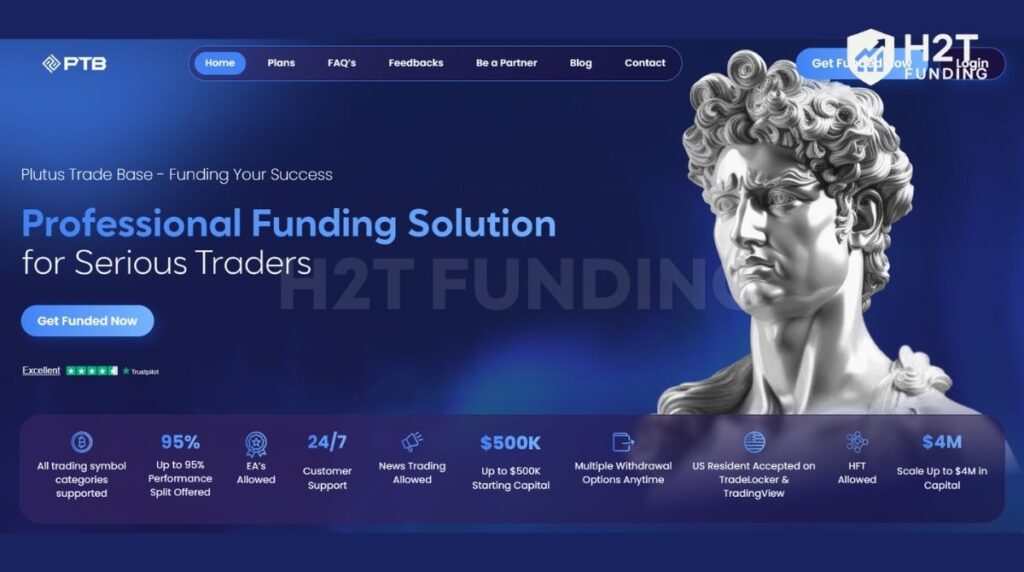

Plutus Trade Base is a legit proprietary trading firm that offers serious traders up to $500,000 in initial capital. They distinguish themselves by accepting US residents and permitting aggressive strategies like High-Frequency Trading (HFT) and News Trading.

Finding a prop firm that allows EAs while offering a 95% profit split is rare in today’s financial markets. However, traders often question whether these flexible conditions and their Excellent Trustpilot rating translate to reliable withdrawals.

This Plutus Trade Base Review examines their simulated trading rules, scaling potential up to $4M, and payout consistency. H2T Funding provides the insights needed to decide if you should trust them with your trading career.

1. What is Plutus Trade Base?

Plutus Trade Base is a proprietary trading firm established in September 2024 and headquartered in Saint Lucia. They provide capital allocation through simulated trading environments, allowing qualified users to manage up to $500,000 in initial virtual capital without risking personal funds.

However, users should heed the general risk warning regarding the speculative nature of these markets and remember that results are based on hypothetical performance.

The firm distinguishes itself by accepting US residents specifically via TradeLocker and TradingView, effectively minimizing common jurisdictional restrictions. They support diverse approaches, including High-Frequency Trading (HFT), News Trading, and Expert Advisors (EAs), executable on top-tier platforms like MT5, cTrader, and DXTrade.

Traders benefit from flexible conditions such as no time limits on evaluations and a highly competitive profit split of up to 95%. To aid performance, their dashboard integrates advanced analytics and risk management tools, ensuring you have the data needed to refine your trading strategy.

2. Our take on Plutus Trade Base

Plutus Trade Base is a proprietary trading firm that operates remarkably like a pay-to-play high-performance vehicle. From our testing, it is evident that this firm is built specifically for aggressive traders who want speed and are willing to pay for premium privileges.

The standout feature is undoubtedly the Lightning Account. It offers a 1-step evaluation with only a 3% profit target, which is statistically one of the best opportunities in the current market to get funded quickly.

However, the experience is not without friction points. Users must purchase Add-Ons for basic features such as weekend holding. In addition, strict liquidity rules prevent traders from withdrawing their full balance.

Note: Prop firm conditions and trader outcomes vary significantly depending on execution style, risk management, and rule interpretation. This review reflects aggregated feedback and analytical assessment, not guaranteed results.

| Pros | Cons |

|---|---|

| Lightning Account requires only a 3% profit target to pass. | Standard accounts have a high $1,000 minimum withdrawal threshold. |

| Accepts US traders via the TradeLocker platform. | Mandatory 3% buffer rule prevents full withdrawals. |

| Instant Funding accounts have a low $10 minimum withdrawal. | Holding trades over the weekend requires a paid add-on. |

| Crypto trading is available 24/7 on all accounts. | The $100k account has stricter drawdown limits than smaller sizes. |

| High-Frequency Trading (HFT) is allowed with an add-on. | The strict consistency rule applies to the Adventure Plan. |

| Offers an industry-leading 95% profit split upgrade. | No platform switching is permitted after purchase. |

| The scaling plan doubles your account size at 14% profit. |

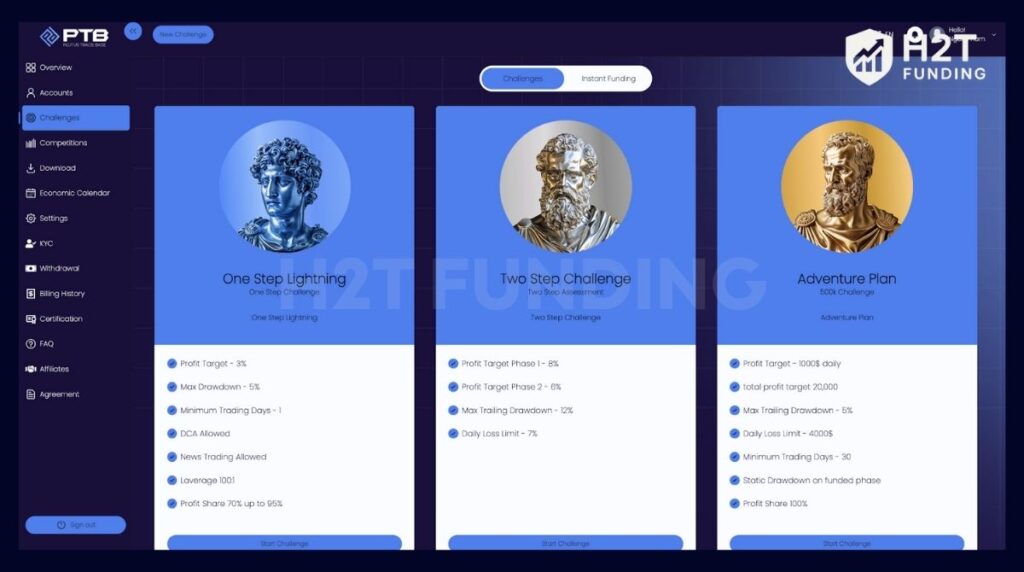

3. Plutus Trade Base programs

Plutus Trade Base offers four distinct evaluation programs tailored to different trading styles: Lightning, Adventure, Challenge, and Instant. Whether you prefer a traditional 2-step evaluation or immediate funding, their diverse lineup ensures there is a suitable option for every strategy.

Explore the specific rules and benefits of each trader’s accounts below to determine which model best aligns with your trading skills and profit objectives.

