If you’ve ever felt stuck between strong trading skills and limited capital, you’re not alone. I’ve been there too, watching my strategy work on demo accounts, but unable to scale it in real markets due to funding constraints.

That’s when I discovered Ment Funding. With its fast-track 1-step challenge, funding sizes from $25K to $2M, and a real scaling plan that can take you up to $5M, this firm isn’t just another name in the prop world; it’s a real chance to prove your edge.

In this Ment Funding review, we’ll explore how Ment stacks up and why more traders are turning to it for their next leap forward.

Disclaimer: Rules, pricing, and trading conditions may change over time. Traders should always verify the latest terms directly on the official Ment Funding websites before purchasing any challenge.

1. Our take on Ment Funding

Ment Funding is a U.S.-based proprietary trading firm founded in 2021, built with one mission in mind: to provide serious traders with meaningful capital, without overcomplicating the process.

Unlike firms with layered verification or strict minimum trading days, Ment takes a minimalist, trader-first approach with its 1-step evaluation model and no time limits.

At its core, the firm offers access to funded trading accounts ranging from $25,000 to $2 million, with the possibility to scale up to $5 million for consistent performers.

Here’s a quick look at the key specifications that define Ment Funding:

| Category | Details |

|---|---|

| Minimum entry fee | $250 |

| Maximum leverage | 1:20 (Forex), 1:10 (Other assets) |

| Profit split | 75% (base) – up to 90% (with add-ons) |

| Evaluation steps | 1 |

| First profit target | 10% |

| Max. daily loss | 5% |

| Max. total drawdown | 6% |

| Challenge time limit | None |

| Maximum fund size | $5,000,000 (with scaling) |

| Trading platforms | MT4, MT5, cTrader, Match Trader, DXTrade |

| Instruments | Forex, Crypto, Indices, Commodities, and Stocks |

| Commission per lot | $7 (Forex); free for other instruments |

| Withdrawal methods | Crypto, bank transfer |

| Payout frequency | Monthly |

| Trustpilot rating | 4.8 / 5 |

Pros and cons of Ment Funding

| Pros | Cons |

|---|---|

| ✅ Simple 1-step challenge with no time pressure | 🚫 No entry-level accounts below $25K |

| ✅ Up to 90% profit split for top-tier traders | 🚫 Initial fee starts at $250, higher than some competitors |

| ✅ Funded accounts up to $2M, scalable to $5M | 🚫 News trading is prohibited, limiting some strategies |

| ✅ Diverse trading platforms: MT4, MT5, cTrader, etc. | 🚫 Educational content is paid, not included in the base package |

| ✅ Backed by ThinkMarkets for tight spreads and execution | 🚫 Limited live customer support, mainly via email and Discord |

| ✅ Trustpilot rating of 4.8/5, showing strong user satisfaction |

In our view, Ment Funding strikes a balance between challenge simplicity and institutional-level funding. It’s not for hobbyists or those looking for low-cost entry points, but for traders with a defined strategy, it offers a serious path toward growth. If you’re ready to prove consistency and respect defined risk, this prop firm might be worth your attention.

2. Challenge types of Ment Funding review

Not every trader thrives under pressure. If you’ve ever felt drained by multi-step evaluations, inconsistent rulebooks, or just the mental fatigue of chasing prop firm “phases,” Ment Funding offers something different, something refreshing. With their one-step challenge model for both Forex and Futures, you can focus purely on what matters: performance and discipline.

Ment understands that skill isn’t proven through bureaucracy. Whether you’re a high-frequency intraday trader or someone who lets swing positions breathe, these challenges are designed to respect your trading style, not force you into a mold.

To help you decide which track suits your strengths, here’s a side-by-side comparison of the two challenge types:

Ment Funding Challenge Comparison Table

| Features | One-Step Forex Challenge | One-Step Futures Challenge |

|---|---|---|

| Profit target | 10% | 10% |

| Max daily loss | 5% | 3% |

| Max drawdown | 6% trailing | 6% trailing |

| Trading period | No time limit | Up to 3 months |

| Leverage | Up to 1:20 | 1 contract or 15 micros |

| Platform fees | None | $52/month |

| First withdrawal | Anytime | Anytime |

| Trading platforms | MT4, MT5, cTrader, DXTrade, Match Trader | Match Trader, DXTrade |

| Account sizes available | $25K to $2M | $25K to $400K |

| News trading | Restricted (6-minute window) | Restricted (6-minute window) |

| Best for | Discretionary or EA traders need freedom | Futures traders with structured discipline |

2.1. One-step forex challenge

This is where I found Ment’s offering shines. The Forex challenge strips away the usual clutter. There are no multi-stage evaluations, no confusing “consistency” rules, and no ticking clock. It’s just you, your strategy, and a clear 10% profit target. Once you hit it, you’re live.

