over €8 million in payouts and a transparent scaling plan for users in 180+ countries.

However, navigating the complex landscape of prop trading rules and hidden fees can be overwhelming for new and experienced traders alike. You need a clear understanding of the risks and rewards before committing your capital.

This The Trading Pit review from H2T Funding will cut through the noise to analyze their evaluation process, platform options, and withdrawal reliability. By the end, you will know exactly if this firm is the right partner to elevate your trading career.

1. What is The Trading Pit?

The Trading Pit is a multi-asset proprietary trading firm headquartered in Liechtenstein, established to bridge the gap between retail and professional trading. Since its launch in October 2022, it has differentiated itself by offering direct market access to Futures alongside standard CFDs.

A key differentiator is their backing by Pinorena Capital, a fintech-focused private equity firm founded by industry veteran Illimar Mattus. This strategic partnership ensures robust financial stability and infrastructure, setting them apart from undercapitalized competitors in the industry.

The firm operates a talent evaluation model in which traders must pass a one-step or two-step challenge to demonstrate their risk management skills. Successful candidates unlock funding ranging from $5,000 to $200,000, with opportunities to scale capital significantly based on consistent performance.

Despite its global reach supporting over 180 countries, The Trading Pit enforces strict regulatory compliance regarding jurisdictions. Consequently, services are currently unavailable to residents in specific regions, most notably the USA, Canada, and Russia.

2. Our take on The Trading Pit

From our perspective, The Trading Pit is a rule-driven prop firm that rewards predictability and discipline. The firm’s structure feels consistent in practice, especially with static drawdowns on CFDs and clearly defined limits on Futures. Once you understand how risk is calculated, the environment becomes stable and easy to plan around.

In real trading conditions, risk management matters more than speed. Traders who leave drawdown buffers, avoid overexposure around news, and respect the Daily Pause on Futures tend to progress smoothly. In contrast, aggressive styles that rely on leverage or one-day profit spikes usually hit restrictions quickly.

Overall, The Trading Pit is not the fastest prop firm to grow an account, but it is one of the more predictable ones. It suits traders who prefer structure, professional platforms, and clear boundaries over flexibility or shortcuts.

| Pros | Cons |

|---|---|

| Offers CFDs, Futures, and Stocks in one ecosystem | Does not accept US clients |

| Uses static drawdown on CFD accounts | Crypto leverage is limited to 1:2 |

| No time limit on challenges | Futures drawdown is relatively tight |

| Supports professional trading platforms | Futures accounts require an activation fee |

| Fast payouts, especially via crypto | News trading is restricted to larger CFD accounts |

3. The Trading Pit programs

The Trading Pit offers a diverse range of trading programs and evaluations tailored to various asset classes, distinguishing it from standard Forex-only firms. Traders can choose between specialized paths for CFDs, Futures, and Stocks, each with unique rules and leverage settings.

This multi-asset approach allows you to select a program that aligns perfectly with your specific trading style and preferred instruments. Below is a breakdown of the available plans to help you determine the best fit for your strategy.

3.1. CFDs

The Contracts for Difference (CFD) challenges are the most accessible entry point for traders familiar with standard Forex and Crypto markets. Executed on the popular MetaQuotes platform (MT4/MT5) and cTrader, these programs provide a seamless transition for retail traders.

You have the flexibility to trade a wide range of instruments, including major currency pairs, commodities, and indices. Depending on your risk appetite, you can select between a rapid single-phase assessment or a traditional two-phase evaluation.

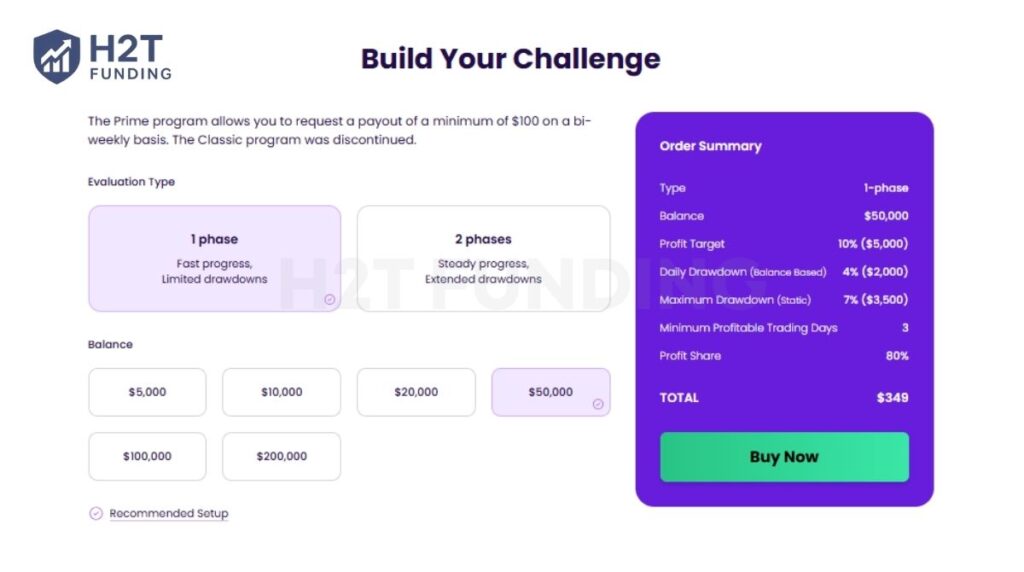

3.1.1. One-step challenge

The One-step challenge is the fastest route to funding at The Trading Pit. It is designed for confident traders who want to bypass the prolonged verification phase and start earning bi-weekly payouts sooner.

To pass, you must achieve a 10% profit target while adhering to a 4% daily drawdown calculated on your balance, not equity. This balance-based calculation is a significant advantage, as it does not penalize you for open floating profits during the day.

A standout feature is the 7% Static Maximum Drawdown. Unlike trailing drawdowns that creep up as your account grows, this limit remains fixed at the initial starting balance relative to the loss allowance. This makes holding swing positions much less stressful compared to other firms.

| Account Size | One-Time Fee | Profit Target (10%) | Daily Loss (4%) | Max Loss (7%) |

|---|---|---|---|---|

| $5,000 | $49 | $500 | $200 | $350 |

| $10,000 | $99 | $1,000 | $400 | $700 |

| $20,000 | $199 | $2,000 | $800 | $1,400 |

| $50,000 | $349 | $5,000 | $2,000 | $3,500 |

| $100,000 | $569 | $10,000 | $4,000 | $7,000 |

The Prime program is highly competitive due to the minimum profitable trading days being set at just 3. Combined with a static drawdown, it offers one of the most trader-friendly environments for a 1-step evaluation in the current market.

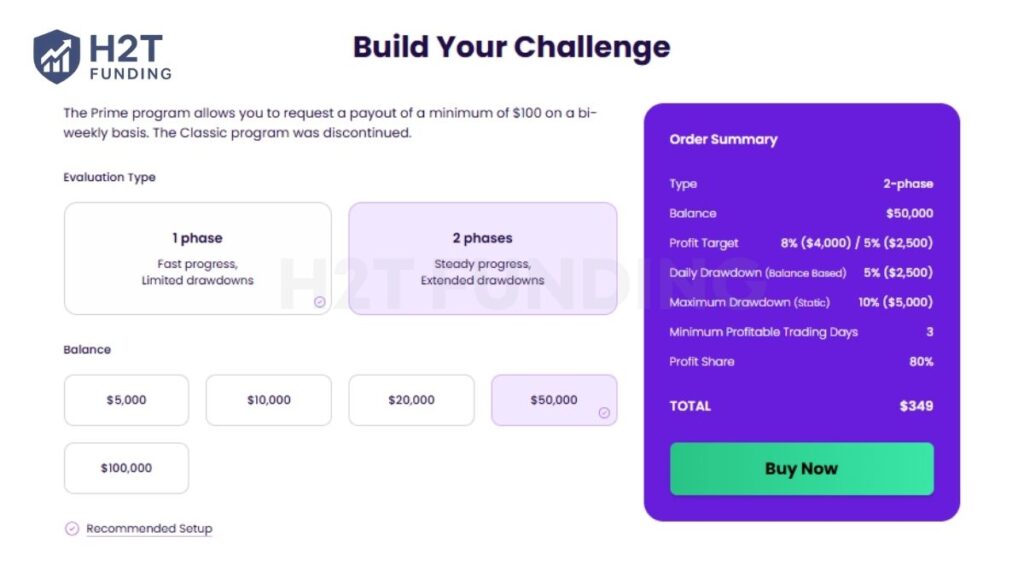

3.1.2. Two-step challenge

The Two-step challenge offers a more traditional path to funding, prioritizing capital preservation over speed. It splits the evaluation into two distinct phases to prove your ability to maintain consistency over time.