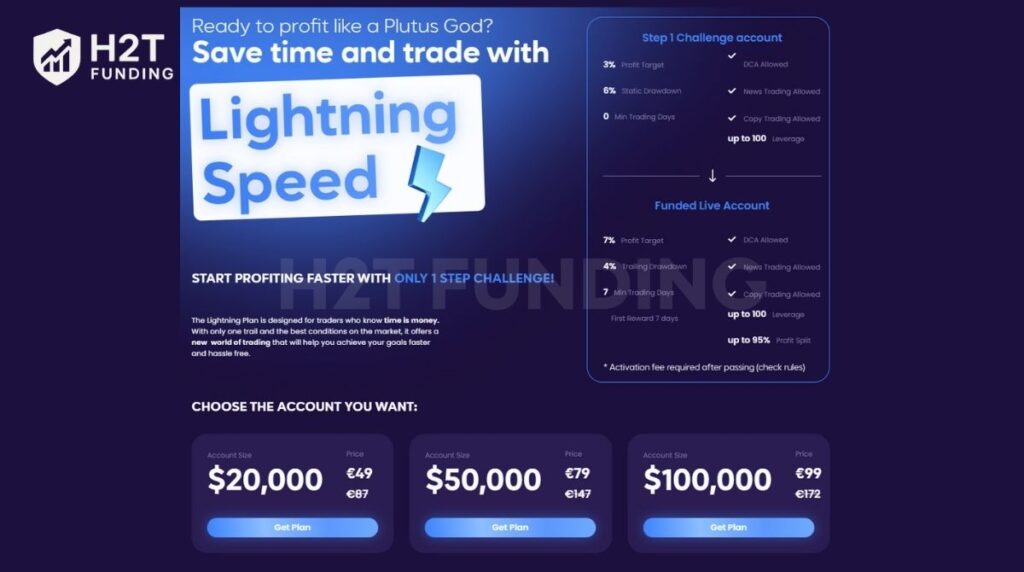

3.1. Lightning account

The Plutus Trade Base Lightning Challenge is a 1-step evaluation designed for traders who value speed and efficiency. With 0 minimum trading days and a low 3% profit target, this program allows skilled users to get funded quickly without unnecessary hurdles.

During the assessment phase, traders benefit from a generous 10% Static Drawdown, providing significant room for market fluctuations. However, once you transition to live trading, the risk parameters tighten to a 4% Trailing Drawdown, requiring stricter risk management to maintain the account.

| Account Size | Price | Profit Target (3%) | Max Static Drawdown (10%) | Funded Trailing Drawdown (4%) |

|---|---|---|---|---|

| $20,000 | €87 | $600 | $2,000 | $800 |

| $50,000 | €147 | $1,500 | $5,000 | $2,000 |

| $100,000 | €172 | $3,000 | $10,000 | $4,000 |

Traders can utilize leverage up to 1:100 throughout both the challenge and funded stages. This account type also permits diverse strategies, including News Trading, DCA, and Copy Trading, ensuring you can trade according to your preferred style.

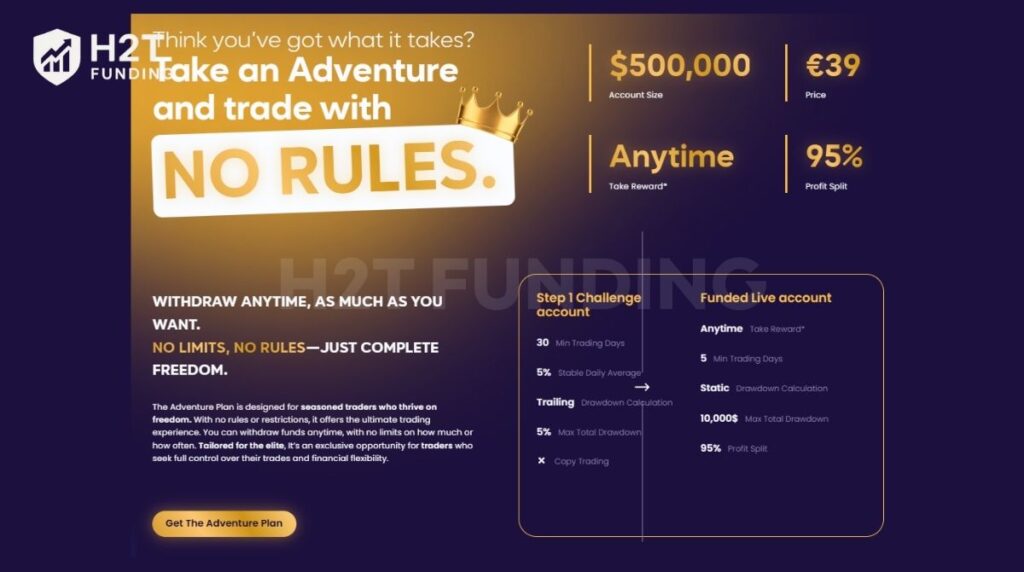

3.2. Adventure account

The Adventure Account is marketed as a No Rules option for elite traders, offering a massive $500,000 account size for a remarkably low entry fee of €69. While the promise of withdrawal anytime and a 95% profit split is attractive, traders must scrutinize the strict operational constraints hidden behind the freedom slogan.

Contrary to the No Rules claim, the Step 1 phase enforces a rigorous consistency rule. You are required to trade for a minimum of 30 days and maintain a 5% Stable Daily Average, preventing users from passing via a single lucky trade.

| Feature | Step 1 (Challenge) | Funded Live Account |

|---|---|---|

| Time Requirement | 30 Min Trading Days | 5 Min Trading Days |

| Drawdown Type | Trailing | Static |

| Max Drawdown | 5% (Percentage based) | $10,000 (Fixed Value) |

| Consistency Rule | 5% Stable Daily Average | N/A |

| Copy Trading | Not Allowed (✖) | Not Allowed (✖) |

It is critical to note that on the Funded Live Account, the maximum total drawdown is fixed at $10,000. On a $500,000 balance, this effectively represents only a 2% risk buffer, meaning tight risk management is essential to avoid breaching the limit.

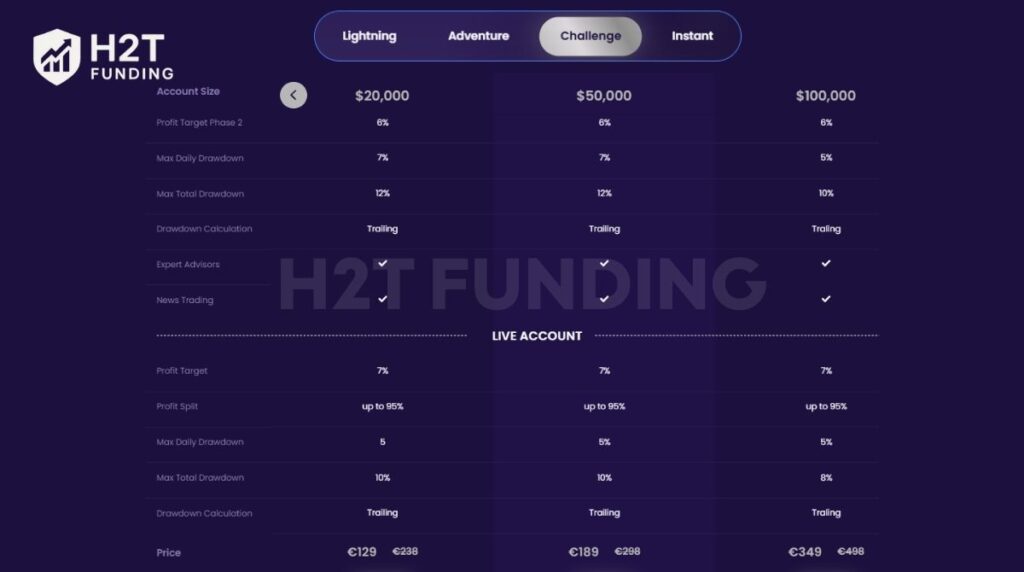

3.3. Challenge account

The Plutus Trade Base Challenge follows a traditional evaluation structure suitable for disciplined traders. It supports Expert Advisors (EAs) and News Trading, offering flexibility for automated and fundamental strategies.

A crucial detail for traders to notice is the inconsistent risk scaling. Unlike most firms, where larger accounts have the same or better conditions, the $100,000 account actually has stricter drawdown limits than the smaller options. While the $20k and $50k accounts allow for a generous 12% Total Drawdown during the challenge, the $100k account restricts this to 10%.

| Account Size | Price | Phase 1 Target (8%) | Phase 2 Target (6%) | Max Daily DD (Challenge) | Max Total DD (Challenge) | Live Account Max Total DD |

|---|---|---|---|---|---|---|

| $20,000 | €238 | $1,600 | $1,200 | $1,400 (7%) | $2,400 (12%) | $2,000 (10%) |

| $50,000 | €298 | $4,000 | $3,000 | $3,500 (7%) | $6,000 (12%) | $5,000 (10%) |

| $100,000 | €498 | $8,000 | $6,000 | $5,000 (5%) | $10,000 (10%) | $8,000 (8%) |

Important considerations:

- Drawdown calculation: The drawdown is trailing across all phases, which moves with your highest equity point.