Key highlights:

- Profit target: 10%

- Max daily loss: 5%

- Max total trailing drawdown: 6%

- Leverage: Up to 1:20

- Trading days required: None

- First withdrawal: Anytime

- Platform fees: None

- News trading: Not allowed

One-step Forex challenge pricing:

| Account Size | Challenge Fee | Profit Target | Max Daily Loss | Max Drawdown |

|---|---|---|---|---|

| $25,000 | $250 | $2,500 | $1,250 | $1,500 |

| $50,000 | $450 | $5,000 | $2,500 | $3,000 |

| $100,000 | $750 | $10,000 | $5,000 | $6,000 |

| $200,000 | $1,500 | $20,000 | $10,000 | $12,000 |

| $400,000 | $3,000 | $40,000 | $20,000 | $24,000 |

| $1,000,000 | $8,600 | $100,000 | $50,000 | $60,000 |

| $2,000,000 | $17,200 | $200,000 | $100,000 | $120,000 |

Why should you choose this challenge?

If you’re like me, someone who prefers simplicity and accountability, this model feels liberating. Here’s what made it stand out:

- No pressure from time limits: Trade when markets are optimal, not when a timer forces you.

- Clear, honest targets: 10% profit with defined risk caps, nothing vague or manipulative.

- Fast access to real capital: Pass once, get funded, no “stage two” waiting room.

- Withdraw anytime: No delays or monthly payout cycles.

- Real trading freedom: Trade at your own pace, no artificial constraints.

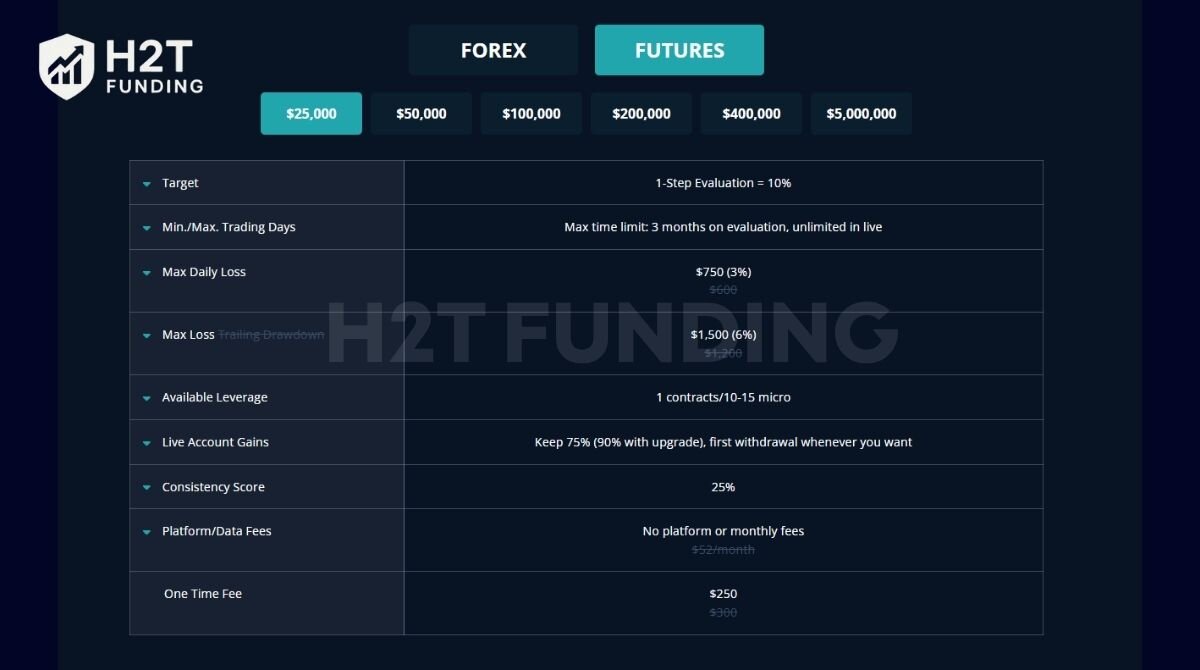

2.2. One-Step futures challenge

Futures traders often face steeper rules and tighter evaluations, but Ment brings the same clarity here, too. With 3 full months to complete the challenge and a 25% consistency requirement, the futures track adds structure without pressure.