The primary advantage here is the expanded risk allowance. You get a generous 10% Static Maximum Drawdown and a 5% Daily Drawdown, providing significantly more breathing room than the single-phase option.

Profit targets are reduced to 8% in Phase 1 and just 5% in Phase 2. Like the one-step program, the daily loss is calculated on the balance, not equity, which prevents a single trade’s fluctuation from breaching your limits.

| Account Size | Price | Phase 1 Target (8%) | Phase 2 Target (5%) | Daily Loss (5%) | Max Loss (10%) |

|---|---|---|---|---|---|

| $5,000 | $49 | $400 | $250 | $250 | $500 |

| $10,000 | $99 | $800 | $500 | $500 | $1,000 |

| $20,000 | $199 | $1,600 | $1,000 | $1,000 | $2,000 |

| $50,000 | $349 | $4,000 | $2,500 | $2,500 | $5,000 |

| $100,000 | $569 | $8,000 | $5,000 | $5,000 | $10,000 |

This plan offers exceptional value. For the same price as the one-step, you gain an extra 3% in overall drawdown buffer and lower profit targets. It is the superior choice for traders who prioritize account longevity over quick funding.

3.2. Futures

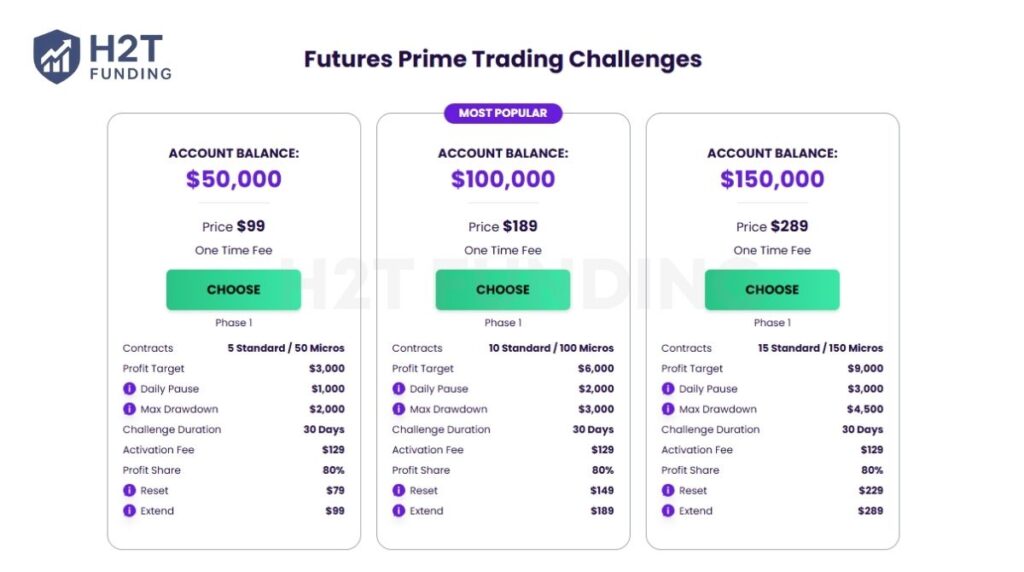

The Futures Prime Trading Challenge is a specialized one-step evaluation designed for traders who require direct market access and professional execution speeds. Unlike the CFD programs, this path allows you to trade standardized contracts on major exchanges with a focus on volume and precision.

While trading in a simulated performance environment, a unique feature of this program is the “Daily Pause” limit rather than a traditional daily loss breach. If you hit this limit ($1,000 to $3,000, depending on account size), your account is disabled for the rest of the day. This prevents further losses instead of immediately terminating the account. This is a massive safety net for active day traders.

Traders should note the Activation Fee of $129, which applies once you pass the evaluation. While the upfront challenge fee is very low (starting at $99), this secondary fee covers the data and administrative setup for the live funded account.

This program is extremely cost-effective for skilled scalpers. However, the Max Drawdown is tighter (around 3-4%) compared to the CFD plans, requiring strict discipline.

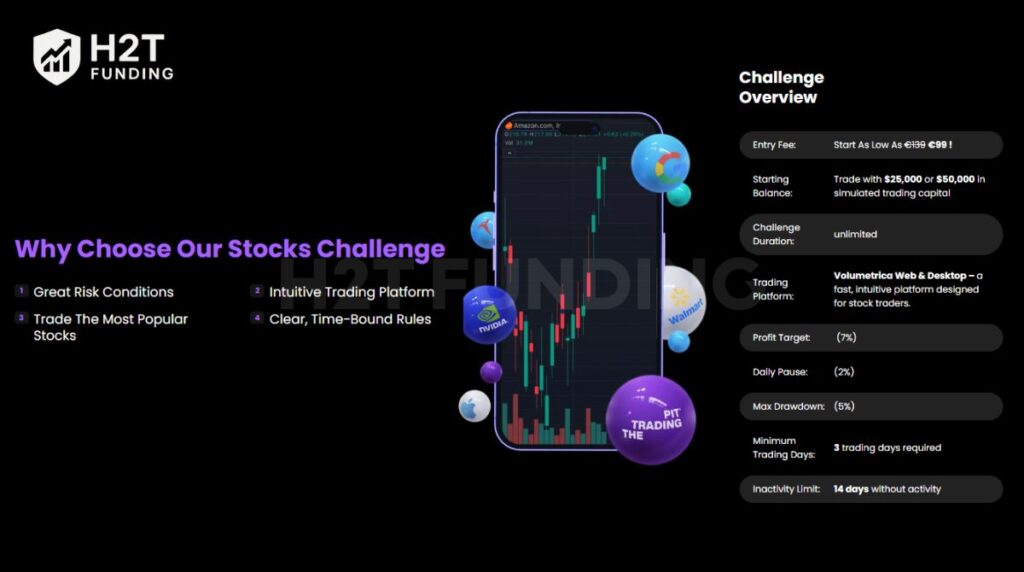

3.3. Stocks

For traders who prefer equity markets over currencies, The Trading Pit offers a specialized Stocks Challenge. This program allows you to trade CFDs on popular global companies like Apple, Tesla, and Nvidia using the advanced Volumetrica Web & Desktop platform.

A major advantage here is the Unlimited Challenge Duration. You are not pressured by a ticking clock, allowing you to wait for high-quality setups during earnings seasons or specific market trends.

The entry barrier is exceptionally low, with fees starting at just €99. However, traders must remain active; there is a 14-day inactivity limit that requires you to place at least one trade every two weeks to keep the account active.

| Feature | Details |

|---|---|

| Account Sizes | $25,000 or $50,000 |

| Profit Target | 7% |

| Daily Pause (Risk) | 2% (Stops trading for the day) |

| Max Drawdown | 5% (Hard limit) |

| Minimum Trading Days | 3 Days |

| Platform | Volumetrica (Web & Desktop) |

The Stocks program is perfect for swing traders who rely on fundamental analysis. While the 2% Daily Pause is quite tight, the 7% Profit Target is lower than most industry standards, making it a fair trade-off for conservative traders.

Verdict on The Trading Pit programs

From a strategic standpoint, The Trading Pit offers one of the most mathematically fair trading environments I have analyzed, largely due to the Static Maximum Drawdown on its CFD accounts. Unlike the trailing drawdowns, this fixed limit allows the risk buffer to grow as profits increase. As a result, it is particularly well-suited for swing traders who need to tolerate overnight volatility without technical breaches.

However, the pricing structure of the Futures program requires careful attention. While the $99 entry fee ($50K) serves as an effective loss leader, the mandatory $129 activation fee after passing nearly doubles the true cost. This is a detail that many beginners tend to overlook.