- Live account tightening: Once funded, the risk limits decrease. For the $100k account, the Total Drawdown shrinks to just 8% on the live stage, requiring precise risk management.

- Profit target: A uniform 7% profit target applies to the Live Account for withdrawal eligibility/scaling.

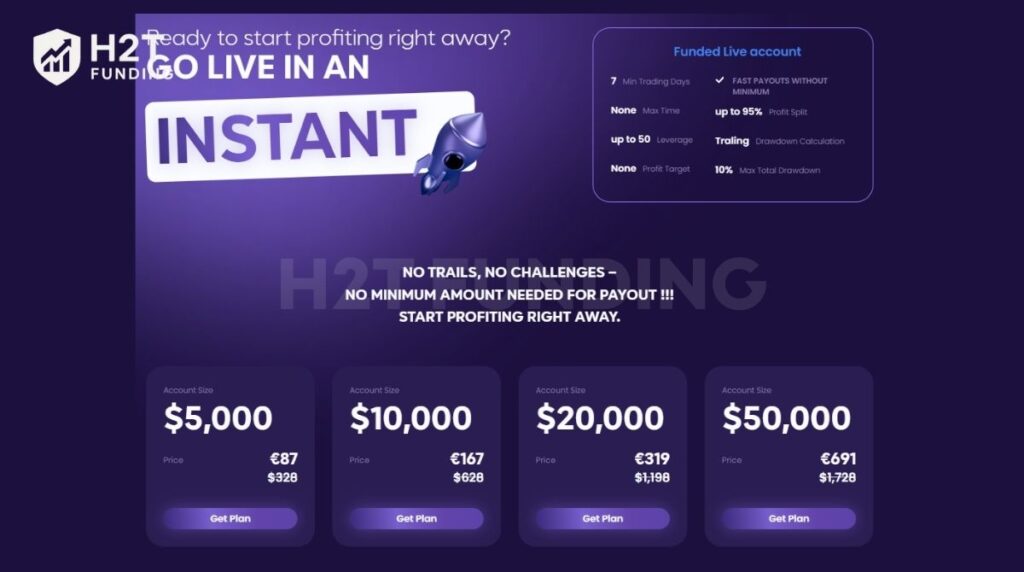

3.4. Instant funding

For traders who find evaluations psychologically draining or time-consuming, the Plutus Trade Base Instant Funding program offers an immediate solution. As the name suggests, there are no challenges and no verification stages. You pay the fee and receive a live-simulated account to start earning right away.

This model is particularly attractive because it removes the pressure of a profit target. You simply trade at your own pace with no time limits. The leverage is capped at 1:50, which is standard for instant accounts but lower than the evaluation models.

Crucially, the 10% Max Total Drawdown (Trailing) is remarkably generous for an instant funding model, where most competitors typically offer only 5-6%.

| Account Size | Price | Max Total Drawdown (10%) | Min Trading Days for Payout |

|---|---|---|---|

| $5,000 | $328 | $500 | 7 Days |

| $10,000 | $628 | $1,000 | 7 Days |

| $20,000 | $1,198 | $2,000 | 7 Days |

| $50,000 | $1,728 | $5,000 | 7 Days |

Beyond the entry speed, the terms are surprisingly trader-friendly. You aren’t restricted by a minimum withdrawal amount, meaning you can access your earnings freely as soon as you satisfy the 7 minimum trading days.

Furthermore, the potential to scale up to a 95% profit split is exceptional for an instant funding model. That makes this a solid choice for traders who trust their current performance results and want to skip the exam anxiety entirely.

Verdict on Plutus Trade Base programs

After digging deep into the math behind these accounts, Plutus Trade Base presents a fascinating puzzle for traders. The value you get depends entirely on which button you click.

From our internal simulations at H2T Funding, the Lightning Account shows the highest pass probability. Seeing a 3% profit target is almost unheard of in this industry. It’s perfect for scalpers or day traders who can secure a few quick wins and get funded. However, this is only suitable if you are disciplined enough to manage the tighter 4% trailing drawdown later.

On the flip side, I have to warn you about the Standard Challenge, specifically the $100k size. It makes absolutely no sense to buy the $100k account because the risk rules are stricter (10% drawdown) than the $50k account (12% drawdown). If you need $100k in funding, do yourself a favor: buy two $50k accounts instead. You will get the same capital but with significantly better drawdown limits.

Lastly, don’t let the Adventure Account marketing fool you. No Rules sounds great until you hit that 5% Stable Daily Average rule. That one rule alone can kill a profitable account if you have just one really good trading day. Unless you are a robot with perfectly consistent lot sizes, I’d steer clear of that one.

4. Plutus Trade Base rules

Plutus Trade Base (PTB) separates professional traders from gamblers through a specific set of guidelines. While they offer strategy freedom, many features require purchasing specific Add-Ons. Failure to adhere to these rules can result in immediate account termination.

Below is a detailed breakdown of what you can and cannot do within their ecosystem.

4.1. General guidelines & allowed practices

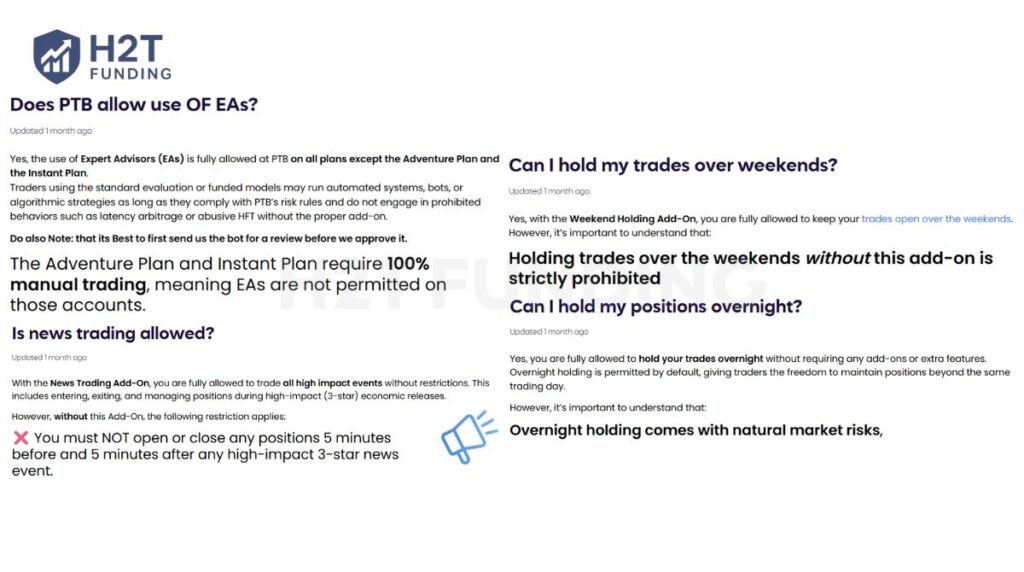

Plutus Trade Base generally supports diverse trading styles, but many freedoms are conditional upon purchasing specific Add-Ons. By default, the platform encourages consistent, manual trading.

- Hold times: There are no time limits on how long you can hold a trade. However, holding trades overnight is allowed by default, but holding over the weekend requires a specific Weekend Holding Add-On.

- Lot sizes: There are no specific lot size limitations. You are free to trade the volume you prefer, provided you do not violate the overall risk margin rules.

- Expert Advisors (EAs): EAs and bots are allowed on standard evaluation and funded models (excluding Adventure & Instant plans). It is highly recommended to submit your bot for review before use.

- Copy trading: You are permitted to copy trades between your own PTB accounts or manually copy external signals.

- Scalping: Professional scalping is welcome, but aggressive high-frequency scalping requires the HFT Add-On, which increases your daily trade limit to 60 (or 100 with DCA).

- News trading: You can hold positions through news events if opened more than 5 minutes prior. To trade actively during the 10-minute window surrounding high-impact news, you must purchase the News Trading Add-On.

4.2. Prohibited trading practices

To maintain a fair simulated trading environment, Plutus Trade Base strictly forbids activities that exploit system vulnerabilities rather than demonstrating genuine trading proficiency. Violation of these rules often leads to immediate account termination.

- System abuse & exploits: Any form of arbitrage (latency, reverse), tick exploitation, or taking advantage of platform errors/freezing prices is banned.

- Prohibited automation: Using High-Frequency Trading (HFT) bots or fast-execution algorithms without the specific HFT Add-On is treated as abusive behavior.