Key highlights:

- Profit target: 10%

- Max daily loss: 3%

- Max total trailing drawdown: 6%

- Leverage: 1 contract or 15 micros

- Evaluation period: Up to 3 months

- Consistency score: 25%

- First withdrawal: Anytime

- Platform/data fee: $52/month

- News trading: Prohibited

Futures challenge pricing:

| Account Size | Challenge Fee | Profit Target | Max Daily Loss | Max Drawdown |

|---|---|---|---|---|

| $25,000 | $250 | $2,500 | $750 | $1,500 |

| $50,000 | $450 | $5,000 | $1,500 | $3,000 |

| $100,000 | $750 | $10,000 | $3,000 | $6,000 |

| $200,000 | $1,500 | $20,000 | $6,000 | $12,000 |

| $400,000 | $3,000 | $40,000 | $12,000 | $24,000 |

Why should you choose this challenge?

As someone who has dabbled in futures trading myself, this challenge impressed me with how structured yet flexible it is:

- Generous time allowance: Up to 90 days lets you ride out quiet market periods.

- Live trader realism: With a 25% consistency score, it simulates real capital management.

- Fair risk rules: Drawdown parameters align with standard prop models.

- Flexible payouts: Once funded, you can request payouts whenever you’re ready.

- Clear cost breakdown: One-time entry fee and monthly data fee, nothing hidden.

Verdict on the challenge types of Ment Funding

What I truly appreciate about Ment Funding is that it feels like it was built by people who actually trade. There’s no fluff. No “gotchas.” Just a fair shot at real capital, with real rules that are visible from day one.

If you’re tired of jumping through hoops or failing because of technicalities, these one-step challenges are a breath of fresh air. You’ll still need discipline. You’ll still need skill. But you’ll no longer need to fight through three phases, two resets, and five hidden clauses just to prove you can manage risk.

3. Trading rules of Ment Trading

No matter how promising your trading strategy is, if you don’t follow the rules of your prop firm, you risk losing all access, capital, and progress. Ment Funding understands this deeply. Their rules are built not to restrict, but to protect both the trader and the firm’s capital.

When I first joined Ment, I was relieved to see how transparent their rulebook was. Instead of hidden traps or vague restrictions, they clearly outline what’s allowed and what will get you disqualified. It’s not about controlling your style; it’s about ensuring consistency, fairness, and long-term growth for serious traders.

Let’s break it down.

3.1. Allowed trading rules

Ment Funding gives traders surprising flexibility, especially compared to many stricter prop firms on the market. You’re allowed to use a range of tools and platforms to fit your style, and some practices that are banned elsewhere are welcomed here.

Here’s what you can do with Ment Funding:

| Rule | Status | Notes |

|---|---|---|

| Custom EAs, scripts, indicators | ✅ Allowed | Traders can use personal or custom-built automated tools. |

| Manual trading | ✅ Allowed | All account types support discretionary trading. |

| Weekend holding | ✅ Allowed (as a paid add-on) | Traders can hold trades over weekends unless otherwise noted. By default, all positions must be closed by 3:45 PM EST on Friday. Traders can purchase an add-on to hold trades over the weekend. |

| Hedging | ✅ Allowed (with limits) | Permitted under defined leverage and lot size, visible in the dashboard. |

| Multiple accounts | ✅ Allowed (with conditions) | Traders can manage several accounts as long as they are not identical in size and follow the funding cap. |

| Account merging | ✅ Allowed (funded phase only) | Funded accounts can be merged if in profit or break even. |

| Scaling past $1M | ✅ Allowed | No cap on compound growth for consistent traders. |

| KYC identity verification | ✅ Required | Only verified individuals may trade their account; no third parties. |

3.2. Prohibited trading rules

Now, Ment does draw a firm line when it comes to high-risk or unethical behavior, and rightfully so. These rules are non-negotiable, and violating them can lead to immediate disqualification, even for funded traders.

| Rule | Status | Explanation |

|---|---|---|

| Martingale or averaging down | ❌ Prohibited | Considered gambling strategies, lacking in long-term sustainability. |

| Latency arbitrage/price exploits | ❌ Prohibited | Any attempt to exploit server delays or pricing errors is grounds for a ban. |

| Insider info/front-running | ❌ Prohibited | All trading must be based on public information only. |

| News trading (red folder) | ❌ Partially allowed | Cannot open new trades 3 minutes before and after high-impact news. Managing open trades is allowed. |

| Copy trading / mirrored trades | ❌ Prohibited | Even copying your own trades across accounts is not allowed. However, traders are generally allowed to copy trades between their own accounts as long as the strategy is their own. |

| Commercial bots or challenge-pass EAs | ❌ Prohibited | Mass-sold bots marketed to “pass challenges” are banned. |

| All-in trading / extreme risk overlap | ❌ Prohibited | Overleveraging or risking large capital on one trade is not tolerated. |

| Strategy switching (eval vs funded) | ❌ Prohibited | You must trade consistently throughout all phases. |

Verdict on the trading rules of Ment Funding

I’ll be honest, my biggest fear when joining any prop firm is breaking a rule I didn’t even know existed. That’s why I respect Ment Funding. Their transparency feels refreshing. You know exactly where the lines are, and if you’re serious about trading, those lines don’t feel restrictive at all; they feel safe.