Even with the added expense, the value proposition remains compelling for serious scalpers. Access to real Level 2 data, combined with the Daily Pause feature acting as an automated circuit breaker, provides a level of risk protection most CFD-only prop firms cannot offer.

4. The Trading Pit rules

Success at The Trading Pit depends not just on your ability to generate profit, but on your strict adherence to their rulebook. Unlike some firms that hide terms in the fine print, The Trading Pit is transparent about its requirements. However, the rules differ significantly across CFDs, Futures, and Stocks.

Below is a detailed breakdown of the general guidelines and specific restrictions for each asset class.

4.1. General guidelines & allowed practices

These fundamental rules apply across most programs, designed to ensure consistent risk management and responsible trading behavior.

- Inactivity Rule:

- CFDs & Futures: Accounts are breached if no trade is placed for 21 consecutive days.

- Stocks: The limit is tighter, at 14 consecutive days.

- Note: Holding a position or having a pending order does not count as activity; a trade must be executed.

- Micro-Scalping Policy: Generally prohibited if you open and close trades within 10-15 seconds to exploit latency or feed delays. If >40% of your profits come from such trades, the account may be flagged.

- Consistent Trading Size: You must avoid “gambling” behavior, such as using massive lot sizes on one trade and tiny lots on others just to pass minimum day requirements. Significant deviations in lot size can be flagged as a breach.

- Hedging: Allowed within the same account for risk management. However, Hedging Arbitrage (trading price differences between markets) and hedging between two different accounts (one buy, one sell) is strictly prohibited.

- Expert Advisors (EAs): Allowed, provided they do not copy external signals, perform HFT/arbitrage, or trade news during restricted windows (for specific accounts).

- VPS Usage: Permitted for running EAs.

4.1.1. Rules for CFDs

CFD accounts offer the most flexibility but come with specific restrictions for larger capital allocations.

- Minimum Profitable Days (Prime): You need 3 profitable days. A day is “profitable” if gains are at least 0.5% of the initial balance.

- Minimum Trading Days (Classic): Requires 5 unique trading days.

- Overnight/Weekend Holding:

- Allowed: You can hold trades overnight and over the weekend (Crypto trading available 24/7 on cTrader).

- Warning: Gaps on Monday open can breach your daily drawdown.

- News Trading:

- Allowed: For accounts up to $50,000.

- Prohibited: For $100,000 and $200,000 accounts (2 minutes before/after high-impact news).

- Scalping: Trades must be held for at least 1 minute on Classic accounts. Prime accounts allow scalping under 1 minute unless it falls under HFT restrictions.

- Copy Trading: Allowed between your own accounts (max $400k total allocation for Earning Accounts).

4.1.2. Rules for Futures

The Trading Pit Futures review rules focus heavily on preventing intraday disasters and ensuring genuine market participation.

- Consistency Rule (40%): A single day cannot account for more than 40% of your total profit target. If you exceed this, the profit target increases. Applies to Challenges only.

- Daily Pause: Instead of a hard breach, hitting the daily loss limit pauses your account until the next day (Futures Prime).

- Overnight Positions:

- Futures Prime: Not allowed. Positions must be closed by 15:55 CT.

- Futures Classic: Allowed overnight but not over the weekend (must close by Friday).

- News Trading:

- Futures Prime: Allowed.

- Futures Classic: Prohibited (2 minutes before/after high-impact news).

- Scalping: Fully allowed on all Futures accounts.

- Copy Trading: Allowed up to 5 accounts max.

4.1.3. Rules for Stocks

Stock trading rules are designed to mimic professional equity desk requirements.

- 10 Cents Rule: A trade is only counted as profitable if it captures at least $0.10 profit per share. Smaller moves are excluded.

- Volume Requirement: You can only trade stocks with an average daily volume of >200,000 shares.

- Overnight Holding: Strictly prohibited. All positions must be closed 5 minutes before the market closes (15:55 CT).

- Halt Trading: No trading allowed during market halts + 1 minute mandatory cooldown after the halt ends.

- Scalping: Trades must be held for at least 1 minute.

- News Trading: Allowed.

4.2. Prohibited trading practices

Engaging in any of the following will result in immediate account termination without refund:

- Gap Trading: Opening trades <2 hours before market close to exploit expected weekend gaps.

- High-Frequency Trading (HFT): Any strategy executing multiple trades per second or exploiting feed latency.

- Gambling Behavior: All-or-nothing bets, overleveraging, or “flipping” accounts.

- Group Trading: Copying trades from other people or sharing signals with friends.

- Grid/Martingale: Strictly forbidden due to the high risk of catastrophic loss.

- Hedging Between Accounts: Taking opposite positions on two different accounts to guarantee a win on one.

From a rule-compliance perspective, The Trading Pit sits in the middle of the industry. Its flexibility for swing trading is attractive, but the stricter news and gambling policies demand careful attention.

When compared with other firms’ risk frameworks and enforcement standards, these rules align closely with broader industry prop firm rules, especially regarding consistency, hedging, and capital protection.

Verdict on The Trading Pit rules

The Trading Pit offers excellent flexibility for swing traders. You can hold positions over weekends and copy trades across your own accounts. This makes scaling a portfolio up to $400,000 seamless and efficient.

However, the News Trading policy creates a dangerous trap. While allowed on smaller accounts, it is strictly banned on $100,000 and $200,000 plans. Many traders overlook this shift and risk immediate termination.

Finally, be cautious with the broad Gambling Policy. Terms like “one-sided bets” give the risk team significant discretion. Always use stop-losses to prove your strategy is calculated, not reckless.

5. The Trading Pit payout rules

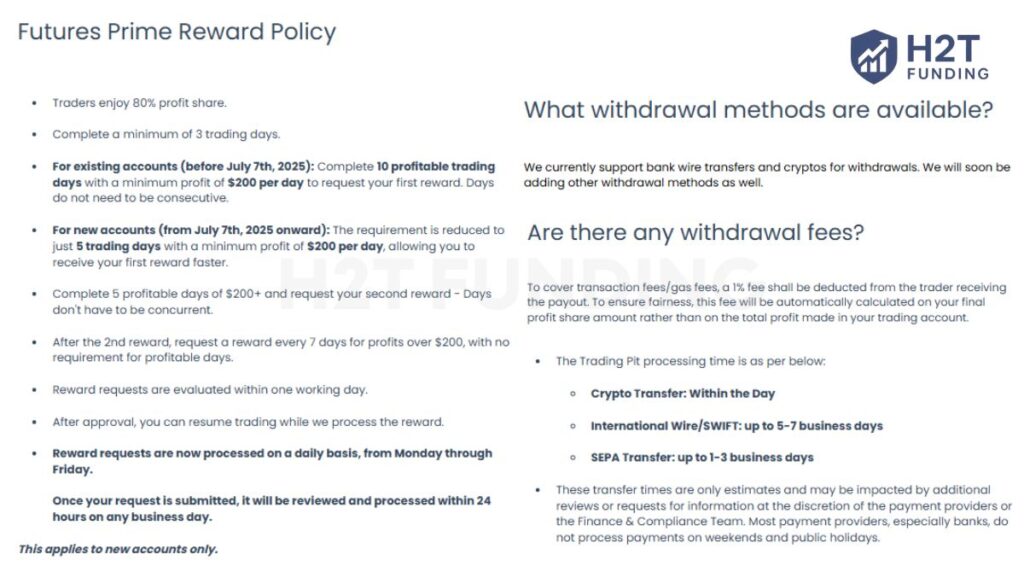

Getting funded is only the first step; withdrawing your profits is the ultimate goal. The Trading Pit offers a consistent 80% profit split across its programs, but the rules for accessing that money differ significantly between CFD and Futures accounts.

5.1. General payout policy

Before requesting a withdrawal, traders should understand the core payout mechanics that apply across all The Trading Pit programs.

- Methods & Currency: You can request withdrawals via International Bank Wire (USD/EUR) or Cryptocurrency. Crypto is the fastest option, typically processed within the day.

- Fees: There is a flat 1% withdrawal fee deducted from your payout to cover gas fees and transaction costs.

- Processing Time: Requests are processed Monday through Friday. While Crypto is instant, Bank Wires (SWIFT) can take 5-7 business days.