- Market manipulation: Practices such as spoofing, layering, wash trading, or coordinated hedging across multiple accounts to manipulate market flow are strictly forbidden.

- Risk management violations:

- Hedging: Strictly prohibited on all accounts.

- Margin limit: You must not use more than 70% of your available margin across all open trades.

- Gambling behavior: Excessive risk-taking, such as all-in bets or inconsistent lot sizing that does not reflect a real strategy, is monitored and restricted.

- Inactivity Rule:

- Challenge accounts: Must execute a trade at least once every 10 days.

- Funded accounts: Must execute a trade at least once every 7 days.

- Third-party copying: Automated copying from external sources is not allowed. This policy protects the firm’s trademark and intellectual property against unauthorized reproduction or violation of copyright laws.

- VPN/VPS Usage: The use of VPNs or VPS services is strictly prohibited and can trigger security flags.

Verdict on Plutus Trade Base rules

To be blunt, PTB operates on a structure where advanced flexibility is unlocked through optional add-ons. The base rules are actually quite restrictive compared to other firms. You don’t get full freedom unless you pay extra for the News, Weekend, or HFT Add-Ons.

The biggest trap here is the 70% Margin Limit. Most traders focus on the drawdown number, but this margin cap can fail you even if you are in profit. You have to watch your leverage usage constantly to avoid a silly breach.

Also, the No VPN/VPS rule is incredibly strict. If you travel often or like trading from a secure remote server, this firm might not be for you. One accidental login from a different IP could trigger a security flag.

Finally, pay attention to the Consistency Rule based on equity. Since unrealized profits count towards your daily limit, a winning trade that you don’t close can actually hurt your consistency score for the next day.

To put these restrictions into perspective, it’s useful to compare them with standard prop firm rules and see how PTB’s add-on–driven model stacks up against the broader industry.

5. Plutus Trade Base payout structure

A prop firm is only as good as its ability to pay out. Plutus Trade Base (PTB) offers a flexible withdrawal system with some unique rules designed to maintain account longevity. While the lack of a payout cap is excellent, traders must be aware of specific buffer requirements and minimum thresholds that vary by account type.

We analyzed the compensation data to clarify how money flows. Below is the essential payout information regarding methods and frequency for your wallet.

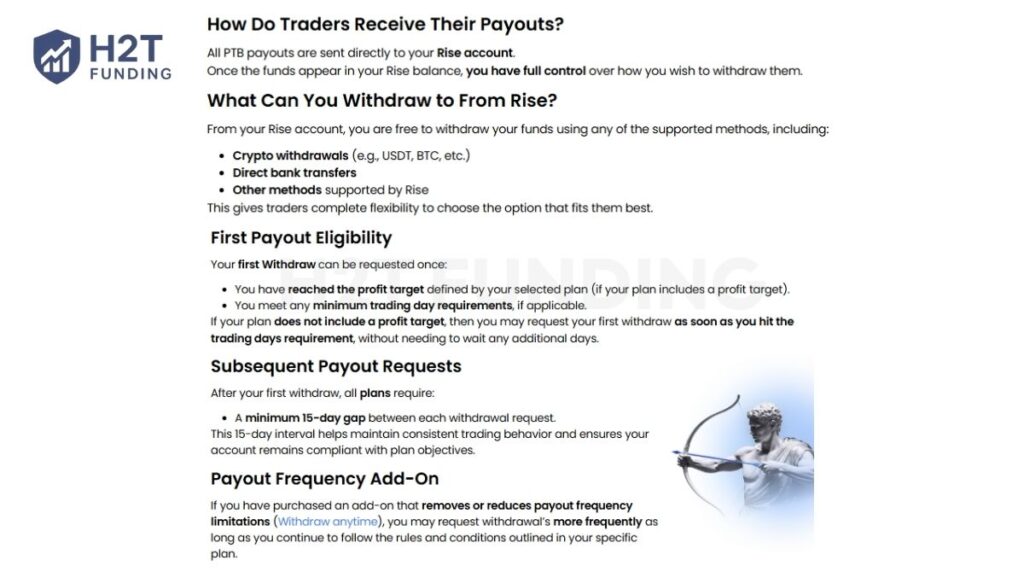

5.1. Payout methods & frequency

- Deposit methods: You can purchase accounts using Crypto (Confirmo), Visa/MasterCard, Google Pay, or Apple Pay. PayPal is exclusively available for residents of Ukraine.

- Payout channels: All earnings are sent to your Rise account. From there, you can transfer funds to your bank or withdraw via Crypto (USDT, BTC).

- Frequency:

- First payout: You can request your first withdrawal as soon as you meet the profit target (if applicable) or the minimum trading days.

- Subsequent payouts: There is a mandatory 15-day gap between withdrawals.

- Anytime add-on: Traders who purchase this specific Add-On can bypass the 15-day rule and withdraw more frequently.

- Profit split: The default split is 70%. However, you can upgrade this to a massive 95% at checkout via an Add-On.

5.2. Minimum payout amounts

This is where the account type matters significantly:

- Standard plans (Lightning, Challenge, Adventure): You must have at least $1,000 in profit to request a withdrawal. This is relatively high for smaller account sizes.

- Instant funding plan: The minimum withdrawal is incredibly low, starting at just $10. This makes the Instant plan perfect for testing the withdrawal process without pressure.

Important: The 3% Buffer Rule: You generally cannot withdraw the last 3% of your account balance. This mandatory buffer ensures your account remains active and has enough margin to continue trading without an immediate breach.

Verdict on Plutus Trade Base payouts

The payout structure here is a distinct mix of high barriers and unique flexibility. The most glaring hurdle is the $1,000 minimum withdrawal for standard accounts. For a trader on a small $5,000 or $10,000 account, generating $1,000 in profit just to cash out is a massive psychological and technical challenge.

However, the Instant Funding model flips this script entirely. With a $10 minimum payout, it offers one of the lowest barriers to entry I have seen. This makes the Instant plan significantly more trustworthy for skeptics who want to test the withdrawal process without grinding for weeks.

Finally, the 3% Buffer Rule is a necessary evil. While it is annoying that you cannot clean out your profit entirely, it effectively saves traders from themselves. By forcing you to leave a cushion, it prevents the common mistake of withdrawing everything and then blowing the account on the very next trade due to zero drawdown room.

For readers who want a broader framework behind these rules, it helps to understand how funded trading accounts work before comparing payout structures across prop firms.

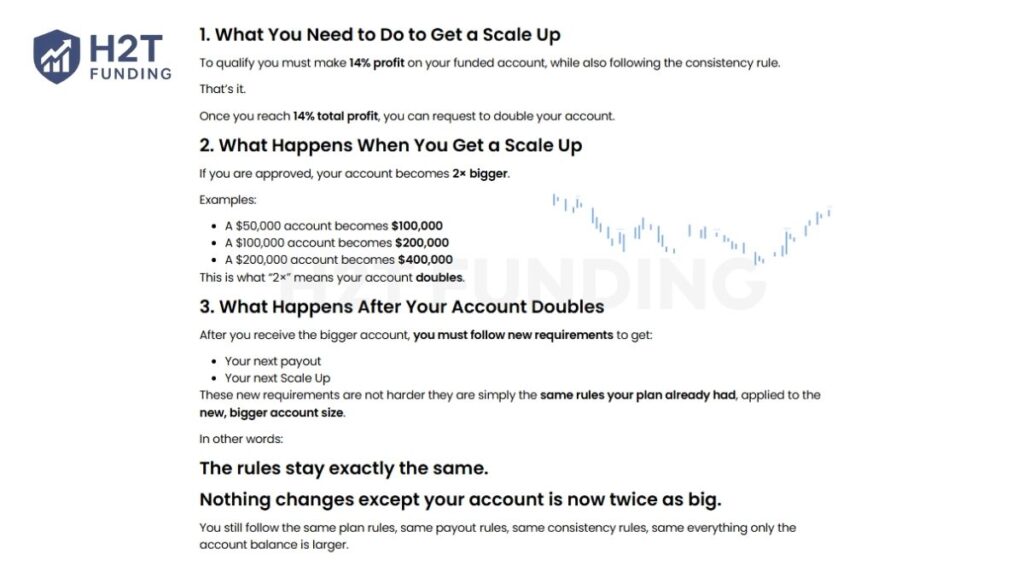

6. Plutus Trade Base scaling plan

Plutus Trade Base offers a highly aggressive scaling structure that allows successful traders to exponentially grow their capital. Unlike firms that increase capital by small increments (e.g., 20%), PTB allows you to double your account size upon meeting the requirements.