I’ve used custom indicators, held trades over weekends, and even merged funded accounts under their conditions, all without issues. As long as you avoid shortcuts, stay within risk limits, and treat the capital with the same discipline you’d use with your own, Ment Funding won’t get in your way.

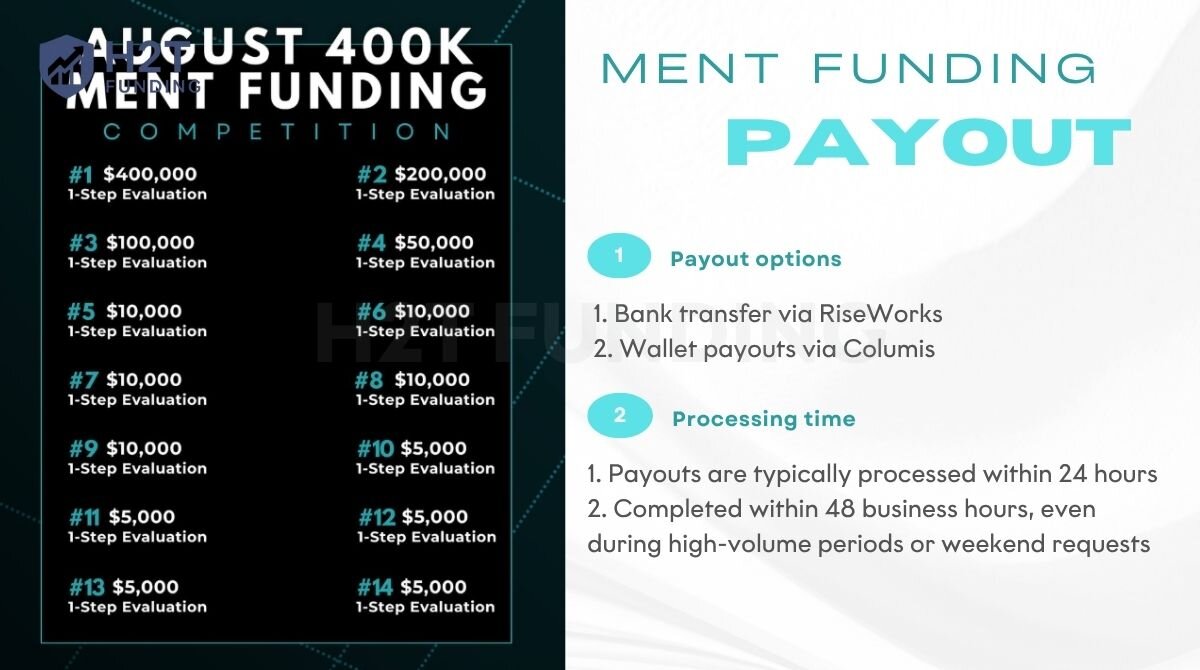

4. The payout structure Ment Funding

When it comes to getting your earnings out, time and transparency matter. At Ment Funding, the payout setup reflects that priority: simple, fast, and built on trader trust. From my own experience, seeing profit requests processed in under 24–48 hours consistently gave me real confidence in the firm’s reliability.

You can choose between two payout methods depending on your preference:

Payout options

- Bank transfer via RiseWorks: This partner handles fiat withdrawals. After your request, you receive an email invitation to set up a RiseWorks account using your valid email. From there, it’s straightforward: link your bank, complete KYC, and funds are transferred efficiently.

- Wallet payouts via Columis: Prefer crypto? Ment supports payouts in USDC or USDT via Columis. Once connected, profits can be sent directly to your crypto wallet.

Processing time

Payouts are typically processed within 24 hours, with most completed within 48 business hours, even during high-volume periods or weekend requests. Users report a 100% payout success rate since mid‑2021, which is rare in this industry.

Verdict on payout structure

Ment Funding’s payout system is exactly what traders need: fast, flexible, and hassle-free. Whether you prefer traditional bank transfers or crypto withdrawals, the process is streamlined and reliable, with most payouts completed within 24–48 hours.

Personally, I appreciate how it adapts to different financial preferences. It’s not just about getting paid; it’s about feeling respected as a trader. And Ment gets that right.

5. Ment Funding scaling plan

Passing the evaluation at Ment Funding is only the beginning. The real potential lies in their scaling plan, which allows traders to grow funded capital up to $5 million per program (Forex and Futures separately), simply by maintaining steady performance and risk discipline.