5.2. CFD Prime payout rules

The rules for CFD traders are straightforward and follow a bi-weekly schedule.

- Frequency: You can request a payout every 14 days.

- Minimum Amount: The minimum withdrawal is $100.

- Trading Days: You must complete at least 5 unique trading days during the cycle to be eligible.

- First Payout: Available 14 days after placing your first trade on the funded account.

5.3. Futures Prime payout rules

Futures traders face stricter payout requirements designed to enforce consistency, especially during the early withdrawal stages. These rules differ depending on whether you are requesting your first, second, or subsequent rewards.

- Minimum Trading Activity: You must complete at least 3 trading days before becoming eligible for any reward request.

- First & Second Payout Requirements: According to The Trading Pit’s official rules, Futures Prime accounts follow a tiered payout structure:

- First reward: Historically required 10 profitable days with a minimum of $200 profit per day.

- Second reward: Required 5 profitable days with at least $200 profit per day. These profitable days do not need to be consecutive.

Updated Rule (Effective July 7, 2025 – New Accounts Only): Beginning Monday, July 7th, 2025, The Trading Pit streamlined the first payout requirement for new Futures Prime accounts. Under the updated structure, traders now need only:

- 5 trading days, each generating a minimum of $200 in profit, to request their first reward.

Ongoing Payout Frequency: After the second reward, traders can request withdrawals every 7 days (weekly) for profits exceeding $200, with no additional profitable-day requirement.

The “Buffer” Trap: Be cautious when withdrawing profits on Futures accounts. Since the Maximum Drawdown trails your End-of-Day (EOD) balance, withdrawing all profits resets your balance closer to the starting level and significantly reduces your drawdown buffer. Leaving a portion of profits in the account is strongly advised to avoid accidental breaches.

5.4. Refund policy

In addition to profit withdrawals, The Trading Pit also outlines clear conditions regarding challenge fee refunds. These rules specify when traders are eligible for a refund, which account types are excluded, and which optional purchases are not covered under the refund policy.

- Eligibility: You receive your initial challenge fee back with your first payout.

- Futures Exception: Refunds do not apply to Futures Prime accounts because these accounts incur a specific data activation fee ($129) instead.

- Restrictions: Any add-ons purchased (like Resets or Extensions) are non-refundable.

Note: All payout conditions outlined above are summarized from The Trading Pit’s official website and its funded account documentation, ensuring accuracy at the time of writing. Traders should always verify the latest terms before requesting a withdrawal.

Verdict on The Trading Pit payouts

The Trading Pit excels in processing speed, particularly with crypto withdrawals arriving within the same day. This rapid turnover puts them ahead of competitors who often delay payments for nearly a week. The flat 1% withdrawal fee is also transparent, avoiding the hidden exchange rate markups found elsewhere.

However, Futures traders face a significant hurdle with the initial payout requirement. You must achieve five separate days with at least $200 in profit to unlock your funds. This specific rule forces a level of aggression that may be uncomfortable for conservative scalpers.

Crucially, Futures traders must never withdraw their entire profit balance. Since the maximum drawdown trails your account balance, emptying your account removes your safety buffer. Always leave a portion of your earnings behind to prevent accidental breaches during market dips.

6. The Trading Pit scaling plan

The ultimate goal of a career trader is not just to get funded, but to manage significant capital. The Trading Pit offers distinct scaling paths for CFDs and Futures, allowing traders to grow their accounts up to $5 million or transition into a professional asset management role.

6.1. CFD scaling plan

The CFD scaling model is designed to reward long-term consistency. It offers a 25% capital increase to traders who prove they can manage risk over time.

To qualify for an upgrade, you must meet three criteria:

- Keep the account active for at least 2 months

- Successfully receive at least 2 payouts

- Accumulate a total profit of 10% on your initial balance

How it compounds: Every 4th scale-up acts as a new milestone. For example, if you start with $100,000, your first four raises are $25,000 each. Once you reach $200,000, your next raise will be calculated on this new base (i.e., + $50,000), significantly accelerating your growth.

6.2. Futures Prime scaling

The Futures Prime plan is built for aggressive growth. Instead of waiting months, your buying power is adjusted daily at 16:00 CT, based on your End-of-Day profit. This structure allows you to increase your position size immediately as you perform well.

Position limits by profit level:

- $0 – $2,500 profit: Trade 2 Standard lots (or 20 Micros)

- Above $2,500 profit: Limits increase to 3 Standard lots

- Above $5,000 profit: Limits increase to 4 Standard lots

Important note: This plan maintains a high 80% profit split throughout.

6.3. Futures classic scaling (Level-based)

The Futures Classic plan functions like a video game with 10 distinct levels. It is a linear progression path, where you must reach a specific profit target to unlock a payout and “level up.”

Progression structure: Hit the target → Receive payout → Move to the next level

Benefits of leveling up:

- Each new level grants more capital

- Deeper drawdown limits

Profit split structure:

- Starts lower (around 60%)

- Scales up to 80% as you reach higher tiers

Upon passing Level 10 of the Scaling Plan, you are invited to a meeting with The Trading Pit management team.

At this stage, you are no longer just a prop trader. You’re offered a partnership contract, opening access to their asset management network, where you can trade significantly larger capital using your own strategy, backed by a professionally verified track record.

Verdict on The Trading Pit scaling plan

The standout feature here is undoubtedly the Futures Prime dynamic scaling. Being able to increase your position size immediately based on the previous day’s profit creates incredible momentum. This eliminates the frustrating wait times found in traditional models, allowing skilled traders to compound quickly.

However, the CFD Scaling Plan feels overly conservative. Requiring two full months and two payouts just to receive a modest 25% capital increase is sluggish compared to industry standards. Traders seeking rapid account exponential growth might find this progression curve too flat.

Finally, be wary of the Futures Classic model. While the level-based progression looks organized, it often starts with a lower 60% profit split. If you are confident in your profitability, the Prime plan is mathematically superior with its immediate 80% share.

7. The Trading Pit instruments and conditions for trading

The Trading Pit offers a diverse range of tradable assets, but the conditions differ significantly depending on whether you are trading CFDs or Futures. Understanding parameters like liquidity, market factors, and how to handle leveraged instruments is essential for accurate position sizing.

7.1. CFD trading conditions

For CFD traders, flexibility is key. There are no hard caps on the number of open lots; instead, your exposure is limited by your account’s available margin.

Leverage overview:

- Forex Pairs: 1:50

- Indices: 1:15

- Commodities & Metals: 1:10

- Stocks & Crypto: 1:2

Margin & Lot Sizing:

Since there is no fixed lot limit, you must calculate your maximum volume based on the asset price and leverage. For example, on a $10,000 account trading EURUSD at 1:50 leverage, your theoretical maximum is around 4.5 lots. However, the firm recommends risking no more than 1.5% to 2% per trade idea to ensure longevity.

7.2. Futures trading conditions

Futures trading involves standardized contracts on regulated exchanges like the CME (Chicago Mercantile Exchange) and EUREX. Costs here are transparent but involve specific exchange fees.

Key Instruments & Commissions: The following table highlights the total cost per side (commission + exchange fees) for popular instruments.

| Instrument | Symbol | Tick Value | Commission | Exchange Fee | Total Cost (Per Side) |

|---|---|---|---|---|---|

| E-mini S&P 500 | ES | $12.50 | $0.50 | $1.30 | $1.80 |

| E-mini NASDAQ 100 | NQ | $5.00 | $0.50 | $1.30 | $1.80 |

| Crude Oil | CL | $10.00 | $0.50 | $1.52 | $2.02 |

| Gold | GC | $10.00 | $0.50 | $1.57 | $2.07 |

| Euro FX | 6E | $6.25 | $0.50 | $1.62 | $2.12 |

- Micro Contracts: For smaller accounts, Micro contracts (like MES, MNQ) are available with significantly lower margins and tick values ($1.25 for MES), making them ideal for granular risk management.

- Total Cost: Always remember to double the “Total Cost Per Side” to calculate the full round-turn cost (entry + exit). For example, a round trip on ES would cost approximately $3.60.

Verdict on The Trading Pit trading conditions

The leverage of 1:50 for Forex on CFD accounts is a “sweet spot.” It is high enough to execute serious intraday strategies but low enough to prevent new traders from blowing up their accounts in minutes, a common issue with 1:100+ leverage firms.