This opportunity is available on all programs except the Adventure Plan.

- Qualification requirement: You must achieve a 14% total profit on your funded account while strictly adhering to the consistency rules.

- The reward: Once the target is met, your account size doubles (2x). For example, a $50,000 account becomes $100,000.

- Operational continuity: After scaling, the rules do not change. You continue trading the larger balance with the exact same drawdown limits and profit split conditions.

- Repeatable growth: This is not a one-time event. You can continue to hit the 14% target on the new account size to scale up again, potentially reaching millions in funding.

Verdict on the scaling plan

The Double Your Account offer is genuinely impressive compared to the industry standard. Most competitors only offer a 25% or 40% capital increase per cycle, so jumping from $50k straight to $100k is a massive accelerator for a trader’s career.

However, do not underestimate the difficulty of the 14% profit target. On a live account where real psychology and risk management come into play, generating 14% net profit without breaching drawdown is a significant challenge that takes time and discipline.

It is also important to remember that the Adventure Plan is excluded. If your goal is to scale up to massive capital, you should avoid the Adventure account and stick to the Lightning or Challenge models where this scaling benefit applies.

7. Spreads & commission fees

Plutus Trade Base distinguishes itself with a zero-commission structure. Unlike many proprietary firms that charge $3 to $7 per round lot, PTB does not deduct any fees from your executed positions, regardless of the asset class or volume.

The cost structure is entirely transparent: your one-time evaluation fee covers everything. Once you purchase a plan, there are no hidden subscription costs, and your profit & loss (P&L) is not eaten away by per-trade charges.

- Commissions: $0 per lot across all trading instruments.

- Hidden fees: None. No recurring monthly charges or maintenance fees.

- Market conditions: Execution mimics real financial markets, ensuring you face actual volatility and liquidity dynamics without artificial markups.

Verdict on spreads & fees

Honestly, a Zero Commission model is a breath of fresh air for most retail traders. It simplifies your math significantly. What you see on the chart is what you get, without having to calculate a $5 or $7 deduction for every trade you take. For swing traders, this is a pure net profit booster.

However, experienced scalpers know there is usually no such thing as a free lunch. Typically, zero-commission accounts have slightly wider spreads than Raw ECN accounts to cover costs. If you are a scalper targeting 3-5 pips, you should definitely test the spreads during the volatile New York overlap to ensure they remain tight enough for your strategy.

8. Plutus Trade Base trading platform

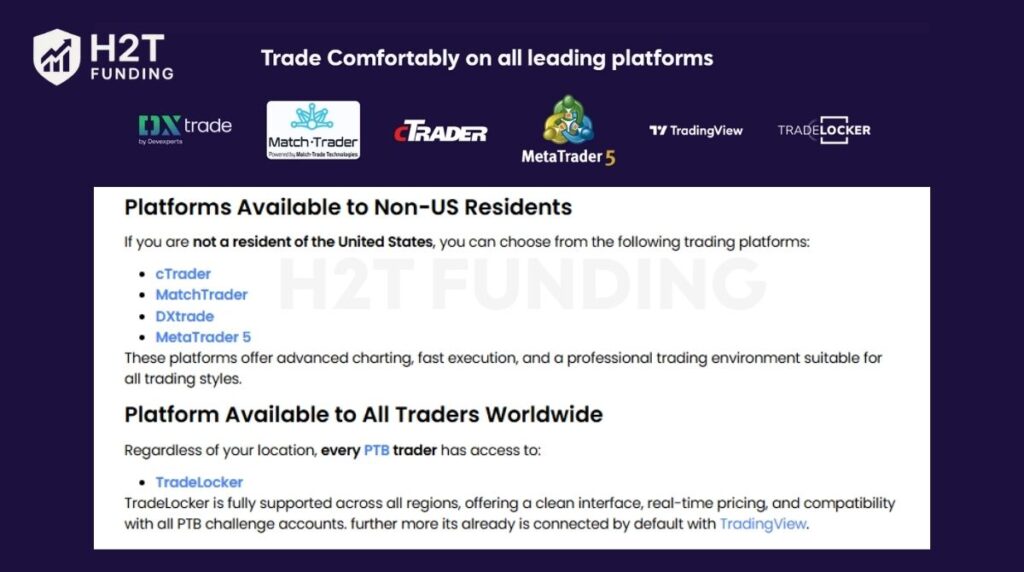

Plutus Trade Base provides a suite of professional educational software interfaces, though availability depends heavily on your residency. Non-US traders enjoy the full lineup, including the industry-standard MetaTrader 5 (MT5), cTrader, MatchTrader, and DXtrade.

For US residents, options are strictly limited due to regulatory compliance. You must use TradeLocker, which fortunately features native integration with TradingView charts, ensuring you still have access to professional analytical tools for your simulated trading.

A critical policy to remember is that you cannot switch platforms once your challenge begins. The only exception is upon passing an evaluation; you may request to change your platform specifically for the Funded Live Account stage before it is generated.

Key platform features:

- TradingView execution: Possible via cTrader or MatchTrader, but PTB provides no technical support or tutorials for this setup; you must configure it yourself.

- MT5 integration: Recently added for non-US clients, restoring a favorite tool for algorithmic traders.

- Mobile accessibility: All platforms support trading via mobile or tablet devices without restrictions.

Verdict on Plutus Trade Base trading platform

For US traders, being restricted to TradeLocker might feel limiting if you are a die-hard MetaTrader user. However, TradeLocker is actually a very capable platform because it integrates TradingView charts by default. Just be warned: the firm explicitly states they won’t help you connect TradingView to other platforms like cTrader, so you need to be tech-savvy enough to figure that out on your own.

9. Plutus Trade Base trading instruments

Plutus Trade Base provides a broad spectrum of tradeable assets via CFDs, ensuring that scalpers, day traders, and swing traders can all find suitable markets. The firm offers institutional-grade conditions across the following categories:

- Forex: Access to a full range of Major, Minor, and Exotic currency pairs.

- Indices: Trade the world’s most popular indices, including the NAS100, SPX500, and DAX40, known for their high liquidity and volatility.

- Metals & commodities: Includes safe-haven assets like Gold (XAUUSD) and Silver (XAGUSD).

- Crypto: 24/7 trading availability on major digital assets, allowing for weekend opportunities.

- Stocks: A curated list of top global companies (Tech, Financials, etc.), available exclusively on TradeLocker.

Verdict on Plutus Trade Base trading instruments

The asset selection here covers all the essentials for a professional trader. The standout feature is definitely the 24/7 Crypto trading, which is a huge bonus for those who want to keep working on weekends when traditional markets are closed.

However, the Stock trading restriction is a critical detail to note. If your strategy relies on individual equities like Tesla or Apple, you are forced to use TradeLocker. Traders who prefer MT5, cTrader, or DXtrade will be locked out of the stock market entirely, so make sure you pick the right platform for your asset class.

For traders who are just starting out and want a clearer roadmap, this guide on how to get a funded trading account offers a helpful next step.

10. Plutus Trade Base customer service and education

Plutus Trade Base (PTB) combines direct support channels with a comprehensive educational technology hub. Their infrastructure is designed not just to solve technical problems but to actively guide traders through the complexities of funding and market analysis.

10.1. Customer support channels

When technical issues arise, speed is everything. PTB offers a multi-tiered support system, though users should be aware of specific operating hours for certain channels.

- Discord (24/7): The Plutus Trade Base Discord is the primary hub for immediate assistance. Users can open support tickets around the clock, making it the most reliable method for urgent technical issues or account inquiries.

- WhatsApp & Email: Direct support is available at support@plutustradebase.com. These channels operate specifically from Sunday through Thursday, between 9:00 AM and 9:00 PM (Cyprus Time).

- Social connectivity: The firm maintains active profiles on Facebook, Instagram, and X (Twitter), serving as secondary touchpoints for general updates.

10.2. The trading academy

Far from being a generic blog, the PTB Academy is categorized into specific learning paths. From Tips for Beginners to advanced Market Analysis, the content is structured to help users improve their trading proficiency.