Once you reach live-funded status, you can double your trading account each time you meet all three criteria:

| Scaling requirements | Detailed |

|---|---|

| 1. Make at least one withdrawal | Indicates you’re actually trading and receiving profits. |

| 2. Show consistency | Within any 6-month window, at least 3 months must record ≥ 2% gains. |

| 3. Reach ≥ 10% total profit over start balance | Includes both realized profits and past withdrawals. |

For example, if you begin with $100K, earn $40K profit, and have already withdrawn some, hitting 10% total gain qualifies you for a new $200K live account. Your previously funded account is closed, and you start fresh with doubled capital.

This model applies separately to Forex and Futures accounts, so you can scale both concurrently, capping out at $5M each if your performance remains consistent.

Verdict on scaling plan

What impressed me most was how the scaling plan rewards discipline and consistency, not luck. You don’t need to hit arbitrary benchmarks; just trade wisely, stay steady, and get rewarded with more capital.

As someone who values long-term compounding, this felt like a partnership: show you can manage small, Ment Funding gives you more. It’s a genuine path to professional-level trading, and that mindset makes this plan stand out.

6. Ment Funding profit split, spread, and commissions

Understanding how much you get to keep, what you pay to trade, and when you can withdraw is crucial for any prop trader. Ment Funding’s profit structure and trading costs are refreshingly clear, making it easier to focus on strategy without constantly second-guessing the fine print.

6.1. Profit split

Ment Funding’s profit-sharing model starts at 75%, which is in line with industry standards. But for traders who prefer higher retention, you can upgrade your split up to 90% by paying approximately 20% more for the funded challenge.

This gives traders the flexibility to choose based on confidence and capital. It’s a one-time decision that can significantly boost long-term earnings for consistent performers.

6.2. Commissions and spreads

All trading accounts at Ment Funding operate under raw spreads starting as low as 0.1 pips on Majors. This means you get market-direct pricing with no markups, only a $7 round-trip commission per lot traded on Forex.

Other instruments, such as indices, commodities, and metals, carry no trading commissions at all. Just clean execution, no hidden costs. Plus, there are no recurring platform or monthly fees, which many other firms quietly add on.

Verdict on profit split and commissions

In my view, Ment Funding keeps the profit-sharing system clean and predictable. If you prefer to keep most of your earnings and believe in your edge, opting for the 90% split makes sense, even though it comes with a slightly higher entry cost. For many, the upside outweighs the one-time extra fee.

The commission structure is transparent too; only Forex trades incur the $7 round-trip fee, with no surprises elsewhere. Having no hidden fees, easy withdrawals, and fair profit-sharing made me feel valued as a trader.

7. Ment Funding Trading Platforms

Ment Funding offers a robust lineup of five professional trading platforms: MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, DXtrade, and Match-Trader.

Each platform caters to different trader needs:

- MT4 is the industry staple, reliable, familiar, and ideal for those who prefer a proven interface.

- MT5 builds on MT4 with more timeframes, improved order management, and better market depth.

- cTrader is favored by advanced traders for its sleek design, powerful charting tools, and built-in support for algorithmic trading.

- DXtrade offers a modern, intuitive layout with built-in risk management features, particularly suited for U.S. traders.

- Match-Trader, also designed for U.S.-based users, delivers a stable, user-friendly environment for executing trades with ease.

All platforms support Expert Advisors (EAs), custom indicators, and advanced charting, ensuring you can run your strategy without limitations.

Verdict on trading platforms

What stood out to me was how much freedom Ment Funding gives you in choosing your tools. I started with MT5 to use my custom indicators, then moved to cTrader as my strategy evolved; its speed and precision made a real difference.

Whether you’re a beginner looking for simplicity or a seasoned trader seeking data depth and control, Ment Funding’s platform variety lets you work the way you want. That kind of flexibility makes all the difference in building confidence and staying consistent.

8. Trading assets and leverage

At Ment Funding, traders can access a focused but effective range of market instruments: forex currency pairs, major indices, and select commodities. This curated selection keeps things streamlined and manageable, though it may feel limiting to those who prefer access to stocks, crypto, or futures beyond the offered markets.

Here are the key details:

- Forex pairs: Tight raw spreads starting from 0.1 pips, ideal for scalpers and precision traders. Each trade incurs a $7 round-trip commission per lot.

- Indices and commodities: Commission-free trading, making these markets cost-effective for longer-term or discretionary strategies.

- Leverage: Up to 1:20 on forex pairs, and 1:10 on indices and commodities, moderate levels that reinforce risk control without overly restricting position size.

Verdict on trading assets and leverage

From my point of view, Ment’s asset suite strikes a smart balance: not overwhelming, but robust enough for most serious traders. The low-cost entry for indices and commodities stands out, especially if you trade those markets more frequently.