However, the 1:2 leverage on Crypto is extremely conservative. If you are a crypto-native trader used to Binance or Bybit, this will feel very restrictive. You will need significantly more capital to open meaningful positions.

For Futures traders, the pricing is highly competitive. A round-turn cost of ~$3.60 for an E-mini S&P 500 contract is in line with, or even cheaper than, many retail discount brokers. This low-cost structure is crucial for scalpers, where every tick counts.

8. The Trading Pit trading platform

The Trading Pit offers a diverse range of trading platforms tailored to specific asset classes, including NinjaTrader, Tradovate, TradingView, and cTrader. Your choice of platform depends entirely on whether you are participating in a Futures, CFD, or Stocks trading challenge.

8.1. Futures trading platforms

Futures traders have the widest variety of options, categorized by the specific challenge tier and data provider.

- Futures Prime Challenges: Supported platforms include Tradovate, NinjaTrader, TradingView, ATAS, Quantower, Volsys, and R/Trader.

- Bring Your Own License (BYOL): Accounts are compatible with Sierra Charts, MotiveWave, Jigsaw, and Volfix. However, The Trading Pit does not provide support for these, and you must own a personal license.

Note on TradingView: To use TradingView, you must connect via Tradovate. You cannot connect via NinjaTrader due to specific broker connection management protocols.

8.2. CFD and Stocks Platforms

For non-futures traders, the platform options are streamlined for efficiency and speed.

- CFD Challenges: These are exclusively traded on MT4, MT5, and cTrader, a highly popular platform known for its user-friendly interface and advanced charting capabilities.

- Important: You must select your platform preference before purchasing the challenge. Once the challenge begins, you cannot switch platforms.

- Stocks Challenges: Access is granted exclusively through the Volumetrica Web Platform. This is a browser-based solution requiring no installation, allowing you to execute and manage trades directly from your dashboard.

8.3. Mobile trading capabilities

Understanding the need for flexibility, The Trading Pit supports mobile trading for most of its major platforms. This allows traders to monitor positions and execute orders on Android and iOS devices.

- Futures Mobile Apps: Available for R/Trader Pro, Tradovate, and NinjaTrader.

- CFD Mobile Apps: cTrader offers a fully functional mobile application for both operating systems.

8.4. Multi-platform connectivity

Advanced traders often require simultaneous connections for order flow analysis or backup management. The Trading Pit allows this under specific conditions:

- Rithmic Data Accounts: If you selected R/Trader Pro, you can connect to two platforms simultaneously (e.g., R/Trader Pro + a third-party analytical tool).

- Tradovate Data Accounts: You can be logged into both NinjaTrader and Tradovate at the same time.

Disclaimer: Platform availability and technical specifications can change. Always verify the latest requirements in your dashboard before starting a challenge.

Verdict on The Trading Pit trading platforms

In my professional opinion, The Trading Pit offers one of the most versatile platform lineups in the current prop firm market. The fact that they provide the industry standards, MetaTrader 4 (MT4) and MetaTrader 5 (MT5), is a massive advantage. It allows the retail traders to jump straight into a challenge without a steep learning curve, keeping the familiarity that is crucial for psychological stability in trading.

However, what truly impresses me is that they don’t just rely on the “classics.” By integrating modern powerhouses like cTrader and TradingView (via Tradovate), alongside institutional-grade Futures platforms like NinjaTrader and Quantower, they bridge the gap between retail and professional trading.

You aren’t forced to adapt your strategy to a subpar web terminal; instead, you get to choose the tool that fits your style. If you value having the freedom to trade on professional-grade software, The Trading Pit is arguably one of the best environments to grow your capital.

9. The Trading Pit customer service and education

A prop firm’s true value isn’t just in its capital, but in how it supports its traders’ growth and resolves issues. The Trading Pit excels in this area, providing a comprehensive academy alongside transparent, accessible support channels. Below is a detailed breakdown of the resources and assistance available to ensure your success.

9.1. The Trading Pit education resource

The Trading Pit goes beyond funding by providing a massive library of resources. They have built a complete “Academy” designed to upskill traders of all levels. Here is a breakdown of the key learning tools available to you:

- Educational eBooks: Detailed guides covering platform FAQs, psychology, and risk management.

- Live Webinars: Real-time “Live Trading Room” sessions focusing on European markets.

- The Podcast Show: Audio episodes featuring experts discussing mindset and retail trading myths.

- Video Academy: Visual tutorials explaining concepts like “Prop vs. Retail Trading.”

- Success Stories: “Hall of Fame” interviews with real funded traders sharing their strategies.

- Market Tools: Essential daily resources including an Economic Calendar and Glossary.

The educational suite provided by The Trading Pit is one of the most complete in the prop firm market. It demonstrates a genuine commitment to your long-term success, offering practical knowledge that goes far beyond simple funding access.

9.2. The Trading Pit customer service

Reliable support is a critical factor when choosing a prop firm, as you need to know there is a real team ready to assist with technical issues or account inquiries. The Trading Pit ensures transparency and accessibility by offering multiple direct contact channels.

You can reach their support team via:

- Live Chat: Instant assistance is available directly through the widget on their website for quick questions.

- Phone Support: They provide a direct phone number (+423 237 9000), which is a rare and highly trustworthy feature in the prop trading industry.

- Email Support: For detailed account queries, you can contact support@thetradingpit.com.

- Contact Form: A structured form is available for specific requests regarding product information or partnership inquiries.

The customer service infrastructure at The Trading Pit is professional and trustworthy. The inclusion of a direct phone line significantly boosts credibility, assuring traders that they are dealing with a legitimate and accessible organization.

Verdict on The Trading Pit customer service and education

The Trading Pit offers an ecosystem that genuinely prioritizes trader development rather than just collecting challenge fees. Their educational content is practical, high-quality, and diverse, catering to both beginners and experienced professionals.

The customer service infrastructure is equally impressive, particularly with the inclusion of a direct phone line. This level of transparency is rare in the prop firm industry and builds immense trust. Overall, they demonstrate a level of professionalism that treats traders as true partners.

10. Experienced trader feedback: The Trading Pit Trustpilot, and The Trading Pit Reddit

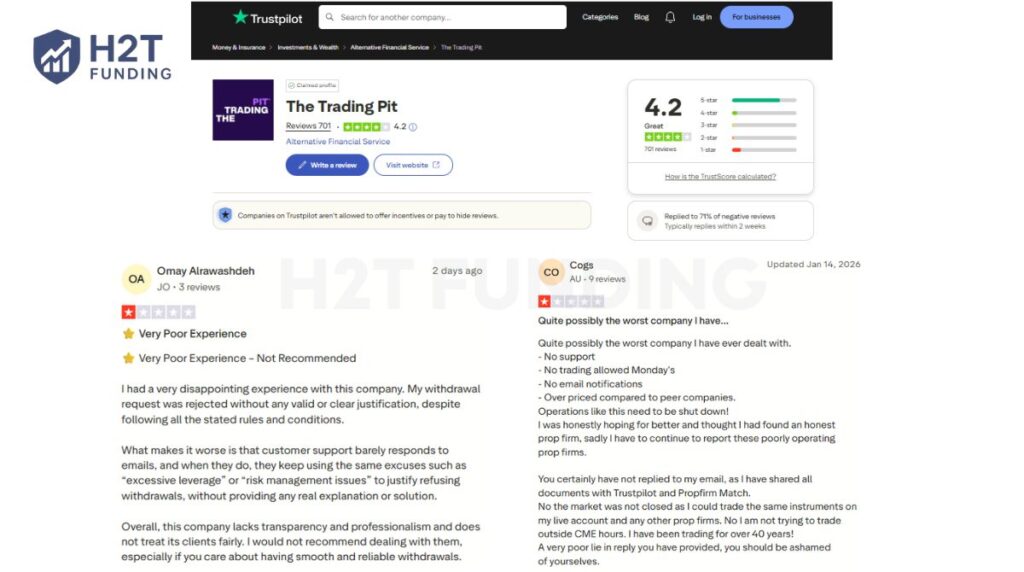

Before committing, it is crucial to analyze The Trading Pit reviews, testimonials, and real client experiences across independent platforms. As of January 26, 2026, The Trading Pit holds a “Great” TrustScore of 4.2/5 based on over 700 reviews. This generally indicates a reliable service, though opinions are sharply divided on specific policies.