- Trading Guides & academy: Covers essential topics like how to get funded and strategies for passing evaluations.

- Market Analysis & news: Features deep dives into asset cycles, such as Why Bitcoin Never Dies and analysis of global events like Cloudflare outages.

- Psychology & mindset: A major focus area with articles like Why Consistency Beats Talent and Trading Into the New Year, helping traders master emotional discipline.

- Important announcements: Keep you updated on platform changes, such as the Ultimate Guide to Scaling Up and new compliance standards.

Verdict on support & education

The support setup here is solid but has one quirk. The 24/7 Discord is a lifesaver and clearly the primary way they want you to interact. It beats waiting for an email. However, the Sunday-Thursday schedule for WhatsApp and Email is annoying if you have a payout issue on a Friday, effectively leaving you waiting until next week for a formal reply.

On the bright side, the Academy is surprisingly good. Most prop firms just post generic What is Forex articles, but PTB is publishing relevant content on Bitcoin cycles and trader psychology. It feels like they actually want you to understand the market, not just gamble. The specific Tips for beginners category is a nice touch for those new to the prop firm model.

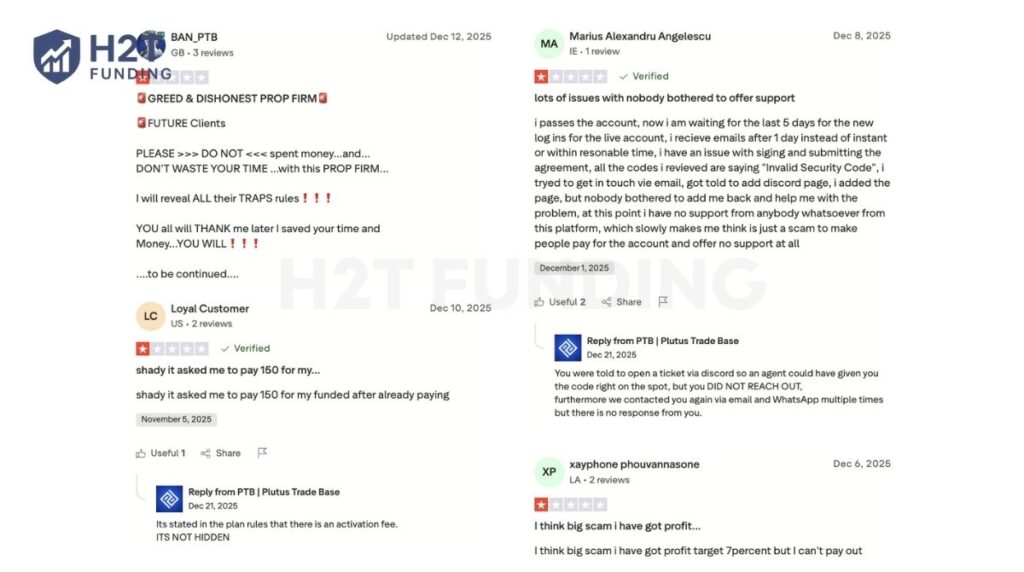

11. Real trader feedback: Plutus Trade Base review Trustpilot, and Plutus Trade Base Reddit

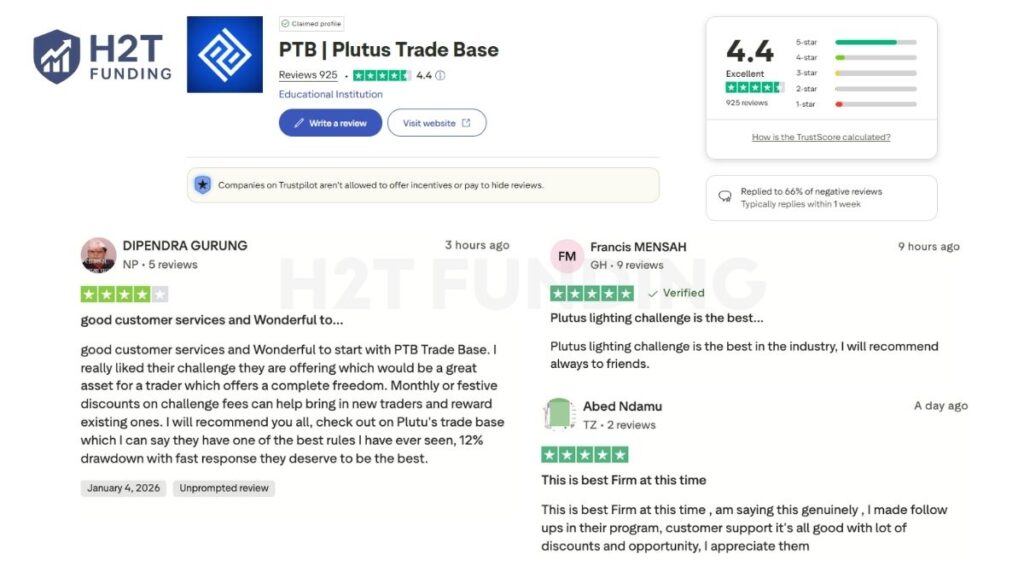

As of January 14, 2026, Plutus Trade Base holds a TrustScore of 4.4/5 from approximately 900 reviews. This relatively low volume suggests the firm is still growing and hasn’t yet reached mass adoption like older competitors. The feedback is distinctively polarized, splitting between satisfied winners and those facing technical hurdles.

Positive reviews frequently praise the Plutus Trade Base Lightning Challenge for its speed and flexible rules. Traders like Francis and Dipendra specifically highlight the generous 12% drawdown and the complete freedom as major advantages. They also commend the responsive support team when navigating discounts or starting new evaluations.

However, critical feedback exposes specific friction points, such as unexpected activation fees for funded accounts. Users like Marius reported Invalid Security Code errors that prevented access to live accounts, causing significant frustration. While PTB actively replies to these issues, technical blockers regarding logins and payouts remain a valid concern.

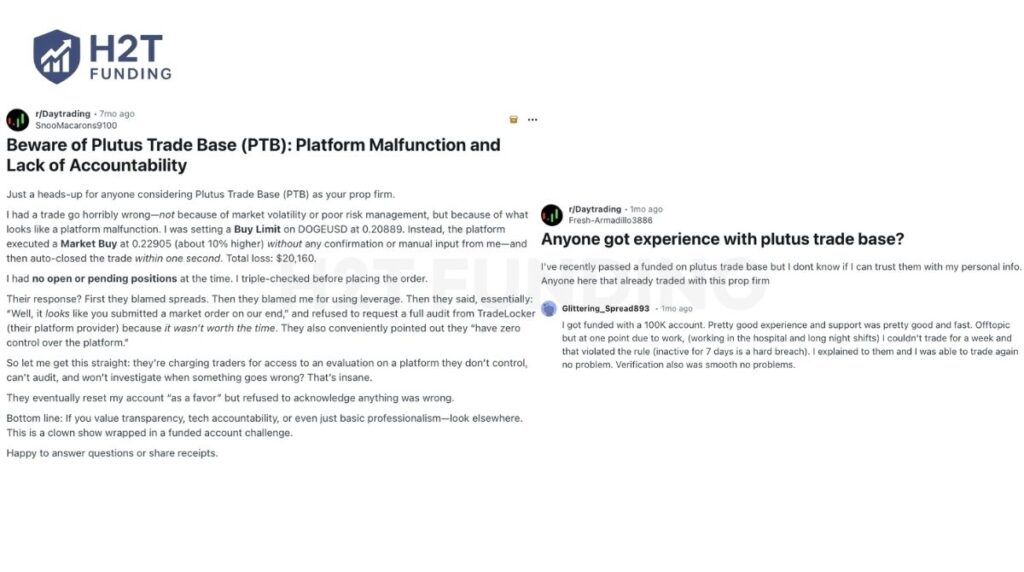

Reddit discussions offer a deeper, more technical perspective on the firm’s reliability. On the positive side, user Glittering_Spread893 shared a success story with a $100k account, noting that support was flexible enough to waive an inactivity breach due to a medical emergency. This indicates a degree of human understanding in their compliance department.

Conversely, complaints regarding the Plutus Trade Base withdrawal process remain a valid concern. A serious thread detailed a TradeLocker malfunction where a limit order executed as a market order, causing a massive loss.