As someone who started with forex scalping and later diversified into index trading, I appreciated the clean leverage structure and cost transparency. It felt straightforward to manage risk and scale strategy, without worrying about random surprises in trading costs.

9. Customer support and education at Ment Funding

When trading with any prop firm, understanding how they support you and whether they help you grow is essential. Ment Funding offers structured tools for both, but there are trade‑offs to consider.

9.1. Education and trading tools

Ment Funding provides a paid education program, called MentFX, which costs around $100 per month. This includes video tutorials, written guides, live webinars, and access to a private trader community. The firm highlights strategies grounded in mathematical principles. They also maintain an active YouTube channel offering some free learning content.

On the downside, there are no free educational courses on the platform itself, and you won’t find a blog or knowledge base in the main account interface. If you want structured training beyond the basics, you must subscribe to MentFX.

9.2. Customer support

Unlike firms that offer phone support or integrated chat, Ment Funding relies on Discord and email channels. Their Discord server includes the CEO and support team, and both communication methods are available 24/7.

However, because live chat is exclusively through Discord, you need the app installed and an account set up to receive help. There’s no direct phone line available.

Verdict on customer support and education

Personally, I appreciate Ment’s transparency about its education offering and the fact that they build a real community through MentFX and YouTube. But if you prefer free learning or community-led content, the lack of complementary options may be limiting.

As for support, having round-the-clock help via Discord and email is reassuring. Yet, I missed being able to click a chat button in my browser or call someone directly. Still, when I did engage via Discord, the responses were prompt and helpful.

10. Ment Funding Trustpilot – What other traders said

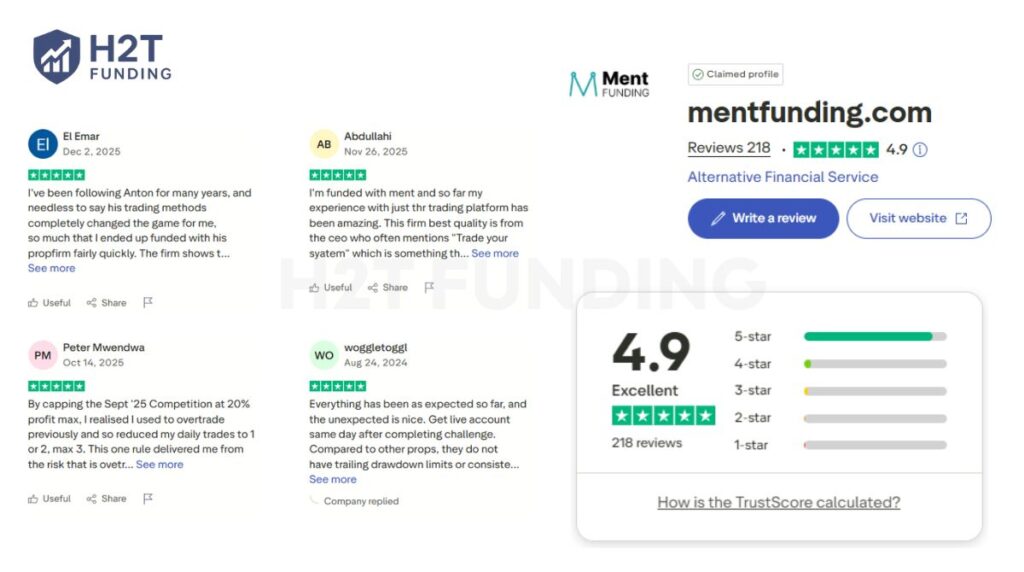

When evaluating a prop firm, hearing from real traders who’ve walked the path is often the most honest reflection of what to expect. With over 218 reviews and a stellar 4.9/5 rating on Trustpilot, Ment Funding has built a strong community reputation for transparency and consistent support.

Traders repeatedly highlight Ment’s clear communication, transparent rules, and the personal presence of CEO Anton in the Discord community. One reviewer shared how they felt very connected to Anton and the tremendous amount of resources provided, emphasizing that the relationship felt more like a partnership than a transaction.

Another trader pointed out the clarity and simplicity of the one-step evaluation, praising it as perfect for the single-phase rule with only 10%. While they noted limitations, like the lack of MT5 at the time and the higher cost of the $1M challenge, they still viewed the platform positively and suggested improvements constructively.

What really stands out is Ment Funding’s responsiveness to criticism. According to Trustpilot, the firm has replied to 100% of its negative reviews, showing they’re not just listening, they’re taking action. That level of attentiveness creates a feeling of mutual respect, which is rare in this space.

11. How to sign up for Ment Funding

If you’ve ever felt intimidated by complex sign-up processes or endless documentation hoops, Ment Funding simplifies the journey while still maintaining necessary security measures.