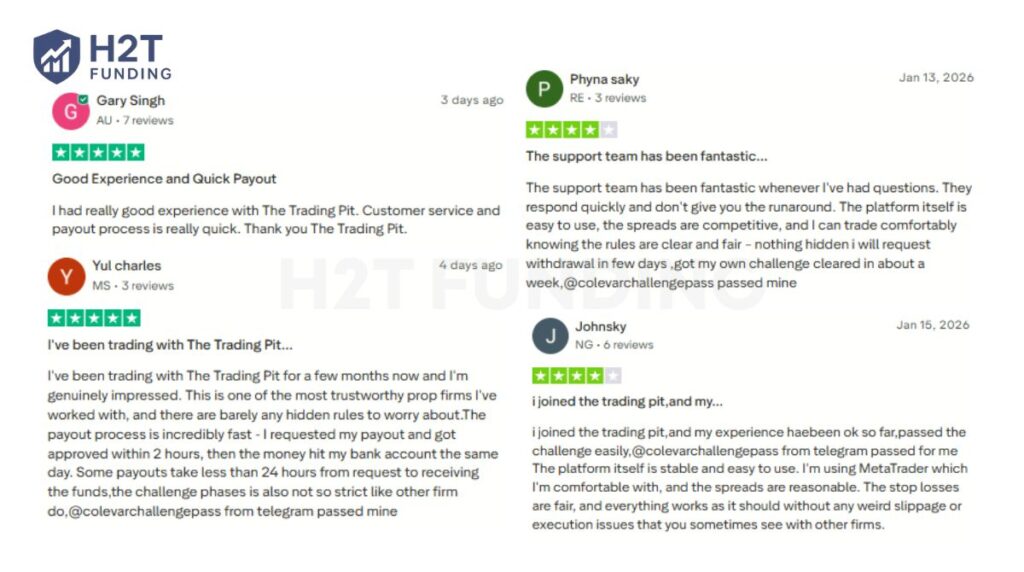

The most consistent praise found on Trustpilot relates to the speed of payouts. Verified users frequently report that withdrawal requests are approved within hours, not days. This confirms that The Trading Pit is a legitimate firm that honors its financial obligations to profitable traders.

However, significant complaints arise regarding the firm’s strict “Risk Management” policies. Negative reviews often mention denied withdrawals due to “excessive leverage” or rule violations. This suggests that while they pay out, they are intolerant of gambling behavior or strategies that break their fine print.

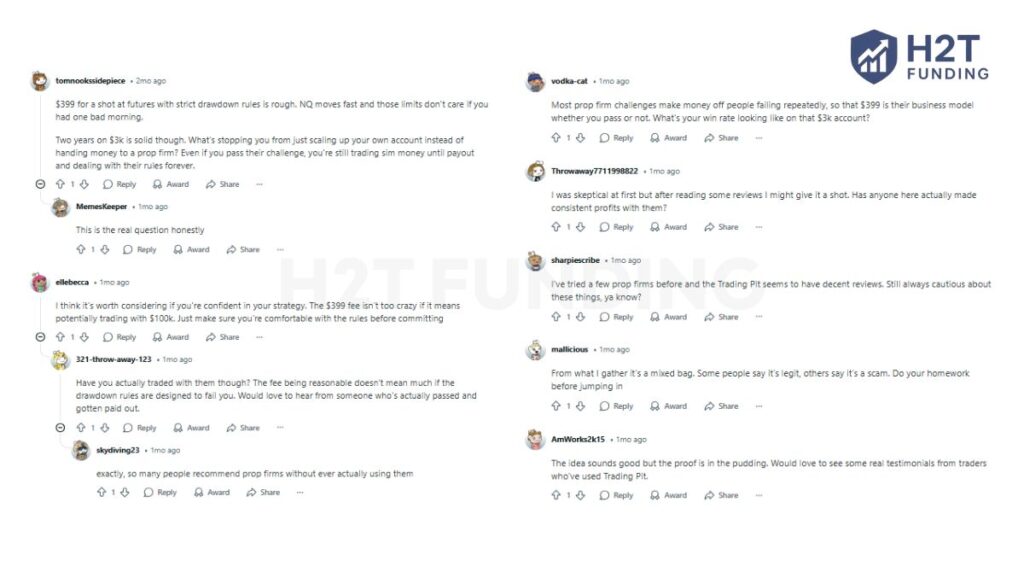

On Reddit, the discussion offers a more critical and unfiltered perspective. Traders debate the value proposition of the challenge fees versus the tight drawdown limits on volatile assets like NQ. The consensus here is that the firm is legitimate but requires a highly disciplined strategy to navigate the rules successfully.

You will also notice a prevalence of reviews mentioning “challenge pass services” on Trustpilot. We strongly advise you to ignore these spam comments and focus on feedback regarding platform stability. Genuine users confirm that execution on MetaTrader is stable with no abnormal slippage, which is vital for day trading.

The Trading Pit is clearly not a scam, but it is not a playground for reckless trading. The feedback indicates that if you follow their risk rules strictly, you will be paid out faster than almost anywhere else. However, if you rely on high leverage or gray-area strategies, you risk having your profits denied.

11. How to sign up for The Trading Pit

Registration is a seamless digital process that takes just a few minutes. You can go from signing up to configuring your funded account quickly by following this roadmap:

- Step 1: Account Registration

- Step 2: Verification and Login

- Step 3: Challenge Configuration

- Step 4: Personal Information

- Step 5: Secure Payment

Follow the detailed walkthrough below to get started.

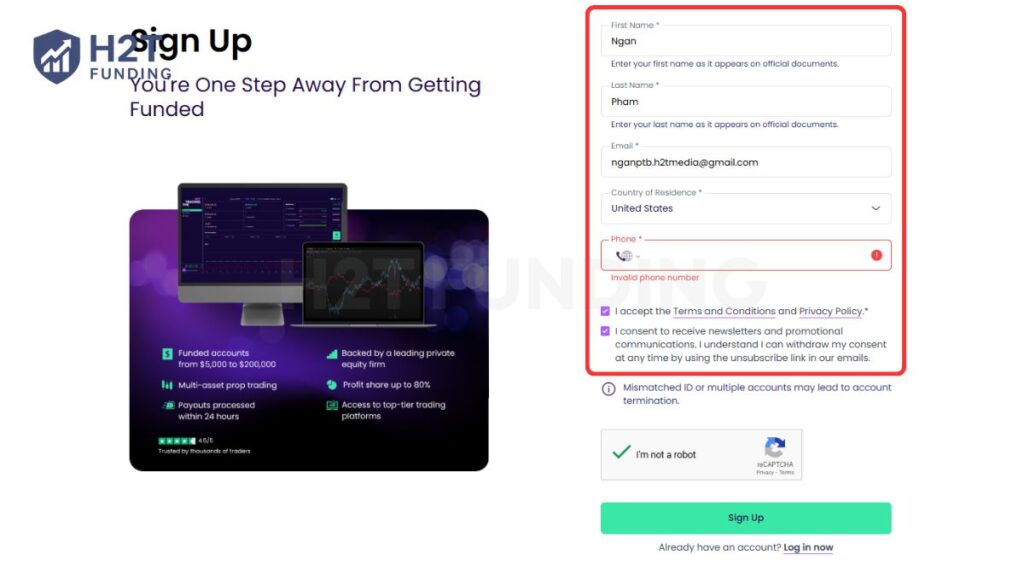

11.1. Step 1: Account registration

Navigate to the official website and click the green “Sign Up” button. Fill in your full name, email address, and phone number in the provided form.

Ensure you check the boxes to accept the Terms and Conditions and Privacy Policy. Complete the captcha verification and click “Sign Up” to create your profile.

11.2. Step 2: Verification and login

Check your email inbox immediately for a message titled “Welcome to The Trading Pit.” This email contains your unique Username and a temporary Password.

Click the “Log in now” button to access The Trading Pit dashboard, where you can also view The Trading Pit leaderboard and track your progress. You will use these credentials to enter the secure client area for the first time.