The user reported that PTB refused to audit the trade, claiming they had zero control over the platform. This lack of accountability for third-party technical bugs is a significant risk factor to consider.

In summary, Plutus Trade Base offers a high-reward environment but carries specific operational risks. While the high rating confirms many traders are getting funded, complaints about platform glitches and hidden fees are notable. It is highly advisable to screen-record your trading sessions to have evidence in case of technical disputes.

For traders evaluating long-term risk and credibility, it’s also worth understanding whether prop trading firms are legit before committing significant capital.

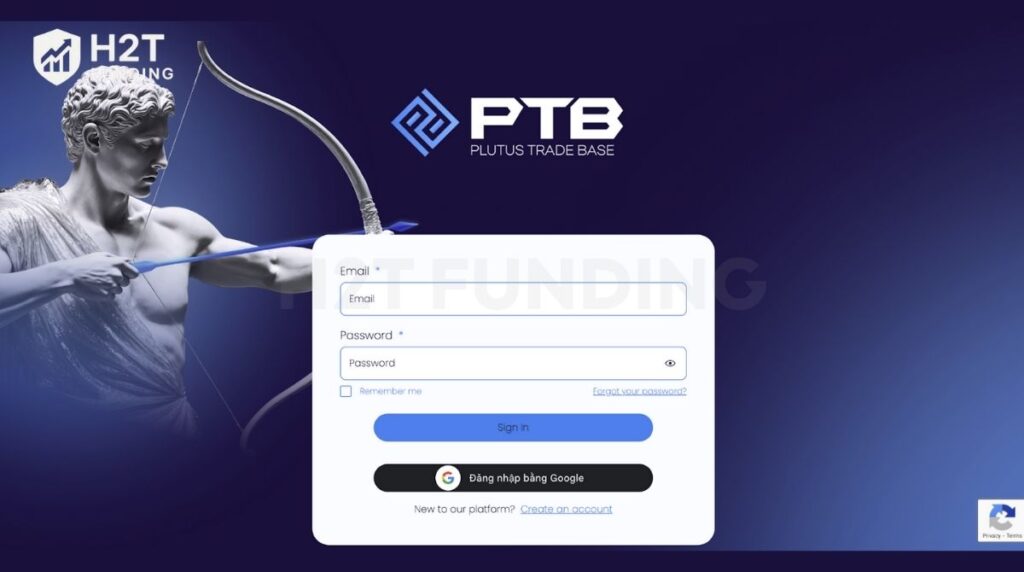

12. How to sign up for Plutus Trade Base

Getting started with Plutus Trade Base is a streamlined digital process designed to get you trading within minutes. The dashboard is modern and intuitive, allowing you to manage your verification, challenge selection, and billing in one secure portal.

- Step 1: Create your secure login credentials or use single sign-on.

- Step 2: Verify your identity and select your residency.

- Step 3: Compare and select your preferred challenge model.

- Step 4: Customize your account with specific Add-Ons and finalize payment.

Follow the detailed walkthrough below to ensure you select the correct platform and configuration for your trading style.

12.1. Step 1: Create your account credentials

Visit the official Plutus Trade Base website and click on the Login button. You will be directed to a secure authentication page. Here, you can register using your email address and a strong password, or utilize the Sign in with Google option for faster, one-click access.

12.2. Step 2: Enter personal details

Once logged in, you must complete your profile by entering your First Name, Last Name, and Phone Number. It is critical to select your correct Country of Residence from the dropdown menu immediately.

This step is vital because it determines which trading platforms (such as MetaTrader 5 vs. TradeLocker) are legally available to you based on local regulations.

12.3. Step 3: Select your evaluation model

Navigate to the Challenges tab on the left sidebar. You will see a visual comparison of the available programs: One Step Lightning, Two Step Challenge, and Adventure Plan. Review the key statistics displayed on each card, such as Profit Targets, Max Drawdown, and Leverage, to decide which risk structure aligns best with your strategy.

12.4. Step 4: Customize plan and checkout

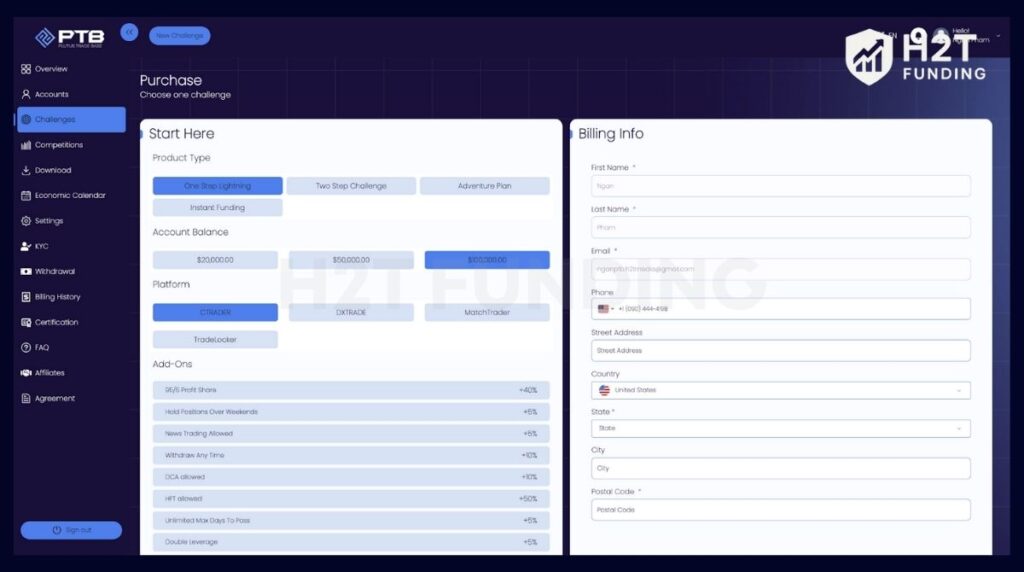

After clicking Start Challenge, you will enter the Purchase screen. First, select your Account Balance (e.g., $20k, $50k, $100k) and your Trading Platform. This is the most crucial step where you must select optional Add-Ons from the list, such as 95% Profit Share, Weekend Holding, or HFT Allowed. Once configured, enter your billing details to complete the payment.

The entire registration process is designed to be completed in under 5 minutes. After payment confirmation, your trading account is generated instantly, and your login details are emailed to you, so you can download the platform and start your evaluation right away.

13. Plutus Trade Base restricted countries

Plutus Trade Base enforces strict geographical limitations to comply with international sanctions and financial regulations. If you reside in or physically operate from any of the jurisdictions listed below, you are completely prohibited from using their services.

List of prohibited countries and regions:

- Afghanistan

- Avtonomna Respublika Krym (Crimea)

- Central African Republic

- Congo (Brazzaville)

- Cuba

- Guinea

- Iran

- Iraq

- Lebanon

- Libya

- Mali

- North Korea

- Pakistan

- Region Crimea

- Region Donetsk

- Region Kherson

- Region Luhansk

- Region Sevastopol

- Region Zaporizhia

- Russian Federation

- Somalia

- South Sudan

- Sudan

- Syria

- Venezuela

- Vietnam

- Yemen

It is critical to understand that using a VPN or VPS to bypass these restrictions is strictly forbidden. The firm actively monitors IP masking, and trading from restricted regions will trigger an immediate hard breach and forfeiture of all fees and profits.

14. Compare Plutus Trade Base vs other prop firms

To determine if Plutus Trade Base is the right choice for you, it is essential to stack their offer against established industry players like TX3, SeacrestFunded, and Apex Trader Funding. The table below highlights the key differences in pricing, platforms, and profit potential.

| Criteria | Plutus Trade Base | TX3 | SeacrestFunded | Apex Trader Funding |

|---|---|---|---|---|

| Challenge Fee | €69 – €1,728 | $50 – $298 | $40 – $500 | From $196 |

| Account Types | 1-step, 2-step, Instant, Adventure | 1-step, 2-step | 1-step, 2-step, 3-step | 1-step (Evaluation) |

| Profit Split | Up to 95% | 80% – 90% | 80% – 90% | 90% – 100% |

| Account Size | $5K – $500K | $5K – $300K | $5K – $100K | $25K – $300K |

| Time Limit | No time limit | No time limit | No time limit | No time limit |

| Profit Target | 3% – 8% (None for Instant) | 5% – 10% | 5% – 10% | 6% |

| Trading Platforms | MT5, cTrader, DXTrade, TradeLocker | Match Trader, Project X | MT5, Match Trader, TradingView | NinjaTrader, Rithmic, Tradovate |

| Asset Types | Forex, Crypto, CFDs, Stocks | Forex, Commodities, Crypto, Futures | Forex, Indices, Crypto, Commodities | Futures (Indices, Commodities, Rates) |

Choosing the right firm depends entirely on your specific trading style, preferred asset class, and budget. While Plutus Trade Base offers the highest potential payout percentage, competitors like Apex dominate specific niches like Futures.