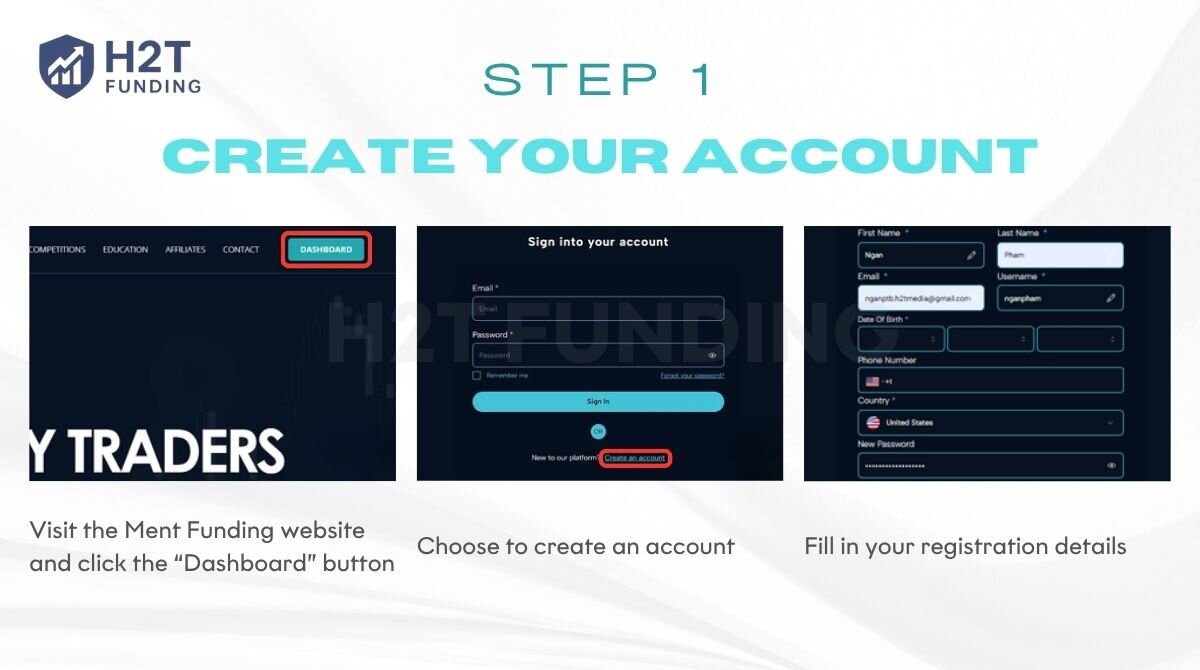

11.1. Step 1: Create your account

Visit the Ment Funding website and click the “Dashboard” button. From there, choose to create an account, then fill in your registration details: full name, email, username, date of birth, country, phone number, and a secure password.

Once you agree to the terms and submit, your account is created in minutes, no documents required at this stage.

11.2. Step 2: Log in and explore your dashboard

After registration, simply sign in via the Ment Funding login with your email and password. You’ll land on your personal dashboard, where you can explore challenge options, funding programs, platforms, and tools, getting a feel for everything before investing.

11.3. Step 3: Complete identity verification

When you’re ready to begin a challenge or request payouts, you will be asked to upload valid ID documents. This step is required to enable withdrawals and ensure regulatory compliance. It’s straightforward, a simple upload and quick approval process.

12. Comparing Ment Funding with other prop firms

Choosing the right prop firm can feel like a high-stakes trade itself, exciting but stressful. Every firm claims to offer “the best deal,” and at first glance, they all seem similar.

But if you’ve ever been burned by a hidden rule or felt stuck in a rigid evaluation, you know how important the fine print really is. That’s why it’s crucial to focus on what truly shapes your trading journey: the evaluation process, profit split, room to scale, and how risk is managed.

This table, part of our broader Ment Funding H2T Funding review, compares top-tier prop firms side-by-side of Ment Funding, FTMO, FundedNext, and Topstep, helping you see which one genuinely fits your style and goals.

| Feature | Ment Funding | FTMO | FundedNext | Topstep |

|---|---|---|---|---|

| Account size range | $25K–$2M per track (scaling up to $5M) | $10K–$200K (scaling plan available) | $6K–$200K (scale up to $4M) | $50K–$150K (Futures only) |

| Evaluation model | 1-step only (Forex & Futures) | 2-step model (Standard and Aggressive) | 1-step or 2-step, depending on the program | 1-step (Trading Combine®) |

| Profit target | 10% flat | ~10% per phase | 10–25% depending on account type | $3K–$9K depending on account size |

| Profit split (live) | 75% base, upgradable to 90% | Up to 90% (varies by performance) | 60–90% (depends on tier) | 100% on first $10K, then 90% |