11.3. Step 3: Challenge configuration

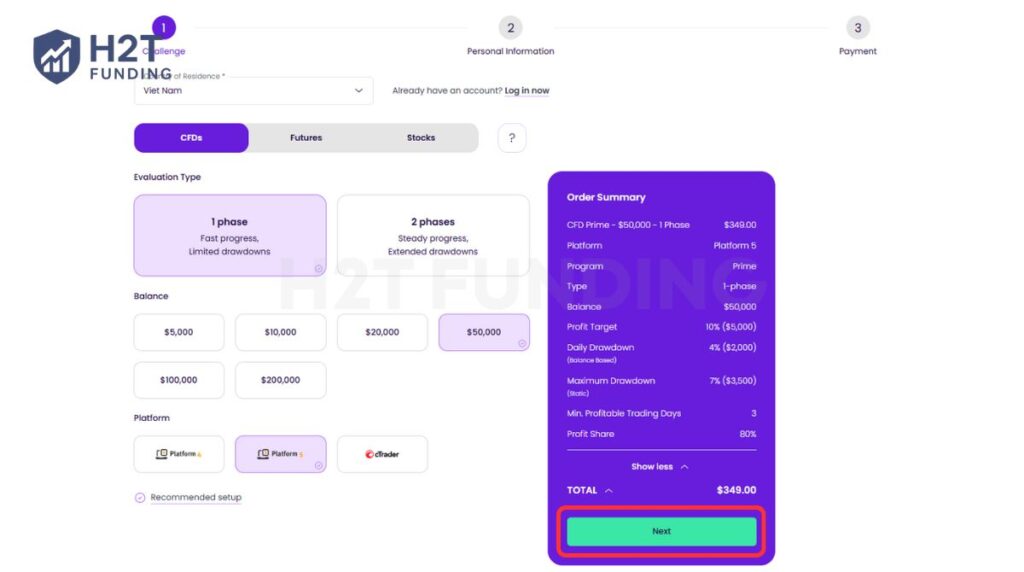

Once logged in, select your asset class: CFDs, Futures, or Stocks. Choose your evaluation type (e.g., 1 Phase) and your desired starting balance.

Select your preferred trading platform, such as cTrader or Platform 5. The “Order Summary” on the right will update to show your specific profit targets and drawdown limits.

11.4. Step 4: Personal information

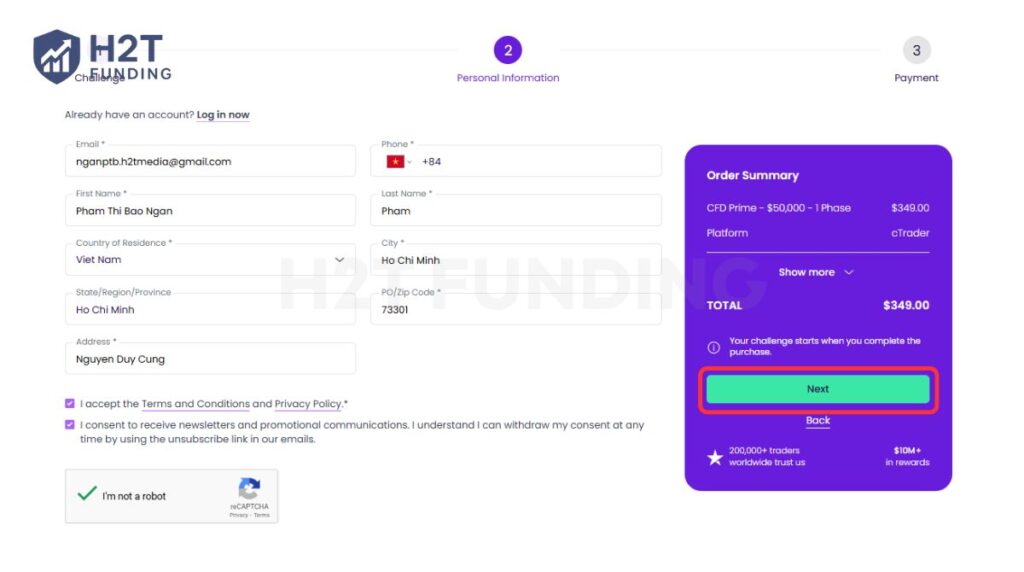

Proceed to fill in your billing details, including your full address and zip code. Make sure this information matches your ID documents for future verification. Review the Order Summary sidebar one last time to confirm the price. Click “Next” to lock in your challenge selection and move to the final step.

11.5. Step 5: Secure payment

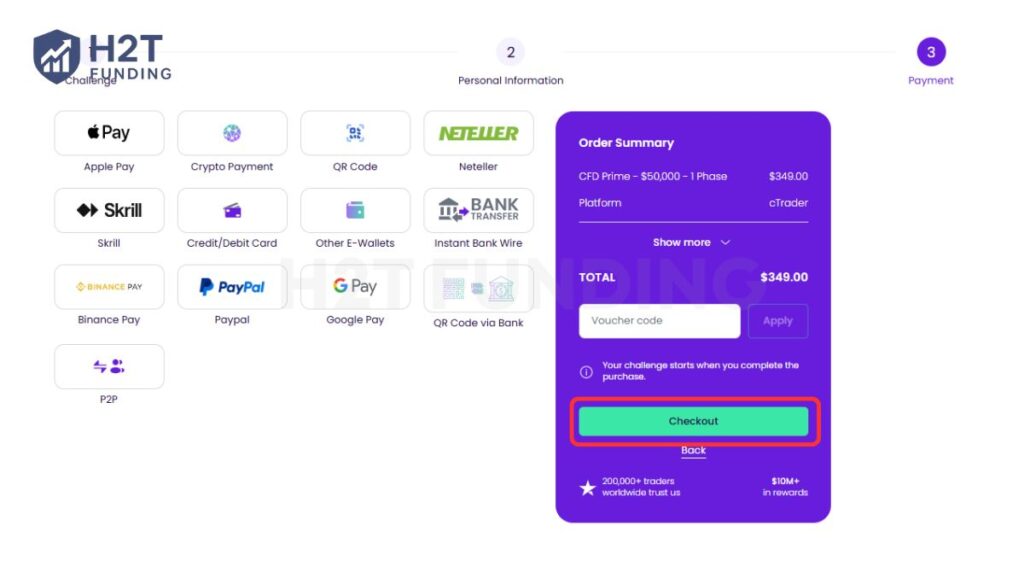

Choose a payment method from options like Credit Card, PayPal, Crypto, or Skrill. If you have The Trading Pit code or a specific The Trading Pit voucher code, enter it in the box and click “Apply.”

Click the green “Checkout” button to finalize your transaction. Your trading account credentials will be generated instantly, allowing you to start the challenge.

The entire registration flow is designed for speed and user convenience. With diverse payment options like Crypto, PayPal, and Skrill, global access is guaranteed. Just ensure you double-check your platform choice before paying to avoid any setup errors.

12. The Trading Pit restricted countries

The Trading Pit operates globally but must strictly adhere to international sanctions and data licensing agreements. Consequently, access to services varies depending on your location and the specific asset class you wish to trade.

The country restrictions and availability rules outlined below are compiled from The Trading Pit’s official website and its data-provider compliance disclosures. If you reside in any of the following nations, you are completely restricted from opening any account with The Trading Pit. No services are available for:

- Burundi

- Cuba

- Iran

- North Korea

- South Sudan

- Sudan

- Syrian Arab Republic

Due to specific regulations from data providers (like Rithmic and Tradovate), Futures trading is not supported for a wider range of countries. Residents in these regions cannot purchase Futures challenges:

- Afghanistan

- Albania

- Antarctica

- Belarus

- Burkina Faso

- Chad

- Congo

- Côte d’Ivoire

- Djibouti

- East Timor

- Guinea-Bissau

- Jordan

- Lao PDR

- Lesotho

- Libya

- Malawi

- Palestinian Territory

- Rwanda

- Sierra Leone

- Somalia

- Tajikistan

- Yemen

Important Note: Your Client Area is smart enough to filter this automatically. It will only display products that are legally available in your country of residence. If “Futures” does not appear in your dashboard, it is not supported in your region.