- Choose Plutus Trade Base if: You may choose this firm if you want the highest possible profit split of up to 95%. It also suits traders who require diverse platforms like cTrader or MT5, or who want to trade Stocks and Crypto 24/7 with a low 3% profit target.

- Choose TX3 if: You prioritize a data-driven dashboard and strong educational support. Their integration with TradeLocker and TopTier Trader Academy makes them excellent for traders focused on skill building and community.

- Choose SeacrestFunded if: You are on a strict budget. With fees starting at just $40, they offer the most affordable entry point. Their 3-step model also provides a unique, lower-risk path for cautious traders.

- Choose Apex Trader Funding if: You are exclusively a Futures trader. They are the industry leader for trading on NinjaTrader and Rithmic, offering a 100% profit split on the first $25k, which is unmatched for commodities and index futures.

In conclusion, Plutus Trade Base is the most versatile option for modern CFD and Crypto traders who want aggressive scaling and high payouts. However, this firm may not be ideal if your strategy relies strictly on Futures markets. If you also need the absolute lowest entry cost, specialized firms like Apex or SeacrestFunded may offer a more suitable environment.

15. Should I choose Plutus Trade Base?

Deciding to join Plutus Trade Base comes down to whether you prioritize speed and scaling over simplicity. This firm is not a one-size-fits-all solution. It is a specialized environment designed for traders who know exactly what they are doing and are willing to pay for specific privileges through Add-Ons.

For strategic traders seeking the easiest path to funding, the Lightning Account is arguably the best offer on the market, thanks to its ultra-low 3% profit target. However, if you are a casual trader who dislikes hidden consistency rules or extra fees for basic features like weekend holding, you might find their structure frustrating.

You should choose Plutus Trade Base if:

- You want the easiest statistical path to funding: The 1-Step Lightning account requires only 3% profit to pass. This is significantly easier than the industry standard of 10%.

- You are a Crypto or Stock Trader: The ability to trade Crypto 24/7 and access specific stocks via TradeLocker is a major advantage for non-Forex traders.

- You use High-Frequency Trading (HFT): Unlike most firms that ban HFT, PTB welcomes it (provided you purchase the Add-On), making it a haven for algo traders.

- You want to scale fast: The ability to double your account size at just 14% profit is a massive accelerator for growing your capital.

You should look elsewhere if:

- You reside in a Restricted Country: If you are from Vietnam, Russia, or other sanctioned regions, you are strictly blocked.

- You are on a tight budget: The base price is low, but the hidden costs of Add-Ons (for news, weekends, or HFT) and the Activation Fee can add up quickly.

- You need the $100k Account: As analyzed, the risk parameters on the $100k challenge are a less efficient risk-to-reward structure compared to smaller accounts.

- You rely on holding trades over the weekend for free: Most competitors allow this by default; PTB charges you for it.

In summary, Plutus Trade Base is an excellent choice for aggressive, experienced traders who can exploit the low profit targets and high leverage. It is less suitable for set-and-forget swing traders who might accidentally breach a consistency rule or forget to buy a weekend holding add-on. If you fit the first category, the profit potential here is among the highest in the industry.

16. Is Plutus Trade Base legit?

Yes, Plutus Trade Base is a legitimate proprietary trading firm. They are a registered entity that has successfully processed payouts to traders via Rise and Crypto, maintaining a verified status and a solid 4.4/5 score on Trustpilot.

However, being legitimate does not mean the platform is flawless. While they are not a scam, the firm has faced valid criticism regarding technical glitches on TradeLocker and strict enforcement of hidden consistency rules.

The risks here are primarily operational rather than malicious. They operate a functioning business model, but their infrastructure is still maturing compared to industry giants like FTMO, meaning bugs can occur.

Ultimately, it is safe to join if you review their legal resources, including the terms of use and privacy policy. Note their clear non-investment statement before signing up. We highly recommend screen-recording your trading sessions for evidence, as their dispute resolution for technical errors can be rigid and slow.

17. FAQs

Non-US traders can choose between MetaTrader 5 (MT5), cTrader, MatchTrader, and DXtrade. Traders residing in the United States are restricted to TradeLocker, which features built-in TradingView integration for charting and analysis.

The standard profit split for all funded accounts starts at 70%. However, you can upgrade this to an industry-leading 95% by purchasing the specific Profit Split Upgrade Add-On during checkout.

You can trade Forex pairs, Cryptocurrencies (24/7), Indices, and Metals (Gold/Silver) via CFDs. A curated list of individual Stocks is also available, but these are exclusive to the TradeLocker platform.

Yes, the Instant Funding program allows you to start earning immediately without passing an evaluation. Sizes range from $5,000 to $50,000, with no profit targets and a 10% maximum drawdown.

For most evaluation accounts like the Lightning and Challenge models, the leverage is capped at 1:100. For Instant Funding accounts, the leverage is set to 1:50 to manage risk on live capital.

By default, you are restricted from opening or closing trades 5 minutes before and after high-impact news. To remove this restriction and trade news freely, you must purchase the News Trading Add-On.

Drawdown limits vary by plan. The Lightning Challenge offers a 10% Static Drawdown during the evaluation, but this changes to a tighter 4% Trailing Drawdown once funded. Always check the specific parameters for your chosen account size.

Payouts are processed exclusively through Rise. Once funds are sent to your Rise wallet, you can withdraw them via Bank Transfer or Crypto (USDT, BTC). A minimum profit of $1,000 is required for standard accounts, or $10 for Instant accounts.

PTB generally does not offer refunds once a service has started. However, if you breach an account, you will automatically receive a 15% discount code via email to purchase a new challenge at a reduced price.

Yes, on all plans except Adventure, you can double your account size (e.g., $50k to $100k) by achieving a 14% total profit. You can continue scaling up to a maximum of $4 million in capital.

No, hedging is strictly prohibited. You cannot hedge positions within the same account or across multiple accounts. Violating this rule will result in an immediate account breach.

For immediate assistance, the Discord server is available 24/7. For formal inquiries, you can contact the support team via Email or WhatsApp from Sunday to Thursday between 9:00 AM and 9:00 PM (Cyprus Time).

The first payout can be requested as soon as you meet the target/trading days. Subsequent payouts are available every 15 days. You can bypass this wait time by purchasing the Withdraw Anytime Add-On.

Yes, EAs and algorithmic trading are allowed on Lightning and Challenge accounts. However, they are prohibited on the Adventure and Instant plans, which require manual execution.

The most affordable entry point is the Adventure Plan, which starts at €69. The Instant Funding program is also accessible, starting at roughly €87 for a $5,000 account.

By default, weekend holding is not allowed. You must close all positions before the market closes on Friday unless you have purchased the specific Weekend Holding Add-On.

18. Conclusion

In this Plutus Trade Base Review, we have uncovered a firm that aggressively caters to modern, high-speed traders. With a 3% profit target on the Lightning account and the ability to trade Crypto 24/7, they offer statistically superior tools for those looking to get funded quickly.

However, the Honest Payout Truths reveal that these benefits come with strict operational strings attached. While their payouts via Rise are legitimate, the $1,000 minimum withdrawal threshold and the mandatory 3% buffer rule are significant hurdles that small-account traders must be financially prepared for.

If you are a disciplined algorithmic trader or a scalper willing to pay for the necessary Add-Ons, Plutus Trade Base is a powerful vehicle for growth. But for casual traders, the hidden costs of weekend holding and the strict consistency rules may outweigh the high profit splits.

Finding the perfect funding partner is rarely a one-stop journey. To see how PTB stacks up against other industry giants like Apex or SeacrestFunded, explore our in-depth comparisons and expert reviews on the H2T Funding blog today.