| Drawdown limits | 6% trailing, 5% daily | 10% max drawdown | 5–10%, varies by model | Varies, tied to account size |

| Leverage | 1:20 (Forex), 1:10 (others) | 1:100 (Forex) | 1:30–1:100 (depending on product) | Futures contracts (not fixed leverage) |

| News trading | Prohibited 3 mins before/after red news | Restricted (depends on model) | Usually not allowed | Allowed |

| Trading platforms | MT4, MT5, cTrader, Match-Trader, DXtrade | MT4, MT5, cTrader | MT4, MT5, FundedNext Web | NinjaTrader, Quantower |

| First payout timing | Anytime after funding | First after 10 days, then bi-weekly | First time, then monthly | Weekly once funded |

| Scaling potential | $5M per track (Forex and Futures tracked separately) | Up to $2M+ with scaling | Up to $4M | Limited to $150K |

| Fee structure | $250–$10,500 (one-time) | Refundable challenge fee | Refundable or monthly fee-based models | Monthly fee + data fees for some platforms |

With years of experience testing and reviewing prop firms, I’ve learned that choosing the right firm isn’t just about the best profit split or biggest account; it’s about finding the model that matches your trading personality and long-term goals.

So, in my view:

- Go with Ment Funding if you’re disciplined, prefer trading at your own pace, and want a serious shot at scaling to $5M without unnecessary complexity.

- Pick FTMO or FundedNext if you’re experimenting, need flexibility, or value strong community support.

- Choose Topstep if your entire edge is in Futures, and you want a firm that specializes in just that.

At the end of the day, no firm is perfect, but the best one is the one that fits you.

13. FAQs

Yes. Ment Funding is a legitimate prop trading firm established in 2021 in the U.S. It has earned trust from traders through transparent one-step evaluation rules, reliable payouts, and high community ratings, even though it operates without formal regulatory licensing.

Yes. Many traders rate Ment Funding highly for its clean rules, fast payouts, and up to 90% profit split. With a 4.8/5 Trustpilot score and 100% response rate to negative reviews, it’s widely regarded as reliable and trader‑focused.

Ment Funding provides funded accounts starting at $25,000 up to $2 million, per track (Forex and Futures separately), with the opportunity to scale each account up to $5 million over time.

Ment Funding partners with ThinkMarkets, a multi-regulated CFD broker. They provide raw pricing, tight spreads, and consistent execution across supported platforms.

No. Ment Funding prohibits copy trading, even copying trades across your own accounts. Each funded account must be traded independently to maintain compliance.

Ment Funding supports five major platforms: MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, DXtrade, and Match‑Trader. All platforms accommodate Expert Advisors, custom indicators, and full technical analysis.

The CEO of Ment Funding is Anton Calmes, who is actively involved in the trading community, frequently engaging via Discord and YouTube, and known for being trader‑focused and transparent.

Ment Funding offers funded accounts up to $2 million per track (Forex and Futures separately). With their scaling plan, you can grow each track up to $5 million, meaning a disciplined trader could manage $10 million total across both asset classes.

Yes. Forex trades are charged a $7 round-trip commission per standard lot via their raw spread accounts with ThinkMarkets. Indices, commodities, and metals have no trading commissions. There are no hidden or recurring fees.

Yes, Ment Funding allows funded accounts to be merged, provided they are in profit or breakeven at the time of the request. This gives traders a streamlined way to manage larger positions without juggling multiple dashboards.

Yes. You can upgrade through Ment Funding’s scaling plan, doubling your account size when you meet the profit, withdrawal, and consistency criteria. This is not just an internal “balance boost”; you receive a brand-new, larger live account with fresh limits.

14. Finally, our verdict about Ment Funding

After thoroughly analyzing all sides of Ment Funding, our Ment Funding review concludes on a strong note: this firm delivers exactly what it promises, clarity, fairness, and serious growth potential.

What sets Ment Funding apart isn’t just the one-step challenge or the clean dashboard; it’s the way it empowers disciplined traders to trade at their own pace, with fewer distractions and greater upside.

Whether you’re just exploring funded programs or have experience with other prop firms, Ment Funding strikes a balance between transparency and ambition that is hard to ignore.

✅ You get fast withdrawals, a generous profit split, and scaling to $5M.

✅ You’re not forced into confusing metrics or arbitrary restrictions.

✅ You trade, earn, and grow on your terms.

Of course, it’s not perfect. Traders looking for free education or a wider asset list might feel limited. But for those who value performance-driven funding and structured scaling, it’s one of the best prop firms currently available.

If you found this Ment Funding reviews helpful, don’t forget to check out our other prop firm reviews on leading prop firms at H2T Funding. We cover the good, the bad, and everything in between, so you can trade smarter.