13. Compare The Trading Pit vs other prop firms

To put The Trading Pit into proper context, it is important to compare it with top-tier prop firms that dominate trader community discussions, including FTMO, Topstep, and My Funded Futures.

The comparison below focuses not only on pricing and features, but also on reputation, payout access, and risk structure, the factors that matter most in real trading conditions.

| Criteria | The Trading Pit | Topstep | FTMO | My Funded Futures |

|---|---|---|---|---|

| Years in Operation | 4 years | 14 years | 11 years | 3 years |

| Trustpilot Score | 4.2/5 | 3.6/5 | 4.8/5 | 4.9/5 |

| Asset Focus | Futures, CFDs, Stocks | Futures only | Forex, Commodities, Indices, Stocks, Crypto | Futures only |

| Evaluation Model | 1-step, 2-step | 2-step | 2-step | 1-step |

| Account Size | $5K – $200K | $50K – $150K | $10K – $200K | $50K – $150K |

| Profit Split | 80% | 90% – 100% | 80% – 90% | 80% – 90% |

| Time Limit | No time limit | No time limit | No time limit | No time limit |

| Payout Frequency | Weekly (after conditions) | 5 winning days of $150+ | Bi-weekly | 5 winning days with at least $100 |

| Trading Platforms | MT4, MT5, cTrader, NinjaTrader, Quantower, TradingView | TopstepX | MT4, MT5, cTrader, DXTrade | NinjaTrader, Tradovate, TradingView, Quantower |

Key differences that matter in practice

Reputation & trust (Years in operation + Trustpilot score):

- Looking at operating history and public trust scores, FTMO clearly leads the group. With 11 years in operation and a 4.8/5 Trustpilot rating, it has built a reputation as one of the most stable and transparent prop firms in the industry.

- Topstep has the longest history (14 years), but its lower Trustpilot score (3.6/5) reflects mixed trader feedback, often related to stricter rules and discipline-focused enforcement.

- My Funded Futures, despite being only 3 years old, stands out with the highest trust score (4.9/5), largely driven by fast payouts and a simple evaluation structure.

- The Trading Pit sits in the middle: 4 years of operation and a 4.2/5 rating suggest solid credibility, but not yet at the benchmark level set by FTMO or the rapid trust adoption seen at My Funded Futures.

Asset focus & flexibility:

This is where The Trading Pit differentiates itself most clearly. While Topstep and My Funded Futures are Futures-only, and FTMO focuses on Forex and CFDs, The Trading Pit is the only firm in this comparison offering Futures, CFDs, and Stocks under one ecosystem.

For traders who want to diversify across asset classes or switch strategies without changing firms, this flexibility is a meaningful advantage that none of the Futures-only competitors can match.

Evaluation model & difficulty:

FTMO and Topstep both rely on a 2-step evaluation, reinforcing consistency but extending the time before traders can access payouts.

My Funded Futures and The Trading Pit offer 1-step options, reducing evaluation friction. However, The Trading Pit also includes 2-step paths, making it more flexible but slightly more complex for new traders to navigate compared to My Funded Futures’ straightforward 1-step model.

Which firm is best for

- The Trading Pit: Traders who want multi-asset flexibility (Futures, CFDs, Stocks) and are comfortable managing trailing drawdown mechanics.

- Topstep: Futures traders who value structure, education, and strict discipline backed by a long-established brand.

- FTMO: Traders seeking maximum reputation, stability, and scalable business-style trading with predictable payouts.

- My Funded Futures: Experienced Futures traders who prioritize speed, simplicity, and minimal restrictions.

14. Should I choose The Trading Pit?

Unlike traditional investors risking their full initial investment, using risk capital here allows you to find the program that fits your specific strategy. Based on our analysis of their rules and assets, The Trading Pit is a specialized tool that works brilliantly for some but not for all.

YES, you should choose The Trading Pit if:

- You are a Multi-Asset Trader: Most firms force you into a box. If you want to trade Futures (NQ, ES) in the morning and scalp Crypto or Forex in the afternoon under one roof, this ecosystem is unrivaled.

- You are a Scalper: With access to professional order flow tools like ATAS and Quantower, plus raw spreads on Futures, you get the execution speed required for tick-perfect entries.

- You Trade for a Living (Not Gambling): The “Daily Pause” feature on Futures accounts acts as a safety net, protecting your career from a single day of emotional tilt. This feature alone saves accounts.

NO, look elsewhere if:

- You need High Crypto Leverage: The 1:2 leverage on crypto is restrictive for retail traders used to 1:100. Unless you have a specific low-leverage strategy, your capital efficiency here will be low.

- You are a News Straddler: If your only edge is gambling on CPI or NFP releases with max leverage, the strict news restrictions on larger accounts ($100k+) will eventually get you banned.

15. Is The Trading Pit legit?

Yes, The Trading Pit is a legitimate prop trading firm, not a scam. It has been operating since October 2022, is headquartered in Liechtenstein, and is backed by Pinorena Capital, which adds a strong layer of financial credibility compared to many underfunded competitors.

Payout reliability confirms this legitimacy. The firm holds a 4.2/5 Trustpilot rating, with consistent feedback praising fast payouts, especially via crypto. However, The Trading Pit strictly enforces its rules, meaning disciplined traders get paid, while rule violations lead to denied withdrawals. Overall, it is legit, but only if you trade by the rules.

Disclaimer:

The content provided in this review is for general information purposes only and does not constitute investment advice or a professional recommendation regarding any financial instrument.

H2T Funding is not involved in the solicitation of securities or the offering of unregistered financial services. Furthermore, this article is not a solicitation to trade in jurisdictions where such activities are prohibited. Traders should carefully read the full risk disclosure document on The Trading Pit’s official website before participating in any evaluation program.

16. FAQs

No. The Trading Pit does not accept US clients due to regulatory and data provider restrictions. If you are based in the US, the Futures, CFDs, and Stocks challenges are not available.

News trading is allowed on smaller CFD accounts, but it is restricted on larger accounts ($100K and $200K) during high-impact news, typically 2 minutes before and after the event. Futures rules vary by program, with Futures Prime allowing news trading.

For CFD Prime accounts, you need at least 3 profitable days, with each day generating a minimum of 0.5% profit. Other programs, such as Futures or Stocks, have different consistency requirements.

No. The Trading Pit does not provide free trials. All challenges require a one-time fee, though the fee is refunded with the first payout on eligible programs.

You should choose The Trading Pit if you want multi-asset access (CFDs, Futures, and Stocks), professional trading platforms, and clear, transparent rules. It is especially strong for disciplined traders and futures scalpers.

Yes. Crypto payouts are supported and are often the fastest withdrawal method, with many traders receiving funds within the same day.

Yes. The Trading Pit charges a flat 1% withdrawal fee, which covers transaction and processing costs. There are no hidden fees beyond this.

You can withdraw funds via cryptocurrency or international bank wire (USD/EUR). Crypto is faster, while bank transfers usually take 5–7 business days.

No. Account merging is not supported. However, copy trading between your own accounts is allowed within the firm’s allocation limits.

CFD and Futures accounts are breached after 21 days of no trading activity, while Stocks accounts have a stricter 14-day inactivity limit. Holding positions does not count as activity.

CFD accounts scale by 25% increments once you meet three conditions: 2 months of activity, 2 payouts, and 10% total profit. Every fourth scale-up recalculates the increases from the new base balance.

Yes. Weekend holding is allowed for CFD accounts, including crypto trading on cTrader. However, traders should be cautious of weekend gaps that may affect drawdown limits.

CFD Challenges are traded on MT4, MT5, and cTrader. Once chosen, the platform cannot be changed during the challenge.

17. Conclusion

This The Trading Pit review shows that the firm is a legitimate, well-structured prop trading company designed for traders who value discipline, transparency, and professional trading conditions.

That said, The Trading Pit is not for everyone. Its strict risk management rules, conservative crypto leverage, and tight futures drawdowns mean that reckless or rule-bending strategies will not survive. Traders who understand the rules, manage risk properly, and focus on consistency are the ones who benefit most from its ecosystem.

If you are comparing prop firms, we recommend exploring the Prop Firm Review category at H2T Funding for more in-depth comparisons and analysis. There, you’ll find detailed reviews, comparisons, and trader-focused insights to help you choose the prop firm that best fits your strategy and long-term goals.